Europe Snacks Vending Machine Market Size, Share, Growth Analysis By Product Type (Confectionery, Bakery & Cookies, Chips, Chocolate, Nuts & Seeds, Others), By Machine Type (Non Refrigerated, Refrigerated), By Payment Mechanism (Cashless, Cash), By Distribution Channel (Direct Sales, Distributors, Online Platforms), By End User (Offices, Educational Institutions, Healthcare, Hospitality, Transportation Hubs, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168006

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Machine Type Analysis

- By Payment Mechanism Analysis

- By Distribution Channel Analysis

- By End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Key Europe Snacks Vending Machine Company Insights

- Recent Developments

- Report Scope

Report Overview

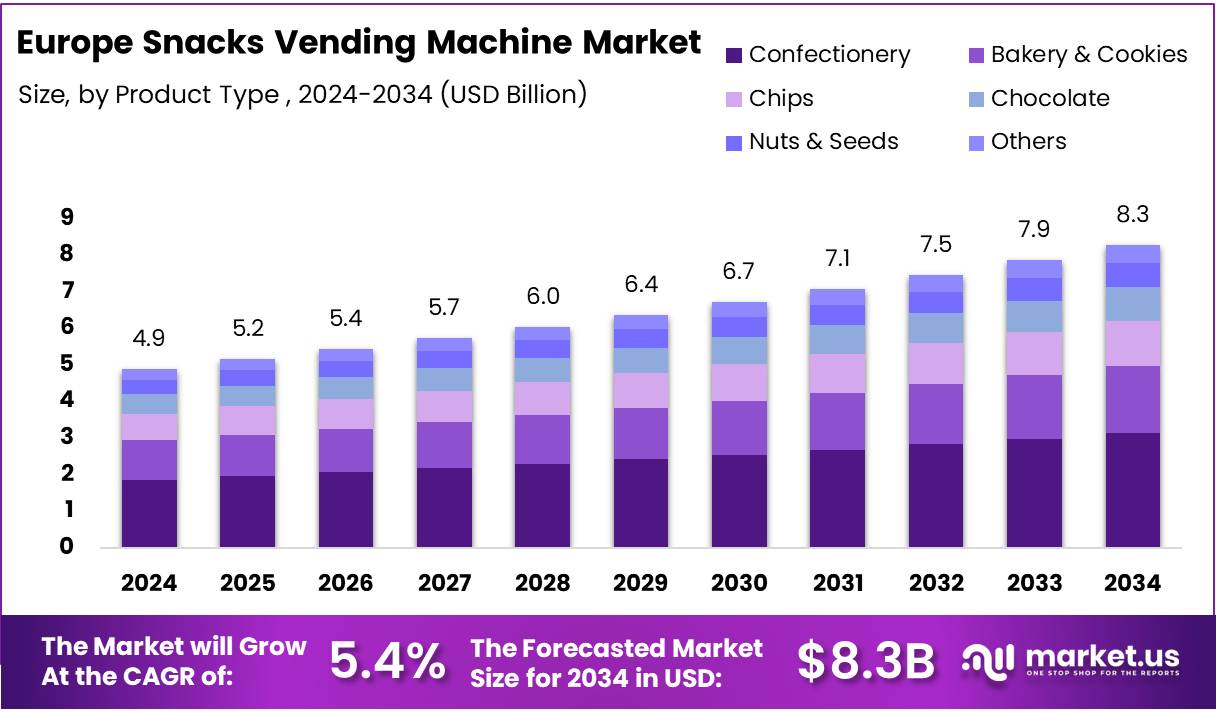

Europe Snacks Vending Machine Market size is expected to be worth around USD 8.3 Billion by 2034, from USD 4.9 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

The Europe Snacks Vending Machine Market represents a growing automated retail segment that delivers packaged snacks through self-service units across high-traffic public and private locations. It supports demand for on-the-go consumption and increases convenience for workplaces, transportation hubs, and educational institutions while reducing staffing and operational pressures for vendors.

Moving forward, the market expands due to rising adoption of smart vending technologies, stronger consumer inclination toward quick snacking, and higher acceptance of digital payments. Operators increasingly deploy energy-efficient machines and contactless systems, supporting operational efficiency and sustaining demand for modern snack vending formats across Europe’s diversified urban environments.

Additionally, the region continues benefiting from opportunities in workplace snacking, transport infrastructure upgrades, and micro-market integration. Governments further encourage digital payments and energy-efficient equipment, which indirectly supports machine modernization. As a result, operators embrace eco-friendly components, improved refrigeration, and optimized product loading to enhance rotation in European snacks vending machine networks.

