Global Engineered Stone Market By Type (Blocks & Slabs, Tiles), By Application (Flooring, Countertops, Other Applications), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 14354

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

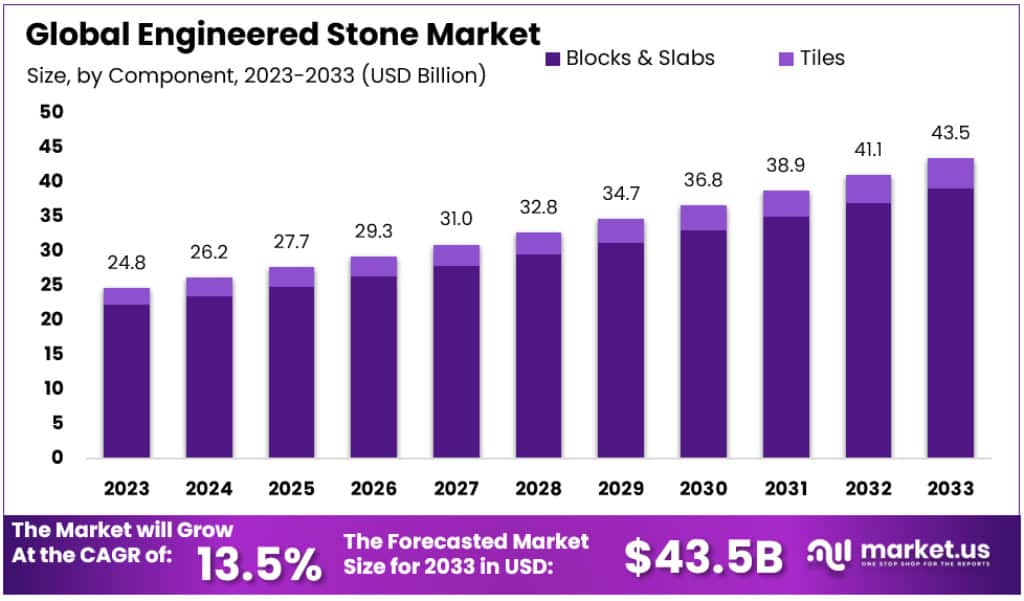

The Global Engineered Stone Market size is expected to be worth around USD 43.5 Billion by 2033, from USD 24.8 Billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2023 to 2033.

Engineered stone is a composite material made of crushed stone bound together by an adhesive, most commonly polymer resin or cement mix. It is also referred to as quartz in the countertop industry. The stone is compressed into slabs that have a similar appearance to natural stone but possess additional benefits not available with natural materials.

Some key characteristics of engineered stone include:

- Non-porous: Engineered stone is 100% non-porous, making it more stain-resistant and easier to maintain than natural stone.

- Uniform Color and Pattern: The color and pattern of engineered stone slabs are more uniform than those of natural stone, as the material is manufactured rather than formed in the earth.

- Hardness: Engineered stone is very hard, nearly as hard as granite, and has a similar appearance to natural stone.

- Durability: Engineered stone slabs are stronger and less prone to cracking than natural stone slabs due to their more uniform structure.

Engineered stone countertops are a popular choice for kitchens and bathrooms, as they offer a high-end look and are more practical than natural stone. They are non-porous, resistant to stains, and easier to fabricate than natural stone.

Key Takeaways

- The Global Engineered Stone Market is expected to reach approximately USD 43.5 Billion by 2033.

- In 2023, the market was valued at USD 24.8 Billion.

- The market is projected to grow at a CAGR of 13.5% from 2023 to 2033.

- Blocks & Slabs held a dominant market position in 2023, with a 92.25% share.

- Engineered stone tiles are expected to grow at a CAGR of approximately 4.8% through 2033.

