Global Event Camera Market Size, Share, Growth Analysis By Type (Event-based Vision Sensors (EVS), Dynamic Vision Sensors (DVS)), By Resolution (Standard, High), By Application (Industrial Automation & Robotics, Automotive & Mobility, Consumer Electronics, Security & Surveillance, Healthcare & Biomedical Imaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177323

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

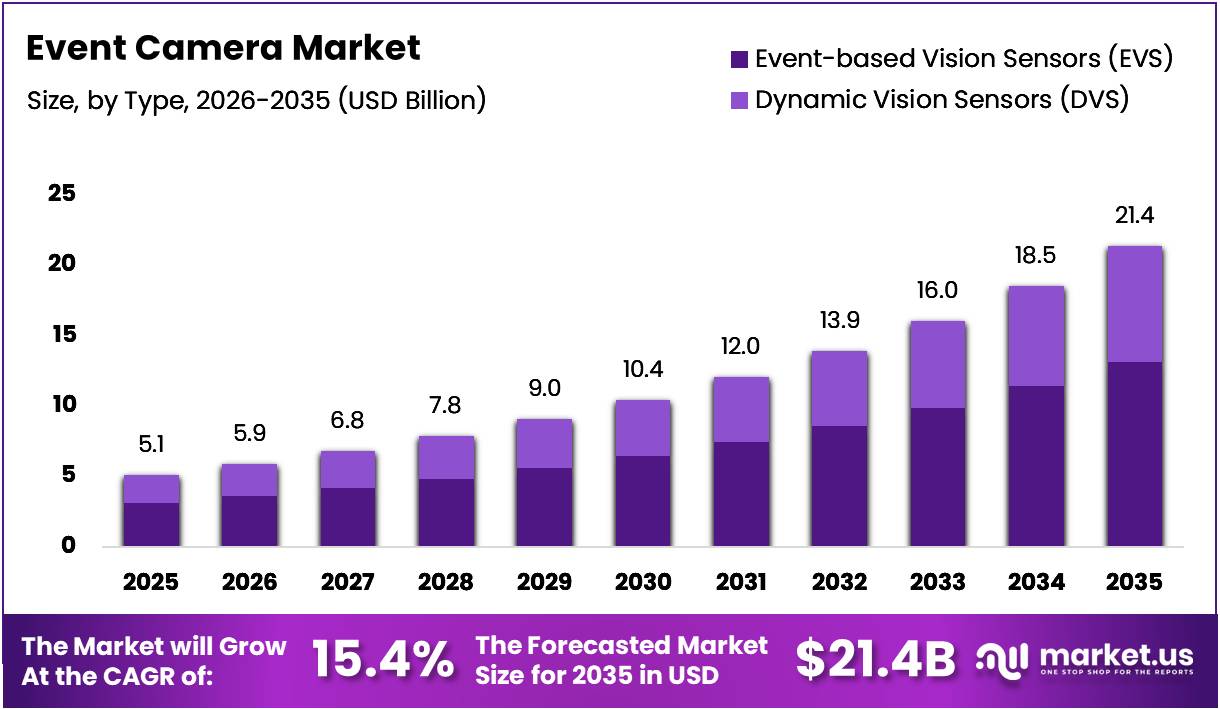

The Global Event Camera Market size is expected to be worth around USD 21.4 Billion by 2035 from USD 5.1 Billion in 2025, growing at a CAGR of 15.4% during the forecast period 2026 to 2035.

Event cameras represent a breakthrough in vision technology that captures visual information differently from traditional frame-based cameras. These neuromorphic sensors detect changes in pixel brightness asynchronously, generating events only when motion or illumination changes occur. This fundamentally different approach enables microsecond temporal resolution and minimal data redundancy.

The market is experiencing robust growth driven by increasing adoption across autonomous vehicles, robotics, and industrial automation sectors. Event-based vision sensors offer superior performance in challenging conditions including high-speed motion tracking, extreme lighting variations, and power-constrained applications. Moreover, their ability to operate with ultra-low latency makes them ideal for real-time decision-making systems.

Government investments in defense modernization and smart manufacturing initiatives are accelerating market expansion. Countries worldwide are funding neuromorphic computing research and bio-inspired vision systems development. Additionally, Industry 4.0 adoption is creating substantial demand for advanced sensing technologies that enhance operational efficiency and enable predictive maintenance capabilities.

