Global EV Charging Software Market Size, Share Analysis Report By Charging Type (Level 1, Level 2, Level 3), By Charging Site (Public, Private), By Application (Commercial, Residential), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151269

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

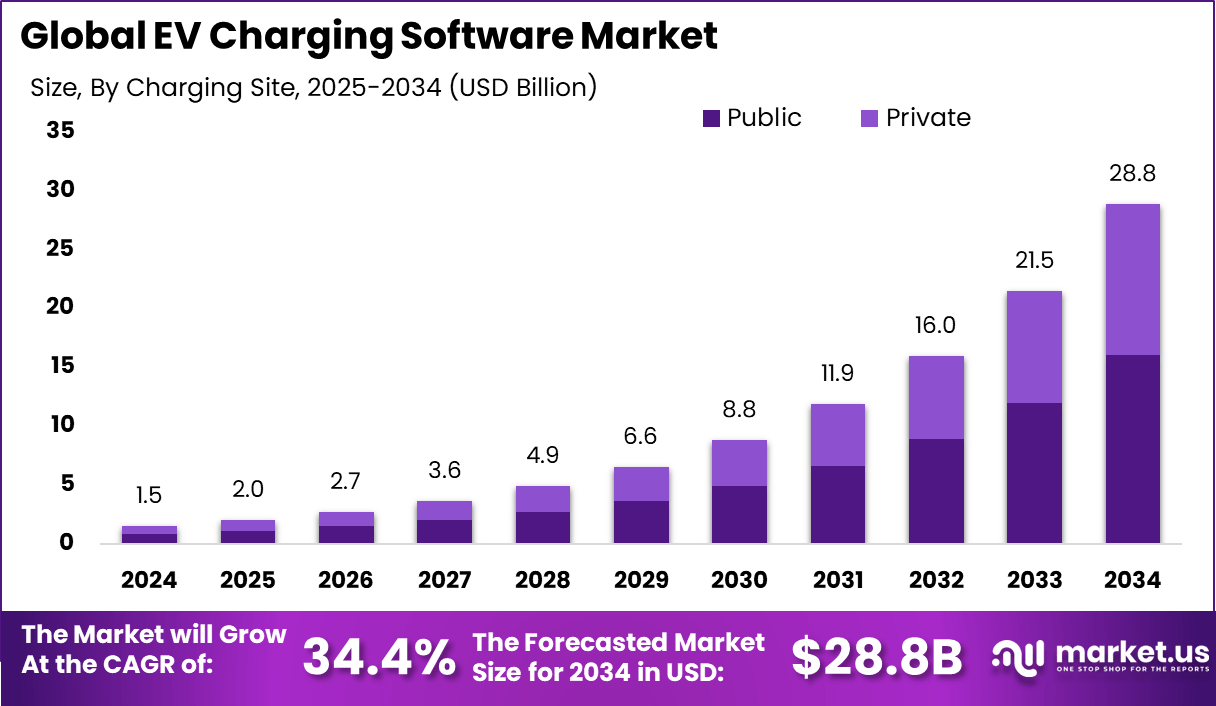

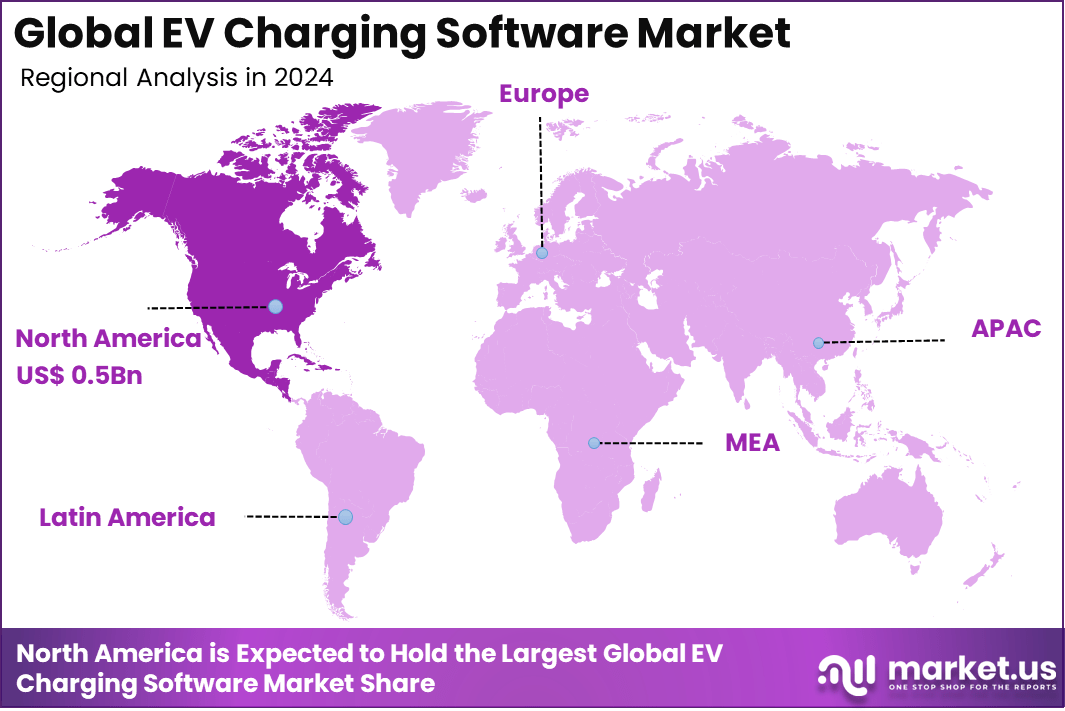

The Global EV Charging Software Market size is expected to be worth around USD 28.8 Billion By 2034, from USD 1.5 billion in 2024, growing at a CAGR of 34.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.3% share, holding USD 0.5 Billion revenue.

The EV charging software market is emerging as a foundational component in the global transition to electric mobility. This software empowers charging operators and service providers to monitor charger health in real time, automate maintenance, process payments, manage user sessions, and optimize energy distribution. Its role extends beyond convenience, as it supports seamless integration with electric utilities and V2G infrastructure – an essential element for future-proofing charging networks.

One of the top drivers in this market is the exponential increase in electric vehicle adoption, which places growing pressure on charging infrastructure. Software systems capable of handling diverse charger types – public, private, home, and commercial – are essential to ensure uptime and service quality. Governments are also actively promoting EV deployment and infrastructure through clean-energy policies and investment programs, stimulating demand for intelligent software platforms.

