Global Eco-Friendly Tea Packaging Market Size, Share, Industry Analysis Report By Material Type (Plastic, Bioplastic, Metal, Fabric, Paper & Paperboard, Glass, Others), By Packaging (Pouches, Bags & Sacks, Stick Pack & Sachets, Bottles, Cans, Boxes & Cartons, Containers, Others), By End User (Institutional, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165562

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Investment and Business Benefits

- Regional Analysis

- By Material Type

- By Packaging

- By End User

- By Distribution Channel

- Key Market Segments

- Emerging Trends

- Growth Factors

- Top 5 Use Cases

- Driver

- Restraint

- Opportunity

- Challenge

- SWOT Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

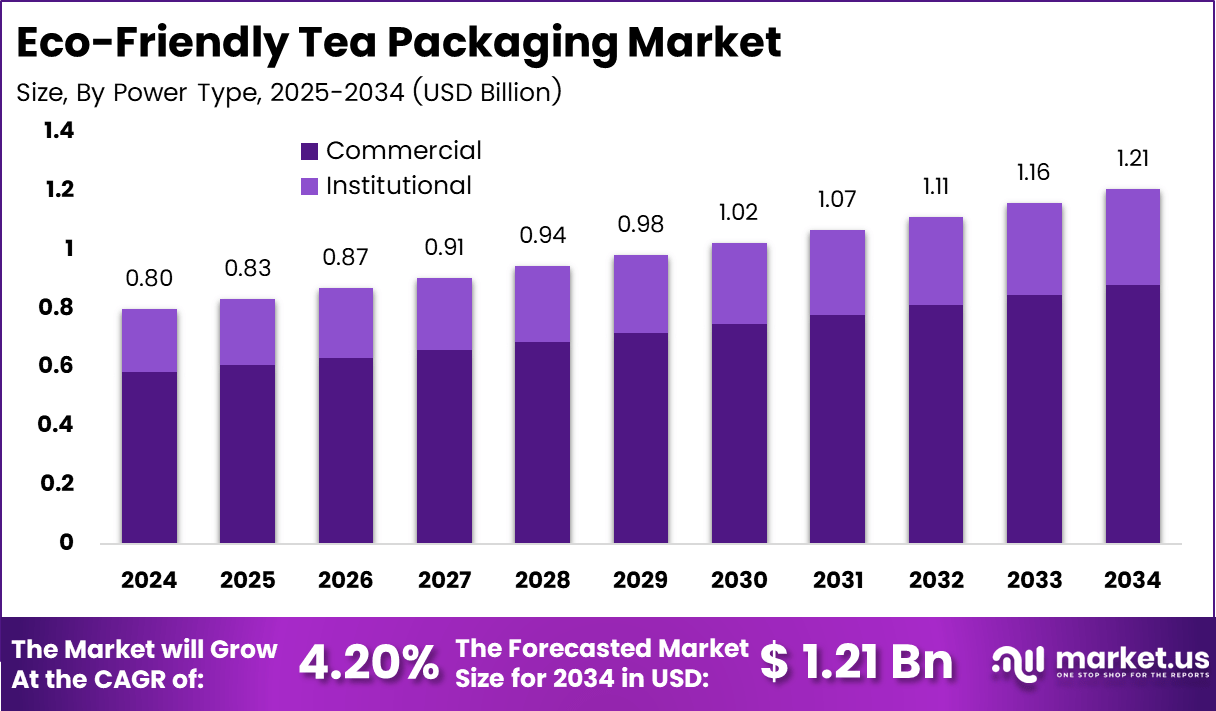

The Global Eco-Friendly Tea Packaging Market reaches USD 0.80 billion in 2024, supported by a steady 4.20% CAGR for 2025–2034, and is forecasted to attain USD 1.21 billion by 2034.