The automotive sector represents a major growth opportunity as manufacturers integrate event cameras into advanced driver assistance systems. These sensors provide critical advantages in detecting fast-moving objects and operating reliably across diverse environmental conditions. Consequently, automotive safety regulations are increasingly favoring technologies that improve real-time hazard detection and collision avoidance performance.

According to Prophesee.ai, event cameras can support dynamic ranges typically above 120-140 dB, far exceeding conventional cameras’ ~60 dB, enabling robust performance in extreme lighting. According to MDPI research, event-based cameras outperformed framed-based cameras in UAV object tracking with improved image enhancement and up to 39.3% higher tracking accuracy.

According to arXiv research, a predictive temporal attention mechanism on event camera streams reduced data communication by ~46.7% and reduced processor computation by ~43.8%, demonstrating how advanced processing techniques can lower real-time workload and power use. Furthermore, event camera integration achieved multi-object segmentation accuracies ~88.8% in office environments and ~89.8% in low-light conditions with response times around 0.12 s in dynamic settings.

Emerging applications in augmented reality, virtual reality, and mixed reality devices are opening new revenue streams. Integration with artificial intelligence accelerators and edge computing platforms is enhancing real-time processing capabilities. Therefore, the convergence of neuromorphic sensing with advanced computational frameworks is expected to drive sustained market growth throughout the forecast period.

Key Takeaways

- Global Event Camera Market is projected to reach USD 21.4 Billion by 2035 from USD 5.1 Billion in 2025, at a CAGR of 15.4%

- Event-based Vision Sensors (EVS) segment dominates by Type with 61.5% market share in 2025

- Standard Resolution segment leads by Resolution with 67.3% market share in 2025

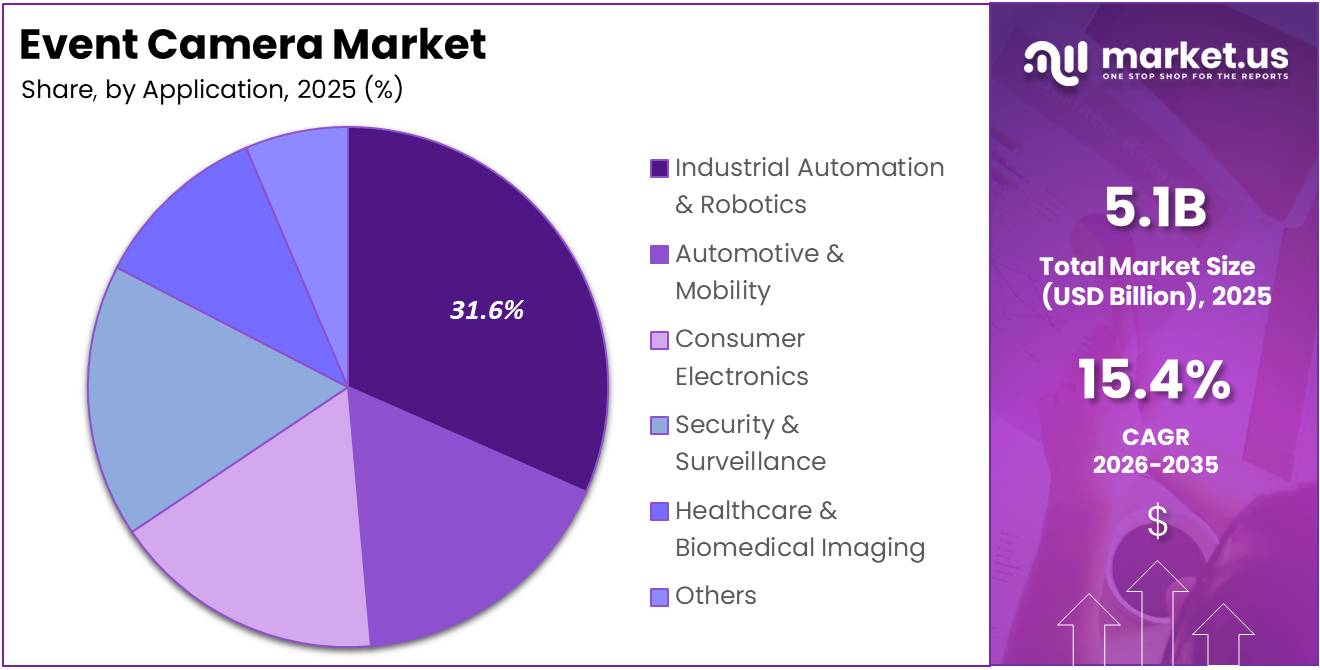

- Industrial Automation & Robotics segment holds 31.6% share by Application in 2025

