Global Encoder Market Size, Share and Analysis Report By Type (Rotary Encoder, Linear Encoder), By Signal Type (Incremental, Absolute), By Technology (Magnetic, Optical, Inductive, Others), By Application (Industrial, Healthcare & Life Sciences, Automotive, Consumer Electronics, Power, Food & Beverage, Aerospace, Printing, Textile, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175593

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Type – Rotary Encoder (57.3%)

- By Signal Type – Incremental (59.6%)

- By Technology – Magnetic (40.4%)

- By Application – Industrial (34.6%)

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

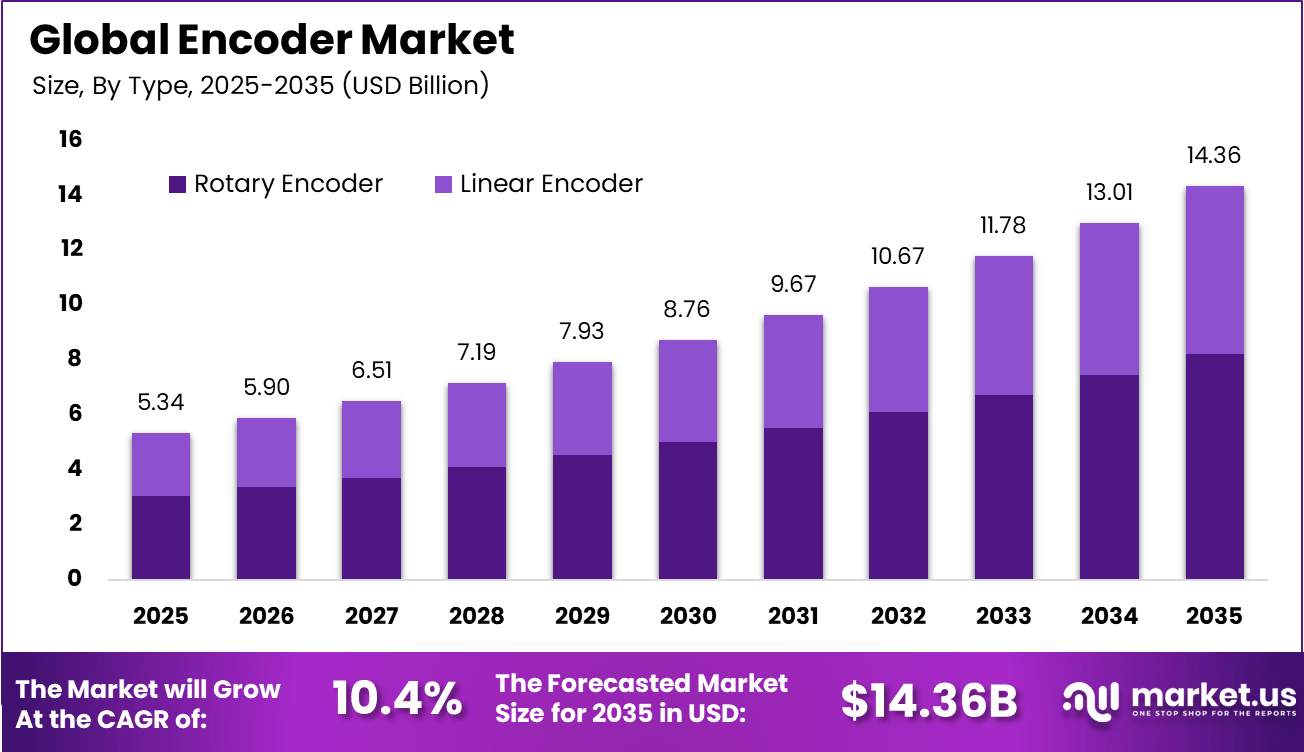

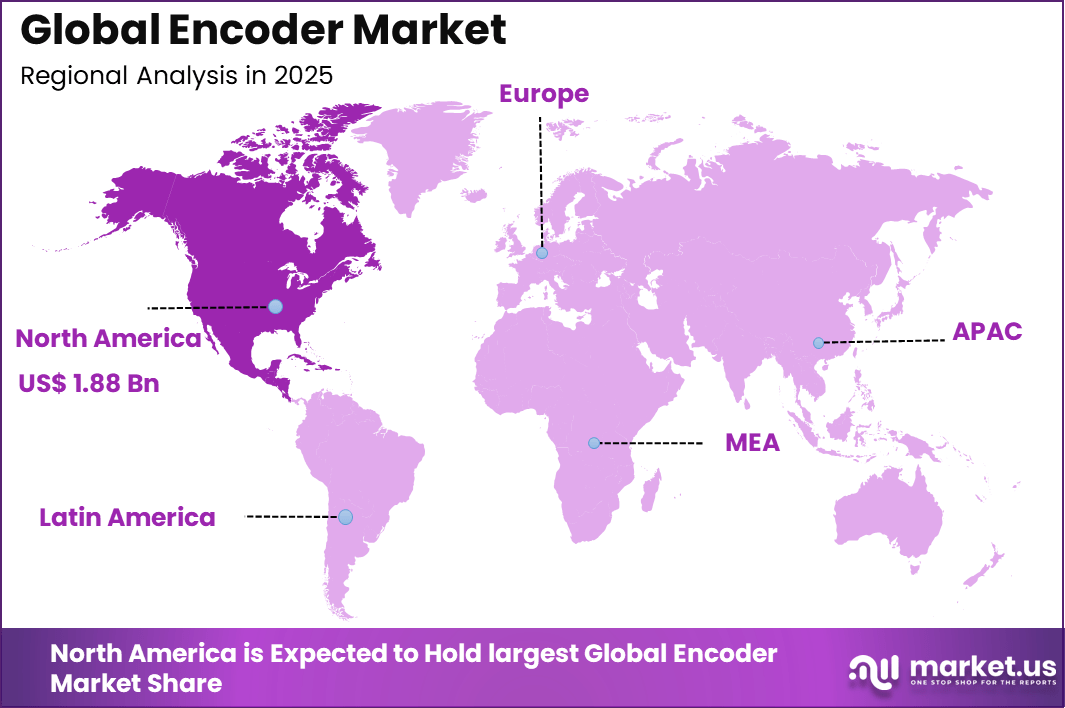

The Global Encoder Market presents a compelling investment opportunity, growing from USD 5.34 billion in 2025 to nearly USD 14.36 billion by 2035, at a CAGR of 10.4%. North America’s dominant position, capturing more than 35.3% share and USD 1.88 billion in revenue, underscores the region’s leadership in automation technologies and long-term growth potential for investors.

The encoder market focuses on sensing devices that convert mechanical motion into electrical signals for position, speed, and direction measurement. These devices are essential components in automation systems, machinery, robotics, and motion control applications. Encoders provide accurate feedback that supports precise control of motors and mechanical equipment. They are widely used across manufacturing, automotive, energy, healthcare equipment, and logistics systems.

One major driving factor of the encoder market is the increasing use of automated production lines. Automated machinery requires accurate feedback to maintain consistent motion control. Encoders ensure precise positioning and speed regulation. Reduced error rates improve production quality. Automation growth strongly supports market demand.

For instance, in February 2025, Baumer introduced the HOG800 series smart encoders for heavy-duty use, with corrosion protection, smart parameterization via Sensor Suite, and status monitoring. Perfect for cranes and mills, they simplify commissioning while delivering legendary robustness in harsh environments.

Demand for encoders is influenced by modernization of industrial infrastructure. Manufacturers upgrade equipment to improve efficiency and reduce downtime. Encoders are integrated into new and retrofitted systems. Improved feedback enhances machine performance. Infrastructure upgrades sustain steady demand.

Key Takeaway

- In 2025, the rotary encoder segment held a leading position in the global encoder market, accounting for 57.3% of the total market share.

- In 2025, the incremental encoder segment dominated the market by type, capturing 59.6% of the global encoder market.

