Global Epoxy Tooling Board Market Size, Share, Growth Analysis Tooling Type (Rapid Prototyping Tools, Production Tools, Composite Tools), Board Density (Low Density, Medium Density, High Density), End-Use Industry (Aerospace & Defense, Automotive, Marine, Wind & Renewable Energy, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176817

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

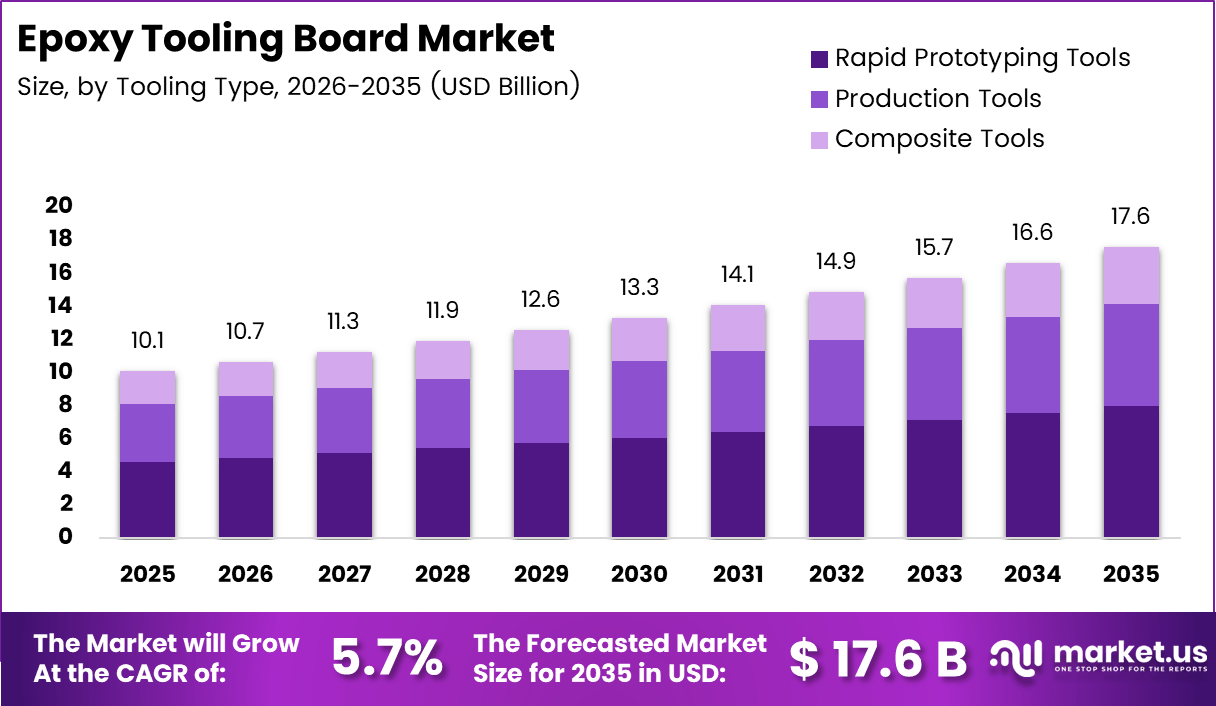

Global Epoxy Tooling Board Market size is expected to be worth around USD 17.6 Billion by 2035 from USD 10.1 Billion in 2025, growing at a CAGR of 5.7% during the forecast period 2026 to 2035.

Epoxy tooling boards are engineered composite materials designed for precision manufacturing applications. These boards combine epoxy resins with reinforcing fillers to create stable, machinable substrates. They serve as foundational materials for creating molds, patterns, and prototypes across multiple industries.

The market experiences robust expansion driven by aerospace and automotive sector demands. Moreover, manufacturers increasingly require materials that withstand high temperatures while maintaining dimensional accuracy. Consequently, epoxy tooling boards have become essential for composite component production and precision tooling applications.

