Global E-Cigarettes Market Size, Share, Statistics Analysis Report By Product (Disposable, Rechargeable, Modular Devices), By Category (Open, Closed), By Distribution Channel (Online, Offline (Convenience Store, Drug Store, Newsstand, Tobacconist Store, Specialty E-cigarette Store)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133098

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

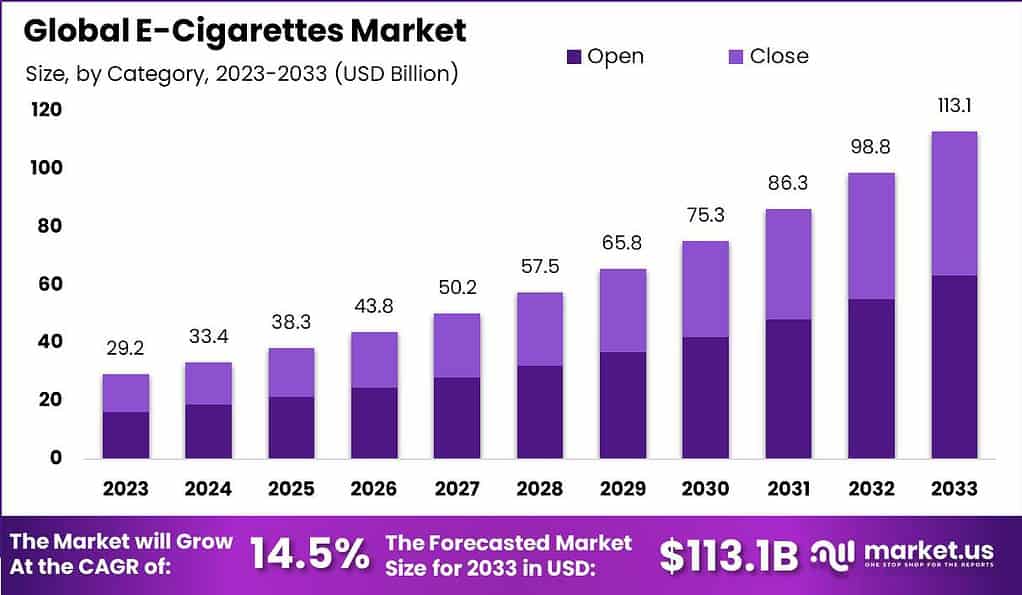

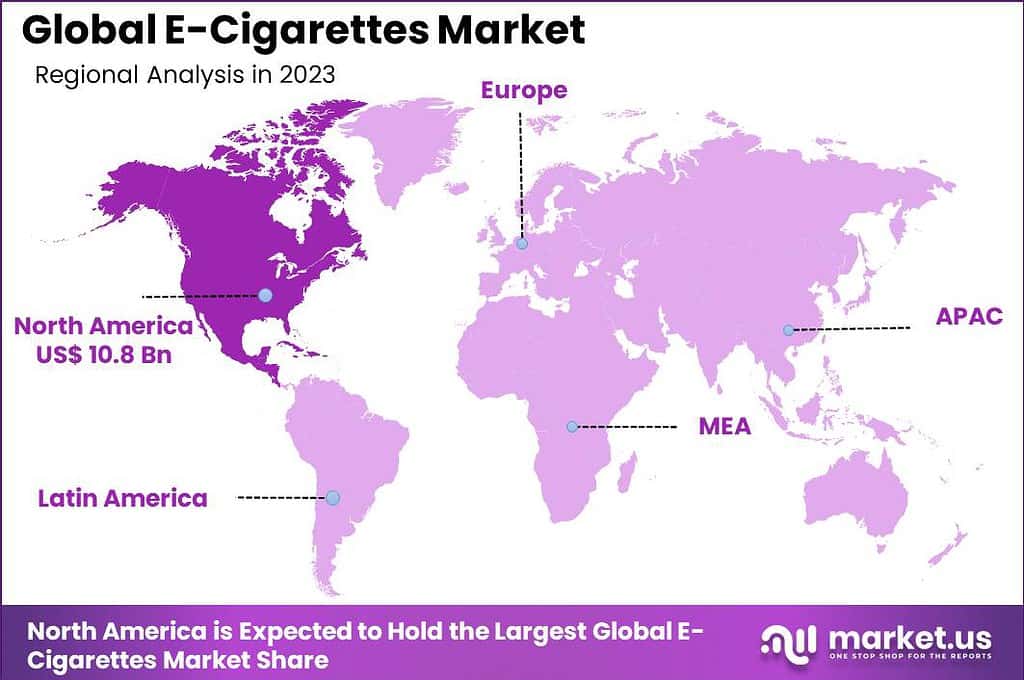

The Global E-Cigarettes Market size is expected to be worth around USD 113.1Billion by 2033, from USD 29.2 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37% share, holding USD 10.8 Billion revenue.

