Global Ebike Race Event Insurance Market Size, Share and Analysis Report By Coverage Type (Third-Party Liability Insurance, Participant Accident & Medical Insurance, Event Cancellation & Postponement Insurance, Others), By Event Type (Organized Competitive Races, Charity & Gran Fondo Rides, Corporate/Team-Sponsored Events, Others), By Policy Duration (Single-Event Coverage, Annual/Multi-Event Coverage), By Purchaser (Event Organizers, Racing Teams, Individual Participants), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172512

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

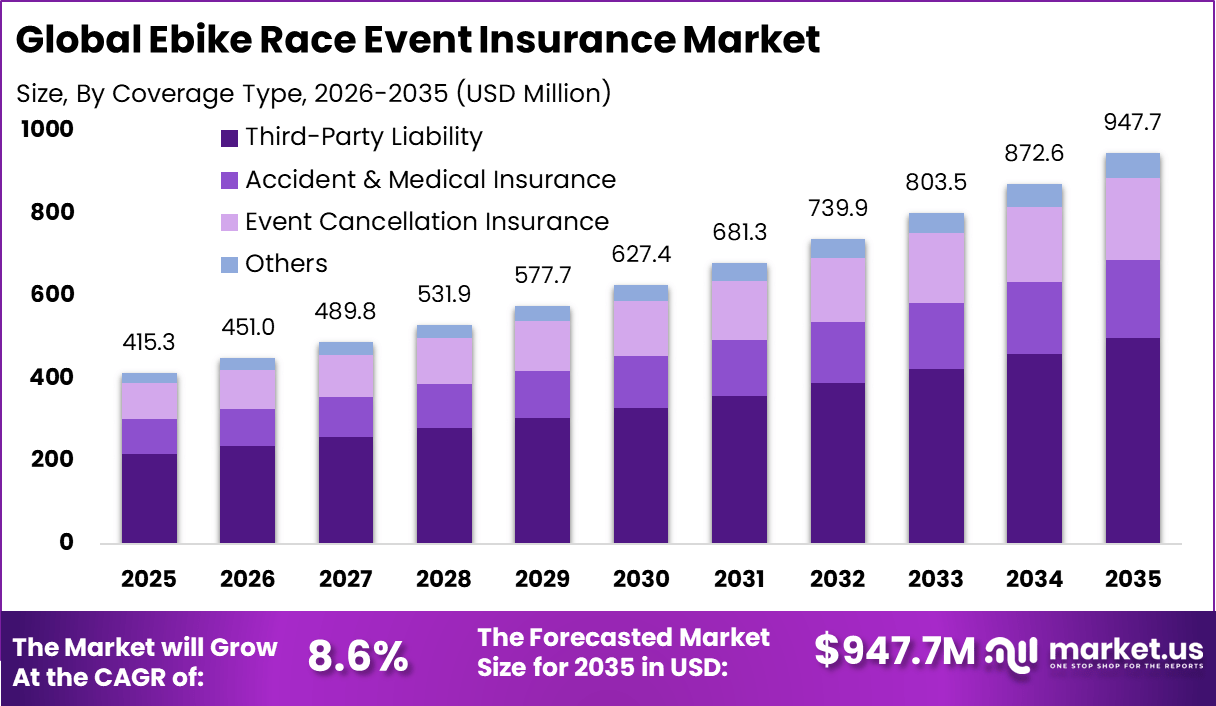

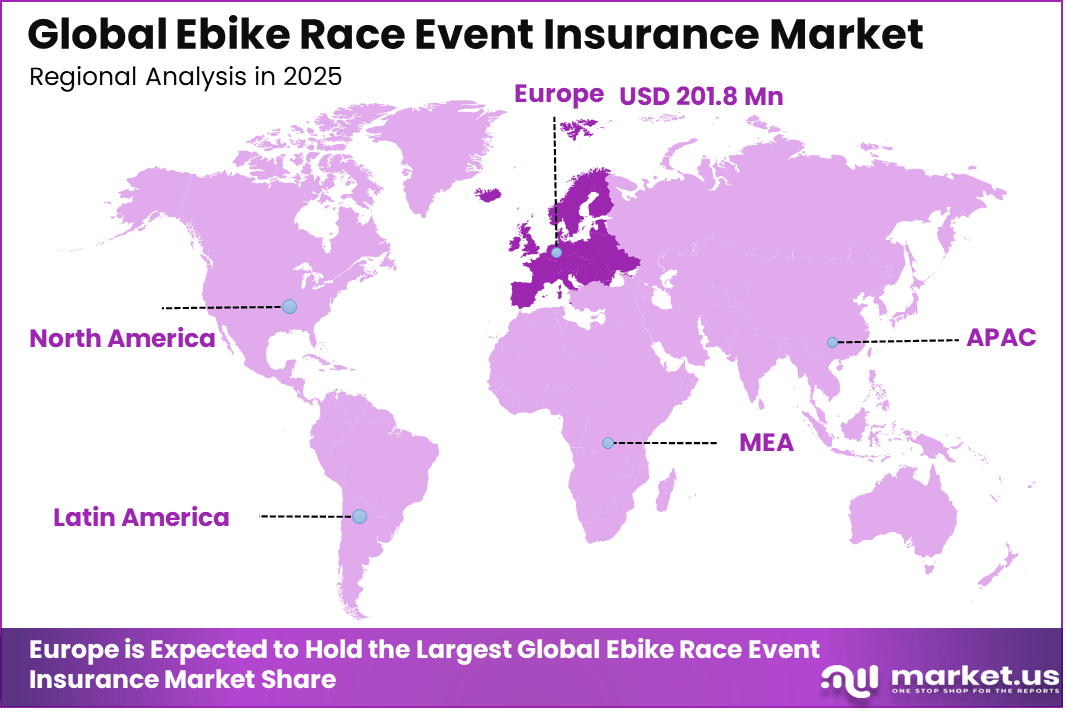

The Global Ebike Race Event Insurance Market size is expected to be worth around USD 947.5 Million By 2035, from USD 415.3 Million in 2025, growing at a CAGR of 8.6% during the forecast period from 2026 to 2035. Europe held a dominan Market position, capturing more than a 48.6% share, holding USD 201.8 Million revenue.

The Ebike Race Event Insurance Market refers to the range of insurance products and services designed to protect organisers, participants, and stakeholders involved in electric bike racing events. This form of insurance is a specialised subset of event insurance that addresses the unique risks associated with competitive e-bike races, including participant injuries, third-party liabilities, and event disruptions. Organisers purchase these policies to transfer financial exposure from unforeseen incidents to an insurer, enabling smoother execution and financial planning.

A key driver is the risk concentration created by timed competition, crowded courses, and public access points, which can lead to higher probability of third-party incidents. Claims exposure is not limited to riders, because spectators, landowners, and nearby property can also be impacted by crashes, course barriers, or course management issues. These realities push organisers to formalise risk transfer through event liability and participant accident coverage.

Technology adoption is rising in event operations, mainly through timing systems, GPS tracking, digital waiver tools, incident reporting apps, and video evidence workflows. These tools can make incidents easier to document, reduce disputes about what happened, and support faster claims notification and investigation. Insurers can also use structured event data to price risk more accurately and apply clearer risk controls. In practice, better data tends to reward organisers who demonstrate strong safety management.

Top Market Takeaways

- Third-party liability insurance dominated coverage types with a 52.7% share, reflecting the need to protect organizers against spectator, rider, and property-related claims.

