Global Electric Vehicle Sound Generator Market Size, Share, Growth Analysis By Product (External Sound Generators, Internal Sound Generators, Customizable Sound Systems), By Propulsion (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Vehicle (Passenger Vehicle, Commercial Vehicle, Two and Three Wheelers, Off-highway Vehicles), By Component (Hardware, Software), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167369

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

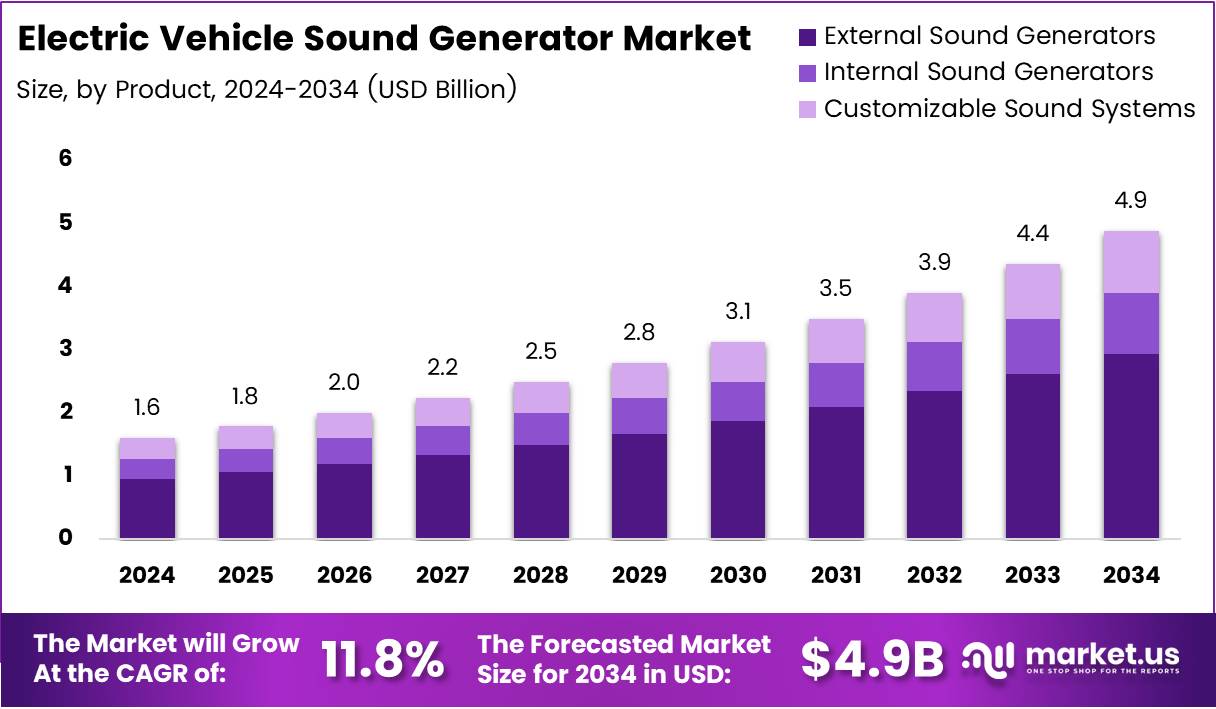

The Global Electric Vehicle Sound Generator Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034.

The Electric Vehicle Sound Generator market refers to advanced acoustic systems that produce artificial driving sounds for EVs to enhance pedestrian awareness and improve safety perception. These generators simulate engine-like audio through external speakers, ensuring compliance with silent vehicle safety norms and reinforcing brand identity in an evolving electric mobility ecosystem.

The Electric Vehicle Sound Generator plays a critical role in supporting road safety and elevating user driving experience. It creates controlled audio cues that alert pedestrians and cyclists of an approaching EV. Additionally, it reinforces emotional connection with the vehicle, making electric models more appealing to consumers who value auditory feedback.

Electric Vehicle Sound Generator Market is growing steadily as rising EV adoption increases the need for safety-centric acoustic technologies. Regulatory pressure and customer demand encourage automakers to integrate sound systems early in design cycles, making audio engineering a mandatory component of future electric mobility solutions.

