Global Doorbell Camera Market Size, Share, Growth Analysis By Product (Wired Doorbell Camera, Wireless Doorbell Camera), By Resolution (1080p, 480p, 720p, Above 1080p), By Application (Residential, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169277

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

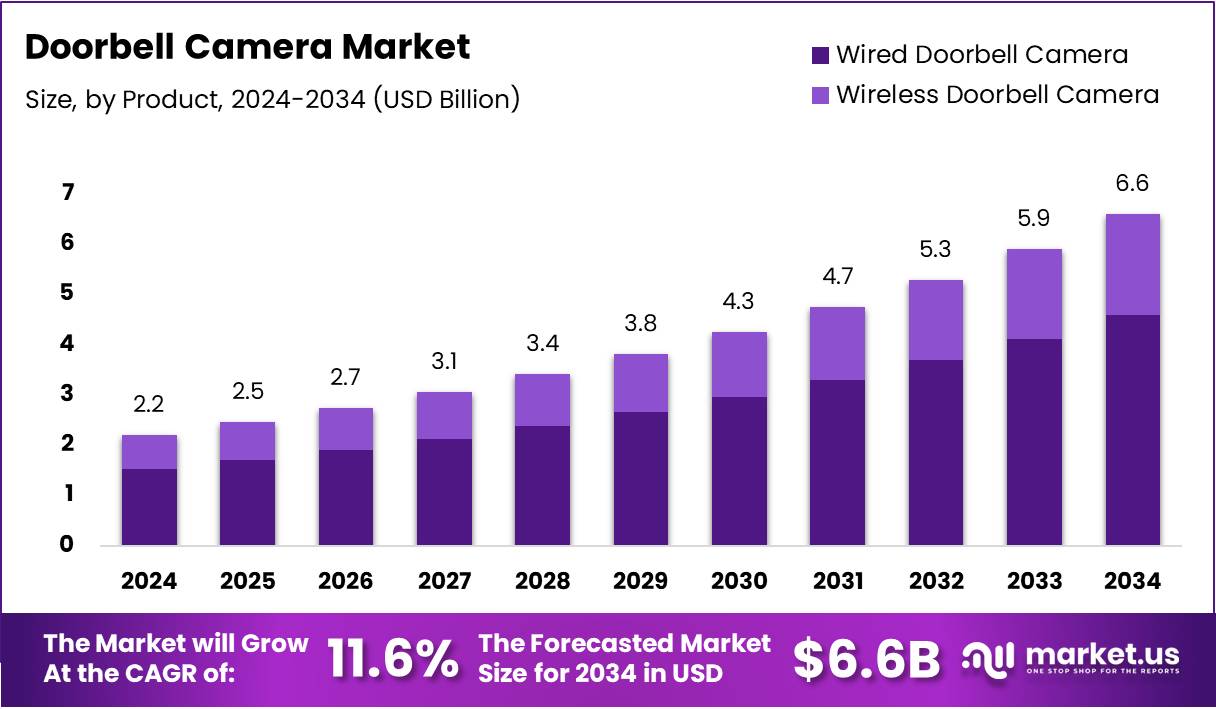

The Global Doorbell Camera Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034.

The Doorbell camera market represents a rapidly evolving segment within the smart home security ecosystem. These intelligent devices integrate video surveillance, motion detection, and two-way communication capabilities into traditional doorbell systems. Consequently, they enable homeowners to monitor, interact with, and record visitors remotely through smartphone applications, fundamentally transforming residential security approaches.

Market growth demonstrates remarkable momentum driven by escalating security concerns and technological advancements. Rising urbanization patterns amplify demand for comprehensive home monitoring solutions. Furthermore, declining hardware costs combined with improved connectivity infrastructure accelerate adoption rates across diverse demographic segments. This expansion trajectory positions doorbell cameras as essential components of modern smart home ecosystems.

Significant opportunities emerge from integration capabilities with broader home automation platforms. Manufacturers increasingly incorporate artificial intelligence for advanced features including facial recognition and package detection. Additionally, subscription-based cloud storage models create recurring revenue streams while enhancing user experience. These innovations collectively expand addressable market segments and strengthen consumer value propositions.

