Global E-Commerce Payment Market Size, Share, Statistics Analysis Report By Payment Method (Credit Cards, Debit Cards, E-Wallets, Cash-on-Delivery, Others), By Platform (Online Marketplaces, Standalone E-commerce Websites, Social Media Platforms), By Industry Vertical (Retail, Electronics, Fashion, Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148496

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

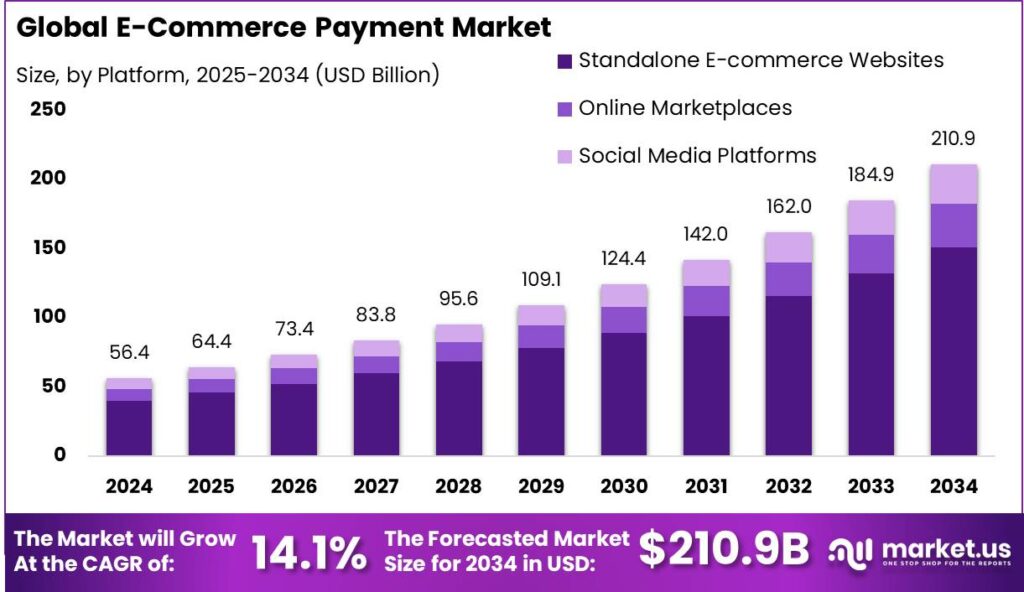

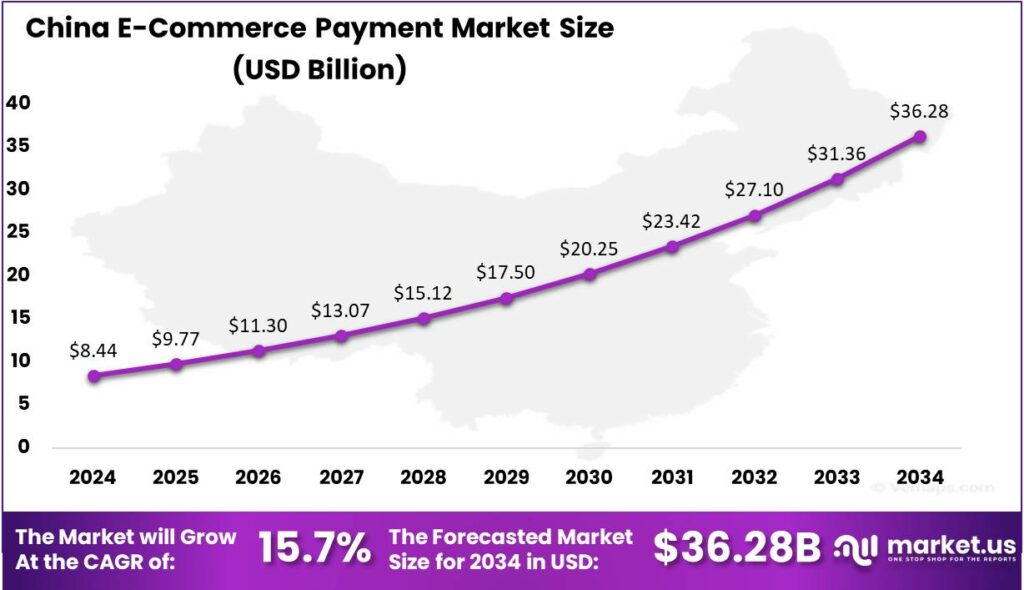

