Global Ethylene Oxide Catalyst Market By Purity(Upto 98%, Above 98%), By Formulations(Technical Material, Wettable Granule, Suspo-Emulsion, Suspension Concentrate, Others), By Application(Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By End-use(Agriculture, Non-Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123430

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

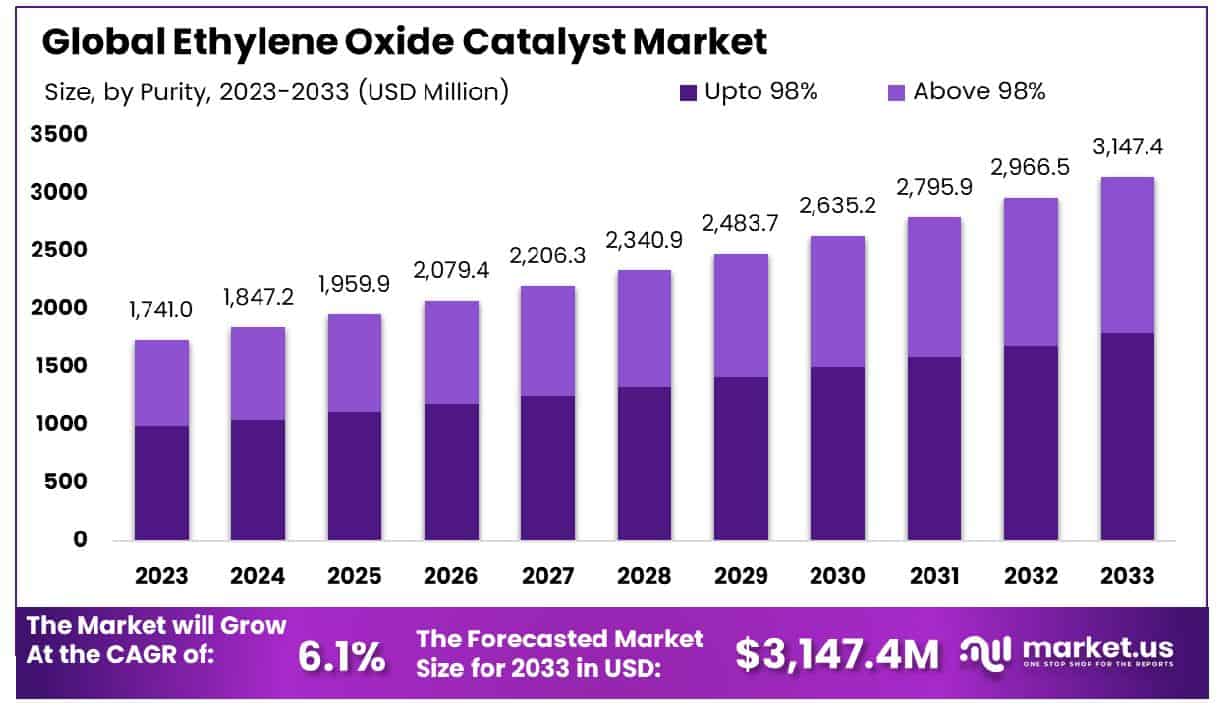

The Global Ethylene Oxide Catalyst Market size is expected to be worth around USD 3,147.4 Million by 2033, From USD 1,741.0 Million by 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Ethylene Oxide Catalyst Market encompasses the production and distribution of catalysts used primarily in the manufacturing of ethylene oxide, a critical precursor for producing essential derivatives like ethylene glycol. These catalysts, typically comprising silver-based materials, are integral to optimizing production efficiency, enhancing yield, and reducing operational costs in ethylene oxide plants.

The market’s strategic importance is underscored by its direct impact on the broader chemical, automotive, and textile industries, where ethylene oxide derivatives are extensively utilized. This market is crucial for executives aiming to leverage advancements in catalytic technologies to streamline operations and drive profitability in their respective sectors.

The Ethylene Oxide Catalyst Market is currently navigating a complex landscape marked by regulatory pressures and evolving industry standards. In 2022, facilities in the U.S. reported a total of 9,166 pounds of ethylene oxide released into the air, indicating a nuanced shift in the market dynamics. Notably, the chemical manufacturing sector remains the predominant source of ethylene oxide emissions.