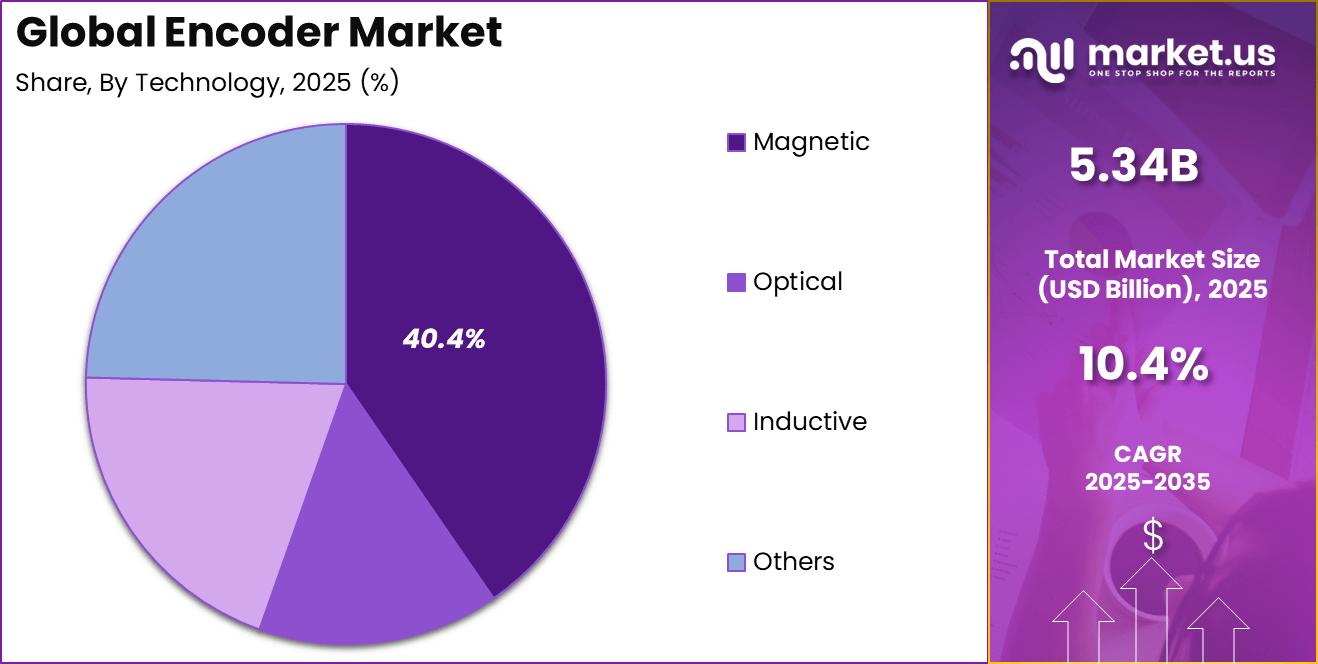

- In 2025, the magnetic encoder segment emerged as the largest technology segment, holding 40.4% of the global market share.

- In 2025, the industrial segment represented the largest application area, capturing 34.6% of the global encoder market.

