Global Electric Bus Battery Pack Market Size, Share Analysis By Propulsion (BEV, PHEV), By Battery Chemistry (LFP, NCA, NCM, MNC, Others), By Capacity (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), By Battery Form (Cylindrical, Pouch, Prismatic), By Material Type (Lithium, Cobalt, Manganese, Natural Graphite, Nickel, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154835

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

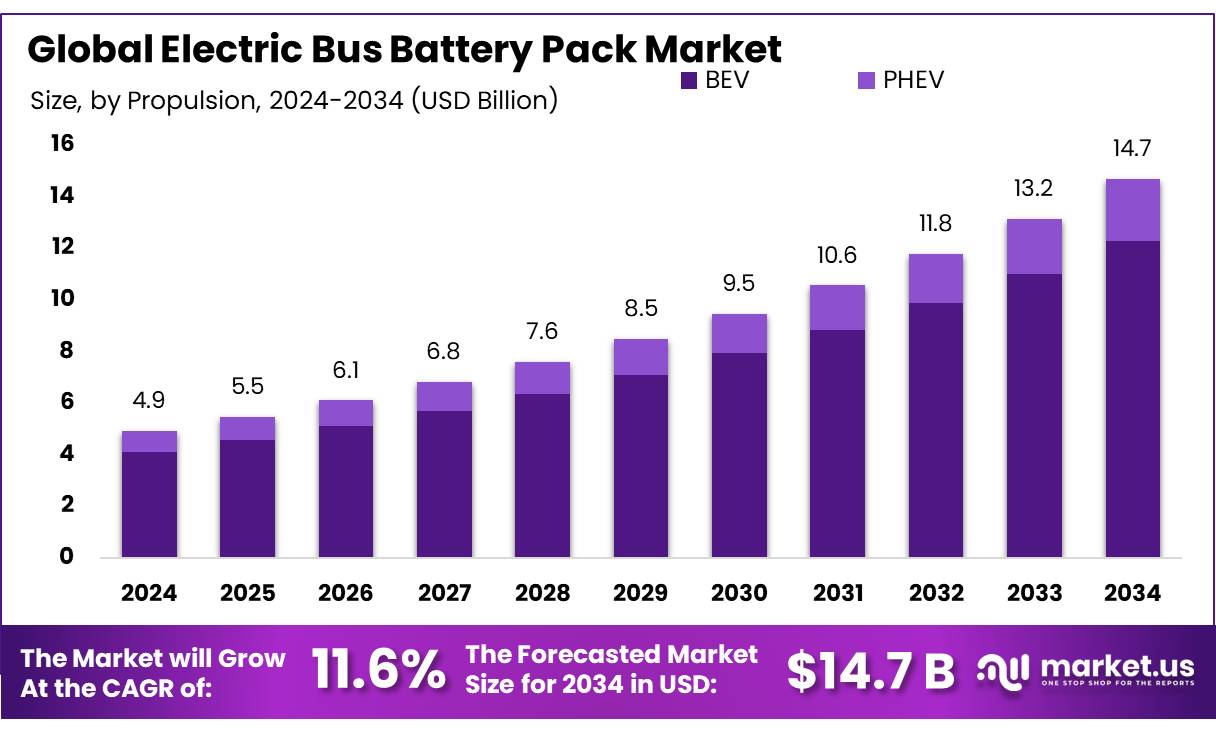

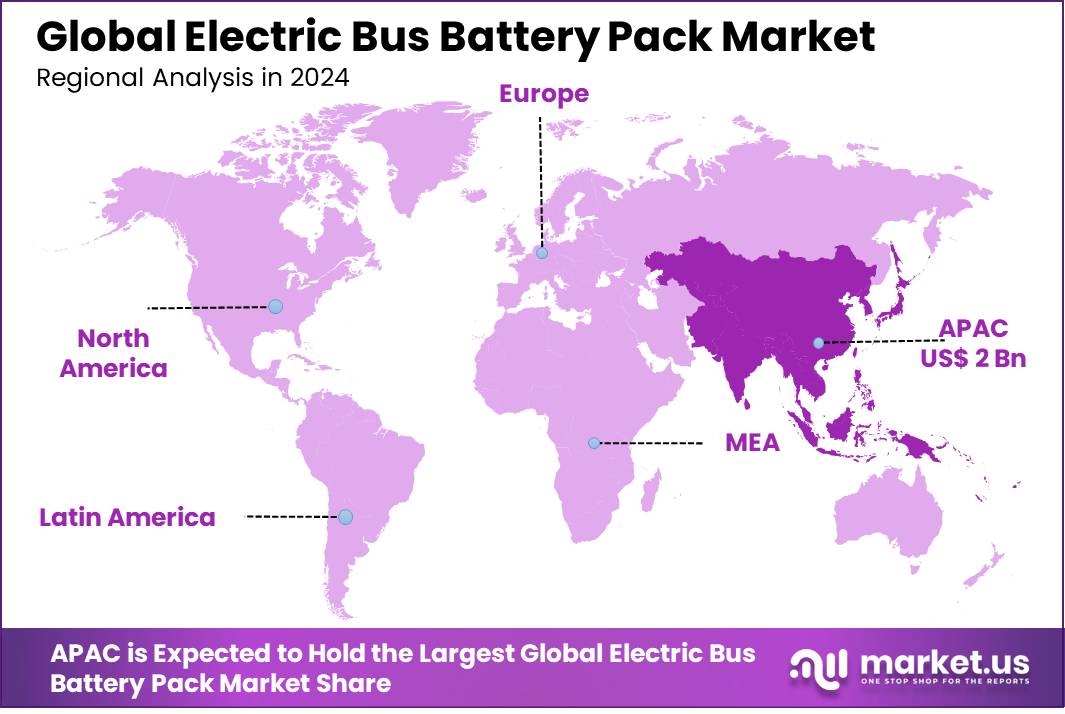

The Global Electric Bus Battery Pack Market size is expected to be worth around USD 14.7 Billion by 2034, from USD 4.9 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.8% share, holding USD 2 Billion revenue.

The electric bus battery pack concentrates industry in India is experiencing significant growth, driven by a confluence of government initiatives, technological advancements, and increasing environmental awareness. The Indian government has launched several schemes to promote electric mobility, including the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) and the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) schemes. These initiatives aim to reduce the upfront cost of electric vehicles (EVs) and encourage the adoption of electric buses across the country.

The industrial landscape for electric bus battery packs in India is experiencing significant transformation. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) Scheme Phase-II, launched in 2019, allocated ₹11,500 crore to incentivize the adoption of electric vehicles (EVs), including electric buses. Under this scheme, 2,636 charging stations were sanctioned across 62 cities in 24 states and union territories, facilitating the widespread deployment of EVs.

Additionally, the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cells (ACC) aims to bolster domestic manufacturing of battery cells, with a proposed subsidy of up to ₹2,000 per kWh for ACCs, contingent on meeting production and value addition targets.

The Indian government has introduced several initiatives to bolster the electric vehicle (EV) ecosystem. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, particularly its second phase (FAME II), has been instrumental in promoting EV adoption. Under this scheme, the government sanctioned 5,595 electric buses across 64 cities and state transport undertakings.

Additionally, under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Phase II scheme, the government has set aside ₹10,000 crore to promote the adoption of EVs, focusing on electric buses, two-wheelers, and four-wheelers. Subsidies of up to ₹20 lakh per bus are provided as incentives to encourage purchases.

These initiatives are part of a broader strategy to achieve a 30% share of EVs in overall vehicle sales by 2030, as outlined by NITI Aayog in its report titled “Unlocking a USD 200 Billion Opportunity Electric Vehicles in India.” The proposed policy includes defined targets and timelines to streamline infrastructure development, incentivize manufacturing, and support consumer adoption of EVs.

