Global Emission Monitoring System (EMS) Market By System Type (Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)), By Component (Hardware, Software, Service), By End User (Power Generation, Chemical, Oil & Gas, Pharmaceutical, Pulp & Paper, Mining, Other End-Use Industries), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 73346

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

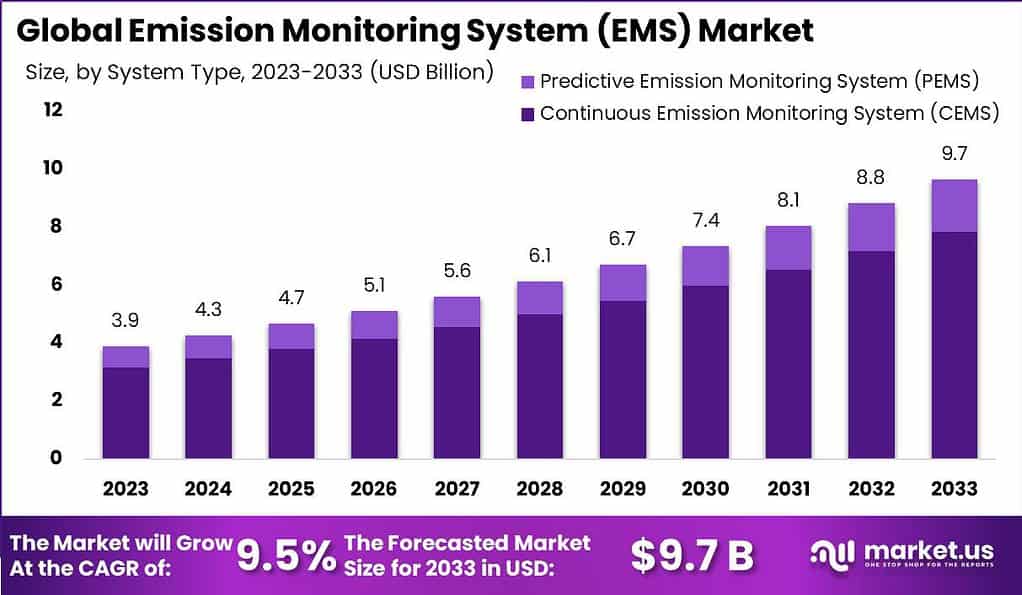

The global Emission Monitoring System (EMS) Market is projected to have a moderate-paced CAGR of 9.5% during the forecast period. The current valuation of the emission monitoring system (EMS) industry is USD 3.9 Billion in 2023. The demand for emission monitoring system is anticipated to reach a high of USD 9.7 Billion by the year 2033.

Emission monitoring systems (EMS) are hardware and software tools used to measure and analyze the emissions released from industrial processes and operations. They play a vital role in helping industries comply with air quality standards and norms. The main goal in the EMS can be to assure that environmental regulations, to track the environmental impacts on industrial activities and aid in the emission reductions of hazardous emissions.

The global EMS market has witnessed steady growth in recent years, driven by stringent emission control regulations imposed by governments worldwide, especially in developed regions like North America and Europe. It is an sector that offers and develops solutions for managing and monitoring emissions from different sources, such as power plants, industrial facilities and other environmental contributors.

Note: Actual Numbers Might Vary In Final Report

The market covers a variety of technologies like gas analyzers and monitors for particulate matter, technology for data collection, as well as software platforms that gather, analyze, and report on emission data. The EMS market is driven by the increasing regulatory requirements, rising environmental issues, and the need for companies to adopt sustainable methods.

Businesses in this market offer an array of options to help companies meet emissions standards, increasing sustainability of the environment, and in ensuring sustainable environmental management. The market is predicted to grow further as environmental regulations grow more strict which will require the use of advanced and effective emissions monitoring systems.