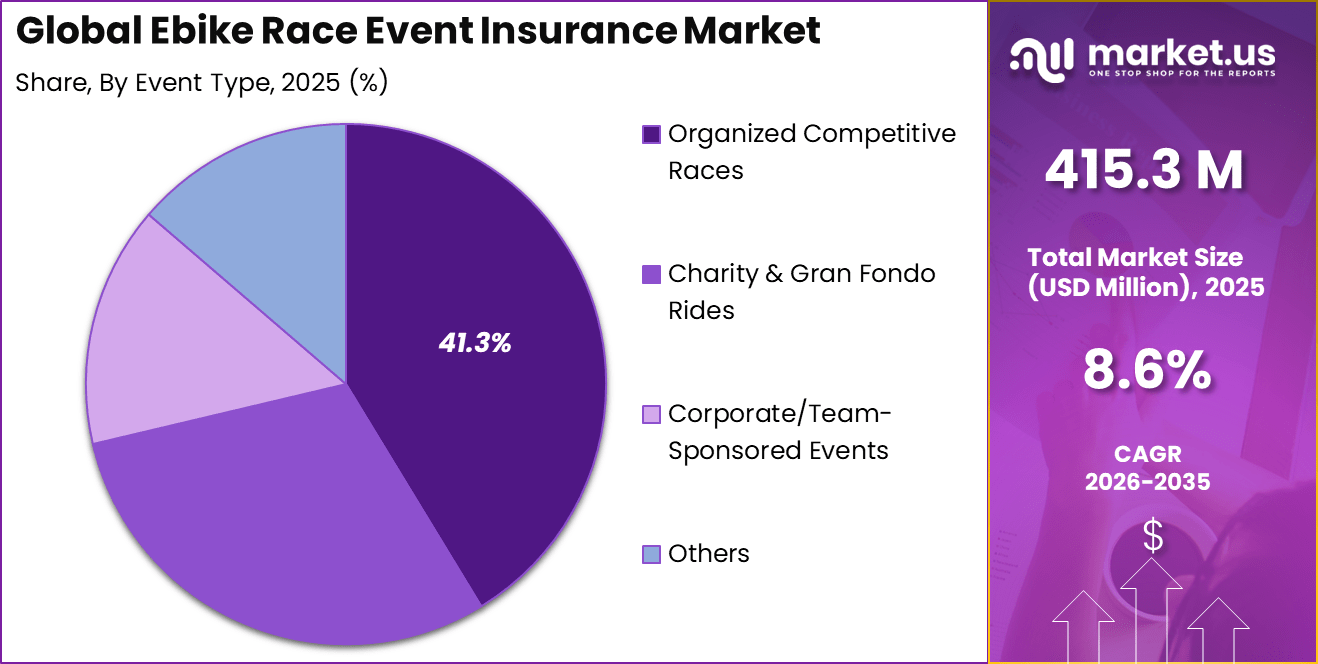

- Organized competitive races accounted for 41.3%, as formally sanctioned events carry higher risk exposure and stricter insurance requirements.

- Single-event policies led with 68.9%, showing preference for flexible, short-term coverage tailored to individual race days.

- Event organizers represented 73.5% of purchasers, driven by regulatory obligations and responsibility for participant and public safety.

- Europe held a leading 48.6% share, supported by a strong cycling culture, frequent race events, and established insurance frameworks.