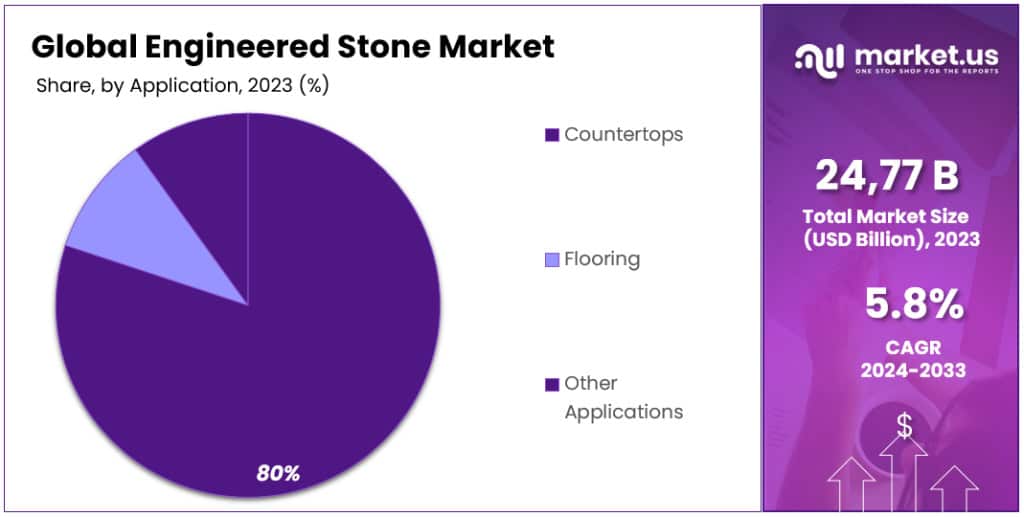

- Countertops captured over 80.7% market share in 2023.

- Flooring is expected to grow at a CAGR of around 4.5% over the forecast period.

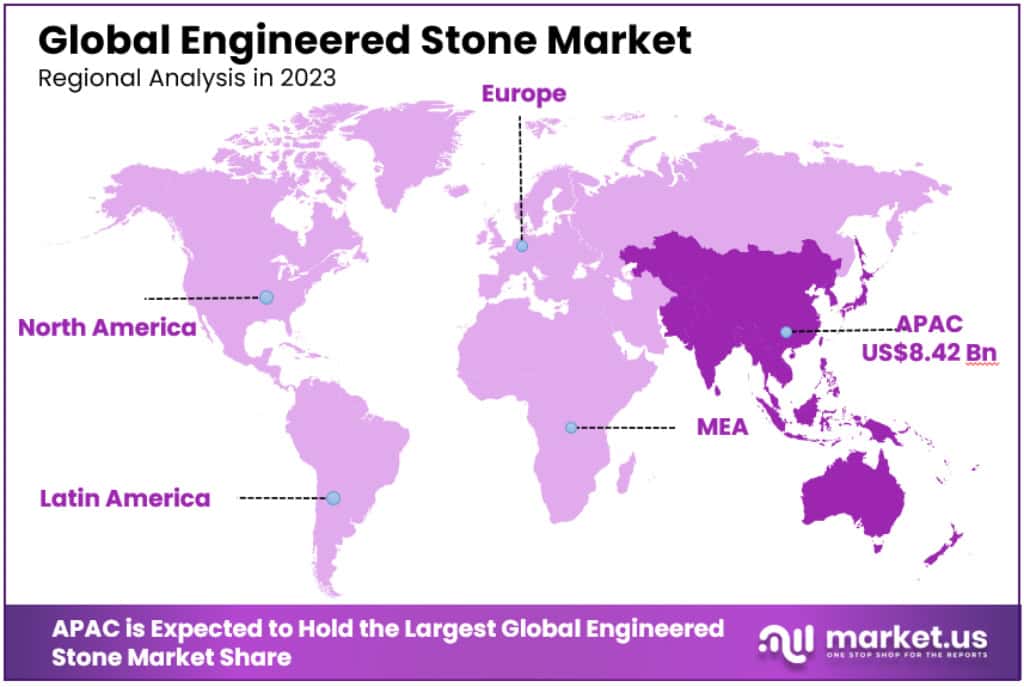

- Asia Pacific leads the market with a dominant 38% share worth USD 8.42 billion in 2023.

- Europe is expected to grow at a CAGR of ~5% during the forecast period.

Product Type Analysis

In 2023, Blocks & Slabs held a dominant market position in the engineered stone market, capturing a significant 92.25% share. This segment’s preeminence is rooted in its ease of installation and maintenance, coupled with its reduced susceptibility to stains from common food substances like oil, wine, and juices. These properties make Blocks & Slabs particularly suitable for kitchen applications, where their large size and non-porous nature are advantageous. Notably, engineered stone in this form is often used in wet areas such as bathrooms, swimming pools, and more, driving its demand in both residential and commercial settings.

The analysis reveals that Blocks & Slabs, favored for their aesthetic appeal and practical advantages over natural stone, constituted a substantial share in recent years. The segment’s adaptability to specific design needs, along with the rising trend for stylish, low-maintenance surfaces, is expected to further fuel its growth.

On the other hand, the engineered stone tiles segment, known for its variety and customizability, is projected to expand at a CAGR of ~4.8% through 2033. These tiles are composed of aggregates bonded with epoxy, offering a broad spectrum of colors, shapes, and sizes. Despite this, the segment faces competition from less expensive alternatives like ceramic tiles.

Quartz, within the broader engineered stone market had significant share, due to its superior durability and low maintenance. Its resistance to scratches, stains, and heat has made it a preferred choice for kitchen countertops and bathroom vanities. The marble and granite segments are also anticipated to see significant growth, driven by their durability and the increasing demand for luxury and sustainable construction materials.

