Global EV Test Equipment Market By Type(Battery electric vehicles, Hybrid electric vehicles, Plug-in hybrid vehicles), By Vehicle(Passenger Vehicle, Commercial Vehicle), By Equipments(Powertrain, Charging Component, Drivetrain test, Axle test, Propulsion system, Inverter test, Fuel transfer pump, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 73338

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

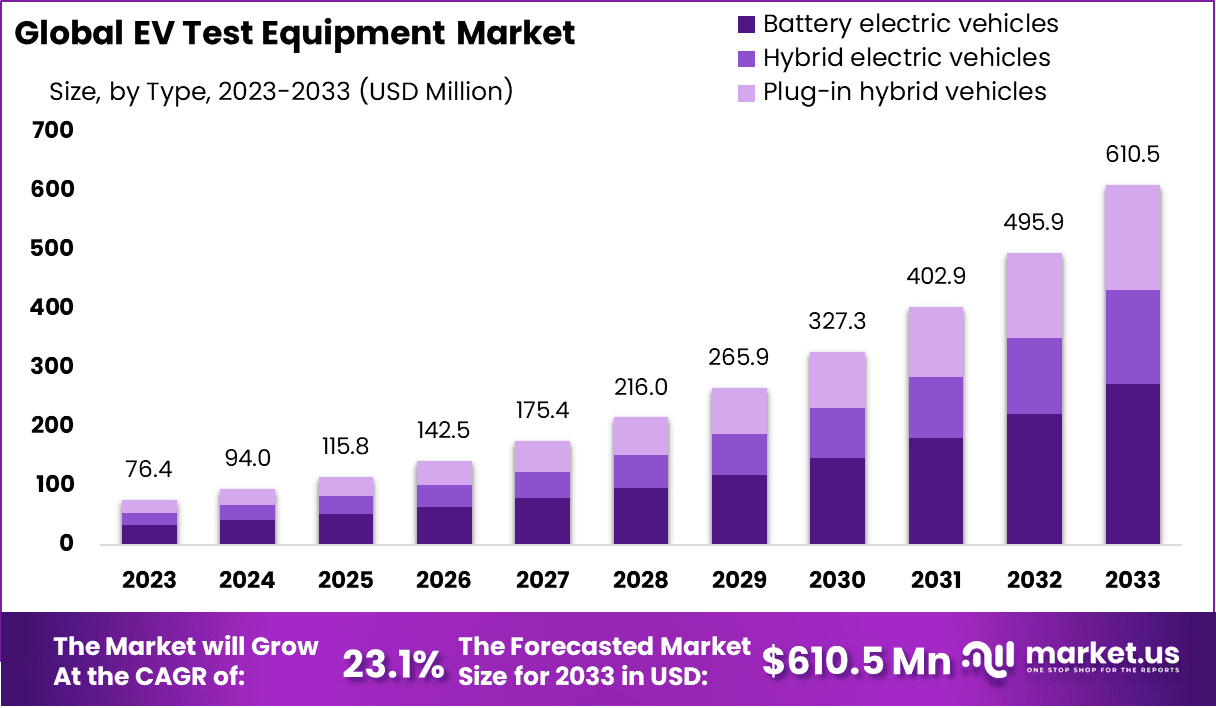

The Global EV Test Equipment Market size is expected to be worth around USD 610.5 Million by 2033, From USD 76.4 Million by 2023, growing at a CAGR of 23.10% during the forecast period from 2024 to 2033. Asia Pacific dominated a 42.6% market share in 2023 and held USD 32.5 Million in revenue from the EV Test Equipment Market.

Electric Vehicle (EV) test equipment comprises a range of devices and systems designed to assess the performance, safety, and compliance of electric vehicles and their components. These include battery testers, drivetrain analyzers, and charging station simulators, crucial for ensuring vehicles meet regulatory standards and perform optimally under various conditions.

The EV Test Equipment Market is experiencing significant growth due to the accelerating adoption of electric vehicles globally. Manufacturers and regulatory bodies increasingly require sophisticated testing tools to ensure these vehicles are safe, efficient, and compliant with international standards, driving demand for advanced EV test equipment.

