Global EV Charging Connector Market By Connector Type (Type 1 (SAE J1772), Type 2 (IEC 62196), CHAdeMO, CCS (Combined Charging System), Wireless Charging), By Charging Level (Level 1 (Low Voltage/Standard Household Outlet), Level 2 (240V Charging Stations), Level 3 (DC Fast Charging)), By Power Output (AC Charging Connectors, DC Charging Connectors), By Application (Residential Charging, Commercial Charging, Fleet Charging), By End-User (Individual Consumers, Fleet Operators, Government and Public Infrastructure), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 84877

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Connector Type Analysis

- Charging Level Analysis

- Power Output Analysis

- Application Analysis

- End-User Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenges

- Key Market Trends

- Key Market Segmentation

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

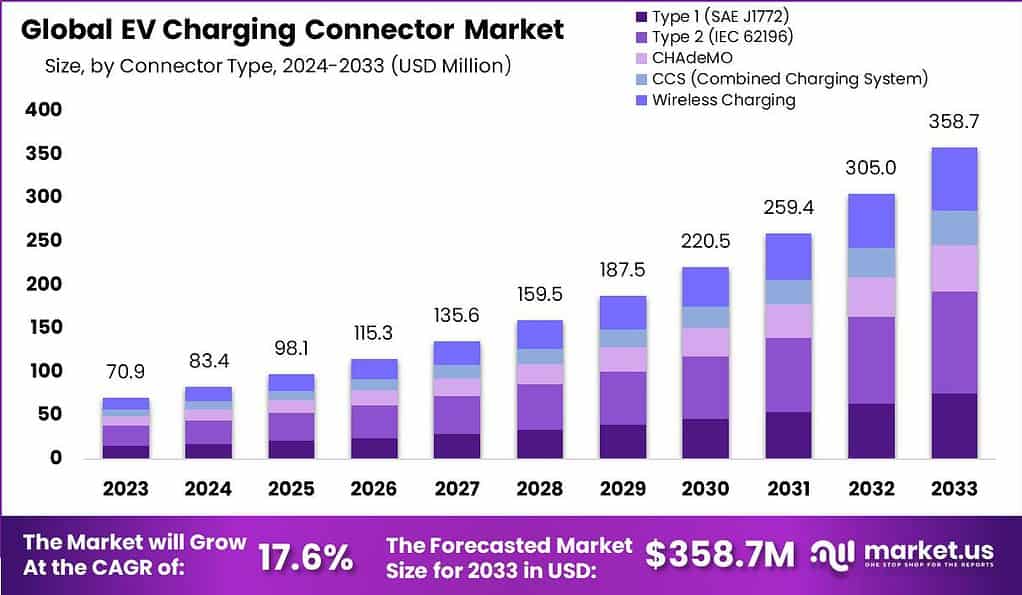

The global EV charging connector market is projected to reach a valuation of USD 358.7 Mn by 2033 at a CAGR of 17.6%, from USD 70.9 Mn in 2023.

An Electric Vehicle (EV) charging connector is a device designed to establish a physical connection between an electric vehicle and a charging station, enabling the charging of the vehicle’s battery. This connector serves as the interface through which electricity is transferred from the charging station to the battery system of the electric vehicle. Its primary function is crucial in ensuring the safe and efficient charging of electric vehicles.

The market for EV charging connectors is undergoing substantial growth due to the global surge in electric vehicle adoption. With an increasing demand for electric vehicles, there is a critical need for compatible charging infrastructure, with charging connectors playing a pivotal role. This market encompasses a variety of stakeholders engaged in the manufacturing, distribution, and installation of EV charging connectors.

Note: Actual Numbers Might Vary In The Final Report

Several key factors are propelling the growth of the EV charging connector market. Government initiatives and regulations advocating for the widespread adoption of electric vehicles, continuous advancements in charging technologies, and the expansion of charging infrastructure networks are among the primary drivers. Additionally, the market is influenced by a growing emphasis on renewable energy sources and the overarching shift toward sustainable transportation solutions.