Governments across key automotive regions invest heavily in electric transportation infrastructure and enforce pedestrian safety standards. Regulatory bodies mandate artificial sound requirements for low-speed EVs, fueling rapid installation of acoustic vehicle alerting systems. These policies accelerate widespread adoption and create a structured demand stream for suppliers worldwide.

Opportunities continue to expand as manufacturers explore AI-driven sound design, smart sensors, and immersive digital audio features. Industry players benefit from collaboration with software developers and acoustic engineers to enhance system precision. Increased interest in custom EV sonic signatures enables new revenue models based on personalization and connected features.

Key Takeaways

- Global Electric Vehicle Sound Generator market size valued at USD 1.6 Billion (2024) and projected to reach USD 4.9 Billion (2034) with a CAGR of 11.8% (2025–2034).

- External Sound Generators dominated the product segment with 57.9% share (2024).

- Battery Electric Vehicles (BEV) led the propulsion segment with 61.2% market share (2024).

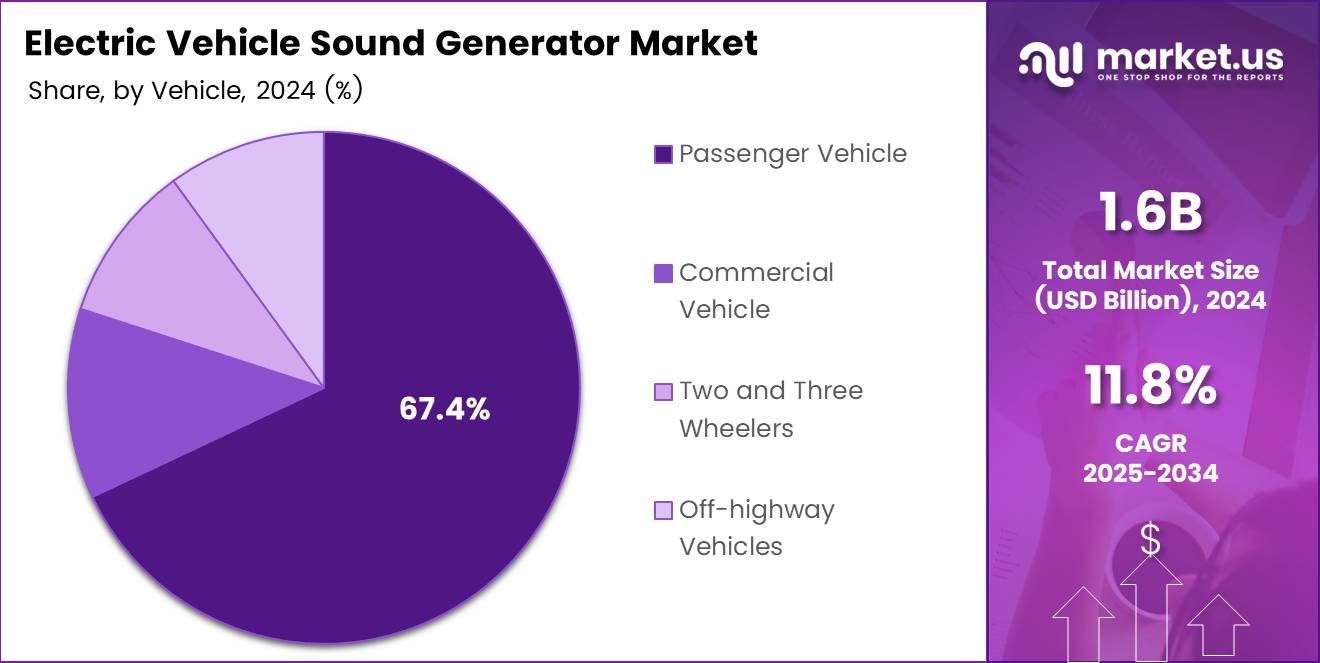

- Passenger Vehicles were the top vehicle category with a 67.4% share (2024).

- Hardware accounted for the majority of the component segment with a 69.5% share (2024).

