Global Edible Packaging Market By Material Type (Lipids, Polysaccharides, Proteins, Composite Films), By Form (Films and Coatings, Boxes and Containers), By Technology (Antimicrobial Packaging, Controlled Release Packaging), By End-Use Applications (Food and Beverages, Pharmaceutical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 34720

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

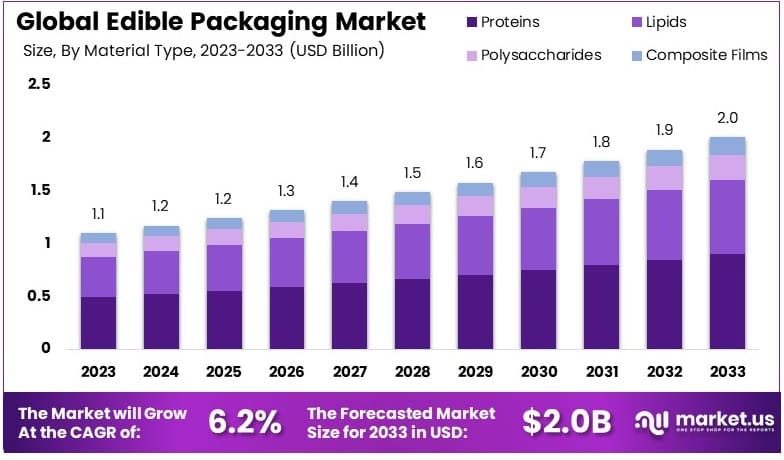

The Global Edible Packaging Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.1 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Edible packaging is a sustainable alternative to traditional packaging, made from natural ingredients like seaweed, starch, and proteins. This packaging can be safely consumed or naturally decompose, reducing waste. Used mainly for food items, it aims to provide a greener solution for single-use packaging needs, aligning with eco-friendly trends.

The edible packaging market focuses on producing and distributing packaging materials that are safe to eat or biodegrade easily. Driven by demand for sustainable options, this market offers products for food and beverage industries. Leading players invest in research to create innovative, edible packaging that meets industry standards and environmental regulations.

Seaweed-based packaging is a prominent example, using seaweed’s polysaccharide content, which ranges from 4% to 76% of its dry weight, to create biodegradable films. This material provides durability and decomposes naturally, meeting the need for eco-friendly alternatives in the packaging industry, especially for single-use items.

Government regulations strongly influence this market. The European Union banned various single-use plastics like plates and straws in July 2021, pushing demand for biodegradable plastic options. Similarly, India’s 2022 ban on certain single-use plastics promotes alternatives such as edible packaging, boosting growth in environmentally responsible packaging solutions.

Private investment also supports market expansion. Nestlé committed USD 2.1 billion toward sustainable packaging innovations, underlining the industry’s shift toward reducing environmental impact. Investments like these reinforce the development of edible packaging, encouraging adoption by major food companies and retail brands.

The packaging sector, responsible for about one-third of global plastic use, faces pressure to adopt greener practices. The European Union set ambitious recycling targets, aiming for 55-80% recycling of packaging waste. Most EU countries achieved the 55% goal by 2021, reflecting progress and regulatory momentum toward sustainable packaging practices.

Key Takeaways

- The Edible Packaging Market was valued at USD 1.1 Billion in 2023 and is expected to reach USD 2.0 Billion by 2033, with a CAGR of 6.2%.

- In 2023, Protein dominates the material segment with 44.7%, driven by its biodegradable properties.

- In 2023, Films & Coatings lead the packaging type with 62.3%, favored for food protection.

- In 2023, Antimicrobial Packaging is the dominant technology, highlighting increased food safety requirements.

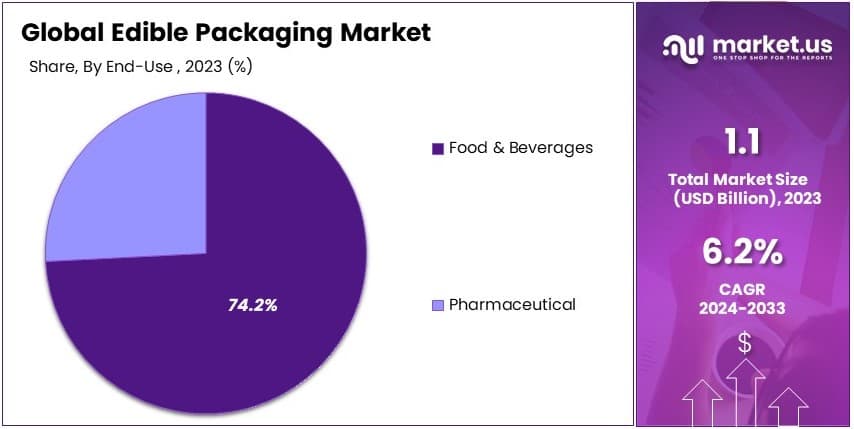

- In 2023, Food & Beverage holds 74.2% of the end-use segment, reflecting its primary application area.