Furthermore, rising interest in healthier snacking and transparent labeling creates opportunities for vendors to add balanced product mixes. Improved product rotation and real-time inventory tracking also strengthen profitability. Many operators introduce localized snack assortments, appealing to changing consumer preferences across Western and Eastern European markets while expanding automated retail penetration.

In addition, supportive policies promoting energy-efficient equipment and digital payment adoption boost machine replacement cycles. The market also benefits from enhanced placement strategies in offices, hospitals, and mobility hubs. These developments help improve margins and strengthen long-term revenue potential for snacks vending machine operators across Europe.

Finally, the market gains credibility from strong usage volumes. According to the European Vending Association, Europe hosts 3.8 million vending machines, demonstrating widespread availability. The association also reports that over 90 million food and drink items are dispensed daily, while modern machines with cashless options earn 20–45% net margins, highlighting strong profitability across the Europe Snacks Vending Machine Market.

Key Takeaways

- The Europe Snacks Vending Machine Market is valued at USD 4.9 Billion in 2024 and projected to reach USD 8.3 Billion by 2034.

- The market is expected to grow at a CAGR of 5.4% from 2025–2034 across Europe.

- Confectionery leads the product type segment with a 37.9% share in Europe.

- Non-Refrigerated machines dominate the machine type segment with 69.2% share.

- Cashless payments account for 76.5% of the payment mechanism segment in Europe.

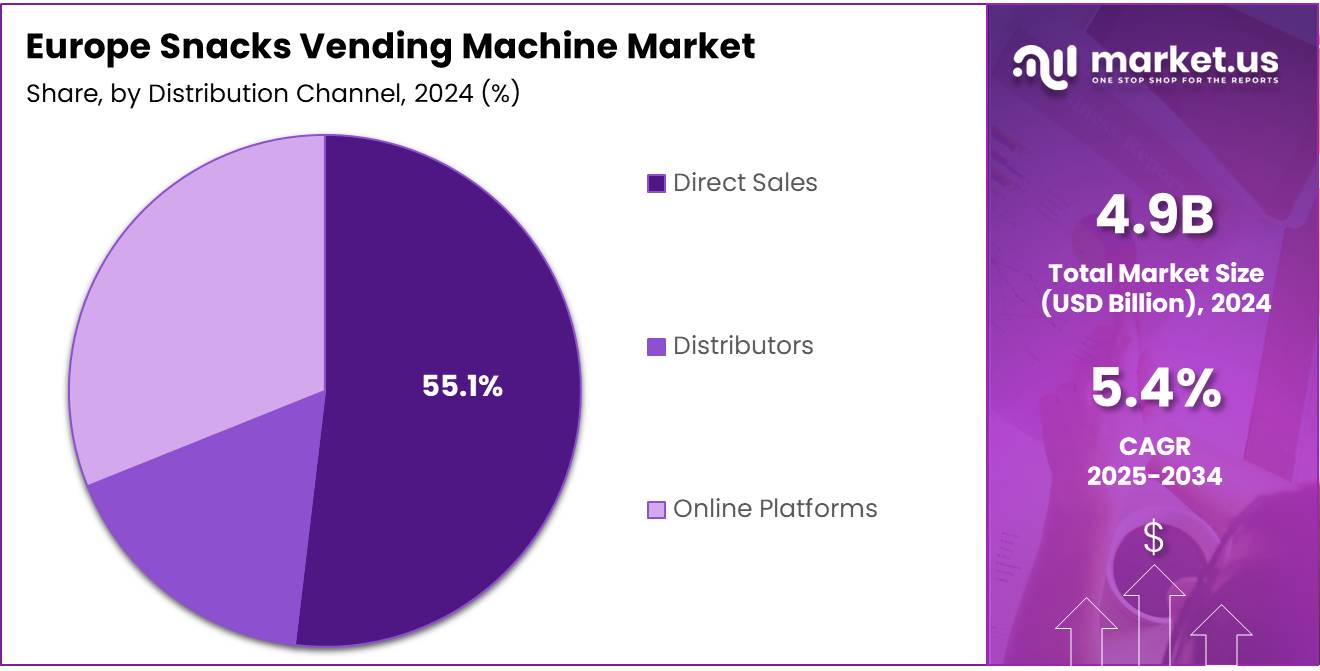

- Direct Sales hold the largest distribution share at 55.1% in Europe.

- Offices represent the top end-user segment with a 26.7% market share.

