Global Equestrian Apparel Market Size, Share, Growth Analysis By Product Type (Topwear (Showshirts, Poloshirts, Showjackets, Others), Bottomwear (Breeches/riding pants, Tights, Others), Others), By Apparel (Sustainable, Unsustainable), By Category (Professional Rider, Recreational Rider), By Consumer Group (Male, Female, Children), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174350

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Overview

- Key Takeaways

- Product Type Analysis

- Apparel Analysis

- Category Analysis

- Consumer Group Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Key Equestrian Apparel Company Insights

- Key Players

- Recent Developments

- Report Scope

Market Overview

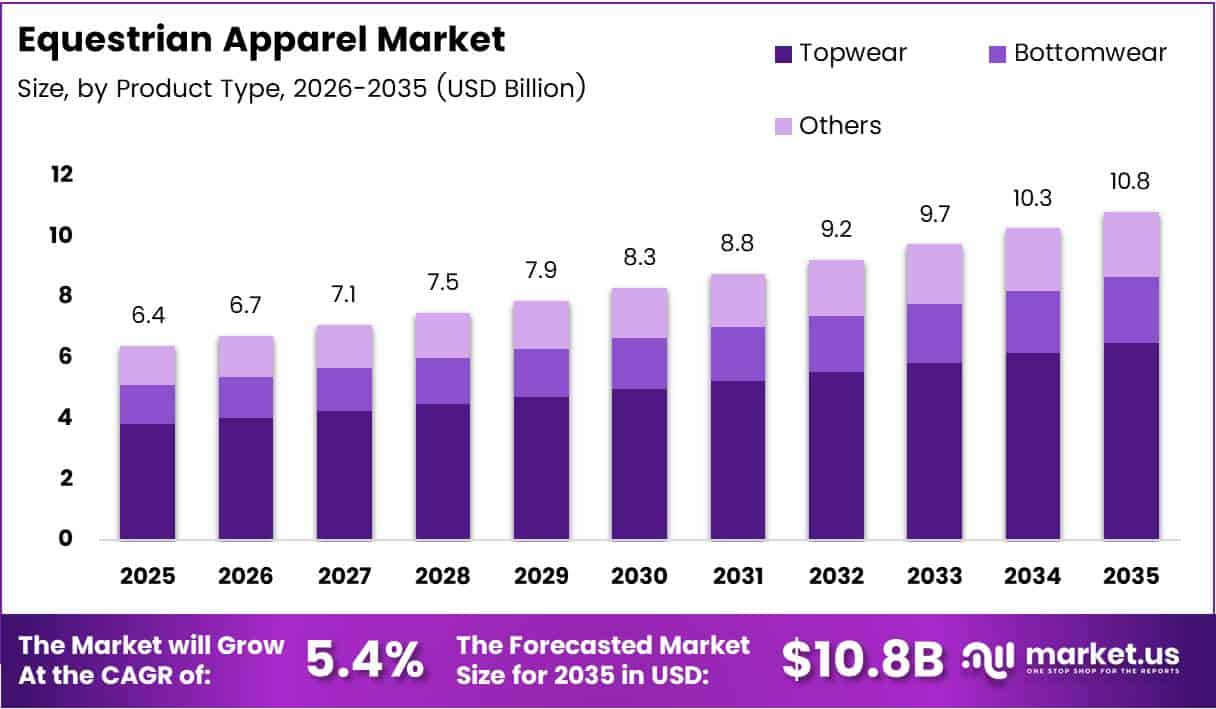

The Global Equestrian Apparel Market size is expected to be worth around USD 10.8 Billion by 2035 from USD 6.4 Billion in 2025, growing at a CAGR of 5.4% during the forecast period 2026 to 2035.

Equestrian apparel encompasses specialized clothing designed for horse riders. This includes riding jackets, breeches, helmets, boots, gloves, and protective gear. Moreover, these products combine functionality with style to ensure safety, comfort, and performance during riding activities.