The adoption of electric buses is also being supported at the state level. For instance, Uttar Pradesh has implemented the “Electric Vehicle Manufacturing and Mobility Policy 2022,” offering subsidies to encourage EV adoption and providing a 100% waiver on road tax and registration fees for EVs purchased within the state. The policy also targets the rollout of 1 million EVs across segments by December 2024 and the deployment of 1,000 electric buses by December 2030.

Key Takeaways

- Electric Bus Battery Pack Market size is expected to be worth around USD 14.7 Billion by 2034, from USD 4.9 Billion in 2024, growing at a CAGR of 11.6%.

- BEV held a dominant market position, capturing more than a 83.8% share in the global electric bus battery pack market.

- NCA battery chemistry held a dominant market position, capturing more than a 48.4% share.

- 40 kWh to 80 kWh held a dominant market position, capturing more than a 56.2% share in the electric bus battery pack market.

- Prismatic held a dominant market position, capturing more than a 59.2% share in the electric bus battery pack market.

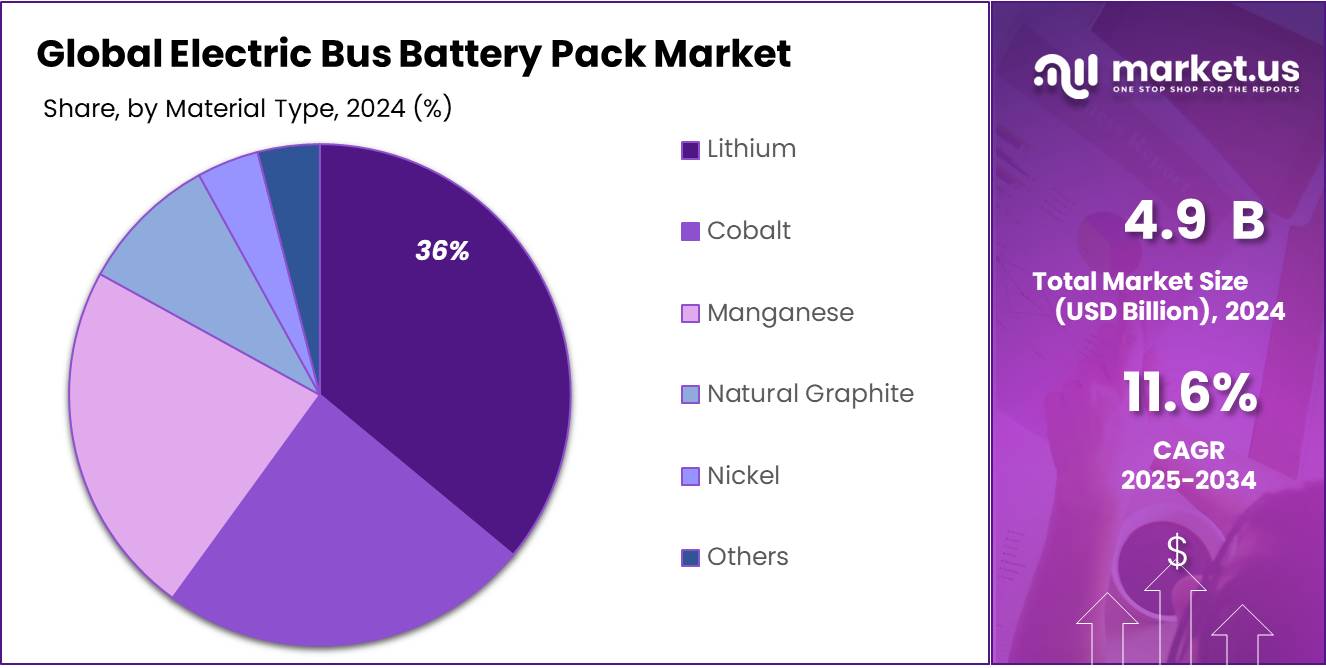

- Lithium held a dominant market position, capturing more than a 36.6% share in the electric bus battery pack market.