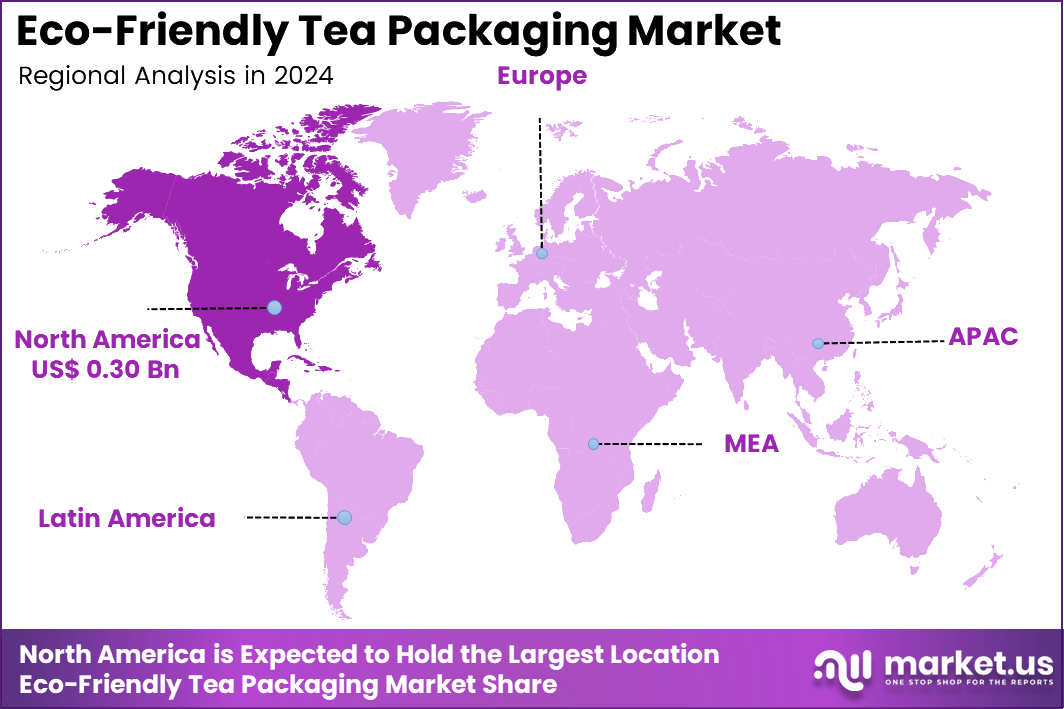

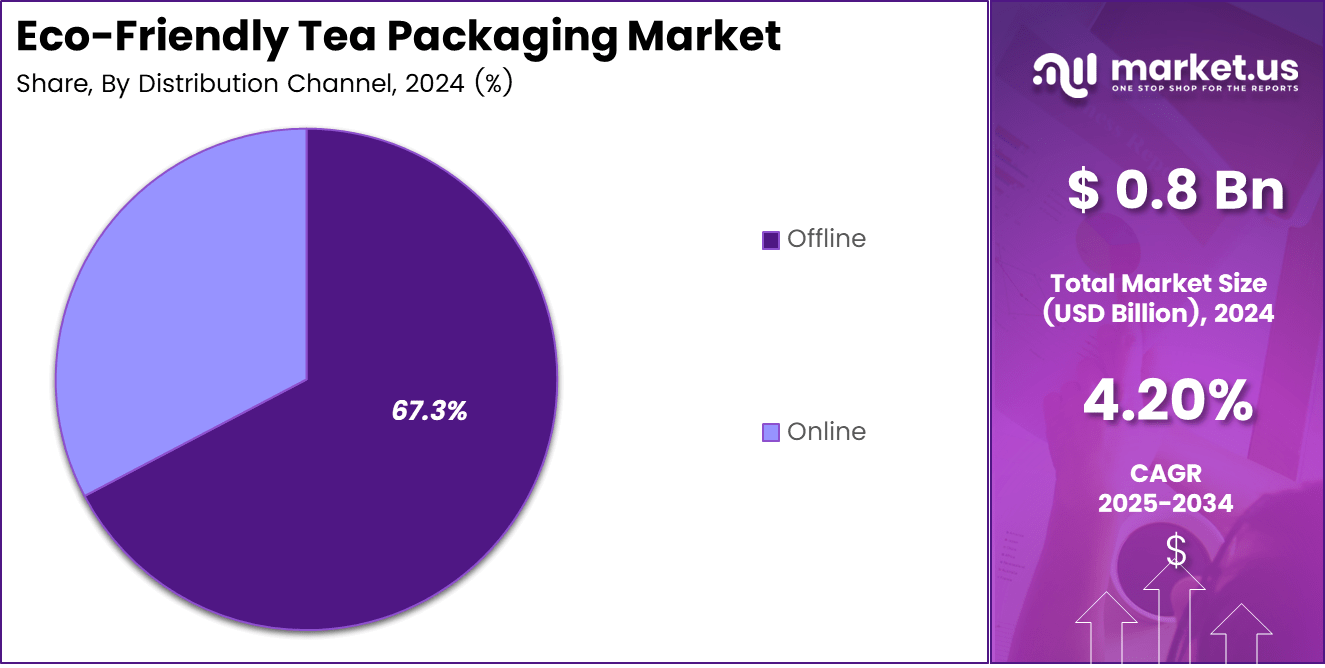

North America leads the global landscape with a share of 38.10% at a valuation of USD 0.30 billion, outperforming all other regions. Offline distribution channels account for the dominant 67.3% share in 2024, reflecting strong retail penetration, while online sales continue to expand with rising e-commerce consumption. On the demand side, commercial end users contribute the majority share, with institutional buyers maintaining stable growth across the forecast horizon.

The eco-friendly tea packaging market is gaining global traction as brands and consumers increasingly prioritize sustainable materials and reduced environmental impact. Rising awareness of plastic pollution, coupled with stricter regulatory policies, Eco-friendly packaging for the tea market is accelerating the shift toward recyclable, compostable, and biodegradable packaging solutions.

Tea manufacturers are adopting eco-friendly packaging for tea products. formats to enhance brand value, support circular economy goals, and meet growing consumer expectations for responsible packaging. The market also benefits from expanding premium tea consumption, stronger retail sustainability commitments, and innovation in plant-based and low-carbon packaging technologies, positioning eco-friendly materials as a core component of the industry’s long-term transformation.

Key Takeaways

- The global eco-friendly tea packaging market is valued at USD 0.80 billion in 2024 and is projected to reach USD 1.21 billion by 2034, reflecting a 4.2% CAGR.

- North America holds the leading regional position at USD 0.30 billion with 38.1% of market share, driven by strong sustainability standards and high specialty tea consumption.

- Offline distribution dominates the market with a 67.3% share, supported by strong retail presence and bulk purchasing patterns.

- Commercial end users account for the majority market contribution, particularly from cafés, hotels, and specialty tea outlets.

- Growing demand for biodegradable, compostable, and recyclable packaging materials continues to shape product innovation and regulatory compliance across global markets.