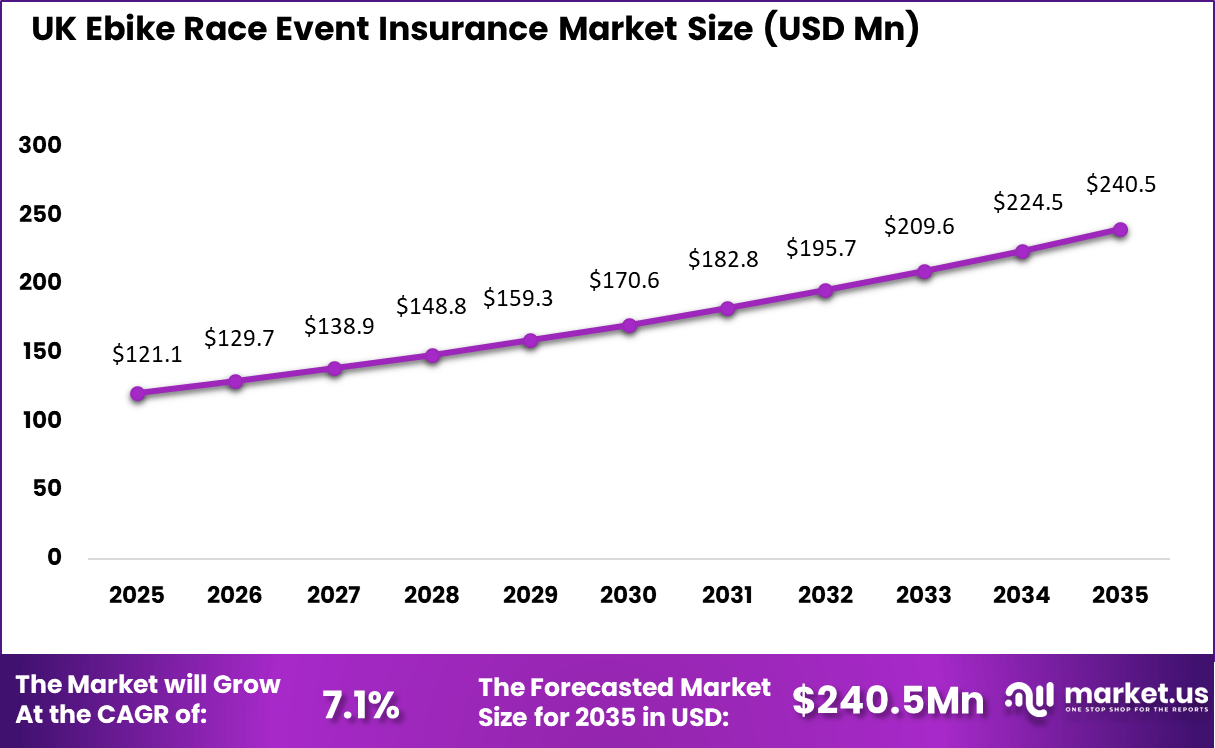

- The UK market reached USD 121.1 million in 2024 and is growing at a 7.14% CAGR, driven by rising e-bike race participation and formalization of competitive events.

Quick Market Facts

Cost Statistics

- Insurance premiums vary by usage type and asset value. For a USD 10,000 bicycle, competitive-use coverage averages about USD 31 per month, compared with USD 29 per month for casual use.

- Member-based pricing can lower costs, as organizations such as Cycling Canada offer flat member rates near USD 26 per month, regardless of competitive participation.

- Event organizers can generate incremental income, with some registration-linked insurance platforms paying lead-generation fees equal to 20% of participant insurance premiums.

Key Risk and Claim Statistics

- Theft remains the most frequent loss event in cycling, with recovery rates typically below 5%, driving demand for comprehensive coverage.

- Public liability limits for event organizers are flexible, commonly ranging from £1 million to £10 million, depending on event scale and venue requirements.

- Coverage caps in standard specialist policies often limit apparel protection to USD 500 per incident and USD 1,000 per year.

- International competition coverage is usually time-bound, with many specialist policies covering up to 60 days of racing abroad.

By Coverage Type

Third-party liability insurance accounts for 52.7%, showing its importance in ebike racing events. This coverage protects organizers against claims related to injury or property damage involving spectators, participants, or third parties. Ebike races involve high speeds and dense crowds, which increases liability exposure. Insurance helps manage legal and compensation risks. Event safety remains a core concern.

Demand for third-party liability coverage is driven by venue requirements and regulatory obligations. Organizers prioritize coverage that addresses public safety risks. Liability insurance also supports partnerships with sponsors and local authorities. Clear coverage terms help manage disputes. This sustains steady adoption.

By Event Type

Organized competitive races represent 41.3%, making them the leading insured event type. These races attract professional riders and large audiences. Structured competition increases operational complexity and risk. Insurance coverage supports planning and execution. Formal race formats require clear risk protection.

Adoption in this segment is driven by the growth of organized ebike competitions. Race organizers seek protection for participants and assets. Insurance supports compliance with governing bodies. Coverage also reassures sponsors and stakeholders. This encourages continued event growth.

By Policy Duration

Single-event coverage accounts for 68.9%, reflecting the short duration of ebike races. Most events are held on specific dates with defined schedules. Single-event policies align coverage with event timelines. This approach controls costs and simplifies administration. Flexibility is a key advantage.

