Global Electric Vehicle Sensor Market Size, Share, Growth Analysis By Product Type (Temperature Sensors, Current Sensors, Position Sensors, Pressure Sensors, Speed Sensors), By Propulsion (Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-In Hybrid Electric Vehicles (PHEVs)), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176970

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

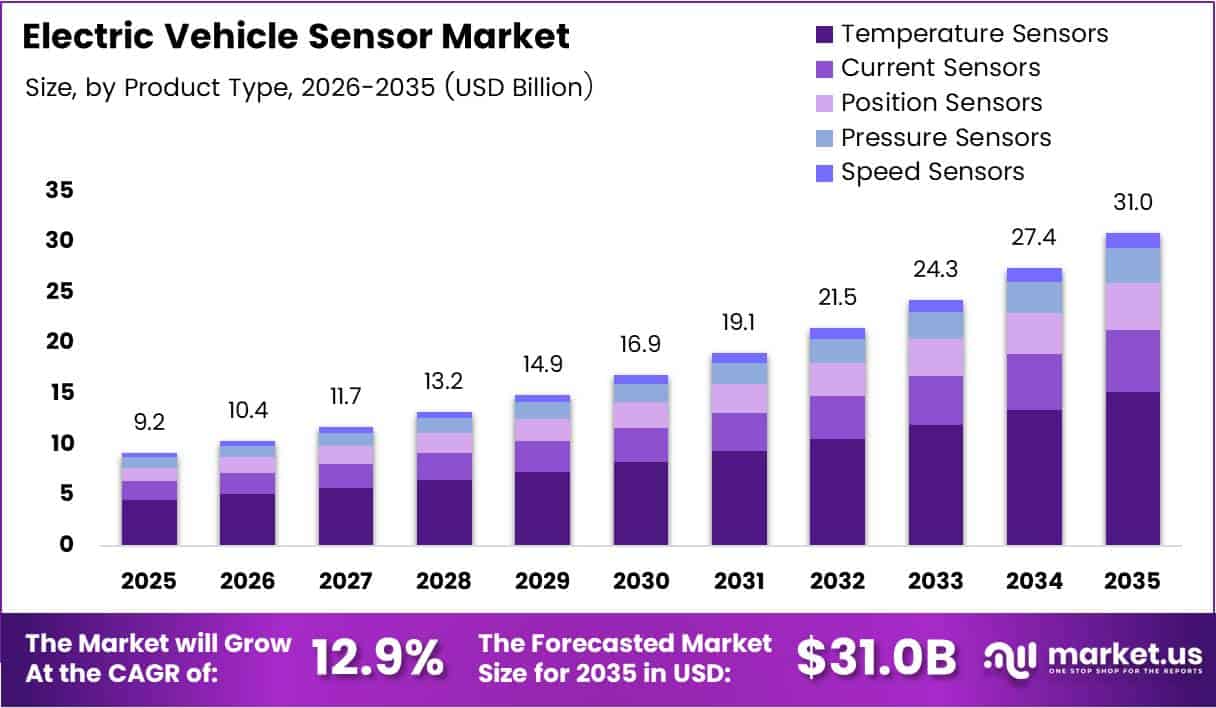

Global Electric Vehicle Sensor Market size is expected to be worth around USD 31.0 Billion by 2035 from USD 9.2 Billion in 2025, growing at a CAGR of 12.9% during the forecast period 2026 to 2035.

Electric vehicle sensors monitor critical vehicle parameters including temperature, current, position, pressure, and speed. These components enable battery management, motor control, safety systems, and autonomous driving capabilities. Sensors form the foundational layer for electric vehicle performance optimization and operational safety.

Automakers integrate sensor networks to comply with emission regulations and enhance vehicle intelligence. Moreover, the expansion of connected vehicle ecosystems drives demand for advanced sensing technologies. Consequently, sensor manufacturers focus on developing automotive-grade products that meet stringent reliability standards.

