Global Earned Wage Access Providers Market Size, Share, Industry Analysis Report By Type of EWA Model (Employer-Integrated (B2B) Model, Direct-to-Consumer (D2C or B2C) Model), By Enterprise Size (Large Enterprises, SMEs), By Revenue Model (Flat Fee per Transaction, Subscription-Based), By Delivery Channel (Mobile Applications, Web Portals, APIs & Embedded Finance), By End-User Industry (Retail & Hospitality, Healthcare, Manufacturing & Warehousing, Gig Economy & Freelancers, BPO & Call Centers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165599

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- User Statistics and Benefits

- Sector-Specific Adoption

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type of EWA Model Analysis

- Enterprise Size Analysis

- Revenue Model Analysis

- Delivery Channel Analysis

- End-User Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

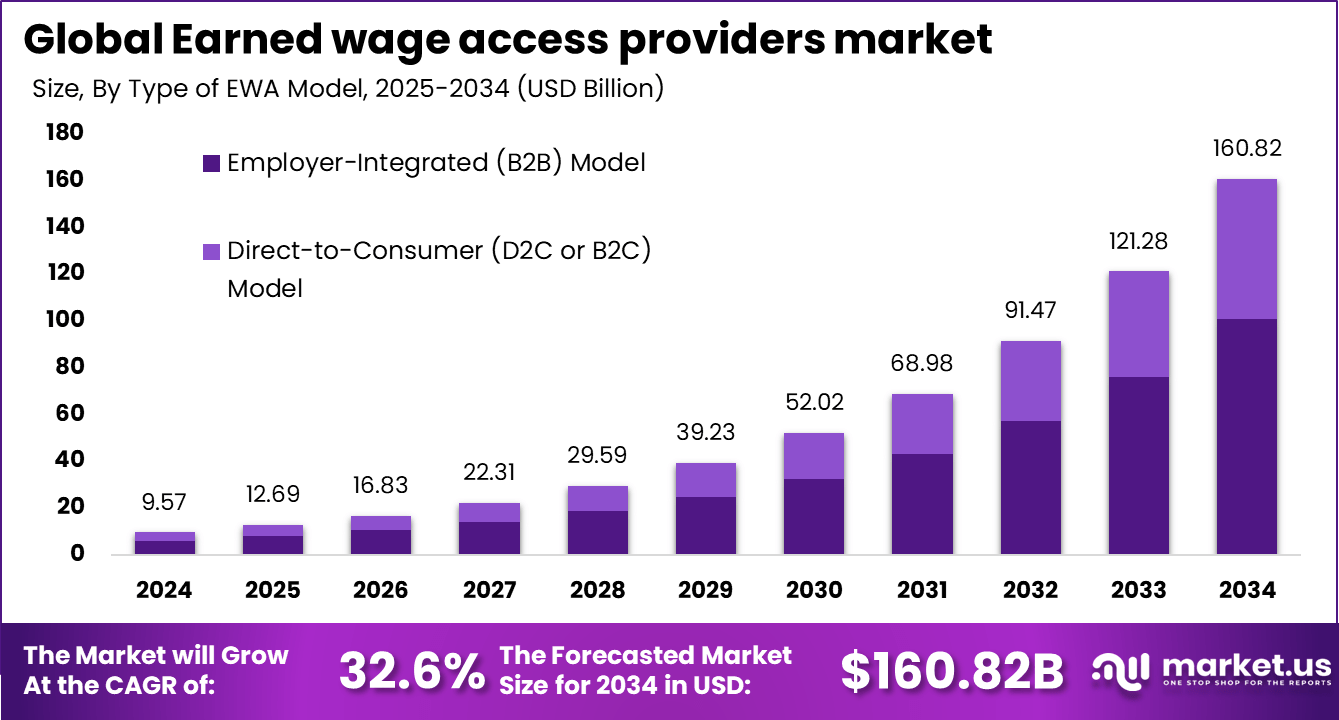

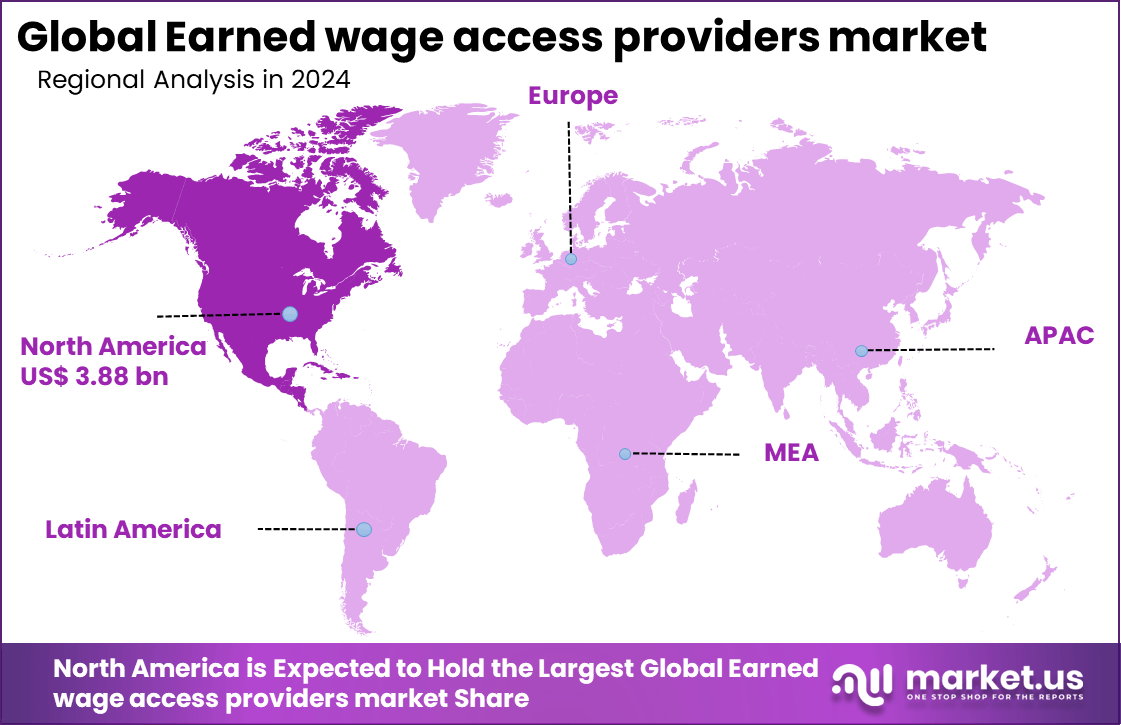

The Global Earned wage access providers market size is expected to be worth around USD 160.82 billion by 2034, from USD 9.57 billion in 2024, growing at a CAGR of 32.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.6% share, holding USD 3.88 billion in revenue.

The earned wage access market has expanded quickly as more workers request early access to wages and more employers adopt flexible pay benefits. The market is now seen as a sizeable part of the wider payroll and financial wellness industry. It has been growing every year because of strong interest from both employees and organisations, supported by rising digital usage and a shift toward flexible payout models.