Key Takeaways

- Market Growth Projection: The Emission Monitoring System (EMS) Market is anticipated to grow to USD 9.7 billion in 2033. This will be accompanied by steady annual growth rate (CAGR) at 9.5%.

- Global Growth Factors: The EMS market has witnessed growth due to stringent emission control regulations worldwide, particularly in developed regions like North America and Europe.

- Segment Dominance: In 2023, the Continuous Emission Monitoring System (CEMS) segment held a dominant market position, capturing over 81% of the market share. CEMS is favored for its accuracy in measuring pollutants and greenhouse gases.

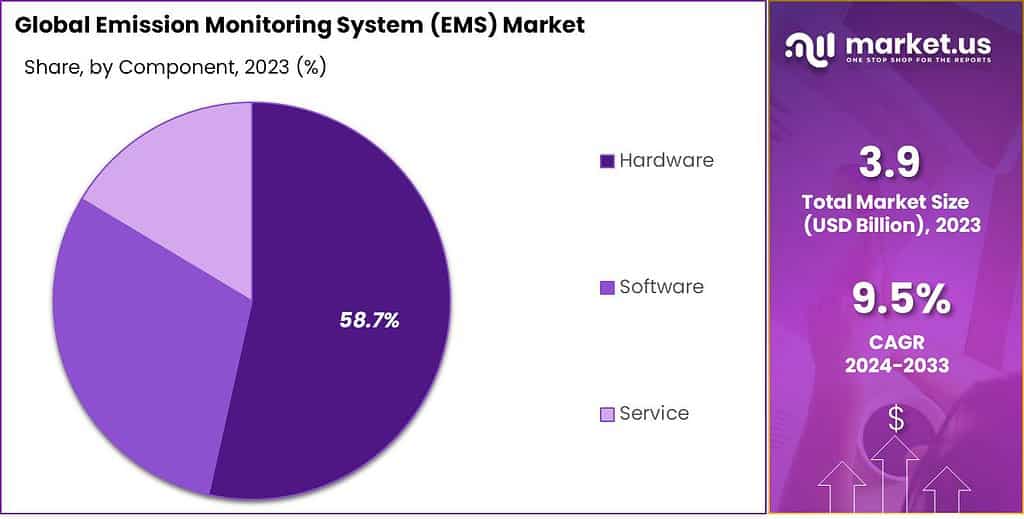

- Hardware’s Crucial Role: Hardware components accounted for more than 58% of the market share in 2023. They play a pivotal role in accurate and real-time emissions measurement, which is vital for regulatory compliance.

- Software and Services: While the Software and Service segments held smaller market shares in 2023, they are essential for data analysis, management, and compliance reporting. These segments are growing in importance as industries recognize the need for efficient data handling.

- End-Use Industries: The Oil & Gas sector asserted dominance in 2023, with a share of more than 27.8%. This industry heavily relies on EMS solutions to monitor emissions and ensure compliance with environmental standards. Power Generation, while significant, held a smaller market share but continues to invest in EMS for emission control.

- Driving Factors: Factors driving the EMS market include stringent environmental regulations, growing awareness of climate change, technological advancements, and the need for reputation management and sustainability.

- Challenges: Challenges faced by the EMS market include high implementation costs, data privacy concerns, complexity of integration with existing systems, and resistance to change within organizations.

- Growth Opportunities: The market has growth opportunities in expanding renewable energy, leveraging IoT and AI integration, global market expansion, and diversifying into emerging industries like electric vehicles and sustainable agriculture.

- Key Market Trend: The integration of EMS with Sustainability Management Software (SMS) is a notable trend, reflecting a shift from compliance to a holistic sustainability approach.