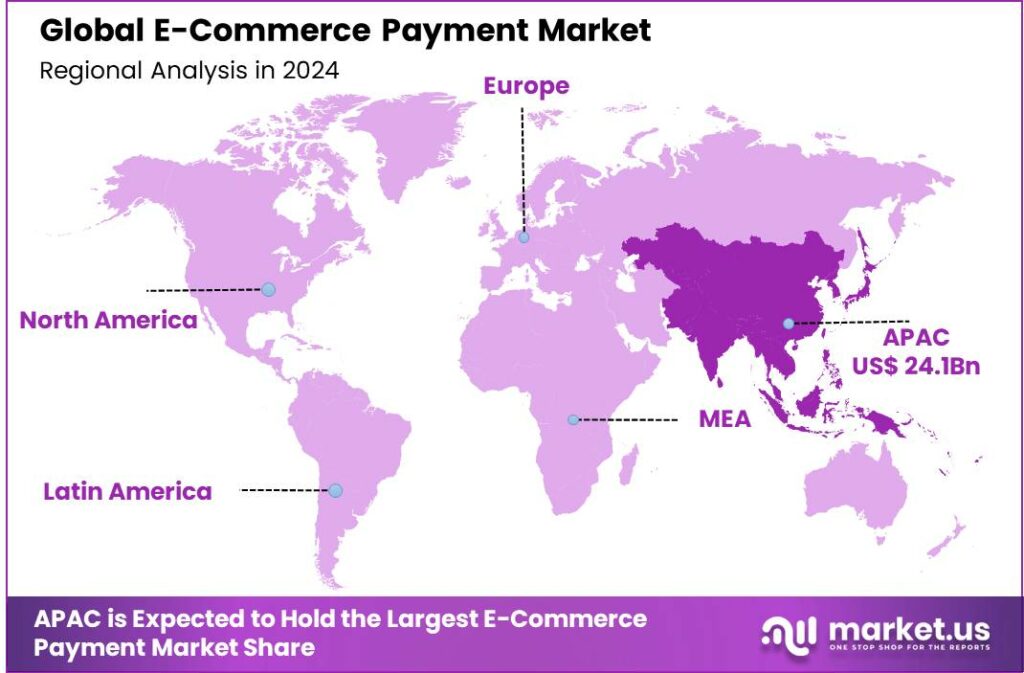

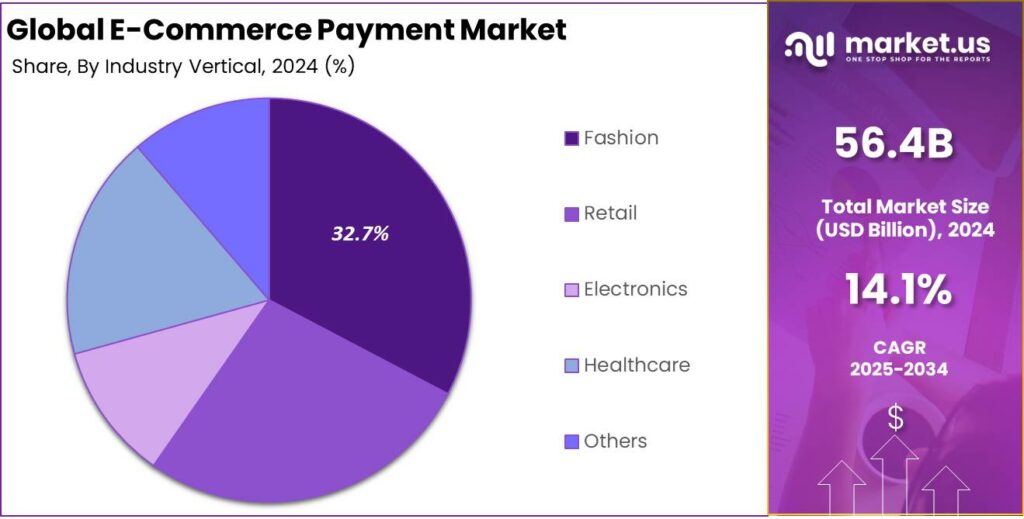

The Global E-Commerce Payment Market size is expected to be worth around USD 210.9 Billion By 2034, from USD 56.4 Billion in 2024, growing at a CAGR of 14.10% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held over 42.8% of the global e-commerce payment market, generating USD 24.1 billion in revenue. Meanwhile, the China e-commerce payment market was valued at USD 8.44 billion, with a projected CAGR of 15.7%.

