Global Engineering Adhesives Market By Product (Epoxies, Polyurethanes, Cyanoacrylates, Methacrylate, Other Products), By Application (Transportation, Construction, Electrical & Electronics, Energy, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 21203

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

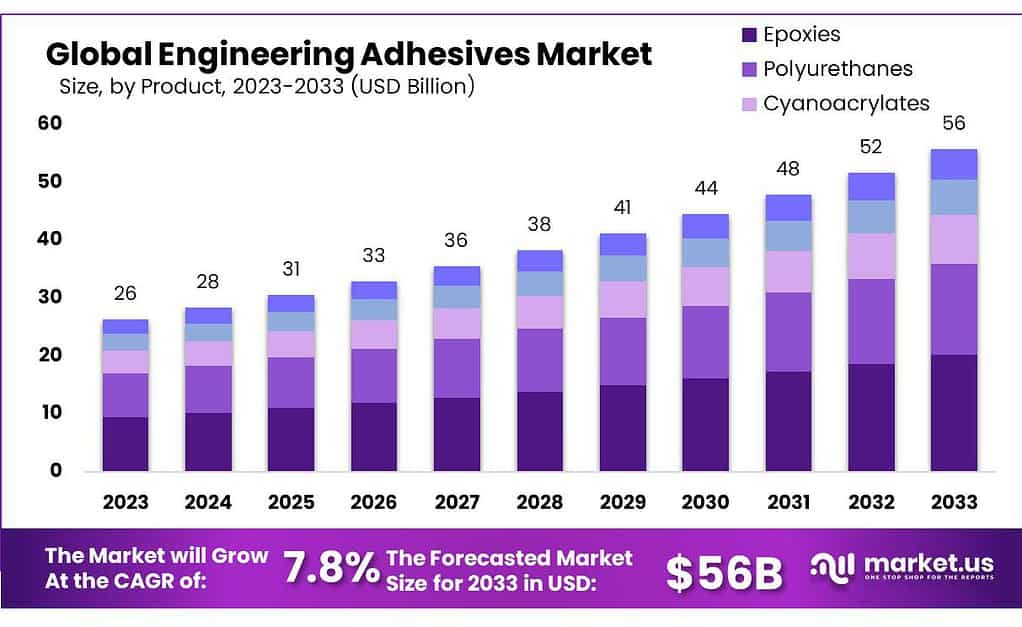

The Engineering Adhesives Market size is expected to be worth around USD 56 billion by 2033, from USD 26 BN in 2023, growing at a CAGR of 7.8% during the forecast period from 2023 to 2033.

The Engineering Adhesives Market refers to the segment of the adhesives industry that focuses on the production, distribution, and sale of specialized adhesives designed for engineering applications. These adhesives are formulated to meet the stringent requirements of various engineering fields, including automotive, aerospace, construction, electronics, and manufacturing among others.

Engineering adhesives are characterized by their superior strength, durability, and resistance to extreme temperatures, chemicals, and environmental conditions, making them crucial for bonding materials in applications where high performance and reliability are paramount.

This market encompasses a wide range of adhesive types, such as epoxies, silicones, cyanoacrylates, polyurethanes, and acrylics, each offering distinct properties tailored to specific engineering needs and applications. The growth of the engineering adhesives market is driven by advancements in materials science, increasing demand for high-performance materials in industrial and consumer products, and the ongoing trend towards lightweight and miniaturized components in various industries.

Key Takeaways

- Market Expansion: Expected to grow from USD 26 billion in 2023 to USD 56 billion by 2033, showcasing a CAGR of 7.8%.

- Epoxies Lead: Dominating the product segment with over 34.9% share in 2023, epoxies are prized for their strength and versatility across industries.

