Global Enterprise AI Governance and Compliance Market By Component (Solutions, Services,Managed Services), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance,Others), By Application (Regulatory Compliance,Ethical AI and Risk Mitigation,Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174006

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Application Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

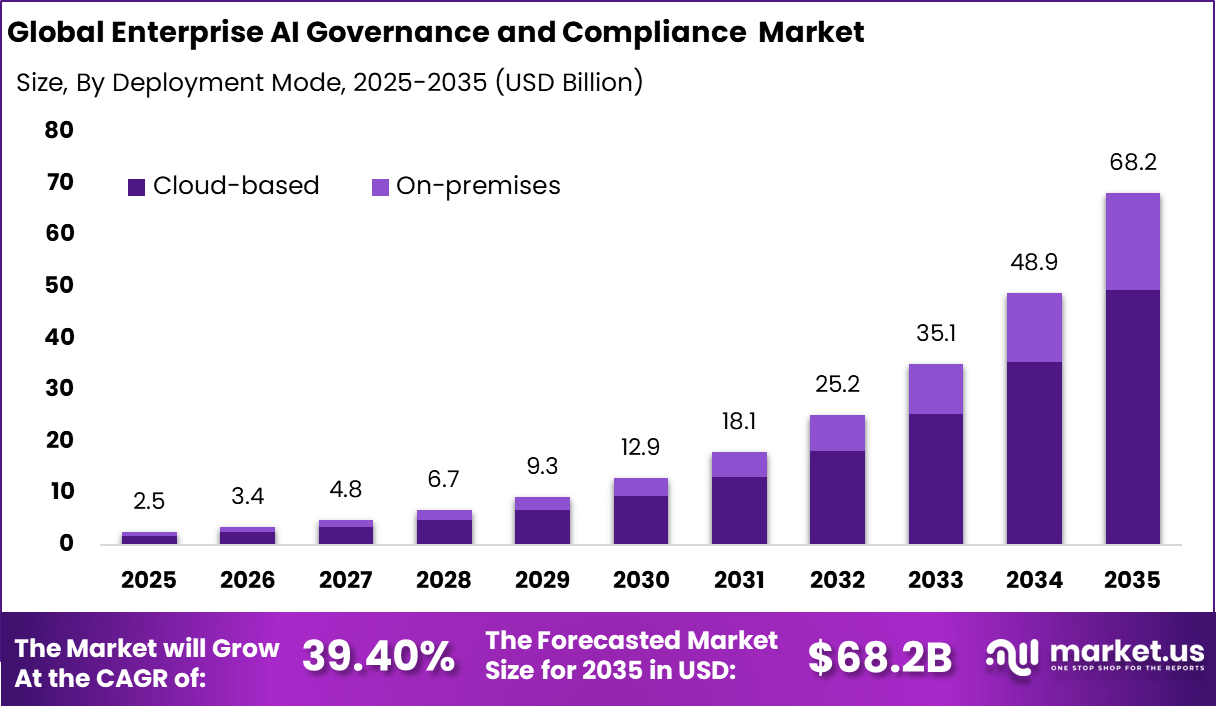

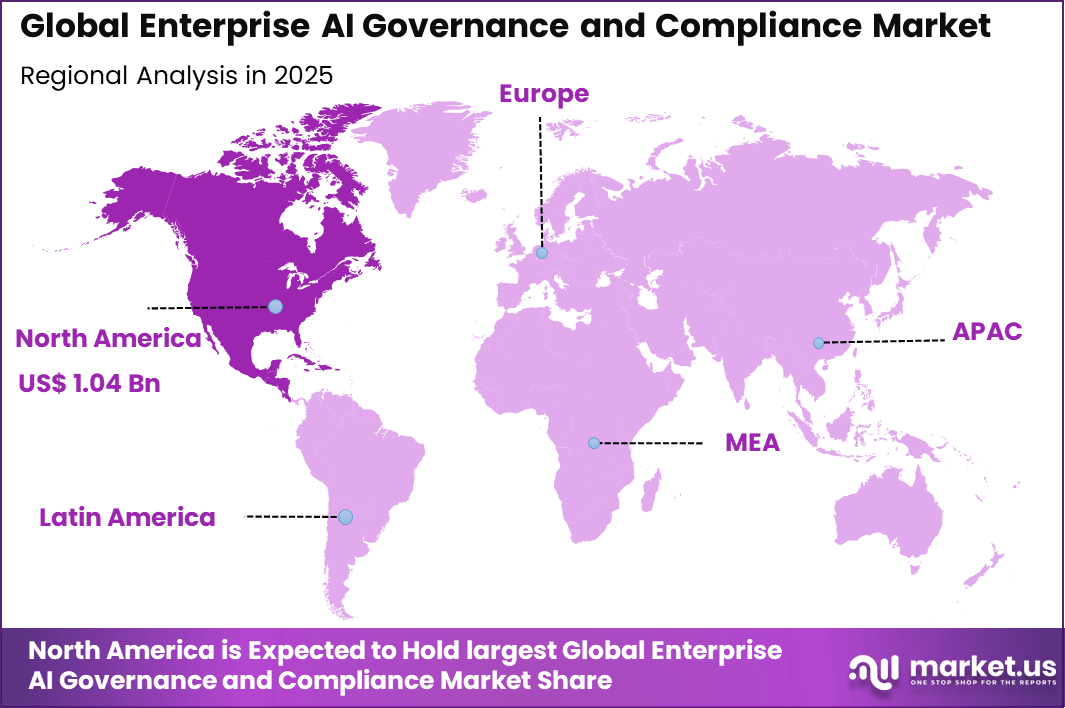

The Global Enterprise AI Governance and Compliance Market generated USD 2.5 billion in 2025 and is predicted to register growth from USD 3.4 billion in 2026 to about USD 68.2 billion by 2035, recording a CAGR of 39.40% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 42.3% share, holding USD 1.04 Billion revenue.

The enterprise AI governance and compliance market refers to platforms and frameworks that help organizations manage, monitor, and control the use of artificial intelligence systems. These solutions address policies, controls, documentation, risk assessment, and accountability across the AI lifecycle. Enterprises use them to ensure AI systems are reliable, transparent, and aligned with internal standards. Adoption spans regulated and non-regulated industries that deploy AI at scale.

The top driving factors for this market are the growing spread of AI applications and rising expectations for transparency and control. Organisations are using AI to streamline operations and improve customer interactions, but unmonitored AI can lead to risks such as unfair decisions, data privacy violations, and operational errors.

Governments and industry bodies are introducing standards and regulations that require visibility into how AI systems make decisions and how data is used. Business leaders also recognise the need to manage reputational risk and build trust with customers and stakeholders. These pressures make structured governance and compliance tools essential as AI adoption increases.

Demand analysis shows that interest in enterprise AI governance and compliance solutions continues to strengthen as organisations formalise AI strategies. Large enterprises with complex operations and regulated environments, such as finance, healthcare, and insurance, prioritise tools that support auditability and reporting. Enterprises that depend on third-party AI models seek governance solutions to enforce consistent practices across internal and external systems.

Demand is also supported by the move toward model lifecycle management, where organisations track AI performance from development through deployment and ongoing monitoring. As expectations for responsible AI increase and regulatory frameworks evolve, investment in governance and compliance solutions is expected to remain robust to support safe, ethical, and compliant AI use.

Top Market Takeaways

- By component, solutions led the enterprise AI governance and compliance market with 68.9% share, providing essential software for monitoring AI ethics and risk management.

- By deployment mode, cloud-based systems captured 72.4%, enabling flexible integration and real-time oversight across distributed AI deployments.