E-cigarettes, also known as electronic cigarettes or vapes, are devices designed to simulate the experience of smoking without burning tobacco. They are typically battery-operated and use a heating element to vaporize a liquid solution, which often contains nicotine along with flavorings and other chemicals. Users inhale the resulting vapor, a practice commonly referred to as vaping.

The e-cigarettes market has seen substantial growth, especially among younger demographics, and is marked by a variety of products such as disposable e-cigarettes, rechargeable devices with prefilled cartridges, and more advanced “mod” systems. Factors driving this market include the perception of e-cigarettes as a less harmful alternative to traditional smoking and their use in smoking cessation, despite mixed evidence regarding their efficacy as quit-smoking aids.

The primary driving factors of the e-cigarettes market include advancements in device technology, increased marketing, and the availability of a wide range of flavored e-liquids. Additionally, social acceptance of vaping over smoking and the perceived lower health risks associated with e-cigarettes compared to traditional tobacco products continue to attract users.

Market demand for e-cigarettes is robust among young adults and former smokers looking for alternatives to traditional tobacco. The market has opportunities for growth through innovation in device technology, expanding flavor offerings, and strategic marketing to adult smokers interested in alternative nicotine delivery systems. The expansion of retail availability and online sales channels further enhances market accessibility.

Technological advancements in e-cigarettes focus on improving the safety, efficiency, and user experience of vaping devices. Innovations include the development of more efficient battery systems, enhanced vapor delivery mechanisms, and smarter features such as Bluetooth connectivity for device monitoring. These advancements aim to provide a better, more customizable vaping experience while potentially reducing exposure to harmful substances.

According to WHO, 88 countries have no minimum age for purchasing e-cigarettes, while 74 countries lack any regulations around these potentially harmful products. E-cigarettes are heavily marketed toward younger audiences, often leveraging social media and influencers.

This strategy is further amplified by the availability of 16,000 enticing flavors, making these products appealing to children and young adults alike. Such a lack of stringent regulations and the widespread appeal of e-cigarettes pose significant public health concerns.

In the United States, as of June 2024, the Centers for Disease Control and Prevention (CDC) reported that nearly 6,300 distinct e-cigarette products were available for purchase. Disposable e-cigarettes, often sold in youth-friendly flavors, have become the most popular choice, capturing 58.1% of total e-cigarette sales in June 2024, equivalent to 12.3 million units.

Between February 2020 and June 2024, disposable e-cigarette sales more than doubled from 26.0% to 58.1%, while prefilled cartridge sales dropped from 73.9% to 41.8%. During this same period, flavored products other than tobacco, including menthol and mint, made up 80.6% (or 17.0 million units) of all e-cigarette sales in June 2024. This high demand for flavored options correlates with the industry’s continued growth, which saw e-cigarette dollar sales reach a total of $488.9 million in June 2024.

Key Takeaways

- The global market for e-cigarettes is projected to experience significant growth, with an anticipated increase from USD 29.2 billion in 2023 to USD 113.1 billion by 2033. This represents a compound annual growth rate (CAGR) of 14.5% over the forecast period from 2024 to 2033.

- In the product category, rechargeable e-cigarettes dominated the market in 2023, holding over 41% of the global share.

- In terms of mechanism, the open system e-cigarettes, which allow for manual refilling of e-liquids, also captured a significant portion of the market in 2023, accounting for more than 56%.