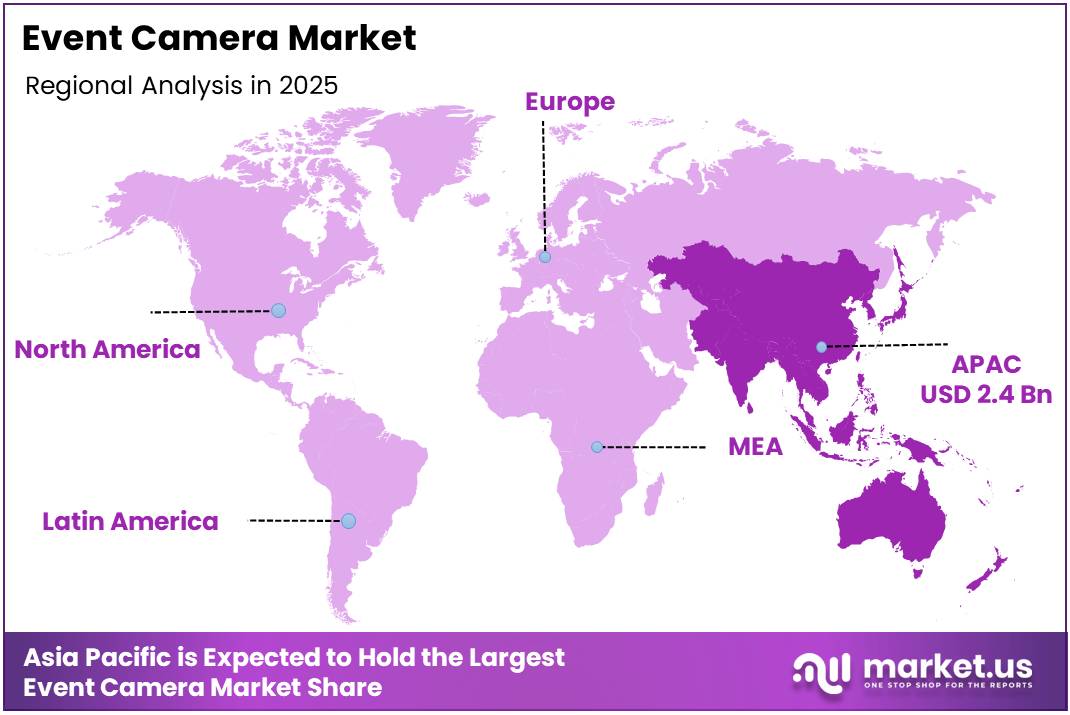

- Asia Pacific region dominates with 48.20% market share, valued at USD 2.4 Billion in 2025

Type Analysis

Event-based Vision Sensors (EVS) dominates with 61.5% due to superior temporal resolution and lower power consumption.

In 2025, Event-based Vision Sensors (EVS) held a dominant market position in the By Type segment of Event Camera Market, with a 61.5% share. These sensors capture asynchronous brightness changes with microsecond precision, enabling ultra-fast motion detection and minimal latency. Their architecture eliminates redundant data transmission, significantly reducing bandwidth requirements and power consumption compared to conventional imaging systems.

Dynamic Vision Sensors (DVS) represent a specialized subset focusing on motion-triggered pixel events with enhanced dynamic range capabilities. These sensors excel in high-speed tracking applications and scenarios requiring simultaneous capture of bright and dark regions. However, their market share remains smaller due to higher complexity in signal processing and integration requirements for mainstream commercial applications.

Resolution Analysis

Standard Resolution dominates with 67.3% due to cost-effectiveness and sufficient performance for most industrial applications.

In 2025, Standard Resolution held a dominant market position in the By Resolution segment of Event Camera Market, with a 67.3% share. Standard resolution sensors typically offer VGA to HD-equivalent pixel counts that adequately serve robotics, gesture recognition, and automotive safety applications. Moreover, these configurations provide optimal balance between spatial detail, processing overhead, and system cost for volume deployments.

High Resolution event cameras deliver enhanced spatial fidelity for applications demanding precise object identification and detailed scene reconstruction. These advanced sensors find adoption in biomedical imaging, aerospace surveillance, and high-end industrial inspection systems. Nevertheless, their higher cost and increased computational requirements currently limit penetration primarily to specialized professional and research-oriented use cases.

