Global Door Handle Market By Type(Lever Handles, Door Knobs, Sliding Door Handles, Pull Handles), By Material(Metal, Plastic, Fiber, Others), By Price Range(Economy, Premium, Luxury), By Distribution Channel(Specialty Stores, Online Retail, Others), By Application(Residential, Commercial), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 12545

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

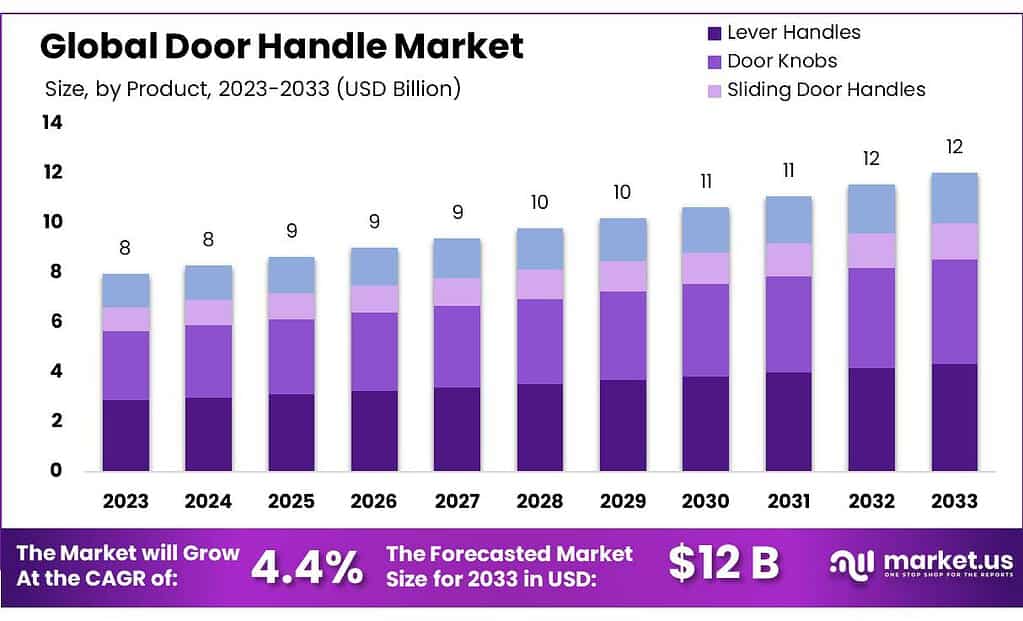

The Door Handle Market size is expected to be worth around USD 12 Billion by 2033, from USD 8 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2023 to 2033.

The door handle market refers to the industry involved in the design, manufacturing, distribution, and sale of door handles, which are essential components of doors used for access and security in various residential, commercial, and industrial settings.

Door handles serve both functional and aesthetic purposes, providing a means to open or close doors while contributing to the overall design and style of the door and the space it secures. The market encompasses a wide range of door handle types, materials, and styles to cater to diverse consumer preferences and the varying requirements of different door applications.

Factors influencing the door handle market include trends in architectural design, security needs, material innovations, and consumer preferences for both residential and commercial spaces. The door handle market is often intertwined with broader trends in the construction and real estate industries, reflecting the demand for doors and related accessories.

Key Takeaways

- Market Growth: The door handle market is set to reach USD 12 billion by 2033, growing at 4.4% CAGR from USD 8 billion in 2023.

- Dominant Types: Lever handles led with 35.00% market share in 2023, known for ease; door knobs maintained a significant presence.

- Price Range Segmentation: The economy segment led in 2023 with 46.7% share; premium handles offer enhanced features; the luxury segment caters to exclusivity.

- Application Focus: Residential applications dominated in 2023 with over 54.6% share; commercial applications are significant, addressing diverse non-residential needs.

- Distribution Channels: Specialty Stores claimed 56.4% share in 2023; Online Retail gaining traction for convenience and broad product access.

- Regional Dominance: Asia Pacific leads with over 36.10% revenue share in 2024, driven by infrastructure development and a booming tourist industry.

By Type Analysis

In 2023, lever handles were leading the market, grabbing over 35.00% of the share. Lever handles are those you press down to open a door, like in many modern homes and commercial spaces. They’re popular because they’re easy to operate, especially for people with mobility issues or when your hands are full. Door knobs also had a significant share of the market.

These are the round handles you twist to open a door. They’re classic and found in many traditional homes and buildings. Despite the rise of lever handles, door knobs remain a preferred choice for many due to their aesthetic appeal and simplicity.

Sliding door handles made up another portion of the market. These handles are specifically designed for sliding doors, which are common in spaces where there isn’t enough room for a swinging door, like closets or patio entrances. Sliding door handles are valued for their space-saving design and ease of use.

Pull handles also had their slice of the market. These handles are typically long bars that you pull to open a door. They’re commonly seen on entrance doors to buildings, as well as on large cabinets or drawers. Pull handles are favored for their sturdy construction and ability to accommodate heavy doors or high-traffic areas.