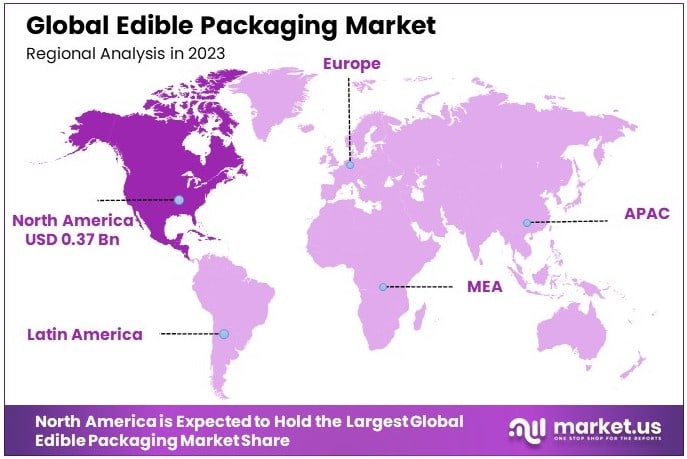

- In 2023, North America dominates with 33.6% of the market, supported by innovations in sustainable packaging.

Type Analysis

Protein dominates with 44.7% due to its effective biodegradability and nutritional benefits.

The edible packaging market is segmented by various material types, among which protein-based materials have emerged as the predominant segment, capturing 44.7% of the market. This dominance can be attributed to the sustainable properties of proteins, which offer both biodegradability and nutritional enhancements to food packaging.

These materials are primarily sourced from animals and plants and are favored for their ability to form strong, edible films and coatings that effectively extend the shelf life of food products.

Lipids, another key material type, contribute to the market by providing water-resistant properties to packaging, which is crucial in maintaining the quality and freshness of food products. Despite their lower market share, lipid-based edible packaging is critical for products that are sensitive to moisture.

Polysaccharides are employed for their versatility and natural abundance, making them essential for creating cost-effective packaging solutions that are also environmentally friendly. Their role in the market is vital as they cater to the increasing demand for sustainable packaging options.

Composite Films combine the properties of proteins, polysaccharides, and lipids, enhancing the mechanical and barrier properties of packaging. Although they constitute a smaller portion of the market, their importance lies in their ability to address the diverse needs of packaging applications through customization.

Form Analysis

Films & Coatings dominate with 62.3% due to their versatility in application and ease of integration into existing packaging lines.

In the edible packaging market, Films & Coatings are the leading form, accounting for 62.3% of the market share. This segment’s dominance is driven by the ease with which these forms can be integrated into existing packaging systems without significant modifications.

Films and coatings are applied directly to food products or as inner layers in multi-layered packaging, offering a practical solution for enhancing the shelf life and flavor of food while reducing waste.

Boxes & Containers play a supportive role in the market, offering rigid packaging solutions that are particularly useful for handling and transporting bulk food items. Although less prevalent than films and coatings, these forms are crucial for specific applications where robust packaging is required.

Technology Analysis

Antimicrobial Packaging is the key technology driving innovation and effectiveness in edible packaging.

Antimicrobial Packaging technology stands out in the edible packaging market for its ability to significantly extend the shelf life of food products by actively preventing the growth of pathogens and spoilage organisms.

This technology incorporates substances that are safe for consumption and effective in maintaining the sensory and nutritional quality of food, thereby gaining a significant position in the market.

Controlled Release Packaging is utilized to maintain the quality and extend the shelf life of packaged foods by regulating the environment inside the packaging. This technology is particularly important for products that are sensitive to changes in pH, moisture, or exposure to oxygen.

End-Use Applications Analysis

Food & Beverages lead with 74.2% due to the high demand for sustainable and innovative packaging solutions in this sector.

The Food & Beverages segment is the largest in the edible packaging market, commanding a 74.2% share. The dominance of this segment is primarily driven by the growing consumer demand for eco-friendly and health-conscious packaging solutions. Edible packaging in this sector not only helps reduce plastic waste but also adds functional value by potentially enriching the food with additional nutrients or flavors.

Pharmaceuticals utilize edible packaging to enhance the delivery and efficacy of pharmaceutical products. While this segment holds a smaller share compared to Food & Beverages, its importance is growing with the advancement of edible films and coatings that can deliver drugs in a controlled manner, improving patient compliance and effectiveness of drug delivery systems.