Government policies worldwide mandate enhanced vehicle safety features and zero-emission transportation solutions. Therefore, electric vehicle production accelerates across developed and emerging markets. Additionally, infrastructure development for smart charging networks creates new opportunities for sensor deployment in vehicle-to-grid communication systems.

Battery management systems rely heavily on multi-sensor architectures to optimize charging cycles and extend battery lifespan. Furthermore, autonomous driving technologies require sophisticated sensor fusion combining radar, camera, and LiDAR data. In February 2026, Infineon agreed to acquire analog/mixed-signal sensor portfolio from ams OSRAM for approximately €570M, strengthening its automotive sensor capabilities.

According to research published in 2025, multi-sensor battery monitoring increased state-of-charge estimation accuracy from 46.1% to 74.5%. This improvement demonstrates how advanced sensing technologies enhance battery performance prediction and management efficiency in electric vehicles.

According to autonomous vehicle research datasets analyzing 56.7M miles, sensor-driven systems showed 96% reduction in vehicle-to-vehicle intersection injury crashes versus human benchmarks. These results validate the critical role sensors play in advancing vehicle safety and autonomous driving capabilities.

Key Takeaways

- Global Electric Vehicle Sensor Market valued at USD 9.2 Billion in 2025, projected to reach USD 31.0 Billion by 2035