- Asia‑Pacific (APAC) region emerged as the clear leader of the electric bus battery pack market, accounting for a commanding 42.8% of the global market and generating approximately USD 2 billion.

By Propulsion Analysis

Battery Electric Vehicles (BEVs) lead the Electric Bus Battery Pack market with 83.8% share in 2024, driven by zero-emission goals and operational efficiency.

In 2024, BEV held a dominant market position, capturing more than a 83.8% share in the global electric bus battery pack market. This strong lead can be linked to the global shift toward cleaner transport solutions, where full battery-electric buses are preferred for their zero tailpipe emissions, lower maintenance costs, and improved energy efficiency.

Across various urban transit systems, BEVs are increasingly selected over hybrid or fuel cell alternatives due to advancements in lithium-ion battery technologies and the falling cost of battery packs. The growing number of government-funded programs, especially in regions such as Asia-Pacific and Europe, is also encouraging mass deployment of BEVs in public fleets. By 2025, BEVs are expected to retain their lead in this segment as more countries adopt stricter emission regulations and continue to invest in electric mobility infrastructure, including charging depots and localized battery manufacturing.

By Battery Chemistry Analysis

Nickel Cobalt Aluminum (NCA) battery chemistry leads with 48.4% share in 2024, favored for its high energy density and long-range performance.

In 2024, NCA battery chemistry held a dominant market position, capturing more than a 48.4% share in the electric bus battery pack market. This strong preference for NCA batteries is mainly due to their higher energy density and longer driving range, which makes them ideal for long-route electric buses operating in urban and intercity transport networks.

Compared to other chemistries, NCA batteries offer a better balance between weight and capacity, allowing electric buses to run longer without needing frequent recharging. Their reliability and cycle life have also made them a preferred choice in regions where performance and endurance are critical. In 2025, NCA chemistry is expected to maintain its lead as manufacturers continue optimizing battery performance and more cities push for efficient, long-range electric public transport systems.

By Capacity Analysis

40 kWh to 80 kWh battery packs dominate with 56.2% share in 2024, driven by their balance of range, weight, and cost for city buses.

In 2024, 40 kWh to 80 kWh held a dominant market position, capturing more than a 56.2% share in the electric bus battery pack market. This capacity range is widely favored for city buses that require moderate driving range without carrying the extra weight of larger batteries. It offers a practical solution for daily urban transit, where frequent stops and shorter distances are common.

Buses with 40–80 kWh battery packs also benefit from faster charging times, which helps reduce downtime and improve operational efficiency for transport fleets. By 2025, this segment is expected to hold its ground as city governments and transit agencies continue to invest in electric buses optimized for medium-range routes, focusing on reliability and cost-efficiency rather than maximum capacity.

By Battery Form Analysis

Prismatic battery cells lead the electric bus battery pack market with 59.2% share in 2024, valued for their compact design and thermal stability.

In 2024, Prismatic held a dominant market position, capturing more than a 59.2% share in the electric bus battery pack market. The widespread use of prismatic cells is mainly due to their space-saving rectangular shape, which allows better packing efficiency inside battery enclosures, especially for large vehicles like electric buses. These cells also offer improved structural integrity and are easier to manage thermally, which is crucial for safety and longevity in public transport systems.

Prismatic batteries are known for their stable performance and are often preferred by bus manufacturers for their compatibility with high-capacity modules. By 2025, the demand for prismatic cells is expected to remain strong as electric bus production scales up globally and transit operators continue to favor battery forms that support long-term reliability and efficient space utilization.

By Material Type Analysis

Lithium-based materials dominate with 36.6% share in 2024, backed by high energy efficiency and long cycle life.

