Global Edtech Market Size, Share, Industry Analysis Report By Deployment Mode (Cloud, On-Premise), By Type (Hardware, Software, Content), By Sector (K-12, Preschool,Higher Education, Other Sectors), By End-User (Business, Consumer), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Feb. 2025

- Report ID: 101919

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report

- Top Market Takeaways

- Quick Market Facts

- Edtech Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- Government Initiatives

- U.S. Edtech Market Size

- By Deployment Mode

- By Type

- By Sector

- By End-User

- Investor Type Impact Matrix

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Challenge Analysis

- Top Emerging Trends

- Growth Factors of edtech

- Customer Impact

- Technological Innovations

- Top Use Cases

- Business Benefits of EdTech

- Key Players Analysis

- Recent Developments

- Report Scope

Report

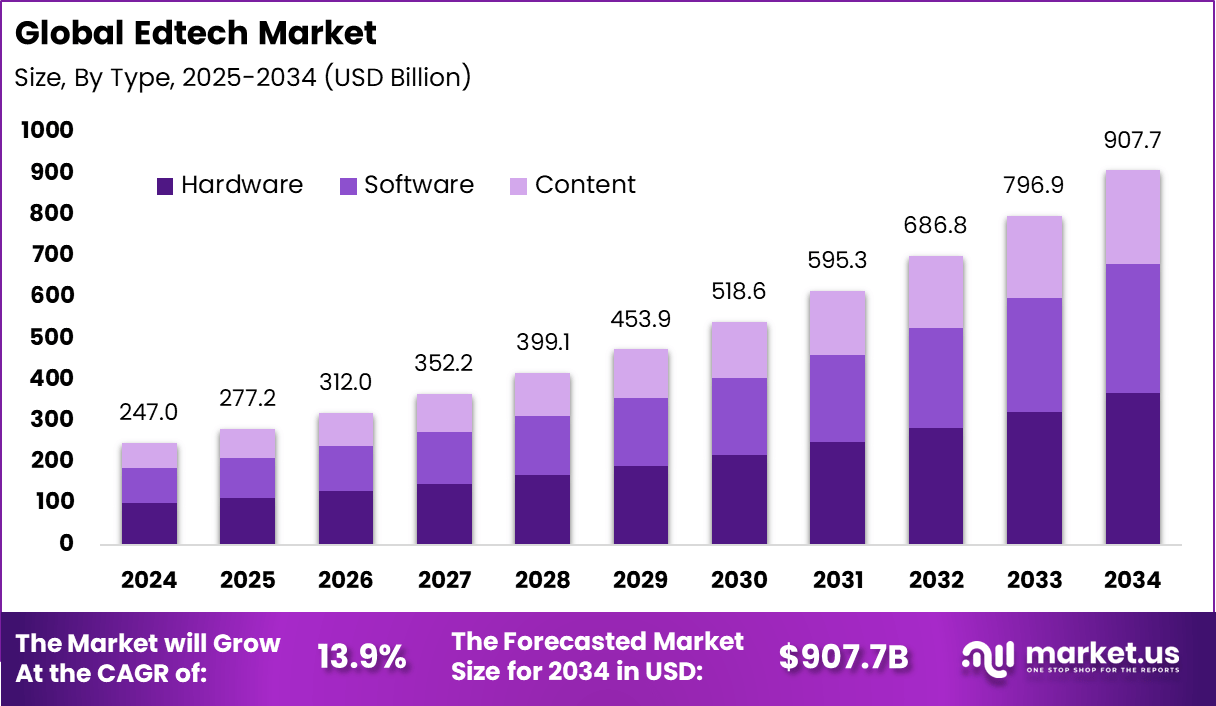

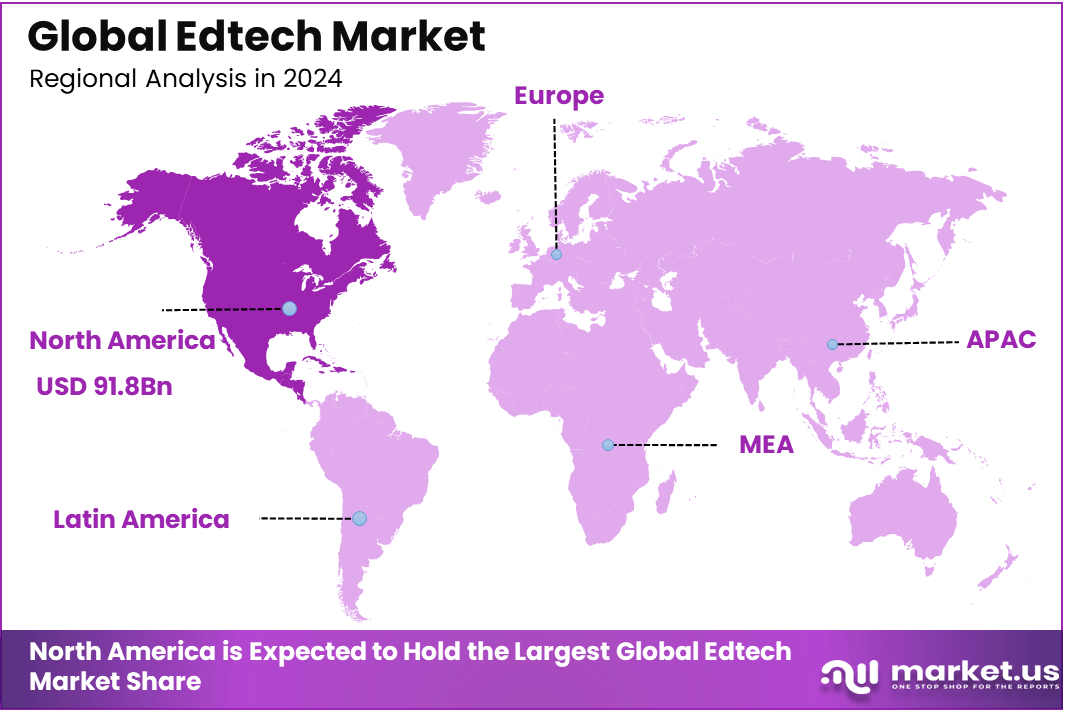

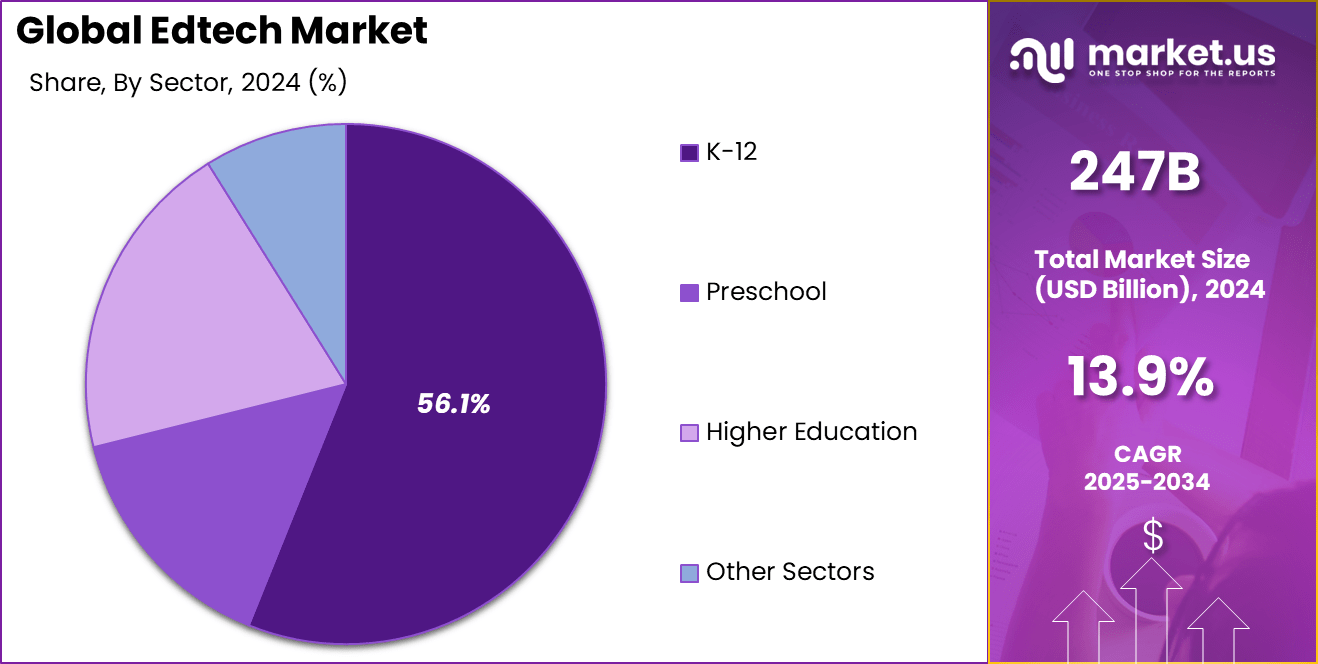

The Global Edtech Market generated USD 247 billion in 2024 and is predicted to register growth from USD 277.2 billion in 2025 to about USD 907.7 billion by 2034, recording a CAGR of 13.9% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37.2% share, holding USD 91.8 Billion revenue.

