Global Drippers Market Size, Share Analysis Report By Drippers Type (Inline NPC, Inline PC, Online NPC, Online PC), By Material Type (PE/HDPE, Silicone/Elastomer, PVC, Biodegradable, Others), By End User (Commercial Farms, Small And Marginal Farmers, Greenhouse Operators, Nurseries, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174746

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

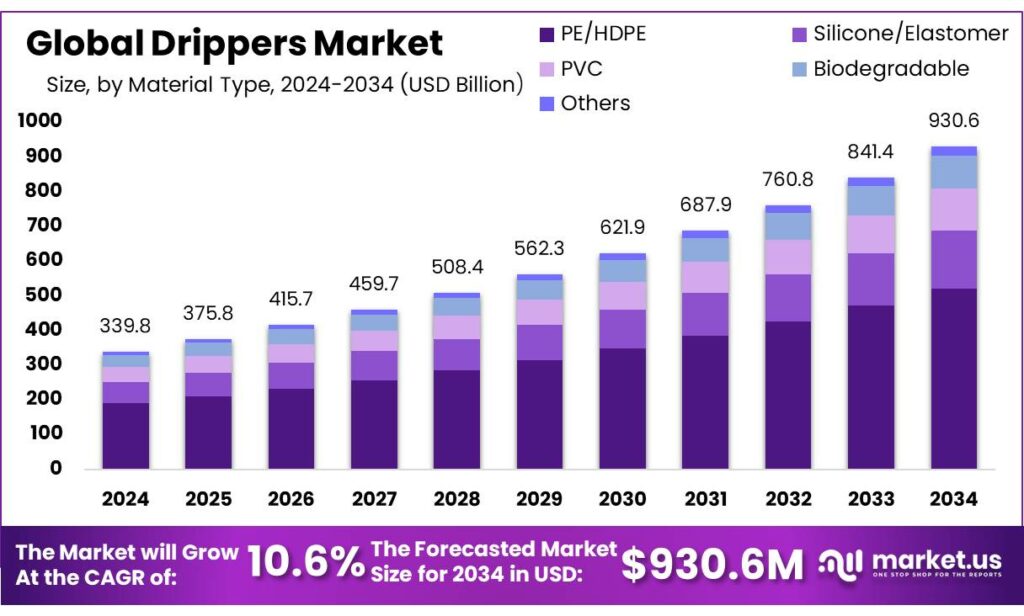

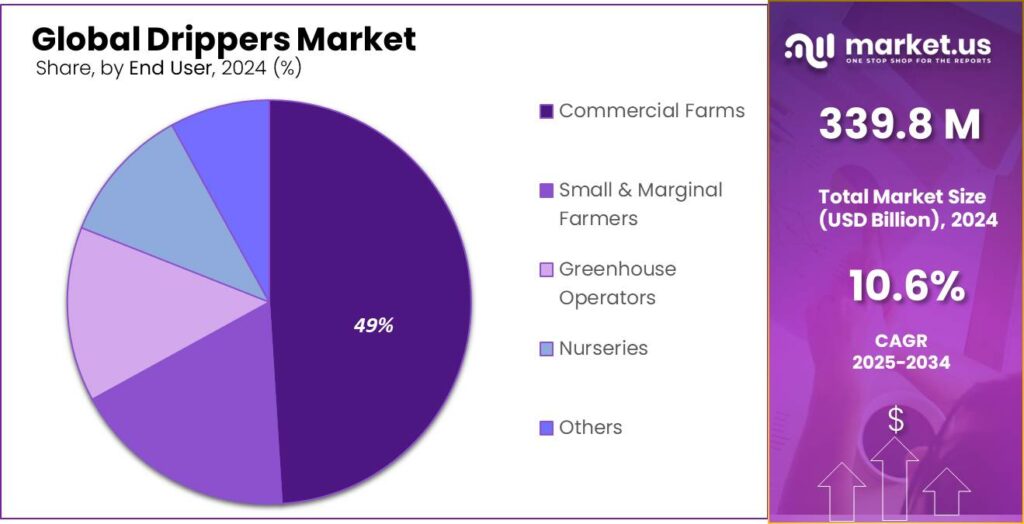

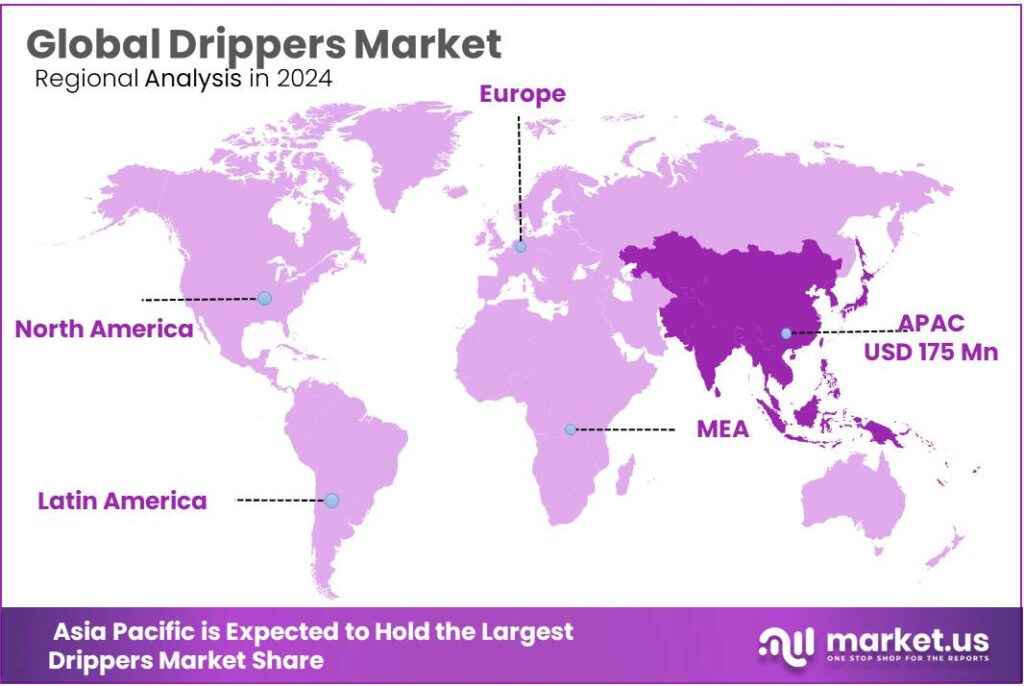

Global Drippers Market size is expected to be worth around USD 930.6 Million by 2034, from USD 339.8 Million in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 51.6% share, holding USD 175.3 Million in revenue.

Industry momentum for drippers is closely linked to the scale and direction of coffee consumption itself. The International Coffee Organization (ICO) estimates world coffee consumption rebounded to about 177.0 million 60-kg bags in coffee year 2023/24, supported largely by demand in non-producing countries. In the U.S.—a key market for specialty formats—consumer participation has strengthened: the National Coffee Association (NCA) reports 66% of adults drink coffee daily.

A major driver is specialty coffee’s steady normalization. A 2024 breakout summary published by the Specialty Coffee Association (SCA) notes that 45% of American adults had a specialty coffee in the past day, and that specialty coffee surpassed traditional coffee in past-day consumption in that dataset. This helps drippers because pour-over is strongly associated with transparency and origin expression—attributes that fit specialty positioning.

Convenience is also becoming less of a barrier as consumers balance café visits with home routines; in the 2025 SCA summary, 74% of past-day specialty coffee drinkers had their coffee prepared at home, reinforcing the home-brewing context where drippers compete well on cost and control.

Government and policy signals also matter because they change what coffee brands emphasize—and drippers benefit when brands sell “traceable, premium” coffee for home brewing. In India, official figures show coffee production of 3,60,500 tonnes (2023–24) and an estimated 3,63,300 tonnes (2024–25), alongside Coffee Board implementation of the Integrated Coffee Development Project (ICDP) covering activities such as replantation, quality upgrades, water augmentation, and area expansion.

In the EU, the European Commission states the deforestation regulation’s entry into application is 30 December 2026 for large/medium operators and 30 June 2027 for micro/small operators—compliance timelines that are accelerating investment in traceability and origin data, which often feature prominently in specialty home-brewing marketing.

Key Takeaways

- Drippers Market size is expected to be worth around USD 930.6 Million by 2034, from USD 339.8 Million in 2024, growing at a CAGR of 10.6%.