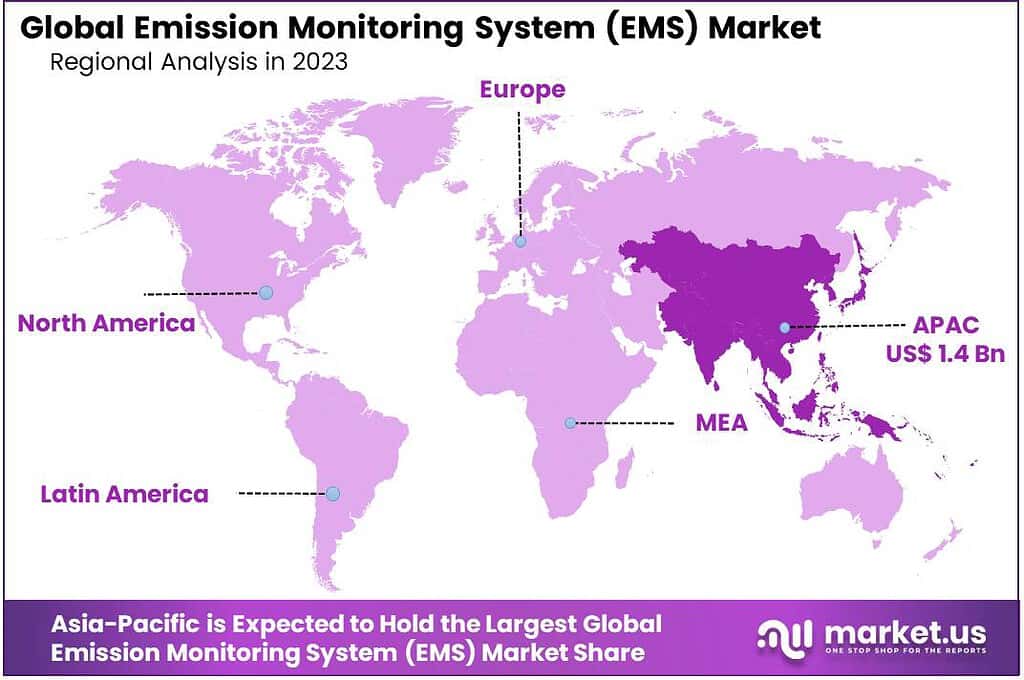

- Regional Analysis: Asia Pacific dominated the market in 2023, driven by industrial growth and stringent regulations. North America and Europe also played significant roles in the EMS market.

- Key Players: Key players in the EMS market include ABB Ltd., Emerson Electric Co., Siemens AG, General Electric Co., AMETEK, Inc., and others who continue to drive innovation in the industry.

Based on System Type

In 2023, the Continuous Emission Monitoring System (CEMS) segment held a dominant market position in the Emission Monitoring System (EMS) Market, capturing more than an impressive 81.3% share. This remarkable market presence can be attributed to the indispensable role that CEMS plays in real-time monitoring and reporting of emissions from industrial processes.

CEMS are highly favored by industries due to their accuracy and reliability in measuring pollutants and greenhouse gases, ensuring compliance with stringent environmental regulations. Their ability to provide continuous, instantaneous data for regulatory compliance and emission reduction strategies positions CEMS as the preferred choice for industries operating in environmentally sensitive areas.

In contrast, the Predictive Emission Monitoring System (PEMS) segment, while significant, secured a relatively smaller share in the market in 2023. PEMS, although gaining traction, is still evolving and primarily used as a complementary tool to CEMS. PEMS leverages advanced data analytics and modeling to predict emissions based on process parameters and historical data.

While it offers the advantage of reduced operational costs and flexibility, its adoption is often driven by industries seeking to optimize emission reduction strategies and improve process efficiency. As PEMS technology matures and gains wider acceptance, it is expected to witness gradual growth in the coming years, offering industries a predictive approach to emissions management.

Based on Component Outlook

In 2023, the Hardware segment emerged as the dominant force in the Emission Monitoring System (EMS) Market, capturing an impressive share of more than 58.7%. This substantial market presence of hardware components can be attributed to their pivotal role in the accurate and real-time measurement of emissions from industrial processes. The hardware components of EMS encompass a range of instruments and sensors that are crucial for monitoring pollutants and greenhouse gases.

