Global Drum Brake Shoe Market Market Size, Share, Growth Analysis By Classification (Automotive OEM Industry, Automotive Aftermarket Industry), By Application (Automotive, Motorcycle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166670

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

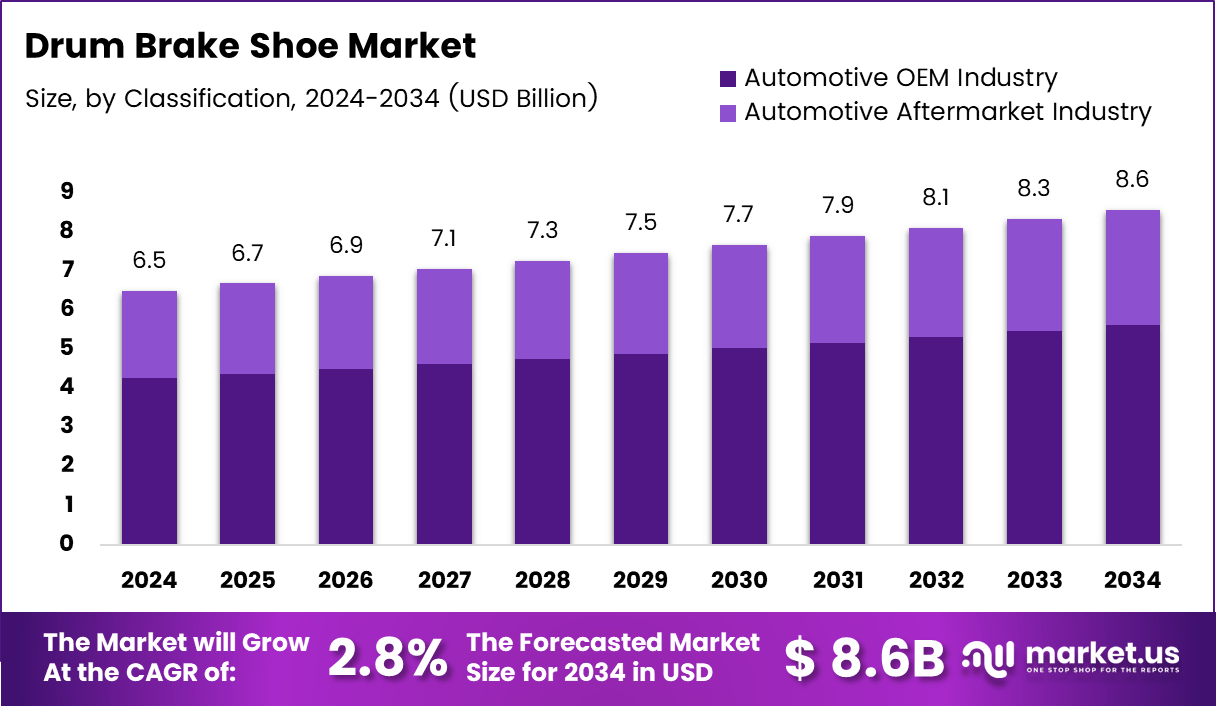

The Global Drum Brake Shoe Market size is expected to be worth around USD 8.6 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 2.8% during the forecast period from 2025 to 2034.

The drum brake shoe market represents a critical component category supporting commercial vehicles, passenger cars, and speciality fleets across multiple global regions. The market maintains relevance because drum systems deliver durability, simple maintenance, and high load-bearing capability, strengthening adoption across heavy vehicle and medium-duty vehicles seeking consistent stopping power.

Moving forward, the market observes accelerating growth as logistics demand rises, e-commerce shipments increase, and vehicle replacement cycles shorten worldwide. Furthermore, emerging regulations on vehicle safety standards encourage regular brake shoe replacement, enhancing aftermarket revenues. Increasing fleet modernisation also drives sustained procurement, particularly in regions implementing stricter inspection norms and enhanced performance certifications.