The market demonstrates robust expansion driven by increasing participation in recreational and competitive horse riding globally. Consequently, rising disposable incomes among affluent consumers fuel demand for premium riding gear. Additionally, safety awareness promotes adoption of certified protective apparel across professional and amateur rider segments.

Professional training academies, riding schools, and equestrian clubs are expanding rapidly worldwide. Therefore, this infrastructure growth creates substantial demand for quality riding apparel. However, the market also benefits from growing lifestyle trends where equestrian fashion merges with athleisure and casual wear segments.

Sustainable fabric adoption represents a significant market evolution. Furthermore, brands increasingly incorporate eco-friendly materials and moisture-wicking technologies into their product lines. Smart textiles with breathable properties enhance rider comfort during extended training sessions and competitions, thereby driving premiumization trends.

Online distribution channels are transforming market accessibility and consumer purchasing behavior. Direct-to-consumer platforms enable brands to reach global audiences efficiently. Additionally, social media influence from professional riders significantly impacts brand preferences and purchasing decisions among younger equestrian enthusiasts.

According to British Equestrian, UK federation memberships rose by 11.7% from 2023 to 2024 across 19 member bodies. Moreover, Great Britain supported approximately 1.82 million regular horse riders in 2023, demonstrating substantial market participation. Additionally, Sport England reports that 88% of adult equestrians and 85% of children in equestrian activity are female, highlighting demographic concentration.

Despite positive growth trajectories, high costs of branded safety-compliant clothing pose challenges. Nevertheless, expanding middle-class populations in emerging markets present untapped opportunities. Customizable clothing solutions and climate-adaptive riding wear further strengthen market potential across diverse geographical regions.

Key Takeaways

- The Global Equestrian Apparel Market is projected to reach USD 10.8 Billion by 2035 from USD 6.4 Billion in 2025, at a CAGR of 5.4%.

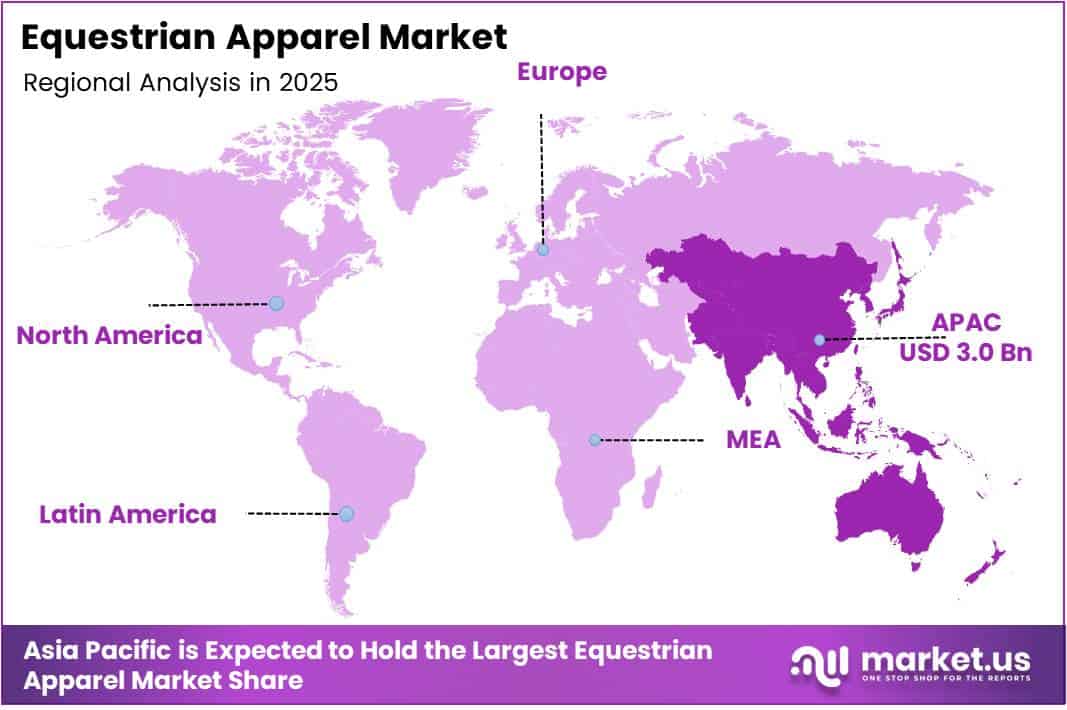

- Asia Pacific dominates with 47.2% market share, valued at USD 3.0 Billion in 2025.