These devices provide the foundation for collecting precise data, ensuring compliance with stringent environmental regulations, and supporting emission reduction efforts across various industries. Given their critical function in emissions monitoring, the hardware segment has enjoyed widespread adoption and trust among businesses seeking to enhance their environmental sustainability and regulatory compliance efforts.

On the other hand, the Software segment, while significant, secured a comparatively smaller share in the market in 2023. EMS software plays a complementary role in data analysis, management, and reporting, providing valuable insights into emissions data collected by hardware components. It serves as a central hub for data interpretation, visualization, and compliance reporting, assisting industries in making informed decisions regarding emissions control and environmental sustainability. The software segment’s importance is growing as industries recognize the need for efficient data management and analysis to meet regulatory requirements and optimize their emission reduction strategies.

Additionally, the Service segment, while essential, also held a significant but smaller share in 2023. EMS services encompass installation, maintenance, calibration, and support services for both hardware and software components. These services are crucial for ensuring the proper functioning and accuracy of EMS systems throughout their lifecycle. Industries rely on service providers to maintain the integrity of their emissions data, troubleshoot issues, and implement best practices in emissions monitoring.

Note: Actual Numbers Might Vary In Final Report

Based on End-Use

In 2023, the Oil & Gas segment asserted its dominance in the Emission Monitoring System (EMS) Market, capturing an impressive share of more than 27.8%. The significant market share in this Oil & Gas sector can be explained by the industry’s strict environmental regulations as well as the necessity of monitoring the emissions of various processes.

The gas and oil industry covers a broad range of activities, ranging including exploration and drilling, up to refinery and distribution all of which generate emissions that require a close eye and reports. To adhere to environmental standards and reduce their carbon footprint, the Oil & Gas industry heavily relies on EMS solutions to track pollutants and greenhouse gases, ensuring compliance and enhancing sustainability efforts.

On the other hand Power Generation, while a significant part of the market Power Generation sector, while large, snared a smaller market share in 2023. Power plants, whether they are powered with fossil fuels or renewable sources, contribute significantly to carbon emissions. As such, the Power Generation industry utilizes EMS to monitor and control emissions, focusing on reducing environmental impact and improving energy efficiency. With growing global concerns about climate change, the Power Generation sector continues to invest in EMS solutions to meet regulatory requirements and achieve cleaner and more sustainable energy production.

Furthermore, other End-Use Industries, such as Chemical, Pharmaceutical, Pulp & Paper, Mining, and various sectors, also played essential roles in the EMS market. These industries have diverse emissions sources and regulatory requirements, making EMS solutions vital for environmental compliance and sustainability initiatives. Each sector faces unique challenges in emissions management, driving demand for tailored EMS systems and services to address their specific needs.

Driving Factors

- Stringent Environmental Regulations: Increasingly strict environmental regulations and emission reduction targets imposed by governments worldwide are a significant driving force behind the EMS market. Industries need EMS solutions to monitor, report, and ensure compliance with these regulations.

- Growing Awareness of Climate Change: Heightened awareness of climate change and its impacts has led to greater corporate responsibility. Companies are adopting EMS to measure and reduce their carbon footprint, reflecting the broader commitment to sustainability.

- Technological Advancements: Rapid advancements in sensor technology, data analytics, and cloud computing have made EMS solutions more accurate, efficient, and cost-effective. These innovations drive the adoption of EMS across industries.

- Public Pressure and Reputation Management: As public concern for the environment increases, businesses face pressure to demonstrate their commitment to sustainability. Implementing EMS not only helps reduce emissions but also enhances a company’s reputation and stakeholder relationships.

Restraining Factors

- High Implementation Costs: The initial cost of deploying EMS can be substantial, including hardware, software, and professional services. This cost can be a barrier for smaller companies or industries with limited budgets.