Government initiatives supporting smart city development indirectly benefit market expansion through improved digital infrastructure. However, regulatory frameworks surrounding data privacy and video surveillance continue evolving across jurisdictions. Compliance requirements particularly influence product development cycles and market entry strategies. Therefore, manufacturers must balance innovation with stringent privacy standards to maintain consumer trust and regulatory adherence.

Consumer adoption metrics reveal substantial market penetration within connected households. According to research, 30% of US internet households owned at least one smart camera or smart video doorbell. Moreover, the average number of smart cameras and/or smart video doorbells reaches 2.21 per household, indicating strong multi-device adoption patterns. These statistics underscore growing consumer confidence in doorbell camera technology and highlight significant room for continued market expansion across untapped household segments.

Key Takeaways

- Global market size projected to reach USD 6.6 Billion by 2034, up from USD 2.2 Billion in 2024.

- Market grows at a strong CAGR of 11.6% between 2025–2034.

- Wired Doorbell Cameras lead the product segment with a dominant share of 69.6% in 2024.

- 1080p resolution dominates the resolution segment with a 44.2% market share.

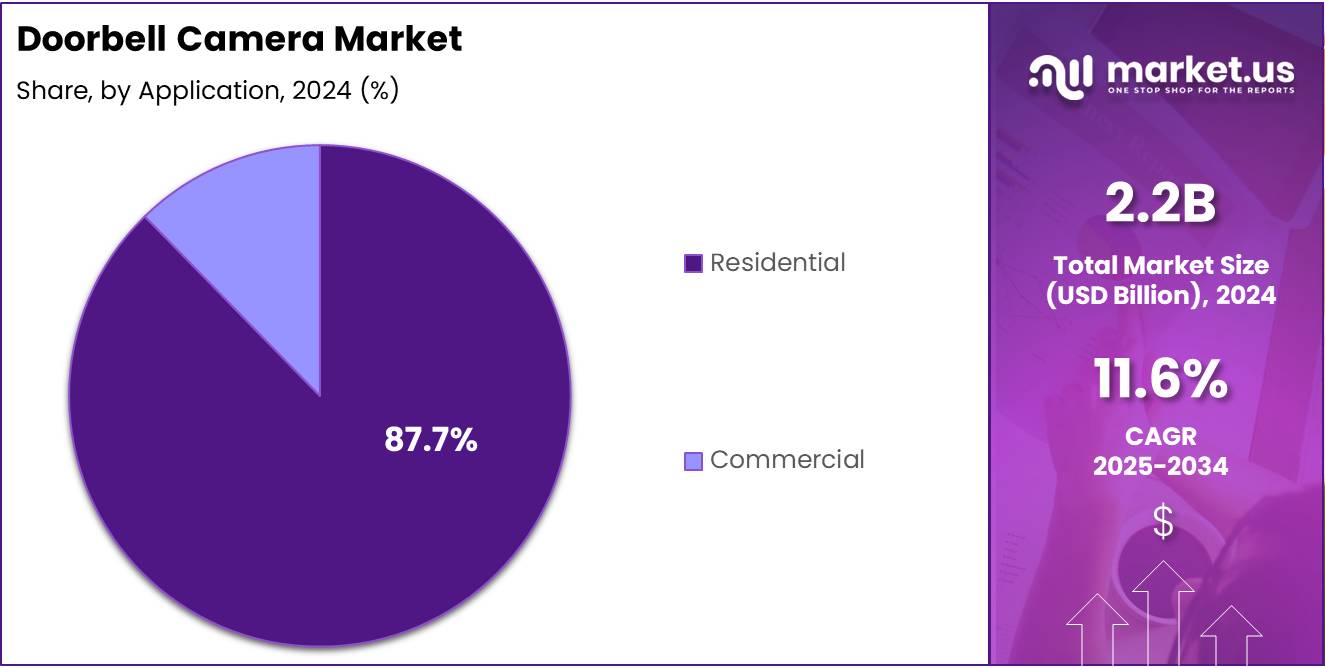

- Residential application accounts for a major share of 87.7% in the application segment.

- Offline distribution channel leads with a 63.9% market share in 2024.