In addition, government investment in road infrastructure, freight corridors, and rural mobility reinforces commercial vehicle usage, creating continuous demand for brake components. Manufacturers benefit as transport authorities upgrade safety testing frameworks and encourage the use of standardised braking systems. This transition supports steady long-term consumption within both OEM and aftermarket channels.

Moreover, opportunities strengthen as electrified commercial vehicles gradually integrate hybrid braking architectures that still retain drum brake assemblies on rear axles for cost and thermal benefits. This enhances replacement potential and expands product penetration across new platforms. Growing attention toward cost-efficient materials further encourages innovation in friction formulations and lightweight metal structures.

According to the Federal Motor Carrier Safety Administration (FMCSA), more than 90% of fleets in the US rely on S-cam type drum brakes across tractors, straight trucks, and trailers, reinforcing dominant adoption. Additionally, according to the US Department of Energy LCA research, a life-cycle assessment for 16.5 × 8.625-inch drum-brake systems quantified environmental impacts covering energy consumption and GHG emissions.

These verified statistics strengthen the market outlook because high penetration of S-cam brakes ensures recurring replacement demand, while LCA insights support sustainability-aligned material development. As regulatory bodies emphasise lifecycle efficiency, drum brake shoes gain renewed focus across commercial sectors, improving growth prospects and reinforcing their strategic importance in long-term fleet maintenance programs.

Key Takeaways

- The Global Drum Brake Shoe Market is valued at USD 6.5 billion in 2024 and projected to reach USD 8.6 billion by 2034.

- The market grows at a steady 2.8% CAGR from 2025 to 2034.

- The Automotive OEM Industry leads the classification segment with a dominant 65.5% share.

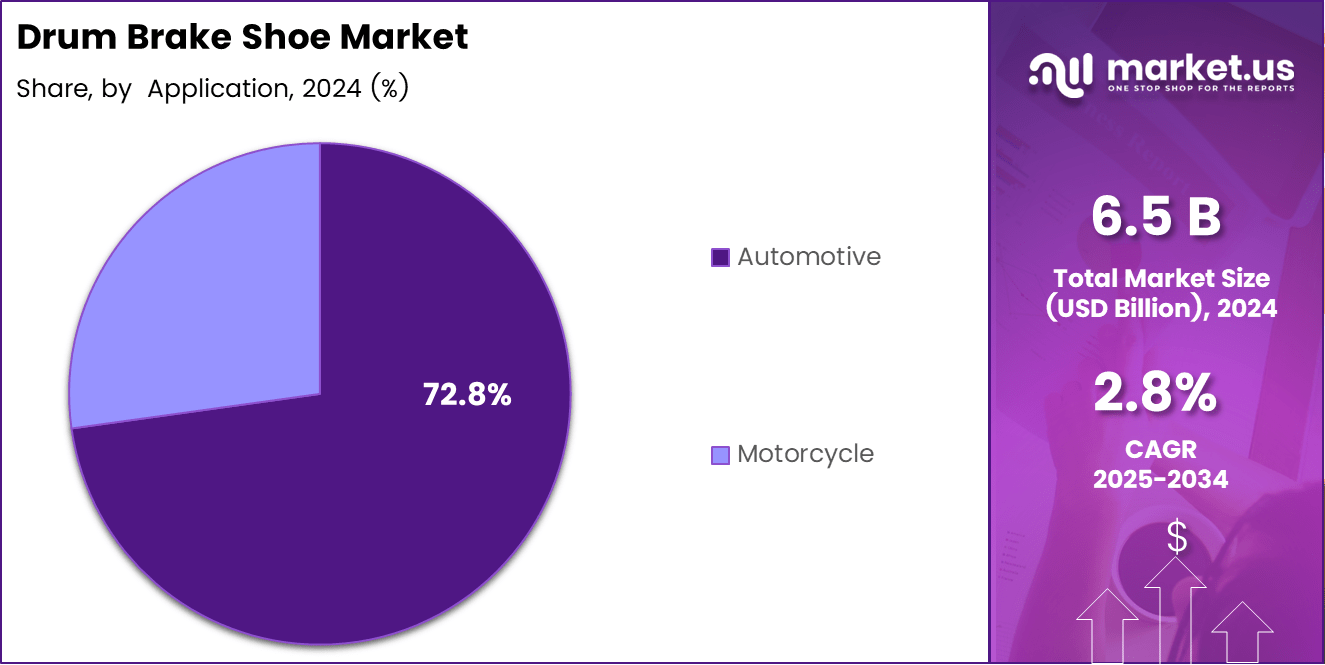

- The Automotive segment dominates application share with 72.8% in 2024.