- Data Privacy Concerns: Gathering and sharing emissions data may raise data privacy and security concerns. Companies must ensure that sensitive information is protected, complying with privacy regulations.

- Complexity of Integration: Integrating EMS with existing systems and processes can be complex and time-consuming. This challenge may deter some organizations from adopting EMS.

- Resistance to Change: Employees and management may resist the introduction of EMS due to concerns about workflow disruptions and the learning curve associated with new technology.

Growth Opportunities

- Expanding Renewable Energy Sector: The growth of renewable energy sources creates opportunities for EMS providers to support the monitoring and optimization of clean energy production, contributing to a sustainable future.

- Evolving IoT and AI Integration: Leveraging the Internet of Things (IoT) and Artificial Intelligence (AI) for real-time data analysis and predictive insights presents growth prospects in EMS, enhancing accuracy and efficiency.

- Global Market Expansion: As more regions worldwide implement environmental regulations, the EMS market has the potential for global expansion, with emerging markets seeking compliance solutions.

- Diverse Industry Applications: Beyond traditional sectors, emerging industries such as electric vehicles and sustainable agriculture offer new applications for EMS, diversifying its market reach.

Challenges

- Data Accuracy and Calibration: Maintaining accurate data from emissions monitoring equipment and ensuring proper calibration can be challenging, as any inaccuracies can lead to compliance issues.

- Interoperability: Compatibility and seamless integration with various EMS components and existing systems pose challenges, requiring standardization and interoperability efforts.

- Evolving Regulations: Frequent changes in environmental regulations can be a challenge for EMS providers and users, requiring continuous adaptation and updates to ensure compliance.

- Environmental Monitoring in Remote Areas: Monitoring emissions in remote or geographically challenging locations can be difficult, requiring innovative solutions and infrastructure.

Key Market Trend

One prominent market trend is the integration of EMS with Sustainability Management Software (SMS) to provide a comprehensive approach to environmental sustainability. This trend reflects the shift from mere compliance to a holistic sustainability strategy that considers emissions alongside broader sustainability goals.

SMS integrates environmental data from EMS with other sustainability metrics, offering organizations a unified platform for monitoring, reporting, and improving their overall sustainability performance. This trend aligns with the growing emphasis on sustainability in business operations and reporting.

Key Market Segments

Based on System Type

- Continuous Emission Monitoring System (CEMS)

- Predictive Emission Monitoring System (PEMS)

Based on Component

- Hardware

- Software

- Service

Based on End-Use

- Power Generation

- Chemical

- Oil & Gas

- Pharmaceutical

- Pulp & Paper

- Mining

- Other End-Use Industries

Regional Analysis

In 2023, Asia Pacific held a dominant market position in the Emission Monitoring System (EMS) Market, capturing more than a 36.6% share. This regional leadership can be attributed to several key factors, including the region’s industrial growth, rising environmental concerns, and stringent regulatory frameworks aimed at curbing emissions.

Countries like China and India, with their rapidly expanding industrial sectors, played a pivotal role in driving the demand for advanced EMS solutions. Additionally, Asia Pacific’s commitment to sustainable practices and clean energy initiatives further fueled the adoption of emission monitoring systems in industries such as power generation, manufacturing, and petrochemicals.

North America also maintained a substantial presence in the EMS market, with a focus on compliance with environmental regulations. The region accounted for a significant share, driven by investments in upgrading existing monitoring infrastructure and the adoption of advanced emissions tracking technologies.

Europe, while not as dominant as Asia Pacific, showcased a strong emphasis on environmental stewardship and sustainable practices. The region secured a notable position in the market, reflecting its commitment to reducing carbon footprints and monitoring emissions across various industries.