Industry adoption accelerates as manufacturers seek alternatives to traditional metal tooling. These boards offer superior machinability and reduced production lead times. Additionally, they provide excellent surface finish capabilities critical for high-quality mold production and prototype development across various manufacturing segments.

Growth opportunities emerge from electric vehicle production and renewable energy sectors. Furthermore, technological advancements enable development of specialized formulations with enhanced properties. Therefore, manufacturers continuously innovate to meet evolving industry requirements for lightweight, durable tooling solutions in modern manufacturing environments.

According to Base Materials, the epoxy material provides consistent performance, maintaining tolerances at elevated temperatures up to 190°C. Additionally, these boards are available in thicknesses up to 200 mm, offering versatility for diverse manufacturing applications.

According to EasyComposites, EB700 epoxy tooling board offers service temperatures up to 130°C with excellent surface finish and stability. This high-quality 700 kg/m³ density board is recommended for CNC machining of highly accurate models, patterns, and low-volume production tools across manufacturing sectors.

Key Takeaways

- Global Epoxy Tooling Board Market projected to grow from USD 10.1 Billion in 2025 to USD 17.6 Billion by 2035 at 5.7% CAGR

- Rapid Prototyping Tools segment dominates Tooling Type category with 45.6% market share in 2025

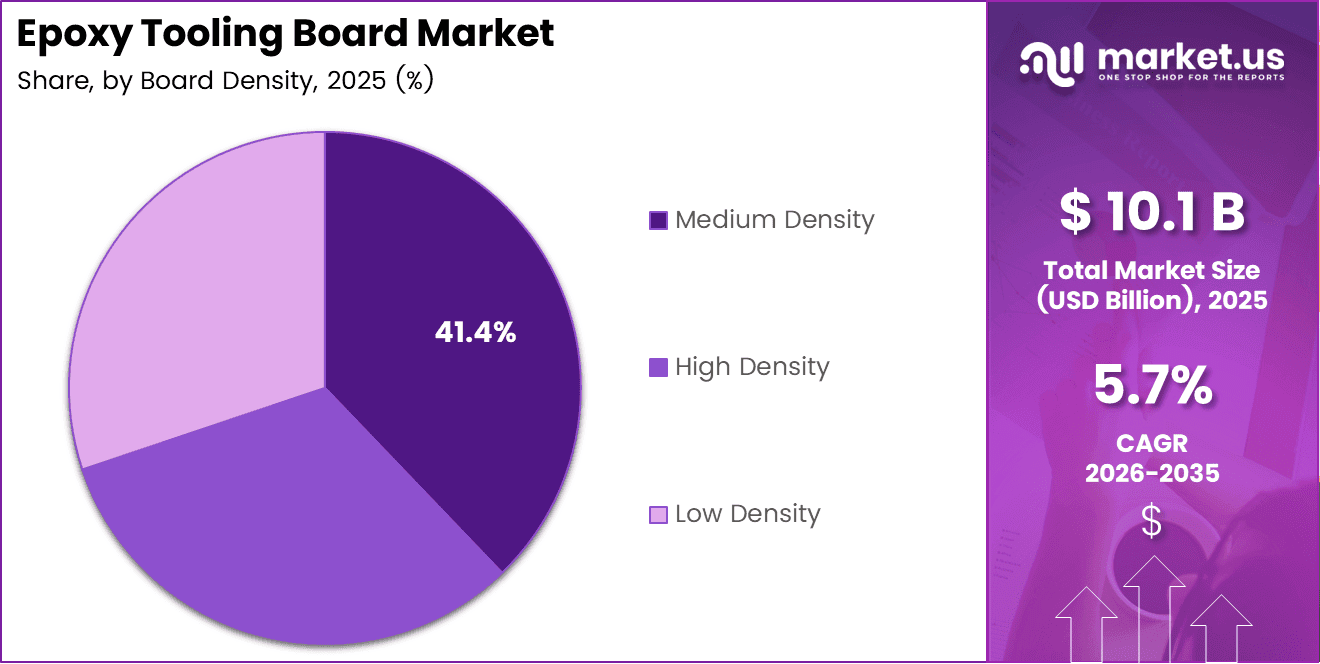

- Medium Density boards lead Board Density segment capturing 41.4% market share

- Aerospace & Defense sector holds largest End-Use Industry share at 32.1% in 2025