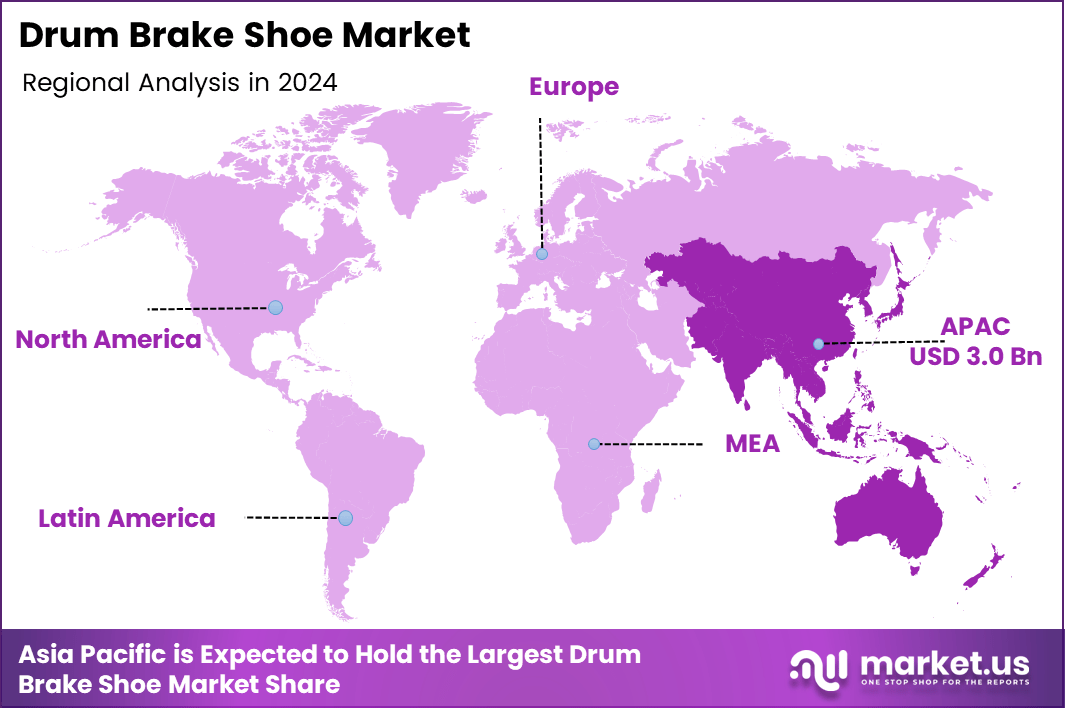

- Asia Pacific remains the largest regional market, holding 46.2% valued at USD 3.0 Billion.

By Classification Analysis

The automotive OEM Industry dominates with 65.5% due to consistent integration of factory-fitted braking components.

In 2024, the Automotive OEM Industry held a dominant market position in the By Classification Analysis segment of the Drum Brake Shoe Market, with a 65.5% share. This segment advanced as manufacturers increasingly prioritised standardised braking components in new vehicles. OEM-installed drum brake shoes offered higher reliability, stronger compatibility, and consistent performance across models. The demand strengthened further as vehicle production expanded across developing economies, encouraging automakers to maintain cost-efficient yet durable braking systems. The strong adoption of OEM-grade materials promoted longer component life, reinforcing the segment’s leading role.