Application Analysis

Countertops held a dominant market position in the engineered stone market, capturing more than a significant 80.7% share, in 2023. The prominence of this segment stems from its stain-resistant properties and the broad array of design, color, and texture choices available, making it a favored option over natural stone. Despite its unsuitability for outdoor use due to UV sensitivity, the countertop segment’s demand remains robust, especially in indoor settings where its aesthetic and functional benefits are most valued.

The flooring segment, with its water resistance and non-porous nature, is expected to advance at a CAGR of ~4.5% over the forecast period. Its suitability for high-traffic areas like kitchens and bathrooms, along with its wear resistance, positions it as a practical choice for both residential and commercial spaces. This segment’s growth is indicative of a shift towards more durable and maintenance-friendly flooring solutions.

Kitchen countertops, in particular, have garnered the largest revenue share due to their durability, stain resistance, and low maintenance needs. As a non-porous material, engineered stone is highly resistant to bacteria, mold, and mildew, further boosting its demand in settings where hygiene is paramount.

Other applications, including wall and exterior coverings and furnishing items, are leveraging engineered stone’s superior aesthetics, durability, and stain resistance. While these segments might not share the same dominance as countertops and flooring, they are integral in providing comprehensive engineered stone solutions across various construction and design needs.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Blocks & Slabs

- Tiles

By Application

- Flooring

- Countertops

- Other Applications

Drivers

- Rising Construction Activities: The global increase in construction projects, including residential, commercial, and infrastructure developments, is significantly driving the market. Engineered stones like quartz are becoming popular due to their aesthetic appeal and durability.

- Eco-Friendly Demand: A growing inclination towards eco-friendly products is propelling market growth. Engineered stone, comprising up to 94% recycled materials, aligns well with sustainable building trends.

- Urbanization and Residential Growth: Rapid urbanization, especially in emerging economies, and the expansion of residential sectors are creating substantial demand. As per industry analyses, the increased interest in attractive and durable infrastructure is amplifying the use of engineered stones.

Restraints

- High Costs and Awareness Gap: The initial high capital cost and a general lack of awareness about the benefits of engineered stone are significant barriers. Additionally, the adverse impact of COVID-19 on construction activities further hampered market growth in 2020-2021.

- Environmental and Health Concerns: The use of resins and additives in manufacturing can release volatile organic compounds (VOCs), posing environmental and health challenges. Continuous exposure to UV rays can also lead to the discoloration and weakening of engineered stones.

Opportunities

- Construction Sector Boom: The continuous rise of the building and construction industry globally presents numerous opportunities. The market is set to benefit from the increasing acceptance of recyclable engineered stones and the surge in renovation and building activities post-COVID-19 restrictions.

- Innovative Applications: There’s a growing trend of using engineered stone in various applications like kitchen worktops, flooring, and bathroom furnishings. Its ability to be produced in large sizes with fewer joints enhances aesthetic appeal, making it a preferred choice for modern constructions.

Challenges

- Production and Environmental Impact: Challenges include addressing the environmental impact of quartz mining and the resin-based production process. The industry is under pressure to develop more sustainable materials and methods.

- Technical Limitations: Engineered stones, particularly quartz, are less heat-resistant compared to natural stones like granite. Their sensitivity to temperature changes and susceptibility to damage from sudden temperature shifts can be limiting factors.

Trends

- Pollution Mitigation and Recyclability: Increasing awareness about pollution mitigation is fostering the production of recyclable engineered stone. Products like porcelain sinks and bottles containing up to 70% recyclable material are gaining traction, expected to fuel market growth.

- Aesthetic and Functional Versatility: The market is witnessing a trend towards stones that offer both aesthetic appeal and robustness. The ability of engineered stone to replicate the appearance of natural stones like granite or marble in various colors and patterns makes it versatile and desirable for a wide range of design preferences.

Regional Analysis

Asia Pacific Dominates the Market

Asia Pacific is leading the global engineered stone market, holding a dominant 38% share worth USD 8.42 billion in 2023. The region, particularly countries like China and India, is experiencing rapid growth due to urbanization, burgeoning construction activities, and an expanding middle-class population. With over 100 manufacturers in China alone and approximately 40 slab production units in India, the region has become a significant hub for engineered stone production. The demand in Asia Pacific is fueled by not only residential and commercial constructions but also by the growing preference for modern and luxurious interiors.

Europe’s Steady Growth

Europe remains a mature market with a strong consumption pattern for engineered stone. Italy, being a traditional leader in supplying engineered stone, significantly contributes to the market’s growth. Renovation and repairing activities in countries like Germany, France, and the U.K. are expected to maintain the region’s demand for engineered stones. Moreover, the market is expected to grow at a CAGR of ~5% during the forecast period due to stringent mining regulations and substantial investments in old building structures’ redevelopment.