E-commerce payment refers to the electronic methods used by consumers to pay for goods and services purchased online. These methods include credit and debit cards, digital wallets, bank transfers, and emerging options like Buy Now, Pay Later (BNPL) services. The primary goal of e-commerce payment systems is to facilitate secure, efficient, and seamless transactions between buyers and sellers in the digital marketplace.

Major factors driving e-commerce payment market growth include the rapid penetration of internet services and smartphones, particularly in emerging markets. Consumers are increasingly digitally engaged, shifting from traditional retail to online platforms. The rise of contactless payments, especially after COVID-19, has boosted the use of digital wallets and QR-code-based payments.

The demand for e-commerce payment solutions is on the rise, with consumers seeking fast, secure, and user-friendly payment options. Digital wallets and BNPL services have gained significant traction, especially among younger consumers who value flexibility and convenience.

As reported by Market.us, The global Buy Now Pay Later (BNPL) market is undergoing substantial expansion, supported by the rising demand for flexible and interest-free credit options, especially among younger consumers. In 2024, the market was valued at approximately USD 19 billion, and it is projected to reach nearly USD 115 billion by 2032, growing at a compelling CAGR of 25.3% throughout the forecast period.

According to recent estimates from Ecommerce Tips, global digital payments revenue is expected to reach USD 14.79 trillion by 2027, highlighting the scale and speed of financial digitization. Presently, two-thirds of adults worldwide are actively using digital payments, with adoption in the United States reaching 89%, indicating near-universal usage in developed markets.

The rise of e-commerce continues to fuel this trend, with online retail projected to contribute 24% of total global consumer spending by 2026. A major enabler of this growth is the increasing preference for digital wallets, which now account for 49% of global e-commerce transactions, outpacing credit cards at 21%. In the U.S., PayPal leads with a 36% share, followed by Apple Pay at 20% and Venmo at 16%, reflecting strong consumer trust and ecosystem integration.

Consumers benefit from e-commerce payment systems through speed, ease, and control. One-click payments, secure storage, and instant confirmations enhance satisfaction. Digital payment trails simplify refunds, while encryption, two-factor authentication, and biometrics ensure safer transactions. Flexible options like EMIs and BNPL plans also enable higher-value purchases with less immediate financial strain.

The e-commerce payment sector presents numerous investment opportunities. As the market continues to grow, there is significant potential for investors to support startups and established companies developing innovative payment solutions. Areas such as mobile payments, AI-driven fraud detection, and blockchain-based systems are attracting considerable interest.

Key Takeaways

- The global e-commerce payment market is projected to grow at a CAGR of 14.10% from 2025 to 2034, reaching a size of USD 210.9 billion by 2034, up from USD 56.4 billion in 2024.

- In 2024, the Credit Cards segment held a dominant market position, capturing over 38.9% of the global e-commerce payment market.

- The Standalone E-commerce Websites segment also led the market in 2024, commanding more than 71.6% of the market share. This dominance was fueled by their direct-to-consumer approach, brand control, and enhanced customer experience.

- The Fashion segment was the largest in the global e-commerce payment market in 2024, holding more than 32.7% of the market share.

- Asia-Pacific held a dominant market position in 2024, accounting for over 42.8% of the global market and generating approximately USD 24.1 billion in revenue.

- In 2024, the China E-commerce Payment market was valued at USD 8.44 billion and is expected to grow at a CAGR of 15.7%, underscoring its critical role in the country’s evolving digital commerce landscape.

Business Benefits

Accepting online payments allows businesses to serve customers globally and locally by offering various payment methods like UPI, wallets, and credit cards. This flexibility caters to diverse customer preferences, potentially increasing conversion rates and sales.

According to the OptinMonster article, Digital wallets like PayPal, Apple Pay, and Google Wallet have seen a 40% jump in usage in the past two years. Among millennials and Gen Z, 60% prefer digital wallets for their speed and convenience.

Online payments are processed quickly, often in real-time, ensuring that funds are available sooner than traditional methods like checks. This prompt payment processing aids in better cash flow management and timely reinvestment in business operations.

Digital payment systems automate various processes, reducing the need for manual intervention in tasks like invoicing and payment tracking. This automation leads to time savings, fewer errors, and streamlined operations, allowing businesses to focus on growth. According to Clearly Payments, mobile devices drive over 85% of online transactions in China, with Alipay and WeChat Pay leading the digital payment scene.