In 2024, Lithium held a dominant market position, capturing more than a 36.6% share in the electric bus battery pack market. Lithium materials are widely chosen for their excellent energy-to-weight ratio, fast charging capabilities, and long lifespan, making them a top choice for powering electric buses in both urban and intercity routes.

These batteries are not only lightweight but also support higher energy densities, allowing buses to travel longer distances without frequent charging. As more cities adopt emission-free transport solutions, lithium-based battery systems continue to play a central role in fleet electrification. By 2025, the dominance of lithium is expected to continue as advancements in lithium technology further enhance performance, safety, and cost-effectiveness, reinforcing its position as a reliable material choice in electric mobility.

Key Market Segments

By Propulsion

- BEV

- PHEV

By Battery Chemistry

- LFP

- NCA

- NCM

- MNC

- Others

By Capacity

- 15 kWh to 40 kWh

- 40 kWh to 80 kWh

- Above 80 kWh

By Battery Form

- Cylindrical

- Pouch

- Prismatic

By Material Type

- Lithium

- Cobalt

- Manganese

- Natural Graphite

- Nickel

- Others

Emerging Trends

Surge in Global Electric Bus Adoption

A significant trend shaping the electric bus battery pack market is the rapid global adoption of electric buses, driven by increasing environmental concerns and supportive government policies. This shift is not only transforming urban transportation but also creating substantial demand for advanced battery technologies.

In 2023, global electric bus sales saw a remarkable 32% increase compared to the previous year, with the United States alone witnessing a 66% surge in electric bus sales. This uptick is largely attributed to stringent emissions regulations and ambitious zero-emission targets set by governments worldwide. For instance, California’s Innovative Clean Transit rule mandates that by 2029, all new public transit bus purchases must be zero-emission, aiming for a fully zero-emission fleet by 2040.

In India, the NITI Aayog has outlined a comprehensive blueprint to accelerate electric vehicle adoption, focusing on enhancing access to financing for electric buses and trucks. This initiative underscores the government’s commitment to reducing emissions and promoting sustainable transportation.

The surge in electric bus adoption is also evident in cities like London, where the fleet of zero-emission buses has grown to over 2,000, with plans to expand to 2,500 by the end of 2025 . Similarly, Toronto’s Transit Commission is set to receive $700 million in funding to electrify its bus fleet, aiming to purchase 340 zero-emission buses and 248 chargers.

Drivers

Increasing Government Support and Initiatives

One of the major driving factors behind the rapid growth of the electric bus battery pack market is the growing government support and initiatives aimed at promoting sustainable transportation. Governments around the world are introducing various policies, subsidies, and financial incentives to boost the adoption of electric buses, especially in urban areas where pollution levels are high and traffic congestion is a daily problem. These initiatives not only encourage public transportation companies to adopt electric buses but also pave the way for infrastructure development, like charging stations, to support the electric vehicle (EV) ecosystem.

For instance, in Europe, the European Commission’s Green Deal aims to make Europe the first climate-neutral continent by 2050, with a clear focus on promoting clean transport. The European Union has also allocated significant funding to support the shift towards electric mobility. A notable example is the Connecting Europe Facility (CEF), which provides funding for electric vehicle infrastructure, including battery charging points.

Similarly, countries like Germany, France, and the UK have been providing subsidies and incentives for the purchase of electric buses. In Germany, for example, a federal program known as the Electromobility Funding Program (EmoG) provides grants and subsidies to transport companies for acquiring electric buses, as well as funding for the necessary charging infrastructure.

In the United States, the Biden administration’s American Jobs Plan has committed significant investment to reduce carbon emissions, including funding for the electrification of buses and trucks. The plan includes a $7.5 billion investment in electric vehicle infrastructure, with a large portion dedicated to electric buses. Additionally, the Low or No Emission Vehicle Program, funded by the U.S. Department of Transportation, offers grants to transit agencies to help them transition to zero-emission buses.

