Global Embedded Lending Market Size, Share, Industry Analysis Report By Solution (Embedded Lending Platform, Embedded Lending Services), By Deployment (Cloud/Web-Based, On-Premise), By Enterprise Size (Small and Mid-sized Enterprises (SMEs), Large Enterprises), By Industry (Retail, Education, Medical and Healthcare, IT/IT Services, Real Estate, Manufacturing, Transportation, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167940

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

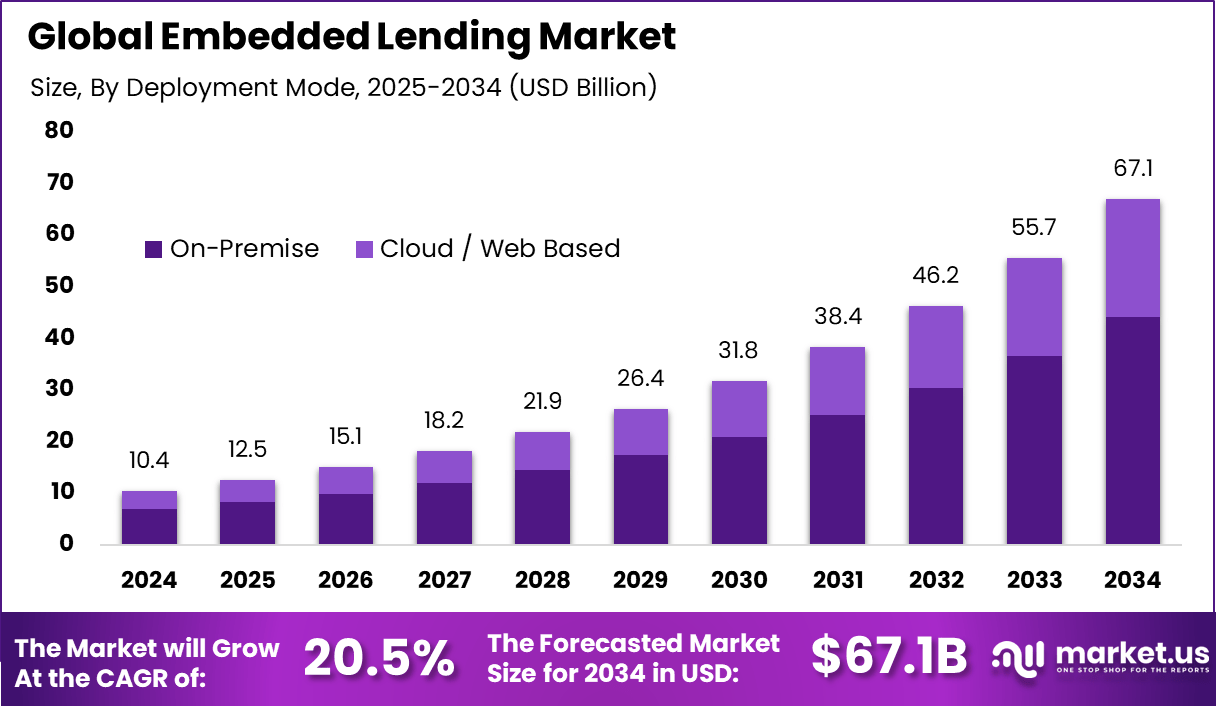

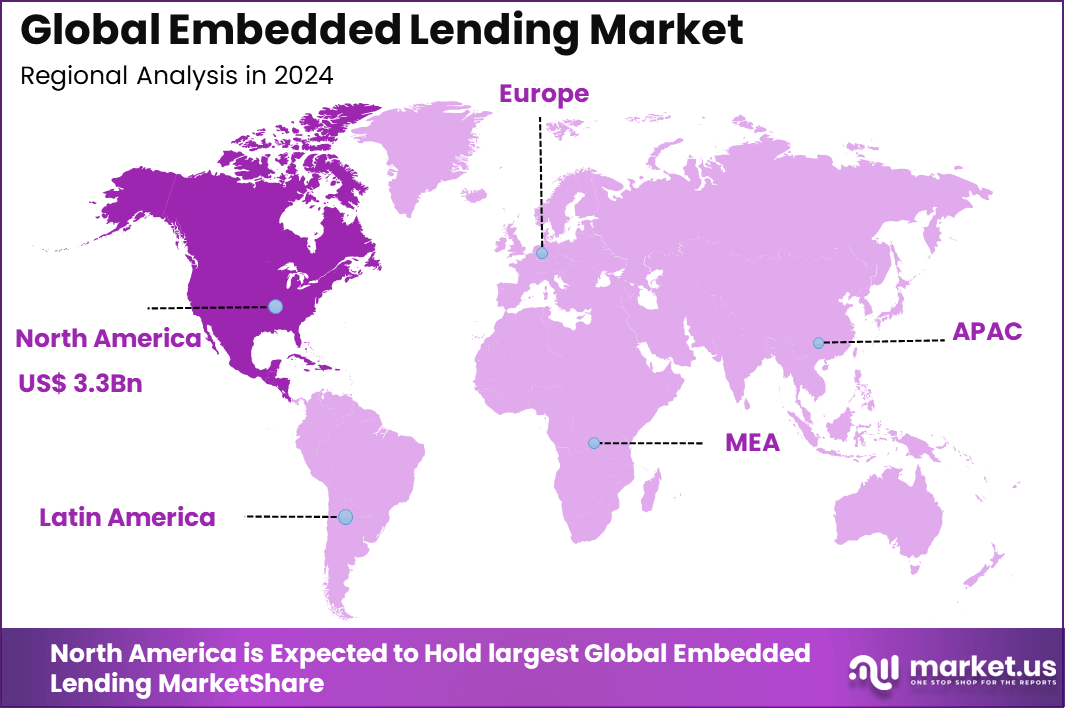

The Global Embedded Lending Market generated USD 10.4 billion in 2024 and is predicted to register growth from USD 12.5 billion in 2025 to about USD 67.1 billion by 2034, recording a CAGR of 20.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37.4% share, holding USD 3.3 Billion revenue.

The embedded lending market has expanded as businesses integrate credit services directly into digital platforms, allowing users to access loans at the point of need. Growth reflects rising digital transactions, wider adoption of fintech infrastructure and increasing demand for seamless financial experiences. Embedded lending is now used across e-commerce, mobility services, retail platforms and enterprise applications to support instant credit decisions and frictionless borrowing.

The growth of the market can be attributed to increasing digital payments, growing trust in online financial services and the need for faster access to credit. Businesses adopt embedded lending to enhance customer convenience, improve checkout conversion and support cash flow solutions. Advances in risk assessment, alternative data and automated underwriting further accelerate adoption across sectors.

Quick Market Facts

- In 2024, the embedded lending platform segment held the dominant position within the solution category with a 68.4% share of the Embedded Lending Market.

- In 2024, the on premise deployment model maintained leadership by accounting for 65.7% of the market.