The growth of the market can be attributed to rising financial stress among workers, which has increased the need for short term access to earned income. Strong smartphone penetration and growing use of digital payroll systems are also supporting adoption. Employers are recognising that flexible wage access can help lower absenteeism and improve workforce stability, which further encourages uptake across different sectors.

The main drivers for the rapid adoption of EWA include rising employee financial stress and increasing living costs, which force many workers to live paycheck to paycheck. The growing gig and hourly economy, with freelancers and part-time workers, fuels demand for flexible income access. Additionally, the broad adoption of cloud-based payroll systems and mobile technologies makes it easier for employers to integrate EWA solutions, creating a seamless experience for users.

According to Market.us, The global Earned Wage Access market is projected to reach USD 61.06 billion by 2034, rising from USD 6.2 billion in 2024 at a 25.7% CAGR from 2025 to 2034. North America accounted for more than 42.4% of the market in 2024, generating about USD 2.62 billion in revenue.

The market for earned wage access providers is driven by the rising financial stress faced by employees and their growing demand for immediate access to earned wages. As more workers live paycheck to paycheck, they seek solutions that help them manage unexpected expenses without relying on expensive loans. Employers are increasingly adopting earned wage access services to improve employee satisfaction and reduce turnover by offering financial flexibility.

For instance, in April 2025, PayActiv launched Visa+, a real-time payout service allowing users to transfer earned wages securely to Venmo and PayPal without sharing bank details. This innovation enhances financial control and convenience, supporting PayActiv’s role as an employer-sponsored EWA and financial wellness provider with fee-free options.