These governmental efforts not only aim to reduce emissions but also create a more sustainable and cleaner future for urban transport.

- According to a report by IEA (International Energy Agency), the number of electric buses worldwide increased from 300,000 in 2020 to over 600,000 in 2023. This growth is largely driven by such supportive government policies and regulations, which directly impact the electric bus battery pack market by increasing demand for more efficient, cost-effective batteries.

Restraints

High Initial Cost of Electric Bus Battery Packs

One of the major restraining factors for the widespread adoption of electric buses is the high initial cost of electric bus battery packs. Although the long-term benefits of electric buses—such as reduced fuel costs and lower emissions—are clear, the upfront expense can still be a significant barrier for many public transportation agencies, especially in developing countries or cities with limited budgets.

The cost of a single electric bus can be 2 to 3 times higher than that of a conventional diesel-powered bus. According to the International Council on Clean Transportation (ICCT), the price of electric buses can range from $700,000 to $900,000, depending on the battery size and other specifications. This is compared to the average price of a diesel bus, which ranges between $300,000 and $500,000. The bulk of the cost is often attributed to the battery pack, which accounts for up to 50% of the total cost of an electric bus. This significant cost difference makes it challenging for many municipalities to invest in electric buses, especially when they are already facing tight budgets.

While many governments have introduced incentive programs and subsidies to offset these costs, the reality is that such financial support is often insufficient to cover the entire cost difference between electric and conventional buses. For instance, in the United States, the Low or No Emission Vehicle Program offers grants, but it’s not always enough to fully alleviate the cost burden for bus operators. Many agencies still face the challenge of covering the gap between the purchase price of electric buses and their available budgets. In some cases, cities have been hesitant to adopt electric buses due to the perceived financial risk.

Moreover, battery technology, while advancing, is still relatively expensive. According to a study by BloombergNEF, the cost of lithium-ion batteries has fallen by nearly 90% over the past decade, but prices are still high compared to traditional fuels. In 2023, the average cost of lithium-ion batteries for electric buses was around $100 per kilowatt-hour (kWh). Even though this is a significant decrease from the $1,000 per kWh seen in the early 2010s, it still remains a major cost component that impacts the total cost of electric buses. This can make it difficult for cities to justify the switch to electric buses when balancing budgets with long-term sustainability goals.

Opportunity

Expanding Charging Infrastructure and Technological Advancements

One of the most promising growth opportunities for the electric bus battery pack market lies in the expansion of charging infrastructure and advancements in battery technology. These developments are crucial in addressing the current limitations of electric buses, such as range anxiety and long charging times, thereby accelerating their adoption in urban public transportation systems.

Governments worldwide are recognizing the importance of robust charging networks to support the transition to electric mobility. For instance, in the United States, the Bipartisan Infrastructure Law has allocated $5 billion through the National Electric Vehicle Infrastructure (NEVI) Formula Program to strategically deploy EV charging infrastructure and establish an interconnected national network to facilitate station data collection, access, and reliability . This initiative is expected to significantly enhance the accessibility and convenience of charging facilities for electric buses.

Technological advancements in battery technology are also playing a pivotal role in this growth opportunity. Innovations are leading to longer battery life, faster charging times, and reduced costs, making electric buses more viable for public transit authorities. For example, the development of solid-state batteries and improvements in lithium iron phosphate (LFP) batteries are contributing to enhanced performance and safety, which are critical factors for the widespread adoption of electric buses.

Furthermore, the integration of renewable energy sources with charging infrastructure is gaining momentum. Utilizing solar and wind energy to power charging stations not only reduces the carbon footprint of electric buses but also promotes energy sustainability. This approach aligns with global efforts to combat climate change and supports the transition to greener public transportation systems.

Regional Insights

APAC leads the electric bus battery pack market with a dominant 42.8% share, valued at USD 2 billion in 2024.