Key Market Segments

By Material Type

- Lipids

- Polysaccharides

- Proteins

- Composite Films

By Form

- Films & Coatings

- Boxes & Containers

By Technology

- Antimicrobial Packaging

- Controlled Release Packaging

By End-Use Applications

- Food & Beverages

- Pharmaceutical

Drivers

Rising Environmental Concerns Drives Market Growth

The growing awareness of environmental issues significantly drives the Edible Packaging Market. As consumers become more conscious of plastic pollution and its impact on the planet, the demand for sustainable alternatives like edible packaging rises.

Additionally, businesses are under increasing pressure to adopt sustainable packaging practices to meet regulatory standards and consumer expectations. This shift towards sustainability not only helps in reducing the carbon footprint but also enhances brand image and loyalty.

Furthermore, the depletion of traditional packaging materials compels manufacturers to explore innovative solutions, thereby fueling the growth of edible packaging. Consequently, the combination of environmental consciousness, regulatory support, and the need for sustainable alternatives creates a robust foundation for the expansion of the edible packaging industry.

Restraints

High Production Costs Restraints Market Growth

Despite its potential, the Edible Packaging Market faces significant restraints, primarily due to high production costs. Manufacturing edible packaging involves specialized materials and processes that are often more expensive than conventional packaging solutions.

This cost barrier can limit the adoption of edible packaging, especially among small and medium-sized enterprises that operate on tighter budgets. Moreover, the investment required for research and development to improve the scalability and efficiency of production further adds to the financial burden.

Additionally, the limited availability of raw materials for edible packaging can drive up costs, making it less competitive in the market. These financial challenges hinder the widespread acceptance and implementation of edible packaging, thereby restraining the overall market growth.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets present substantial growth opportunities for the Edible Packaging Market. As these regions experience economic growth and increased consumer spending, there is a rising demand for innovative and sustainable packaging solutions.

Additionally, the expansion of the food and beverage industry in emerging economies creates a favorable environment for the adoption of edible packaging. Collaborations with local food manufacturers and distributors can further enhance market penetration and acceptance.

Furthermore, government initiatives aimed at promoting sustainability and reducing plastic waste in these regions provide additional incentives for businesses to invest in edible packaging technologies. Consequently, the rapid development and urbanization in emerging markets offer a significant avenue for the expansion and success of the edible packaging industry.

Challenges

Supply Chain Complexities Challenges Market Growth

The Edible Packaging Market encounters several challenges, with supply chain complexities being a major obstacle. Managing the sourcing and transportation of specialized edible materials requires a well-coordinated and efficient supply chain, which can be difficult to establish and maintain.

Additionally, the perishable nature of edible packaging necessitates stringent storage and handling protocols to prevent spoilage and ensure quality. These logistical challenges increase operational costs and can lead to delays in production and distribution.

Moreover, the lack of standardized processes and infrastructure for edible packaging further complicates supply chain management. As a result, these complexities pose significant hurdles to the scalability and widespread adoption of edible packaging solutions, thereby challenging the overall growth of the market.

Growth Factors

Technological Innovations in Edible Materials Are Growth Factors

Technological innovations in edible materials are pivotal growth factors for the Edible Packaging Market. Advances in biotechnology and material science have led to the development of new edible polymers and bioplastics that are more durable, versatile, and cost-effective.

These innovations enable the creation of packaging that can better preserve food products while being fully biodegradable and safe for consumption. Furthermore, improvements in manufacturing techniques have increased the scalability and efficiency of producing edible packaging, making it more accessible to a broader range of industries.

The continuous investment in research and development fosters the creation of innovative solutions that meet the evolving needs of consumers and businesses alike. As a result, technological advancements play a crucial role in driving the expansion and adoption of edible packaging across various sectors.

Emerging Trends

Integration of Smart Packaging Technologies Is Latest Trending Factor

Smart packaging technologies are the latest trending factors driving the Edible Packaging Market forward. The integration of features such as sensors, QR codes, and interactive elements into edible packaging enhances functionality and consumer engagement.

These advancements allow for real-time tracking of product freshness, improved supply chain transparency, and personalized consumer experiences. Additionally, smart edible packaging can provide valuable data insights for manufacturers, enabling better inventory management and quality control.

The trend towards incorporating technology into packaging not only adds value to the end product but also differentiates brands in a competitive market. Consequently, the adoption of smart packaging technologies represents a significant trend that propels the growth and innovation within the edible packaging industry.

Regional Analysis

North America Dominates with 33.6% Market Share

North America leads the Edible Packaging Market with a 33.6% share, amounting to USD 0.37 billion. This dominance is driven by strong demand for sustainable packaging solutions, high awareness of environmental issues, and strict regulations on plastic usage. The U.S. is the largest contributor, with Canada showing growing adoption.

The region benefits from a well-developed food and beverage sector, advanced R&D capabilities, and supportive government policies promoting eco-friendly packaging. Additionally, rising health consciousness and increasing demand for biodegradable packaging in food and personal care products support market performance.