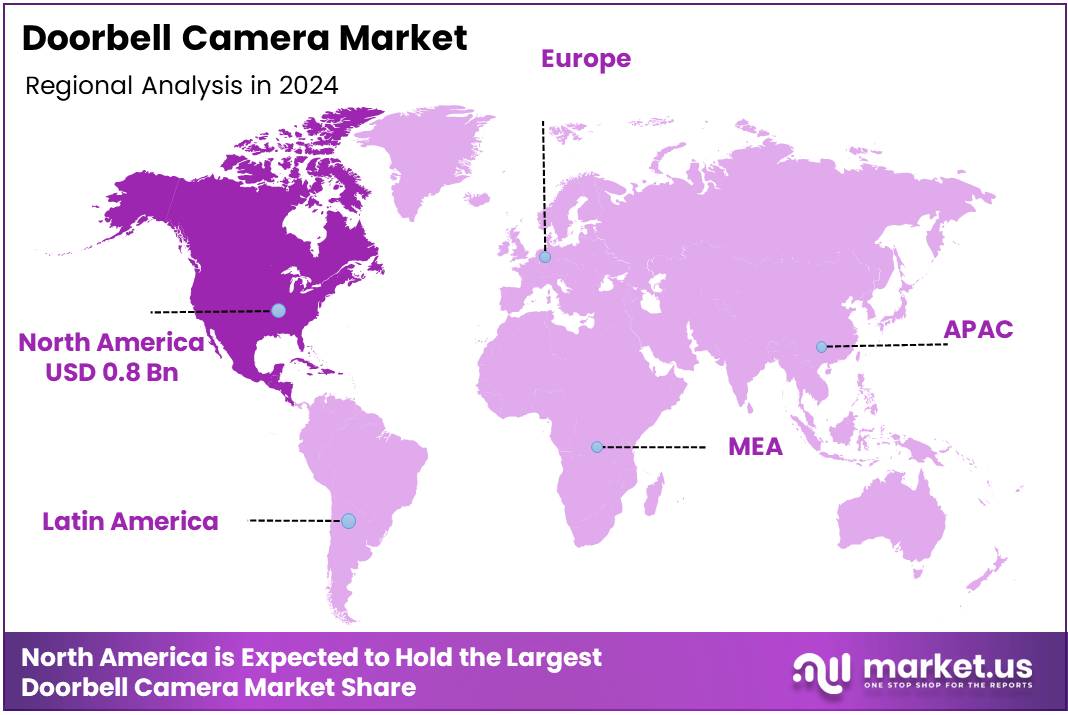

- North America is the leading regional market with a 37.8% share valued at USD 0.8 Billion.

By Product Analysis

Wired Doorbell Camera dominates with 69.6% due to its reliable connectivity and consistent power supply.

In 2024, Wired Doorbell Camera held a dominant market position in the By Product Analysis segment of Doorbell Camera Market, with a 69.6% share. This significant dominance stems from the product’s superior reliability and uninterrupted power supply, eliminating battery replacement concerns. Moreover, wired systems deliver consistent video streaming without connectivity interruptions, making them highly preferred for security-conscious consumers.

Wireless Doorbell Camera represents the alternative segment, gaining traction among consumers seeking flexible installation options. These devices appeal particularly to renters and homeowners who prefer DIY installation without complex wiring requirements. Furthermore, wireless models offer portability and easier relocation, making them suitable for temporary housing situations.

By Resolution Analysis

1080p dominates with 44.2% due to its optimal balance between image clarity and affordability.

In 2024, 1080p held a dominant market position in the By Resolution Analysis segment of Doorbell Camera Market, with a 44.2% share. This resolution standard provides excellent clarity for identifying visitors and capturing important details without overwhelming storage requirements. Consequently, consumers appreciate the balance between video quality and data management, as 1080p footage remains manageable for cloud storage and local recording. Additionally, this resolution ensures facial recognition accuracy while maintaining reasonable bandwidth consumption, making it ideal for both residential and commercial applications.

480p represents the entry-level resolution segment, catering to budget-conscious consumers prioritizing basic functionality over premium features. These cameras provide adequate surveillance for general monitoring purposes while consuming minimal bandwidth and storage space. Nevertheless, the segment faces declining adoption as consumers increasingly demand higher clarity for better security assurance and detailed footage capture.