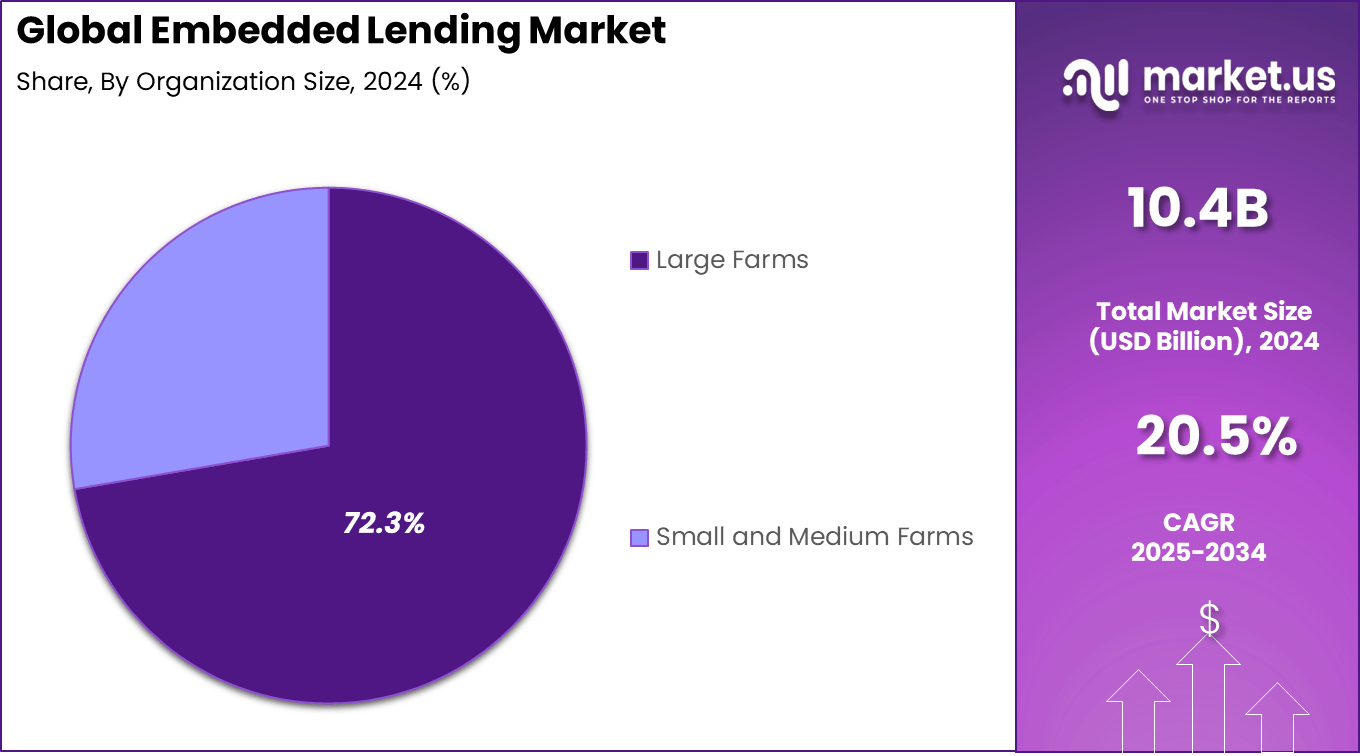

- In 2024, large enterprises represented the strongest adopter group, securing a 72.3% share in the Embedded Lending Market.

- In 2024, the retail industry emerged as the leading vertical, contributing 35.7% to overall market demand.