Analysts’ Viewpoint

Analysts observe that the eco-friendly tea packaging market is demonstrating stable, long-term momentum as global sustainability priorities strengthen. The market’s rise from USD 0.80 billion in 2024 to a projected USD 1.21 billion by 2034, supported by a 4.20% CAGR, indicates consistent structural demand rather than short-term shifts. North America’s leading positionwith a share of 38.10% at USD 0.30 billion highlights a mature regulatory landscape and strong consumer preference for responsibly packaged tea products.

Distribution dynamics remain shaped by traditional purchasing behavior, with offline retail contributing a dominant 67.3% share, although online channels continue gaining relevance. Commercial end users maintain the largest share of demand, reflecting high consumption volumes in cafés, tea shops, hotels, and foodservice chains. Analysts believe material innovations in recyclable, biodegradable, and compostable formats will drive competitive differentiation across the coming decade as sustainability becomes a core purchasing criterion globally.

Investment and Business Benefits

Investors view the eco-friendly tea packaging market as a stable and future-forward opportunity due to the global shift toward sustainable materials and responsible consumption. The sector attracts long-term interest because regulatory frameworks continue to tighten around plastic waste, creating consistent demand for recyclable and compostable solutions.

Investments in this space align well with ESG-focused portfolios, offering positive environmental impact alongside steady market expansion. As consumer awareness grows, investor confidence strengthens, making eco-friendly packaging an appealing avenue for those seeking predictable, sustainability-driven growth.

Businesses adopting eco-friendly tea packaging gain stronger brand differentiation and enhanced customer trust, particularly among environmentally conscious consumers. Sustainable packaging supports compliance with evolving regulations, reducing penalties and operational risks linked to single-use plastics.