The market’s expansion is propelled by stringent environmental regulations and the push for lower emissions, necessitating rigorous testing of EVs to ensure compliance and performance.

Demand for EV test equipment is surging as automotive manufacturers intensify the development of electric vehicles to meet consumer and regulatory expectations for sustainability and innovation.

The market sees considerable opportunities in developing integrated testing systems that can reduce costs and complexity, catering to the growing needs of EV manufacturers and component suppliers.

The EV Test Equipment market is experiencing significant growth driven by the increasing adoption of electric vehicles (EVs) and the corresponding need for advanced testing solutions. With global environmental regulations tightening, there is a heightened focus on ensuring that electric vehicles meet stringent performance, safety, and efficiency standards.

This trend is supported by substantial investments in EV infrastructure and technology development. The Indian government’s initiative, which launched with an outlay of ₹10,900 crore under the FAME II scheme, aims to foster EV adoption. It includes an allocation of ₹780 crore specifically for enhancing testing facilities, equipping them with advanced technology necessary for comprehensive EV assessments.

This investment is poised to expand the capacity and capabilities of testing infrastructures, thus propelling the demand for EV Test Equipment. Furthermore, the initiative targets a sales goal of 6-7 million hybrid and electric vehicles annually by providing fiscal incentives. This ambitious target not only underscores the market’s potential but also amplifies the necessity for robust testing

Key Takeaways

- The Global EV Test Equipment Market size is expected to be worth around USD 610.5 Million by 2033, From USD 76.4 Million by 2023, growing at a CAGR of 23.10% during the forecast period from 2024 to 2033.

- In 2023, Battery electric vehicles held a dominant market position in the type segment of the EV Test Equipment Market, with a 44.8% share.

