Global Duck Boots Market Size, Share, Growth Analysis By Material (Rubber, Canvas, Leather, Cotton), By End User (Men, Women, Kids), By Sales Channel (Specialty Stores, Multi Brand Stores, Independent Small Retailers, Online Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171194

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

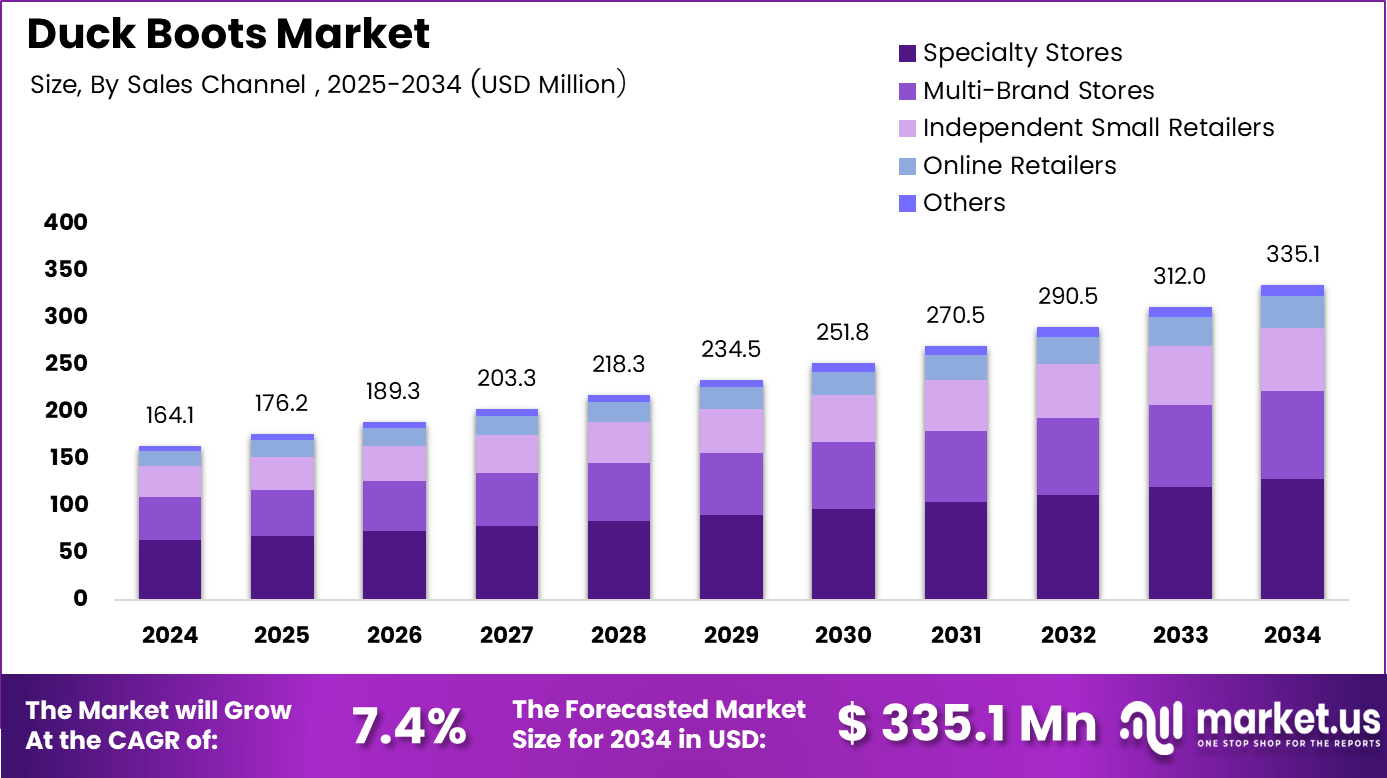

The Global Duck Boots Market size is expected to be worth around USD 335.1 million by 2034, from USD 164.1 million in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Duck Boots market represents a specialized footwear segment focused on waterproof, insulated, and traction oriented boots for wet and cold conditions. From a business perspective, this market serves outdoor recreation, workwear, and casual lifestyle demand. Consequently, utility driven design and seasonal protection define its core value proposition across regions.