Latin America, Middle East, and Africa collectively contributed to the market, with varying degrees of adoption influenced by regional economic factors and environmental priorities. These regions demonstrated potential for growth as they continued to address environmental challenges and implement emission control measures.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Emission Monitoring System (EMS) market boasts a competitive landscape with key players contributing significantly to its growth and innovation. Among the prominent companies in this sector, some have played pivotal roles in shaping the industry.

These key players, along with others in the Emission Monitoring System market, continue to drive innovation and contribute to the evolution of the industry, addressing the increasing demand for effective and sustainable emission management solutions.

Top Key Players

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- General Electric Co.

- AMETEK, Inc.

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Teledyne Technologies Inc.

- Fuji Electric Co., Ltd.

- Sick AG

- ENVEA Group

- Other Key Players

Recent Developments

- In July 2023, Hyundai Motor Company and Kia Corporation introduced their Supplier CO2 Emission Monitoring System (SCEMS), powered by artificial intelligence and blockchain technology. This system aims to regulate the carbon emissions of their collaborative business partners. SCEMS is designed to compute carbon emissions at various stages within the supply chain of cooperative partners while ensuring transparency and integrity of data.

- In March 2023, Picarro, Inc. and LESNI A/S entered into a collaborative agreement to deliver cutting-edge Ethylene Oxide (EtO or EO) monitoring systems to medical device and contract sterilization plants globally. This collaboration involves integrating Picarro’s innovative Continuous Emission Monitoring Systems (CEMS) with LESNI’s expertise in emissions control and abatement, offering comprehensive solutions to the industry.

Report Scope

Report Features Description Market Value (2023) US$ 3.9 Bn Forecast Revenue (2033) US$ 9.7 Bn CAGR (2024-2033) 9.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By System Type (Continuous Emission Monitoring System (CEMS), Predictive Emission Monitoring System (PEMS)), By Component (Hardware, Software, Service), By End User (Power Generation, Chemical, Oil & Gas, Pharmaceutical, Pulp & Paper, Mining, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Emerson Electric Co., Siemens AG, General Electric Co., AMETEK, Inc., Thermo Fisher Scientific Inc., Honeywell International Inc., Rockwell Automation, Inc., Teledyne Technologies Inc., Fuji Electric Co., Ltd., Sick AG, ENVEA Group, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an Emission Monitoring System (EMS)?An Emission Monitoring System (EMS) is a set of tools and technologies designed to monitor, measure, and analyze emissions of pollutants and gases released into the environment. It aids in compliance with environmental regulations and contributes to reducing harmful emissions.

How big is Emission Monitoring System (EMS) Market?The Global Emission Monitoring System (EMS) Market is anticipated to be USD 9.7 billion by 2033. It is estimated to record a steady CAGR of 9.5% in the Forecast period 2024 to 2033. It is likely to total USD 4.3 billion in 2024.

Why is there a growing demand for EMS solutions?The increasing demand for EMS solutions is driven by stricter environmental regulations, the need for industries to adhere to emission standards, and a growing awareness of the environmental impact of industrial processes.

In which industries are EMS solutions commonly used?EMS solutions find applications in various industries, including power generation, manufacturing, oil and gas, chemical processing, and transportation. They are essential for industries aiming to monitor and manage their environmental footprint.

What are the benefits of using an EMS for businesses?Businesses benefit from EMS by ensuring compliance with environmental regulations, avoiding fines, enhancing operational efficiency, and improving their overall environmental performance. EMS also aids in building a positive corporate image.

What is the future outlook for the EMS market?The EMS market is expected to witness continued growth due to ongoing environmental concerns, increasing regulatory requirements, and the global shift toward sustainable and eco-friendly industrial practices. Technological advancements will likely play a key role in shaping the future of the EMS market.

Emission Monitoring System (EMS) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Emission Monitoring System (EMS) MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- General Electric Co.

- AMETEK, Inc.

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Teledyne Technologies Inc.

- Fuji Electric Co., Ltd.

- Sick AG

- ENVEA Group

- Other Key Players