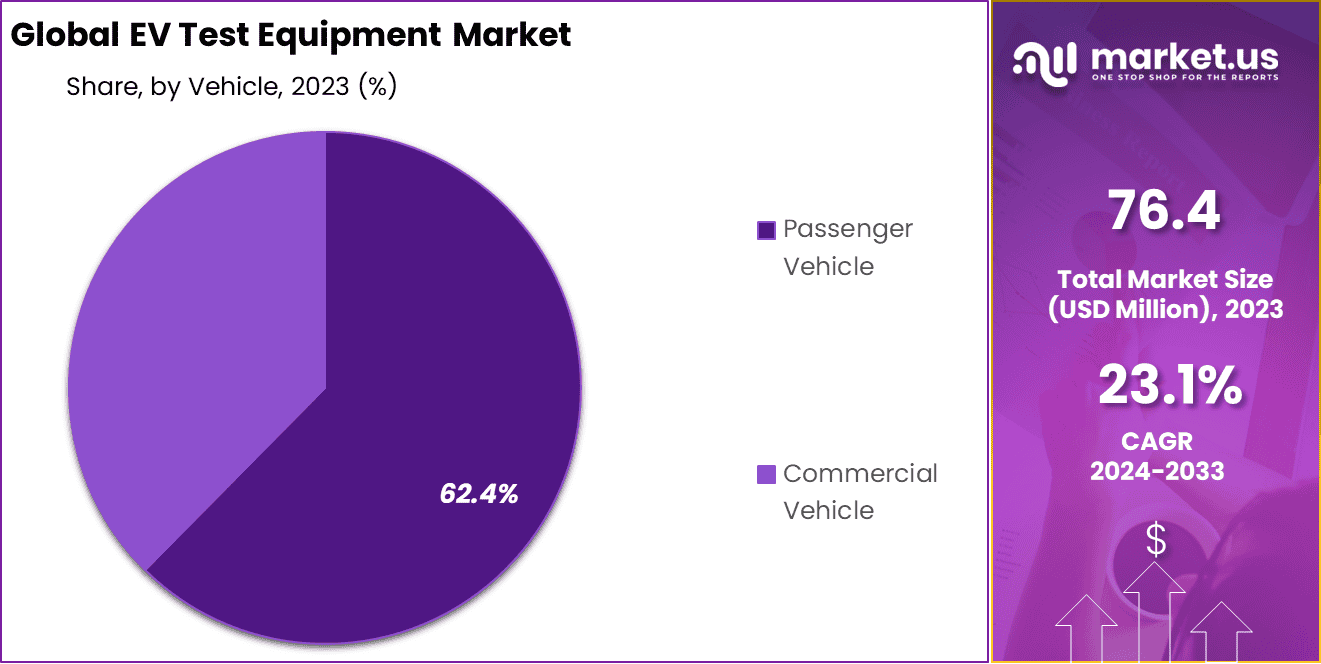

- In 2023, Passenger Vehicles held a dominant market position in the By Vehicle segment of the EV Test Equipment Market, with a 62.4% share.

- In 2023, Charging Components held a dominant market position in the By Equipments segment of the EV Test Equipment Market, with a 21.6% share.

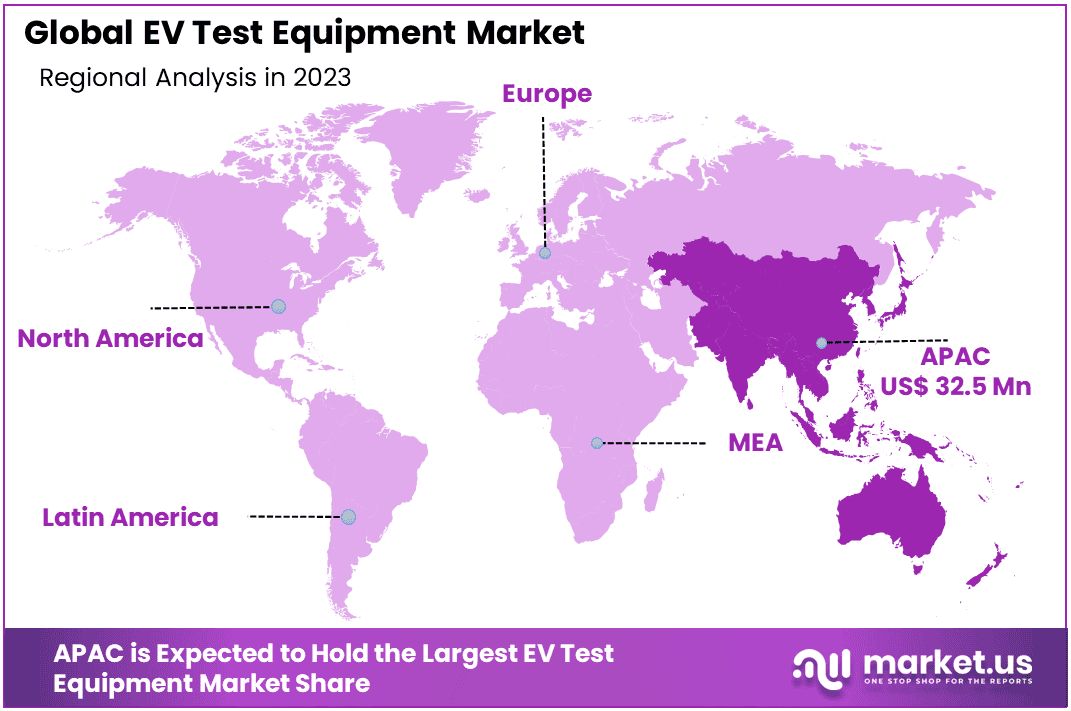

- Asia Pacific dominated a 42.6% market share in 2023 and held USD 32.5 Million revenue of the EV Test Equipment Market.

By Type Analysis

In 2023, the “By Type” segment of the EV Test Equipment Market was led by Battery Electric Vehicles (BEVs), capturing a dominant 44.8% market share. This segment outpaced Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), which held shares of 29.7% and 25.5%, respectively.