North America’s Sustainable Expansion

In North America, particularly the U.S., the market is witnessing sustainable growth with an expanding construction sector and a rising trend of home renovations. The region’s focus on green construction materials and energy-efficient solutions is further propelling the demand. With the construction industry recovering post-COVID-19, the U.S. market is playing a crucial role in the regional expansion.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global engineered stone market is highly competitive with the presence of many large and medium-sized companies. These firms are actively employing strategies like mergers, acquisitions, and partnerships to expand their market presence. For instance, Breton S.p.A., a key player, has enhanced its global footprint by establishing authorized workshops in multiple countries, including Italy, France, China, India, and Brazil. Brand recognition and the offer of customized services are crucial factors that are helping these companies increase their market share.

Companies like LX Hausys, Johnson Marble & Quartz, Technistone A.S., and Caesarstone Ltd. are leading the market with their extensive product portfolios and strong geographic presence. These companies, along with others like Belenco, Quarella Group Ltd., and Quartzforms, are investing heavily in research and development to innovate and introduce new products. This focus on innovation is a significant strategy for staying competitive and capturing a larger market share.

According to industry reports, major players are also leveraging government funding and increasing their investment in new technologies. These initiatives are expected to benefit their growth and enhance their offerings in the market. For example, LG Hausys, A.St.A. WORLD-WIDE, and other key players are adopting advanced technologies to improve their product quality and meet the evolving needs of their customers.

Маrkеt Кеу Рlауеrѕ

- LX Hausys

- Johnson Marble

- Quartz

- Technistone A.S.

- Caesarstone Ltd.

- Belenco

- Quarella Group Ltd.

- Quartzforms

- Stone Italiana S.p.A.

- Cosentino S.A.

- VICOSTONE

- LG Hausys

- A.St.A. WORLD-WIDE

- Other Key Players

Recent Developments

Acquisitions

- October 2023: Spain’s Cosentino acquired Okite, an Italian brand famous for its high-quality, marble-like quartz surfaces. This move significantly boosts Cosentino’s presence in the luxury engineered stone segment.

- November 2023: Silestone by Cosentino, known for its quartz surfaces, collaborated with luxury fashion designer Elie Saab to launch a new collection. This line features quartz surfaces inspired by Saab’s elegant fabric designs, reflecting a growing trend of incorporating high-fashion elements into home decor.

New Trends

- Sustainable Engineered Stone: The demand for eco-friendly products is rising. In response, brands like Silestone have introduced lines like ECO, made with up to 50% recycled materials, catering to environmentally conscious consumers.

- Innovative Surface Finishes: Caesarstone introduced HybriQ technology, creating surfaces with improved scratch and stain resistance, showcasing the industry’s commitment to innovation.

- Personalization and Customization: The desire for unique home spaces is driving companies to offer more personalization options. Cambria Quartz, for instance, launched a Design Studio tool, enabling customers to tailor their quartz surfaces to their specific tastes.

Company News

- October 2023: LG Hausys, a major player from Korea, announced a $1 billion investment to expand its manufacturing capacity in North America. This reflects the region’s increasing appetite for engineered stone.

- November 2023: The International Surface Fabricators Association (ISFA) held its annual Stone Summit, focusing on new industry trends, including the adoption of automation and AI in engineered stone production, highlighting the sector’s technological advancements.

Report Scope

Report Features Description Market Value (2023) USD 24.8 Billion Forecast Revenue (2033) USD 43.5 Billion CAGR (2023-2033) 13.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Blocks & Slabs, Tiles), By Application (Flooring, Countertops, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape LX Hausys, Johnson Marble, Quartz, Technistone A.S., Caesarstone Ltd., Belenco, Quarella Group Ltd., Quartzforms, Stone Italiana S.p.A., Cosentino S.A., VICOSTONE, LG Hausys, A.St.A. WORLD-WIDE and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the engineered stone market in 2023?A: The Engineered Stone market size was USD 24.8 Billion in 2023.

Q: What is the projected CAGR at which the engineered stone market is expected to grow at?A: The Engineered Stone market is expected to grow at a CAGR of 13.5% (2023-2033).

Q: List the key industry players of the Engineered Stone market?A: LX Hausys, Johnson Marble, Quartz, Technistone A.S., Caesarstone Ltd., Belenco, Quarella Group Ltd., Quartzforms, Stone Italiana S.p.A., Cosentino S.A., VICOSTONE, LG Hausys, A.St.A. WORLD-WIDE and Other Key Players. engaged in the Engineered Stone market.

-

-

- LX Hausys

- Johnson Marble

- Quartz

- Technistone A.S.

- Caesarstone Ltd.

- Belenco

- Quarella Group Ltd.

- Quartzforms

- Stone Italiana S.p.A.

- Cosentino S.A.

- VICOSTONE

- LG Hausys

- A.St.A. WORLD-WIDE

- Other Key Players