By Product Type Analysis

Confectionery dominates with 37.9% driven by strong impulse buying and consistent workplace demand.

In 2024, Confectionery held a dominant market position in the By Product Type segment of the Europe Snacks Vending Machine Market, with a 37.9% share. Its quick purchase appeal and wide flavour range support higher turnover. Additionally, strong brand visibility across offices and transit points further boosts repeat sales momentum.

Bakery & Cookies continued gaining traction as consumers looked for familiar, comforting snacks during short breaks. The segment benefits from longer shelf life and rising preference for portion-controlled baked items. Vendors expand offerings through diverse flavours, appealing to both younger consumers and workplace buyers seeking convenient snacking options.

Chips advanced steadily as consumers preferred salty snacks with strong flavour innovation. Vending operators increasingly stock premium and low-fat alternatives to attract health-conscious buyers. Chips also benefit from strong packaging durability that suits vending formats, ensuring product freshness and higher acceptance across urban micro-markets.

Chocolate sustained high engagement due to brand loyalty and impulse-driven demand. Seasonal variants and mini-packs help vending operators increase turnover while maintaining affordability. Its year-round consumption pattern ensures stable demand, especially in high-traffic office corridors and educational institutions where quick energy boosts are preferred.

Nuts & Seeds increased in relevance with Europe’s growing focus on healthier snacking. High protein content and natural energy appeal make them suitable for workplaces and travel hubs. Premium seed mixes and roasted options support higher margins for operators while addressing shifting dietary patterns across young professionals.

Others recorded stable adoption as vending operators experiment with new snacks, dried fruits, and functional bites. These options allow customization based on venue demographics. Their presence enhances flexibility in inventory rotation, helping meet varied snacking preferences across universities, co-working spaces, and modern hospitality environments.

By Machine Type Analysis

Non Refrigerated dominates with 69.2% due to simpler operation and lower maintenance needs.

In 2024, Non Refrigerated machines held a dominant market position in the By Machine Type segment of the Europe Snacks Vending Machine Market, with a 69.2% share. Operators prefer them for lower energy use, easy stocking, and better compatibility with dry packaged snacks sold across office buildings and learning environments.

Refrigerated machines expanded gradually as demand for chilled snacks and premium items increased. These units attract buyers seeking fresh formats like cold bars or yogurt snacks. While higher in maintenance, their growing appeal across transport hubs and hospitals strengthens their long-term adoption potential within diversified vending portfolios.

By Payment Mechanism Analysis

Cashless dominates with 76.5% supported by rising digital adoption.

In 2024, Cashless systems held a dominant market position in the By Payment Mechanism segment of the Europe Snacks Vending Machine Market, with a 76.5% share. Users increasingly rely on contactless cards and mobile wallets, reducing transaction friction and improving machine uptime while also supporting higher purchase frequency across busy locations.

Cash payments maintained relevance in mixed-traffic venues where digital access varies. These machines remain essential for public spaces, offering accessibility for all users. Despite declining usage, they ensure broader coverage and support occasional buyers who prefer traditional payment methods across certain regional clusters and community facilities.

By Distribution Channel Analysis

Direct Sales dominates with 55.1% due to operator preference for controlled deployment.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Europe Snacks Vending Machine Market, with a 55.1% share. Companies prefer direct procurement for better cost control, tailored configurations, and streamlined maintenance schedules across offices, schools, and transportation ecosystems.

Distributors contributed significantly by helping smaller operators access machines without long purchase cycles. They provide flexible leasing and diverse machine options, enabling rapid expansion into new localities. Their role grows as emerging operators seek scalable solutions without heavy upfront investment in equipment.

Online Platforms advanced steadily as businesses adopt digital procurement for quick comparisons and faster delivery. Online purchasing allows operators to access updated models and spare parts easily. The channel continues rising as remote management trends and digital convenience influence decision-making across vending entrepreneurs.

By End User Analysis

Offices dominate with 26.7% supported by consistent workplace snacking demand.

In 2024, Offices held a dominant market position in the By End User segment of the Europe Snacks Vending Machine Market, with a 26.7% share. Workplace culture encourages quick snacking, driving steady engagement. Employers increasingly adopt vending solutions to support employee convenience and reduce time spent on external breaks.

Educational Institutions expanded steadily as students prefer quick snacks during breaks. Operators introduce affordable and healthier options to match evolving campus preferences. Vending machines remain essential for high-traffic academic zones due to consistent footfall and demand for accessible, low-cost snacking choices throughout the day.