The EdTech market is expanding as digital transformation reshapes learning across academic institutions and corporate environments. Educational technology platforms now support virtual classrooms, content management, collaboration tools, and analytics driven performance tracking. The integration of hardware, software, and connectivity solutions has created a structured digital learning ecosystem. Institutions are increasingly aligning technology investments with long term academic and workforce development goals.

Rapid advancement in cloud computing, artificial intelligence, and mobile connectivity has strengthened the adoption of EdTech solutions. Hybrid learning models remain embedded within educational frameworks, reinforcing sustained demand for digital infrastructure. Organizations across sectors are prioritizing scalable systems that improve accessibility, engagement, and measurable outcomes. As digital literacy becomes fundamental to economic growth, EdTech continues to gain strategic importance.

According to data reported by the World Economic Forum, the next decade is expected to witness the graduation of approximately 800 million K-12 students and 350 million post-secondary students globally. At the same time, global expenditure on education is forecasted to reach an estimated USD 10 trillion by 2030, reflecting the rising importance of education in supporting economic development and societal advancement.

Based on the research findings from PIE News, the Indian edtech sector has demonstrated resilience despite a funding crunch in 2024. In the first nine months of the year, the sector managed to raise $278 million, marking a modest 3% increase from the $269 million raised during the same period in 2023. This slight growth reflects the sector’s ability to attract investment, even in a challenging economic environment.

According to data analysis conducted by Inc42, PhysicsWallah, a leading edtech unicorn, has emerged as the dominant player in the sector. The Noida-based platform alone accounted for $210 million of the total funding in the first three quarters of 2024. This significant contribution highlights PhysicsWallah’s strong market position and its ability to secure investor confidence amid a broader funding slowdown.

Top Market Takeaways

- By deployment mode, on-premise solutions dominate with 70.3%, reflecting institutions’ preference for control and data security.

- By type, hardware accounts for 40.5%, driven by demand for smart devices, interactive panels, and connected classroom tools.

- By sector, K-12 leads with 56.1%, highlighting early adoption of digital learning platforms in schools.

- By end-user, businesses represent 67.8%, showcasing corporate investment in training and upskilling through digital learning tools.

- North America holds 37.2%, supported by mature EdTech ecosystems and strong institutional adoption.

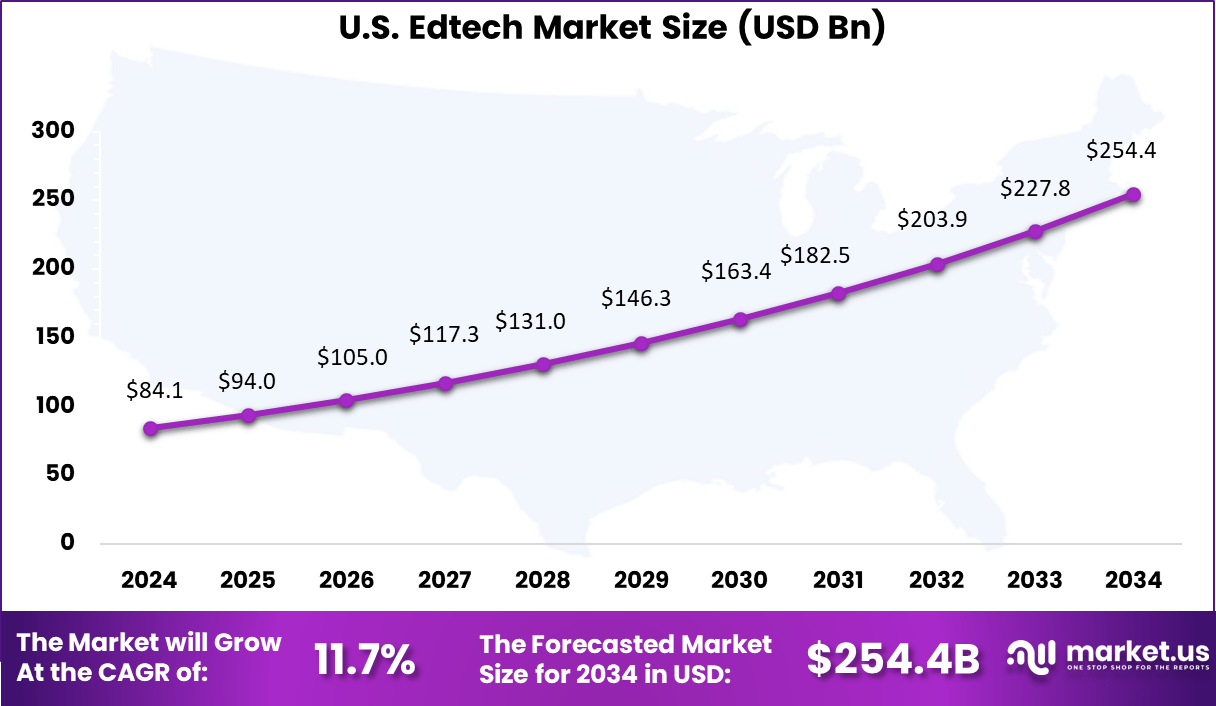

- The US market reached USD 84.14 billion and is expanding at a steady CAGR of 11.7%, underscoring sustained investment in digital education infrastructure.