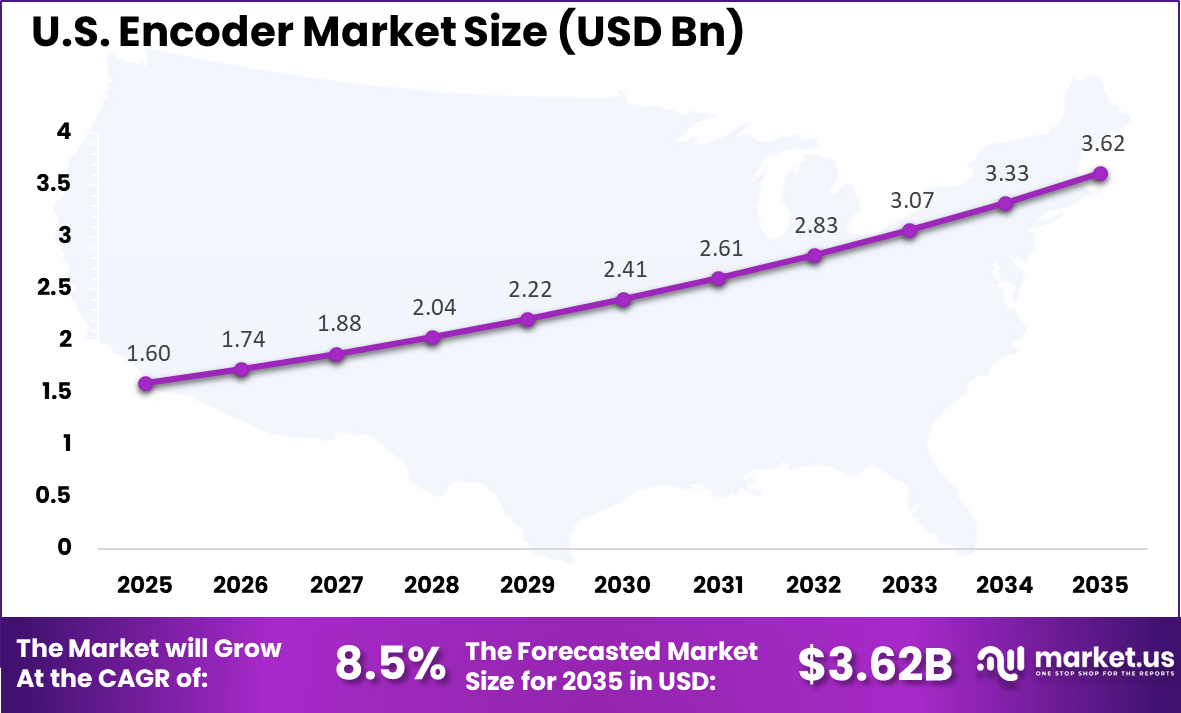

- The U.S. encoder market was valued at USD 1.60 billion in 2025, supported by a strong compound annual growth rate of 8.5%.

- In 2025, North America maintained a dominant regional position in the global encoder market, accounting for more than 35.3% of the total market share.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of industrial automation Demand for precise motion and position feedback ~3.1% Global Short Term Expansion of smart manufacturing Increased use of sensors and feedback systems ~2.6% North America, Europe Short Term Adoption of robotics Encoder integration in robotic joints and actuators ~2.1% Global Mid Term Rising use of magnetic encoders Reliability in harsh industrial environments ~1.6% Global Mid Term Infrastructure modernization Upgrades to automated production lines ~1.0% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Price pressure Intense competition among encoder manufacturers ~2.4% Global Short Term Supply chain disruptions Dependence on electronic components ~2.0% Global Short Term Technology substitution Adoption of alternative sensing technologies ~1.6% Global Mid Term Integration complexity Compatibility with legacy control systems ~1.3% Global Mid Term Economic slowdowns Reduced capital spending in manufacturing ~1.0% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High initial equipment cost Advanced encoders priced at a premium ~2.8% Emerging Markets Short to Mid Term Limited technical expertise Installation and calibration challenges ~2.3% Global Mid Term Standardization issues Variability in encoder specifications ~1.9% Global Mid Term Maintenance requirements Periodic calibration and servicing ~1.5% Global Long Term Slow SME adoption Cost sensitivity among smaller manufacturers ~1.2% Global Long Term By Type – Rotary Encoder (57.3%)

Rotary encoders account for 57.3%, making them the most widely used encoder type. These devices measure rotational position, speed, and direction. Rotary encoders are commonly installed in motors and machinery. They support precise motion control in automated systems. Reliability and accuracy are key performance requirements.

The dominance of rotary encoders is driven by broad industrial adoption. Many applications require continuous rotational feedback. Rotary encoders are compatible with various control systems. Their design supports long operational life. This sustains strong demand across industries.