The Automotive Aftermarket Industry segment expanded steadily as vehicle owners preferred timely brake replacements to maintain safety and efficiency. The aftermarket sector advanced due to rising vehicle maintenance cycles and frequent brake servicing needs, especially in older vehicles. Affordable replacement parts, wide availability, and competitive pricing helped strengthen the aftermarket’s relevance. Growing access to independent workshops also contributed to rising brake shoe replacement demand, ensuring this segment remained an essential contributor.

By Application Analysis

Automotive dominates with 72.8% driven by high installation rates across passenger and commercial vehicles.

In 2024, the Automotive segment held a dominant market position in the By Application Analysis segment of the Drum Brake Shoe Market, with a 72.8% share. The application grew as drum brakes remained widely used across compact cars, light commercial vehicles, and utility-based transportation fleets. Cost-effective functioning, strong braking force, and ease of maintenance allowed manufacturers to continue adopting drum brake shoes for rear-wheel assemblies. The segment benefited from rising vehicle sales and consistent demand for economical braking systems.

The Motorcycle segment progressed as two-wheeler manufacturers incorporated drum brake shoes in budget and mid-range models. Motorcycles used drum brakes for rear wheels due to their lower maintenance needs and high durability under daily usage. Increased two-wheeler ownership in urban and semi-urban regions supported steady demand for replacement brake shoes. The affordability and simple servicing of drum brake shoes further reinforced usage across commuter bikes, strengthening this segment’s market contribution.

Key Market Segments

By Classification

- Automotive OEM Industry

- Automotive Aftermarket Industry

By Application

- Automotive

- Motorcycle

Drivers

Rising demand for heavy commercial vehicles in rural and off-highway regions drives market growth

Rising demand for heavy commercial vehicles in rural and off-highway regions supports the steady expansion of the drum brake shoe market. More trucks, tractors, and construction vehicles operate in rough terrains where durability matters the most. These vehicles rely on drum brake shoes because they tolerate dust, mud, and moisture better than many alternative systems. As rural transport networks improve and agricultural activities increase, the need for reliable braking components becomes stronger, encouraging manufacturers to focus on sturdier designs and long-life materials.

The increased adoption of low-maintenance braking components for fleet operations also strengthens market growth. Fleet owners in logistics, mining, and construction prefer brake systems that require minimal servicing to reduce downtime and running costs. Drum brake shoes meet this requirement because they provide longer replacement cycles and consistent performance under heavy loads. This shift toward cost-effective maintenance strategies drives continuous demand from both large and mid-sized fleet operators.

The expansion of aftermarket servicing networks across developing economies further accelerates market development. Growing access to repair centers, local workshops, and authorized service providers makes drum brake shoe replacements more convenient and affordable for vehicle owners. As more commercial vehicles age and enter the replacement cycle, the aftermarket segment becomes a major revenue contributor, reinforcing overall market growth.

Restraints

Rapid Shift Toward Disc-Brake Systems Restrains Market Growth

The rising adoption of disc-brake systems across new vehicle platforms acts as a major restraint for the drum brake shoe market. Many automakers are increasingly choosing disc brakes because they offer stronger stopping power, better water resistance, and improved performance in fast-moving traffic environments. This shift reduces the use of drum brake shoes, especially in mid-range and premium vehicles. As more models transition to disc-brake configurations, the demand for traditional drum brake components is expected to slow down in both OEM and aftermarket channels.

Another significant restraint comes from the limited heat-dissipation capabilities of drum brake shoes during high-performance or continuous braking conditions. Drum systems trap more heat due to their closed structure, which weakens braking efficiency and increases the chances of wear. This limitation makes them less suitable for vehicles that operate under heavy loads, high speeds, or demanding driving conditions. As consumer expectations for safety and performance increase, more manufacturers prefer braking technologies that can handle higher thermal stress. This performance gap further narrows the use of drum brake shoes, restricting their market expansion in the long term.

Growth Factors

Growing Role of AI-Driven Predictive Vehicle Diagnostics Creates New Opportunities

Artificial intelligence (AI) is becoming a powerful tool in modern vehicles, and its growing role is creating valuable opportunities for automotive operating systems. AI-driven predictive diagnostics allow vehicles to detect and address issues before they occur, improving on-road safety and reducing unexpected repair costs. Operating systems that support intelligent monitoring and real-time analysis are expected to gain strong traction.