Quick Market Facts

- Cloud deployment is gradually increasing from 28.1% in 2019 to 29.4% in 2024.

- On-Premise deployment is slowly declining from 71.9% to 70.6% in the same period.

- Overall, On-Premise remains dominant, but Cloud adoption is steadily growing.

- Hardware is gradually declining from 41.5% in 2019 to 40.5% in 2024.

- Software shows steady growth, increasing from 27.9% to 29.0%.

- Content remains almost stable, around 30.6% across the years.

- K-12 steadily increases from 54.2% in 2019 to 56.1% in 2024, remaining the largest sector.

- Preschool stays almost stable, moving slightly from 11.3% to 11.4%.

- Higher Education shows a gradual decline from 20.0% to 19.2%.

- Other Sectors also decline steadily from 14.5% to 13.3%.

- Business end-users show a gradual decline from 68.6% in 2019 to 67.8% in 2024.

- Consumer end-users steadily increase from 31.4% to 32.2% during the same period.

- Overall, business remains dominant, but consumer share is slowly rising.

- North America share is declining from 39.9% in 2019 to 37.2% in 2024.

- Europe is also showing a slow decline from 30.2% to 29.4%.

- Asia-Pacific is growing steadily, rising from 20.9% to 24.2%.

- Latin America remains stable around 6%.

- Middle East & Africa shows slight growth from 3.0% to 3.2%.

Edtech Statistics

- United States: Students engaging with devices for over 60 minutes per week demonstrate superior academic outcomes, highlighting the effective integration of technology in education.

- Skillademia’s Research: eLearning through EdTech platforms enhances information retention rates by 25% to 40%, underscoring the efficiency of digital learning tools. Additionally, 84% of learners report increased engagement with gamified EdTech solutions, suggesting the effectiveness of interactive learning formats.

- Human Resources Perspective: A significant 61% of HR leaders view online credentials as equivalent to those obtained through traditional, in-person educational programs, validating the credibility of online education in professional settings.

- Market Growth Projection: The EdTech sector is anticipated to expand at a compounded annual growth rate (CAGR) of 15% in the coming years, reflecting robust sectoral momentum.

- Corporate EdTech Market: Currently valued at $27.5 billion, this segment of the EdTech industry caters predominantly to business and corporate clients, indicating a substantial market for professional and continuous education.

- Higher Education Trends: Over 70% of colleges are planning to introduce new online undergraduate programs within the next three years, which points to a growing shift towards online higher education offerings.

According to exploding topics, Corporate EdTech is a rapidly growing industry, currently valued at $27.5 billion. The sector’s expansion is reflected in the fact that over 70% of colleges plan to launch one or more online undergraduate programs within the next three years. Additionally, digital learning has become the most popular strategy for corporate skill-building, indicating a strong demand for EdTech solutions.

Indian EdTech giant Byju’s raised $800 million in its latest funding round, highlighting the significant investment in the sector. In the U.S., BetterUp stands as the most valuable EdTech unicorn, offering professional learning and development solutions. The growth of these companies underscores the increasing reliance on technology in education.

However, the learning curve associated with EdTech has posed challenges. During the pandemic, 71% of teachers reported spending more time troubleshooting technology, leading to less time for student instruction. Despite these challenges, 87% of K-12 educators noted an improvement in their tech skills, though around 60% still feel there is inadequate training for EdTech.

Drivers Impact Analysis

Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Expansion of Digital Learning Platforms in K 12 and Higher Education +3.1% North America, Asia Pacific Medium to Long Term Corporate Upskilling and Workforce Reskilling Demand +2.6% North America, Europe Short to Medium Term Rising Adoption of AI Based Personalized Learning Tools +2.1% Global Medium Term Growth in Mobile Learning and Affordable Internet Access +1.7% Asia Pacific, Latin America Immediate to Medium Term Government Initiatives Supporting Digital Education +1.2% Asia Pacific, Europe Long Term Restraint Impact Analysis

Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Digital Divide and Infrastructure Gaps -2.4% Emerging Markets Medium Term Data Privacy and Student Information Regulations -1.8% Europe, North America Medium Term High Content Development and Platform Costs -1.3% Global Short Term Resistance to Technology Adoption in Traditional Institutions -0.9% Europe, Asia Pacific Medium Term Platform Saturation and Intense Competition -0.6% North America Ongoing Government Initiatives

The U.S. Department of Education has recently allocated a substantial ~$277 million in new grant funding through the Education Innovation and Research (EIR) program, aimed at enhancing educational equity and innovation. This allocation underscores a strategic approach towards accelerating academic recovery following the significant disruptions caused by the COVID-19 pandemic.