- Topwear segment holds 49.2% share in the By Product Type category.

- Sustainable apparel accounts for 69.5% share in the By Apparel segment.

- Professional Rider category captures 69.3% share in the By Category segment.

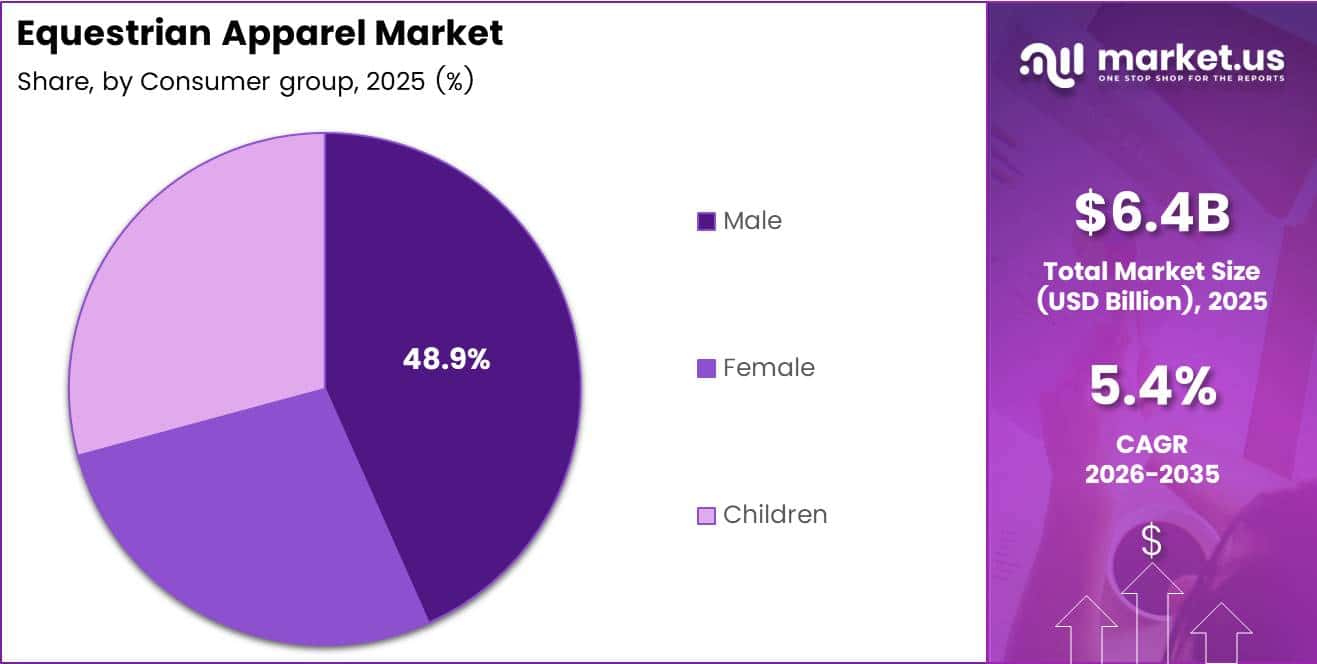

- Male consumer group represents 48.9% share in the By Consumer Group segment.

- Online distribution channel commands 59.1% share in the By Distribution Channel segment.

Product Type Analysis

Topwear dominates with 49.2% due to its essential functionality and diverse product range for riders.