- Market growing at CAGR of 12.9% during forecast period 2026-2035

- Temperature Sensors segment dominates By Product Type with 34.8% market share

- Battery Electric Vehicles (BEVs) lead By Propulsion segment with 56.2% share

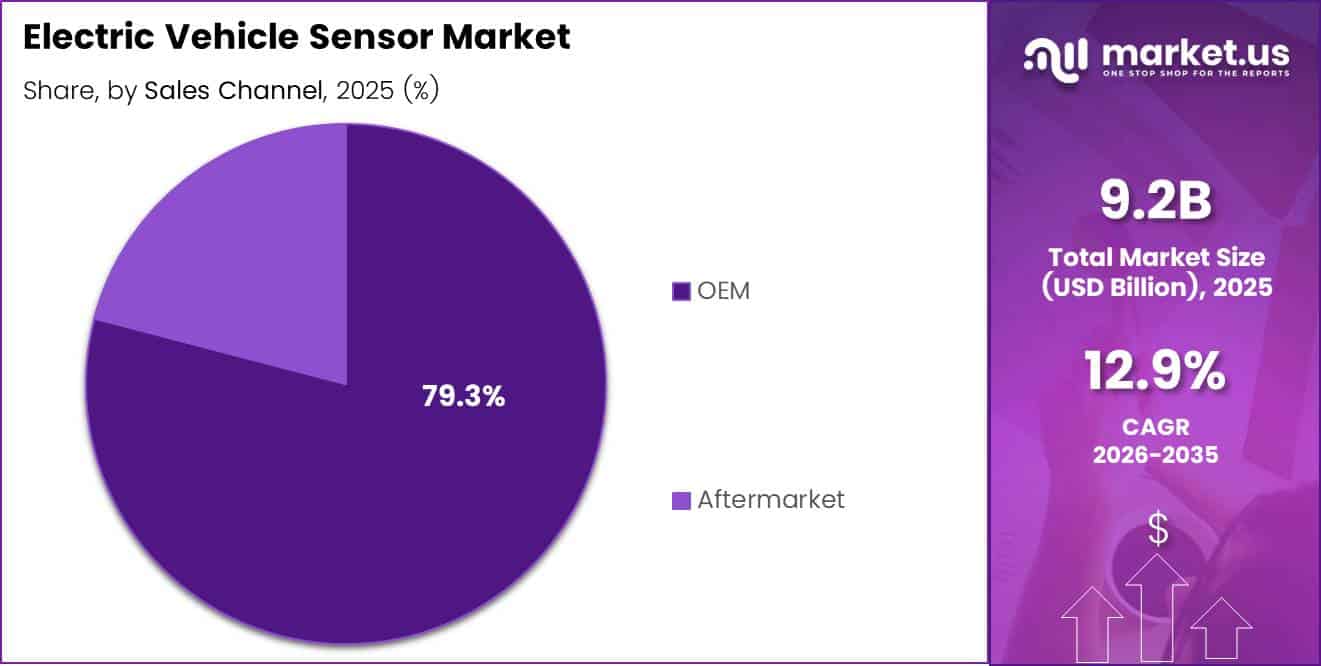

- OEM sales channel accounts for 79.3% of total market distribution

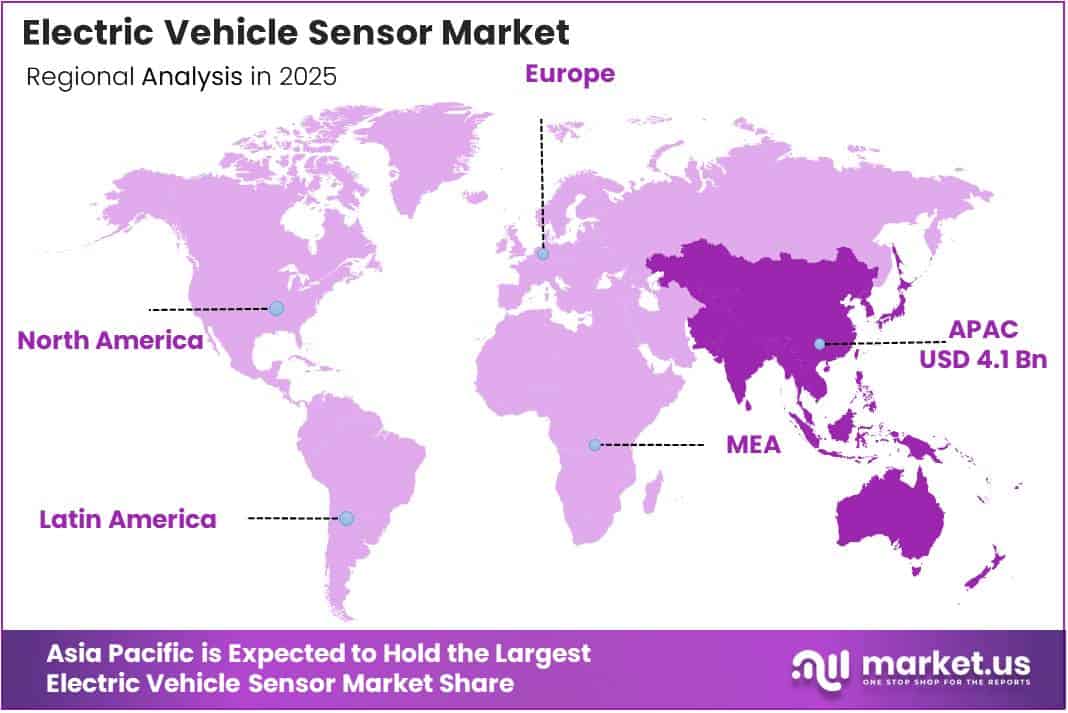

- Asia Pacific region dominates with 45.20% market share, valued at USD 4.1 Billion

Product Type Analysis

Temperature Sensors dominate with 34.8% due to critical battery thermal management requirements.

In 2025, Temperature Sensors held a dominant market position in the By Product Type segment of Electric Vehicle Sensor Market, with a 34.8% share. Battery thermal management systems require continuous temperature monitoring to prevent overheating and optimize charging efficiency. Consequently, automakers install multiple temperature sensors across battery packs, power electronics, and motor assemblies to ensure safe operation.

Current Sensors monitor electrical flow within battery systems and charging infrastructure. These components enable precise power management and prevent overcurrent conditions that could damage vehicle electronics. Moreover, current sensing technologies support regenerative braking systems by measuring energy recovery during deceleration.

Position Sensors track motor shaft angles, steering inputs, and suspension movement in electric vehicles. Automotive manufacturers integrate these sensors for precise motor control and enhanced vehicle dynamics. Additionally, position sensing enables advanced driver assistance features that require accurate spatial awareness.