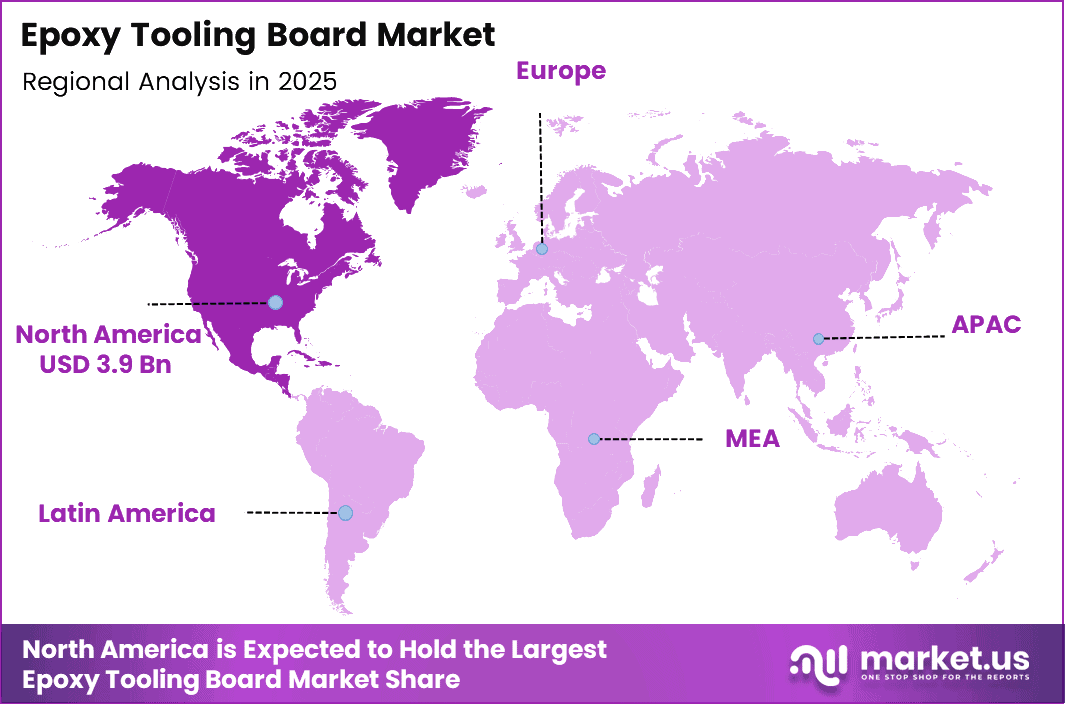

- North America dominates regional market with 38.7% share valued at USD 3.9 Billion

- High temperature resistant formulations and lightweight materials emerge as key trending factors

Tooling Type Analysis

Rapid Prototyping Tools dominates with 45.6% due to increasing demand for faster product development cycles.

In 2025, ‘Rapid Prototyping Tools’ held a dominant market position in the ‘Tooling Type’ segment of Epoxy Tooling Board Market, with a 45.6% share. This dominance reflects growing industry emphasis on accelerated development timelines. Manufacturers increasingly adopt rapid prototyping to reduce time-to-market and validate designs efficiently before full-scale production.

Production Tools represent significant market presence supporting manufacturing operations. These tools enable consistent quality in medium to high-volume manufacturing environments. Additionally, production tools offer durability and dimensional stability required for repetitive manufacturing processes across automotive and aerospace applications.

Composite Tools serve specialized applications in advanced material manufacturing. These tools facilitate production of carbon fiber and fiberglass components. Furthermore, composite tools provide essential thermal stability and surface quality required for high-performance composite part production in demanding industrial applications.