In 2025, Topwear held a dominant market position in the By Product Type segment of Equestrian Apparel Market, with a 49.2% share. This category includes showshirts, poloshirts, showjackets, and other essential upper body garments. Topwear’s dominance stems from its critical role in competitive riding events where appearance and functionality converge. Additionally, riders require multiple topwear items for different riding disciplines and weather conditions.

Showshirts represent formal competition attire featuring technical fabrics with moisture-wicking properties. These garments combine elegance with performance, making them indispensable for show jumping and dressage events. Moreover, customization options enable riders to showcase individual style while maintaining professional standards. Consequently, showshirts command premium pricing in the topwear category.

Poloshirts serve as versatile training and casual riding apparel across various equestrian disciplines. Their breathable construction ensures comfort during extended practice sessions and recreational riding activities. Furthermore, poloshirts bridge the gap between performance wear and lifestyle fashion, appealing to broader consumer demographics beyond competitive riders.

Showjackets provide essential protection and formal presentation in high-level competitions and events. These structured garments feature technical innovations including stretch panels and ventilation systems. Additionally, showjackets reflect brand prestige and rider professionalism, driving demand among serious equestrian enthusiasts and professionals.

Bottomwear comprises breeches, riding pants, tights, and other lower body garments essential for riding safety and comfort. Breeches feature reinforced knee patches and strategic stretch zones for optimal saddle contact. Moreover, modern bottomwear incorporates compression technology and seamless construction to prevent chafing during prolonged riding sessions.

Others category includes specialized products such as base layers, vests, and seasonal outerwear that complement core riding apparel. These items address specific functional needs across different climates and riding conditions. Therefore, the others segment supports comprehensive wardrobe solutions for diverse equestrian activities.

Apparel Analysis

Sustainable apparel dominates with 69.5% due to growing environmental consciousness and ethical consumption trends.

In 2025, Sustainable apparel held a dominant market position in the By Apparel segment of Equestrian Apparel Market, with a 69.5% share. This substantial dominance reflects a fundamental shift in consumer values toward environmentally responsible riding gear. Moreover, brands increasingly adopt organic cotton, recycled polyester, and biodegradable materials to meet sustainability demands.

Sustainable equestrian apparel manufacturers prioritize transparent supply chains and ethical production practices. Consequently, eco-conscious riders actively seek certifications such as GOTS and OEKO-TEX when purchasing riding clothing. Additionally, sustainable products often incorporate innovative technologies that reduce water consumption and chemical usage during manufacturing processes.

Unsustainable apparel continues serving price-sensitive market segments and regions with limited sustainable product availability. Traditional manufacturing processes offer cost advantages that appeal to budget-conscious recreational riders. However, this segment faces declining market share as sustainability becomes a mainstream expectation rather than a premium positioning strategy.

Category Analysis

Professional Rider category dominates with 69.3% due to higher spending capacity and frequent apparel replacement needs.

In 2025, Professional Rider category held a dominant market position in the By Category segment of Equestrian Apparel Market, with a 69.3% share. Professional riders require extensive wardrobes meeting strict competition regulations and sponsor obligations. Moreover, these consumers prioritize performance-enhancing features and durability over price considerations.

Professional equestrians participate in multiple competitions annually, necessitating specialized apparel for different disciplines and seasons. Consequently, they invest significantly in technical riding gear that offers competitive advantages. Additionally, professional riders influence purchasing decisions across recreational segments through social media presence and brand endorsements.

Recreational Rider segment represents amateur enthusiasts and casual riders pursuing equestrian activities for leisure and fitness. This category demonstrates price sensitivity and lower purchase frequency compared to professional segments. However, recreational riders increasingly adopt professional-grade apparel as riding becomes a lifestyle statement beyond competitive performance.

Consumer Group Analysis

Male consumer group dominates with 48.9% share alongside significant female participation in equestrian activities.