North America’s presence in the edible packaging market is expected to grow further. The focus on reducing plastic waste and innovations in materials like seaweed, rice, and potato starch will enhance market expansion.

Regional Mentions:

- Europe: Europe sees steady growth, driven by stringent sustainability regulations and high consumer demand for organic and biodegradable packaging solutions.

- Asia Pacific: Asia Pacific shows rapid growth, supported by rising awareness of sustainable packaging and government initiatives promoting eco-friendly alternatives, especially in countries like Japan, China, and India.

- Middle East & Africa: The region experiences gradual growth, driven by increasing awareness of plastic waste reduction and initiatives to improve packaging sustainability in urban areas.

- Latin America: Latin America shows potential, driven by expanding food and beverage sectors and rising interest in sustainable packaging solutions, especially in markets like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The edible packaging market is growing rapidly, driven by demand for sustainable solutions and reduced plastic waste. The top four companies in this market are Notpla Ltd, Evoware, Loliware, and Tipa Corp. These companies maintain strong positions by focusing on innovation, biodegradable materials, and expanding product applications.

Notpla Ltd is a leader in seaweed-based packaging, offering biodegradable alternatives for food and beverage packaging. Its focus on natural materials and compostable solutions supports its leadership in the European market. The company targets eco-conscious consumers and businesses looking to reduce plastic use.

Evoware specializes in seaweed-based packaging, focusing on food wraps and sachets. It emphasizes affordability and waste reduction, making it popular in Southeast Asia. Evoware’s sustainable approach helps address plastic waste while offering cost-effective alternatives.

Loliware produces edible cups and straws using seaweed and plant-based ingredients. The company’s focus on eliminating single-use plastic aligns with global sustainability trends. It has gained attention for its innovative designs and collaborations with food service providers.

Tipa Corp develops flexible packaging solutions made from compostable materials for food and non-food products. Its products decompose like organic waste, supporting the circular economy. Tipa’s focus on diverse applications and expanding distribution networks strengthens its market presence.

These companies drive growth by innovating natural and biodegradable packaging, positioning them as leaders in the edible packaging market.

Top Key Players in the Market

- Notpla Ltd

- Evoware

- Loliware

- Tipa Corp

- MonoSol LLC

- Devro plc

- DuPont

- Ingredion Inc.

- Glanbia Plc

- Coveris Holdings

- JRF Technology LLC

- WikiCell Designs Inc.

- Tate & Lyle Plc

- Pace International LLC

- Safetraces, Inc.

- Watson, Inc.

- Mantrose UK Ltd.

- Apeel Sciences

- Regeno Bio-Bags

- Other Key Players

Recent Developments

- GFRP and DisSolves: In February 2024, Generation Food Rural Partners I, LP (GFRP), an investment fund by Big Idea Ventures, acquired DisSolves, a Pittsburgh-based startup specializing in edible packaging films. DisSolves’ patented films dissolve in liquids and are designed for applications like protein pods and instant coffee packs. This acquisition aims to pilot sustainable packaging solutions with major food producers.

- SEE (formerly Sealed Air): In June 2024, SEE introduced three advanced skin packaging solutions compatible with its CRYOVAC® Darfresh® systems, featuring enhanced oxygen barriers and reduced plastic usage by up to 51%. This innovation aligns with SEE’s commitment to sustainability in the food packaging industry.

- Sabert Corporation: In April 2024, Sabert launched a line of compostable pulp trays for produce and proteins, catering to environmentally conscious consumers. The trays are designed to support hybrid cooking trends and offer up to 30 days of shelf life, providing sustainable alternatives to foam packaging.

Report Scope

Report Features Description Market Value (2023) USD 1.1 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Lipids, Polysaccharides, Proteins, Composite Films), By Form (Films and Coatings, Boxes and Containers), By Technology (Antimicrobial Packaging, Controlled Release Packaging), By End-Use Applications (Food and Beverages, Pharmaceutical) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Notpla Ltd, Evoware, Loliware, Tipa Corp, MonoSol LLC, Devro plc, DuPont, Ingredion Inc., Glanbia Plc, Coveris Holdings, JRF Technology LLC, WikiCell Designs Inc., Tate & Lyle Plc, Pace International LLC, Safetraces, Inc., Watson, Inc., Mantrose UK Ltd., Apeel Sciences, Regeno Bio-Bags, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Notpla Ltd

- Evoware

- Loliware

- Tipa Corp

- MonoSol LLC

- Devro plc

- DuPont

- Ingredion Inc.

- Glanbia Plc

- Coveris Holdings

- JRF Technology LLC

- WikiCell Designs Inc.

- Tate & Lyle Plc

- Pace International LLC

- Safetraces, Inc.

- Watson, Inc.

- Mantrose UK Ltd.

- Apeel Sciences

- Regeno Bio-Bags

- Other Key Players