Demand for EV charging software is rooted in the need for operational efficiency, enhanced user experience, and revenue generation. Charging network operators are seeking tools that improve station availability, enable dynamic pricing strategies, facilitate streamlined billing, and maintain comprehensive audit trails. Reporting features and analytics dashboards are increasingly valued for their role in guiding growth strategies and reducing energy waste.

For instance, In March 2024, Edenred completed the acquisition of Spirii, a Danish software company known for its expertise in electric vehicle charging solutions. Spirii offers a flexible and scalable EV charging platform used by energy companies, businesses, and municipalities across Europe. This acquisition marked Edenred’s strategic move into the fast-growing eMobility ecosystem, aiming to strengthen its digital payment and fleet management services by integrating end-to-end EV charging capabilities.

Investment opportunities are especially attractive in cloud-native and SaaS-oriented platforms that can scale rapidly across geographies. There is notable interest in companies providing V2G and energy management integration, dynamic pricing, and turnkey solutions for fleets. M&As are on the rise, particularly among fintech and mobility cloud firms in markets such as China, North America, and the Nordics – where digital infrastructure and EV penetration are most advanced.

Key Takeaways

- The Global EV Charging Software Market is projected to grow from USD 1.5 billion in 2024 to approximately USD 28.8 billion by 2034, reflecting a strong CAGR of 34.4% during the forecast period.