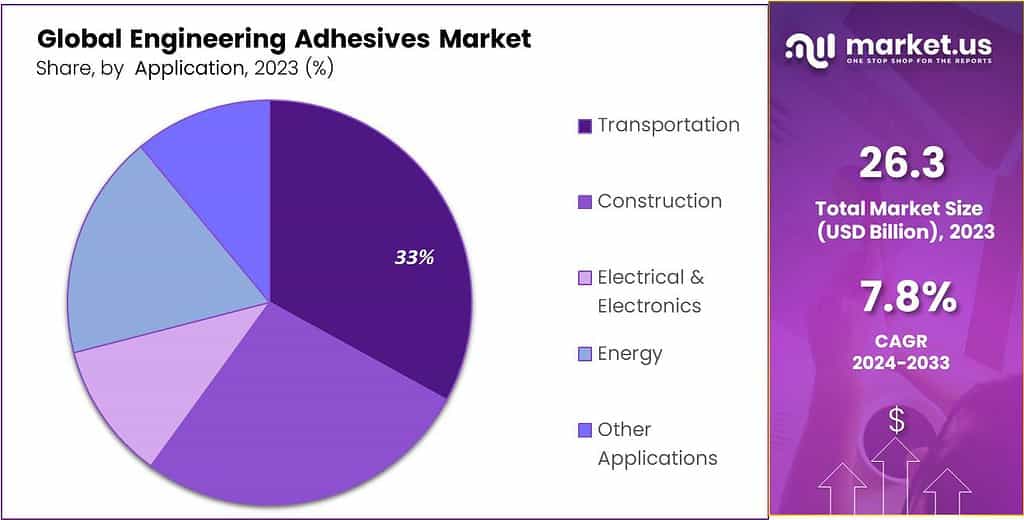

- Transportation’s Top Spot: Holding over 33.8% of the application market share, highlighting its critical role in automotive and aerospace manufacturing.

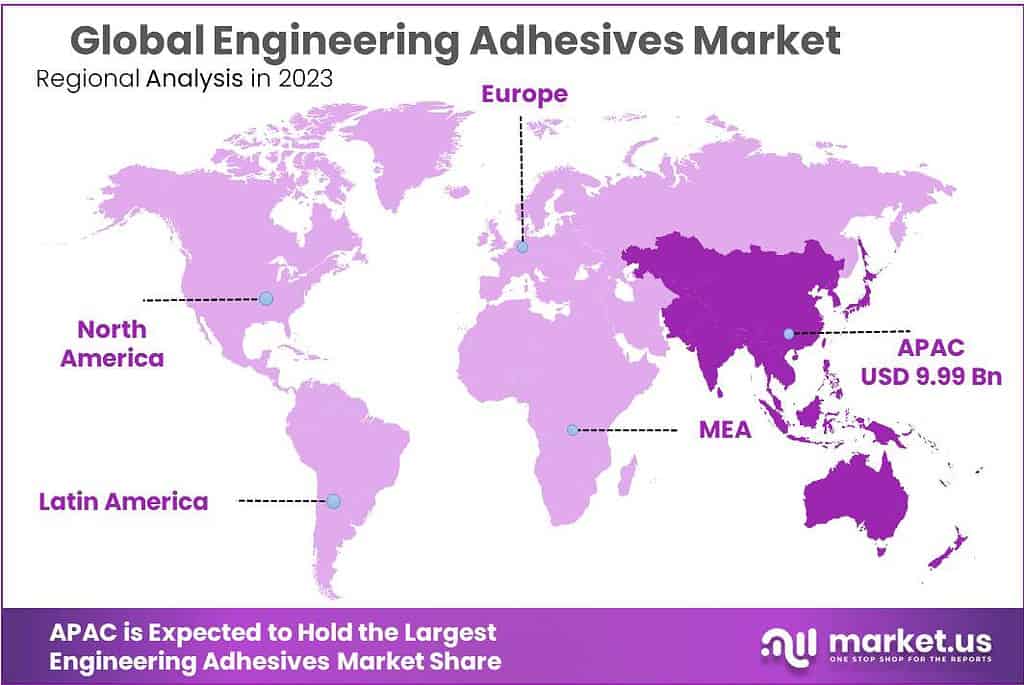

- Asia Pacific Dominance: With more than 38% market share, driven by China’s industrial growth and leadership in wind energy.