Analysis of state-administered test scores from the academic years 2021-2022 and 2022-2023 reveals modest improvements in student performance in math and reading. However, these gains have not universally returned to pre-pandemic levels, highlighting a partial and uneven recovery across different student demographics.

This funding is strategically distributed among various critical areas: $90.3 million is dedicated to STEM (Science, Technology, Engineering, and Math) education, reflecting an emphasis on key skills that are crucial for future competitiveness and innovation. A further $87.2 million is aimed at enhancing social emotional well-being, including aspects of student engagement, an area that is vital for holistic educational outcomes.

Additionally, $76.5 million is allocated specifically for educational projects in rural areas, addressing the unique challenges faced by these communities. The distribution of these funds represents a targeted effort to bridge the gap for those students who have been most significantly affected by the pandemic and who are traditionally exposed to systemic inequalities in education.

India is emerging as the world’s second-largest online education market, trailing only the USA. This growth is largely supported by substantial government investments, as evidenced by the INR 73,498 Cr allocation for the Department of School Education and Literacy in the Interim Budget of 2024-25. This significant budget underscores the government’s commitment to enhancing educational infrastructure and access, positioning India as a global leader in the online education sector.

In addition to general education funding, the Interim Budget of 2024-25 has also earmarked INR 255 Cr for the establishment of three Artificial Intelligence Centres of Excellence (CoE). This investment is expected to catalyze innovation and technological advancements in the education sector, further solidifying India’s position in the global online education market.

U.S. Edtech Market Size

The U.S. Edtech market is a major contributor within North America, valued at over USD 84 billion with a strong growth pace of 11.7% CAGR. The country’s leadership is built on a robust K-12 sector and widespread adoption of Edtech in corporate training programs. Federal and state-level initiatives promote digital learning infrastructure, supporting broad use of AI-enhanced tools and content management systems.

In the U.S., investments focus on improving educational outcomes through personalized, technology-enabled instruction combined with data analytics. Emphasis on flexible, accessible learning options aligns with rising demand for lifelong learning and workforce development, further bolstering the market’s expansion.

In 2024, North America holds a commanding 37.2% stake in the global Edtech market, driven by high internet penetration, advanced infrastructure, and significant investments in digital learning. The region is marked by widespread adoption of on-premise solutions due to strict data privacy concerns and a preference for customized educational technologies.

Edtech Market by Regional Analysis (%), 2020-2024

Region 2019 2020 2021 2022 2023 2024 North America 39.9% 39.3% 38.8% 38.2% 37.3% 37.2% Europe 30.2% 30.1% 29.9% 29.8% 29.6% 29.4% Asia-Pacific 20.9% 21.6% 22.3% 22.9% 24.1% 24.2% Latin America 5.9% 5.9% 5.9% 6.0% 5.9% 6.0% Middle East & Africa 3.0% 3.0% 3.1% 3.2% 3.1% 3.2% The region also benefits from a mature market for innovative educational tools, including AI-powered learning platforms and immersive technologies. Educational institutions and businesses alike are key demand drivers, fueling sustained growth in digital education ecosystems.

By Deployment Mode

On premise solutions accounted for 70.3% of adoption in the EdTech market. Educational institutions often prioritize direct control over academic records, examination data, and internal communication systems. Internal deployment allows institutions to implement customized security protocols aligned with regulatory requirements. This preference reflects long term focus on data governance and operational stability.

Institutions also value compatibility with existing campus infrastructure and administrative platforms. Many schools and universities operate established IT ecosystems that require seamless integration with learning management systems. On premise deployment reduces reliance on third party hosting providers. This approach strengthens operational independence and system oversight.

Customization flexibility further supports internal hosting decisions. Institutions can tailor system configurations according to curriculum structure and assessment standards. Direct infrastructure management enables faster adjustments when academic policies change. These factors continue to sustain demand for on premise solutions.