Key Takeaways

- Market Growth Projection: The EV charging connector market is projected to reach a valuation of USD 358.7 Mn by 2033, exhibiting a remarkable CAGR of 17.6% from the base year of 2023, where it was valued at USD 70.9 Mn.

- Definition and Importance: EV charging connectors are crucial devices that establish a physical connection between electric vehicles and charging stations. They play a pivotal role in enabling the safe and efficient charging of electric vehicles.

- Driving Factors: Several factors are driving the growth of the EV charging connector market, including government initiatives promoting electric vehicle adoption, continuous advancements in charging technologies, and the expansion of charging infrastructure networks.

- Connector Type Analysis: In 2023, the Type 2 (IEC 62196) segment dominated the market with a share of 32.7%, primarily due to its broad compatibility with electric vehicles in Europe. Type 1 (SAE J1772), favored for its reliability, also had a significant presence.

- Charging Level Analysis: The Level 2 (240V Charging Stations) segment held the largest market share at 58% in 2023. This level balances speed and convenience and is suitable for residential and commercial settings.

- Power Output Analysis: In 2023, the AC Charging Connectors segment dominated the market with a 70% share, while DC Charging Connectors designed for rapid charging are gaining importance and are expected to see significant growth.

- Application Analysis: The Commercial Charging segment led in 2023 with a share of 45%, driven by the adoption of electric vehicles in commercial fleets and the expansion of public charging infrastructure.

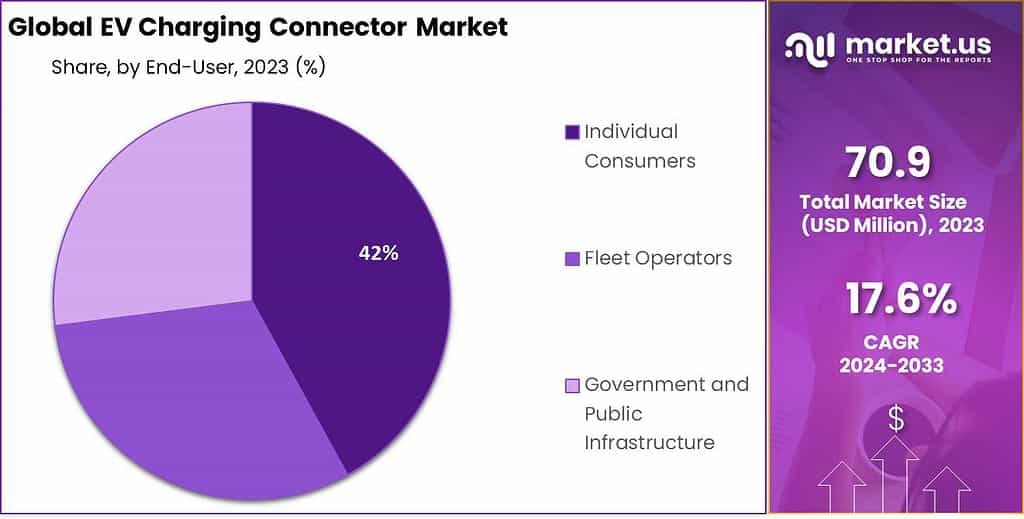

- End-User Analysis: In 2023, Individual Consumers held the dominant market position with a 42% share, driven by increasing ownership of electric vehicles among private users. Fleet Operators and Government and Public Infrastructure segments also experienced growth.