China Market Analysis

In 2024, the China E-Commerce Payment market reached an estimated value of USD 8.44 billion, reflecting its critical role in supporting the country’s fast-paced digital commerce environment. This value underscores the growing reliance of Chinese consumers and businesses on seamless digital payment methods, particularly in online retail, mobile shopping, and cross-border transactions.

The market is anticipated to expand at a compound annual growth rate (CAGR) of 15.7% or higher, driven by widespread mobile wallet adoption, government support for cashless transactions, and increasing penetration of smartphones.

Digital payment platforms like Alipay and WeChat Pay have become integral to daily life, enabling everything from grocery shopping to cross-border transactions. Innovations such as QR code payments, biometric authentication, and embedded systems are enhancing convenience and security, driving widespread adoption across urban and rural areas.

China’s evolving regulatory environment supports safer, more transparent e-commerce payments, boosting trust among users and merchants. As digital transformation progresses, demand for scalable, secure, real-time payment solutions is growing, driven by a tech-savvy consumer base. This positions China as a global leader in e-commerce payment innovation.

In 2024, Asia-Pacific held a dominant market position in the global E-Commerce Payment market, capturing more than a 42.8% share and generating approximately USD 24.1 billion in revenue. This regional dominance can be attributed to the region’s massive internet penetration, rising smartphone usage, and the widespread integration of digital wallets into everyday consumer transactions.

Countries like China, India, Japan, and South Korea have witnessed a surge in mobile-first digital commerce, where platforms such as Alipay, WeChat Pay, Paytm, and KakaoPay have become embedded in daily life. These platforms are not just payment tools but have evolved into full-fledged digital ecosystems, offering financial services, shopping, ticketing, and more, all from a single app interface.

Asia-Pacific’s e-commerce payment leadership is bolstered by government initiatives like India’s “Digital India” and China’s financial digitization efforts, boosting trust in digital payments, especially in smaller cities. Additionally, fintech startups in Southeast Asia are expanding micro-finance and e-payment solutions for unbanked populations, driving greater market participation.

Annual mega-sales events in China and India have significantly boosted the region’s payment volume, with record-breaking digital transactions highlighting the efficiency of its e-payment infrastructure. Asia-Pacific’s dominance in this sector is set to continue, driven by a youthful demographic, expanding mobile internet, and growing cross-border commerce, solidifying its position as the global leader in e-commerce payment innovation.

Payment Method Analysis

In 2024, Credit Cards segment held a dominant market position, capturing more than a 38.9% share in the global e-commerce payment market. This dominance is due to the widespread use of credit cards on major online retail platforms, offering flexibility, deferred payments, and rewards, which are highly appealing to urban consumers.

Another contributing factor to the strong performance of credit cards is the high level of trust they enjoy among consumers due to built-in fraud protection mechanisms. Credit card issuers often provide robust consumer protection policies, including chargeback rights and advanced verification technologies such as two-factor authentication, EMV chip encryption, and biometric integrations.

The dominance of the credit card segment is also reinforced by strong institutional support from banks and financial institutions. Many credit card companies have entered into partnerships with leading e-commerce players to offer exclusive discounts, no-cost EMIs, and cashback programs. These promotional tactics continue to increase transaction volumes and encourage repeat usage.

Despite the rise of digital wallets and newer payment methods, credit cards maintain their relevance due to their strong infrastructure, global interoperability, and loyalty programs. In mobile-first economies, many digital wallets are still funded by linked credit cards, ensuring their continued role as a key element in the e-commerce payment ecosystem.

Platform Analysis

In 2024, Standalone E-commerce Websites segment held a dominant market position, capturing more than a 71.6% share, driven by their direct-to-consumer approach, brand control, and enhanced customer experience. Unlike third-party platforms, standalone sites give sellers full control over the interface, promotions, and pricing, which directly contributes to increased consumer trust and repeat transactions.

The growing preference for digital independence among businesses has further strengthened the demand for standalone e-commerce platforms. Companies are increasingly choosing to build their own websites to avoid commission fees charged by online marketplaces and to collect first-party consumer data that can be used for personalized marketing.

Standalone websites offer direct buyer-brand relationships, reducing payment friction and enhancing post-sale services. With flexible payment options like local wallets, international gateways, and subscription billing, businesses improve conversion rates and reduce cart abandonment, driving growth, especially in digitally advanced regions like North America and Asia.

The standalone e-commerce segment is set to maintain its lead with ongoing investments in digital branding, user experience, and secure payment systems. As consumers prioritize brand transparency, data security, and fraud protection, direct shopping on brand-owned platforms is becoming increasingly popular, further boosting loyalty and reducing reliance on intermediaries.