Cloud-native automotive OS platforms represent another major opportunity. As automakers shift more functions to the cloud, systems that provide seamless connectivity and rapid data processing will become increasingly essential. Cloud-based OS environments enable quicker updates, seamless feature integration, and improved overall vehicle performance, making them increasingly attractive.

The expansion of autonomous Mobility-as-a-Service (MaaS), such as self-driving taxis and shared autonomous shuttles, also fuels new demand. These vehicles rely on operating systems with high stability, strict security, and strong processing capabilities to ensure safe and consistent operation in dynamic environments.

Additionally, the rise of open-source automotive software frameworks is opening new pathways for faster innovation. By reducing development complexity and cost, open-source platforms allow manufacturers to build scalable and customizable OS solutions, supporting the rapid evolution of software-defined vehicles.

Emerging Trends

Adoption of Eco-Friendly Brake Friction Formulations Drives Market Growth

The adoption of eco-friendly, copper-free brake friction formulations is a major trend shaping the drum brake shoe market. Automakers and suppliers are moving toward environmentally safe materials because several regions have introduced rules to reduce copper pollution from brake dust. This shift encourages manufacturers to develop advanced friction mixes that offer the same stopping performance while supporting cleaner mobility goals.

Another important trend is the rising integration of automated manufacturing systems in brake shoe production. Companies are investing in robotics, precision moulding, and automated inspection tools to improve accuracy and reduce human error. This approach increases production efficiency and ensures that brake shoes meet the strict quality standards required by global vehicle manufacturers. Automation also helps suppliers manage high-volume orders more consistently.

The growing trend of modular brake assemblies is also gaining attention. These modular designs let technicians replace parts quickly without removing the entire brake system. This improves service convenience and reduces downtime for commercial vehicles and passenger cars. Fleet operators prefer modular solutions because they lower servicing costs and extend the life of drum brake systems. As easy servicing becomes a priority, modular assemblies continue to attract strong demand across developing markets.

Regional Analysis

Asia Pacific Leads the Drum Brake Shoe Market with a Market Share of 46.2%, Valued at USD 3.0 Billion

Asia Pacific represents the most dominant regional market due to its large automotive manufacturing base and strong demand from commercial and two-wheeler segments. In 2024, the region accounted for a substantial 46.2% share, reaching USD 3.0 billion, supported by rapid vehicle production in China, Japan, and Southeast Asia. Expanding aftermarket servicing networks and increasing the adoption of cost-effective braking components further strengthen the region’s leadership. Urbanisation and a growing commercial fleet sector continue to boost replacement demand for drum brake shoes.

North America Drum Brake Shoe Market Trends

North America shows steady growth driven by a strong vehicle maintenance culture and rising demand for replacement brake components. The region benefits from an established automotive aftermarket and higher adoption of advanced friction materials compliant with environmental regulations. Commercial trucks and off-road vehicles contribute significantly to the recurring replacement cycle, supporting stable market expansion.

Europe Drum Brake Shoe Market Trends

Europe’s market is shaped by strict braking safety regulations and a mature automotive manufacturing landscape. Demand remains consistent across passenger cars, speciality vehicles, and light commercial fleets. Sustainability-focused reforms and preference for low-copper brake materials continue to accelerate product upgrades, supporting long-term market stability.

Middle East & Africa Drum Brake Shoe Market Trends

The Middle East & Africa region experiences growing demand due to expanding commercial transport, infrastructure development, and the rising use of utility vehicles. A large share of older vehicle fleets boosts replacement rates for drum brake shoes. Economic growth in GCC nations further contributes to increased aftermarket activity.

Latin America Drum Brake Shoe Market Trends

Latin America displays gradual growth supported by vehicle parc expansion and increasing adoption of budget-friendly braking components. Countries such as Brazil and Mexico drive most of the regional demand through their strong automotive aftermarket networks. Rising urban mobility and aging vehicles continue to support replacement-driven market opportunities.