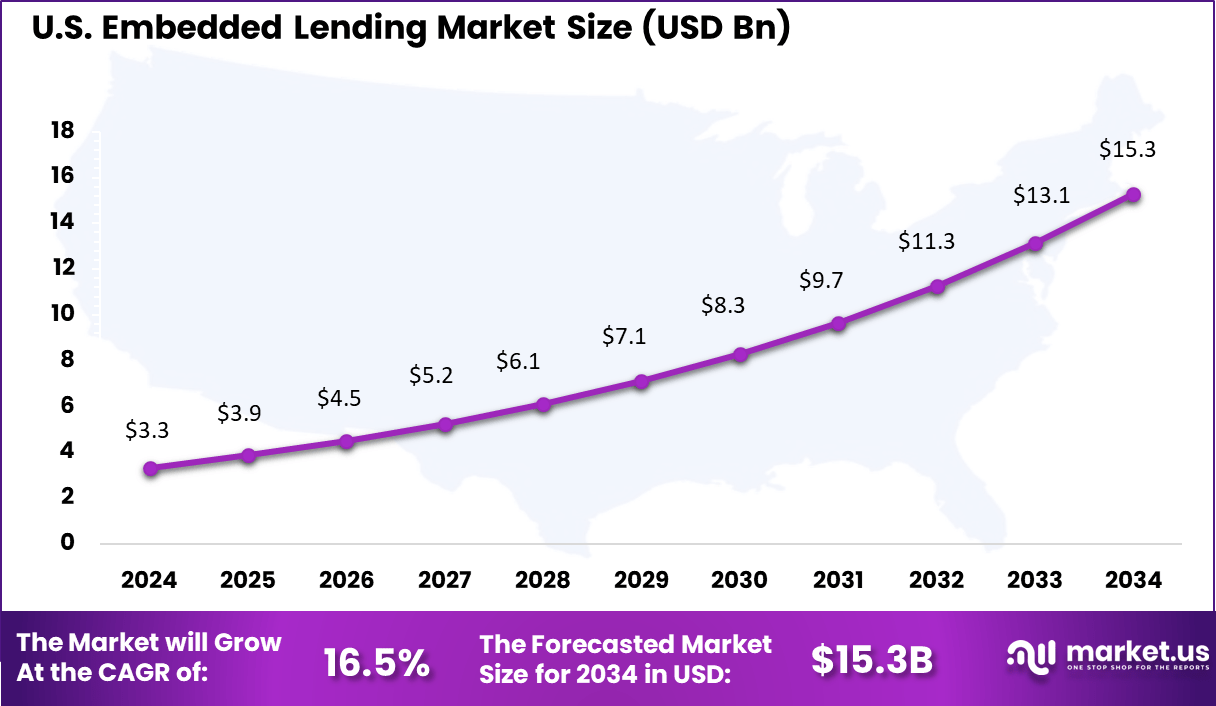

- North America accounted for a significant 37.4% share of the global market, with the US recording a valuation of USD 3.32 Billion and demonstrating a stable 16.5% CAGR.

Consumer and Business Adoption

- More than 40% of consumers are willing to switch to a platform that provides embedded lending options, indicating strong demand for integrated credit access.

- 56% of Gen Z and 55% of millennials show high interest in using embedded lending services, reflecting strong adoption potential among younger digital-first users.

- 29% of consumers would rely on embedded lending for unexpected emergency expenses, highlighting its role in financial resilience.

- U.S. embedded finance revenue is projected to grow from USD 30.82 billion in 2024 to USD 89.59 billion by 2029, driven by sustained adoption across sectors.

Partnership and Technology

- 96% of sponsor banks maintain multiple embedded finance partnerships, with many engaged in 6 to 10 active collaborations.

- Growth is driven by advances in APIs, payment infrastructure, and strategic ecosystem partnerships, enabling seamless financial integration.

- Embedded delivery models enhance the customer experience by unifying financial and non-financial services, although application friction remains a challenge in certain markets.

By Solution

Embedded lending platforms dominate the market with a strong 68.4% share. These platforms streamline credit services by integrating lending functionalities directly into existing business ecosystems, allowing customers to access loans without leaving the merchant or service provider’s environment.

This integration improves the user experience by enabling quick loan approvals and automated credit decisions powered by data analytics and AI, facilitating smoother and faster lending operations for consumers and businesses alike. The platform approach is favored for its scalability and flexibility.

Businesses using these embedded lending platforms can customize loan offerings and risk models to meet specific customer needs while maintaining control over compliance and operational efficiency. This dominance reflects a broader shift to embed financial services deeply within digital customer journeys, especially as more industries seek seamless solutions to accelerate digital transformation.

By Deployment

On-premise deployment holds a significant 65.7% of the embedded lending market. Many large institutions prefer on-premise solutions for their perceived control over sensitive customer data and compliance with strict regulatory requirements.

Hosting embedded lending software locally in private data centers reassures organizations about security and governance while enabling them to tailor platform capabilities closely to their internal processes. This preference also stems from the conservative nature of established financial institutions and enterprises, which balance innovation with risk management.