The predominance of BEVs in the market can be attributed to the global shift towards fully electric transportation solutions, driven by increasing environmental concerns and supportive government policies promoting zero-emission vehicles.

The demand for EV test equipment in the BEV segment is fueled by the need for rigorous testing protocols that ensure safety, efficiency, and compliance with stringent regulatory standards. Manufacturers are increasingly investing in advanced testing technologies that can accurately simulate real-world conditions and assess the performance of electric drivetrains, battery systems, and charging processes.

As the market for electric vehicles continues to expand, the role of specialized EV test equipment becomes critical in facilitating the development of reliable and high-performing BEVs, thereby supporting sustained market growth in this segment.

By Vehicle Analysis

In 2023, the “By Vehicle” segment of the EV Test Equipment Market was predominantly led by Passenger Vehicles, which secured a commanding 62.4% market share, compared to Commercial Vehicles at 37.6%. This significant lead underscores the robust demand for passenger EVs, driven by consumer preferences shifting towards sustainable and energy-efficient personal transportation options.

This trend is bolstered by extensive government incentives, stringent emissions regulations, and an expanding global infrastructure for electric vehicle charging.

The elevated demand for EV test equipment in the passenger vehicle sector is primarily due to the need to ensure vehicle safety, performance, and compliance with international standards. Automakers are focused on deploying comprehensive testing procedures that include battery performance assessments, drivetrain efficiency analysis, and safety checks to enhance vehicle reliability and consumer trust.

As the adoption of electric passenger vehicles accelerates, the requirement for advanced and precise testing equipment escalates, supporting the growth and development of new technologies within this segment. This dynamic is expected to continue propelling the demand for EV test equipment, ensuring the passenger vehicle segment maintains its market dominance.

By Equipments Analysis

In 2023, the “By Equipment” segment of the EV Test Equipment Market was prominently led by Charging Components, which claimed a dominant market share of 21.6%. This segment outperformed others, including Powertrain, Drivetrain Test, Axle Test, Propulsion System, Inverter Test, Fuel Transfer Pump, and Others, highlighting its critical role in the ecosystem of electric vehicle testing.

The focus on Charging Components reflects the industry’s priority to enhance the efficiency and reliability of EV charging solutions, a pivotal factor in the consumer adoption of electric vehicles.

The prominence of Charging Components is driven by the necessity to test and verify the compatibility and performance of various EV chargers under diverse operating conditions. This ensures that electric vehicles can be charged safely, efficiently, and uniformly across different networks and geographies.

As EV adoption grows globally, the demand for robust and interoperable charging infrastructure surges, thereby increasing the need for comprehensive testing of these components to prevent failures and optimize charging times. The development of advanced charging solutions, such as ultra-fast chargers and wireless charging technologies, further underlines the significance of this segment, maintaining its lead in the EV Test Equipment Market.

Key Market Segments

By Type

- Battery electric vehicles

- Hybrid electric vehicles

- Plug-in hybrid vehicles

By Vehicle

- Passenger Vehicle

- Commercial Vehicle

By Equipment

- Powertrain

- Charging Component

- Drivetrain test

- Axle test

- Propulsion system

- Inverter test

- Fuel transfer pump

- Others

Drivers

EV Test Equipment Market Drivers

The EV Test Equipment Market is experiencing substantial growth due to several key drivers. As governments worldwide impose stricter emissions regulations, the demand for electric vehicles (EVs) is escalating, necessitating advanced testing equipment to ensure these vehicles meet safety and performance standards.

Additionally, the automotive industry’s shift towards electrification is prompting manufacturers to invest heavily in R&D, further fueling the need for EV test equipment. This market is also propelled by technological advancements in EV components, which require rigorous testing to validate their efficacy and reliability.

Moreover, consumer awareness and demand for sustainable transportation solutions are driving automakers to enhance their EV offerings, thereby boosting the market for EV test equipment.

Restraint

Challenges Facing EV Test Equipment Market

A significant restraint in the EV Test Equipment Market is the high cost associated with advanced testing machinery. These sophisticated tools, essential for ensuring the performance and safety of electric vehicles, require substantial investment, which can be a barrier for smaller manufacturers and startups.