For Instance, in May 2025, SICK AG launched the ANS/ANM58 ProfiNet absolute rotary encoder, aimed at high-productivity spots. It handles quick communication with PLCs for smooth rotation detection in machines. This fits rotary needs in demanding production, underlining why this type leads with reliable angle tracking across industries.

By Signal Type – Incremental (59.6%)

Incremental signal types represent 59.6%, making them the leading signal category. Incremental encoders provide relative position information. They generate pulses as the shaft rotates. These signals support speed and direction measurement. Simplicity supports wide usage.

Growth in incremental encoders is driven by cost efficiency. Many applications do not require absolute position data. Incremental systems are easier to integrate. Maintenance requirements remain low. This keeps incremental encoders widely adopted.

For instance, in April 2025, Pepperl+Fuchs extended its incremental rotary encoders with high-pulse options up to 50,000 per turn. Built for precise speed readout in conveyors and tools, they thrive in compact industrial fits. This highlights incremental growth through simple, tough signal output for motion tasks.

By Technology – Magnetic (40.4%)

Magnetic technology accounts for 40.4%, highlighting its strong presence in the market. Magnetic encoders use magnetic fields for position sensing. They perform well in harsh environments. Resistance to dust and vibration improves durability. Reliability remains a major advantage.

Adoption of magnetic technology is driven by industrial conditions. Factories operate in challenging environments. Magnetic encoders maintain performance under stress. They require less frequent calibration. This sustains steady adoption of magnetic encoders.

For Instance, in February 2025, Baumer advanced its magnetic encoder line for harsh sites, focusing on compact designs with top accuracy. These non-contact units resist dirt and vibrations in heavy gear, perfect for magnetic tech demands. The update drives adoption where durability beats out fragile options.

By Application – Industrial (34.6%)

Industrial applications represent 34.6%, making them the leading usage area. Encoders support automation, robotics, and machinery control. Accurate motion feedback improves productivity. Industrial systems require consistent performance. Precision remains essential.

Growth in industrial applications is driven by automation adoption. Manufacturing facilities upgrade control systems. Encoders support efficient machine operation. Integration with industrial controllers improves reliability. This keeps industrial applications central to demand.

For Instance, in March 2025, Rockwell Automation enhanced its CIP Safety encoders for industrial safety nets up to SIL 3. These track positions in material handling and auto lines blend safety with standard controls. It shows industrial pull for encoders that lift uptime in factories.

By Region

North America accounts for 35.3%, supported by strong industrial automation activity. The region invests in advanced manufacturing technologies. Encoder usage supports process efficiency. Infrastructure modernization supports demand. The region remains influential.

For instance, in August 2024, Honeywell International completed the acquisition of Sensys Technologies, a leading provider of encoder solutions, significantly expanding its industrial automation portfolio. This strategic move strengthens Honeywell’s position in high-precision motion control systems and reinforces North American leadership in encoder technology for manufacturing and robotics applications.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Advanced industrial automation and robotics 35.3% USD 1.88 Bn Advanced Europe Strong manufacturing and factory automation 29.6% USD 1.58 Bn Advanced Asia Pacific Rapid industrialization and robotics adoption 25.1% USD 1.34 Bn Developing Latin America Gradual automation in manufacturing 5.6% USD 0.30 Bn Developing Middle East and Africa Early stage industrial automation 4.4% USD 0.24 Bn Early

The United States reached USD 1.60 Billion with a CAGR of 8.5%, reflecting steady growth. Expansion is driven by industrial upgrades. Automation adoption supports encoder demand. Manufacturing investments continue. Market momentum remains stable.