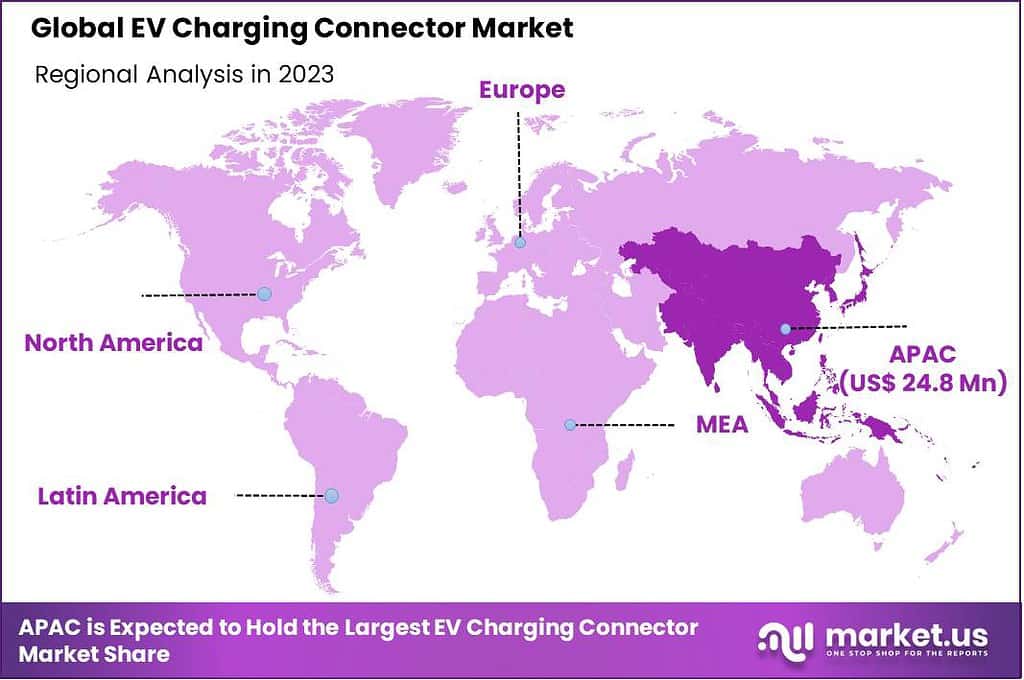

- Regional Analysis: In 2023, the Asia-Pacific (APAC) region held the largest market share at 35%, primarily due to the rapid adoption of electric vehicles in countries like China, Japan, and South Korea. North America and Europe also demonstrated significant market presence.

- Key Market Players: Prominent companies in the EV charging connector market include Tesla Inc., ABB Group, Siemens AG, Schneider Electric, Bosch Automotive Service Solutions, and others.

Connector Type Analysis

In 2023, the Type 2 (IEC 62196) segment held a dominant market position in the EV Charging Connector Market, capturing more than a 32.7% share. This prominence is primarily due to the connector’s broad compatibility with electric vehicles in Europe and increasing adoption worldwide. Type 2 connectors are renowned for their versatility, supporting both single-phase and three-phase power, which enables faster charging and contributes to their widespread acceptance. Meanwhile, the Type 1 (SAE J1772) segment, primarily utilized in North America and parts of Asia, maintained a significant presence, favored for its reliability and safety features.

The CHAdeMO segment, originally developed in Japan, has seen consistent growth due to its strong international standardization and the ability to facilitate rapid charging. However, its market share has been challenged by the emergence of the Combined Charging System (CCS), which combines the benefits of AC and DC charging into a single interface, offering an efficient and future-proof solution, especially in Europe and North America.

Wireless charging technology, though currently holding a smaller share, is poised for substantial growth, driven by advancements in technology and increasing consumer demand for convenience and innovation. This segment is expected to grow at an accelerated rate, reflecting broader trends towards automation and advanced technology in the EV infrastructure. Collectively, these segments form a dynamic and competitive landscape, driven by technological advancements, regional preferences, and evolving standards in the rapidly growing electric vehicle market.