Companies benefit from improved supply-chain efficiency through lightweight, biodegradable materials that lower waste-management burdens. Tea brands, cafés, and hospitality operators increasingly prefer eco-friendly packaging, opening new B2B revenue channels for packaging suppliers. Overall, sustainability integration boosts competitive positioning, customer loyalty, and long-term operational resilience.

Regional Analysis

North America stands as the dominant regional market for the eco-friendly tea packaging market, holding a 38.1% market share, valuation of USD 0.30 billion, as shown in the regional distribution graph. This leading position reflects strong adoption of sustainable packaging solutions supported by mature environmental policies and well-developed recycling infrastructure. The region’s premium tea segment continues to expand, driving demand for recyclable paperboard, compostable pouches, and plant-based films.

Retail channels and specialty tea outlets contribute significantly to growth, as many align their procurement strategies with sustainability goals. With consumers showing a higher willingness to choose responsibly packaged products, North America remains a high-value market where innovation, regulatory compliance, and brand sustainability commitments reinforce long-term demand for eco-friendly tea packaging.

By Material Type

Paper & Paperboard leads the Material Type category with 39.7%, driven by its strong recyclability, biodegradability, and widespread acceptance among tea brands aiming to reduce environmental impact. This dominance reflects the shift toward natural, fiber-based materials as consumers increasingly prefer sustainable packaging.

Plastic, bioplastic, metal, fabric, glass, and other materials continue to serve niche or functional roles within the market, but they remain secondary compared to the rapid adoption of paper-based solutions. The overall trend shows a clear industry movement toward renewable, compostable, and low-impact materials, positioning Paper & Paperboard as the primary choice for eco-friendly tea packaging.

By Packaging

Pouches dominate the Packaging category with 49.2%, supported by their lightweight structure, cost efficiency, and strong suitability for both loose tea and tea blends in retail and commercial settings. Their resealable formats and lower material usage further strengthen adoption among sustainability-focused brands.

Bags & Sacks, Stick Pack & Sachets, Bottles, Cans, Boxes & Cartons, and Containers continue to serve specific functional or branding needs, such as premium presentation or bulk storage. However, these categories remain secondary as the market increasingly shifts toward flexible formats. Other packaging options hold smaller shares but contribute to niche applications where durability, aesthetics, or product-specific requirements guide material choice.

By End User

Commercial end users dominate the market with 72.9%, driven by strong demand from cafés, hotels, restaurants, tea chains, and large foodservice operators that prioritize sustainable packaging for high-volume consumption. This segment benefits from the growing shift toward environmentally responsible procurement practices and the rising popularity of premium and specialty teas served in commercial settings.

Institutional users, including offices, educational facilities, and healthcare establishments, represent a smaller but steadily growing share as sustainability becomes a standard expectation across organizational purchasing decisions. The overall trend shows a clear preference for eco-friendly tea packaging within commercial environments, where brand image and customer experience play a significant role.

By Distribution Channel

Offline distribution leads the market with 67.3%, supported by the strong presence of supermarkets, hypermarkets, specialty tea stores, and traditional retail outlets where consumers prefer to evaluate packaging and product quality directly. Established brick-and-mortar networks continue to drive higher sales volumes for eco-friendly tea packaging as brands position sustainable products prominently on shelves.

Online channels account for the remaining share and are expanding steadily, driven by e-commerce platforms, direct-to-consumer tea brands, and subscription-based tea services. Although smaller, the online segment is gaining traction as digital retail adoption increases and consumers seek convenient access to sustainable packaged tea products.

Key Market Segments

By Material Type

- Plastic

- Bioplastic

- Metal

- Fabric

- Paper & Paperboard

- Glass

- Others

By Packaging

- Pouches

- Bags & Sacks

- Stick Pack & Sachets

- Bottles

- Cans

- Boxes & Cartons

- Containers

- Others

By End User

- Institutional

- Commercial

By Distribution Channel

- Offline

- Online

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Emerging trends in the eco-friendly tea packaging market highlight a rapid transition toward circular, low-carbon packaging systems driven by rising consumer expectations and brand sustainability commitments. One of the most notable shifts is the increasing adoption of biodegradable and compostable materials, particularly plant-based films and paper composites that reduce dependence on traditional plastics. Lightweight flexible packaging formats, especially pouches, continue gaining traction as brands seek to minimize material usage and lower transportation emissions.