In 2025, Male consumer group held a dominant market position in the By Consumer Group segment of Equestrian Apparel Market, with a 48.9% share. Male riders demonstrate strong purchasing power and preference for technical performance features in riding apparel. Moreover, competitive disciplines such as polo and eventing attract substantial male participation globally.

Female consumers represent a nearly equal market share and exhibit distinct preferences for style-integrated performance wear. Women riders often seek versatile designs that transition between barn, competition, and casual settings. Additionally, female equestrians demonstrate higher engagement with sustainable and ethically produced riding apparel brands.

Children segment encompasses young riders developing skills through riding school programs and junior competitions. This category requires frequent size replacements and prioritizes safety certifications and protective features. Furthermore, children’s riding apparel benefits from parental purchasing decisions that emphasize quality and durability over short-term value.

Distribution Channel Analysis

Online channel dominates with 59.1% due to convenience, extensive selection, and competitive pricing advantages.

In 2025, Online distribution channel held a dominant market position in the By Distribution Channel segment of Equestrian Apparel Market, with a 59.1% share. E-commerce platforms enable global brand access and eliminate geographical limitations for specialized equestrian products. Moreover, online retailers offer detailed product information, sizing guides, and customer reviews that facilitate informed purchasing decisions.

Direct-to-consumer brands leverage digital channels to build communities and engage riders through content marketing and social media. Consequently, online platforms reduce distribution costs and enable competitive pricing structures. Additionally, subscription models and personalized recommendations enhance customer retention and lifetime value in digital marketplaces.

Offline distribution channels include specialized tack shops, sporting goods retailers, and brand flagship stores serving local equestrian communities. Physical retail provides tactile product experiences and expert fitting consultations valued by traditional customers. However, offline channels face challenges from reduced foot traffic and higher operational costs compared to digital alternatives.

Key Market Segments

By Product Type

- Topwear

- Showshirts

- Poloshirts

- Showjackets

- Others

- Bottomwear

- Breeches/riding pants

- Tights

- Others

- Others

By Apparel

- Sustainable

- Unsustainable

By Category

- Professional Rider

- Recreational Rider

By Consumer Group

- Male

- Female

- Children

By Distribution Channel

- Online

- Offline

Drivers

Rising Global Participation in Recreational and Competitive Horse Riding Activities

Equestrian sports participation continues expanding across developed and emerging markets globally. Growing middle-class populations seek premium recreational activities that offer fitness, social engagement, and lifestyle benefits. Consequently, increased rider numbers directly translate to higher demand for specialized riding apparel and protective equipment.

Competitive riding events attract substantial participation from amateur and professional riders pursuing championships and recognition. Moreover, media coverage of prestigious events like Olympic equestrian competitions elevates sport visibility and aspiration. Additionally, youth programs introduced through schools and community centers cultivate long-term riding apparel consumers.

Riding schools, training academies, and equestrian clubs proliferate in urban and suburban areas worldwide. These facilities require students and members to maintain appropriate riding attire for safety and instructional purposes. Therefore, institutional demand supplements individual consumer purchases, creating stable baseline market growth.

Restraints

High Cost of Branded and Safety-Compliant Equestrian Clothing

Premium equestrian apparel commands significantly higher prices compared to conventional athletic wear and casual clothing. Specialized materials, safety certifications, and technical construction processes increase manufacturing costs substantially. Consequently, price sensitivity among recreational riders and budget-conscious consumers limits market penetration and purchase frequency.

Safety-certified protective gear including helmets, body protectors, and reinforced footwear represents mandatory investments for responsible riding. However, these essential items often exceed purchasing budgets for entry-level and occasional riders. Moreover, children require frequent size replacements, multiplying financial barriers for families supporting young equestrian enthusiasts.

Brand premiums associated with established equestrian labels further inflate retail pricing structures across product categories. Additionally, limited competition in specialized riding apparel segments reduces pricing pressure and maintains elevated margin expectations. Therefore, affordability challenges constrain market expansion beyond affluent consumer demographics.