Industry Vertical Analysis

In 2024, the Fashion segment held a dominant market position in the global E-Commerce Payment market, capturing more than a 32.7% share. This leadership is largely driven by the fast-paced growth of online fashion retailing, where consumers are increasingly favoring digital platforms for purchasing clothing, footwear, and accessories.

A key factor behind the dominance of the fashion segment is the high frequency of purchases compared to other verticals. Consumers tend to buy fashion items more regularly than electronics or healthcare products, leading to a higher number of transactions processed through digital payment gateways.

Furthermore, mobile shopping has become the primary channel for fashion purchases, where integrated payment systems such as one-click checkouts and mobile wallets have significantly reduced cart abandonment rates. E-wallets, buy-now-pay-later (BNPL) options, and real-time payments have become particularly popular in this vertical, offering flexibility and convenience for price-sensitive buyers.

International fashion brands and cross-border e-commerce have boosted digital payment activity, with consumers increasingly shopping from global marketplaces using secure, multi-currency payment methods. Payment providers have optimized platforms for smoother, localized transactions, ensuring regional compliance and fraud protection, making fashion e-commerce more reliable and scalable.

Key Market Segments

By Payment Method

- Credit Cards

- Debit Cards

- E-Wallets

- Cash-on-Delivery

- Others

By Platform

- Online Marketplaces

- Standalone E-commerce Websites

- Social Media Platforms

By Industry Vertical

- Retail

- Electronics

- Fashion

- Healthcare

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

The Rise of Mobile Payments and Digital Wallets

The proliferation of smartphones and the increasing availability of internet connectivity have significantly influenced consumer behavior, leading to a surge in mobile payments and digital wallet usage. This shift has been instrumental in driving the growth of e-commerce payments. Mobile payment solutions offer convenience, speed, and enhanced security features, which have resonated well with consumers.

The integration of biometric authentication and tokenization in digital wallets has further bolstered consumer confidence in using these platforms for online transactions. Moreover, the seamless user experience provided by mobile payment applications has reduced friction in the checkout process, thereby increasing conversion rates for e-commerce merchants.

Restraint

Security Concerns and Fraud Risks

Despite the advancements in digital payment technologies, security concerns remain a significant restraint in the e-commerce payment landscape. The increasing sophistication of cyber threats poses challenges to both consumers and merchants, potentially hindering the adoption of online payment systems.

Consumers often express apprehension regarding the safety of their personal and financial information when conducting online transactions. High-profile data breaches and incidents of identity theft have heightened these concerns, leading to reluctance in adopting digital payment methods.

This lack of trust can result in cart abandonment and reduced sales for e-commerce businesses. Merchants, on the other hand, face the dual challenge of protecting customer data and maintaining compliance with regulatory standards.

Opportunity

Expansion into Emerging Markets

Emerging markets present a substantial opportunity for the growth of e-commerce payments. The combination of increasing internet penetration, smartphone adoption, and a growing middle class has created a conducive environment for digital commerce in these regions.

Many consumers in emerging markets have historically been underserved by traditional banking systems. The advent of mobile payment solutions has bridged this gap, offering accessible and convenient financial services.

Government initiatives aimed at promoting digital financial inclusion further bolster this opportunity. Policies that support infrastructure development, regulatory frameworks, and financial literacy programs contribute to a favorable environment for e-commerce payment growth.

Challenge

Complexities of Cross-Border Transactions

Cross-border e-commerce transactions introduce a myriad of complexities that pose significant challenges to payment systems. These challenges encompass regulatory compliance, currency conversion, and logistical considerations. Regulatory frameworks vary across countries, requiring e-commerce businesses to navigate a complex landscape of laws and standards.

Following anti-money laundering (AML) rules, data protection laws, and tax regulations takes careful planning and often requires legal and administrative support. On top of that, currency conversion adds more challenges. Changing exchange rates can impact pricing and profits, while extra fees may discourage international customers from buying.

Emerging Trends

The e-commerce payments landscape is rapidly evolving, driven by technology and changing consumer preferences. Digital wallets like Apple Pay, Google Pay, and PayPal are gaining popularity, offering secure, convenient options. Contactless payments are also on the rise, fueled by health concerns, enabling quick and hygienic transactions. These trends present both opportunities and challenges for businesses.