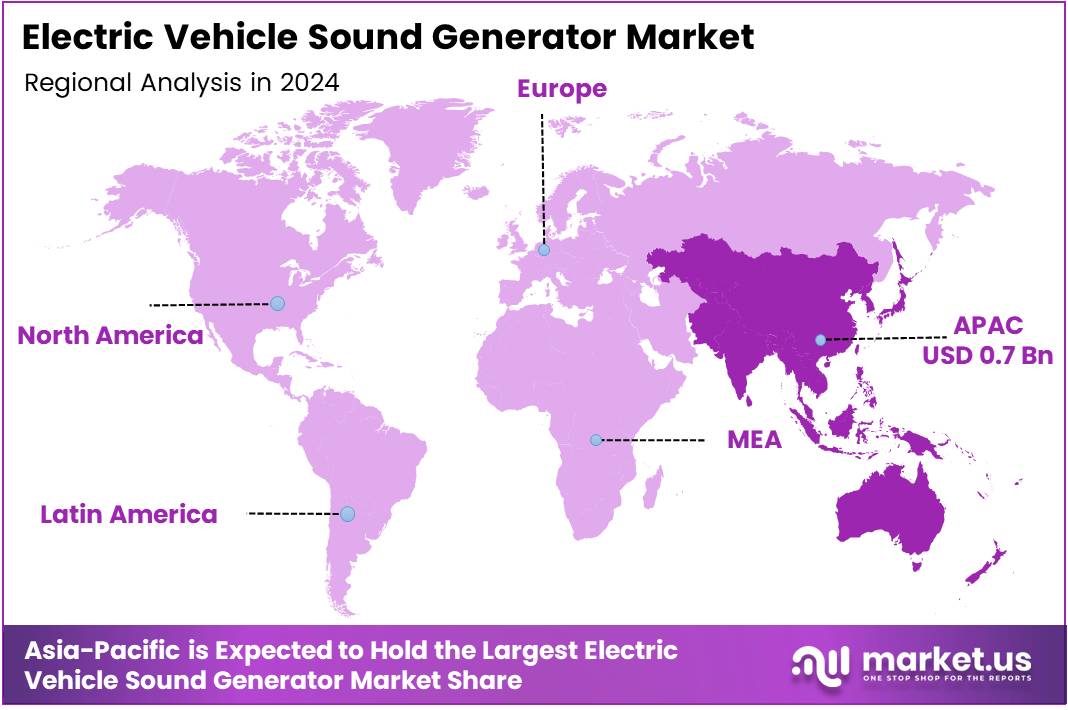

- Asia Pacific led geographically with a 46.9% market share valued at USD 0.7 Billion (2024).

By Product Analysis

In 2024, External Sound Generators held a dominant market position in the By Product segment of the Electric Vehicle Sound Generator Market, with a 57.9% share.

External Sound Generators led the segment with a 57.9% share in 2024, driven by strong regulatory mandates for external pedestrian warning systems and improved road safety. Automakers increasingly integrated external acoustic units to alert nearby pedestrians, enhancing compliance standards and ensuring better safety performance in electric mobility.

Internal Sound Generators continued to gain momentum as OEMs enhanced cabin experiences with simulated engine acoustics. These systems supported user engagement and helped bridge the gap between traditional ICE driving feel and EV silence. As a result, they increasingly appealed to premium and performance EV segments worldwide.

Customizable Sound Systems expanded steadily as consumers demanded personalization in EV sound profiles. These systems allowed brands and drivers to create unique auditory identities tailored to lifestyle and driving modes. Growing interest in brand acoustics and luxury-based differentiation strengthened the adoption of advanced sound customization.

By Propulsion Analysis

In 2024, Battery Electric Vehicles (BEV) held a dominant market position in the By Propulsion segment of the Electric Vehicle Sound Generator Market, with a 61.2% share.

Battery Electric Vehicles led with a 61.2% share in 2024, largely due to rapid global adoption of fully electric vehicles and mandatory sound compliance for EV pedestrian safety. Increased production and supportive subsidies accelerated BEV demand, creating strong deployment opportunities for sound generator solutions across passenger and commercial fleets.

Hybrid Electric Vehicles offered consistent integration opportunities for acoustic alert solutions due to silent driving at low speeds. Their dual propulsion structure reinforced the need for sound generators, as safety regulators ensured hybrid systems produce sound cues during electric-powered operation to enhance pedestrian awareness.