Edtech Market Share By Deployment Mode (%), 2019-2024

Deployment Mode 2019 2020 2021 2022 2023 2024 Cloud 28.1% 28.4% 28.6% 28.9% 29.2% 29.4% On-Premise 71.9% 71.6% 71.4% 71.1% 70.8% 70.6% By Type

Hardware represented 40.5% of market participation, reflecting continued investment in physical digital infrastructure. Smart boards, tablets, and connected classroom tools are widely adopted to enhance interactive learning. These devices support multimedia instruction and collaborative classroom engagement. Institutions treat hardware as a core enabler of digital education delivery.

Interactive devices improve visual comprehension and real time student participation. Teachers integrate videos, simulations, and assessments directly into classroom sessions. This enhances learning retention and supports diverse instructional methods. Hardware therefore strengthens classroom engagement outcomes.

Device connectivity also enables hybrid learning environments. Students access educational resources both within school premises and remotely. Institutions invest in reliable infrastructure to maintain uninterrupted access. Hardware adoption remains central to modern learning ecosystems.

Edtech Market Share By Type (%), 2019-2024

Type 2019 2020 2021 2022 2023 2024 Hardware 41.5% 41.3% 41.1% 40.9% 40.7% 40.5% Software 27.9% 28.1% 28.3% 28.5% 28.8% 29.0% Content 30.6% 30.6% 30.6% 30.6% 30.6% 30.5% By Sector

K 12 education led with 56.1% share, indicating strong early stage adoption of digital platforms. Schools increasingly integrate structured learning systems to improve foundational education. Digital tools support lesson planning, performance tracking, and standardized assessment preparation. Early integration enhances digital literacy among students.

Teachers utilize online resources to supplement classroom instruction. Analytical dashboards help identify learning gaps and track student progress. This structured monitoring supports timely academic intervention. Schools therefore remain key contributors to market expansion.

Edtech Market Share By Sector (%), 2019-2024

Sector 2019 2020 2021 2022 2023 2024 K-12 54.2% 54.6% 55.0% 55.4% 55.9% 56.1% Preschool 11.3% 11.3% 11.3% 11.3% 11.3% 11.4% Higher Education 20.0% 19.8% 19.6% 19.5% 19.2% 19.2% Other Sectors 14.5% 14.3% 14.1% 13.8% 13.6% 13.3% Parental communication also improves through digital platforms. Academic updates and attendance information are shared efficiently. Transparent communication strengthens coordination between families and institutions. These operational benefits reinforce adoption in the K 12 segment.

By End-User

Businesses accounted for 67.8% of market demand, reflecting strong corporate investment in employee development. Organizations increasingly adopt digital learning systems for training and compliance programs. Online modules provide consistent instruction across geographically distributed teams. This supports workforce productivity and skill alignment.

Corporate upskilling initiatives focus on technical competencies and leadership development. Learning management systems track employee participation and certification completion. Automated evaluation tools measure knowledge retention effectively. Digital platforms therefore enhance training accountability.

Cost efficiency further supports corporate adoption. Digital programs reduce travel and classroom infrastructure expenses. Training content can be updated centrally and deployed instantly. Businesses continue integrating digital learning into strategic workforce planning.

Edtech Market Share By End-User (%), 2019-2024

End-User 2019 2020 2021 2022 2023 2024 Business 68.6% 68.5% 68.3% 68.1% 67.9% 67.8% Consumer 31.4% 31.5% 31.7% 31.9% 32.1% 32.2% Investor Type Impact Matrix

Investor Type Impact on CAGR Forecast (~%) Geographic Relevance Investment Horizon Education Technology Corporations +2.9% Global Long Term Venture Capital in Learning Platforms +2.3% North America, Asia Pacific Medium Term Private Equity in Digital Education Infrastructure +1.6% Europe, North America Medium to Long Term Corporate Strategic Investors +1.2% Global Medium Term Public Sector Funding Bodies +0.8% Asia Pacific, Europe Long Term Key Market Segments

Deployment Mode

- Cloud

- On-Premise

Type

- Hardware

- Software

- Content

Sector

- K-12

- Preschool

- Higher Education

- Other Sectors

End-User

- Business

- Consumer

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand for Personalized Learning

A major growth driver is the increasing demand for tailored educational experiences. Learners and instructors seek platforms that adapt content according to skill levels, preferences, and performance. Adaptive learning algorithms and analytics help customize instruction and practice, improving engagement and learning outcomes. This personalization supports diverse learning populations and encourages continuous skill development.

Another driver is the expansion of remote and blended learning models. Organizations require flexible frameworks to deliver education beyond physical classrooms. Digital platforms enable consistent learning access regardless of location, improving inclusivity for students and working professionals seeking to upskill or reskill.

Restraint Analysis

Infrastructure Inequality and Access Barriers

One restraint arises from unequal access to digital infrastructure. Reliable internet connectivity and modern devices remain unavailable for some learners, particularly in underserved regions. Without adequate infrastructure, adoption of advanced learning technologies is limited, which can widen educational divides rather than close them.