Furthermore, the rapid pace of technological advancements in the EV sector means that test equipment can quickly become obsolete, necessitating continuous updates and replacements. This ongoing need for the latest technology adds financial strain and complicates long-term planning for businesses involved in EV production and testing.

Additionally, the complexity of global standards and regulations requires testing equipment to be highly adaptable, further escalating costs and challenging market growth.

Opportunities

Expanding Opportunities in EV Test Equipment

The EV Test Equipment Market is poised for expansion, driven by the increasing integration of electric vehicles into commercial fleets and public transport systems. This trend presents significant opportunities for the development of specialized testing tools that cater to unique fleet requirements, such as durability and long-term operational reliability.

Moreover, as regions like Asia-Pacific and Europe aggressively pursue electric mobility solutions, the demand for localized testing solutions that comply with regional standards is rising. This regional expansion offers ample opportunities for market players to innovate and tailor their offerings.

Additionally, the advent of autonomous electric vehicles introduces a new dimension of testing for connectivity and automated systems, further broadening the market’s scope.

Challenges

Navigating EV Test Equipment Challenges

The EV Test Equipment Market faces notable challenges, primarily stemming from the rapid evolution of EV technologies. As electric vehicles incorporate increasingly complex systems like advanced battery technologies and electronic controls, test equipment must also evolve swiftly to keep pace.

This constant need for upgrades can lead to logistical and financial burdens for testing companies. Additionally, the market is hindered by a lack of standardized testing protocols across different countries, complicating the process for manufacturers that operate on a global scale.

This lack of uniformity can delay product launches and increase development costs as companies must adapt to varying international standards. Furthermore, the specialized nature of this equipment requires highly skilled personnel, and the shortage of such expertise can impede the effective deployment and utilization of advanced testing tools.

Growth Factors

Driving Growth in EV Test Equipment

The growth of the EV Test Equipment Market is propelled by several key factors. The surge in global EV sales due to environmental concerns and favorable government policies is significantly driving demand for comprehensive testing of electric vehicles and their components.

Advances in battery technology and the complexity of electric drivetrains necessitate sophisticated testing equipment to ensure performance, safety, and compliance with regulatory standards. Additionally, the expansion of EV infrastructure, like charging stations, demands rigorous testing equipment to verify system compatibility and efficiency.

This is complemented by the automotive industry’s focus on innovation and quality, which supports continued investments in testing capabilities to maintain high standards and foster consumer confidence in EV technologies.

Emerging Trends

Emerging Trends in EV Test Equipment

Emerging trends in the EV Test Equipment Market are reshaping how electric vehicles are tested and evaluated. A significant trend is the adoption of wireless testing technologies, which offer more flexibility and reduce the complexity involved in testing procedures.

There is also a shift towards automation in testing processes to enhance accuracy and efficiency, minimizing human error and speeding up the time-to-market for new EV models. Additionally, the integration of artificial intelligence and machine learning in test equipment is becoming prevalent, allowing for more predictive and adaptive testing scenarios that can simulate a variety of environmental and operational conditions.

These technological advancements are making EV test equipment more capable and efficient, meeting the growing demands of an evolving automotive industry.

Regional Analysis

In 2023, the global EV Test Equipment Market showcased significant regional dynamics, with Asia Pacific emerging as the dominant region, holding a commanding 42.6% market share and a market value of USD 32.5 million.

This dominance is largely attributed to the rapid growth of the electric vehicle industry in countries such as China, Japan, and South Korea, where substantial government incentives and robust manufacturing capabilities have fostered extensive market development. Additionally, Asia Pacific’s lead in battery technology and electric vehicle production has catalyzed demand for advanced testing equipment in the region.

Meanwhile, Europe follows closely, driven by stringent EU regulations on emissions and the high adoption rates of electric vehicles across its member states. North America also shows strong market activity, supported by technological advancements and the presence of major automotive players focusing on EV innovation.