- Inline NPC held a dominant market position, capturing more than a 42.7% share in the global drippers market.

- PE/HDPE held a dominant market position, capturing more than a 56.9% share in the global drippers market.

- Commercial Farms held a dominant market position, capturing more than a 49.2% share in the global drippers market.

- Asia Pacific dominates the Drippers Market with a share of 51.6%, valued at USD 175.3 Mn.

By Drippers Type Analysis

Inline NPC dominates the Drippers Market with a strong 42.7% share in 2024.

In 2024, Inline NPC held a dominant market position, capturing more than a 42.7% share in the global drippers market. This leadership is largely driven by its steady water-flow performance, long-term reliability, and suitability for large-scale irrigation layouts.

Inline Non-Pressure-Compensating (NPC) drippers continue to be preferred in farms where uniform field gradients allow consistent discharge without the added cost of pressure-compensating components. Farmers value Inline NPC drippers because they are simple to install across long lateral lines and offer lower maintenance needs compared with more complex emitter types. Their affordability is another factor strengthening adoption in price-sensitive regions.

By Material Type Analysis

PE/HDPE dominates the Drippers Market with a solid 56.9% share in 2024 due to durability and cost balance.

In 2024, PE/HDPE held a dominant market position, capturing more than a 56.9% share in the global drippers market. This strong presence is mainly linked to the material’s proven durability under continuous water flow, sunlight exposure, and varying soil conditions.

Polyethylene and high-density polyethylene drippers are widely used because they resist cracking, chemical reactions, and corrosion from fertilizers, which makes them dependable across multiple cropping cycles. Farmers and irrigation installers also prefer PE/HDPE drippers because they are lightweight, flexible, and easy to transport, reducing handling issues during large field installations.

By End User Analysis

Commercial Farms lead the Drippers Market with a strong 49.2% share in 2024 due to large-scale irrigation adoption.

In 2024, Commercial Farms held a dominant market position, capturing more than a 49.2% share in the global drippers market. Their leadership comes from the increasing shift toward efficient irrigation systems that help large growers manage water scarcity, optimize fertilizer use, and maintain consistent crop yields.

Commercial farms usually operate on extensive acreage, making drip systems an economic necessity rather than an option. Drippers allow these farms to reduce water wastage, stabilize output, and manage labor more efficiently compared with traditional irrigation practices. Expansion of high-value crops—such as vegetables, fruits, and orchards—further reinforces commercial adoption.

Key Market Segments

By Drippers Type

- Inline NPC

- Inline PC

- Online NPC

- Online PC

By Material Type

- PE/HDPE

- Silicone/Elastomer

- PVC

- Biodegradable

- Others

By End User

- Commercial Farms

- Small & Marginal Farmers

- Greenhouse Operators

- Nurseries

- Others

Emerging Trends

Smart, sensor-led drip systems are becoming the new normal

A clear latest trend in drippers is the move from “basic drip lines” to smart, automation-led micro-irrigation, where the dripper is no longer just a plastic emitter—it becomes the delivery point for a system guided by sensors and data. This shift is picking up speed because water is tighter, labour is costlier, and farmers want more predictable results. The UN’s World Water Development Report 2024 statistics note that agriculture uses roughly 70% of freshwater withdrawals worldwide, so even small improvements in irrigation efficiency matter at scale.

In 2026, a strong example of this trend is visible in India at the state-program level. On January 7, 2026, Andhra Pradesh launched a technology-driven micro-irrigation initiative under PMKSY that emphasizes data, sensors, and automation for water and fertiliser application. The program states the automation-based approach can save 20–30% water, and it offers financial aid up to ₹2.4 lakh per hectare (with 55% subsidy for small/marginal and SC/ST farmers and 45% for others).

Governments are also scaling the base of micro-irrigation coverage, which creates a wider runway for these smarter upgrades in 2025. A Government of India release (PIB, 31 January 2025) states that from FY16 to FY25, ₹21,968.75 crore was released to states for PDMC and 95.58 lakh hectares were covered under micro-irrigation. That expansion matters because it builds the installed base—millions of hectares where the next step is not “adopt drip,” but “make drip work better.”