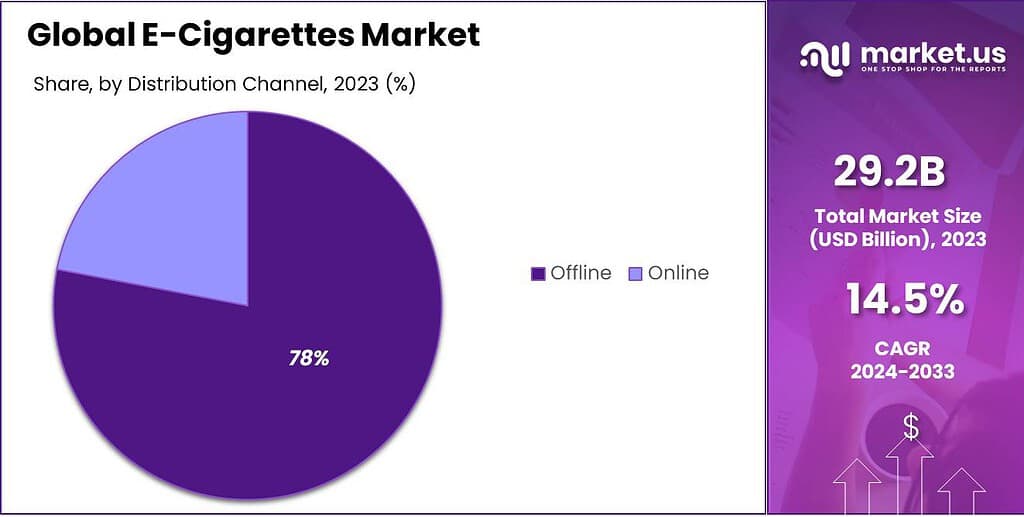

- Distribution channels show a clear trend towards offline sales, with this segment capturing more than 78% of the market in 2023.

- Geographically, North America was the leading market for e-cigarettes in 2023, with over 37% of the global market share.

North America E-Cigarettes Market Size

In 2023, North America held a dominant market position in the e-cigarette industry, capturing more than a 37% share and achieving revenues around USD 10.8 billion. This significant market share is attributed to several key factors:

Firstly, there is a high level of awareness regarding the health risks associated with traditional tobacco use among the North American population. This awareness has driven many smokers to switch to e-cigarettes, which are perceived as a safer alternative due to their lack of tar and other harmful combustion byproducts. The increasing health consciousness among consumers, particularly in the United States and Canada, continues to propel the demand for vaping products.

Secondly, the region benefits from the presence of major e-cigarette companies that actively engage in market expansion through innovative product offerings and aggressive marketing strategies. Companies like Juul Labs, British American Tobacco, and Altria Group have a strong foothold in the market, promoting their brands through social media and online platforms, which further enhances product accessibility and consumer awareness.

Furthermore, North America exhibits a robust retail distribution network for e-cigarettes, including specialty vape shops, online stores, and various other retail outlets, making these products widely available to a diverse customer base. This ease of availability, combined with a broad range of flavored e-cigarette options, appeals to both existing smokers and new users, particularly younger adults who are drawn to novel and varied vaping experiences.

These factors collectively contribute to North America’s leading position in the global e-cigarette market, characterized by a high adoption rate of vaping devices and an ongoing shift towards less harmful alternatives to traditional tobacco products. The market is expected to continue growing, driven by ongoing innovations in e-cigarette technology and flavors, further enhancing the user experience and attracting more consumers in the region

Product Analysis

In 2023, the Rechargeable segment held a dominant market position in the global E-Cigarettes market, capturing more than a 41% share. This segment’s strength is largely due to consumer preferences for cost-effectiveness and sustainability. Rechargeable e-cigarettes offer the advantage of being reused, reducing the need for frequent purchases and thereby aligning with environmentally conscious values. This aspect appeals particularly to regular users who view rechargeable devices as a long-term investment compared to disposable options.

Furthermore, the rechargeable e-cigarettes market benefits from the wide availability of customizable options that cater to individual tastes and preferences in nicotine strength and flavors. This personalization is supported by a robust market of e-liquids and accessories, enhancing user experience and satisfaction. The adaptability of these devices allows users to modify their vaping experience according to their needs, driving the segment’s growth.

The ongoing technological advancements in battery life and atomizer efficiency in rechargeable e-cigarettes also contribute to their dominant market position. Manufacturers are continually innovating to extend battery life and improve the overall performance of the devices, which enhances the convenience and appeal of rechargeable e-cigarettes. These improvements are crucial in maintaining user loyalty and expanding the customer base, which in turn supports the segment’s strong market share.

Moreover, the economic advantage of rechargeable e-cigarettes over the long term, combined with their environmental benefits and technological enhancements, positions this segment for continued growth. Consumers are increasingly aware of the ongoing costs associated with smoking or vaping, and rechargeable models offer a viable, cost-effective alternative that aligns with the global shift towards more sustainable consumption practices.

Category Analysis

In 2023, the Open segment held a dominant market position in the global E-Cigarettes market, capturing more than a 56% share. This segment’s prominence is driven by the flexibility and customization it offers to users. Open system e-cigarettes allow users to refill their devices with e-liquids of their choice, which makes it possible to adjust nicotine levels and explore a variety of flavors.

This capability to personalize the vaping experience attracts a diverse user base, from new entrants to seasoned vapers looking for a more tailored experience. The appeal of open systems is further enhanced by their cost-effectiveness. Since users can purchase e-liquids separately, the ongoing cost of vaping can be significantly lower compared to using pre-filled cartridges or pods found in closed systems.