The markets in the Middle East & Africa, and Latin America, though smaller in comparison, are experiencing gradual growth due to increasing awareness of sustainability and the introduction of supportive government policies aimed at reducing carbon footprints, creating new opportunities for market expansion in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global EV Test Equipment Market witnessed significant contributions from leading companies such as AVL Chroma ATE, Durr Group, Dynomerk Controls, and Horiba Ltd., each playing a pivotal role in shaping the dynamics of this rapidly evolving industry.

AVL Chroma ATE has established itself as a frontrunner in the market by offering a comprehensive range of testing solutions tailored for electric vehicles and batteries. Their equipment is renowned for precision and adaptability, allowing for extensive application across various stages of EV development. This adaptability is particularly crucial as the industry continues to push the boundaries of EV technology, demanding more sophisticated testing protocols.

Durr Group, traditionally known for its excellence in automation and production systems, has successfully leveraged its expertise to introduce innovative EV test systems. Their solutions, which often integrate advanced industrial robotics and data analytics, help manufacturers enhance production efficiency and product quality, ensuring Durr’s strong position in the market.

Dynomerk Controls stands out for its specialized focus on drivetrain testing. Their systems are designed to offer detailed insights into drivetrain efficiency and durability, an area of critical importance as EV manufacturers strive to extend vehicle range and performance under diverse operating conditions.

Horiba Ltd., a giant in the field of precision instruments, continues to expand its footprint in the EV test equipment sector by developing integrated solutions that address both regulatory compliance and consumer performance expectations. Their ability to combine testing with diagnostic capabilities makes them invaluable to continuous innovation in EV technology.

These key players, through their specialized offerings and strategic market approaches, are essential to the ongoing growth and technological advancement in the EV Test Equipment Market. Their efforts not only meet current industry needs but also lay the groundwork for future developments in electric vehicle testing.

Top Key Players in the Market

- AVL Chroma ATE

- Durr Group

- Dynomerk Controls Horiba Ltd.

- Intertek Group Plc

- Keysight Technologies, Inc.

- Maccor Inc.

- National Instruments Corporation Toyo System Co., Ltd.

- TÜV Rheinland Wonik Pne Co., Ltd

Recent Developments

- In August 2023, Keysight Technologies, Inc. launched a new series of battery testing equipment in August 2023 designed to significantly reduce testing time. This launch aims to meet the increasing demands for faster, more efficient testing processes in the rapidly growing electric vehicle market.

- In May 2023, Intertek Group Plc expanded its operations by opening a new state-of-the-art EV testing facility in Germany. This facility focuses on safety and performance testing for electric vehicles and their components, reflecting the company’s commitment to supporting the global shift toward electric mobility.

- In March 2023, Maccor Inc. received a strategic investment of $15 million in March 2023, aimed at enhancing its research and development capabilities. This funding is directed towards advancing their EV battery testing technologies, crucial for ensuring the reliability and performance of electric vehicles.

Report Scope

Report Features Description Market Value (2023) USD 76.4 Billion Forecast Revenue (2033) USD 610.5 Billion CAGR (2024-2033) 23.10% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Battery electric vehicles, Hybrid electric vehicles, Plug-in hybrid vehicles), By Vehicle(Passenger Vehicle, Commercial Vehicle), By Equipments(Powertrain, Charging Component, Drivetrain test, Axle test, Propulsion system, Inverter test, Fuel transfer pump, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AVL Chroma ATE, Durr Group, Dynomerk Controls Horiba Ltd., Intertek Group Plc, Keysight Technologies, Inc., Maccor Inc., National Instruments Corporation Toyo System Co., Ltd., TÜV Rheinland Wonik Pne Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EV Test Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

EV Test Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AVL Chroma ATE

- Durr Group

- Dynomerk Controls Horiba Ltd.

- Intertek Group Plc

- Keysight Technologies, Inc.

- Maccor Inc.

- National Instruments Corporation Toyo System Co., Ltd.

- TÜV Rheinland Wonik Pne Co., Ltd