Drivers

Growing Water Scarcity and Food Demand: A Key Driver for Drippers Adoption

One of the biggest reasons drippers (drip irrigation emitters) are gaining traction in farms around the world is the urgent need to use water more wisely while producing enough food for a growing population. Farming already takes up a huge share of the world’s freshwater. According to the Food and Agriculture Organization (FAO), agriculture accounts for about 70 percent of all freshwater withdrawals globally, making it by far the largest water user among all sectors.

Many regions face dry spells more often, and with climate change making rainfall less reliable, farmers cannot afford to lose water through old practices like flood irrigation. This is where drippers stand out. By delivering water drop by drop directly to the root zone, drippers can cut water waste dramatically when compared to broad-area watering methods. Research on micro-irrigation systems in India shows that drip and sprinkler irrigation can reduce irrigation costs by 20–50 percent, with an average saving of 32.3 percent in water use.

Governments across the world are backing programs that reward efficient water use. In India, for example, the Union Government’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aims to expand micro-irrigation across the country to improve water-use efficiency and support farm incomes. As per the Economic Survey of India, from FY16 to FY25, the Per Drop More Crop component of PMKSY helped cover 95.58 lakh hectares under micro-irrigation. This shows that policy support is expanding the footprint of efficient irrigation methods, and drippers are a core part of that shift.

The human side of this story is clear: farmers must face water shortages, rising input costs, and unpredictable weather. With irrigation consuming such a large share of available water, even modest improvements in efficiency can mean the difference between a successful season and crop stress. Drippers help bridge this gap by reducing the volume of water needed per hectare while still supporting healthy plant growth. In places where water is shared among many farms or where aquifers are dropping, this makes drippers not just a smart option, but often a necessary one.

Restraints

Clogging and maintenance needs slow down dripper use

A major restraining factor for drippers is clogging, which often turns a water-saving system into a “constant checking” job for farmers. Drippers work by pushing water through very small passages, and that precision is also their weakness. FAO’s drip irrigation guidance explains that emitter waterways are typically only 0.2 to 2.0 mm wide, so even fine sediments, algae, or mineral deposits can block them if the water is not clean.

Water quality is the real trigger behind most clogging problems, especially in areas that rely on open canals, ponds, or groundwater with high dissolved minerals. A practical benchmark comes from the University of Florida IFAS extension: it notes that when suspended solids exceed 50 parts per million (ppm) in irrigation water, clogging problems are likely, and the risk can become severe as solids rise further.

In practice, that means a farmer must budget for filtration equipment and keep it working properly. This maintenance requirement shows up clearly in adoption studies. A peer-reviewed paper on constraints faced under PMKSY (India) reported that farmers rated “high cost of maintenance” (89.38) and “high cost of equipment/spare parts” (88.75) among the leading constraints. Another farm-level constraints paper observed that 48.3% of surveyed farmers agreed that micro-irrigation systems face “more clogging problem,” underlining how common this issue feels at field level.

Government programs are trying to expand micro-irrigation, but the same programs also highlight why maintenance matters. For example, India’s PMKSY micro-irrigation push aims to raise water-use efficiency and expand coverage, yet systems only deliver real benefits when farmers can manage filtration, flushing, and periodic servicing.

Opportunity

Scaling micro-irrigation through public support

A major growth opportunity for drippers is the rapid expansion of micro-irrigation as countries try to protect water supplies while keeping food production stable. The background numbers explain why this is moving from “nice to have” to “must do.” The FAO states that agriculture accounts for 70% of freshwater withdrawals worldwide, which means irrigation efficiency is one of the fastest ways to ease pressure on rivers, reservoirs, and groundwater. UNESCO’s 2024 World Water Development Report statistics page echoes the same point: agriculture uses roughly 70% of global freshwater withdrawals.

The opportunity becomes even larger in Asia-Pacific, where irrigation dominates regional water use. FAO analysis for the region notes that irrigated agriculture accounts for nearly 90% of freshwater withdrawals in Asia and the Pacific. That creates a strong “policy pull” for drip systems—governments have a clear incentive to help farmers shift from high-loss irrigation methods to targeted watering. In practical terms, every new hectare brought under drip irrigation needs reliable emitters, replacement parts, and service networks.

India is one of the clearest examples of how government programs can unlock scale. A Press Information Bureau release (31 January 2025) states that from FY16 to FY25 (end of Dec 2024), ₹21,968.75 crore was released to states for the Per Drop More Crop (PDMC) scheme, and 95.58 lakh hectares were covered under micro-irrigation during that period. This matters for the drippers market because it signals long-term institutional backing—exactly the kind of environment where suppliers can build distribution, local manufacturing, and after-sales support.