Another key trend is the integration of water-based inks, natural adhesives, and chemical-free printing technologies to improve safety and reduce environmental impact. Brands are also exploring smart packaging elements—such as QR codes and digital traceability—to communicate sourcing transparency and sustainability credentials to consumers.

Refillable and reusable packaging formats are gaining interest among premium tea brands targeting waste-conscious buyers. Additionally, supply chains are shifting toward collaboration with certified sustainable material suppliers, reinforcing responsible forestry and ethical sourcing practices across global markets.

Growth Factors

Growth in the eco-friendly tea packaging market is supported by rising global sustainability awareness, with surveys indicating that nearly 50% of consumers now prefer products packaged in environmentally responsible materials. Government regulations are strengthening this shift, as more than 65% of countries with active tea markets have introduced or tightened policies targeting single-use plastics.

Brands are responding quickly, with sustainability commitments increasing by over 40% across the beverage sector. In addition, e-commerce demand for tea has expanded by almost 30%, accelerating the use of lightweight, recyclable, and compostable packaging formats. Together, these forces are driving consistent market acceleration.

Top 5 Use Cases

- Sustainable retail packaging for loose tea and tea bags using recyclable or compostable materials.

- Eco-friendly takeaway packaging used by cafés, tea houses, and foodservice outlets.

- Premium gift tea sets featuring biodegradable boxes and paper-based designs.

- Lightweight e-commerce and subscription packaging that minimizes shipping impact.

- Refillable and zero-waste retail systems supported by compostable or paper-based refill packs.

Driver

Growing shift toward sustainable choices

Recent research shows a steady rise in consumers choosing products with environmentally responsible packaging. Many tea buyers now prefer recyclable or biodegradable formats because they want their daily purchases to reflect their values. For instance, premium and organic tea brands are switching to paper-based or plant-derived materials to match this expectation and strengthen trust with their customers.

As more people adopt this preference, the demand spreads across supermarkets, specialty stores and cafes. This wider adoption encourages suppliers to innovate faster, improve material performance and gradually reduce cost barriers, making eco-friendly tea packaging more accessible for both large and small tea brands.

Restraint

Higher cost of sustainable materials

Industry publications indicate that eco-friendly packaging still costs more than traditional plastic formats due to specialty coatings, certified papers, and biodegradable films. For instance, a brand that uses compostable laminates may need new machinery or extra processing steps to maintain freshness and aroma protection, increasing its overall production cost.

These higher costs create resistance among smaller tea producers who work with narrow profit margins. Until manufacturing becomes more efficient or material prices fall, the cost difference may slow down the market’s transition, especially in value-priced tea categories.

Opportunity

Rise of premium and specialty tea formats

According to recent market analyses, the rapid growth of premium, artisanal, and organic tea varieties creates a strong opening for eco-friendly packaging. Consumers buying these teas often expect packaging that reflects quality, purity, and environmental responsibility. For instance, using stand-up pouches made from paper-based laminates offers both high shelf appeal and a sustainable message.

This segment allows brands to justify higher packaging investments, improve margins, and differentiate themselves in a crowded market. As subscription boxes and online tea platforms expand, suppliers can introduce lightweight, sustainable packaging that reduces shipping waste while enhancing brand perception.

Challenge

Uneven recycling systems and disposal habits

Studies on consumer behaviour highlight that sustainable packaging works only when supported by proper recycling or composting infrastructure. Many regions lack consistent systems, which means eco-friendly packaging may not reach the correct end-of-life destination. For instance, a compostable pouch may still end up in general waste because the local facility does not process compostable materials.

This gap creates confusion among consumers and weakens trust in sustainability claims. Brands must offer clear disposal guidance and collaborate with waste-management partners to ensure their packaging delivers real environmental benefits rather than becoming another form of contamination in the waste stream.