This economic advantage makes open systems particularly attractive in markets where consumers are more price-sensitive. Additionally, the open segment benefits from a strong community of enthusiasts who value the ability to experiment with different hardware configurations, such as tanks and coils, which can alter vapor output and flavor intensity. This community often shares knowledge and experiences, helping to educate new users and fostering a sense of camaraderie that can enhance customer loyalty and drive segment growth.

Technological advancements in device safety and e-liquid quality also contribute to the robust market share of open systems. Innovations that reduce leakage and enhance battery safety address some of the initial concerns about open systems, making them more appealing to a broader audience. As manufacturers continue to introduce safer and more user-friendly products, the open segment is likely to maintain its dominance in the E-Cigarettes market.

Distribution Channel Analysis

In 2023, the Offline segment held a dominant market position in the global E-Cigarettes market, capturing more than a 78% share. This substantial market share is primarily attributed to the widespread availability and accessibility of e-cigarette products through various brick-and-mortar outlets such as convenience stores, drug stores, and specialty e-cigarette shops.

These venues offer immediate product access and the advantage of direct customer service, which is particularly valuable for consumers new to vaping who require guidance and hands-on experience before making a purchase.

Moreover, the offline distribution channel benefits from the consumer’s ability to physically inspect products, compare different models side by side, and receive immediate assistance in troubleshooting issues. Such tangible shopping experiences help build consumer trust and satisfaction, which are crucial for product loyalty and repeat purchases. This is especially significant in the case of more complex products like modular devices, which may require some explanation or demonstration, ideally suited to an in-store setting.

Additionally, the offline channel’s dominance is supported by the personal interaction that occurs in physical stores. Consumers often rely on recommendations from store personnel, who can provide expertise and personalized advice based on the consumer’s smoking habits and preferences. This level of personalized interaction is something that online channels struggle to match.

Lastly, despite the growth of e-commerce, many consumers still show a preference for buying e-cigarettes from offline stores due to concerns about product authenticity, long shipping times, and the risks of online fraud. Specialty e-cigarette stores, offering a wide variety of products and knowledgeable staff, cater effectively to the enthusiast market, further reinforcing the strength of the offline segment in the E-Cigarettes market.

Key Market Segments

By Product

- Disposable

- Rechargeable

- Modular Devices

By Category

- Open

- Closed

By Distribution Channel

- Online

- Offline

- Convenience Store

- Drug Store

- Newsstand

- Tobacconist Store

- Specialty E-cigarette Store

Driver

Health Consciousness and Technological Advancements

The primary driver of the e-cigarette market is the growing health consciousness among smokers and the technological advancements in e-cigarette devices. As public awareness increases about the harmful effects of traditional tobacco cigarettes, many smokers are turning to e-cigarettes as a less harmful alternative. This shift is largely driven by the perception that e-cigarettes offer a safer way to enjoy smoking without the tar and carcinogens associated with traditional smoking.

The technological enhancements in e-cigarette devices, which improve the user experience by offering features like temperature control, long-lasting batteries, and sleek designs, also play a crucial role. The convenience and customization capabilities of these devices make them appealing to a broad range of consumers, from young adults to long-time smokers looking for a safer option.

Restraint

Stringent Regulations

A significant restraint facing the e-cigarette market is the stringent regulatory environment in various countries. Governments worldwide, including those in the United States, Brazil, and India, have implemented strict regulations regarding the sale, marketing, and use of e-cigarettes. These regulations often include bans on certain flavors, restrictions on nicotine content, and stringent marketing restrictions that limit companies’ ability to reach potential consumers.

Furthermore, incidents of e-cigarettes causing injuries due to battery explosions and concerns about the presence of harmful chemicals have also prompted regulatory bodies to take a cautious approach. This regulatory scrutiny not only affects the availability of these products but also inhibits the growth of the market by creating uncertainties among manufacturers and consumers alike.

Opportunity

Expansion into New Markets

The e-cigarette market presents significant opportunities for expansion into new geographic and demographic segments. Emerging markets in the Asia-Pacific region, particularly countries with large populations and increasing disposable incomes, are ripe for the introduction of e-cigarette products. These regions exhibit a growing openness to tobacco alternatives, driven by an increasing awareness of health issues associated with smoking and a younger population more receptive to new technologies and modes of consumption.

The online sales channel, in particular, offers a robust platform for market expansion due to its ability to reach a broad audience at relatively low costs. Online platforms provide an excellent opportunity for e-cigarette companies to expand their geographic footprint and tap into new customer segments.