- European Market: Captures 23.8% of the global volume, propelled by the aerospace and marine sectors, with an annual turnover of approximately USD 247 billion.

- North American Influence: Accounts for 21.8% of the market volume in 2023, with strong demand in automotive and packaging industries.

Product Analysis

In 2023, the Engineering Adhesives market saw Epoxies emerge as the frontrunner, capturing a substantial share of over 34.9%. Epoxies’ dominance in the Engineering Adhesives market in 2023 highlights their remarkable versatility and strength, distinguishing them among various adhesive types.

Epoxy adhesives’ wide use across industries such as construction, automotive, and manufacturing is due to their exceptional bonding abilities; providing strong connections between metals, plastics, and composites.

Engineers and builders highly value the reliability of rubber seals when used under extreme temperatures or mechanical stress, such as temperature variations or mechanical strain. Their use ensures structures, components, and products remain securely joined even in challenging environments – an advantage that contributes to their wide adoption.

Epoxies have proven themselves as one of the premier adhesive types available, alongside Polyurethanes, Cyanoacrylates, and Methacrylates. While each adhesive type offers its own set of applications and strengths for various engineering tasks, Epoxies have proven themselves a go-to choice in instances when strong adhesion is paramount.

Epoxies’ dominance in this market not only shows their current usage but also indicates their immense potential for continued development across different industries. Their adaptability, strength and reliability make them indispensable components in numerous engineering projects and ensure lasting and reliable bonding solutions across diverse applications and sectors.

Application Analysis

In 2023, within the Engineering Adhesives market, Transportation emerged as the leading application, holding a substantial share of over 33.8%. Among various sectors relying on these adhesives, the transportation industry stood out, showcasing a strong preference for these bonding solutions.

Transportation industries such as automotive and aerospace heavily relied upon engineering adhesives for various uses. Adhesives were essential in assembling vehicles, aircraft, and their parts – from providing structural integrity and durability assurance, securing parts together securely, and improving overall safety and performance – these engineering adhesives played an essential part.

Transportation was one of the primary users of engineering adhesives, highlighting its dependence on strong and reliable bonding solutions. Automotive production for instance relies heavily on engineering adhesives to join various materials together while simultaneously increasing fuel efficiency by decreasing vehicle weight and improving crash resistance.

While transportation held the lead, other sectors like Construction, Electrical & Electronics, Energy, and various other applications also utilized engineering adhesives for their specific needs. However, the significant share held by the transportation sector in 2023 emphasized the critical role of adhesives in ensuring the quality, safety, and performance of vehicles and aircraft, solidifying their position as a vital component in the transportation industry’s manufacturing processes.

Key Market Segments

By Product

- Epoxies

- Polyurethanes

- Cyanoacrylates

- Methacrylates

- Other Products

By Application

- Transportation

- Construction

- Electrical & Electronics

- Energy

- Other Applications

Drivers

The growth of the Engineering Adhesives market was propelled by several key drivers. Firstly, the rising demand from various industries such as automotive, construction, and electronics played a pivotal role. These industries rely heavily on engineering adhesives for assembling parts, maintaining structural integrity, and increasing overall product performance – increasing market demand significantly.

Engineered adhesives were instrumental in supporting lightweight materials in industries like automotive and aerospace, helping increase fuel efficiency in vehicles while simultaneously improving performance of aerospace components, reflecting an industry shift towards lighter yet more resilient materials.

Technological innovations in adhesive formulations also contributed to market expansion. Ongoing innovations resulted in stronger and more resilient adhesives capable of withstanding various conditions, broadening application possibilities across industries and increasing adoption rates in various engineering applications.