On-premise models facilitate customization and integration with legacy systems, critical for large enterprises managing complex operations. However, cloud adoption is rising as providers improve security and offer greater operational flexibility for emerging fintech firms and smaller organizations.

By Enterprise Size

Large enterprises lead with a 72.3% market share in embedded lending adoption. Their significant IT infrastructure and financial resources enable them to integrate embedded lending seamlessly across multiple business lines and geographic markets.

Large enterprises benefit from economies of scale in deploying customized, compliant platforms that support sizeable loan volumes with sophisticated risk assessment capabilities. Furthermore, these enterprises often drive industry innovation by partnering with fintech firms or developing proprietary solutions to maintain competitive advantages.

Their early adoption shapes market trends and standards, enabling faster uptake of advanced lending features such as AI-driven underwriting and real-time credit monitoring. The dominance of large enterprises reflects the critical role embedded lending plays in enhancing their customer offerings and operational efficiency.

By Industry

Retail accounts for the largest demand segment with 35.7% share. Embedded lending in retail enables consumers to access credit at the point of sale, simplifying purchasing by offering options like Buy Now, Pay Later (BNPL) or installment loans. This enhances customer purchasing power and encourages higher sales volumes by making financing options transparent and easily accessible during the shopping experience.

Retailers benefit by increasing conversion rates and average order values while differentiating themselves through flexible payment solutions. Additionally, embedded lending platforms provide retailers with improved customer data insights and risk management tools. This industry’s rapid digitalization and growth in e-commerce have played key roles in driving widespread adoption of embedded credit solutions.

Regional Insight

In 2024, North America commands a significant 37.4% market share with a strong presence of embedded lending solutions driven by advanced fintech ecosystems and favorable regulatory environments. The robust infrastructure and tech adoption in the US foster innovation and rapid deployment of embedded lending across diverse sectors including retail, healthcare, and services.

The US specifically represents a major market valued at about USD 3.32 billion, growing at a healthy 16.5% CAGR as embedded lending solutions become integral to modern financial service delivery. The country’s leadership reflects investments in AI, real-time data analytics, and open banking frameworks that enhance risk assessment and customer experience. These trends position North America as a pivotal region for embedded lending technology advancement and adoption.

Emerging Trends

Emerging trends include the expansion of embedded lending into business-to-business (B2B) financing, with working capital loans and invoice financing becoming common in supply chains. The integration of AI for underwriting and fraud prevention is advancing, allowing hyper-personalized loan offers based on transaction data.

Some platforms also experiment with crypto-backed loans and tokenized credit solutions, widening access to funding. Collaboration between traditional banks and fintech firms is deepening, combining compliance with innovation to improve embedded lending platforms’ reach and effectiveness.

Growth Factors

Looking ahead, the growth of embedded lending is likely to continue strongly as digital ecosystems expand and consumers expect financial services to be part of everyday digital interactions. Opportunities lie in diversifying loan products, targeting SMEs with flexible terms, and geographic expansion into emerging economies.

Improving risk models and regulatory frameworks will further enable scalable embedded lending solutions. In this evolving landscape, embedded lending is becoming a core driver of digital economic growth and a key tool for businesses to enhance customer engagement and revenue streams.

Key Market Segments

By Solution

- Embedded Lending Platform

- Embedded Lending Services

By Deployment

- Cloud / Web Based

- On-Premise

By Enterprise Size

- Small and Mid-sized Enterprises (SMEs)

- Large Enterprises

By Industry

- Retail

- Education

- Medical and Healthcare

- IT / IT Services

- Real Estate

- Manufacturing

- Transportation

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

The embedded lending market is growing primarily due to the increasing demand for seamless credit access integrated directly within digital platforms. This integration streamlines the buying process for customers by providing instant financing options during transactions, which enhances customer experience and boosts sales for businesses. The rise of fintech partnerships and the use of advanced technologies such as AI for better risk assessment are key drivers pushing market growth.