Pressure Sensors measure brake hydraulic pressure, tire inflation levels, and battery cooling system performance. These devices contribute to safety systems and operational efficiency monitoring. Furthermore, pressure sensing supports predictive maintenance by detecting abnormal operating conditions before component failure.

Speed Sensors provide wheel rotation data for traction control, anti-lock braking, and vehicle stability systems. Electric drivetrains rely on speed sensing for motor control synchronization and torque distribution. Therefore, these sensors remain essential for electric vehicle performance optimization and safety compliance.

Propulsion Analysis

Battery Electric Vehicles (BEVs) dominate with 56.2% due to zero-emission mandates and charging infrastructure expansion.

In 2025, Battery Electric Vehicles (BEVs) held a dominant market position in the By Propulsion segment of Electric Vehicle Sensor Market, with a 56.2% share. Pure electric architectures require comprehensive sensor networks for battery management, thermal control, and range optimization. Consequently, BEV platforms integrate higher sensor counts compared to hybrid configurations, driving segment growth.

Hybrid Electric Vehicles (HEVs) combine internal combustion engines with electric motors, requiring sensors for both powertrains. These vehicles use sensing technologies to coordinate power switching between electric and gasoline modes. Moreover, HEV systems monitor battery state-of-charge to maximize fuel efficiency during urban driving cycles.

Plug-In Hybrid Electric Vehicles (PHEVs) feature larger batteries than conventional hybrids, enabling extended electric-only driving range. Sensor networks in PHEVs manage charging infrastructure communication and battery thermal regulation. Additionally, these vehicles require position sensors for transmission mode selection between electric and hybrid operation.

Sales Channel Analysis

OEM dominates with 79.3% due to factory integration requirements and warranty compliance standards.

In 2025, OEM held a dominant market position in the By Sales Channel segment of Electric Vehicle Sensor Market, with a 79.3% share. Vehicle manufacturers install sensor systems during production to meet safety certifications and performance specifications. Therefore, original equipment integration ensures proper calibration and compatibility with vehicle electronics architectures.

Aftermarket sensors serve replacement needs and vehicle upgrade applications for older electric vehicle models. Owners replace failed sensors to maintain vehicle functionality and safety system operation. Moreover, aftermarket channels provide opportunities for sensor performance upgrades as technology advances beyond original equipment specifications.

Key Market Segments

By Product Type

- Temperature Sensors

- Current Sensors

- Position Sensors

- Pressure Sensors

- Speed Sensors

By Propulsion

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-In Hybrid Electric Vehicles (PHEVs)

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Global Electric Vehicle Production Driving Demand for Advanced Vehicle Sensors

Automakers worldwide expand electric vehicle manufacturing capacity to meet emission reduction targets and consumer demand. This production surge requires substantial sensor volumes for battery management, motor control, and safety systems. Consequently, sensor manufacturers scale operations to support automotive industry electrification timelines.

Government incentives and regulatory mandates accelerate electric vehicle adoption across major automotive markets. Moreover, declining battery costs make electric vehicles economically competitive with conventional powertrains. According to research analyzing autonomous vehicle datasets, sensor-driven systems demonstrated 91% reduction in airbag-deployment crash events versus human drivers, highlighting safety advantages.

Advanced driver assistance systems and autonomous driving technologies require sophisticated sensor integration. Therefore, vehicle manufacturers invest heavily in radar, camera, and LiDAR sensor fusion architectures. Additionally, connected vehicle platforms create demand for sensors that enable vehicle-to-everything communication and smart infrastructure interaction.

Restraints

High Cost Associated with Automotive-Grade Sensor Manufacturing and Testing

Automotive-grade sensors must withstand extreme temperatures, vibrations, and electromagnetic interference throughout vehicle lifecycles. Manufacturers invest significantly in qualification testing to meet automotive industry reliability standards. Consequently, sensor production costs remain substantially higher than consumer electronics applications, limiting price reduction potential.