However, a significant 7% increase in emissions from 2021 to 2022 can be attributed to the entrance of newly-reporting contract sterilization facilities. This increase contrasts with the broader decade-long trend where ethylene oxide emissions have substantially declined by 43%, from 124,000 pounds in 2013 to 9,166 pounds in 2022. This reduction reflects the industry’s successful efforts to enhance safety and environmental standards.

Looking ahead, the Ethylene Oxide Catalyst Market is poised for transformation, influenced by regulatory changes and the push for more sustainable industrial practices. Companies operating in this space will need to continue innovating and adapting to maintain compliance and leverage new market opportunities arising from these regulatory shifts.

Key Takeaways

- The ethylene oxide catalyst market is projected to grow from USD 1,741.0 million in 2023 to USD 3,147.4 million by 2033, at a 6.1% CAGR.

- Asia-Pacific holds 39.8% of the Ethylene Oxide Catalyst Market, USD 692.9 Mn.

- By Purity Up to 98% holds 61.2% of the market share.

- Formulations include Technical Material, Wettable Granules, Suspo-Emulsion, and others.

- Cereals and Grains application dominates with 47% market coverage.

- End-use in Agriculture constitutes 67.5% of market utilization.

Driving Factors

Rising Demand for Polyester Fibers in the Textile Industry

The surge in demand for polyester fibers within the textile industry emerges as a significant catalyst for the Ethylene Oxide Catalyst market. Polyester, primarily derived from ethylene, is integral to producing fabrics that offer durability, resistance to shrinking and stretching, and improved wrinkle resistance. As the textile sector expands, fueled by the growing population and increasing income levels, especially in developing regions, the demand for polyester fibers escalates.

This demand propels the production of ethylene oxide, which in turn boosts the need for efficient catalysts to enhance production rates and yields. This relationship underscores the pivotal role of the textile industry in driving the growth of the Ethylene Oxide Catalyst market.

Increased Use of Antifreeze in Automotive Applications

The automotive sector’s reliance on ethylene glycol, a derivative of ethylene oxide, for antifreeze and coolant solutions significantly contributes to the expansion of the Ethylene Oxide Catalyst market. Ethylene glycol is essential for maintaining engine operation under extreme temperatures, which is critical for vehicle performance and longevity.

The growth of the automotive industry, particularly with the increasing production and sales of vehicles globally, heightens the demand for antifreeze. This increased production necessitates the efficient synthesis of ethylene oxide, thus elevating the demand for advanced catalysts that can enhance production efficiency and reduce associated environmental impacts.

Global Expansion of Personal Care and Pharmaceutical Sectors

The global expansion of the personal care and pharmaceutical industries plays a critical role in driving the demand for ethylene oxide catalysts. Ethylene oxide is widely used for sterilizing medical supplies and manufacturing a variety of personal care products, such as detergents, thickeners, and solvents. As health awareness increases and consumer preferences shift towards more hygienic and sterile products, the demand for ethylene oxide escalates.

This increase is particularly pronounced in emerging markets where healthcare infrastructure is developing rapidly, further stimulated by the global aging population. This rising demand underpins the growth of the Ethylene Oxide Catalyst market, as manufacturers seek more efficient and environmentally friendly catalytic processes to meet global standards and regulations.

Restraining Factors

Stringent Environmental Regulations Regarding Volatile Organic Compound Emissions

The imposition of stringent environmental regulations concerning the emissions of volatile organic compounds (VOCs) significantly impacts the Ethylene Oxide Catalyst market. Ethylene oxide is categorized as a VOC and a potential carcinogen, leading regulatory bodies worldwide to enforce tight controls on its production and use. These regulations necessitate the development of catalysts that can minimize VOC emissions during ethylene oxide production.

Although these stringent standards pose challenges, they also drive innovation within the catalyst market. Companies are compelled to develop more efficient and environmentally friendly catalyst technologies, which, while initially slowing growth due to compliance costs and operational adjustments, ultimately enhance market sustainability and open new opportunities for advanced product offerings.