Growth Opportunities

Rapid Expansion of Online Direct-to-Consumer Equestrian Apparel Platforms

Digital commerce eliminates traditional retail barriers and enables niche equestrian brands to reach global audiences efficiently. Direct-to-consumer models reduce intermediary costs and allow competitive pricing while maintaining product quality standards. Consequently, online platforms democratize access to specialized riding apparel across geographical and economic boundaries.

E-commerce personalization technologies enable customized product recommendations based on riding discipline, experience level, and style preferences. Moreover, virtual fitting tools and augmented reality applications reduce online purchase hesitation and return rates. Additionally, subscription services for consumable items like riding socks and gloves create recurring revenue streams.

Social commerce integration connects riders with brand communities and peer recommendations through Instagram, TikTok, and specialized equestrian platforms. Furthermore, influencer partnerships amplify brand visibility among target demographics and drive conversion through authentic product endorsements. Therefore, digital innovation continuously expands addressable market opportunities.

Emerging Trends

Sustainable and Eco-Friendly Fabric Adoption in Riding Apparel Lines

Environmental consciousness fundamentally reshapes product development priorities across the equestrian apparel industry. Brands increasingly source organic cotton, recycled polyester, and plant-based leather alternatives to reduce ecological footprints. Moreover, biodegradable packaging and carbon-neutral shipping options complement sustainable product positioning strategies.

Circular economy principles encourage take-back programs where manufacturers recycle used riding apparel into new products. Consequently, extended producer responsibility initiatives gain traction among environmentally committed brands and consumers. Additionally, transparency regarding supply chain practices and material certifications becomes competitive differentiation rather than optional enhancement.

Smart textile integration delivers performance benefits while supporting sustainability objectives through durable, long-lasting garment construction. Furthermore, moisture-wicking and temperature-regulating fabrics reduce washing frequency and water consumption during garment care. Therefore, technological innovation and environmental responsibility converge in next-generation riding apparel development.

Regional Analysis

Asia Pacific Dominates the Equestrian Apparel Market with a Market Share of 47.2%, Valued at USD 3.0 Billion

Asia Pacific holds a dominant market position with 47.2% share, valued at USD 3.0 Billion in 2025. This region benefits from rapidly expanding middle-class populations and increasing disposable incomes supporting premium recreational activities. Moreover, countries like China, Japan, and India witness substantial growth in riding schools, clubs, and competitive events. Additionally, cultural appreciation for equestrian sports combined with government support for sports infrastructure accelerates market development across Asia Pacific nations.

North America Equestrian Apparel Market Trends

North America maintains a mature and sophisticated equestrian apparel market characterized by high per-capita spending and brand loyalty. The United States hosts numerous prestigious riding competitions and training facilities that drive premium product demand. Moreover, established equestrian heritage in Canada supports stable market participation across professional and recreational segments. Additionally, North American consumers exhibit strong preferences for innovative technologies and sustainable product attributes.

Europe Equestrian Apparel Market Trends

Europe represents a traditional stronghold for equestrian culture with deep historical roots in competitive riding disciplines. Countries including Germany, the UK, and France maintain robust riding communities and world-class training infrastructure. Moreover, European consumers demonstrate sophisticated taste for premium craftsmanship and heritage brand authenticity. Additionally, stringent safety regulations and quality standards ensure high product compliance across the European market landscape.

Latin America Equestrian Apparel Market Trends

Latin America exhibits growing interest in equestrian activities supported by agricultural traditions and ranching heritage. Brazil and Mexico lead regional market development through expanding riding clubs and competitive event participation. Moreover, increasing urbanization creates demand for recreational riding opportunities and associated apparel products. Additionally, affordable product segments gain traction as equestrian sports reach broader demographic groups.