The Duck Boots category shows steady expansion as consumers increasingly prioritize durability and weather resilience. Moreover, urban adoption rises as functional footwear integrates into everyday fashion. As a result, demand extends beyond hunting and outdoor use into commuting, travel, and light adventure activities across developed and emerging economies.

Growth momentum further strengthens due to climate variability and higher rainfall frequency in several regions. In parallel, infrastructure investments in outdoor tourism and recreational facilities support footwear consumption. Additionally, safety regulations emphasizing slip resistance in occupational environments indirectly support adoption, especially within logistics, utilities, and municipal workforce segments.

Opportunities increasingly emerge from sustainable material innovation and lightweight sole engineering. Manufacturers emphasize recycled content, improved grip, and reduced shoe weight to enhance comfort. Therefore, eco conscious consumers and performance oriented users converge, expanding addressable demand. E commerce penetration further improves product accessibility and brand visibility in non traditional retail markets.

Government policies promoting sustainable manufacturing and responsible material sourcing also shape long term prospects. Environmental standards on rubber processing and waste reduction encourage adoption of recycled sole materials. Simultaneously, import export regulations on leather sourcing influence supply chains, pushing manufacturers toward alternative fabrics and compliant production processes.

Performance validation plays a subtle but influential role in consumer trust. According to expedition archives, mountaineering teams have relied on advanced rubber sole technology at elevations reaching 28,251 feet. Separately, manufacturer testing disclosures note waterproof insulated designs capable of withstanding temperatures as low as –25°F under extreme conditions.

Material innovation continues shaping differentiation within the Duck Boots market. According to manufacturer sustainability disclosures, eco friendly soles now incorporate at least 30% recycled material while maintaining grip. Meanwhile, lightweight sole engineering innovations highlight designs that are 50% thinner and 30% lighter, improving comfort without compromising stability, according to technical product documentation.

Overall, the Duck Boots market balances functional necessity with evolving lifestyle preferences. With continued investment in sustainable materials, regulatory alignment, and performance enhancement, the segment remains commercially attractive. Consequently, it offers consistent opportunities for product premiumization, seasonal merchandising, and value driven consumer engagement across global footwear markets.

Key Takeaways

- The global Duck Boots Market is projected to reach USD 335.1 million by 2034, expanding from USD 164.1 million in 2024 at a 7.4% CAGR.

- By material, Rubber dominates the market with a leading share of 45.7%, driven by superior waterproofing and durability performance.