High Cost of Catalyst Production and Silver Volatility

The production of ethylene oxide catalysts, particularly those based on silver, involves significant expenditure, influenced by the volatility in silver prices. Silver-based catalysts are pivotal in the ethylene oxide production process due to their high selectivity and efficiency. However, fluctuations in silver prices can lead to unpredictable costs, affecting the financial planning of catalyst manufacturers. The high cost of catalyst production not only impacts pricing strategies but also the profitability of catalyst manufacturers.

Furthermore, the volatility of silver prices introduces a layer of financial risk that can deter investment in catalyst production capabilities, restraining the market growth. Together, the high production costs and material price volatility necessitate strategic planning and innovative solutions to manage expenses and maintain market stability.

By Purity Analysis

Ethylene Oxide Catalyst market by purity up to 98% holds a substantial share of 61.2%.

In 2023, the “Up to 98%” purity segment held a dominant market position in the By Purity segment of the Ethylene Oxide Catalyst Market, capturing more than a 61.2% share. This segment’s lead in the market can be attributed to its widespread application across various industries where slightly lower purity levels are sufficient and cost-effective. Industries such as textiles, antifreeze production, and certain non-critical chemical synthesis processes primarily utilize this purity grade, balancing cost and performance effectively.

On the other hand, the “Above 98%” purity segment, while smaller, caters to applications requiring high-grade ethylene oxide, especially in sectors where the highest purity is non-negotiable, such as in certain pharmaceutical applications and food and beverage sterilization. This segment benefits from stringent industry standards and regulations that demand superior quality and performance, justifying the higher price point associated with this purity level.

The substantial market share of the “Up to 98%” segment underscores the broader industrial demand for ethylene oxide where absolute purity is less critical than cost and efficiency. This segment’s dominance is also a reflection of the larger volume of applications that do not require the premium properties of the highest purity ethylene oxide, making it a key driver of volume growth in the market.

As the Ethylene Oxide Catalyst market progresses, the dynamics between these two segments may shift with technological advancements that could lower the cost of achieving higher purities or with regulatory changes that might impose stricter purity requirements across more applications. This ongoing evolution will continue to shape the competitive landscape and strategic positioning within the market.

By Formulations Analysis

Available formulations include Technical Material, Wettable Granule, Suspo-Emulsion, Suspension Concentrate, and others.

In 2023, Technical Material, Wettable Granule, Suspo-Emulsion, and Suspension Concentrate formulations collectively held a dominant market position in the By Formulations segment of the Ethylene Oxide Catalyst Market. Each formulation caters to specific industrial needs and application methods, influencing their adoption rates and market penetration.

Technical Material stands as a foundational form, often used in the initial stages of product development and manufacturing. Its versatility makes it a popular choice for a broad range of chemical processes, where it is later adapted into more specific formulations.

Wettable Granules (WG) are highly favored in applications requiring precise dosing and reduced dust exposure, making them suitable for both agricultural and industrial environments. Their ease of use and safety profile contribute significantly to their market share.

Suspo-emulsion (SE) formulations provide the benefits of both suspension concentrates and emulsifiable concentrates, offering improved stability and efficacy. This dual nature drives its popularity, particularly in pesticide and herbicide applications where performance in diverse environmental conditions is critical.

Suspension Concentrate (SC) formulations are preferred for their high active ingredient content and absence of organic solvents, aligning with the increasing regulatory and environmental pressures to reduce VOC emissions. SCs are especially prevalent in the agricultural sector, where they ensure the effective delivery of active ingredients without the complications of solvent-based formulations.

The “Others” category includes specialized formulations tailored to niche markets or innovative new applications that are emerging in response to technological advancements and shifting market demands.

By Application Analysis

By application, Cereals and Grains dominate, contributing to 47% of the Ethylene Oxide Catalyst market usage.

In 2023, Cereals and Grains held a dominant market position in the By Application segment of the Ethylene Oxide Catalyst Market, capturing more than a 47% share. This significant market share reflects the extensive use of ethylene oxide in processing and storing cereals and grains, which are staple foods globally. The demand in this segment is driven by the need to maintain crop quality and extend shelf life, ensuring food security and market stability.