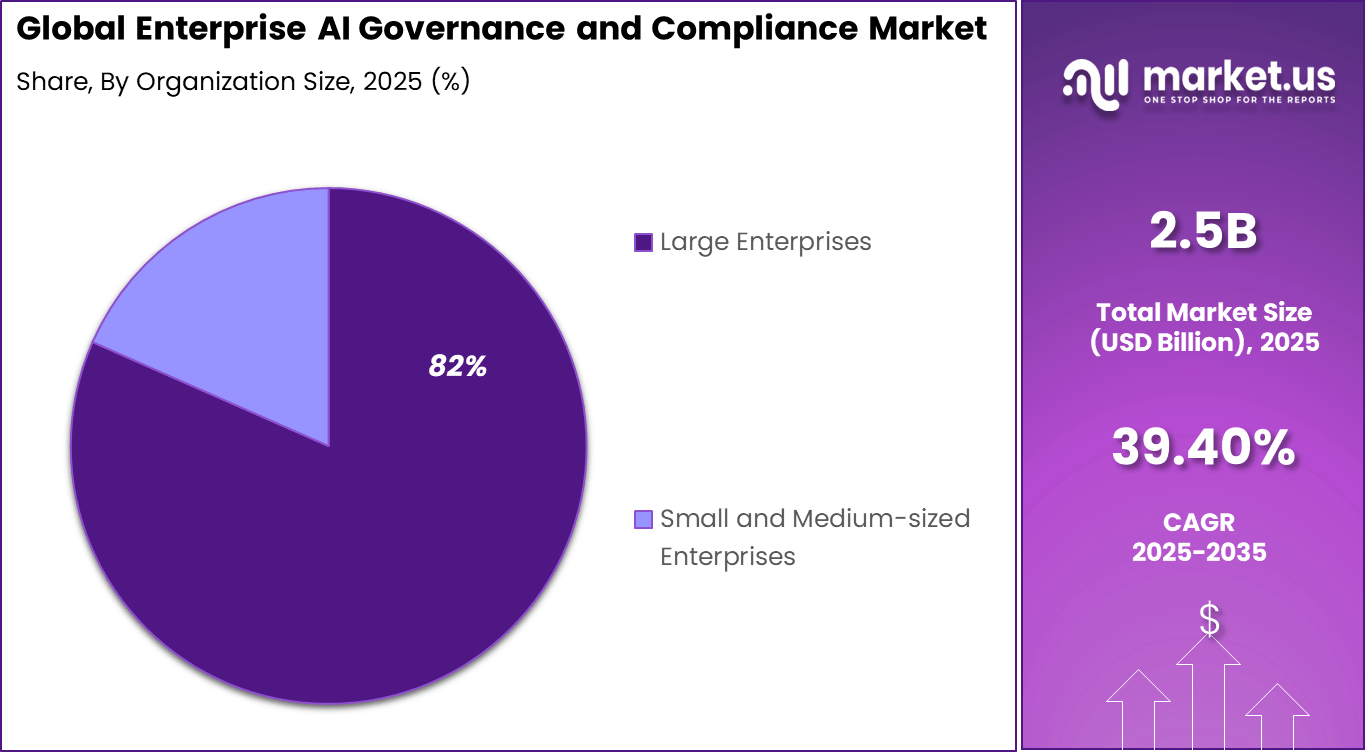

- By organization size, large enterprises dominated at 81.6%, requiring robust governance for complex AI portfolios under regulatory scrutiny.

- By end-user industry, banking, financial services, and insurance held 47.3%, prioritizing compliance to mitigate AI-driven financial risks.

- By application, regulatory compliance accounted for 58.3%, focusing on standards like GDPR and emerging AI laws.