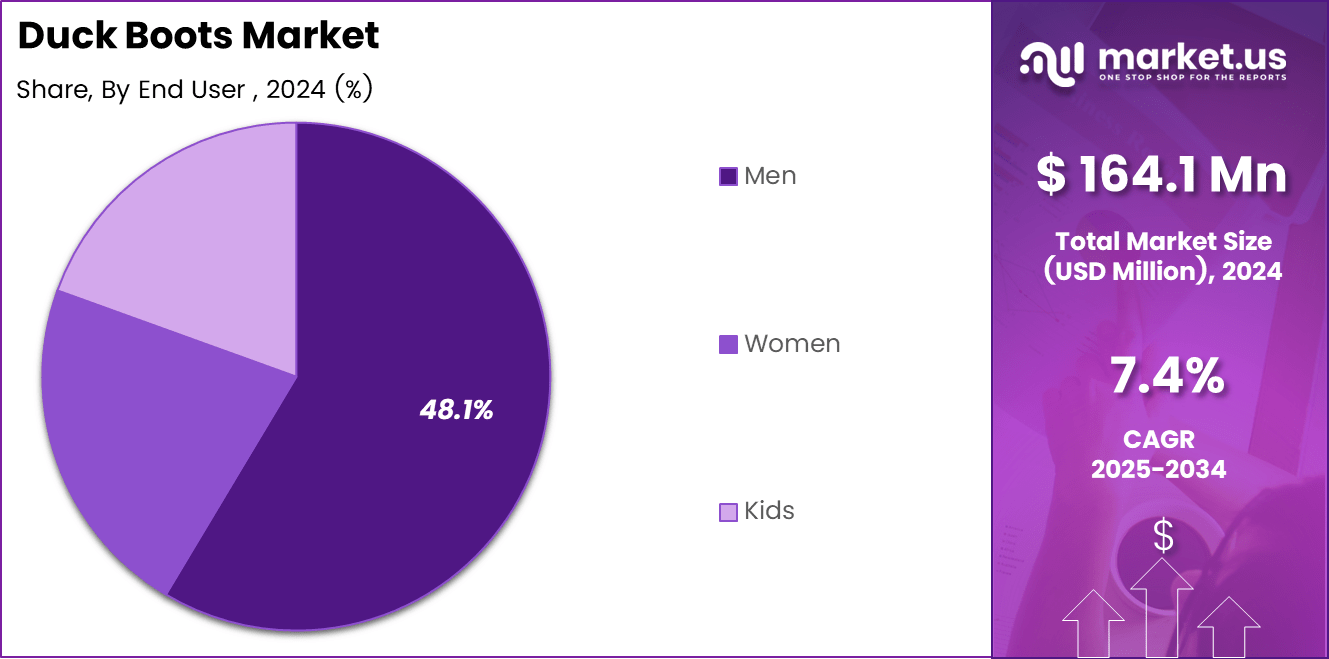

- By end user, Men represent the largest segment with a market share of 48.1%, supported by higher adoption in outdoor and utility footwear use.

- By sales channel, Specialty Stores lead distribution with a share of 38.5%, reflecting strong demand for expert guidance and fit assurance.

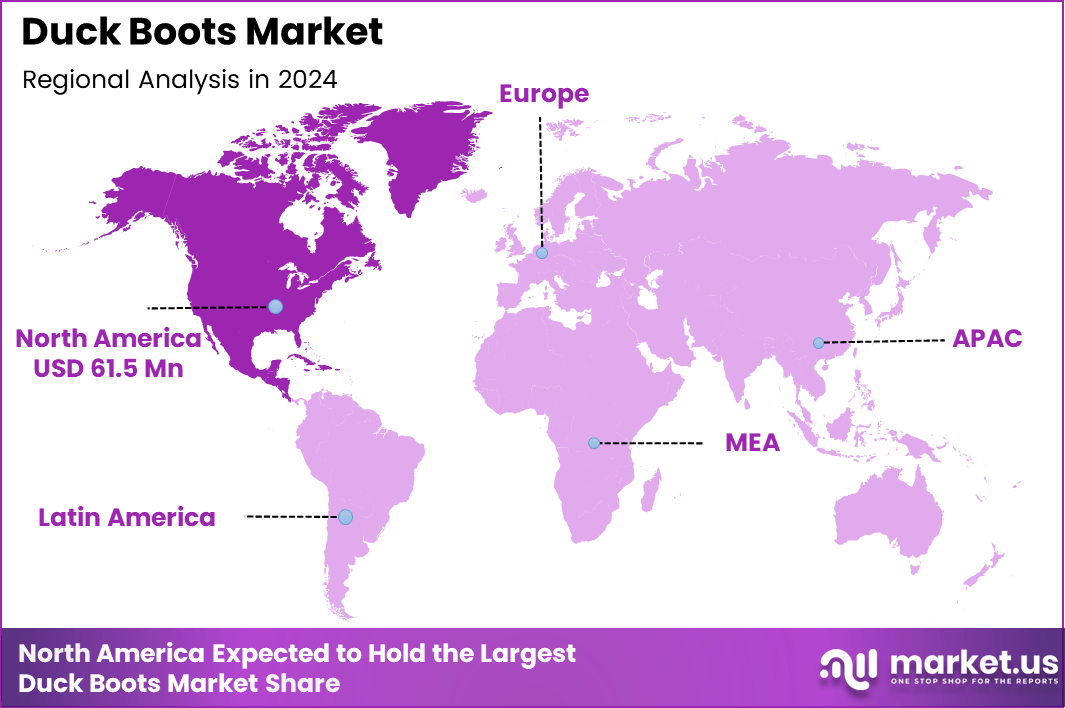

- Regionally, North America dominates the market with a share of 37.5%, accounting for a market value of USD 61.5 million.