Plug-In Hybrid Electric Vehicles exhibited expanding implementation of sound generators as automakers launched new PHEV platforms globally. Enhanced safety requirements and longer EV-only driving modes increased the importance of audible alerts for urban transportation, encouraging broader adoption across mid-range and premium models.

Fuel Cell Electric Vehicles also contributed to sound generator development, particularly in markets investing in hydrogen mobility. Although this segment remained comparatively smaller, its silent high-efficiency operation required synthetic acoustic solutions to ensure regulatory compliance while reinforcing futuristic vehicle identity.

By Vehicle Analysis

In 2024, Passenger Vehicle held a dominant market position in the By Vehicle segment of the Electric Vehicle Sound Generator Market, with a 67.4% share.

Passenger Vehicles accounted for a strong 67.4% share in 2024, supported by rising EV adoption among consumers and strict safety regulations for sound warnings in urban driving. Automakers integrated premium sound solutions to enhance both safety and brand experience, significantly boosting demand across compact, luxury, and performance EV models.

Commercial Vehicles exhibited increasing uptake due to expanding electrified logistics fleets and last-mile delivery networks. Sound generators were essential for urban pedestrian safety and night-time operations, prompting fleet operators to integrate reliable, regulation-compliant acoustic systems for vans, buses, and light trucks.

Two and Three Wheelers showed growing deployment across electric scooters, delivery two-wheelers, and three-wheeler passenger carriers. Operators adopted audible warning systems to mitigate accident risks in congested city zones, improving rider and pedestrian safety in high-density regions.

Off-highway Vehicles saw gradual expansion of sound solutions to improve operational safety in work environments. Mining vehicles, electric tractors, and industrial machinery benefited from customized acoustic cues, ensuring hazard awareness for workers and nearby personnel during low-noise EV operation.

By Component Analysis

In 2024, Hardware held a dominant market position in the By Component segment of the Electric Vehicle Sound Generator Market, with a 69.5% share.

Hardware secured a commanding 69.5% share in 2024, reflecting the strong demand for speakers, transducers, controllers, and amplifiers across electric and hybrid vehicles. Manufacturers prioritized reliable hardware to meet global safety compliance standards, delivering robust and integrated systems capable of exterior and interior sound delivery for diverse vehicle platforms.

Software demonstrated rapid expansion as automakers focused on digital sound design and signal processing technologies. Customizable sound libraries and adaptive algorithms enabled dynamic vehicle acoustics based on speed, mode, and environment. The shift toward personalization and brand-defining sound signatures supported ongoing investment in software-enhanced EV acoustic systems.

Key Market Segments

By Product

- External Sound Generators

- Internal Sound Generators

- Customizable Sound Systems

By Propulsion

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

By Vehicle

- Passenger Vehicle

- Sedan

- SUV

- Hatchback

- Commercial Vehicle

- LCV

- MCV

- HCV

- Two and Three Wheelers

- Off-highway Vehicles

By Component

- Hardware

- Speakers

- Amplifiers

- Controllers

- Actuators

- Wiring Harnesses

- Software

- Sound Design Applications

- Control Systems

- User Interface Systems

Drivers

Mandatory Global Compliance with Acoustic Vehicle Alerting System (AVAS) Safety Regulations Drives Market Growth

The Electric Vehicle Sound Generator market is gaining strong momentum as many countries enforce strict AVAS regulations to enhance pedestrian safety. Automakers are required to equip EVs with artificial sound systems, especially at low speeds, to reduce road accidents involving visually impaired individuals and pedestrians. This regulatory pressure has made sound generators a core component rather than an optional feature in new EV models.

In addition, the rising adoption of autonomous and semi-autonomous EV platforms is pushing demand for more advanced sound signatures that help improve vehicle detection in mixed traffic environments. As EVs move toward higher automation levels, acoustic cues become essential to signal motion intent and enhance urban safety.

Consumer preference is also shifting toward personalizable sound profiles, allowing drivers to choose audio that reflects brand identity and driving style. Luxury EV manufacturers are increasingly using sound as a differentiator and marketing tool.