- North America led the market in 2024, accounting for over 36.3% of global revenue, with regional earnings crossing USD 0.5 billion.

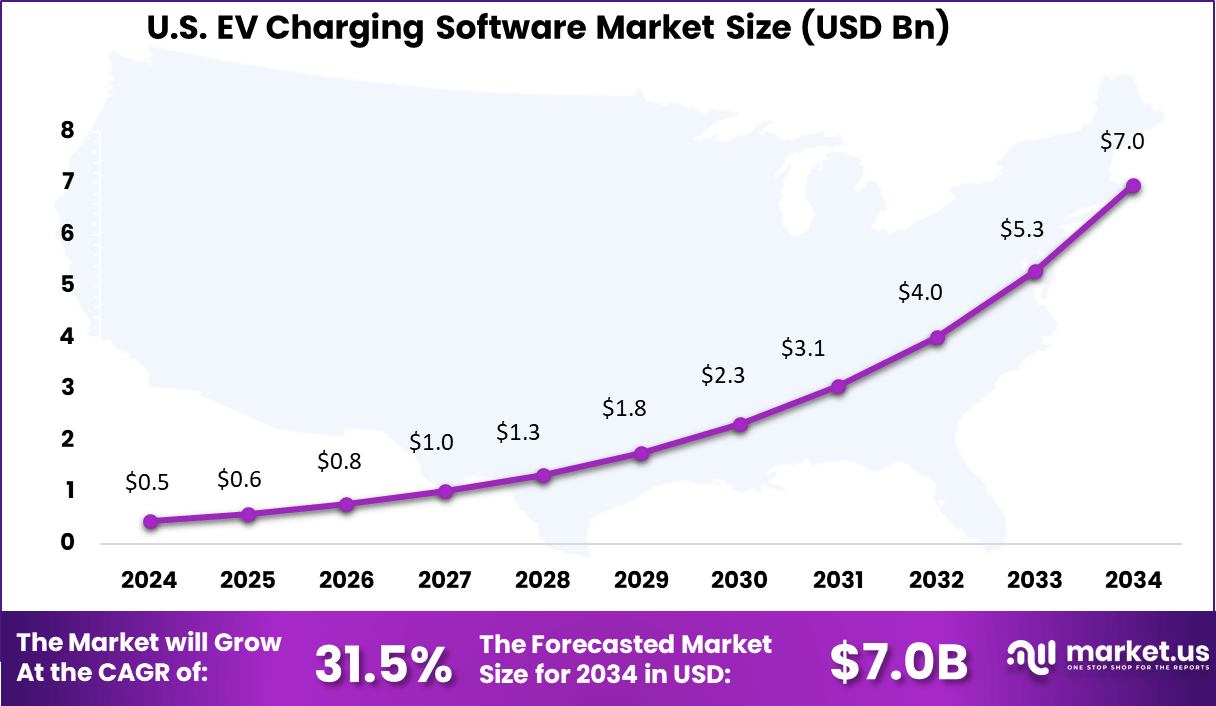

- The U.S. market alone contributed USD 0.45 billion, expanding steadily at a CAGR of 31.5%, supported by nationwide EV infrastructure initiatives.

- Level 1 charging software dominated by 40.4% share, driven by its widespread use in residential and workplace settings.

- Public charging sites held the largest market share at 55.7%, due to increasing deployment in urban hubs, shopping malls, and highways.