By Material Analysis

Rubber dominates with 45.7% share, supporting total market value of 164.1 Mn due to durability and weather resistance.

In 2024, Rubber held a dominant market position in the By Material Analysis segment of Duck Boots Market, with a 45.7% share. Moreover, rubber remains preferred for waterproofing and traction. As a result, manufacturers continue prioritizing rubber soles and shells to meet functional outdoor and cold-weather usage needs.

In contrast, Canvas plays a supporting role by offering lightweight comfort and breathability. Consequently, canvas-based duck boots attract consumers seeking casual wear and transitional weather footwear. Although less protective than rubber, canvas improves style flexibility and supports seasonal collections across lifestyle and urban outdoor segments.

Similarly, Leather contributes premium appeal and long-term durability. Therefore, leather duck boots appeal to consumers valuing aesthetics and longevity. Brands often position leather variants in higher price tiers, aligning craftsmanship with heritage branding while balancing water resistance through treated finishes.

Meanwhile, Cotton-based materials support affordability and comfort. As a result, cotton duck boots cater to entry-level buyers and light-duty use. Although limited in extreme weather performance, cotton blends enhance softness and support everyday wear across milder climates.

By End User Analysis

Men dominate with 48.1% share due to higher adoption in outdoor, workwear, and utility-focused footwear.

In 2024, Men held a dominant market position in the By End User Analysis segment of Duck Boots Market, with a 48.1% share. Additionally, men-driven demand benefits from outdoor recreation, labor-intensive usage, and cold-region mobility needs, reinforcing consistent purchase volumes across functional footwear categories.

Women represent a steadily expanding user base driven by design-focused adaptations. Consequently, brands introduce slimmer profiles, varied colors, and lifestyle-oriented finishes. These changes support broader fashion integration, positioning duck boots as both protective and style-compatible footwear for seasonal wardrobes.

Kids form an important niche segment emphasizing safety and comfort. Therefore, duck boots for children focus on slip resistance, insulation, and easy fastening. Parents increasingly value durable seasonal footwear, supporting stable demand during winter and monsoon periods.

By Sales Channel Analysis

Specialty Stores dominate with 38.5% share due to expert guidance and product-focused retail experiences.

In 2024, Specialty Stores held a dominant market position in the By Sales Channel Analysis segment of Duck Boots Market, with a 38.5% share. Furthermore, these stores provide fit expertise and material explanations, strengthening buyer confidence for functional footwear purchases.

Multi-Brand Stores expand accessibility by offering brand comparisons in one location. As a result, consumers benefit from price and style variety, supporting impulse and replacement purchases during peak seasonal demand cycles.

Independent Small Retailers maintain relevance through localized trust and regional preferences. Therefore, they serve climate-specific demand and community-based buying behavior, especially in semi-urban and rural markets.

Online Retailers continue gaining attention through convenience and wider assortments. Meanwhile, Others, including pop-ups and direct sales, complement distribution by addressing niche and promotional opportunities.

Key Market Segments

By Material

- Rubber

- Canvas

- Leather

- Cotton

By End User

- Men

- Women

- Kids

By Sales Channel

- Specialty Stores

- Multi Brand Stores

- Independent Small Retailers

- Online Retailers

- Others

Drivers

Rising Demand for Waterproof Footwear Drives Duck Boots Market Growth

Rising consumer demand for waterproof footwear remains a core driver of the Duck Boots market. Consumers living in regions with heavy rainfall, snow, and cold temperatures actively seek footwear that keeps feet dry and warm. Duck boots address this need through rubber based lower sections and protective uppers, making them a practical choice for daily use in harsh weather conditions.

The increasing adoption of outdoor lifestyles also supports market growth. Activities such as hiking, camping, fishing, and winter travel encourage consumers to invest in footwear that performs reliably across varied terrains. Duck boots offer traction, insulation, and moisture protection, aligning well with these outdoor usage patterns.