Furthermore, the expansion of urban e-mobility fleets such as electric scooters and delivery vehicles is creating new demand for low-speed alert systems. These fleets operate mainly in crowded cities, making pedestrian warning sounds necessary to prevent collisions and ensure regulatory compliance.

Restraints

Acoustic System Integration Complexity Increasing Overall EV Production Costs

Despite strong growth potential, the Electric Vehicle Sound Generator market faces key restraints linked to system integration challenges. Adding AVAS systems to EVs increases overall production complexity, as manufacturers must ensure compatibility with existing electrical architecture and meet regulatory acoustic standards across global markets. This can raise development timelines and increase costs for both premium and mass-market vehicles.

Another major restraint is maintaining consistent and clear sound output across different driving environments. Electric vehicles operate in varied conditions, including busy urban areas, quiet residential zones, tunnels, and highways. Designing sound systems that adjust effectively without becoming disruptive or overly loud remains a technical hurdle.

Moreover, environmental factors such as weather, ambient noise, and road conditions can affect sound performance. The need for adaptive acoustic control systems requires more advanced sensors and software, which further increases costs.

These challenges may slow adoption among cost-sensitive manufacturers and low-budget EV models, delaying widespread deployment of high-precision sound solutions in developing regions.

Growth Factors

Development of AI-Powered Smart Sound Systems for Adaptive Driving Scenarios Creates New Opportunities

There are significant growth opportunities emerging as the Electric Vehicle Sound Generator market evolves alongside digital and audio innovations. One major opportunity lies in using AI-powered adaptive sound systems that modify acoustic output in real time based on speed, surroundings, and driving behavior. This can improve safety while enhancing personalization for different user experiences.

Automakers are also exploring subscription-based sound design services, allowing drivers to upgrade vehicle acoustics through paid sound packs—similar to digital infotainment upgrades. This new revenue model supports recurring income beyond traditional car sales.

Partnerships with entertainment and gaming audio experts are opening doors for highly immersive and branded soundscapes. These collaborations can help automakers build stronger emotional connections with customers through signature acoustics that represent modern vehicle identity.

Additionally, the aftermarket segment presents a promising opportunity as EV owners show increasing interest in custom sound modifications and performance-oriented acoustic upgrades. Companies specializing in retrofit sound generator kits and downloadable sound themes are likely to see strong demand in the coming years.

Emerging Trends

Emergence of Hyper-Realistic 3D Spatial Audio for Exterior Vehicle Sound Generation Becomes a Trend

The Electric Vehicle Sound Generator market is experiencing notable trends driven by rapid advancements in audio technology and evolving consumer expectations. One major trend is the development of 3D spatial audio systems that create directional and hyper-realistic sound. These systems improve pedestrian awareness by projecting sound based on vehicle movement and surroundings.

Another rising trend is the demand for region-specific sound themes that reflect cultural and market preferences. Automakers are experimenting with localized sound identities for different countries to strengthen emotional appeal while maintaining safety compliance.

Cloud-connected sound libraries enabling over-the-air acoustic updates are gaining popularity as manufacturers shift toward software-driven vehicles. This feature allows drivers to update or modify sound themes without physical service visits.

Finally, many automakers are shifting toward nature-inspired and eco-themed acoustic signatures to reinforce sustainability branding. These sounds, such as soft wind tones or rhythmic harmonic pulses, help align EV identity with environmentally friendly transportation and appeal to green-minded consumers.

Regional Analysis

Asia Pacific Dominates the Electric Vehicle Sound Generator Market with a Market Share of 46.9%, Valued at USD 0.7 Billion

The Asia Pacific region holds the leading position in the Electric Vehicle Sound Generator market, contributing a commanding 46.9% market share valued at USD 0.7 Billion. The region’s rapid EV adoption, government-led electrification initiatives, and growing focus on road safety compliance are key drivers of demand. Expanding electric mobility infrastructure and increasing production of battery-powered vehicles further reinforce Asia Pacific’s dominance in the market.

North America Electric Vehicle Sound Generator Market Trends

North America continues to experience steady growth in the Electric Vehicle Sound Generator sector, supported by stringent safety regulations for pedestrian protection and rising electric car penetration. Consumer preference for high-tech automotive components and policies promoting EV production contribute to sustained market expansion. The presence of advanced manufacturing capabilities and incentives for EV adoption further elevate the region’s market trajectory.