By Material

When it comes to door handles, they come in different materials. Metal handles are quite popular. You’ll find them in various finishes like stainless steel or brass, giving doors a sleek and sturdy look. Plastic handles are another option. They’re lightweight and often used in more casual settings. While they may not have the same durability as metal, they’re affordable and come in many colors and styles.

Then there are fiber handles. These are made from materials like fiberglass or carbon fiber, known for their strength and resilience. They’re often chosen for their modern appearance and ability to withstand wear and tear. And finally, there are handles made from other materials like wood or glass.

These can add a touch of elegance or uniqueness to a door, depending on the design and craftsmanship. Each material offers its own set of benefits and can cater to different preferences and budgets in the door handle market.

By Price Range

In 2023, the Economy segment took the lead in the door handle market, accounting for over 46.7% of the share. This indicates that a significant portion of consumers opted for door handles in the lower price range.

Economy door handles are designed to offer affordability without compromising too much on quality and functionality. They cater to budget-conscious consumers who prioritize cost-effectiveness and may be willing to sacrifice some design options or material quality for a lower price point.

Premium door handles represent another segment of the market. These handles typically come with a higher price tag compared to economy options, but they offer enhanced features, better materials, and more sophisticated designs. Consumers willing to invest a bit more in their door hardware often choose premium handles for their durability, aesthetics, and overall quality.

Then there’s the Luxury segment, which caters to consumers seeking the utmost in quality, design, and exclusivity. Luxury door handles are crafted from high-end materials like solid brass or exotic woods, and they often feature intricate detailing and custom finishes. These handles are typically chosen for upscale residential properties, luxury hotels, and high-end commercial spaces where aesthetics and prestige are paramount.

Application Analysis

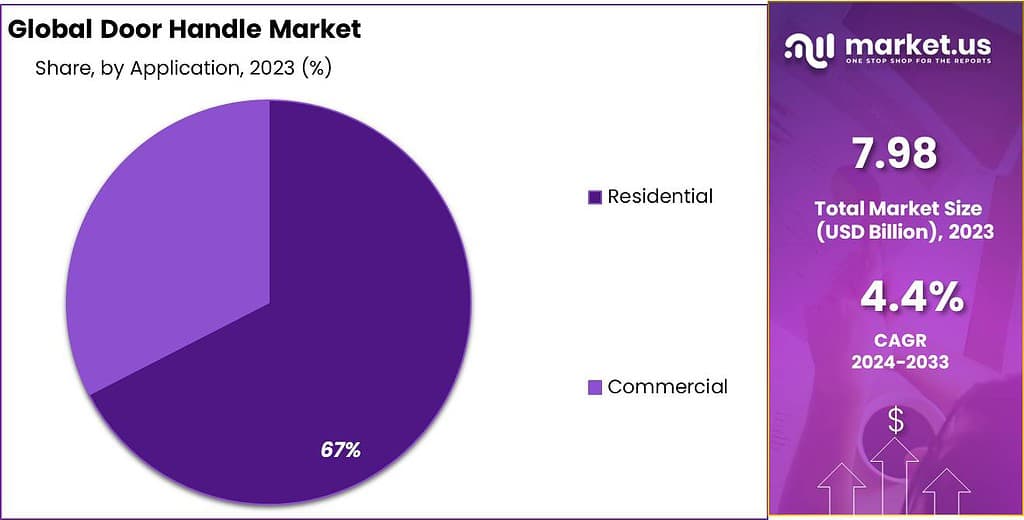

In 2023, residential applications dominated the door handle market, holding more than 54.6% of the share. This indicates that the majority of door handle purchases were for use in homes rather than commercial spaces.

Residential door handles are designed with the needs and preferences of homeowners in mind. They often prioritize aesthetics, offering a wide range of styles, finishes, and designs to complement various home décor themes. Functionality is also essential, with an emphasis on ease of use and durability to withstand daily wear and tear in a household environment.

Commercial applications also play a significant role in the market. These include door handles used in offices, retail stores, hotels, and other non-residential buildings. Commercial door handles may have different requirements compared to residential ones, such as the need for heavy-duty construction to withstand frequent use or security features for restricted-access areas.

While residential applications currently dominate the door handle market, the commercial segment remains substantial, reflecting the diverse needs of different end-users. As trends in architecture, interior design, and building construction continue to evolve, both residential and commercial segments are expected to drive further growth and innovation in the door handle industry.

By Distribution Channel

In 2023, Specialty Stores emerged as the dominant distribution channel in the door handle market, securing over 56.4% of the share. This indicates that a significant portion of consumers preferred to purchase their door handles from specialized retailers. Specialty Stores, also known as hardware stores or home improvement stores, offer a wide selection of door handles along with expert advice and assistance.

Customers appreciate the convenience of being able to browse various handle options in person and receive personalized recommendations based on their specific needs and preferences.

Online Retail represents another significant distribution channel in the door handle market. With the rise of e-commerce, many consumers opt to purchase door handles online due to the convenience of shopping from home and access to a broader range of products.

Online retailers offer door handles in various styles, materials, and price points, making it easy for customers to find the perfect fit for their needs. Other distribution channels in the market may include department stores, wholesale distributors, and direct sales from manufacturers. These channels cater to different segments of consumers and offer additional options for purchasing door handles.