720p serves as a mid-tier option, offering improved clarity compared to 480p while remaining more affordable than higher resolutions. This segment attracts cost-sensitive buyers seeking reasonable image quality without premium pricing. However, market preference continues shifting toward higher resolutions as technology becomes more accessible and affordable for mainstream consumers.

Above 1080p encompasses premium resolutions including 2K and 4K options, targeting security enthusiasts demanding maximum detail and clarity. These high-resolution cameras excel in capturing fine details such as license plates and distant objects. Although adoption grows steadily, higher costs and increased storage requirements limit mainstream penetration, positioning this segment primarily within luxury and high-security applications.

By Application Analysis

Residential dominates with 87.7% due to increasing home security awareness and smart home adoption.

In 2024, Residential held a dominant market position in the By Application Analysis segment of Doorbell Camera Market, with a 87.7% share. This overwhelming dominance reflects growing homeowner concerns about package theft, unauthorized visitors, and overall property security. Furthermore, the integration of doorbell cameras with smart home ecosystems enhances convenience through features like remote monitoring, two-way communication, and automated notifications.

Additionally, declining product prices and simplified installation processes have made these security solutions accessible to average homeowners, driving widespread adoption across various housing types and demographic segments.

Commercial applications encompass office buildings, retail establishments, and business facilities requiring professional security solutions. These installations typically demand advanced features such as integration with existing security systems, multi-user access, and enhanced durability for high-traffic environments.

Although smaller than residential, this segment demonstrates steady growth as businesses recognize the value of visitor management, delivery verification, and premises security. Moreover, commercial users often invest in higher-resolution models and professional installation services, contributing significantly to overall market revenue despite representing a smaller volume share.

By Distribution Channel Analysis

Offline dominates with 63.9% due to consumer preference for physical product inspection and professional guidance.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of Doorbell Camera Market, with a 63.9% share. Traditional retail channels including electronics stores, home improvement centers, and security equipment specialists continue attracting consumers who value hands-on product evaluation before purchase.

Moreover, offline retailers provide immediate product availability, professional consultation, and often include installation services, which particularly appeal to less tech-savvy buyers. Additionally, the ability to compare multiple models side-by-side and receive expert recommendations enhances customer confidence, especially for first-time purchasers investing in home security solutions.

Online distribution channels encompass e-commerce platforms, manufacturer websites, and digital marketplaces, offering convenience and competitive pricing. This segment appeals particularly to tech-savvy consumers comfortable with self-installation and remote customer support. Furthermore, online channels provide extensive product reviews, comparison tools, and frequently better pricing due to reduced overhead costs.

This segment experiences rapid growth as digital shopping becomes mainstream, though concerns about installation complexity and the inability to physically inspect products before purchase currently limit its market share compared to traditional retail channels.

Key Market Segments

By Product

- Wired Doorbell Camera

- Wireless Doorbell Camera

By Resolution

- 1080p

- 480p

- 720p

- Above 1080p

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Drivers

Rising Home Security Awareness and Smart Technology Adoption Drive Doorbell Camera Market Growth

Urban homeowners are becoming increasingly concerned about protecting their properties. This growing awareness stems from rising crime rates and the need for better residential security. More people now view doorbell cameras as essential tools rather than luxury items, pushing market demand upward.

The global expansion of smart home ecosystems plays a crucial role in market growth. As households adopt connected devices like smart speakers and thermostats, doorbell cameras naturally fit into these integrated systems. This compatibility makes adoption easier and more appealing to tech-savvy consumers.

Remote monitoring capabilities have emerged as a key purchase driver. Homeowners want real-time access to their front doors from anywhere using smartphones. This feature proves particularly valuable for busy professionals and frequent travelers who need to monitor deliveries and visitors while away from home.

Package theft has become a significant concern in residential areas. The rise in online shopping has unfortunately led to increased porch piracy incidents. Doorbell cameras offer a practical deterrent and evidence-gathering solution, motivating homeowners to invest in these devices. The ability to capture video footage of thieves helps law enforcement and insurance claims, making these cameras an attractive security investment.

Restraints

Privacy Concerns Over Continuous Video Surveillance Restrain Market Growth

The doorbell camera market faces significant challenges that limit its expansion potential. Privacy issues remain a major concern for consumers and regulatory bodies alike. Many homeowners worry about constant video recording of their properties and surrounding areas. These devices capture footage of neighbors, passersby, and delivery personnel without their explicit consent. This creates legal and ethical questions about surveillance boundaries in residential neighborhoods.