Healthcare settings rely on vending machines for round-the-clock snack access for staff and visitors. Hospitals and clinics prefer compact, reliable machines that serve diverse dietary needs. Their continuous operations support stable sales volumes in environments where convenience and time efficiency remain top priorities.

Hospitality adopted vending to enhance guest convenience, especially in budget and mid-scale hotels. Machines placed in lobbies and corridors provide quick access to snacks without requiring staffed counters. This supports operational efficiency while addressing the needs of travelers seeking late-night or on-the-go refreshments.

Transportation Hubs recorded strong usage due to high movement and frequent impulse purchases. Airports, metro stations, and bus terminals utilize vending machines to meet traveler expectations for fast service. Compact layouts and reliable stocking help drive stable turnover across these dynamic environments.

Others cover community centers, public buildings, and recreational venues where vending machines fill service gaps. Flexible placement and low staffing needs make them suitable for diverse end-user profiles. Their presence supports modern convenience culture and broadens market penetration across multiple urban and suburban clusters.

Key Market Segments

By Product Type

- Confectionery

- Bakery & Cookies

- Chips

- Chocolate

- Nuts & Seeds

- Others

By Machine Type

- Non Refrigerated

- Refrigerated

By Payment Mechanism

- Cashless

- Cash

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

By End User

- Offices

- Educational Institutions

- Healthcare

- Hospitality

- Transportation Hubs

- Others

Drivers

Increasing Demand for Quick On-The-Go Snacking Across Urban European Lifestyles

The Europe snacks vending machine market is expanding as consumers increasingly prefer quick on-the-go snacking. Busy work schedules, longer commuting hours, and the rise of single-person households are pushing people toward convenient snack options. This shift supports strong demand for vending machines placed in offices, transport hubs, and public areas across major European cities.

At the same time, the rapid expansion of digital payments is making vending machine transactions faster and more accessible. With widespread use of contactless cards, mobile wallets, and QR payments, consumers now make purchases without cash. This seamless buying experience encourages more frequent usage and improves overall machine turnover, helping operators achieve better profitability.

Additionally, compact snack vending units are gaining popularity in Europe, especially in small retail and hospitality settings. Hotels, cafés, co-working spaces, and local shops increasingly adopt these smaller machines to offer added convenience without occupying large floor space. Their flexible installation and lower maintenance needs make them attractive for businesses looking to enhance customer service.

Restraints

Declining Footfall in Traditional Vending Locations Restrains Market Growth

The Europe snacks vending machine market is experiencing pressure due to falling visitor numbers in traditional placement areas. Offices, transport hubs, and educational institutions are seeing lower daily footfall as hybrid work models and flexible travel routines become more common. This shift reduces consistent demand for quick snacks, ultimately limiting machine utilisation. As a result, operators face declining sales volumes and weaker profitability across several urban markets.

Additionally, this drop in routine visitors forces vending machine providers to rethink their location strategy. They must invest more time and resources in identifying alternative high-traffic zones, which increases operational complexity. This transition period further slows down market momentum, especially for small and regional operators.

Another restraint comes from the limited availability of approved vending spaces in highly regulated European city centres. Many municipalities impose strict rules on outdoor equipment placement, visual design, and hygiene compliance. These restrictions reduce the number of authorised public spots where snack vending machines can be installed. Consequently, operators struggle to expand their networks even in cities with strong consumer demand.

Moreover, compliance with local regulations often requires additional permits and cost-heavy approvals. This adds financial burden and delays installation timelines, creating operational barriers. Together, these challenges limit the full growth potential of Europe’s snacks vending machine market.

Growth Factors

Expansion of Smart Cashless Snack Vending Drives Market Growth

The Europe Snacks Vending Machine Market offers strong growth opportunities as more universities and co-working hubs adopt smart cashless vending. These spaces attract young and tech-savvy users who prefer quick and convenient snack purchases. As contactless transactions grow across Europe, operators can expand placement and drive higher usage.

Additionally, the rising focus on health and wellness across Europe creates a major opportunity for integrating healthy snack ranges. Consumers are increasingly choosing low-sugar, high-protein, and clean-label snacks. By upgrading product selections, vending operators can tap into this fast-growing demand and strengthen customer loyalty in workplaces, gyms, and education settings.

Moreover, micro-market concepts are emerging as a complementary opportunity to traditional vending. These small, self-service retail setups provide a wider range of snacks and beverages while still requiring minimal staffing. They suit corporate offices, residential complexes, and logistics hubs where employees look for flexible food options. As companies modernize employee facilities, micro-markets can expand significantly.