In addition, digital literacy barriers impact effective use of EdTech tools. Participants must understand how to navigate platforms and interpret learning analytics. Teachers and learners with limited technology experience may find adoption difficult, reducing the potential benefits of digital instruction.

Opportunity Analysis: Integration of AI and Immersive Technologies

Significant opportunity exists in embedding artificial intelligence into EdTech platforms to support automated feedback, intelligent tutoring, and adaptive content sequencing. AI-enhanced systems can identify knowledge gaps and recommend targeted practice, improving learning efficiency and mastery rates.

Another opportunity lies in immersive technologies such as virtual reality and augmented reality that simulate interactive environments for experiential learning. These formats support deeper conceptual understanding and engagement, especially in areas requiring practical skills and visualization of complex phenomena.

Challenge Analysis

Data Privacy and Ethical Use

A prominent challenge involves protecting learner data privacy. EdTech platforms collect sensitive personal and performance information. Ensuring that data is handled responsibly, securely, and in compliance with regulatory standards requires robust governance frameworks. Failure to do so can undermine trust in digital learning ecosystems.

Another challenge comes from content quality and alignment with pedagogical standards. Digital offerings must maintain academic rigor and relevance to ensure learning objectives are met. Poorly designed content or misaligned assessments can lead to ineffective instruction and diminished outcomes.

Top Emerging Trends

One emerging trend is analytics-driven learning optimization. Platforms leverage engagement and performance data to provide instructors with insights that support course refinement and personalized guidance. This trend enhances instructional effectiveness by identifying patterns that improve learner trajectories.

Another trend is the growth of micro-credentialing and modular learning pathways. Learners increasingly seek short, focused credentials that demonstrate specific competencies. Digital platforms facilitate these modular structures, making skills validation more flexible and aligned with workforce demands.

Growth Factors of edtech

The growth of edtech is being driven by factors such as widespread internet access, increasing smartphone penetration, and the demand for personalized learning solutions. In India specifically, over 900 million active internet users in 2025 have significantly boosted the online education market. Nearly 90% of these users access the internet daily, often using it for learning purposes alongside entertainment and communication.

This digital connectivity enables a broad user base for edtech platforms, facilitating rapid adoption and innovation in the sector. Moreover, government support plays a major role in the expansion of edtech. Significant funding is being allocated to improve digital infrastructure, smart classrooms, and online learning platforms.

Governments are also promoting AI and skill development programs to prepare students and professionals for evolving industry needs. In India, initiatives like the National Educational Alliance for Technology make adaptive learning solutions accessible to economically disadvantaged students, while investments in AI Centers of Excellence foster innovation and a skilled AI workforce.

Customer Impact

Learners benefit from increased flexibility and accessibility. Digital platforms allow self-paced study and on-demand resources that support varied schedules and life commitments. This convenience expands education beyond traditional institutional constraints.

For educators and institutions, EdTech enables data-informed instruction and resource allocation. Insights derived from learner interaction patterns guide curriculum adjustments and identify areas where additional support may be needed. This responsiveness improves teaching quality and learner satisfaction.

Technological Innovations

- AI for Creator Productivity: AI tools are increasingly used to augment content creation, helping educators and creators draft lesson plans and manage communications more efficiently.

- Immersive Learning Technologies: Virtual Reality (VR) and Augmented Reality (AR) are transforming traditional learning environments by providing immersive educational experiences that enhance student engagement and understanding.

- Hybrid Learning Models: Combining online and offline education, hybrid learning supports flexibility in learning styles and enhances students’ management and organization skills.

- Quantum Computing in Education: This emerging technology is being explored for its potential to analyze vast amounts of educational data, providing new insights into student performance and learning gaps.

- Personalized Learning: Advanced algorithms and data analytics are enabling more tailored educational experiences that adapt to the individual needs of students, improving outcomes.

Top Use Cases

- Artificial Intelligence for Content Creation: AI is increasingly being used to enhance productivity for content creators in the educational sector. It assists in tasks such as generating lesson plans and drafting communications to students, thereby freeing up time for educators to focus on more personalized student interactions.

- Gamification and Immersive Learning: The integration of game elements and immersive technologies such as VR (Virtual Reality) and AR (Augmented Reality) in learning environments is transforming education. These tools make learning more engaging by adding elements of competition and interactive experiences that mirror real-life scenarios.

- Mobile Learning and Microlearning: With the ubiquitous nature of mobile devices, learning has become more accessible. Mobile learning allows students to access educational materials from anywhere, while microlearning breaks down content into small, manageable segments, making it easier for learners to absorb and retain information.