Application Analysis

Industrial Automation & Robotics dominates with 31.6% due to growing demand for high-speed quality inspection and real-time motion control.

In 2025, Industrial Automation & Robotics held a dominant market position in the By Application segment of Event Camera Market, with a 31.6% share. Event cameras enable robotic systems to react to environmental changes within microseconds, substantially improving safety and precision in collaborative manufacturing environments. Additionally, their ability to track fast-moving objects makes them essential for pick-and-place operations and assembly line quality control.

Automotive & Mobility applications leverage event cameras for advanced driver assistance systems, autonomous navigation, and in-cabin monitoring solutions. These sensors provide critical advantages in detecting pedestrians, cyclists, and vehicles under challenging lighting conditions including direct sunlight and nighttime scenarios. Consequently, automotive manufacturers are increasingly integrating event-based vision to enhance safety features and meet evolving regulatory requirements.

Consumer Electronics adoption focuses on smartphone photography, gaming peripherals, and wearable devices requiring low-power motion sensing capabilities. Event cameras enable always-on visual awareness with minimal battery drain, supporting features like gesture control and contextual image capture. However, integration challenges and cost considerations currently restrict widespread consumer market penetration beyond premium device segments.

Security & Surveillance systems utilize event cameras for perimeter monitoring, intrusion detection, and activity recognition across diverse environmental conditions. The technology’s exceptional low-light performance and minimal data storage requirements offer compelling advantages over conventional CCTV infrastructure. Furthermore, event-based analytics reduce false alarm rates by accurately distinguishing relevant motion events from background noise and environmental changes.

Healthcare & Biomedical Imaging applications employ event cameras for retinal prosthetics, neural activity monitoring, and high-speed microscopy requiring exceptional temporal resolution. These sensors capture rapid physiological processes that traditional imaging systems miss due to frame rate limitations. Therefore, research institutions and medical device manufacturers are exploring neuromorphic vision for breakthrough diagnostic and therapeutic applications.

Others segment encompasses emerging applications including drone navigation, sports analytics, virtual reality tracking, and scientific instrumentation. Event cameras provide unique capabilities for specialized use cases requiring extreme speed, dynamic range, or power efficiency. Consequently, this diverse category continues expanding as developers discover novel applications leveraging asynchronous vision sensing advantages.

Key Market Segments

By Type

- Event-based Vision Sensors (EVS)

- Dynamic Vision Sensors (DVS)

By Resolution

- Standard

- High

By Application

- Industrial Automation & Robotics

- Automotive & Mobility

- Consumer Electronics

- Security & Surveillance

- Healthcare & Biomedical Imaging

- Others

Drivers

Rising Adoption of Event-Based Vision in Autonomous Vehicles and Advanced Driver Assistance Systems Drives Market Growth

Event cameras are transforming automotive safety by enabling real-time hazard detection with microsecond latency that conventional cameras cannot achieve. Autonomous vehicle platforms require sensors capable of tracking fast-moving objects, pedestrians, and vehicles across varying lighting conditions including tunnels, direct sunlight, and nighttime driving. Moreover, event-based vision systems consume significantly less power while providing continuous environmental monitoring essential for safety-critical applications.

Advanced driver assistance systems increasingly integrate event cameras to enhance collision avoidance, lane departure warnings, and adaptive cruise control functionality. These sensors excel at detecting subtle motion changes that indicate potential hazards before they become visible to traditional frame-based cameras. Additionally, regulatory bodies worldwide are establishing stricter automotive safety standards that favor technologies offering superior real-time perception capabilities.

The automotive industry’s shift toward electrification amplifies demand for power-efficient sensing solutions that minimize battery drain without compromising performance. Event cameras align perfectly with this requirement, delivering exceptional motion detection while operating at fractional power levels compared to conventional imaging systems. Consequently, major automotive manufacturers are accelerating event camera integration across vehicle platforms from entry-level models to premium autonomous driving systems.

Restraints

High System Integration Complexity Compared to Conventional Frame-Based Cameras Limits Market Adoption

Event cameras generate asynchronous data streams fundamentally different from traditional frame-based image sequences, requiring specialized processing algorithms and hardware architectures. Development teams face steep learning curves adapting existing computer vision pipelines to handle event-driven data efficiently. Moreover, limited availability of experienced engineers familiar with neuromorphic vision systems increases development timelines and integration costs for organizations.