Key Takeaway

- The Employer-Integrated (B2B) Model led the market in 2024, securing a 62.8% share as companies increasingly embedded EWA into payroll and HR systems.

- Large Enterprises dominated adoption with a 76.5% share, reflecting strong uptake among organizations focused on retention and financial wellness.

- The Subscription-Based model accounted for 70.3%, supported by predictable pricing and ease of scaling across workforce segments.

- Mobile Applications captured 42.6%, driven by employee preference for instant access through smartphones.

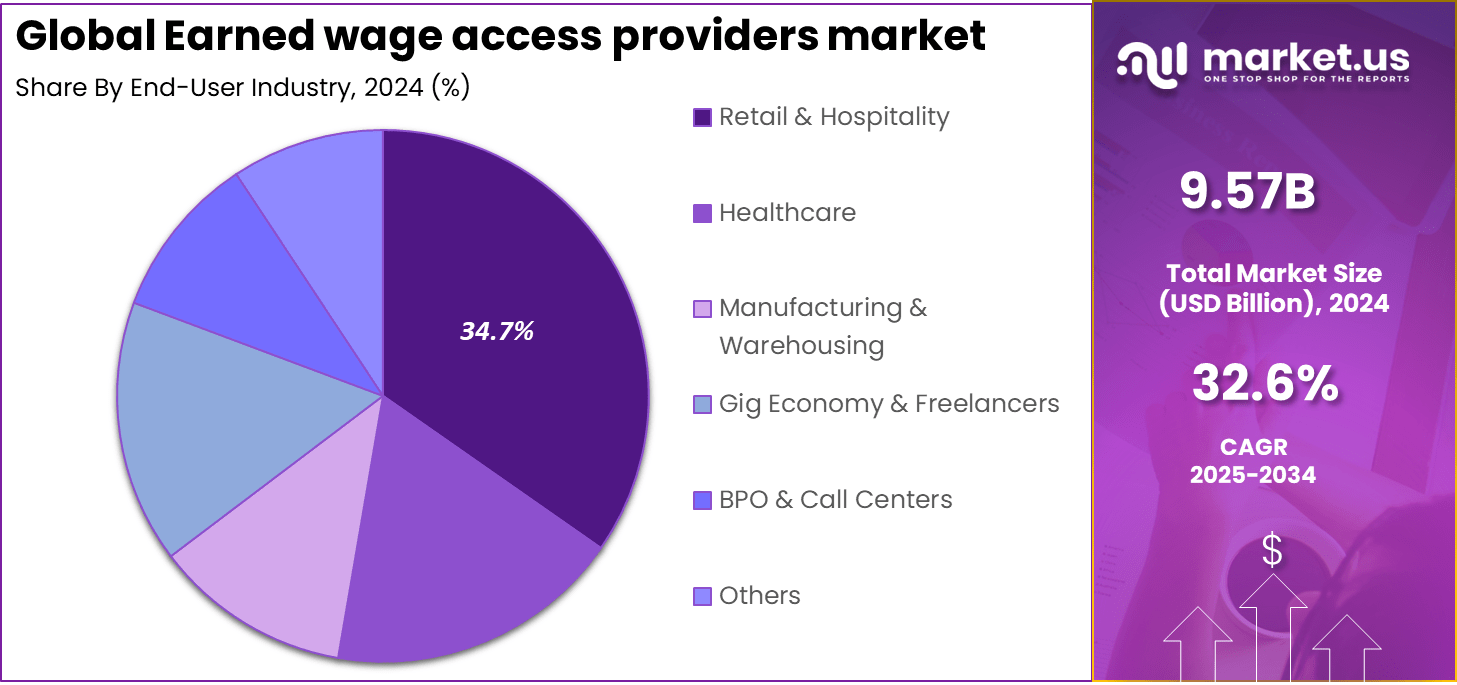

- The Retail and Hospitality sector held 34.7%, highlighting strong demand for EWA in high-turnover, hourly-wage industries.