In 2024, the Asia‑Pacific (APAC) region emerged as the clear leader of the electric bus battery pack market, accounting for a commanding 42.8% of the global market and generating approximately USD 2 billion in revenue. This dominant position reflects the region’s expansive public transport electrification policies and its robust industrial ecosystem. China, in particular, reinforces this leadership through substantial government backing—such as the “New Energy Vehicle” (NEV) programme—and extensive deployment of electric buses, which comprise a significant majority of global battery pack demand.

This regional dominance is underpinned by an integrated supply chain established battery manufacturers, evolving in‑region production capabilities, and economies of scale inherent to APAC’s vast transport markets. The prevalence of public procurement of electric buses—coupled with expanding infrastructure for charging and maintenance—has solidified APAC’s position. As cities across the region adopt transport decarbonization plans, APAC’s leadership is projected to persist into 2025 and beyond, supported by policy incentives, localized manufacturing, and high fleet electrification rates.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BYD began as a battery producer in 1995 and has since evolved into a global green‑tech powerhouse with deep vertical integration—from raw materials to finished vehicles. Its signature Blade Battery, noted for safety, durability, and range, now features in its electric buses and many partner vehicles. In July 2025, electric bus sales soared 128.5% year‑on‑year, rising from 267 units in July 2024 to 610 units in July 2025, underscoring strong commercial momentum in public transit electrification.

Hefei‑based Gotion High‑Tech operates in lithium‑ion battery manufacturing, including applications for electric buses. In 2023, the company produced approximately 17.1 GWh in EV batteries, equivalent to roughly 2.4% global market share—having grown 23.1% compared to the previous year. Its growing output reflects increasing presence in public transit electrification across China.

Farasis Energy, headquartered in Ganzhou, China, specializes in lithium‑ion battery development with a growing focus on electric vehicles. In 2023, it achieved roughly 16.7 GWh of EV battery output, equating to around 2.3% of global volume—a significant year‑on‑year increase of 123%. Backed by major automotive partners, Farasis continues gaining traction in electric transit applications.

Top Key Players Outlook

- BYD Company Ltd.

- CATL

- China Aviation Battery Co. Ltd. (CALB)

- Farasis Energy (Ganzhou) Co. Ltd.

- Gotion High-Tech Co. Ltd.

- Hitachi

- Leclanché SA

- LG Energy Solution Ltd.

- NFI Group Inc.

- Panasonic Holdings Corporation

Recent Industry Developments

In 2024, BYD produced about 155.7 GWh of electric vehicle batteries and sold 4.30 million vehicles overall—testimony to its scale and influence.

In 2024 Farasis Energy, reported CNY 11,680 million in revenue from battery systems, achieving a gross profit of CNY 1,151 million—a clear sign of improving margins

Report Scope

Report Features Description Market Value (2024) USD 4.9 Bn Forecast Revenue (2034) USD 14.7 Bn CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion (BEV, PHEV), By Battery Chemistry (LFP, NCA, NCM, MNC, Others), By Capacity (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), By Battery Form (Cylindrical, Pouch, Prismatic), By Material Type (Lithium, Cobalt, Manganese, Natural Graphite, Nickel, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BYD Company Ltd., CATL, China Aviation Battery Co. Ltd. (CALB), Farasis Energy (Ganzhou) Co. Ltd., Gotion High-Tech Co. Ltd., Hitachi, Leclanché SA, LG Energy Solution Ltd., NFI Group Inc., Panasonic Holdings Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Bus Battery Pack MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Bus Battery Pack MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Company Ltd.

- CATL

- China Aviation Battery Co. Ltd. (CALB)

- Farasis Energy (Ganzhou) Co. Ltd.

- Gotion High-Tech Co. Ltd.

- Hitachi

- Leclanché SA

- LG Energy Solution Ltd.

- NFI Group Inc.

- Panasonic Holdings Corporation