The absence of standardized software ecosystems and development tools creates significant barriers for companies evaluating event camera adoption. Unlike conventional cameras with mature software libraries and extensive documentation, event-based vision requires custom algorithm development for basic tasks. Additionally, compatibility issues between different manufacturers sensor outputs complicate multi-vendor system integration and limit component interchangeability.

Organizations must invest substantially in retraining technical staff and developing proprietary processing frameworks to leverage event camera capabilities effectively. This upfront investment in knowledge and infrastructure deters smaller companies and startups with limited resources. Therefore, market growth remains constrained until comprehensive development toolkits and standardized interfaces become widely available across the industry.

Growth Factors

Expanding Applications in Augmented Reality, Virtual Reality, and Mixed Reality Devices Accelerate Market Expansion

Event cameras offer transformative advantages for AR, VR, and MR systems requiring ultra-low latency head tracking and hand gesture recognition. These applications demand sensors capable of capturing rapid movements without motion blur while minimizing computational overhead on battery-powered wearable devices. Moreover, event-based vision enables always-on spatial awareness with power consumption low enough for all-day operation in consumer headsets.

Integration of event cameras with AI accelerators and edge computing platforms unlocks real-time scene understanding and object recognition capabilities previously impossible. Neuromorphic processors optimized for asynchronous event streams enable sophisticated visual intelligence running locally on devices without cloud connectivity. Additionally, this convergence reduces latency, enhances privacy, and enables responsive interactions essential for immersive extended reality experiences.

Growing research funding for neuromorphic computing and bio-inspired vision systems is accelerating technology maturation and commercial viability. Government agencies, academic institutions, and private investors recognize event cameras potential to revolutionize multiple industries beyond traditional imaging applications. Furthermore, increasing demand from smart manufacturing and Industry 4.0 initiatives drives adoption as factories seek advanced sensors for predictive maintenance and quality control automation.

Emerging Trends

Hybrid Sensor Architectures Combining Event-Based and Frame-Based Imaging Reshape Market Landscape

Manufacturers are developing hybrid sensors that capture both asynchronous events and conventional frames within single integrated devices. These architectures leverage event streams for motion detection and tracking while utilizing frame data for detailed scene reconstruction and color information. Moreover, hybrid approaches simplify system integration by providing familiar frame outputs alongside event data for gradual algorithm migration.

Advancements in event-based SLAM and real-time 3D perception algorithms are expanding application possibilities across robotics, autonomous systems, and spatial computing platforms. Researchers have demonstrated superior mapping accuracy and robustness compared to traditional visual SLAM approaches, particularly in challenging lighting conditions. Additionally, event-driven 3D reconstruction enables unprecedented temporal resolution for capturing dynamic scenes and fast-moving objects.

Miniaturization of event camera modules for consumer and wearable electronics is accelerating mainstream market penetration beyond industrial and professional applications. Semiconductor manufacturers are developing compact sensor packages with integrated processing that fit smartphone form factors and smartwatch dimensions. Furthermore, rising collaboration between semiconductor firms and AI software developers is creating optimized end-to-end solutions that lower adoption barriers and accelerate time-to-market for innovative products.

Regional Analysis

Asia Pacific Dominates the Event Camera Market with a Market Share of 48.20%, Valued at USD 2.4 Billion

Asia Pacific leads the global event camera market with a 48.20% share, valued at USD 2.4 Billion in 2025. The region’s dominance stems from strong semiconductor manufacturing capabilities, substantial investments in robotics and automation, and rapidly growing automotive electronics sectors. Moreover, countries like China, Japan, and South Korea are aggressively pursuing neuromorphic computing research and smart manufacturing initiatives that drive event camera adoption.

North America Event Camera Market Trends

North America represents a significant market driven by advanced research institutions, defense applications, and early adopter technology companies. The region’s aerospace and surveillance sectors actively integrate event cameras for applications requiring extreme dynamic range and low-light performance. Additionally, substantial venture capital funding supports startups developing innovative event-based vision solutions across autonomous vehicles, augmented reality, and industrial automation domains.

Europe Event Camera Market Trends

Europe demonstrates strong market growth fueled by automotive industry investments in advanced driver assistance systems and autonomous driving technologies. European manufacturers prioritize safety-critical applications where event cameras provide critical performance advantages over conventional sensors. Furthermore, regional research collaborations between universities and industry partners are advancing event-based computer vision algorithms and standardization efforts.