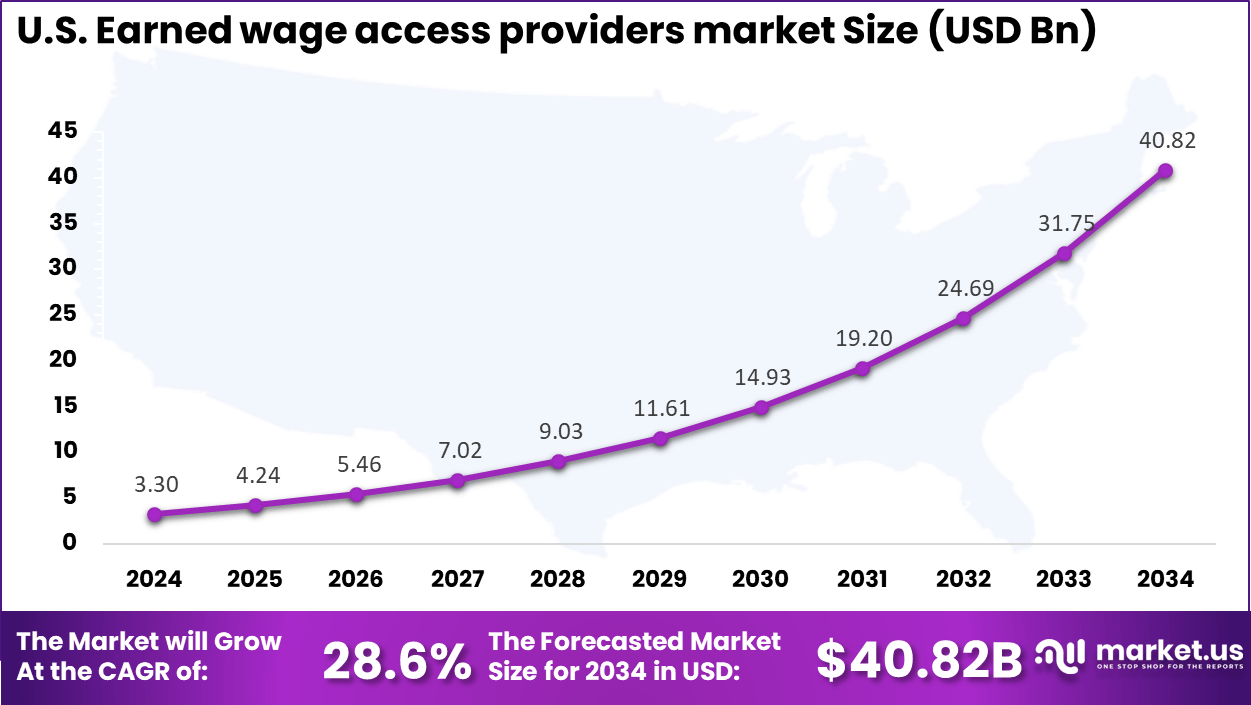

- The U.S. market reached USD 3.30 billion in 2024, expanding at a 28.6% CAGR, supported by rapid employer adoption and worker demand for flexible pay.

- North America maintained leadership with a 40.6% share, driven by mature fintech ecosystems and broad financial wellness initiatives.

User Statistics and Benefits

- User growth: Earned Wage Access (EWA) continues to expand rapidly. More than 7 million workers used EWA services in 2022, with unique users rising from 1.9 million in 2021 to 2.8 million in 2022.

- Transaction and fund activity: The volume of EWA transactions increased by 93.2% between 2021 and 2022. Advanced funds grew at a similar pace, rising by 94.7%, reflecting strong demand and higher user engagement.

- Reported benefits:

- 77% of users reported lower financial stress.

- 82% of users felt less anxious about money.

- 72% said they gained better control and confidence in their financial decisions.

- 81% reported higher self-esteem as a result of improved short-term financial stability.

Sector-Specific Adoption

- Retail and e-commerce: This sector holds a 21% market share in 2024, making it the leading adopter of earned wage access. The high turnover rate and the presence of a large hourly workforce make EWA an effective tool for improving recruitment and supporting employee retention.

- Large enterprises: Organizations with large workforces accounted for nearly 60% of the market in 2024. These companies use EWA to strengthen retention, increase employee engagement, and reduce financial stress among staff, which supports overall productivity.

- Other sectors: Industries such as healthcare, logistics, and hospitality are also experiencing strong EWA adoption. These sectors rely heavily on shift-based and hourly employees, making flexible wage access an important component of workforce management and employee satisfaction.

Role of Generative AI

Generative AI plays an important role in earned wage access (EWA) by enabling real-time analysis of payroll data to ensure workers access only the wages they have safely earned. This AI-driven approach minimizes disruptions in cash flow and payroll cycles, allowing employees instant access to funds without creating financial risks for employers.