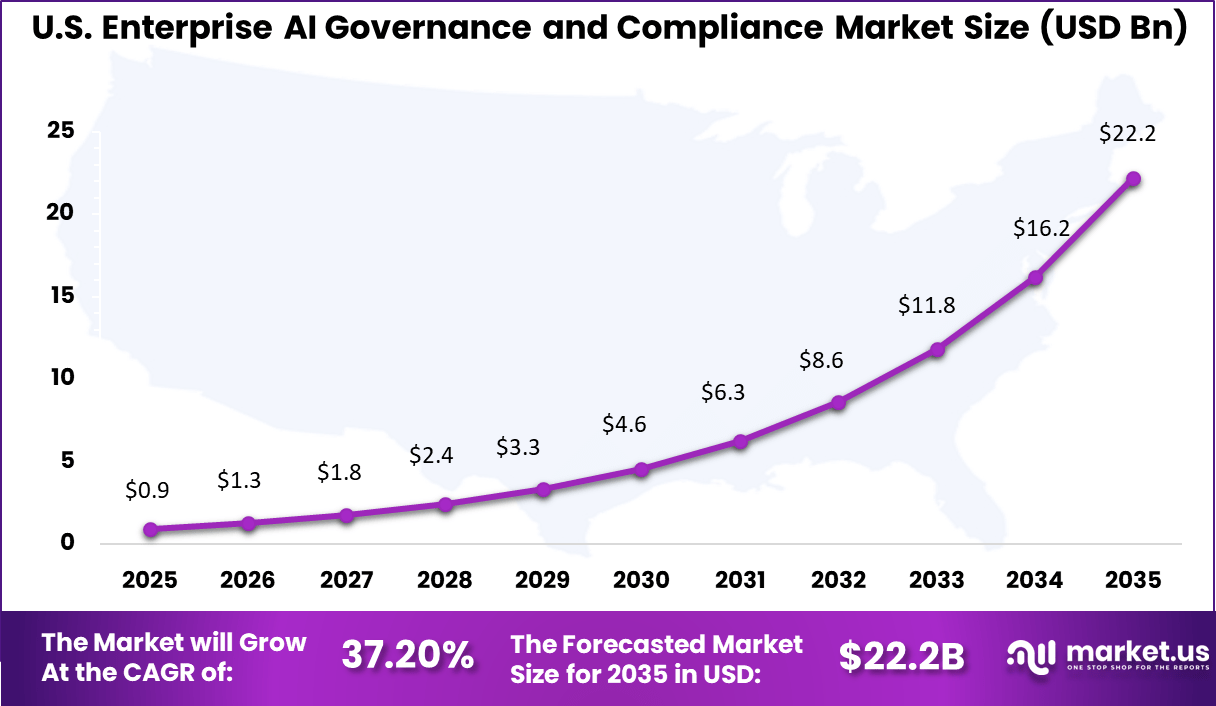

- North America represented 42.3% of the global market, with the U.S. valued at USD 0.94 billion and growing at a CAGR of 37.20%.

Component Analysis

Solutions account for 68.9% of the Enterprise AI Governance and Compliance market, showing that organizations mainly invest in dedicated platforms rather than advisory or standalone services. These solutions provide policy management, model monitoring, audit trails, risk scoring, and documentation across the AI lifecycle.

Enterprises use them to track how models are built, trained, deployed, and updated, ensuring accountability and transparency. This structured approach helps reduce operational and legal risk associated with AI usage.

From an implementation view, solution platforms enable centralized control and consistent governance across teams and use cases. They integrate with data, ML pipelines, and security tools to enforce rules automatically. The strong share of this segment reflects enterprise demand for scalable, repeatable governance capabilities that can keep pace with expanding AI adoption.

Deployment Mode Analysis

Cloud-based deployment holds 72.4% of the market, driven by the need for flexibility and rapid rollout. Cloud platforms allow enterprises to deploy governance controls across multiple AI systems without maintaining complex infrastructure. They also support frequent updates as regulations and internal policies evolve. This is critical in a fast-changing regulatory environment.

Cloud deployment improves collaboration across compliance, legal, and technology teams by providing shared dashboards and reports. It also supports secure access for distributed teams. The strong adoption of cloud-based deployment reflects preference for scalable and cost-efficient governance platforms that align with modern enterprise architectures.

Organization Size Analysis

Large enterprises represent 82% of the market, highlighting that AI governance needs are most acute in complex organizations. These enterprises operate multiple AI models across business units, regions, and functions. Governance platforms help them standardize controls, manage risk consistently, and ensure oversight at scale. Centralized governance is essential to avoid fragmented compliance efforts.

Large enterprises also face higher regulatory scrutiny and reputational risk. They require detailed reporting and audit readiness for internal and external stakeholders. The strong dominance of this segment reflects how AI governance has become a strategic priority for enterprises managing large and diverse AI portfolios.

End-User Industry Analysis

The BFSI sector accounts for 47.3% of end-user adoption, making it the largest industry segment. Financial institutions use AI for credit decisions, fraud detection, customer analytics, and risk management. These use cases are highly regulated and require strict controls over data usage, model fairness, and explainability. Governance platforms help ensure AI decisions align with regulatory and ethical standards.

In BFSI, failure to govern AI can lead to compliance penalties and loss of trust. Governance solutions provide transparency into model behavior and decision outcomes. The strong share of BFSI reflects the industry’s focus on responsible AI adoption and regulatory alignment.

Application Analysis

Regulatory compliance represents 58.3% of application demand, making it the leading use case in the market. Enterprises use governance platforms to map AI activities to regulatory requirements and internal policies. These tools help document model decisions, data sources, and control measures in a structured manner. This supports audits and regulatory reviews.

Compliance-focused applications also help organizations prepare for new and evolving AI regulations. Automated monitoring reduces manual effort and improves consistency. The strong share of this application reflects rising pressure on organizations to demonstrate responsible and compliant AI usage.