Compatibility problems with existing home security infrastructure also hinder market growth. Many older security systems cannot integrate smoothly with modern doorbell cameras. Homeowners face costly upgrades or complete system replacements to ensure proper functionality. Technical integration challenges create additional expenses beyond the initial purchase price.

Installation complexity adds another barrier for average consumers. Some doorbell cameras require professional setup or complex wiring modifications. This increases overall costs and discourages budget-conscious buyers. These combined restraints slow down market adoption despite growing interest in smart home security solutions. Manufacturers must address these concerns to unlock the market’s full potential.

Growth Factors

Rising Smart Home Integration and Advanced Security Features Drive Market Expansion

The doorbell camera market is experiencing strong growth through AI-powered facial recognition technology. This feature helps homeowners identify visitors automatically and detect suspicious activity in real-time. Users can receive instant alerts when familiar faces or unknown persons approach their door, making home security smarter and more reliable.

Smart home ecosystems are creating massive opportunities for doorbell camera manufacturers. These devices now connect seamlessly with voice assistants, smart locks, and lighting systems. As more households adopt connected devices, doorbell cameras become essential components of integrated home security networks, expanding the customer base significantly.

Cloud-based video storage solutions are transforming how people use doorbell cameras. Instead of relying on physical storage, users can access recorded footage from anywhere through mobile apps. This convenience appeals to tech-savvy consumers and eliminates concerns about losing important video evidence due to device theft or damage.

Energy-efficient and solar-powered doorbell cameras represent another promising growth area. These models reduce installation complexity and eliminate battery replacement hassles. Solar-powered options are particularly attractive for locations without existing doorbell wiring, opening up new market segments and making advanced security accessible to more homeowners across different property types.

Emerging Trends

Rise of Video Doorbells with Two-Way Audio Communication Drives Market Growth

The doorbell camera market is experiencing significant momentum driven by several key factors. Video doorbells equipped with two-way audio communication are becoming increasingly popular among homeowners. This feature allows residents to speak directly with visitors through their smartphones, even when they are away from home. The ability to screen visitors and communicate remotely provides enhanced security and convenience, making these devices highly attractive to consumers seeking modern home protection solutions.

Mobile app-controlled security devices are gaining widespread acceptance as consumers embrace connected home technology. Homeowners appreciate the ability to monitor their front doors in real-time from anywhere using their smartphones. These apps provide instant notifications, live video feeds, and recording capabilities, giving users complete control over their home security at their fingertips.

The adoption of 4K Ultra HD resolution in doorbell cameras represents a major technological advancement. Higher resolution cameras deliver crystal-clear images that help identify visitors, packages, and potential security threats with remarkable detail. This improved image quality significantly enhances the effectiveness of home surveillance systems.

DIY installation kits are making home security more accessible to average consumers. These user-friendly systems eliminate the need for professional installation, reducing costs and allowing homeowners to set up their security devices quickly and easily without technical expertise.

Regional Analysis

North America Dominates the Doorbell Camera Market with a Market Share of 37.8%, Valued at USD 0.8 Billion

North America maintains its dominant position in the global doorbell camera market, commanding a substantial market share of 37.8% with a valuation of USD 0.8 billion. This leadership stems from high adoption of smart home technologies, robust residential security awareness, and widespread broadband connectivity. The United States drives growth through increasing package theft concerns, rising disposable incomes, and IoT-enabled device proliferation. The region benefits from advanced retail channels, smart city initiatives, and a tech-savvy consumer base investing in premium home security solutions.

Europe Doorbell Camera Market Trends

Europe represents a significant market for doorbell cameras, driven by stringent residential security regulations and GDPR data privacy compliance. The United Kingdom, Germany, and France witness accelerated adoption due to urbanization, increasing burglary instances, and heightened property protection awareness. Market growth is propelled by artificial intelligence features including facial recognition and motion detection, alongside smart home ecosystem expansion that seamlessly connects doorbell cameras with other security devices across residential properties.