In addition, AI models predict peak withdrawal periods and monitor employee withdrawal behaviors, helping to optimize fund allocation and maintain smooth financial operations in organizations. Access to AI assistance increases worker productivity by 15% on average, demonstrating how AI integration benefits both employees and employers in managing earnings effectively.

Beyond just facilitating wage access, generative AI also helps reduce administrative overhead for businesses by automating compliance checks and fraud detection in wage disbursement. This supports a more secure and transparent payroll system where timely access to earned wages becomes consistent and reliable.

Investment and Business Benefits

Investment in EWA technology and providers is promising due to increasing employer demand and expanding gig economies globally. The shift to digital payroll and the rise of financial wellness programs create fertile ground for EWA solutions to grow. Innovations in app-based financial management and partnerships with payroll companies provide scalable business models.

Investors may find opportunities in startups offering integrated EWA services, financial education tools, and enhanced user experience platforms targeting underserved worker populations. The business benefits of EWA are seen in improved workforce productivity, stronger employee morale, and reduced turnover expenses.

Early access to wages leads to lower stress levels, resulting in more consistent attendance and focus. Enhanced job satisfaction creates a positive workplace culture and decreases recruitment and training costs related to high employee churn. Providing EWA also signals that a company values employee wellbeing, improving brand reputation and competitiveness in tight labor markets.

U.S. Market Size

The market for earned wage access providers within the U.S. is growing tremendously and is currently valued at USD 3.30 billion, the market has a projected CAGR of 28.6%. This growth is driven by rising financial stress among employees who increasingly seek financial flexibility to manage unexpected expenses. Many workers live paycheck to paycheck, boosting demand for early access to earned wages as an alternative to costly payday loans.

Employers also drive market expansion by integrating EWA solutions as part of workforce wellness programs to improve retention and reduce absenteeism. Advances in digital payroll, mobile payment apps, and real-time payment infrastructure enable seamless, scalable deployment of these services, making them widely accessible across industries like retail, hospitality, and gig work. Regulatory clarity and fintech innovation further support this growth, positioning the U.S. as a key leader.

For instance, in September 2025, DailyPay announced the launch of a new Frontline Communications solution aimed at improving employee engagement and workplace connectivity for employers using its platform. This solution enhances real-time access to earned wages and fosters productive employer-employee relationships.

In 2024, North America held a dominant market position in the Global Earned wage access providers market, capturing more than a 40.6% share, holding USD 3.88 billion in revenue. This dominance is largely due to the region’s early adoption of digital payroll systems and the presence of major EWA providers like DailyPay and Payactiv.

The U.S. financial ecosystem supports seamless wage disbursements through advanced payment infrastructures such as FedNow and Real-Time Payments. Growing demand for financial flexibility among hourly and gig workers further drives adoption. Employers increasingly integrate EWA in HR platforms to enhance employee financial wellness and retention.

For instance, in September 2025, PayActiv launched “Access-as-a-Service℠,” an API-driven infrastructure allowing large enterprises and HCM platforms to embed EWA and financial wellness features under their own brand, offering scalable and customizable earned wage access solutions.

Type of EWA Model Analysis

In 2024, the Employer-Integrated (B2B) Model segment held a dominant market position, capturing a 62.8% share of the Global Earned wage access providers market. This model is preferred due to its close integration with payroll systems, allowing real-time calculation of earned wages and automated repayment through payroll deductions.

It provides regulatory clarity and higher trust from both employers and employees. Large enterprises particularly favor this model as it fits seamlessly into their existing HR and payroll ecosystems, reducing operational friction and default risks. Its growing adoption is tied to employers’ increasing focus on employee financial wellness and retention.

This EWA model’s popularity stems from its ability to offer a transparent and automated solution that embeds early wage access within regular payroll cycles. It contrasts with direct-to-consumer models, which do not require employer integration but carry more risk and fewer regulatory safeguards. The employer-integrated approach fosters a more sustainable and trusted environment for early wage disbursements, helping businesses retain talent and improve workforce satisfaction.