Environmental regulations encouraging adhesive use over traditional fastening methods were another influential factor. Adhesives tend to be considered more eco-friendly than mechanical fasteners, making them compatible with regulatory goals that promote sustainability across industries.

The cost-effectiveness and efficiency of adhesives compared to conventional joining methods were additional compelling drivers. Adhesives offered reduced weight, enhanced design flexibility, and lower assembly costs, contributing to their widespread adoption across diverse engineering applications.

Collectively, these drivers propelled the Engineering Adhesives market by meeting the demand for strong, lightweight, and environmentally friendly bonding solutions. Their utilization across industries enhanced overall product quality, performance, and sustainability.

Restraints

Several restraints affected the Engineering Adhesives market dynamics. Firstly, stringent regulations and compliance standards posed a significant challenge. Adhesives must adhere to various industry-specific regulations, leading to complexities in formulation and usage. Meeting these standards often added costs and complexities to the manufacturing process, impacting market growth and adoption.

Adhesives faced limitations in extreme conditions, such as high temperatures or high-stress environments, impacting their performance. Their inability to match the robustness of traditional mechanical fasteners in such conditions restricted their application in industries where durability under extreme situations was crucial.

Material compatibility presented another restraint. Adhesives require compatible materials for effective bonding, limiting their usage across diverse applications where material compatibility is essential. The challenge of ensuring optimal adhesion to various substrates or materials hindered their broader application. Cost factors played a significant role in restraining market expansion.

Although adhesives offer long-term benefits, the initial setup costs and investments in specialized equipment for adhesive application deterred some industries from adopting adhesive bonding over conventional methods, impacting their widespread use.

Additionally, maintaining consistent quality and adhering to stringent standards remained a challenge. Ensuring quality control throughout the adhesive application process and meeting industry standards demanded rigorous testing and validation, adding complexity and costs to the manufacturing and implementation processes.

Overcoming these restraints necessitated continuous innovation to enhance adhesive performance in extreme conditions, develop more versatile formulations for diverse materials, and streamline manufacturing processes to reduce costs. Addressing these challenges was crucial to fostering wider adoption of adhesives across a broad spectrum of engineering applications.

Opportunities

The Engineering Adhesives market unveiled various promising opportunities ripe for exploration and growth. Firstly, advancements in adhesive technology were key. Developing adhesives compatible with advanced materials like lightweight composites became crucial as industries increasingly embraced these materials. Innovations in adhesive formulations tailored to these materials could unlock new market segments and applications.

High-performance adhesives catering to extreme conditions represented another significant opportunity. Industries such as aerospace and automotive sought adhesives capable of enduring harsh environments without compromising strength or durability. Meeting this demand for resilient bonding solutions could lead to substantial market expansion.

Continuous technological advancements in adhesives, focusing on enhancing bonding strength, flexibility, and quicker curing times, presented growth prospects. These advancements created opportunities to broaden the scope of adhesive applications across diverse industries by offering improved performance and versatility. The rising environmental consciousness paved the way for eco-friendly adhesives.

Formulating adhesives using sustainable and bio-based materials, with reduced environmental impact, resonated with the sustainability objectives of many industries. This niche for environmentally friendly adhesives showcased potential for growth and market penetration.

Industries seeking customized adhesive solutions for specific applications, such as electronics, healthcare, and renewable energy, offered tailored opportunities. Developing specialized adhesives to meet unique industry requirements and challenges presented avenues for targeted growth and expansion. The burgeoning demand in emerging markets provided significant growth potential.

As industries in developing regions expanded, the need for advanced adhesive solutions surged, creating opportunities for market expansion and establishing a foothold in new geographical territories. Leveraging these opportunities necessitated strategic investment in research and development to create advanced, specialized, and environmentally conscious adhesive solutions.

Tailoring offerings to industry-specific needs and seizing opportunities in emerging markets could drive substantial growth in the dynamic Engineering Adhesives market.

Challenges

The Engineering Adhesives market grappled with various challenges impeding its progression. Firstly, meeting stringent regulatory standards proved daunting. Adhesives must comply with diverse and stringent industry regulations, leading to complexities in formulation and application.