Middle East & Africa Equestrian Apparel Market Trends

Middle East & Africa demonstrates concentrated market activity in affluent Gulf Cooperation Council nations with substantial equestrian investments. The UAE and Saudi Arabia host international competitions and maintain world-class riding facilities that support premium apparel demand. Moreover, traditional horseback riding heritage in African regions creates niche market opportunities. Additionally, climate-specific riding apparel for extreme heat conditions drives specialized product development in these markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Equestrian Apparel Company Insights

Ariat International maintains a leading position in the equestrian apparel market through innovative product development and strong brand recognition. The company combines advanced technologies with traditional craftsmanship to deliver performance-oriented riding wear. Moreover, Ariat’s extensive distribution network spans online platforms and specialty retailers globally, ensuring broad market accessibility. Additionally, the brand’s focus on athlete partnerships and competitive sponsorships reinforces its premium positioning among professional and recreational riders.

Charles Owen specializes in safety-certified riding helmets and protective headwear that meet stringent international standards. The company’s heritage in British equestrian tradition supports strong brand credibility among safety-conscious consumers. Furthermore, Charles Owen invests continuously in research and development to enhance impact protection and comfort features. Consequently, the brand commands premium pricing and loyal customer following across competitive riding disciplines.

Eskadron represents a premium European equestrian brand recognized for high-quality riding apparel and horse equipment. The company emphasizes design excellence and functional innovation that appeals to style-conscious professional riders. Moreover, Eskadron’s seasonal collections incorporate fashion-forward aesthetics while maintaining technical performance standards. Additionally, strategic partnerships with equestrian athletes and influencers amplify brand visibility across key European and international markets.

Horze operates as an accessible equestrian brand offering comprehensive riding apparel and equipment at competitive price points. The company’s direct-to-consumer model enables affordable pricing while maintaining acceptable quality standards for recreational riders. Furthermore, Horze’s extensive product range addresses diverse consumer needs across multiple riding disciplines and experience levels. Therefore, the brand successfully captures value-oriented market segments seeking functional riding apparel without premium price tags.

Key Players

- Ariat International

- Charles Owen

- Dublin

- Equi-Star

- Eskadron

- Goode Rider

- Helite

- Horze

- Kentucky Horsewear

- Kingsland Equestrian

Recent Developments

- March 2025, LBO France acquires a majority stake in Amahorse, a leading player in equestrian apparel and accessories. This strategic investment strengthens LBO France’s portfolio in the specialized sports equipment sector while providing Amahorse with capital resources for international expansion and product innovation initiatives.

- January 2025, Leading equestrian firms Horseware Ireland and EquiFit announce Merger. This consolidation creates a comprehensive equestrian product provider combining Horseware’s apparel expertise with EquiFit’s protective equipment specialization, enhancing competitive positioning in the global market.

- October 2024, SmartEquine will be acquired by Chewy. This acquisition enables Chewy to expand its product offerings beyond pet supplies into the equestrian market, leveraging its established e-commerce infrastructure and customer base for cross-selling opportunities.

- August 2024, Second Avenue Capital Partners Announces $15 Million Dover Saddlery Partnership to Support Strategic Growth. This significant investment provides Dover Saddlery with financial resources to modernize retail operations, enhance digital capabilities, and expand product assortment across riding apparel and equipment categories.

Report Scope

Report Features Description Market Value (2025) USD 6.4 Billion Forecast Revenue (2035) USD 10.8 Billion CAGR (2026-2035) 5.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Topwear (Showshirts, Poloshirts, Showjackets, Others), Bottomwear (Breeches/riding pants, Tights, Others), Others), By Apparel (Sustainable, Unsustainable), By Category (Professional Rider, Recreational Rider), By Consumer Group (Male, Female, Children), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ariat International, Charles Owen, Dublin, Equi-Star, Eskadron, Goode Rider, Helite, Horze, Kentucky Horsewear, Kingsland Equestrian Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ariat International

- Charles Owen

- Dublin

- Equi-Star

- Eskadron

- Goode Rider

- Helite

- Horze

- Kentucky Horsewear

- Kingsland Equestrian