Charging Level Analysis

In 2023, the Level 2 (240V Charging Stations) segment held a dominant market position in the EV Charging Connector Market, capturing more than a 58% share. This segment’s popularity stems from its balance between speed and convenience, providing a faster charge than Level 1 without the high costs associated with Level 3 installations. Suitable for both residential and commercial settings, Level 2 chargers are versatile and can fully charge an electric vehicle overnight, making them the preferred choice for daily EV users and businesses looking to provide charging solutions to employees and customers.

The Level 1 (Low Voltage/Standard Household Outlet) charging is the most basic and accessible option, requiring no special installation beyond a standard household outlet. While it’s the slowest charging method, providing about 4-5 miles of range per hour, its ease of use makes it a viable entry point for new EV owners or those with minimal daily driving needs. This segment appeals to individuals and businesses seeking a cost-effective, albeit slower, charging solution.

Level 3 (DC Fast Charging) represents the premium end of the market, offering rapid charging capabilities that can add 60 to 100 miles of range in just 20 minutes. Though it captures a smaller market share due to higher infrastructure and equipment costs, its importance is growing alongside the increasing number of EVs on the road and the demand for quick turnaround times. Level 3 charging is particularly relevant for commercial and public applications, where speed is crucial to accommodate multiple users and minimize downtime.

Each charging level segment caters to different needs, ranging from convenience and affordability to speed and efficiency. As the EV market continues to expand and technology evolves, these segments are likely to see shifts in their market share, reflecting changing consumer preferences, technological advancements, and economic factors.

Power Output Analysis

In 2023, the AC Charging Connectors segment held a dominant market position in the EV Charging Connector Market, capturing more than a 70% share. This significant market presence is attributed to the widespread use of AC charging in residential and commercial settings, where the slower charge rate is offset by the convenience of overnight charging or topping up during work hours.

AC connectors are favored for their compatibility with home and public charging infrastructure and the ability to use standard electrical systems without the need for complex installations. Their cost-effectiveness and ease of installation make them a popular choice for many EV owners and businesses looking to provide charging solutions without significant upfront investments.

On the other hand, DC Charging Connectors are designed for rapid charging and are typically found at dedicated charging stations along highways and in areas where quick turnaround is essential. While they currently hold a smaller share of the market due to higher costs and more specialized infrastructure requirements, their importance is growing rapidly. The ability to provide an 80% charge in as little as 20 minutes makes DC connectors particularly attractive for long-distance travel and commercial fleets where time is of the essence. As battery technology improves and the demand for faster charging solutions increases, the DC Charging Connectors segment is expected to see significant growth.

Both AC and DC charging connectors play crucial roles in the EV ecosystem, catering to different user needs and scenarios. The AC segment’s dominance is driven by its accessibility and convenience for everyday use, while the DC segment’s potential lies in meeting the evolving demands for quick and efficient charging solutions. As the market continues to expand and diversify, the dynamics between these two segments will be shaped by technological advancements, consumer preferences, and the broader transition towards sustainable transportation.

Application Analysis

In 2023, the Commercial Charging segment held a dominant market position in the EV Charging Connector Market, capturing more than a 45% share. This segment’s prominence is primarily attributed to the escalating adoption of electric vehicles (EVs) in commercial fleets and the expansion of public charging infrastructure. Businesses and municipalities are increasingly investing in commercial charging solutions to accommodate the growing number of EVs, driving the demand for robust and efficient charging connectors.

The segment’s growth is further bolstered by government incentives and policies aimed at reducing carbon emissions, which encourage the installation of public charging stations. Data indicates a significant uptrend in commercial charging infrastructure investments, with a compound annual growth rate (CAGR).

On the other hand, the Residential Charging segment is also expanding steadily, driven by the rising number of EV owners who prefer the convenience of home charging solutions. This segment benefits from technological advancements that have led to the development of faster and more reliable home chargers, making residential charging increasingly viable for daily EV users.