Latin America Event Camera Market Trends

Latin America shows emerging adoption primarily concentrated in industrial automation and security surveillance applications. Growing manufacturing sector modernization initiatives create opportunities for event camera integration in quality control and process monitoring systems. However, market penetration remains limited by budget constraints and preference for established conventional imaging technologies among regional enterprises.

Middle East & Africa Event Camera Market Trends

Middle East and Africa exhibit nascent market development focused on security, surveillance, and defense applications requiring robust performance under harsh environmental conditions. Government investments in smart city infrastructure and border security systems create opportunities for event camera deployment. Nevertheless, market growth faces challenges including limited local technical expertise and reliance on imported technology solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Samsung leverages its extensive semiconductor manufacturing expertise to develop advanced event-based vision sensors targeting mobile, automotive, and IoT applications. The company’s global supply chain capabilities and established relationships with device manufacturers position it strategically for large-scale event camera commercialization. Moreover, Samsung’s investments in AI processing and neuromorphic computing create synergies that enhance event camera system performance and market competitiveness.

Sony Corporation applies its imaging sensor leadership to event camera development, combining decades of conventional sensor expertise with cutting-edge neuromorphic technologies. The company’s strong presence in automotive, industrial, and consumer electronics markets provides diverse commercialization pathways for event-based vision products. Additionally, Sony’s ongoing collaborations with automotive manufacturers and robotics companies accelerate real-world deployment and technology validation.

Prophesee.ai specializes exclusively in event-based vision technology, offering comprehensive sensor solutions and software development kits for industrial and automotive applications. The company’s focused strategy enables deep technical expertise and close collaboration with early adopters across high-value market segments. Furthermore, Prophesee’s partnerships with leading semiconductor manufacturers facilitate technology transfer and volume production readiness.

iniVation AG provides event camera modules and development platforms targeting research institutions, autonomous systems developers, and specialized industrial applications. The company’s neuromorphic vision sensors combine event-based pixels with advanced on-chip processing capabilities for reduced system complexity. Consequently, iniVation’s solutions appeal to developers requiring high-performance vision sensing with flexible customization options and comprehensive technical support.

Key players

- Samsung

- Sony Corporation

- Prophesee.ai

- iniVation AG

- Northrop Grumman

- CenturyArks Co., Ltd.

- OMNIVISION

- IMAGO Technologies GmbH

- LUCID Vision Labs Inc.

- Pepperl+Fuchs SE

Recent Developments

- January 2026 – Keenfinity Group acquires Avonic to expand its Audio Conference Solutions with Intelligent Video Capabilities, strengthening its position in unified communication systems and enabling integration of advanced vision technologies into collaborative workspace solutions.

- October 2025 – CenturyArks Launches First Commercial Event-Based Vision Camera Module with MIPI Interface, providing standardized connectivity that simplifies integration with existing embedded systems and accelerates adoption across mobile, automotive, and industrial applications.

- August 2025 – EVS has signed an agreement to acquire Telemetrics, a vendor specializing in robotic camera systems for media production, expanding capabilities in automated broadcast and live event coverage with precision motion control technologies.

- June 2025 – Audinate, the developer of the Dante AV-over-IP media platform, has announced its agreement to acquire Iris Studios, a U.S.-based company specializing in AI-driven, cloud-based camera control technology for enhanced networked video production workflows.

- January 2025 – Ross Video Acquires EagleEye to Enhance Camera Motion Systems Portfolio, strengthening its automated production capabilities and expanding offerings for broadcast, corporate, and education market segments with advanced pan-tilt-zoom camera solutions.

Report Scope

Report Features Description Market Value (2025) USD 5.1 Billion Forecast Revenue (2035) USD 21.4 Billion CAGR (2026-2035) 15.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Event-based Vision Sensors (EVS), Dynamic Vision Sensors (DVS)), By Resolution (Standard, High), By Application (Industrial Automation & Robotics, Automotive & Mobility, Consumer Electronics, Security & Surveillance, Healthcare & Biomedical Imaging, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Samsung, Sony Corporation, Prophesee.ai, iniVation AG, Northrop Grumman, CenturyArks Co., Ltd., OMNIVISION, IMAGO Technologies GmbH, LUCID Vision Labs Inc., Pepperl+Fuchs SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsung

- Sony Corporation

- Prophesee.ai

- iniVation AG

- Northrop Grumman

- CenturyArks Co., Ltd.

- OMNIVISION

- IMAGO Technologies GmbH

- LUCID Vision Labs Inc.

- Pepperl+Fuchs SE