BNPL services such as Afterpay and Klarna are gaining traction, enabling consumers to make purchases and pay in installments without interest. This trend is particularly appealing to younger demographics seeking flexible payment options.

Some e-commerce platforms are now accepting cryptocurrencies like Bitcoin and Ethereum, catering to a growing market of digital currency users. This provides an alternative payment method and appeals to tech-savvy consumers. Additionally, AI is enhancing shopping experiences by personalizing recommendations, detecting fraud, and streamlining payment processes through machine learning algorithms that analyze purchasing patterns.

Key Player Analysis

The e-commerce payment industry is growing rapidly, driven by the demand for secure, fast, and easy payment solutions.

Apple Pay has revolutionized the digital payment space by turning iPhones and Apple Watches into secure wallets. Apple Pay offers seamless integration with Apple devices, enabling faster, safer payments through Face ID, Touch ID, and tokenization. Its focus on user privacy and simplicity sets it apart. Strong in markets with high Apple product usage, it benefits from strong customer loyalty and adoption.

Adyen is a global payment platform known for its all-in-one solution for merchants. Adyen stands out for supporting multiple payment methods, currencies, and regions through a single system. It powers payments for major brands like Uber, Spotify, and eBay. Its scalability and deep data insights help businesses optimize payments and reduce fraud.

CyberSource, a Visa company, specializes in payment security and fraud management. It offers flexible and secure online payment solutions to businesses of all sizes. CyberSource is distinguished by its advanced risk management tools and global reach. Trusted by large enterprises like airlines, banks, and retailers, it prioritizes security.

Top Key Players in the Market

- Apple Pay

- Adyen

- CyberSource

- Worldpay

- Stripe

- 2Checkout

- PayPal

- Braintree

- Checkout.com

- Square

- Google Pay

- Amazon Payments

- Mercado Pago

- Others

Top Opportunities for Players

- Digital Wallets and Contactless Payments: The adoption of digital wallets and contactless payment methods is accelerating. Consumers increasingly prefer seamless, secure, and convenient payment options, leading to the widespread use of mobile wallets and contactless cards. This trend is expected to continue, offering payment providers opportunities to innovate and expand their services.

- Buy Now, Pay Later (BNPL) Services: BNPL services are gaining popularity, particularly among younger consumers seeking flexible payment options. BNPL solutions boost purchasing power by enabling customers to split purchases into installments, reducing cart abandonment rates. Payment providers can tap into this trend by integrating BNPL options into their platforms.

- Expansion into Emerging Markets: Emerging markets present significant growth opportunities for e-commerce payment providers. The rise of smartphones and internet connectivity in Southeast Asia, Africa, and Latin America is boosting digital payment adoption. Adapting payment solutions to local preferences and regulations can ease market entry and growth.

- Integration of Artificial Intelligence (AI) and Machine Learning: The integration of AI and machine learning technologies is transforming the e-commerce payments landscape. These technologies enhance fraud detection, personalize customer experiences, and streamline payment processes. Payment providers investing in AI capabilities can improve operational efficiency and offer more secure, user-friendly services.

- Real-Time and Cross-Border Payment Solutions: The demand for real-time and cross-border payment solutions is increasing as consumers and businesses seek faster and more efficient transaction methods. Developing infrastructure that supports instant payments and simplifies international transactions can position payment providers as leaders in the global e-commerce ecosystem.

Recent Developments

- In May 2025, Square has introduced the Square Handheld, a compact, all-in-one device powered by its new unified POS app designed to help businesses of any size streamline everything from payments to back-end operations.

- In April 2025, Amazon’s new ‘Buy for Me’ beta lets shoppers use the Amazon app to find and buy products from other retailers when the item isn’t sold on Amazon.

Report Scope

Report Features Description Market Value (2024) USD 56.4 Bn Forecast Revenue (2034) USD 210.9 Bn CAGR (2025-2034) 14.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Payment Method (Credit Cards, Debit Cards, E-Wallets, Cash-on-Delivery, Others), By Platform (Online Marketplaces, Standalone E-commerce Websites, Social Media Platforms), By Industry Vertical (Retail, Electronics, Fashion, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Pay, Adyen, CyberSource, Worldpay, Stripe, 2Checkout, PayPal, Braintree, Checkout.com, Square, Google Pay, Amazon Payments, Mercado Pago, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Pay

- Adyen

- CyberSource

- Worldpay

- Stripe

- 2Checkout

- PayPal

- Braintree

- Checkout.com

- Square

- Google Pay

- Amazon Payments

- Mercado Pago

- Others