Board Density Analysis

Medium Density dominates with 41.4% due to optimal balance between machinability and structural performance.

In 2025, ‘Medium Density’ held a dominant market position in the ‘Board Density’ segment of Epoxy Tooling Board Market, with a 41.4% share. This category offers ideal combination of mechanical strength and ease of machining. Consequently, manufacturers prefer medium density boards for diverse tooling applications requiring balanced performance characteristics.

Low Density boards provide advantages for lightweight tooling applications. These materials offer excellent machinability and reduced material costs. Moreover, low density variants suit applications where weight reduction is critical, particularly in aerospace prototyping and pattern making requiring minimal structural demands.

High Density boards deliver superior mechanical properties and thermal resistance. These formulations withstand demanding production environments with elevated temperatures. Therefore, high density options serve applications requiring maximum dimensional stability and durability in high-temperature composite manufacturing and precision tooling operations.

End-Use Industry Analysis

Aerospace & Defense dominates with 32.1% due to stringent precision requirements and composite material adoption.

In 2025, ‘Aerospace & Defense’ held a dominant market position in the ‘End-Use Industry’ segment of Epoxy Tooling Board Market, with a 32.1% share. This sector demands exceptional precision and temperature resistance for component manufacturing. Additionally, increasing aircraft production and composite material adoption drive sustained demand for high-performance tooling solutions.

Automotive industry represents substantial market opportunity with growing electrification trends. Electric vehicle production requires specialized tooling for battery housings and lightweight structural components. Furthermore, automotive manufacturers increasingly adopt composite materials to achieve fuel efficiency targets and regulatory compliance standards.

Marine sector utilizes epoxy tooling boards for boat hull and deck mold production. These applications require excellent water resistance and dimensional stability. Moreover, marine manufacturers value the superior surface finish capabilities enabling production of high-quality fiberglass and composite vessel components.

Wind & Renewable Energy segment drives demand through turbine blade manufacturing. Large-scale wind turbine production requires stable, precise tooling materials. Consequently, renewable energy expansion creates significant growth opportunities for epoxy tooling board manufacturers serving this specialized application segment.

Others category encompasses diverse industrial applications including construction, consumer goods, and general manufacturing. These sectors utilize epoxy tooling boards for custom fabrication and specialized molding applications. Therefore, this segment contributes to overall market diversity and stability.

Key Market Segments

Tooling Type

- Rapid Prototyping Tools

- Production Tools

- Composite Tools

Board Density

- Low Density

- Medium Density

- High Density

End-Use Industry

- Aerospace & Defense

- Automotive

- Marine

- Wind & Renewable Energy

- Others

Drivers

Increasing Use of High Precision Composite Molds Drives Market Growth

Aerospace and automotive manufacturers require increasingly precise composite molds for advanced component production. Therefore, epoxy tooling boards provide necessary dimensional accuracy and stability. These materials enable manufacturers to achieve tight tolerances essential for modern composite manufacturing processes requiring exceptional quality standards.

Rising demand for durable and heat-resistant tooling materials accelerates market adoption. Prototype development requires materials withstanding elevated temperatures without dimensional changes. Moreover, epoxy formulations maintain structural integrity during thermal cycling, ensuring consistent results throughout development and production phases in demanding manufacturing environments.

Growing adoption of CNC machining enhances tooling accuracy and repeatability. Consequently, epoxy boards’ excellent machinability enables precise automated manufacturing processes. Additionally, expansion of lightweight material manufacturing requires stable tooling solutions that maintain precision while supporting advanced composite production techniques across multiple industrial applications.

Restraints

High Material and Processing Costs Limit Market Adoption

Epoxy tooling boards require significant investment compared to conventional tooling alternatives. Therefore, small and medium manufacturers face budget constraints limiting adoption. Initial material costs and specialized processing equipment create financial barriers, particularly for businesses operating with limited capital resources and tight production budgets.