Another key driver is the growing preference for durable and long lasting footwear. Consumers are becoming more value conscious and prefer products that offer extended wear life. Duck boots, known for sturdy construction and reinforced materials, meet this expectation and reduce frequent replacement costs.

Additionally, casual fashion trends now blend utility with everyday wear. Duck boots have transitioned from purely functional footwear to lifestyle products worn in urban settings. Their rugged appearance and versatility allow brands to position them as both practical and fashionable, expanding their consumer base.

Restraints

Seasonal Sales Dependence Limits Duck Boots Market Expansion

Seasonal demand fluctuations act as a major restraint for the Duck Boots market. Sales peak during monsoon and winter months, while warmer seasons often experience reduced demand. This uneven sales cycle creates challenges for inventory planning and revenue consistency across the year.

Higher production costs also restrict market growth. Duck boots typically use a combination of rubber soles and leather or canvas uppers. This hybrid construction increases material and manufacturing expenses, which can raise retail prices and limit affordability for price sensitive consumers.

Limited breathability compared to lightweight casual footwear further restrains adoption. Duck boots focus on waterproofing and insulation, which may reduce airflow during prolonged wear. Consumers in mild or transitional climates often prefer breathable sneakers or casual shoes, reducing everyday usage of duck boots.

These restraints collectively influence purchasing decisions and limit market penetration in non seasonal regions. Manufacturers must carefully balance performance, comfort, and pricing to reduce these limitations and broaden year round demand.

Growth Factors

Product Innovation with Sustainable Materials Creates New Growth Opportunities

Product innovation using sustainable and eco friendly raw materials presents strong growth opportunities for the Duck Boots market. Consumers increasingly prefer footwear made with recycled rubber, plant based coatings, and responsibly sourced leather. Sustainable designs enhance brand appeal and align with evolving environmental values.

Expansion into emerging urban markets also offers growth potential. Cities in regions with monsoon driven climates experience frequent rainfall, creating practical demand for waterproof Sneakers. Urban consumers seek stylish yet functional boots suitable for commuting, driving steady adoption of duck boots beyond traditional outdoor users.

Customization and limited edition collaborations with fashion brands further open new opportunities. Personalized color options, sole patterns, and exclusive designer partnerships attract younger consumers and fashion focused buyers. These strategies help brands differentiate products and command premium pricing.

Together, sustainability, urban expansion, and creative collaborations enable manufacturers to reach new customer segments while strengthening brand positioning and long term market growth.

Emerging Trends

Advanced Insulation and Heritage Design Trends Shape Duck Boots Market

Integration of insulated linings for extreme weather performance remains a key trend. Brands increasingly enhance thermal protection to support usage in sub zero conditions, improving comfort during prolonged outdoor exposure and cold urban commutes.

Minimalist and heritage inspired boot designs are gaining popularity. Consumers appreciate classic silhouettes, neutral colors, and traditional craftsmanship elements. These designs appeal to both older buyers seeking reliability and younger consumers drawn to vintage aesthetics.

Increased focus on slip resistant and ergonomic sole technologies also shapes market trends. Improved traction patterns and cushioned midsoles enhance stability on wet or icy surfaces, addressing safety concerns and expanding functional appeal.

Finally, adoption of recyclable rubber and responsibly sourced leather materials reflects a growing commitment to sustainability. These trends influence purchasing decisions and encourage manufacturers to invest in cleaner production processes while maintaining performance standards.

Regional Analysis

North America Dominates the Duck Boots Market with a Market Share of 37.5%, Valued at USD 61.5 Million

North America represents the leading regional market, supported by cold climate exposure and frequent wet weather conditions across the US and Canada. The region accounted for 37.5% of the Duck Boots Market, reaching a value of USD 61.5 Million, driven by strong seasonal demand and outdoor lifestyle adoption. Consumers increasingly favor waterproof and insulated footwear for daily commuting and recreational use. Stable retail infrastructure and high purchasing power further reinforce regional dominance.