- Data Analytics and Learning Analytics: Utilizing data to tailor educational experiences and improve outcomes is a growing trend. Data analytics in education can help in personalizing instruction and measuring student engagement and performance, providing insights that help educators enhance learning processes.

- Chatbots for Personalized Learning: AI-powered chatbots are being used to provide personalized tutoring and support, helping students with everything from homework assistance to administrative tasks. These chatbots improve engagement and learning outcomes by offering tailored help and maintaining communication with students.

Business Benefits of EdTech

- Cost Reduction: By digitizing and automating administrative tasks, EdTech platforms reduce operational costs and make educational resources more affordable.

- Increased Engagement and Retention: Technologies like AI and VR improve engagement through interactive and personalized learning experiences, which can lead to higher course completion rates and better knowledge retention.

- Scalability: Online platforms enable educational institutions and businesses to scale their offerings globally without significant increases in costs.

- Accessibility: EdTech makes education more accessible to people worldwide, including those in remote or underserved regions.

- Data-Driven Insights: The use of analytics in EdTech allows educators to track progress and tailor instruction to meet the needs of each student, thereby optimizing learning outcomes.

Key Players Analysis

The EdTech market is shaped by dynamic and innovative companies, with Coursera Inc., BYJU’S, and Chegg Inc. at the forefront.

Coursera Inc. has distinguished itself as a leader by providing a broad spectrum of online courses, professional certificates, and degree programs in partnership with top universities and companies worldwide. The platform is known for its extensive course offerings that cater to a diverse range of professional and educational needs, helping individuals enhance their skills and careers in a flexible learning environment.

BYJU’S is another dominant player, originating from India and rapidly expanding globally. It specializes in offering highly engaging and personalized learning programs for K-12 students. BYJU’S has made significant headlines with its innovative use of animation for teaching complex subjects and its aggressive expansion strategy through acquisitions of various educational platforms, broadening its international presence.

Chegg Inc. focuses on providing digital and physical textbook rentals, online tutoring, and other student services. It has become essential to college students in the United States and beyond, by offering solutions to academic challenges and helping students save on textbook costs. Chegg’s services are designed to assist students in navigating their educational journeys more effectively, making it a key resource in the academic success of millions.

Top Market Leaders

- Coursera Inc.

- BYJU’S

- Chegg Inc.

- 2U Inc.

- Amazon Inc.

- Blackboard Inc.

- Edutech

- Alphabet Inc. (Google LLC)

- edX Inc.

- Instructure, Inc.

- Udacity, Inc.

- upGrad Education Private Limited

- Other Key Players.

Recent Developments

- In March 2025, CleverTap partnered with upGrad to add a deep-learning module to upGrad’s Digital Marketing and Product Management courses. These courses are run with Duke CE and MICA. The goal is to help students learn more about customer retention, AI-based marketing, and engagement through practical learning and academic content.

- In March 2025, the Delhi government signed an MoU with the BIG Institute, which includes the National Skill Development Corporation International and ed-tech company Physics Wallah. This program will provide free online coaching to over 1.63 lakh government school students for NEET and CUET exams.

- In March 2025, Microsoft Education and Adobe teamed up to bring Adobe Creative Cloud apps into Microsoft Teams for Education. This move is meant to give teachers and students better tools to create and learn inside the digital classroom.

- In January 2025, Banco Santander joined with Coursera to offer 10,000 scholarships. These scholarships provide one-year access to more than 13,000 courses in 13 countries. Learners can also earn certificates from companies like IBM, Microsoft, Google, and AWS. The goal is to help people build skills in areas like data science, cybersecurity, and marketing.

- In May 2025, the European Commission approved Google’s plan to buy Duolingo for USD 1.1 billion. The deal was allowed after regulatory review and is expected to help Google grow its education-related services.

Report Scope

Report Features Description Market Value (2024) USD 247.7 Bn Forecast Revenue (2034) USD 907.7 Bn CAGR(2025-2034) 13.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud, On-Premise), By Type (Hardware, Software, Content), By Sector (K-12, Preschool,Higher Education, Other Sectors), By End-User (Business, Consumer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Coursera Inc., BYJU’S, Chegg, Inc., Blackboard Inc., Edutech, Google LLC, edX Inc., Instructure, Inc., Udacity, Inc., upGrad Education Private Limited, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Coursera Inc.

- BYJU'S

- Chegg Inc.

- 2U Inc.

- Amazon Inc.

- Blackboard Inc.

- Edutech

- Google LLC

- edX Inc.

- Instructure, Inc.

- Udacity, Inc.

- upGrad Education Private Limited

- Other Key Players.