Processing complexity adds to overall production expenses and timeline extensions. Consequently, manufacturers must invest in skilled labor and specialized machining capabilities. Moreover, these additional requirements increase operational costs, making epoxy tooling boards less attractive for price-sensitive applications and budget-conscious manufacturing operations.

Limited recyclability and environmental concerns present growing challenges for market expansion. Additionally, epoxy-based products generate disposal issues at end-of-life stages. Therefore, increasing environmental regulations and sustainability requirements create hesitation among environmentally conscious manufacturers seeking more recyclable and eco-friendly tooling material alternatives.

Growth Factors

Technological Advancements Accelerate Market Expansion

Rising investment in electric vehicle production tooling creates substantial growth opportunities. Consequently, automotive manufacturers require specialized tooling for battery components and lightweight structures. Moreover, rapid prototyping demands in EV development drive adoption of high-performance epoxy boards enabling faster iteration cycles and design validation processes.

Growing demand from wind energy and renewable composite manufacturing expands market potential. Therefore, turbine blade production requires large-scale, stable tooling materials. Additionally, renewable energy sector growth drives sustained demand for epoxy tooling boards capable of supporting complex composite manufacturing operations.

Increasing outsourcing of tooling boards by small and mid-size manufacturers creates new revenue streams. Furthermore, technological advancements in low-density and high-strength epoxy formulations enhance product performance. Consequently, these innovations enable manufacturers to access improved tooling solutions meeting diverse application requirements across expanding industrial segments.

Emerging Trends

Digital Manufacturing Integration Reshapes Market Landscape

Development of high-temperature resistant epoxy tooling boards addresses evolving industry requirements. Therefore, manufacturers formulate materials withstanding extreme thermal conditions during composite curing processes. Moreover, these advanced formulations enable production of complex components requiring elevated temperature stability and dimensional accuracy throughout manufacturing cycles.

Growing preference for lightweight and easy-to-machine tooling materials drives product innovation. Consequently, manufacturers develop formulations balancing reduced density with maintained mechanical properties. Additionally, integration of digital manufacturing and CAD-driven tooling design streamlines production workflows, enabling faster turnaround times for custom tooling applications.

Increasing use of epoxy tooling boards in short-run and custom production models expands market applications. Furthermore, manufacturers recognize cost-effectiveness for limited production volumes compared to traditional metal tooling. Therefore, this trend enables greater flexibility in manufacturing operations while maintaining quality standards across diverse industrial applications.

Regional Analysis

North America Dominates the Epoxy Tooling Board Market with a Market Share of 38.7%, Valued at USD 3.9 Billion

North America leads the market due to robust aerospace and automotive manufacturing sectors. The region benefits from advanced manufacturing infrastructure and significant R&D investments. Moreover, strong presence of key industry players and early adoption of composite manufacturing technologies contribute to market dominance, with the market valued at USD 3.9 Billion representing 38.7% share in 2025.

Europe Epoxy Tooling Board Market Trends

Europe demonstrates significant market presence driven by aerospace and renewable energy sectors. Additionally, stringent environmental regulations encourage adoption of advanced manufacturing materials. Therefore, European manufacturers increasingly invest in high-performance tooling solutions supporting composite production and sustainable manufacturing initiatives across automotive and wind energy industries.

Asia Pacific Epoxy Tooling Board Market Trends

Asia Pacific experiences rapid growth fueled by expanding automotive and aerospace manufacturing capabilities. Consequently, countries like China, Japan, and India invest heavily in advanced manufacturing infrastructure. Moreover, growing electric vehicle production and increasing outsourcing activities create substantial opportunities for epoxy tooling board manufacturers throughout the region.

Latin America Epoxy Tooling Board Market Trends

Latin America shows moderate growth potential with developing manufacturing sectors. Therefore, Brazil and Mexico lead regional adoption driven by automotive industry expansion. Additionally, increasing investment in renewable energy projects creates emerging opportunities for tooling material suppliers serving wind turbine and composite manufacturing applications.