Europe Electric Vehicle Sound Generator Market Outlook

Europe remains one of the most proactive markets, driven by transportation decarbonization goals and government legislation mandating acoustic vehicle alerting systems for EVs. The region benefits from high consumer awareness of road safety and strong adoption of next-generation EV technologies. Continuous investments in EV manufacturing facilities and green mobility initiatives further strengthen market demand across major European countries.

Middle East and Africa Electric Vehicle Sound Generator Market Overview

The Middle East and Africa market for Electric Vehicle Sound Generators is growing gradually, supported by smart city developments and rising investments in EV charging networks. While EV adoption is still at an early stage, government sustainability programs and premium vehicle imports are emerging as primary growth drivers. Expansion of clean transportation initiatives is expected to accelerate demand in the coming years.

Latin America Electric Vehicle Sound Generator Market Insights

Latin America is witnessing a progressive uptake in Electric Vehicle Sound Generator technology, driven by increasing awareness of EV safety requirements and gradual transition toward electric public and private mobility. Government incentives for EV imports and infrastructure development are contributing to the market’s steady expansion. Rising interest in smart mobility solutions positions the region for incremental future market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Electric Vehicle Sound Generator Company Insights

The global Electric Vehicle Sound Generator market in 2024 is shaped significantly by leading technology developers and automotive suppliers, each pushing advancements in acoustic safety and regulatory compliance.

Ansys continues to strengthen its position through simulation-driven product development, helping EV manufacturers design compliant Acoustic Vehicle Alerting Systems (AVAS) with reduced testing costs and faster prototyping cycles. Its software-led approach enables precise tuning of exterior and interior sound signatures, supporting OEMs facing increasing global safety mandates.

Aptiv leverages its strong automotive electronics footprint to integrate sound-generation hardware seamlessly into broader safety and sensing architectures. In 2024, the company is expected to benefit from rising demand for holistic EV safety platforms where AVAS is bundled with ADAS and connectivity features. Its ability to scale production efficiently positions Aptiv well in both premium and mid-segment EV markets.

Brigade Electronics maintains a focused trajectory specializing in safety acoustic systems for commercial EV fleets and heavy-duty vehicles. With urban electrification policies increasing the number of electric buses, delivery vans, and municipal EVs, Brigade continues to gain traction by offering robust and durable AVAS solutions tailored to industrial and low-speed environments.

Continental remains a critical market driver by combining sound-generation modules with intelligent control units and sensor fusion capabilities. The company’s investments in smart mobility and integrated safety ecosystems enable EV manufacturers to adopt AVAS not just for compliance, but also for brand-specific acoustic design. Its global partnerships and manufacturing scale support long-term competitive strength across North America, Europe, and Asia.

Top Key Players in the Market

- Ansys

- Aptiv

- Brigade Electronics

- Continental

- Denso

- ECCO

- Forvia Hella

- Harman International

- Hyundai

- STMicroelectronics

Recent Developments

- In Apr 2025, BMW unveiled its innovative HypersonX soundscape for the Neue Klasse electric models, enhancing the driving experience with futuristic audio cues tailored to acceleration, deceleration, and dynamic driving moods.

- In Aug 2025, Meta Platforms, Inc. completed the acquisition of the audio-AI startup WaveForms AI, strategically expanding Meta’s capabilities in AI-generated sound technologies and immersive audio for metaverse-focused applications.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (External Sound Generators, Internal Sound Generators, Customizable Sound Systems), By Propulsion (Battery Electric Vehicles, Hybrid Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), By Vehicle (Passenger Vehicle, Commercial Vehicle, Two and Three Wheelers, Off-highway Vehicles), By Component (Hardware, Software) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ansys, Aptiv, Brigade Electronics, Continental, Denso, ECCO, Forvia Hella, Harman International, Hyundai, STMicroelectronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Vehicle Sound Generator MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Vehicle Sound Generator MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansys

- Aptiv

- Brigade Electronics

- Continental

- Denso

- ECCO

- Forvia Hella

- Harman International

- Hyundai

- STMicroelectronics