U.S. Drum Brake Shoe Market Trends

The U.S. market is driven by a high volume of pickup trucks, SUVs, and commercial vehicles that continue to use drum brake systems, particularly in rear-wheel configurations. A well-established aftermarket and strong consumer preference for routine maintenance sustain product demand. Technological improvements in wear-resistant formulations also support replacement cycles across fleet operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Drum Brake Shoe Market Company Insights

The global Drum Brake Shoe Market in 2024 reflects a stable competitive landscape shaped by material innovation, expanding aftermarket demand, and rising adoption of environmentally safer friction technologies.

BOSCH maintains a strong industry position due to its broad automotive ecosystem and consistent investment in advanced braking materials designed for longer service life. Its presence across global distribution channels strengthens reliability perceptions among fleet operators and service centers.

Nisshinb continues to benefit from its technical precision and strong foothold in Asian automotive manufacturing. Its focus on friction stability and alignment with copper-free standards supports growing demand from regional OEMs.

Zhuhai Glory Friction Material expands its influence through cost-efficient production and rapid scaling capabilities, serving both domestic and international aftermarket needs. The company’s portfolio increasingly emphasizes abrasion-resistant formulations, improving durability in commercial vehicle applications.

ZF Aftermarket remains well-positioned due to its extensive service network and engineering expertise in braking components that align with global safety regulations. Its strong aftermarket support structure helps strengthen brand preference across Europe and North America.

Tenneco maintains steady momentum by enhancing its friction product lines and supporting heavy-duty vehicle segments through advanced wear-resistant materials. Its experience in high-load braking environments ensures continued aftermarket relevance.

MAT Holdings leverages its vertically integrated operations to provide cost-effective brake shoe solutions with consistent quality, especially across developing markets. Akebono maintains a technology-driven strategy, developing noise-reducing friction compounds favored in mid- to high-end passenger vehicles.

Sangsin Brake strengthens its market share through optimized manufacturing and demand from Asian passenger and commercial vehicle fleets. Brembo upholds premium standards, focusing on performance-oriented friction products suitable for specialized applications. ADVICS remains influential through its engineering precision and integration with leading OEM platforms, supporting global adoption of reliable drum brake solutions.

Top Key Players in the Market

Top Key Players

- BOSCH

- Nisshinb

- Zhuhai Glory Friction Material

- ZF Aftermarket

- Tenneco

- MAT Holdings

- Akebono

- Sangsin Brake

- Brembo

- ADVICS

Recent Developments

- In December 2024, Accenture agreed to acquire AOX, a German embedded-software company focused on advanced automotive system architectures. This move strengthens Accenture’s capabilities in next-generation vehicle software and embedded engineering services.

- In January 2025, Red Hat announced that its “In-Vehicle Operating System” achieved mixed-criticality functional-safety certification toward ISO 26262 ASIL-B. This certification milestone positions Red Hat as a key player in secure, safety-compliant automotive OS platforms.

- In June 2025, NXP Semiconductors completed the acquisition of TTTech Auto, a leader in safety-critical automotive middleware and system solutions. The integration aims to accelerate NXP’s roadmap for reliable, scalable platforms for automated and software-defined vehicles.

- In April 2025, Marvell Technology, Inc. announced a US $2.5 billion agreement to sell its Automotive Ethernet business to Infineon Technologies AG. The deal enhances Infineon’s portfolio for high-performance automotive connectivity while allowing Marvell to refocus on core markets.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Classification (Automotive OEM Industry, Automotive Aftermarket Industry), By Application (Automotive, Motorcycle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BOSCH, Nisshinb, Zhuhai Glory Friction Material, ZF Aftermarket, Tenneco,

MAT Holdings, Akebono, Sangsin Brake, Brembo, ADVICSCustomization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BOSCH

- Nisshinb

- Zhuhai Glory Friction Material

- ZF Aftermarket

- Tenneco

- MAT Holdings

- Akebono

- Sangsin Brake

- Brembo

- ADVICS