Technical complexity increases when integrating multiple sensor types within vehicle electronic architectures. Sensor fusion algorithms require extensive validation to ensure accurate data interpretation across diverse operating conditions. Moreover, compatibility challenges arise when coordinating sensors from different suppliers within single vehicle platforms.

Small-volume electric vehicle production prevents economies of scale in sensor procurement and integration. Additionally, frequent technology updates require continuous engineering resources for sensor calibration and software validation. Therefore, automakers face ongoing cost pressures that slow sensor technology adoption in price-sensitive vehicle segments.

Growth Factors

Technological Advancements Accelerate Market Expansion

Autonomous and semi-autonomous vehicle development creates unprecedented demand for advanced sensor technologies. Manufacturers design sensor systems capable of real-time environmental perception and predictive decision-making. Consequently, investments in sensor miniaturization and performance enhancement accelerate product innovation cycles across the automotive supply chain.

Emerging automotive markets demonstrate rapid electric vehicle adoption driven by urbanization and pollution concerns. According to 2025 research, hybrid physics plus reinforcement learning EV charging prediction models achieved R² of 99.2% accuracy and 1.6% MAPE, improving prediction robustness by 35% versus baseline models. In July 2025, LG Innotek signed a strategic partnership and invested up to $50 million in LiDAR sensor company Aeva.

Smart city infrastructure deployment integrates vehicle-to-everything communication requiring advanced sensor capabilities. Additionally, energy-efficient sensor designs reduce power consumption, extending electric vehicle range. Therefore, continuous innovation in MEMS technology enables compact sensors suitable for space-constrained automotive applications.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Sensor fusion technologies combine radar, camera, and LiDAR data streams to create comprehensive vehicle environmental awareness. Automotive manufacturers adopt multi-modal sensing architectures that improve object detection accuracy and system redundancy. Consequently, sensor integration complexity drives demand for advanced signal processing and artificial intelligence capabilities.

According to research published in 2025, multi-modal sensing including thermal, gas, optical, mechanical, and electrical sensors enabled SOC estimation accuracy improvement up to 74.5% versus traditional sensing methods. Battery management systems increasingly rely on diverse sensor inputs to optimize charging strategies and predict remaining useful life.

Artificial intelligence algorithms process sensor data in real-time, enabling predictive maintenance and adaptive vehicle control. Moreover, MEMS-based compact automotive sensors reduce installation complexity while maintaining performance standards. Additionally, adding expansion plus surface temperature sensing signals improved SOC accuracy by 74.5%, optical sensing by 46.1%, and force plus anode potential sensing by 60.6%.

Regional Analysis

Asia Pacific Dominates the Electric Vehicle Sensor Market with a Market Share of 45.20%, Valued at USD 4.1 Billion

Asia Pacific leads global electric vehicle sensor demand with a 45.20% market share, valued at USD 4.1 Billion, driven by China’s electric vehicle production dominance and regional manufacturing capabilities. Government policies across Japan, South Korea, and India promote electric mobility through subsidies and charging infrastructure investments. Moreover, established automotive supply chains enable rapid sensor technology adoption and cost optimization.

North America Electric Vehicle Sensor Market Trends

North American automakers accelerate electric vehicle platform development supported by federal emission regulations and consumer incentives. The United States focuses on domestic battery production and sensor technology development to secure automotive supply chain independence. Additionally, autonomous vehicle testing programs create demand for advanced sensor systems across the region.

Europe Electric Vehicle Sensor Market Trends

European markets enforce stringent emission standards that accelerate internal combustion engine phase-out timelines. Germany, France, and the United Kingdom invest heavily in electric vehicle manufacturing capacity and charging infrastructure networks. Consequently, European sensor suppliers develop specialized technologies for premium electric vehicle segments emphasizing performance and safety features.

Latin America Electric Vehicle Sensor Market Trends

Latin American markets gradually adopt electric vehicles driven by urban air quality concerns and public transportation electrification initiatives. Brazil leads regional electric vehicle sales while Mexico develops manufacturing capabilities for North American automotive exports. However, limited charging infrastructure and higher vehicle costs constrain broader market penetration.