For instance, in May 2025, Allied Motion Technologies showcased advanced motor technologies featuring integrated encoder solutions for robotics and automation at Automate 2025. The demonstrations highlighted precision encoders in frameless motors and integrated servo systems, underscoring U.S. innovation in high-performance motion control for Industry 4.0 applications.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Industrial manufacturers Very High ~34.6% Precision control and efficiency Long term capital investment Automation solution providers High ~26.4% Integrated motion control systems Strategic partnerships Robotics manufacturers High ~18.7% Accurate positioning and feedback Product embedded adoption OEM component suppliers Moderate ~13.2% Portfolio expansion Volume based supply SMEs Low ~7.1% Cost driven automation Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Magnetic sensing technology Durable position sensing ~3.2% Growing Incremental signal processing Real time motion feedback ~2.7% Mature Digital communication interfaces High speed data transfer ~2.1% Mature Miniaturization techniques Compact encoder designs ~1.5% Growing Industrial IoT integration Smart monitoring and diagnostics ~0.9% Developing Driver Analysis

The encoder market is being driven by the increasing need for precise motion control and measurement across industrial automation, robotics, automotive systems, and consumer electronics. Encoders convert motion or position information into digital signals that systems can interpret, enabling accurate feedback for speed, position, and direction control.

As manufacturing and industrial operations adopt automation to improve productivity and reduce errors, demand for reliable encoders that support high resolution and real-time feedback continues to strengthen. Growth in smart machines, servomechanisms, and embedded control systems reinforces the requirement for advanced encoders that integrate seamlessly into digital control architectures.

Restraint Analysis

A primary restraint in the encoder market relates to the technical complexity and integration challenges associated with high-precision applications. Advanced encoder solutions often require compatibility with specific motor types, control systems, and communication protocols, which can complicate design and increase development effort for OEMs and system integrators.

In sectors with legacy equipment, retrofitting encoders or upgrading control systems may require additional engineering resources and custom interfaces, which can slow deployment and raise implementation cost. Compatibility and standardisation issues may constrain adoption in settings where interoperability across varied hardware ecosystems is essential.

Opportunity Analysis

Emerging opportunities in the encoder market are linked to the expansion of Industry 4.0, intelligent robotics, and real-time monitoring systems that rely on accurate motion and position feedback to optimise performance. Encoders that combine high resolution with robust environmental resilience are increasingly required in harsh industrial conditions, autonomous vehicles, and precision instrumentation.

There is strong potential for solutions that support predictive maintenance by providing continuous health and performance data that can be analysed for early indication of wear or failure. Encoders integrated with digital communication standards such as industrial Ethernet, fieldbus, and sensor networks further extend opportunity by enabling scalable, connected motion control architectures.

Challenge Analysis

A central challenge confronting this market involves balancing measurement precision with durability and cost effectiveness. High-performance encoders capable of delivering fine resolution, fast response, and low noise often demand advanced materials, tight manufacturing tolerances, and rigorous calibration, which can elevate product cost.

Ensuring long-term reliability in environments subject to vibration, shock, dust, and temperature variation requires robust mechanical design and protective features, adding complexity to product development. Manufacturers must also manage supply chain considerations for specialised components to maintain quality while controlling production cost.

Emerging Trends

Emerging trends in the encoder market include the integration of smart functions such as self-diagnostics, condition monitoring, and digital calibration that enhance operational awareness and reduce maintenance overhead. Encoders with built-in health indicators can communicate status data to control systems, supporting proactive servicing and reducing unplanned downtime.

Another trend is the adoption of sealed, ruggedised designs that provide high performance in challenging industrial and outdoor environments. Wireless connectivity options for encoder data are also gaining interest for applications where cabling is impractical or adds cost.

Growth Factors

Growth in the encoder market is supported by the expanding adoption of automation and robotics across manufacturing, logistics, and processing industries that demand reliable motion control solutions. Continued development of electric and autonomous vehicles, precision instrumentation, and smart infrastructure reinforces demand for position and feedback sensors with high accuracy and fast responsiveness.

Advances in semiconductor, sensing, and packaging technologies enhance encoder capability, reduce size, and improve integration with digital control platforms. As industries prioritise efficiency, quality, and real-time operational insight, encoders remain essential components of advanced motion and control systems.