Challenge

Health Risks and Public Perception

Despite their growth, e-cigarettes face significant challenges related to health risks and public perception. Although marketed as a safer alternative to traditional cigarettes, e-cigarettes are not without health risks, as they still involve nicotine, a highly addictive substance. Public and regulatory concerns persist regarding the long-term health effects of e-cigarettes, compounded by reports of product malfunctions and injuries.

Additionally, the industry struggles with the perception that it targets younger demographics with flavored products. This has led to public backlash and calls for further restrictions on flavored nicotine products, which could severely limit market growth. Addressing these health concerns and improving the safety and reliability of products are crucial for the sustained growth of the e-cigarette market.

Growth Factors

The e-cigarette market is experiencing robust growth driven by increased awareness of the health risks associated with traditional tobacco smoking. As consumers become more health-conscious, they are turning to e-cigarettes as a perceived safer alternative. This shift is bolstered by technological innovations in e-cigarette design, such as improved battery life, customizable experiences, and sleeker designs that enhance user satisfaction.

Furthermore, the market is benefiting from the broadening demographic appeal, reaching not only long-time smokers but also younger adults seeking alternatives to smoking. The ability to use e-cigarettes in smoke-free areas also adds to their appeal, providing significant market growth potential.

Emerging Trends

One of the most prominent trends in the e-cigarette market is the increasing diversity of product offerings, especially with the rise of flavor varieties. Consumers can choose from a wide range of e-cigarette flavors, from traditional tobacco to exotic fruits, which caters to a broader audience and enhances the appeal of vaping over smoking.

The market has also seen a shift towards more convenient and user-friendly devices, such as pod-based systems that are easy to use and maintain. These systems are particularly popular among new users who value simplicity. Moreover, the integration of technology such as Bluetooth connectivity, which allows users to track their usage and control device settings via smartphone apps, is setting new standards in the industry.

Business Benefits

The e-cigarette market offers numerous business benefits, including high growth potential and diversification opportunities for tobacco companies looking to mitigate the declining sales of traditional cigarettes. The market’s expansion is supported by a growing consumer base that is increasingly aware of the harmful effects of smoking and seeks nicotine products that do not produce tar and other harmful combustion byproducts.

Additionally, the global regulatory landscape, while challenging, also presents opportunities for innovation in product safety and marketing strategies that can further differentiate brands in a competitive market. Companies that navigate these regulations effectively can gain significant first-mover advantages in new markets

Key Players Analysis

One of the leading firm in the market is Juul Labs, known for sleek designs and high nicotine pods. It targets adult smokers and has a global reach. Another prominent player in the market is British American Tobacco. It offers products like Vype, and glo, emphasizing innovation and global market reach.

Top Key Players in the Market

- Altria Group, Inc.

- British American Tobacco

- Imperial Brands

- International Vapor Group

- Japan Tobacco Inc.

- NicQuid

- JUUL Labs, Inc.

- Philip Morris International Inc.

- J. Reynolds Vapor Company

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

- Other Key Players

Recent Developments

- In May 2024, Philip Morris International (PMI) introduced its IQOS device, which heats tobacco instead of burning it, to the U.S. market. This launch followed PMI’s reacquisition of U.S. marketing rights for IQOS from Altria.

- In June 2023, Altria Group, Inc. finalized the acquisition of NJOY Holdings, Inc., a key player in the vaping industry. This strategic move reflects Altria’s efforts to diversify its portfolio and capture a larger share of the rapidly growing e-vapor market. NJOY’s innovative product line, including its popular NJOY ACE and PODS, will now be marketed under NJOY, LLC, a dedicated subsidiary of Altria.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Bn Forecast Revenue (2033) USD 113.1 Bn CAGR (2024-2033) 14.5% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Disposable, Rechargeable, Modular Devices), By Category (Open, Closed), By Distribution Channel (Online, Offline (Convenience Store, Drug Store, Newsstand, Tobacconist Store, Specialty E-cigarette Store) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Altria Group, Inc., British American Tobacco, Imperial Brands, International Vapor Group, Japan Tobacco Inc., NicQuid, JUUL Labs, Inc., Philip Morris International Inc., R.J. Reynolds Vapor Company, Shenzhen IVPS Technology Co., Ltd., Shenzhen KangerTech Technology Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Altria Group, Inc.

- British American Tobacco

- Imperial Brands

- International Vapor Group

- Japan Tobacco Inc.

- NicQuid

- JUUL Labs, Inc.

- Philip Morris International Inc.

- J. Reynolds Vapor Company

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

- Other Key Players