Europe Duck Boots Market Trends

Europe shows steady demand for duck boots, particularly in Northern and Western countries experiencing prolonged rainy seasons. Growing interest in durable, weather resistant footwear for urban use supports market expansion. Sustainability focused purchasing behavior also encourages demand for long lasting and repairable footwear products. Seasonal tourism and outdoor walking culture contribute to consistent regional uptake.

Asia Pacific Duck Boots Market Trends

Asia Pacific is emerging as a growth oriented region due to rising urbanization and increasing exposure to Western fashion influences. Expanding middle class populations and higher awareness of functional footwear drive gradual adoption. Demand remains concentrated in colder and high rainfall zones, supported by growing e commerce penetration. The region shows improving acceptance of utility focused casual footwear.

Middle East and Africa Duck Boots Market Trends

The Middle East and Africa market remains niche, with demand primarily linked to travel, leisure, and imported fashion consumption. Limited cold weather conditions restrict mass adoption, yet premium and utility footwear sees selective demand. Growth is supported by international tourism and expanding retail access. Urban consumers show interest in functional fashion for overseas travel use.

Latin America Duck Boots Market Trends

Latin America demonstrates moderate growth potential, supported by seasonal rainfall and increasing outdoor activity participation. Urban consumers increasingly seek durable footwear suited for wet conditions. Expanding retail availability and improving brand awareness support gradual market penetration. Demand is mainly concentrated in southern and coastal regions with variable climates.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Duck Boots Company Insights

From an analyst viewpoint, the global Duck Boots Market in 2024 reflects a balance between functional performance and lifestyle positioning. Leading brands focus on waterproof construction, insulation, and traction while aligning designs with everyday wear trends. Consequently, established outdoor footwear players continue strengthening brand equity, distribution reach, and material innovation to sustain competitive advantage.

Timberland remains a benchmark player due to its strong heritage in rugged footwear and outdoor authenticity. The company emphasizes durable materials and weather-ready designs, which resonate with consumers seeking reliability and brand trust. As a result, Timberland sustains strong visibility across both utility-driven and lifestyle-oriented duck boot demand.

Bogs Footwear differentiates through comfort-led waterproof boots designed for extreme and wet conditions. The brand prioritizes insulation, easy pull-on designs, and all-weather usability. Consequently, Bogs attracts consumers focused on functional performance, particularly for work, farming, and cold-weather daily use.

Columbia Sportswear leverages its broad outdoor apparel ecosystem to position duck boots as part of an integrated cold-weather solution. The company emphasizes lightweight insulation and traction technologies aligned with active outdoor lifestyles. Therefore, Columbia benefits from cross-category brand loyalty and strong seasonal demand cycles.

Lacrosse Footwear focuses on premium performance and durability, especially for hunting, work, and rugged outdoor environments. The brand’s emphasis on heavy-duty construction and weather resistance supports its appeal among professional and utility-driven users. As a result, Lacrosse maintains a solid niche presence within the duck boots segment.

Overall, these players shape market dynamics through material innovation, performance differentiation, and brand-led storytelling. Their strategies highlight how functional footwear continues evolving into a versatile category, supporting steady growth and long-term consumer relevance within the global Duck Boots Market.

Top Key Players in the Market

- Timberland

- Bogs Footwear

- Columbia Sportswear

- Lacrosse Footwear

- North Face

- Xtratuf

- Ugg

Recent Developments

- In Dec 10, 2024, Salehe Bembury’s Crocs Cypress Duck Boot officially made its debut, launching in the aptly named “Mallard” colorway. The release highlights Bembury’s continued influence in footwear design, blending outdoor inspired aesthetics with Crocs’ distinctive comfort focused construction.

Report Scope

Report Features Description Market Value (2024) USD 164.1 million Forecast Revenue (2034) USD 335.1 million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Rubber, Canvas, Leather, Cotton), By End User (Men, Women, Kids), By Sales Channel (Specialty Stores, Multi Brand Stores, Independent Small Retailers, Online Retailers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Timberland

- Bogs Footwear

- Columbia Sportswear

- Lacrosse Footwear

- North Face

- Xtratuf

- Ugg