Key Market Segments

By Type

- Rotary Encoder

- Linear Encoder

By Signal Type

- Incremental

- Absolute

By Technology

- Magnetic

- Optical

- Inductive

- Others

By Application

- Industrial

- Healthcare & Life Sciences

- Automotive

- Consumer Electronics

- Power

- Food & Beverage

- Aerospace

- Printing

- Textile

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading industrial automation players such as Omron Corporation, Johannes Heidenhain GmbH, and Honeywell International hold strong positions in the encoder market. Their portfolios cover rotary and linear encoders used in factory automation, robotics, and CNC machinery. High accuracy, durability, and long lifecycle performance remain key strengths. Rockwell Automation Inc. and Pepperl+Fuchs SE benefit from deep integration with control systems.

Precision sensing and motion control specialists such as Panasonic Holdings Corp., Baumer Holding AG, and Renishaw plc focus on high-resolution and compact encoder designs. SICK AG strengthens the segment with safety-rated and industrial-grade encoders. Sensata Technologies, through brands such as Hengstler and Dynapar, serves transportation and heavy equipment markets.

Motion-focused and niche manufacturers such as Maxon Group, FAULHABER, and Allied Motion Technologies support robotics and medical devices. TE Connectivity, Posital FRABA B.V., and Tamagawa Seiki Co., Ltd. expand coverage across automotive and aerospace segments. Other regional players increase competition. This diverse landscape supports steady innovation and wide application adoption.

Top Key Players in the Market

- Omron Corporation

- Johannes Heidenhain GmbH

- Honeywell International

- Rockwell Automation Inc.

- Pepperl+Fuchs SE

- Panasonic Holdings Corp.

- Baumer Holding AG

- Sensata Technologies (Hengstler and Dynapar)

- Renishaw plc

- SICK AG

- Maxon Group

- FAULHABER Drive Systems

- Allied Motion Technologies

- AMETEK (Haydon Kerk, Maurey)

- Canon Precision Inc.

- CUI Devices

- TE Connectivity

- Posital FRABA B.V.

- Tamagawa Seiki Co., Ltd.

- Others

Recent Developments

- In October 2025, Rockwell Automation launched the ControlLogix 5590 controller, featuring advanced encoder integration for high-speed processing and expanded memory in industrial automation. This powerhouse supports complex operations across process, motion, and robotics, helping manufacturers build scalable systems with seamless encoder feedback for precision control.

- In May 2025, HEIDENHAIN showcased innovative inductive rotary encoders at AUTOMATICA, offering SIL 3 safety and mechanical compatibility with the optical series. These encoders enhance robot and cobot feedback with improved accuracy, reinforcing their leadership in high-precision motion control.

Report Scope

Report Features Description Market Value (2025) USD 5.3 Bn Forecast Revenue (2035) USD 14.3 Bn CAGR(2026-2035) 10.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Rotary Encoder, Linear Encoder), By Signal Type (Incremental, Absolute), By Technology (Magnetic, Optical, Inductive, Others), By Application (Industrial, Healthcare & Life Sciences, Automotive, Consumer Electronics, Power, Food & Beverage, Aerospace, Printing, Textile, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Omron Corporation, Dr. Johannes Heidenhain GmbH, Honeywell International, Rockwell Automation Inc., Pepperl+Fuchs SE, Panasonic Holdings Corp., Baumer Holding AG, Sensata Technologies (Hengstler and Dynapar), Renishaw plc, SICK AG, Maxon Group, FAULHABER Drive Systems, Allied Motion Technologies, AMETEK (Haydon Kerk, Maurey), Canon Precision Inc., CUI Devices, TE Connectivity, Posital FRABA B.V., Tamagawa Seiki Co., Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Omron Corporation

- Johannes Heidenhain GmbH

- Honeywell International

- Rockwell Automation Inc.

- Pepperl+Fuchs SE

- Panasonic Holdings Corp.

- Baumer Holding AG

- Sensata Technologies (Hengstler and Dynapar)

- Renishaw plc

- SICK AG

- Maxon Group

- FAULHABER Drive Systems

- Allied Motion Technologies

- AMETEK (Haydon Kerk, Maurey)

- Canon Precision Inc.

- CUI Devices

- TE Connectivity

- Posital FRABA B.V.

- Tamagawa Seiki Co., Ltd.

- Others