There is also a newer, fast-emerging opportunity around smart/automated micro-irrigation, where drippers are paired with sensors and controlled fertigation. A January 2026 report on a PMKSY-linked initiative in Andhra Pradesh describes automation-based micro-irrigation that can save 20–30% water, and mentions financial aid up to ₹2.4 lakh per hectare (with similar 55%/45% subsidy structure).

Regional Insights

Asia Pacific leads Drippers demand as farms chase water efficiency

Asia Pacific dominates the Drippers Market with a share of 51.6%, valued at USD 175.3 Mn in 2024, and the leadership is closely tied to the region’s water reality and the scale of irrigated farming. In many Asia-Pacific countries, irrigation is the biggest water user, so the fastest wins come from improving how water is delivered to crops. FAO highlights that water shortages are a growing risk for food security in the region, and that irrigated agriculture accounts for nearly 90% of freshwater withdrawals—a level that naturally pushes governments and growers toward precise systems like drippers.

Policy support is another tailwind. In India, the Government of India reported that under the Per Drop More Crop (PDMC) push, ₹21,968.75 crore was released to states from FY16 to FY25 (end of Dec 2024), and 95.58 lakh hectares were covered under micro-irrigation—expanding the installed base where drippers are a core component. Scale also matters: China’s irrigated footprint is among the world’s largest, with research citing 65.87 million hectares of irrigated area—meaning even small upgrades toward drip and micro-irrigation can translate into large volumes of drippers over time.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hunter Industries generates annual revenues exceeding USD 1 billion and operates in more than 120 countries, making it a prominent supplier of landscape and agricultural irrigation solutions. Hunter’s dripline and emitter technologies focus on uniform water distribution and high clog-resistance. With strong R&D investments, the company continues expanding its commercial drip portfolio for farms needing efficient and low-maintenance irrigation.

Netafim, a global drip irrigation pioneer, serves growers in 110+ countries and manages over 17 manufacturing plants worldwide. Its technologies irrigate more than 10 million hectares annually through precision drippers and automated irrigation systems. Netafim promotes “Grow More With Less,” emphasizing up to 50% water savings for farmers using drip systems, strengthening its leadership in sustainable irrigation solutions.

Jain Irrigation supports farmers in 126 countries and maintains 30+ manufacturing locations globally. The company’s drip solutions cover millions of hectares in India, Africa, and Latin America. Jain’s micro-irrigation technologies help achieve 30–60% water savings, and the company supports over 6 million small and marginal farmers, making it one of the largest integrated drip irrigation providers worldwide.

Top Key Players Outlook

- Toro Company

- Rivulis Irrigation Ltd.

- Hunter Industries, Inc.

- Netafim Limited

- Jain Irrigation Systems Ltd.

- Rain Bird Corporation

- Chinadrip Irrigation Equipment Co., Ltd.

- Elgo Irrigation Ltd.

- Metzer

- Azud

Recent Industry Developments

In 2024, Toro reported approx. USD 4.58 billion in total revenue worldwide, with irrigation being a meaningful part of professional water-management offerings.

Report Scope

Report Features Description Market Value (2024) USD 339.8 Mn Forecast Revenue (2034) USD 930.6 Mn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drippers Type (Inline NPC, Inline PC, Online NPC, Online PC), By Material Type (PE/HDPE, Silicone/Elastomer, PVC, Biodegradable, Others), By End User (Commercial Farms, Small And Marginal Farmers, Greenhouse Operators, Nurseries, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Toro Company, Rivulis Irrigation Ltd., Hunter Industries, Inc., Netafim Limited, Jain Irrigation Systems Ltd., Rain Bird Corporation, Chinadrip Irrigation Equipment Co., Ltd., Elgo Irrigation Ltd., Metzer, Azud Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Toro Company

- Rivulis Irrigation Ltd.

- Hunter Industries, Inc.

- Netafim Limited

- Jain Irrigation Systems Ltd.

- Rain Bird Corporation

- Chinadrip Irrigation Equipment Co., Ltd.

- Elgo Irrigation Ltd.

- Metzer

- Azud