Key Reasons for Adoption

- Enterprise use of artificial intelligence is expanding across business functions

- Regulatory scrutiny around data use, transparency, and accountability is increasing

- Risk management needs are rising due to complex and automated decision systems

- Trust in AI outputs is required for enterprise-wide adoption

- Organizations need structured control over AI models and data pipelines

Benefits

- Compliance readiness is improved through standardized governance frameworks

- Operational risks are reduced by monitoring model behavior and decisions

- Transparency is strengthened across AI development and deployment processes

- Stakeholder confidence is increased through responsible AI practices

- Long-term scalability of AI initiatives is supported with clear oversight

Usage

- Used by enterprises to define policies for ethical and responsible AI use

- Applied in regulated industries to align AI systems with legal requirements

- Deployed to monitor AI model performance and decision consistency

- Utilized in audits to document AI lifecycle and data usage

- Integrated into enterprise AI platforms for continuous governance and control

Emerging Trends

Key Trend Description Automated compliance auditing Tools scan AI models for bias and regulatory adherence automatically. Explainable AI frameworks Systems provide transparency into decision-making processes. Federated learning protocols Privacy-preserving training across decentralized data sources. Real-time risk monitoring Continuous oversight of AI deployments in production. Blockchain audit trails Immutable logs for model changes and compliance proofs. Growth Factors

Key Factors Description Stringent AI regulations Laws like the EU AI Act mandate governance frameworks. Enterprise AI adoption surge Scaling deployments require structured oversight. Ethical AI imperatives Demand to mitigate bias and ensure fairness. Data privacy concerns Protection against breaches in AI pipelines. Risk management needs Preventing high-stakes failures in critical applications. Key Market Segments

By Component

- Solutions

- AI Model Governance & Lifecycle Management

- Bias Detection & Fairness Monitoring

- Explainability & Interpretability Tools

- Compliance & Regulatory Reporting

- Risk Management & Auditing

- Others

- Services

- Professional Services

- Consulting & Advisory

- Implementation & Integration

- Training & Education

- Managed Services

- Professional Services

- Others

By Deployment Mode

- On-premises

- Cloud-based

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare & Life Sciences

- Government & Public Sector

- Retail & E-commerce

- IT & Telecommunications

- Others

By Application

- Regulatory Compliance

- Ethical AI & Risk Mitigation

- Operational Transparency

- Model Performance & Validation

- Others

Regional Analysis

North America accounted for 42.3% share, supported by early enterprise adoption of artificial intelligence and strong emphasis on responsible and compliant AI deployment. Organizations across banking, healthcare, technology, and government have increasingly adopted AI governance and compliance solutions to manage model risk, data usage, and ethical considerations.

Demand has been driven by rising regulatory scrutiny, growing use of high impact AI systems, and board level focus on transparency and accountability. Enterprises in the region have prioritized governance frameworks to ensure AI systems align with internal policies and external regulations.

The U.S. market reached USD 0.94 Bn and is projected to grow at a 37.20% CAGR, reflecting rapid expansion of AI applications across enterprises. Adoption has been driven by the need to manage complex AI models, ensure explainability, and meet evolving regulatory and industry standards. AI governance and compliance platforms have helped U.S. organizations document model behavior, monitor bias, and maintain audit readiness.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The enterprise AI governance and compliance market is being driven by the rapid expansion of artificial intelligence across critical business functions that require accountability and regulatory alignment. Organisations increasingly deploy AI in decision sensitive areas such as risk assessment, customer engagement, and automated operations, which heightens exposure to ethical, legal, and compliance risks.

AI governance frameworks enable enterprises to define policies, monitor model behaviour, and maintain audit trails across the AI lifecycle. This structured oversight strengthens trust, supports regulatory readiness, and ensures that AI systems operate within approved ethical and operational boundaries.

Restraint Analysis

A key restraint in the enterprise AI governance and compliance market relates to the complexity of implementing governance controls across diverse AI environments. Many organisations operate multiple AI models across cloud, on premise, and hybrid infrastructures, making unified oversight challenging.

Aligning governance tools with existing data pipelines, development workflows, and business processes often requires specialised expertise and organisational coordination. Limited internal maturity around AI risk management can further slow adoption and reduce the effectiveness of governance initiatives.

Opportunity Analysis

Strong opportunities are emerging as enterprises seek scalable solutions that embed governance directly into AI development and deployment processes. AI governance platforms that support automated policy enforcement, bias assessment, and compliance documentation can significantly reduce manual oversight effort.