Lastly, the Fleet Charging segment is witnessing substantial growth due to the rise in electric commercial vehicles and governmental fleet electrification mandates. Companies are focusing on reducing operational costs and carbon footprints by adopting EVs, which in turn fuels the need for specialized fleet charging connectors and infrastructure. As fleets transition to electric, the demand for high-power, fast-charging connectors capable of servicing multiple vehicles simultaneously is expected to surge, presenting lucrative opportunities for market players in the EV Charging Connector space.

End-User Analysis

In 2023, the Individual Consumers segment held a dominant market position in the EV Charging Connector Market, capturing more than a 42% share. This leadership is attributed to the surging ownership of electric vehicles among private users, driven by increasing environmental awareness, supportive government policies, and a wider range of affordable EV models.

Individual consumers are seeking convenient, fast, and reliable charging solutions, leading to heightened demand for advanced charging connectors. The market for this segment is further expected to grow robustly, with projections indicating a compound annual growth rate (CAGR) over the next 10 years, as EV technology becomes more accessible and consumer charging infrastructure expands.

The Fleet Operators segment is also experiencing significant growth. As businesses aim to reduce operational costs and meet sustainability goals, there’s a marked shift towards electric fleets. This shift is accelerating the demand for dependable and rapid charging connectors suited for commercial use. Fleet operators require customized solutions to efficiently manage multiple vehicles, necessitating the development of sophisticated charging systems and connectors. This segment’s expansion is expected to continue as logistics and transportation companies increasingly adopt EVs.

Meanwhile, the Government and Public Infrastructure segment is pivotal in establishing a foundational network for EV charging. Governments worldwide are investing heavily in public charging infrastructure to facilitate the EV transition, enhance energy security, and meet environmental targets. This investment is not only encouraging wider EV adoption but is also critical in supporting the other market segments by providing the necessary public infrastructure for EVs. As cities and countries aim to become more sustainable, the emphasis on expanding and upgrading public EV charging facilities is set to increase, making this segment a key area of growth in the EV Charging Connector Market.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Rising Environmental Awareness: Growing consciousness about climate change and pollution has led consumers and governments to favor cleaner, electric transportation solutions, directly boosting the demand for EV charging connectors.

- Supportive Government Policies: Many governments are offering incentives such as tax rebates, grants for charging infrastructure, and stricter emissions regulations, encouraging both consumers and manufacturers to shift towards electric vehicles.

- Advancements in Technology: Continuous improvements in EV and charging technology, including faster charging times and longer battery life, are making electric vehicles more appealing and practical for everyday use.

- Increasing Investment in Infrastructure: The expansion of public and private charging networks is essential for EV adoption, with significant investments being made to enhance accessibility and convenience for EV users.

Restraining Factors

- High Initial Infrastructure Costs: The upfront cost of setting up charging stations is substantial, deterring investment in some regions and slowing down the expansion of charging networks.

- Range Anxiety Among Consumers: Potential EV buyers are often concerned about the availability and proximity of charging stations, which can restrain the market growth for EVs and related charging technologies.

- Technological Compatibility Issues: As different EVs may require different connectors or charging standards, the lack of a universal standard can complicate the usage and roll-out of charging infrastructure.

- Limited Grid Capacity: In some areas, the existing electrical grid may not have the capacity to support a widespread increase in EV charging, posing a significant challenge to market growth.

Growth Opportunities

- Wireless Charging Development: Innovations in wireless EV charging technology present a significant growth opportunity, potentially offering greater convenience and faster adoption rates.

- Emerging Markets: As countries with currently low EV penetration begin to adopt electric vehicles, there’s a substantial opportunity for market expansion into new, untapped markets.

- Fleet Electrification: The trend of electrifying public and private vehicle fleets, including buses, trucks, and corporate cars, can significantly drive demand for charging connectors.

- Integration with Renewable Energy: Linking EV charging infrastructure with renewable energy sources like solar and wind provides an opportunity for sustainable and cost-effective growth.