The Pulses and Oilseeds segment also represents a considerable portion of the market, benefitting from the use of ethylene oxide in enhancing the safety and longevity of these high-protein crops. As global dietary patterns shift towards more plant-based proteins, the demand in this segment is expected to see robust growth.

Fruits and Vegetables follow closely, where ethylene oxide plays a crucial role in sterilization and preservation processes. This application is particularly important given the perishable nature of these products and the global trend towards healthier, fresher food choices.

The ‘Others’ category encompasses a variety of minor applications in different agricultural sectors, including ornamental plants and non-food crops. While smaller in scale, these applications contribute to the diversity and resilience of the Ethylene Oxide Catalyst market.

Collectively, these segments highlight the pervasive role of ethylene oxide across various agricultural applications. The dominance of cereals and grains is anchored in their fundamental role in global agriculture and food supply chains, while growth in other segments is spurred by evolving consumer preferences and agricultural practices. As the market evolves, technological innovations and regulatory changes will likely further influence these dynamics, presenting ongoing opportunities and challenges in the Ethylene Oxide Catalyst market.

By End-use Analysis

In terms of end-use, the agriculture sector is the largest, accounting for 67.5% of the market.

In 2023, Agriculture held a dominant market position in the By End-use segment of the Ethylene Oxide Catalyst Market, capturing more than a 67.5% share. This substantial portion underscores the critical role of ethylene oxide in agricultural applications, primarily in the production of agrochemicals such as pesticides and fertilizers. The reliance on these products to enhance crop yield and quality in response to global food demand drives the consumption of ethylene oxide, reflecting directly on the catalyst market.

The Non-Agriculture segment, although smaller in market share, represents a diverse array of industries including pharmaceuticals, textiles, and automotive, where ethylene oxide is used in sterilization processes, as a raw material in polyester production, and in the manufacture of antifreeze, respectively. This segment benefits from the broad applications of ethylene oxide across various industrial sectors, supporting steady growth despite holding a lesser share compared to agriculture.

The stark contrast in market share between these segments highlights the specific demand dynamics within the Ethylene Oxide Catalyst market. Agriculture’s dominance is bolstered by increasing agricultural intensification, particularly in emerging economies where the expansion of agrochemical use is critical to meet escalating food production targets. Meanwhile, the non-agriculture segment’s growth is fueled by innovations in product usage and expanding industrial activities globally, which diversify the applications of ethylene oxide and, by extension, influence the demand for catalysts.

Key Market Segments

By Purity

- Upto 98%

- Above 98%

By Formulations

- Technical Material

- Wettable Granule,

- Suspo-Emulsion

- Suspension Concentrate

- Others

By Application

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By End-use

- Agriculture

- Non-Agriculture

Growth Opportunities

Development of More Efficient and Environmentally Friendly Catalysts

The Ethylene Oxide Catalyst market in 2023 stands poised to capitalize on significant growth opportunities by developing more efficient and environmentally friendly catalysts. Innovations in catalyst technology that enhance the selectivity and yield of ethylene oxide production while reducing harmful emissions are critical. Such advancements align with the global push towards sustainability and stricter environmental regulations.

By improving efficiency, these new catalysts reduce the consumption of raw materials and energy, thereby lowering production costs and enhancing the environmental profile of the manufacturing process. This shift meets regulatory compliance and appeals to a broader range of stakeholders, including environmentally conscious consumers and investors looking for sustainable investment opportunities. The companies that lead in these technological advancements are likely to gain a competitive edge in the market, attracting partnerships and funding aimed at sustainable industrial practices.

Expansion into Emerging Markets with Increasing Industrial Activities

2023 offers a strategic opportunity for the Ethylene Oxide Catalyst market to expand into emerging markets that are experiencing increased industrial activities. Countries in regions such as Asia-Pacific and Latin America are witnessing rapid industrial growth, heightened by urbanization and economic development. These markets present a fertile ground for the application of ethylene oxide in sectors such as textiles, automotive, and healthcare, which are flourishing in these regions.