These capabilities are particularly valuable in regulated industries where transparency, explainability, and audit readiness are essential. As organisations prioritise responsible AI adoption, governance solutions are increasingly viewed as strategic enablers rather than compliance overhead.

Challenge Analysis

A central challenge in this market is balancing governance rigor with innovation speed. Excessive controls or rigid approval processes may slow model experimentation and delay business outcomes. Governance systems must therefore remain flexible, adaptive, and aligned with agile development practices. Ensuring explainability of AI decisions without overwhelming stakeholders with technical complexity also remains a practical challenge that requires careful system design and cross functional collaboration.

Competitive Analysis

Key players such as IBM Corporation, Microsoft Corporation, and Google LLC focus on enterprise scale AI governance frameworks. Their platforms support model transparency, risk management, and regulatory alignment. AI monitoring tools are embedded across cloud and hybrid environments. Salesforce, Inc. strengthens adoption through responsible AI features within business applications. These players benefit from strong enterprise trust and global customer bases.

Specialized analytics and governance providers such as SAS Institute Inc., H2O.ai, Inc., and DataRobot, Inc. emphasize model governance and lifecycle control. Their solutions address bias detection, explainability, and audit readiness. Fiddler Labs, Inc. and Arize AI, Inc. focus on real time monitoring and performance drift detection. Demand is driven by rising regulatory scrutiny and enterprise AI scale.

Risk and compliance focused vendors such as MetricStream, Inc., OneTrust, LLC, and SAP SE integrate AI governance with enterprise compliance workflows. Oracle Corporation supports data governance at scale. Consulting firms like Accenture plc and PwC Advisory Services LLC guide strategy and implementation. Other vendors expand regional coverage and innovation.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Salesforce, Inc.

- SAS Institute Inc.

- H2O.ai, Inc.

- DataRobot, Inc.

- Fiddler Labs, Inc.

- Arize AI, Inc.

- MetricStream, Inc.

- OneTrust, LLC

- SAP SE

- Oracle Corporation

- Accenture plc

- PwC Advisory Services LLC

- Others

Future Outlook

Growth in the Enterprise AI Governance and Compliance market is expected to increase as organizations deploy AI across critical business functions. Companies are focusing on managing model risk, data usage, transparency, and regulatory compliance to avoid legal and ethical issues.

Rising government attention on AI accountability and responsible use is supporting steady demand. Over time, standardized governance frameworks, automated monitoring, and audit tools are likely to make AI oversight more practical and scalable across enterprises.

Recent Developments

- IBM Corporation acquired Seek AI in June 2025 to power up watsonx.governance, delivering end-to-end compliance for agentic AI models across enterprises. The platform now flags bias and drift in real-time, aligning with NIST and EU AI Act standards for regulated industries. IBM’s focus on trustworthy AI helped it capture 25% market share in governance tools by late 2025.

- Microsoft Corporation launched enhanced Microsoft Purview AI governance in February 2025, bundling regulatory templates and risk scoring for Azure-hosted models. Partnerships like Saidot integration streamline compliance audits, cutting manual reviews by 60%. This positions Microsoft as a leader in scalable enterprise oversight amid rising global regs.

Report Scope

Report Features Description Market Value (2025) USD 2.5 Bn Forecast Revenue (2035) USD 68.2 Bn CAGR(2025-2035) 39.40% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services,Managed Services), By Deployment Mode (On-premises, Cloud-based), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance,Others), By Application (Regulatory Compliance,Ethical AI and Risk Mitigation,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Salesforce, Inc., SAS Institute Inc., H2O.ai, Inc., DataRobot, Inc., Fiddler Labs, Inc., Arize AI, Inc., MetricStream, Inc., OneTrust, LLC, SAP SE, Oracle Corporation, Accenture plc, PwC Advisory Services LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Enterprise AI Governance and Compliance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Enterprise AI Governance and Compliance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Salesforce, Inc.

- SAS Institute Inc.

- H2O.ai, Inc.

- DataRobot, Inc.

- Fiddler Labs, Inc.

- Arize AI, Inc.

- MetricStream, Inc.

- OneTrust, LLC

- SAP SE

- Oracle Corporation

- Accenture plc

- PwC Advisory Services LLC

- Others