Asia Pacific Doorbell Camera Market Trends

Asia Pacific experiences rapid doorbell camera market growth, fueled by expanding middle-class populations, smart home penetration, and urban crime rates. China, Japan, South Korea, and India lead expansion through affordable products, rising internet penetration, and DIY security preferences. Digital transformation initiatives, government-backed smart city projects, and wireless battery-operated solutions drive regional adoption.

Middle East and Africa Doorbell Camera Market Trends

The Middle East and Africa market evolves gradually with increasing residential security investments and home automation awareness. GCC countries, particularly UAE and Saudi Arabia, lead adoption through luxury housing developments and smart building initiatives. African regions face connectivity and affordability constraints, though urban centers show promising growth driven by security concerns.

Latin America Doorbell Camera Market Trends

Latin America presents emerging opportunities with Brazil, Mexico, and Argentina leading adoption. The market grows through escalating security concerns, urban crime rates, and smartphone penetration enabling remote monitoring. Despite economic volatility, expanding middle class, accessible e-commerce pricing, and preventive security awareness contribute to steady expansion in gated communities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Doorbell Camera Company Insights

ASSA ABLOY, a global leader in access solutions, leverages its extensive experience in physical security to integrate advanced doorbell camera systems with comprehensive access control platforms, appealing particularly to commercial and high-end residential segments. The company’s emphasis on interoperability and robust security protocols positions it as a trusted choice for consumers seeking enterprise-grade protection.

Hangzhou Hikvision Digital Technology Co. Ltd. maintains its position as one of the world’s largest video surveillance equipment manufacturers, bringing substantial R&D capabilities and economies of scale to the doorbell camera market. Their products typically offer competitive pricing combined with advanced features such as AI-powered facial recognition and superior image quality, making them attractive options across diverse market segments.

Ring LLC, acquired by Amazon, has effectively democratized smart doorbell technology through aggressive pricing strategies, seamless integration with the broader Amazon ecosystem, and innovative subscription-based cloud storage services. Ring’s brand recognition and user-friendly mobile applications have made it synonymous with video doorbells in many consumer markets.

Vivint, Inc. distinguishes itself through professional installation services and comprehensive smart home integration, targeting homeowners who prefer turnkey security solutions rather than DIY installations. The company’s subscription-based model, combining hardware, professional monitoring, and ongoing support, appeals to consumers seeking hassle-free, full-service smart home security ecosystems. Together, these key players are driving market growth through continuous innovation, competitive pricing, and expanding distribution channels.

Top Key Players in the Market

- ASSA ABLOY

- AUXTRON

- Hangzhou Hikvision Digital Technology Co. Ltd.

- IFI Techsolutions

- Napco Security Technologies, Inc.

- Ring LLC

- SkyBell Technologies Inc.

- Vivint, Inc.

- VTech Communications, Inc.

- Zmodo

Recent Developments

- In August 2025, Philips Hue introduced its first video doorbell, the Hue Secure, equipped with a 2K image sensor and a wide fish-eye lens for improved doorstep clarity.It also supports seamless connectivity with Hue smart lights via Zigbee, enabling automated lighting responses for enhanced home security.

- In May 2024, Xiaomi launched the Smart Maoyan 2 smart doorbell camera featuring a long-lasting 8000 mAh battery (up to 300 days) for low-maintenance operation.The device includes a 3-megapixel camera with a 180° wide-angle lens, giving homeowners a broader view of entry points.

- In August 2024, Ring rolled out its upgraded Battery Doorbell, designed with improved power efficiency and enhanced battery life for everyday use.It also includes color night vision and a 150° field-of-view camera, delivering clearer visuals in both day and low-light scenarios.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 6.6 Billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Wired Doorbell Camera, Wireless Doorbell Camera), By Resolution (1080p, 480p, 720p, Above 1080p), By Application (Residential, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ASSA ABLOY, AUXTRON, Hangzhou Hikvision Digital Technology Co. Ltd., IFI Techsolutions, Napco Security Technologies, Inc., Ring LLC, SkyBell Technologies Inc., Vivint, Inc., VTech Communications, Inc., Zmodo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ASSA ABLOY

- AUXTRON

- Hangzhou Hikvision Digital Technology Co. Ltd.

- IFI Techsolutions

- Napco Security Technologies, Inc.

- Ring LLC

- SkyBell Technologies Inc.

- Vivint, Inc.

- VTech Communications, Inc.

- Zmodo