Challenges

- Infrastructure Scalability: Rapidly scaling up charging infrastructure to keep pace with EV adoption rates is a complex challenge, requiring coordination between various stakeholders.

- Technological Standardization: The lack of standardized connectors and charging protocols can lead to compatibility issues and hinder market growth.

- Energy Supply and Demand Management: Ensuring a reliable and consistent energy supply to meet the growing demand from EVs, especially during peak times, remains a significant challenge.

- Consumer Education and Perception: Overcoming misconceptions and educating potential users about EV and charging technology’s benefits and practicalities is crucial for market growth.

Key Market Trends

- Fast Charging Technology: The development and adoption of fast and ultra-fast charging stations, reducing the time required to charge EVs significantly, is a prominent trend in the market.

- Smart Charging Systems: Integration of smart technology in charging systems that can communicate with the grid, manage load, and optimize charging times is becoming increasingly common.

- Public-Private Partnerships: Collaborations between governments and private companies to expand charging infrastructure are trending, helping to accelerate the deployment of charging stations.

- Mobile and App-Based Charging Services: The rise of mobile apps and services for locating and accessing charging stations, as well as managing payments and other services, reflects a significant trend towards user-friendly charging solutions.

Key Market Segmentation

Connector Type

- Type 1 (SAE J1772)

- Type 2 (IEC 62196)

- CHAdeMO

- CCS (Combined Charging System)

- Wireless Charging

Charging Level

- Level 1 (Low Voltage/Standard Household Outlet)

- Level 2 (240V Charging Stations)

- Level 3 (DC Fast Charging)

Power Output

- AC Charging Connectors

- DC Charging Connectors

Application

- Residential Charging

- Commercial Charging

- Fleet Charging

End-User

- Individual Consumers

- Fleet Operators

- Government and Public Infrastructure

Regional Analysis

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the EV Charging Connector Market, capturing more than a 35% share. This is largely due to the rapid adoption of electric vehicles in countries like China, Japan, and South Korea, propelled by strong government support, advancements in EV technology, and a growing awareness of environmental issues.

The demand for EV Charging Connector in North America was valued at US$ 24.8 Million in 2023 and is anticipated to grow significantly in the forecast period. The region is not only a significant consumer market but also a hub for innovation and manufacturing in the EV sector. The market is expected to continue its robust growth with a projected CAGR in the next 10 years, driven by ongoing investments in charging infrastructure and technology.

North America is also a key player in the EV Charging Connector Market, with a significant adoption rate of electric vehicles, especially in the United States and Canada. The market is supported by a combination of policy initiatives, an increasing number of EV models available, and a growing commitment to sustainability among consumers and corporations. The region is seeing rapid expansion in both residential and public charging stations, catering to the growing demand for convenient and fast charging options.

Europe stands out for its strong commitment to reducing carbon emissions and its aggressive targets for EV adoption. The European Union’s supportive policies and incentives for electric vehicles and renewable energy have spurred significant growth in the EV Charging Connector Market. Countries like Norway, Germany, and the Netherlands are leading in terms of EV penetration and infrastructure development. The market is expected to maintain a healthy growth rate, with a focus on expanding and upgrading the charging network to accommodate the rising number of EVs.

Latin America and the Middle East and Africa (MEA) regions, while currently smaller markets, are showing promising growth potential. In Latin America, countries such as Brazil and Mexico are beginning to invest more in EV infrastructure, driven by urbanization, increasing environmental concerns, and the potential for energy diversification.

The MEA region is witnessing a growing interest in reducing oil dependency and improving air quality, leading to early stages of EV adoption and infrastructure development. As these regions continue to develop economically and technologically, they are expected to increasingly contribute to the global EV Charging Connector Market’s growth.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The EV charging connector market is characterized by the presence of several key players that contribute to the development, manufacturing, and distribution of EV charging connectors. These players offer a range of charging connectors and related products to support the growing demand for electric vehicle charging infrastructure.