By establishing a presence in these emerging markets, catalyst manufacturers can tap into new customer bases and benefit from the local growth dynamics. The expansion strategy not only diversifies the market reach but also mitigates risks associated with dependency on mature markets. Moreover, the local production of ethylene oxide catalysts can reduce logistical costs and streamline supply chains, enhancing market penetration and overall profitability in these burgeoning economies.

Latest Trends

Adoption of Nano-Technology in Catalyst Manufacturing

In 2023, the global Ethylene Oxide Catalyst market was significantly shaped by the adoption of nano-technology in catalyst manufacturing. This trend capitalizes on the unique properties of nanoparticles, which enhance the activity and selectivity of catalysts. Nano-technology facilitates the development of catalysts with increased surface area and active sites, leading to higher reaction efficiencies and lower energy requirements.

The integration of nano-technology not only boosts the performance of ethylene oxide production but also enables manufacturers to meet the growing demand for high-quality ethylene oxide used in a variety of industrial applications. As industries continue to seek more efficient and cost-effective production methods, the adoption of nano-technology in catalyst design is likely to become a pivotal competitive differentiator, driving innovation and attracting investment in research and development.

Increased Focus on Catalyst Recycling and Long-Term Usability

Another prominent trend in the Ethylene Oxide Catalyst market is the increased focus on catalyst recycling and long-term usability. With environmental concerns and sustainability becoming central to industrial operations, companies are increasingly prioritizing the lifecycle management of catalysts. Recycling catalysts not only reduces waste and environmental impact but also lowers the costs associated with raw material procurement, especially in volatile commodity markets.

The emphasis on extending the usability of catalysts through regeneration and recycling techniques is reshaping market strategies. This approach not only aligns with global sustainability goals but also enhances the economic efficiency of the ethylene oxide production process. Companies that innovate in this area are likely to see enhanced market reputation and customer loyalty, driven by their commitment to sustainable practices.

Regional Analysis

In 2023, the Asia-Pacific Ethylene Oxide Catalyst market holds a 39.8% share, valued at USD 692.9 million.

The Ethylene Oxide Catalyst market is segmented into five key regions: North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America, each exhibiting distinct market dynamics and growth potentials.

Asia-Pacific is the dominant region in the Ethylene Oxide Catalyst market, commanding a 39.8% market share with a valuation of USD 692.9 million. The region’s dominance is propelled by robust industrial growth, particularly in China and India, where there is significant expansion in the textile, automotive, and personal care industries. These sectors heavily rely on ethylene oxide for production processes, thus driving demand for efficient catalysts.

In North America, the market is driven by advanced technological adoption and stringent environmental regulations that mandate the use of high-efficiency and low-emission catalysts. The U.S. is a significant contributor, focusing on innovative catalyst technologies that enhance ethylene oxide production while minimizing environmental impact.

Europe follows a similar trajectory with a strong emphasis on sustainability and environmental compliance. The region’s mature markets, including Germany and France, are investing in recycling and long-term usability of catalysts, aligning with the European Union’s green policies.

The Middle East & Africa region is witnessing gradual growth, influenced by its developing petrochemical sector. Investments in expanding refinery capacities, particularly in the Gulf countries, are expected to boost the demand for ethylene oxide catalysts.

Latin America, though smaller in comparison, shows potential due to increasing industrial activities in countries like Brazil and Argentina. The region is slowly adopting more advanced technologies to improve its competitive stance in the global market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Ethylene Oxide Catalyst market is characterized by the participation of several key companies, each contributing to the dynamic landscape through strategic innovations, geographic expansions, and technology integration. Companies like AnHui HaiShun Chemical, BASF, and Bayer are prominent players, demonstrating robust capabilities in research and development, which allow for enhancements in catalyst efficiency and environmental compliance.

BASF, a leader in chemical solutions, continues to pioneer advanced catalyst technologies that support higher yield processes, reducing the environmental footprint of ethylene oxide production. Bayer, with its diversified expertise in chemicals and pharmaceuticals, leverages its interdisciplinary knowledge to enhance the quality and application efficiency of its catalyst products.

Emerging players such as Hangzhou Weiyuan Chemical and Kaimei Taike (Tianjin) Chemical Technology also play crucial roles, particularly in Asia-Pacific, by responding rapidly to regional demands and customizing solutions to local industrial needs. Their focus on market-specific challenges helps in addressing the unique environmental and operational requirements of the Asia-Pacific region.