SWOT Analysis

Strengths

- Growing consumer demand for sustainable and environmentally responsible packaging solutions

- Strong alignment with global regulations restricting single-use plastics

- High brand value enhancement through eco-friendly packaging adoption

- Versatile material options such as biodegradable paper, compostable films, and plant-based alternatives

Weaknesses

- Higher production and material costs compared to conventional packaging

- Limited barrier properties in some eco-friendly materials affect shelf life

- Inconsistent recycling infrastructure across regions

- Supply chain dependency on certified sustainable raw materials

Opportunities

- The rising popularity of premium and specialty teas requires innovative packaging formats

- Expansion of refillable, reusable, and zero-waste retail models

- Technological advancements in compostable films and fiber-based laminates

- Increasing interest from cafés, hotels, and commercial buyers seeking sustainable procurement

Threats

- Competition from low-cost conventional packaging solutions

- Regulatory uncertainties in emerging markets

- Risk of greenwashing affecting consumer trust

- Fluctuations in raw material supply, such as sustainably sourced paper and plant fibers.

Key Players Analysis

In 2024, the global eco-friendly tea packaging market is influenced by the strategic positioning of key players. Amcor Plc holds about 22.1% market share in its segment, which underscores its strength in sustainable, flexible packaging solutions for food and beverage brands. DS Smith PLC reported revenue of approximately USD 8.56 billion in 2024, positioning it strongly in fibre-based and recyclable packaging, although it faced a 17% decline year-on-year.

ProAmpac LLC leverages its expertise in compostable and high-barrier pouch formats tailored for tea and similar FMCG products, helping brands meet sustainability mandates. WestRock Company targets the renewal of paper-based supply chains and fibre-based alternatives, aligning its performance with the broader packaging trend toward recyclability and reduced plastic content.

Top Key Players

- Amcor Plc

- DS Smith PLC

- ProAmpac LLC

- WestRock Company

- Mondi PLC

- Sonoco Products Company

- Graham Packaging Company

- Novolex Holdings, Inc.

- Goglio SpA

- Co-Pack Inc.

Recent Development

- In Feb 2025, Clessidra-backed Everton completed the acquisition of Eastern Tea, strengthening its footprint in the specialty and private-label tea segment while expanding sourcing and blending capabilities across international markets.

- In Dec 2024, TreeHouse Foods announced plans to acquire a private-label tea manufacturer for $205M, aiming to reinforce its beverage portfolio and scale private-label offerings for North American retail customers.

- In Nov 2024, Fortis Solutions Group acquired Groupe Lelys, enhancing its flexible packaging capabilities and strengthening its position in premium packaging solutions for food, beverage, and consumer goods brands.

Report Scope

Report Features Description Market Value (2024) USD 0.8 Bn Forecast Revenue (2034) USD 1.21 Bn CAGR(2025-2034) 4.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Amcor Plc, DS Smith PLC, ProAmpac LLC, WestRock Company, Mondi PLC, Sonoco Products Company, Graham Packaging Company, Novolex Holdings Inc., Goglio SpA, Co-Pack Inc. Segments Covered By Material Type(Plastic, Bioplastic, Metal, Fabric, Paper & Paperboard, Glass, Others), By Packaging(Pouches, Bags & Sacks, Stick Pack & Sachets, Bottles, Cans, Boxes & Cartons, Containers, Others)By End User(Institutional, Commercial), By Distribution Channel(Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aten International Co., Ltd., Vertiv Holdings Co, Dell Technologies Inc., Belkin International, Inc., Tripp Lite, Black Box KVM Limited, Adder Technology Limited, D-Link Corporation, Emerson Electric Co., Fujitsu Limited, Guntermann & Drunck GmbH, Hewlett Packard Enterprise Development LP, IHSE GmbH, Schneider Electric SE, Eaton Corporation plc, Shenzhen CKL Technology Co., Ltd., Legrand, WEY Group, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Eco-Friendly Tea Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Eco-Friendly Tea Packaging MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Plc

- DS Smith PLC

- ProAmpac LLC

- WestRock Company

- Mondi PLC

- Sonoco Products Company

- Graham Packaging Company

- Novolex Holdings, Inc.

- Goglio SpA

- Co-Pack Inc.