Preference for single-event policies is driven by ease of customization. Organizers can tailor coverage to event size and location. Policy terms are clear and time-bound. Renewal is only needed for future events. This supports strong adoption.

By Purchaser

Event organizers hold 73.5%, highlighting their primary role in purchasing insurance. Organizers manage logistics, participants, and public access. Insurance is essential to protect against operational risks. Coverage supports financial stability. Organizers are accountable for safety standards.

Adoption by organizers is driven by contractual and legal requirements. Many venues require proof of insurance before approval. Organizers also seek protection against unforeseen incidents. Insurance supports responsible event management. This keeps organizers as the main buyers.

By Region

Europe accounts for 48.6%, supported by strong adoption of ebikes and competitive racing culture. The region hosts numerous organized cycling events. Safety regulations are well established. Insurance uptake reflects mature event management practices. The region remains a key market.

The United Kingdom reached USD 121.1 Million with a CAGR of 7.14%, indicating steady growth. Expansion is driven by increasing ebike participation and organized races. Event organizers focus on risk mitigation. Insurance remains a standard requirement. Market growth continues at a stable pace.

Key Market Segments

By Coverage Type

- Third-Party Liability Insurance

- Participant Accident & Medical Insurance

- Event Cancellation & Postponement Insurance

- Others

By Event Type

- Organized Competitive Races

- Charity & Gran Fondo Rides

- Corporate/Team-Sponsored Events

- Others

By Policy Duration

- Single-Event Coverage

- Annual/Multi-Event Coverage

By Purchaser

- Event Organizers

- Racing Teams

- Individual Participants

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Popularity of eBike Race Events

The global expansion of eBike race events is driving demand for specialized event insurance. Organizers and participants increasingly recognize the financial and legal risks associated with accidents, equipment damage, and third-party liabilities at competitive and recreational races. This awareness is prompting stakeholders to secure tailored insurance solutions to protect against unforeseen costs and liabilities. The surge in eBike participation levels is supporting a broader need for formal risk management mechanisms at events.

Heightened Risk Awareness and Regulatory Requirements

A growing emphasis on risk mitigation and regulatory compliance is contributing to the adoption of eBike race event insurance. As organized races become more common across diverse regions, the potential for injury and property loss has heightened awareness of protective coverage. Organizers are thus more inclined to invest in insurance products that cover liability, accidents, and cancellations. Regulatory environments in various regions also reinforce the need for comprehensive coverage to meet safety standards.

Restraint

Lack of Standardized Risk Frameworks

The absence of consistent risk assessment standards across regions and event types is restraining market expansion. Insurers face complexity when creating products that can be uniformly applied to diverse race formats and regulatory environments. This fragmentation increases administrative costs and complicates policy design. As a result, some organizers may delay purchasing comprehensive coverage until clearer frameworks are established.

Limited Awareness Among Smaller Event Organizers

Smaller or community-based eBike events often operate with limited budgets and lower awareness of formal insurance requirements. These events may underestimate the value of tailored coverage, relying instead on general liability policies that do not fully protect against specific eBike race risks. This restraint affects overall market penetration, particularly in emerging regions where organized racing is still developing.

Opportunity

Development of Integrated and Customizable Insurance Solutions

Significant opportunity exists for insurers to develop bundled policies that cover multiple risks together. Such offerings could integrate liability, accident, equipment, and event cancellation coverage in one customizable package. This approach can simplify purchasing for organizers and enhance protection. Insurers that leverage data analytics and digital tools for risk assessment may also penetrate new customer segments and improve service delivery.

Expansion into Emerging Geographic Markets

Emerging markets, especially in Asia Pacific and Latin America, present growth potential due to rising eBike adoption and an expanding base of race events. Urbanization, increasing disposable incomes, and supportive mobility policies in these regions are facilitating event organisation. By partnering with local associations and leveraging region-specific insights, insurers can tailor products to meet local needs and regulatory conditions, thus capturing new demand.