For Instance, in September 2025, DailyPay expanded its platform by adding a Frontline Communications solution designed to boost engagement and connection between employers and employees. This development supports its position in the employer-integrated (B2B) segment, helping large enterprises enhance workforce productivity by offering real-time access to earned wages through seamless payroll integration.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 76.5% share of the Global Earned wage access providers market. These organizations generally have sizable hourly or shift-based workforces in sectors such as retail, healthcare, manufacturing, and logistics. Their scale and resources allow them to implement complex EWA systems that comply with multifaceted regulatory environments across jurisdictions.

Large companies also benefit from EWA as a tool to reduce employee turnover and improve engagement, which is critical in high-turnover industries. The adoption by large enterprises is driven by the need to offer competitive employee benefits that improve financial wellness. These firms can efficiently manage vendor partnerships and integrate EWA within broader employee support programs. In contrast, smaller enterprises are gradually adopting EWA but at a slower pace due to resource constraints and less complex payroll needs.

For instance, in November 2025, Earnin announced plans to expand its earned wage services internationally to markets including the UK, Canada, Australia, and New Zealand. This move highlights Earnin’s strategic focus on broadening its user base mainly via mobile applications and subscription models, catering mostly to large enterprises and retail & hospitality sectors where hourly workers dominate. Earnin continues to develop its platform to meet growing demand for flexible wage access among diverse industries.

Revenue Model Analysis

In 2024, The Subscription-Based segment held a dominant market position, capturing a 70.3% share of the Global Earned wage access providers market. This model involves charging employers a recurring fee for access to the EWA platform, which often includes software licensing, customer support, and integration services. Subscription models are preferred by enterprises because they provide predictable costs and ongoing updates or improvements to the software without requiring large upfront investments.

Subscription pricing supports long-term partnerships between EWA providers and enterprises, aligning incentives around continuous service quality and platform enhancements. This contrasts with transaction-based models, which charge per use and can deter frequent wage access requests. Providers adopt subscription models to establish stable revenue streams and encourage deeper customer engagement.

For Instance, in January 2025, Rain Technologies focused on financial wellness apps with a strong employer-integrated and subscription-based approach by launching pay-on-demand services native to Workday. The company secured $116 million in funding to scale its EWA offerings, targeting large enterprises in North America’s retail and hospitality sectors. This strategic funding supports Rain’s mobile app delivery and subscription revenue model.

Delivery Channel Analysis

In 2024, The Mobile Applications segment held a dominant market position, capturing a 42.6% share of the Global Earned wage access providers market. The mobile-first approach meets the needs of modern workers who demand convenient, real-time access to their earned wages. Mobile apps offer user-friendly interfaces, instant notifications, and the ability to request funds quickly, making them ideal for hourly and gig workers who manage their finances on the go.

The widespread use of smartphones and advances in secure payment technologies have propelled mobile apps as the preferred EWA channel. These apps also integrate with payroll and payment systems, facilitating seamless wage transfers and improving the user experience. Employers embrace mobile delivery to boost employee satisfaction and engagement through accessible financial wellness tools.

For Instance, in March 2025, FlexWage emphasized its fully employer-integrated EWA solution that enables HR teams to control access limits, fee structures, and ensure compliance with labor laws. FlexWage’s offering aligns with the subscription revenue model and mobile app delivery channels, targeting large enterprises looking for transparent and compliant earned wage access options, particularly within retail and hospitality industries.

End-User Industry Analysis

In 2024, the Retail & Hospitality segment held a dominant market position, capturing a 34.7% share of the Global Earned wage access providers market. These industries typically have large numbers of hourly, part-time, and seasonal workers, leading to high employee turnover and financial stress. EWA solutions help this workforce by providing timely access to earned wages, which improves employee retention and reduces absenteeism.

Retailers and hospitality businesses leverage EWA as a key benefit to enhance financial wellness, a crucial factor in these labor-intensive sectors. Availability of flexible pay addresses common challenges like unexpected expenses and paycheck-to-paycheck living. The EWA adoption in these sectors is supported by deep integration with payroll systems and the need for competitive employee benefits to attract and keep staff.

For Instance, in May 2025, Wagestream secured €352 million in debt financing to expand its financial well-being and earned wage access solutions across the UK, Europe, and the U.S. Wagestream’s business model focuses on subscription-based revenue with mobile app delivery, serving largely retail and hospitality sectors within large enterprises. Its tailored loans and pay-on-demand offerings demonstrate its commitment to accessible, transparent financial solutions.