Middle East & Africa Epoxy Tooling Board Market Trends

Middle East & Africa represents emerging market opportunity with growing industrial diversification efforts. Consequently, aerospace and renewable energy investments drive gradual market development. Moreover, infrastructure development projects and increasing manufacturing capabilities create foundation for future growth in epoxy tooling board adoption across various industrial applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

RAMPF Tooling Solutions maintains strong market position through innovative epoxy formulation technologies and comprehensive product portfolios. The company focuses on developing high-performance tooling boards serving aerospace and automotive sectors. Additionally, RAMPF invests significantly in research and development, creating specialized solutions for demanding composite manufacturing applications requiring exceptional precision and thermal stability.

Trelleborg AB leverages extensive materials engineering expertise to deliver advanced epoxy tooling solutions globally. The company emphasizes sustainable manufacturing practices while maintaining product performance standards. Moreover, Trelleborg’s broad distribution network and technical support capabilities strengthen its competitive position across diverse industrial markets requiring specialized tooling materials.

Huntsman Corporation offers comprehensive epoxy systems supporting various tooling applications through advanced chemical formulations. The company’s global manufacturing footprint enables efficient supply chain management and customer service. Furthermore, Huntsman continues expanding its product portfolio to address evolving market requirements in composite manufacturing and precision tooling applications worldwide.

Sika Axson combines chemical expertise with application-specific engineering to provide targeted tooling solutions. The company focuses on developing materials optimized for specific manufacturing processes and end-use requirements. Additionally, Sika Axson emphasizes technical collaboration with customers, ensuring tooling boards meet precise application specifications across aerospace, automotive, and renewable energy sectors.

Key players

- RAMPF Tooling Solutions

- Trelleborg AB

- Huntsman Corporation

- Sika Axson

- Base Group

- BCC Products Inc.

- Curbell Plastics

- Guangzhou LiHong Mould Material Co.

- Alchemie Ltd.

- Gurit Holding AG

- OBO Tooling & Moulding

- MGC-Chemical

- Coastal Enterprises Co.

- SHD Composite Materials

- General Plastics Manufacturing Co.

- Other Key Players

Recent Developments

- January 2026 – Additive Engineering Solutions acquired Momentous Mold & Machine, bringing 2,000 years of combined expertise in precision tooling. The acquisition enhances capabilities in advanced CNC machining and ITAR-certified solutions for complex aerospace and defense challenges from prototype to production.

- July 2024 – Lucintel forecasted the Epoxy Tooling Board Market to reach $144.0 million by 2030. This projection reflects growing industry adoption and increasing demand for advanced tooling materials across aerospace, automotive, and renewable energy manufacturing sectors globally.

Report Scope

Report Features Description Market Value (2025) USD 10.1 Billion Forecast Revenue (2035) USD 17.6 Billion CAGR (2026-2035) 5.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Tooling Type (Rapid Prototyping Tools, Production Tools, Composite Tools), Board Density (Low Density, Medium Density, High Density), End-Use Industry (Aerospace & Defense, Automotive, Marine, Wind & Renewable Energy, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape RAMPF Tooling Solutions, Trelleborg AB, Huntsman Corporation, Sika Axson, Base Group, BCC Products Inc., Curbell Plastics, Guangzhou LiHong Mould Material Co., Alchemie Ltd., Gurit Holding AG, OBO Tooling & Moulding, MGC-Chemical, Coastal Enterprises Co., SHD Composite Materials, General Plastics Manufacturing Co., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- RAMPF Tooling Solutions

- Trelleborg AB

- Huntsman Corporation

- Sika Axson

- Base Group

- BCC Products Inc.

- Curbell Plastics

- Guangzhou LiHong Mould Material Co.

- Alchemie Ltd.

- Gurit Holding AG

- OBO Tooling & Moulding

- MGC-Chemical

- Coastal Enterprises Co.

- SHD Composite Materials

- General Plastics Manufacturing Co.

- Other Key Players