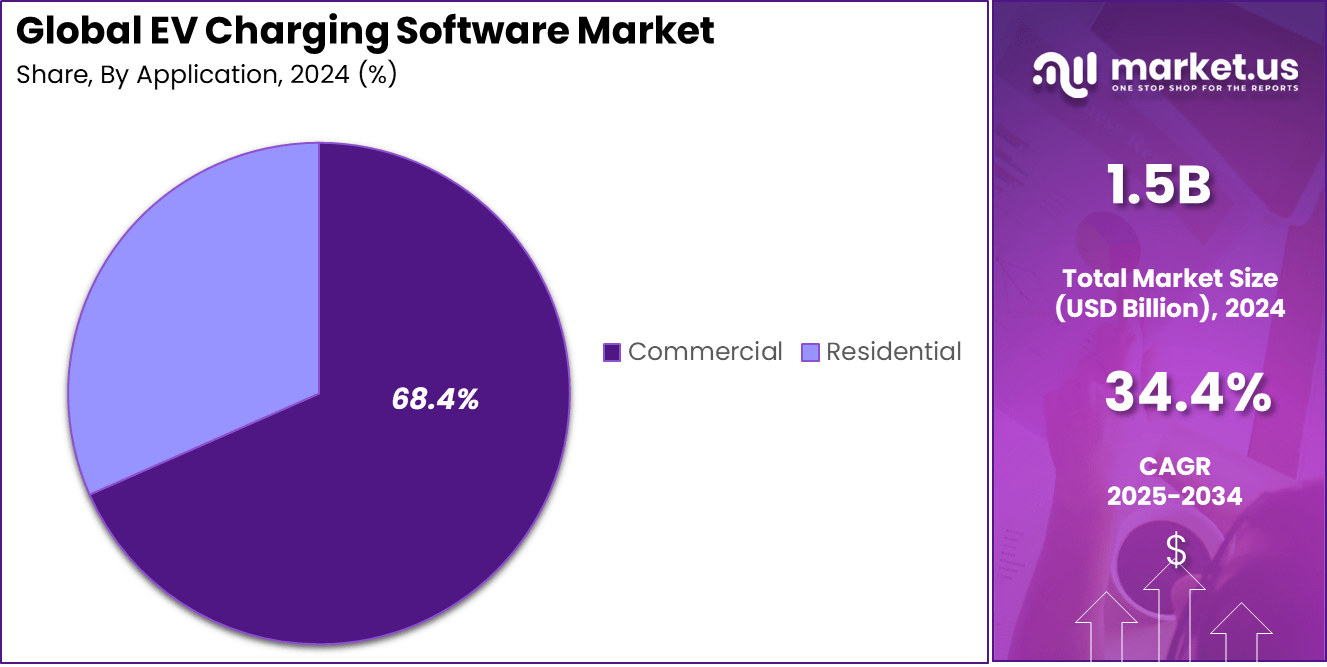

- Commercial application segment captured a commanding 68.4% share, as fleet operators and EV service providers prioritized smart software integration for scaling operations.

Role of AI

The role of Artificial Intelligence (AI) in EV charging software is increasingly pivotal, as it elevates the ecosystem from static hardware to dynamic, adaptive infrastructure. AI solutions are now embedded in core software layers to enhance operational efficiency, grid compatibility, and user satisfaction.

Grid Load Optimization is a key application area where AI forecasts demand trends and adjusts charging schedules in real time. This intelligent balancing prevents grid overload, shifts charging to lower-cost windows, and safeguards both utility infrastructure and end-users.

In Smart Routing and Station Availability Prediction, AI analyzes spatial usage data and charging patterns to guide drivers to less congested stations. By reducing idle waiting and optimizing route choices, these systems foster a smoother charging experience and better network flow.

Predictive Maintenance and Fault Detection leverage AI to continuously monitor charger health. Based on sensor data, AI models can forecast wear and anomalies – enabling preemptive servicing, which notably improves reliability and reduces downtime.

US Market Dominance

The US EV Charging Software Market is valued at USD 0.5 Billion in 2024 and is predicted to increase from USD 1.8 Billion in 2029 to approximately USD 7.0 Billion by 2034, projected at a CAGR of 31.5% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 36.3% share and generating USD 0.5 billion in revenue within the EV charging software market. This leadership can be attributed to strong policy support, widespread EV adoption, and the presence of a mature digital infrastructure.