Emerging Trends

Integration of earned wage access into mobile and cloud platforms is a prominent trend, offering workers convenient, anytime access to their wages. Nearly 90% of EWA users prefer mobile apps for accessing funds, showing a shift toward seamless digital experiences. Another important trend is embedding wage access within broader financial wellness programs offered by employers, reflecting a holistic approach to employee financial health.

Employers are also incorporating earned wage access into payroll ecosystems that support gig workers and part-time employees who seek flexibility. This broadens the reach of EWA beyond traditional full-time roles and aligns pay with hours worked. The trend supports workforce diversity and helps companies attract and retain a wider talent pool by responding to the financial needs of various employee groups.

Growth Factors

One main factor fueling earned wage access growth is widespread financial stress affecting workers. Surveys find that 88% of full-time employees experience financial strain, making flexible access to wages essential for managing day-to-day expenses.

Providing early wage access helps employees avoid costly credit options and reduces reliance on loans. With 76% of workers stating that cash flow flexibility improves their job satisfaction, EWA becomes a critical benefit.

Technological improvements also boost growth by enabling smoother integration with payroll systems and secure real-time payments. AI-driven analytics enhance risk management and user experience, promoting more frequent use of early wage access. Employers see benefits through higher employee engagement, lower absenteeism, and reduced turnover, all linked to easing financial concerns among staff.

Key Market Segments

By Type of EWA Model

- Employer-Integrated (B2B) Model

- Direct-to-Consumer (D2C or B2C) Model

By Enterprise Size

- Large Enterprises

- SMEs

By Revenue Model

- Flat Fee per Transaction

- Subscription-Based

By Delivery Channel

- Mobile Applications

- Web Portals

- APIs & Embedded Finance

By End-User Industry

- Retail & Hospitality

- Healthcare

- Manufacturing & Warehousing

- Gig Economy & Freelancers

- BPO & Call Centers

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Focus on Employee Financial Wellness

The increasing focus on employee financial wellness is a key driver for earned wage access (EWA) adoption. Many employees face challenges managing day-to-day expenses due to irregular income or unexpected costs. EWA enables workers to access wages they have already earned before the formal payday, offering immediate relief from financial pressures. This helps employees avoid costly short-term credit options and reduces stress linked to cash flow gaps.

Employers benefit from offering EWA because it improves workforce satisfaction and loyalty. Providing early wage access supports staff retention and creates a healthier workplace environment. The adoption is also boosted by technological advances, including cloud payroll systems and mobile platforms, making EWA easy to implement and use for diverse employee bases such as hourly and gig workers.

For instance, in October 2025, DailyPay highlighted how their earned wage access solution boosts employee motivation by allowing workers to access their earned pay before payday. Their platform gives employees flexibility and control, which helps reduce financial stress and improve work engagement. DailyPay’s approach focuses on empowering employees with easier access to wages while supporting employers in retaining motivated staff.

Restraint

Regulatory Complexity and Uncertainty

Regulatory complexity is a major restraint hindering the growth of the earned wage access market. Different countries and even states have varying laws about whether EWA constitutes a form of credit or a payroll advance. This lack of clear regulation creates uncertainty for providers about compliance requirements, such as licensing and fee disclosure. Such ambiguity discourages investment and slows expansion into new markets.

Operational issues further complicate adoption. Delays or glitches in accessing wages, lack of clarity on transaction fees, and limits on withdrawal amounts can reduce consumer confidence. As a result, service providers must navigate a patchwork of legal frameworks while maintaining system reliability to sustain user trust and ensure long-term viability.

For instance, in June 2025, PayActiv registered as an official earned wage access provider in Utah, following new state legislation that clarifies regulatory standards for EWA services. This regulatory move illustrates the challenges EWA companies face with varied laws that impact their operations and expansion. Navigating these complex and evolving compliance environments remains a hurdle for providers like PayActiv aiming to scale responsibly and build trust.

Opportunities

Expanding Financial Inclusion

Earned wage access presents a significant opportunity to enhance financial inclusion. By allowing workers to access earned income instantly, EWA helps those on tight budgets avoid payday loans and other high-cost borrowing. This is particularly valuable for gig workers, part-time staff, and individuals with poor or no credit history who lack access to traditional financial products.

Integration with real-time payment platforms means EWA can be scaled easily and tailored to individual needs. Offering this benefit broadens access to earned wages, reducing financial stress and enabling workers to better manage unexpected expenses. Employers see this as an opportunity to strengthen employee well-being and build a more loyal workforce with increased productivity.