Top Key Players

- Tesla Inc.

- ABB Group

- Siemens AG

- Schneider Electric

- Bosch Automotive Service Solutions

- ChargePoint Inc.

- Delta Electronics Inc.

- Schaltbau Holding AG

- Phoenix Contact

- Tritium Pty Ltd

- Eaton Corporation

- Leviton Manufacturing Co. Inc.

- Other Key Players

Recent Developments

- In 2023, TE Connectivity, a prominent provider of high-performance connectivity solutions, successfully acquired OMNIBUS. This strategic move bolsters TE’s position in the high-voltage EV charging market. OMNIBUS specializes in the development of high-power charging connectors specifically designed for commercial electric vehicles (EVs).

- In 2023, Weidmüller, a key player in connectivity solutions, entered into a partnership with Electrovaya. This collaboration is geared towards the joint development of integrated charging solutions tailored for electric buses and trucks. The focus is on advancing technology to cater to the unique charging needs of larger electric vehicles in the commercial sector.

- In 2023, Amphenol, a major player in the connectivity industry, successfully completed the acquisition of MTS Systems. This strategic acquisition serves to broaden Amphenol’s portfolio of EV charging connectors and enhance its presence in the North American market. The move is aimed at strengthening Amphenol’s position in the rapidly growing electric vehicle charging segment.

Report Scope

Report Features Description Market Value (2023) USD 70.9 Mn Forecast Revenue (2033) USD 358.7 Mn CAGR (2023-2032) 17.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Connector Type (Type 1 (SAE J1772), Type 2 (IEC 62196), CHAdeMO, CCS (Combined Charging System), Wireless Charging), By Charging Level (Level 1 (Low Voltage/Standard Household Outlet), Level 2 (240V Charging Stations), Level 3 (DC Fast Charging)), By Power Output (AC Charging Connectors, DC Charging Connectors), By Application (Residential Charging, Commercial Charging, Fleet Charging), By End-User (Individual Consumers, Fleet Operators, Government and Public Infrastructure) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Tesla Inc., ABB Group, Siemens AG, Schneider Electric, Bosch Automotive Service Solutions, ChargePoint Inc., Delta Electronics Inc., Schaltbau Holding AG, Phoenix Contact, Tritium Pty Ltd, Eaton Corporation, Leviton Manufacturing Co. Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the EV Charging Connector Market?The EV Charging Connector Market refers to the industry involved in the development, manufacturing, and distribution of connectors used to establish a physical connection between electric vehicles and charging stations for the purpose of charging the vehicle's battery.

How big is EV charging connector market?The global EV charging connector market is projected to reach a valuation of USD 358.7 Mn by 2033 at a CAGR of 17.6%, from USD 70.9 Mn in 2023.

What Factors are Driving Growth in the EV Charging Connector Market?Growth in the EV Charging Connector Market is primarily driven by the increasing adoption of electric vehicles, government initiatives promoting sustainable transportation, advancements in charging technologies, and the expansion of charging infrastructure networks.

Which Companies are Prominent in the EV Charging Connector Market?Prominent companies in the EV Charging Connector Market include TE Connectivity, Yazaki, Amphenol, and others, each contributing to the development and innovation of charging connector solutions.

What is the Significance of Wireless Charging in the EV Charging Connector Market?Wireless Charging represents an advanced segment in the market, offering a cordless and automated charging experience. Although currently holding a smaller market share, it is expected to grow as technology matures and becomes more cost-effective.

EV Charging Connector MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

EV Charging Connector MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla Inc.

- ABB Group

- Siemens AG

- Schneider Electric

- Bosch Automotive Service Solutions

- ChargePoint Inc.

- Delta Electronics Inc.

- Schaltbau Holding AG

- Phoenix Contact

- Tritium Pty Ltd

- Eaton Corporation

- Leviton Manufacturing Co. Inc.

- Other Key Players