The United States alone accounted for a significant share of this regional dominance, backed by federal initiatives like tax credits and clean energy mandates that accelerated EV deployment across both urban and rural charging networks. The demand for intelligent software platforms surged as public and commercial sectors focused on optimizing charging station operations, user experience, and grid load balancing.

By Charging Type Analysis

In 2024, Level 1 segment held a dominant market position, capturing more than a 40.4% share in the EV charging software market. The dominance of this segment can be attributed to its widespread use in residential settings and workplace parking lots, particularly in North America and parts of Europe.

Level 1 charging systems are relatively simple to deploy as they utilize standard 120V outlets, making them cost-effective and easy for mass adoption among first-time EV users. This simplicity has made it attractive for households and small businesses seeking a low-cost entry into EV ownership without needing extensive electrical upgrades or infrastructure investment.

Additionally, the rising preference for overnight home charging is reinforcing the demand for Level 1-compatible software solutions. These platforms enable energy usage tracking, schedule optimization, and remote monitoring, offering users convenience without the need for fast-charging speeds.

By Charging Site Analysis

In 2024, Public segment held a dominant market position, capturing more than a 55.7% share in the EV charging software market. This leadership was driven by the rapid expansion of public charging infrastructure across urban areas, highways, and commercial centers. Governments and municipalities have been actively investing in public EV infrastructure to support clean transportation goals and accommodate the rising number of electric vehicles.

As a result, there has been strong demand for charging management software tailored for public settings, enabling operators to monitor charger availability, manage user access, facilitate payment transactions, and optimize energy consumption in real-time. The public charging environment requires advanced software capabilities that go beyond basic charging functions.

These platforms often integrate with mobile apps, offer location-based services, support dynamic pricing, and enable remote diagnostics to improve operational efficiency. With rising usage in fleet services, taxi aggregators, and retail locations, the need for scalable, interoperable, and user-friendly public EV charging software has become essential.

By Application Analysis

In 2024, Commercial segment held a dominant market position, capturing more than a 68.4% share in the EV charging software market. This leadership was primarily influenced by the growing presence of EV chargers in shopping malls, office complexes, hotels, fleet depots, and public parking facilities.

The rising adoption of electric vehicles by delivery services, ride-hailing operators, and corporate fleets has increased the need for robust software systems to manage large-scale charging operations efficiently. These platforms are designed to handle complex scheduling, monitor charger performance across multiple sites, generate usage reports, and support billing systems – features essential in high-traffic commercial environments.

Moreover, businesses are increasingly viewing EV charging as a value-added service to attract customers, comply with sustainability targets, and create new revenue streams. Commercial charging software supports demand response, energy load balancing, and dynamic pricing, which are critical for managing costs and ensuring grid stability during peak usage.

Key Market Segments

By Charging Type

- Level 1

- Level 2

- Level 3

By Charging Site

- Public

- Private

By Application

- Commercial

- Residential

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Smart Charging and Dynamic Pricing

Modern EV charging software platforms increasingly include smart charging features that adjust power delivery based on grid demand and energy price fluctuations. These systems enable dynamic pricing, encouraging users to charge during off-peak hours when electricity is cheaper. By using real-time data feeds, smart charging helps balance grid load while offering cost savings to end users and operators.

Alongside pricing optimization, intelligent load management is enabled by integration with home energy systems and renewable sources. For example, charging sessions can automatically shift when solar output peaks or when household energy consumption is low. This trend supports sustainability goals by reducing carbon intensity and easing pressure on the electrical grid – a win-win for operators and users.

Driver

Growing EV Adoption and Policy Support

Rising electric vehicle adoption is a primary driver for EV charging software expansion. As more EVs hit the roads, operators need robust software to manage station availability, billing, reliability, and network planning. The increasing volume of charging sessions makes advanced software critical for efficient operation .

Governments worldwide are also reinforcing this trend through subsidies, tax credits, and supportive policies. These measures incentivize the deployment of charging infrastructure and accompanying software, helping operators recover costs and expand service rapidly. Policy backing ensures that software innovation remains aligned with national electrification targets.