Restraint

However, a major restraint in the embedded lending market is the complexity of regulatory compliance. Since embedded lending blurs the lines between financial and non-financial sectors, it faces challenges around data privacy, consumer protection, and anti-money laundering rules across different jurisdictions. These regulatory hurdles slow down adoption and increase operational costs for providers integrating lending into various platforms.

Opportunity

Opportunity lies in expanding embedded lending to new merchant categories and underserved sectors like small and mid-sized enterprises (SMEs). SMEs benefit from faster and more flexible credit access through embedded solutions, which traditional lending often fails to serve efficiently. The growth of e-commerce and digitization in emerging markets creates a fertile ground for embedded lending innovations, opening new frontiers for industry expansion.

Challenge

A key challenge for embedded lending is ensuring cybersecurity and data privacy. Handling sensitive financial and user data within digital ecosystems requires robust security frameworks to prevent breaches and secure consumer trust. Additionally, maintaining seamless integration while complying with evolving technical and regulatory standards demands ongoing investment and innovation from market players.

Competitive Analysis

Turnkey Lender, Lendflow, Afterpay, and Banxware lead the embedded lending market with platforms that integrate credit decisioning, loan origination, and repayment automation directly into digital workflows. Their solutions enable businesses to offer financing at checkout or within service platforms. These companies focus on real-time underwriting, API-based deployment, and seamless customer experiences.

Rising demand for instant credit access and embedded financial services reinforces their leadership across retail, fintech, and B2B ecosystems. Affirm, Klarna, Tapwater, Alchemy, Migo, and Liberis strengthen the market with flexible lending models such as BNPL, merchant cash advances, and revenue-based financing. Their platforms support transparent repayment schedules, enhanced risk scoring, and frictionless approval flows.

Kanmon, Sivo, Hokodo, Jaris, Biz2X, and other participants expand the embedded lending landscape with niche, sector-focused financing tools. Their offerings include trade credit automation, supply-chain financing, embedded B2B lending, and credit-as-a-service infrastructure. These companies prioritize scalable APIs, compliance alignment, and fast onboarding for partners.

Top Key Players in the Market

- Turnkey Lender

- Lendflow

- Afterpay

- Banxware

- Affirm

- Klarna

- Tapwater

- Alchemy

- Migo

- Liberis

- Kanmon

- Sivo

- Hokodo

- Jaris

- Biz2X

- Others

Recent Developments

- August, 2025: TurnKey Lender secured growth investment from private equity firm Sundance Growth to accelerate its AI-powered cloud lending platform. The funding aims to scale product development and expand sales, focusing heavily on generative AI enhancements to meet rising demand in embedded finance and banking automation.

- June, 2025: Banxware received a €10 million strategic investment from UniCredit to fuel expansion of its embedded SME lending platform. The partnership will deepen its integration with UniCredit’s banking-as-a-service infrastructure while shifting to a forward flow lending model that unlocks scalability and capital efficiency.

Report Scope

Report Features Description Market Value (2024) USD 10.4 Bn Forecast Revenue (2034) USD 67.1 Bn CAGR(2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Embedded Lending Platform, Embedded Lending Services), By Deployment (Cloud/Web-Based, On-Premise), By Enterprise Size (Small and Mid-sized Enterprises (SMEs), Large Enterprises), By Industry (Retail, Education, Medical and Healthcare, IT/IT Services, Real Estate, Manufacturing, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Turnkey Lender, Lendflow, Afterpay, Banxware, Affirm, Klarna, Tapwater, Alchemy, Migo, Liberis, Kanmon, Sivo, Hokodo, Jaris, Biz2X, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Turnkey Lender

- Lendflow

- Afterpay

- Banxware

- Affirm

- Klarna

- Tapwater

- Alchemy

- Migo

- Liberis

- Kanmon

- Sivo

- Hokodo

- Jaris

- Biz2X

- Others