Emerging Trends

Rising Shift Toward AI-Optimized Snack Recommendations Drives Market Trends

The Europe snacks vending machine market is seeing strong traction as operators increasingly adopt AI-driven recommendation systems. These smart interfaces help personalise snack choices based on purchase history and real-time demand. As a result, vending machines are becoming more interactive, improving user engagement and encouraging repeat purchases across busy urban locations.

Touchless snack dispensing technologies are also trending as consumers continue to prefer safer and more hygienic purchasing experiences. This shift grew after the pandemic, but it now remains a long-term behavioural change. Touchless systems, using QR codes or mobile apps, help reduce physical contact and improve overall convenience, especially in high-traffic settings like universities and transport hubs.

Another major trend shaping the market is the growing inclusion of locally sourced and sustainable snack brands. European consumers increasingly look for eco-friendly products, and vending operators are responding by stocking regional items with lower carbon footprints. This transition supports local producers while aligning vending machines with broader sustainability goals across Europe.

Key Europe Snacks Vending Machine Company Insights

Crane Co. remains a leading innovator in Europe’s snacks vending segment, leveraging reliable hardware and scalable service models. As an analyst, I see Crane’s strength in long-term contracts and maintenance capabilities that reduce downtime for operators. Their focus on modular machines supports quick product mix changes and cost-efficient upgrades for network operators.

Sanden Holdings Corporation brings strong refrigeration and compact-unit expertise relevant to snack freshness and energy efficiency. From an industry viewpoint, Sanden’s technology helps operators meet sustainability and product-quality demands while containing operating expenses. Their reputation for durable components makes them a preferred choice for busy urban locations.

Azkoyen, S.A. is notable for user interface advances and integrated cashless payment options that increase transaction speed and basket size. Analysts observing purchasing behavior note Azkoyen’s emphasis on software-driven merchandising, which supports dynamic pricing and targeted promotions. This capability improves revenue per machine and strengthens operator margins.

Evoca Group S.p.A. combines broad portfolio diversity with strong after-sales support, offering both premium and compact snack vending solutions. In my assessment, Evoca’s integrated service network and customizable machine designs give operators flexibility across channels from offices to transit hubs. Their attention to lifecycle services helps control total cost of ownership and preserves network uptime.

Top Key Players in the Market

- Crane Co.

- Sanden Holdings Corporation

- Azkoyen, S.A.

- Evoca Group S.p.A.

- Fuji Electric Co., Ltd.

- Seaga Manufacturing, Inc.

- Bianchi Vending S.p.A.

- Jofemar

- Automatic Products Company, Inc.

- Westomatic Vending Machines Ltd.

Recent Developments

- In January 2025, Husky acquired Selfly Store in Europe, aiming to strengthen its leadership in intelligent refrigeration and microstore vending solutions.This move enables Husky to expand its footprint across 20+ countries with advanced automated retail capabilities.

- In March 2024, Selecta Group formed a strategic partnership with TINE to advance food and beverage vending solutions in Norway.The collaboration focuses on building a sustainable development model that enhances modern vending experiences.

- In May 2024, Panasonic Corporation introduced its next-generation vending machines powered by advanced AI systems.These machines integrate facial recognition for personalized recommendations and offer seamless contactless payments to elevate user experience.

- In March 2024, Nestlé and PepsiCo established a new partnership to add Nestlé products to PepsiCo’s vending networks.This initiative supports Nestlé’s expansion while enabling PepsiCo to diversify its product offerings in automated retail.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 8.3 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Confectionery, Bakery & Cookies, Chips, Chocolate, Nuts & Seeds, Others), By Machine Type (Non Refrigerated, Refrigerated), By Payment Mechanism (Cashless, Cash), By Distribution Channel (Direct Sales, Distributors, Online Platforms), By End User (Offices, Educational Institutions, Healthcare, Hospitality, Transportation Hubs, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Crane Co., Sanden Holdings Corporation, Azkoyen, S.A., Evoca Group S.p.A., Fuji Electric Co., Ltd., Seaga Manufacturing, Inc., Bianchi Vending S.p.A., Jofemar, Automatic Products Company, Inc., Westomatic Vending Machines Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Snacks Vending Machine MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Snacks Vending Machine MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Crane Co.

- Sanden Holdings Corporation

- Azkoyen, S.A.

- Evoca Group S.p.A.

- Fuji Electric Co., Ltd.

- Seaga Manufacturing, Inc.

- Bianchi Vending S.p.A.

- Jofemar

- Automatic Products Company, Inc.

- Westomatic Vending Machines Ltd.