Adhering to these standards often increased manufacturing intricacies and expenses, impacting market growth and adoption. Performance limitations in extreme conditions presented another hurdle. In scenarios involving high temperatures, intense pressures, or exposure to harsh chemicals, certain adhesives might not maintain their effectiveness, limiting their usability in industries requiring resilience in challenging environments.

Material compatibility and ensuring strong bond strength remained persistent challenges. Some adhesives faced limitations in effectively adhering to specific materials, curbing their widespread application in industries reliant on robust bonding solutions and material compatibility. Cost-effectiveness and implementation costs were significant hurdles.

Despite the long-term benefits of adhesives, the initial setup expenses and investments in specialized application equipment deterred some industries from adopting adhesive bonding over conventional methods, impacting their broader use.

Ensuring consistent quality control and adhering to rigorous industry standards throughout the adhesive application process posed challenges. Maintaining uniform quality and meeting stringent testing standards demanded substantial investments in quality control measures. Keeping pace with continuous technological advancements presented a challenge.

Staying updated with innovative adhesive technologies and investing in research and development to enhance adhesive performance and versatility demanded significant efforts and resources. Addressing these challenges necessitated a focused approach towards research and development to enhance adhesive resilience in extreme conditions, develop versatile formulations compatible with diverse materials, and streamline manufacturing processes to reduce costs.

Overcoming these hurdles was essential to fostering wider acceptance and application of adhesives across varied engineering sectors.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 38% in 2023. This is due to China’s massive industrial sector, which includes construction, automobile, energy, electronics, and automotive. The fastest growing sector in China, and all around the globe, is wind energy. The wide use of adhesive products is necessary for the manufacturing of wind turbine blades. According to the Global Energy Council, China leads in terms of both land- and sea-based wind power capacity.

Europe held a 23.8% share of the global market in volume in 2023. The country’s market will be driven by transportation, including the aerospace and marine sectors. According to the Aerospace & Defense Industries Association in Europe (Aerospace & Defense Industries Association), the sector’s annual turnover is approximately USD 247 billion. This sector has a high demand for adhesive products that can bond composites, metals, and plastics.

North America was responsible for 21.8% of the volume share in 2023. The market is driven by the increasing consumption in the automotive and packaging industries. Vendors will have many opportunities in the woodworking industry due to the need for structural bonding applications.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Multinational companies dominate the global engineering adhesive market. They are present at all stages of the value chain. These companies can integrate into the value chain to lower their operations and procuration costs, and diversify their businesses in different end-use industries.

Market Key Players

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Permabond LLC

- Arkema S.A.

- 3M Company

- Anabond

- Hexion Inc.

- Other Key Players

Recent Developments

In February 2023, 3M Corporation, founded in Minnesota and operating worldwide since 1886, serves industries including industry, worker safety, healthcare and consumer products. They acquired Tesa in February 2023 – long considered the premier producer of adhesive tapes and solvents.

In January 2023, Henkel is an industry-leading manufacturer of adhesives, sealants and functional coatings. Recently they unveiled an exciting addition to their Locite structural adhesive product range – Loctite EA 9462 structural epoxy adhesive which promises outstanding performance.

Report Scope

Report Features Description Market Value (2023) USD 26 Bn Forecast Revenue (2033) USD 56 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Capsules, Tablets), By End User(Antidiarrheal, Detoxification, Eliminate Swelling), By Distribution Channels(Pharmacies & Drug Stores, Supermarket/Hypermarket, Online Retailers, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Jacobi Carbons, Country Life, FORZA, Amy Myrers, Schizandu Organics, CarboTech AC GmbH, Nature’s Way, Holland & Barrett, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Engineering Adhesives MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Engineering Adhesives MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Permabond LLC

- Arkema S.A.

- 3M Company

- Anabond

- Hexion Inc.

- Other Key Players