Challenge

Regulatory Fragmentation Across Regions

Regulatory variability across countries and local jurisdictions presents a persistent challenge for insurers and event organizers. Differences in liability laws, mandatory coverage requirements, and safety guidelines make it difficult to standardize products globally. This fragmentation increases complexity for insurers and may delay coverage adoption by organizers unfamiliar with cross-border regulations.

Rapid Evolution of eBike Technology

The fast-paced evolution of eBike designs and event formats introduces uncertainty in risk modeling and policy pricing. New technologies and high-performance bikes alter risk profiles, requiring insurers to continuously update underwriting models. This dynamic environment makes it challenging to predict claim trends and may slow product innovation.

Competitive Analysis

Allianz SE, AXA SA, and Zurich Insurance Group lead the ebike race event insurance market by offering comprehensive coverage for participant injury, event liability, equipment damage, and cancellation risks. Their policies are designed for high speed competitive environments and large public gatherings. These insurers rely on strong underwriting expertise and global event risk frameworks. Growing popularity of organized ebike racing continues to support their leadership.

Aon plc, Marsh & McLennan Companies, Chubb, Ltd., Generali Group, and Aviva plc strengthen the market through brokerage services and tailored insurance programs for race organizers and sponsors. Their solutions address rider safety, third party liability, and regulatory compliance. These providers emphasize customized coverage structures and efficient claims handling. Rising event scale and sponsorship involvement support wider adoption.

Hiscox, Ltd., Tokio Marine Holdings, Sompo Holdings, Munich Re, Swiss Re, and Beazley plc expand the landscape with specialty insurance and reinsurance capacity for niche and high risk sporting events. Their offerings support risk transfer and financial protection for complex race formats. These companies focus on flexibility and actuarial precision. Increasing number of ebike competitions continues to drive steady market growth.

Top Key Players in the Market

- Allianz SE

- AXA SA

- Zurich Insurance Group, Ltd.

- Aon plc

- Marsh & McLennan Companies, Inc.

- Chubb, Ltd.

- Generali Group

- Aviva plc

- Hiscox, Ltd.

- Lockton Companies, Inc.

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Munich Re

- Swiss Re, Ltd.

- Beazley plc

- Others

Recent Developments

- On June 12, 2025, Allianz Australia gained approval for a partnership with the Royal Automobile Association, acquiring its general insurance business including motor lines relevant to e-bike events.

- Aon plc facilitates risk management for global events as a leading broker. Aon provides event insurance solutions through its digital platforms, aiding organizers of races including e-bike competitions. In February 2025, Aon partnered with Floodbase and Swiss Re on a parametric storm surge solution, expanding risk tools indirectly relevant to outdoor events.

Report Scope

Report Features Description Market Value (2025) USD 415.3 Mn Forecast Revenue (2035) USD 947.7 Mn CAGR(2026-2035) 8.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Third-Party Liability Insurance, Participant Accident & Medical Insurance, Event Cancellation & Postponement Insurance, Others), By Event Type (Organized Competitive Races, Charity & Gran Fondo Rides, Corporate/Team-Sponsored Events, Others), By Policy Duration (Single-Event Coverage, Annual/Multi-Event Coverage), By Purchaser (Event Organizers, Racing Teams, Individual Participants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA SA, Zurich Insurance Group, Ltd., Aon plc, Marsh & McLennan Companies, Inc., Chubb, Ltd., Generali Group, Aviva plc, Hiscox, Ltd., Lockton Companies, Inc., Tokio Marine Holdings, Inc., Sompo Holdings, Inc., Munich Re, Swiss Re, Ltd., Beazley plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ebike Race Event Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Ebike Race Event Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- AXA SA

- Zurich Insurance Group, Ltd.

- Aon plc

- Marsh & McLennan Companies, Inc.

- Chubb, Ltd.

- Generali Group

- Aviva plc

- Hiscox, Ltd.

- Lockton Companies, Inc.

- Tokio Marine Holdings, Inc.

- Sompo Holdings, Inc.

- Munich Re

- Swiss Re, Ltd.

- Beazley plc

- Others