Middle East & Africa Electric Vehicle Sensor Market Trends

Middle Eastern countries explore electric vehicle adoption as part of economic diversification strategies beyond petroleum dependence. South Africa develops electric vehicle assembly operations while GCC nations invest in charging infrastructure for smart city projects. Nevertheless, fossil fuel subsidies and climate challenges slow regional electric vehicle market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Analog Devices Inc. delivers precision signal processing and power management solutions for electric vehicle sensor applications. The company develops integrated circuits that convert analog sensor signals into digital data for vehicle control systems. Their sensor interface technologies enable accurate measurement of battery parameters, motor currents, and environmental conditions. Additionally, Analog Devices focuses on automotive-grade products meeting stringent reliability and temperature range requirements.

Denso Corporation manufactures comprehensive sensor systems for electric vehicles including temperature, pressure, and position sensing technologies. As a leading automotive supplier, Denso integrates sensor products with vehicle electronic architectures for major automakers worldwide. The company invests heavily in research to develop next-generation sensing solutions. Their manufacturing scale enables cost-effective sensor production meeting automotive industry volume requirements and quality standards.

Amphenol Advanced Sensors specializes in temperature and pressure sensing solutions designed specifically for harsh automotive environments. The company supplies sensors for battery thermal management, HVAC systems, and powertrain applications across electric vehicle platforms. Furthermore, Amphenol develops customized sensing solutions addressing unique customer requirements for emerging architectures. Their engineering expertise supports rapid product development cycles matching accelerated automotive electrification timelines.

Infineon Technologies AG provides semiconductor solutions including current sensors, microcontrollers, and power management devices for electric vehicles. The company’s sensor technologies enable precise battery monitoring, motor control, and charging infrastructure communication. Infineon expands its sensor portfolio through strategic acquisitions including analog sensor assets from ams OSRAM in February 2026. Therefore, Infineon strengthens its position supporting automotive electrification and autonomous driving technologies.

Key players

- Analog Devices Inc.

- Denso Corporation

- Amphenol Advanced Sensors

- Infineon Technologies AG

- Allegro MicroSystems, LLC

- AMS Osram AG

- Kohshin Electric Corporation

- LEM

- Renesas Electronics Corporation

- Sensata Technologies

Recent Developments

- April 2024 – Microchip acquired VSI Co., expanding its automotive sensor connectivity technology portfolio to strengthen position in electric vehicle sensor integration and communication systems for next-generation vehicle architectures.

- July 2025 – STMicroelectronics agreed to acquire part of NXP’s MEMS sensor business for up to $950M, enhancing its automotive sensor manufacturing capabilities and technology portfolio for electric vehicle applications across global markets.

- June 2025 – Continental launched eRTS rotor temperature sensor technology to directly measure heat inside EV motors with much higher accuracy than indirect methods, improving motor thermal management and performance optimization capabilities.

Report Scope

Report Features Description Market Value (2025) USD 9.2 Billion Forecast Revenue (2035) USD 31.0 Billion CAGR (2026-2035) 12.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Temperature Sensors, Current Sensors, Position Sensors, Pressure Sensors, Speed Sensors), By Propulsion (Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Plug-In Hybrid Electric Vehicles (PHEVs)), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Analog Devices Inc., Denso Corporation, Amphenol Advanced Sensors, Infineon Technologies AG, Allegro MicroSystems, LLC, AMS Osram AG, Kohshin Electric Corporation, LEM, Renesas Electronics Corporation, Sensata Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Vehicle Sensor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Electric Vehicle Sensor MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Analog Devices Inc.

- Denso Corporation

- Amphenol Advanced Sensors

- Infineon Technologies AG

- Allegro MicroSystems, LLC

- AMS Osram AG

- Kohshin Electric Corporation

- LEM

- Renesas Electronics Corporation

- Sensata Technologies