Restraint

Hardware and Grid Integration Complexity

Despite software advances, integration with charging hardware and power grids introduces complexity and cost. Different charger models may support various protocols (e.g., OCPP), and older infrastructure may lack needed interfaces. Ensuring seamless connectivity, data exchange, firmware updates, and remote diagnostics demands engineering effort and robust API design.

Moreover, coordinating software with grid operators for load management introduces additional challenges. Smart charging must work with utility demand-response systems and abide by power quality standards. Achieving this coordination without disrupting grid stability requires careful testing and infrastructure investments – all of which can slow software rollout and adoption.

Opportunity

Value-added Services and Grid Integration

As EV charging software grows more mature, providers can offer expanded services like vehicle-to-grid (V2G) energy trading, demand-side response, and predictive maintenance. V2G allows EV owners to sell stored energy back to the grid during peak demand, monetizing their assets and supporting grid resilience .

Software platforms can also include tools for charger uptime monitoring, analytics dashboards, and predictive maintenance alerts – delivering higher uptime and lower operational costs. These value-added features deepen service offerings for fleet operators, commercial sites, and utilities, opening new revenue streams beyond basic charging management.

Challenge

Interoperability and Cybersecurity

A persistent challenge in EV charging software is interoperability. Charging networks remain fragmented, with multiple vendors adopting different standards and roaming agreements. Achieving seamless cross-network access requires unified protocols and integration frameworks to reduce user friction and increase infrastructure utilization.

Cybersecurity is equally pressing. Connected chargers and cloud platforms are potential targets for data breaches, ransomware, or unauthorized control. The rise of V2G and grid-integrated scenarios amplifies risk, as manipulation could impact electricity supply. Strong encryption, secure authentication, and vigilant monitoring are essential to maintain trust and system integrity .

Key Player Analysis

The EV Charging Software market is characterized by a competitive landscape, driven by innovation in areas such as white‑label platforms, energy management, operations monitoring, and vehicle‑to‑grid integration. Key participants form a diverse ecosystem spanning global regions and specialization.

Ampeco offers a hardware‑agnostic, white‑label software platform that prioritizes flexibility in branding and integration. The platform excels in load‑management, billing and payment workflows, and supports EV roaming and remote diagnostics. A strong emphasis is placed on device compatibility and operational uptime – capabilities that have earned recognition across Europe and North America.

ChargeLab, based in Canada, delivers a full‑stack backend solution tailored for hardware‑independent deployments. Its modular, white‑label system is designed for easy customization, enabling seamless user‑facing apps, payments, API access, and support for session monitoring. Notable collaboration with hardware giants like ABB highlights its capability for integrated solutions.

ChargePoint is recognized as one of the most extensive public charging networks in North America. Its software suite provides comprehensive session management, reporting, pricing control, and mobile payment functionality, designed for seamless user experience. ChargePoint’s strength is further enhanced by its deep hardware integration and capacity to support large-scale infrastructure deployments .

Top Key Players Covered

- Ampeco Ltd

- Etrel

- Driivz

- EVBox

- Shell

- Evconnect

- Chargelab

- Chargepoint

- Virta

- Touch GmbH

- Others

Recent Developments

- In April 2025, Ampeco Ltd Released its Q1 2025 platform update, which introduced new tools to help operators manage charging networks more efficiently, including improvements in energy flexibility, billing, monitoring, and roaming.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 28.8 Bn CAGR (2025-2034) 34.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Charging Type (Level 1, Level 2, Level 3), By Charging Site (Public, Private), By Application (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ampeco Ltd, Etrel, Driivz, EVBox, Shell, Evconnect, Chargelab, Chargepoint, Virta, Touch GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EV Charging Software MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

EV Charging Software MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ampeco Ltd

- Etrel

- Driivz

- EVBox

- Shell

- Evconnect

- Chargelab

- Chargepoint

- Virta

- Touch GmbH

- Others