Companies like Syngenta and Corteva, traditionally known for their agricultural focus, integrate ethylene oxide catalysts in the production of agrochemicals, thus diversifying the application landscape of the market. This not only broadens the market scope but also introduces specialized catalysts tailored for specific industrial applications.

Sumitomo Chemical and UPL are notable for their strategic expansions and collaborations, aiming to harness global growth opportunities and reinforce their market positions. These companies invest in scalable production capacities to meet the growing global demand effectively.

Market Key Players

- AnHui HaiShun Chemical

- BASF

- Bayer

- Corteva

- Element Solutions

- Gowan

- Hangzhou Weiyuan Chemical

- Indofil

- ISAGRO

- Junkai (Tianjin) Chemical

- Kaimei Taike (Tianjin) Chemical Technology

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL

- Vesino Industrial

- Wuxi City Jia Bao Pharmaceutical

Recent Development

- In 2023, Kaimei Taike (Tianjin) Chemical Technology has been actively engaged in the ethylene oxide catalyst sector. The ethylene oxide (EO) market experienced significant growth, with a capacity increase of 14.91%, or 1.12 million tons per year, culminating in a total capacity of 8.633 million tons by year’s end.

- In September 2022, ISAGRO will use Shell’s S-896 catalyst for ethylene oxide production, enhancing selectivity and reducing CO2 emissions, aligning with sustainability and economic efficiency goals

Report Scope

Report Features Description Market Value (2023) USD 1,741.0 Million Forecast Revenue (2033) USD 3,147.4 Million CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity(Upto 98%, Above 98%), By Formulations(Technical Material, Wettable Granule, Suspo-Emulsion, Suspension Concentrate, Others), By Application(Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By End-use(Agriculture, Non-Agriculture) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AnHui HaiShun Chemical, BASF, Bayer, Corteva, Element Solutions, Gowan, Hangzhou Weiyuan Chemical, Indofil, ISAGRO, Junkai (Tianjin) Chemical, Kaimei Taike (Tianjin) Chemical Technology, Nufarm, Sumitomo Chemical, Syngenta, UPL, Vesino Industrial, Wuxi City Jia Bao Pharmaceutical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Ethylene Oxide Catalyst Market Size in 2023?The Global Ethylene Oxide Catalyst Market Size is USD 1,741.0 Million in 2023.

What is the projected CAGR at which the Global Ethylene Oxide Catalyst Market is expected to grow at?The Global Ethylene Oxide Catalyst Market is expected to grow at a CAGR of 6.1% (2024-2033).

List the segments encompassed in this report on the Global Ethylene Oxide Catalyst Market?Market.US has segmented the Global Ethylene Oxide Catalyst Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Purity(Upto 98%, Above 98%), By Formulations(Technical Material, Wettable Granule, Suspo-Emulsion, Suspension Concentrate, Others), By Application(Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By End-use(Agriculture, Non-Agriculture)

List the key industry players of the Global Ethylene Oxide Catalyst Market?AnHui HaiShun Chemical, BASF, Bayer, Corteva, Element Solutions, Gowan, Hangzhou Weiyuan Chemical, Indofil, ISAGRO, Junkai (Tianjin) Chemical, Kaimei Taike (Tianjin) Chemical Technology, Nufarm, Sumitomo Chemical, Syngenta, UPL, Vesino Industrial, Wuxi City Jia Bao Pharmaceutical

Name the key areas of business for Global Ethylene Oxide Catalyst Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Ethylene Oxide Catalyst Market.

Ethylene Oxide Catalyst MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Ethylene Oxide Catalyst MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AnHui HaiShun Chemical

- BASF

- Bayer

- Corteva

- Element Solutions

- Gowan

- Hangzhou Weiyuan Chemical

- Indofil

- ISAGRO

- Junkai (Tianjin) Chemical

- Kaimei Taike (Tianjin) Chemical Technology

- Nufarm

- Sumitomo Chemical

- Syngenta

- UPL

- Vesino Industrial

- Wuxi City Jia Bao Pharmaceutical