For instance, in July 2025, Rain Technologies announced a seamless integration of its EWA solution within the Workday platform. This embedded functionality enables employers to activate earned wage access quickly and easily while providing employees instant access to wages inside their existing HR systems. The integration exemplifies an opportunity to broaden financial benefits adoption through trusted workplace software, enhancing financial inclusion and employee retention.

Challenges

Avoiding Financial Dependency

One of the biggest challenges in the earned wage access market is preventing financial dependency on early wage withdrawals. While EWA provides immediate relief for cash flow issues, it is not a solution for chronic income insufficiency. Some users may become reliant on repeatedly accessing wages early, causing shortfalls in future pay periods and greater financial instability.

Providers face pressure to design responsible programs with transparent pricing and consumer safeguards. Educating users about the potential risks and monitoring usage patterns is important to avoid turning EWA into a cycle similar to payday lending. Employers must also align EWA offerings within their broader workforce management and compliance frameworks to maintain balance and ensure positive outcomes for employees.

For instance, in November 2025, Earnin expanded from direct-to-consumer earned wage access into B2B payroll services amid intensified scrutiny and consumer group criticism. This transition addresses the challenge of ensuring responsible use and regulatory compliance as the sector faces public and legal pressure. Earnin’s shift reflects how providers must balance ease of access with safeguards to prevent overuse and potential financial dependency among employees.

Key Players Analysis

DailyPay, Earnin, and PayActiv lead the earned wage access providers market with strong adoption across retail, logistics, and service industries. Their platforms enable real-time access to accrued wages, improving employee liquidity and reducing financial stress. Rain Technologies, FlexWage, and Wagestream focus on enterprise partnerships, offering integrated payroll APIs, employer dashboards, and compliance-focused disbursement models.

Refyne, CloudPay NOW, Instant Financial, and Hastee expand the competitive landscape with mobile-first platforms designed for global and remote workforces. Their systems emphasize fast transactions, financial literacy tools, and multi-country payroll integration. Growing demand for flexible pay options is driving adoption across both large enterprises and SMEs.

Other major players contribute to market growth through enhanced risk checks, employer controls, and improved transaction transparency. Advancements in digital payment rails, embedded finance, and payroll automation are strengthening operational efficiency for earned wage access providers. As financial wellness programs gain importance, partnerships between fintech firms, payroll companies, and employers are increasing, supporting broader access to earned wages and promoting long-term workforce stability.

Top Key Players in the Market

- DailyPay

- Earnin

- PayActiv

- Rain Technologies, Inc.

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Other Major Players

Recent Developments

- In July 2025, Wagestream acquired UK pensions technology firm Zippen to expand financial well-being offerings. The move addresses the UK’s large pool of unclaimed pension assets, particularly among low and middle-income workers. Wagestream aims to integrate pensions, salary-linked services, and financial education to help employees manage long-term financial health.

- In April 2025, PayActiv launched Visa+, a real-time payout service allowing users to transfer earned wages securely to Venmo and PayPal without sharing bank details. This innovation enhances financial control and convenience, supporting PayActiv’s role as an employer-sponsored EWA and financial wellness provider with fee-free options.

Report Scope

Report Features Description Market Value (2024) USD 9.57 Bn Forecast Revenue (2034) USD 160.8 Bn CAGR(2025-2034) 32.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of EWA Model (Employer-Integrated (B2B) Model, Direct-to-Consumer (D2C or B2C) Model), By Enterprise Size (Large Enterprises, SMEs), By Revenue Model (Flat Fee per Transaction, Subscription-Based), By Delivery Channel (Mobile Applications, Web Portals, APIs & Embedded Finance), By End-User Industry (Retail & Hospitality, Healthcare, Manufacturing & Warehousing, Gig Economy & Freelancers, BPO & Call Centers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DailyPay, Earnin, PayActiv, Rain Technologies, Inc., FlexWage, Wagestream, Refyne, CloudPay NOW, Instant Financial, Hastee, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Earned Wage Access Providers MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Earned Wage Access Providers MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DailyPay

- Earnin

- PayActiv

- Rain Technologies, Inc.

- FlexWage

- Wagestream

- Refyne

- CloudPay NOW

- Instant Financial

- Hastee

- Other Major Players