Key Market Segments

By Type

- Lever Handles

- Door Knobs

- Sliding Door Handles

- Pull Handles

By Material

- Metal

- Plastic

- Fiber

- Others

By Price Range

- Economy

- Premium

- Luxury

By Distribution Channel

- Specialty Stores

- Online Retail

- Others

By Application

- Residential

- Commercial

Drivers

Construction and Real Estate Trends: The demand for door handles is closely linked to the construction industry and real estate market. Growth in residential and commercial construction projects, as well as renovations and remodeling activities, drives the need for door hardware, including handles.

Housing Market Conditions: Factors such as population growth, urbanization, and disposable income levels impact the housing market, which in turn affects the demand for door handles. Economic stability and favorable mortgage rates can stimulate housing demand, leading to increased sales of door handles.

Design and Aesthetics: Consumer preferences for door handle designs, finishes, and styles play a significant role in driving market demand. Trends in interior design, architecture, and home décor influence the choice of door handles, with consumers seeking products that enhance the overall aesthetic appeal of their living or working spaces.

Technological Advancements: Innovations in door handle materials, manufacturing processes, and functionality contribute to market growth. Features such as smart locks, touchless operation, and integrated security systems are increasingly sought after by consumers, driving the adoption of advanced door handle technologies.

Environmental Awareness: Growing awareness of environmental sustainability and eco-friendly practices influences purchasing decisions in the door handle market. Consumers are increasingly inclined towards products made from sustainable materials, such as recycled metals or bio-based polymers, and manufactured using environmentally friendly processes.

Regulatory Standards and Building Codes: Compliance with building codes, safety regulations, and accessibility requirements shapes the demand for door handles. Manufacturers must ensure that their products meet industry standards for durability, fire safety, accessibility, and ADA (Americans with Disabilities Act) compliance, driving innovation and product development efforts.

Restraints

In some regions, there might already be a lot of door handle options available, making it harder for new products to stand out or for existing businesses to expand. During economic downturns, people might spend less on home renovations or construction projects, leading to reduced demand for door handles.

Other types of door entry systems, like keyless locks or automatic doors, compete with traditional door handles, especially in commercial settings. The cost of materials and manufacturing processes can be high, especially for door handles made from premium or specialized materials, which can limit affordability and market penetration.

Meeting safety standards and building codes can add complexity and costs to manufacturing door handles, especially when it comes to factors like fire safety or accessibility requirements. Increasing awareness of environmental issues may lead consumers to prefer eco-friendly alternatives, which could pose a challenge for door handle manufacturers using materials or processes perceived as harmful to the environment.

Opportunities

There are several chances for growth and success in the door handle market. One of the primary opportunities lies in the rising construction activities. As more homes, offices, and buildings are constructed or renovated, there’s a growing demand for door handles. Businesses can seize this opportunity by providing a wide range of products to meet various construction needs.

Technological advancements also present a significant opportunity for innovation in the door handle market. With the increasing popularity of smart home technology, there’s room for developing smart door handles with features like keyless entry or remote access, catering to the needs of tech-savvy consumers.

Additionally, customization and personalization are becoming increasingly important to consumers. Companies can offer customization options, such as different finishes, designs, and materials, to appeal to individual tastes and preferences, thereby capitalizing on this trend.

As environmental awareness grows, there’s a growing demand for eco-friendly door handle options made from sustainable materials or using environmentally friendly manufacturing processes. This presents an opportunity for companies to offer green alternatives to traditional door handles.

Challenges

One significant challenge is market saturation. In some regions, there might already be a lot of door handle options available, making it harder for new products to stand out or for existing businesses to expand. This saturation can lead to increased competition and price pressure, making it challenging for companies to maintain profitability.

Economic downturns pose another challenge for the door handle market. During periods of economic instability, people may spend less on home renovations or construction projects, leading to reduced demand for door handles. This can result in decreased sales and revenue for businesses operating in the market.

Furthermore, competition from alternative products can be a hurdle for traditional door handle manufacturers. Other types of door entry systems, like keyless locks or automatic doors, compete with traditional door handles, especially in commercial settings. This competition can limit market growth and require businesses to innovate and differentiate their products to remain competitive.

Manufacturing costs present another challenge for door handle manufacturers. The cost of materials and manufacturing processes can be high, especially for door handles made from premium or specialized materials. This can impact affordability and market penetration, particularly in price-sensitive markets or during economic downturns.

Regulatory compliance is also a challenge for door handle manufacturers. Meeting safety standards and building codes can add complexity and costs to manufacturing door handles, especially when it comes to factors like fire safety or accessibility requirements. Ensuring compliance with these regulations requires investment in research and development, as well as ongoing monitoring and testing of products.

Finally, changing consumer preferences and trends can present challenges for businesses in the door handle market. Shifts in design trends or preferences for different types of door hardware could impact the demand for traditional door handles, requiring manufacturers to adapt their product offerings accordingly. Staying attuned to evolving consumer preferences and market trends is essential for businesses to remain competitive in the door handle market.

Regional Analysis

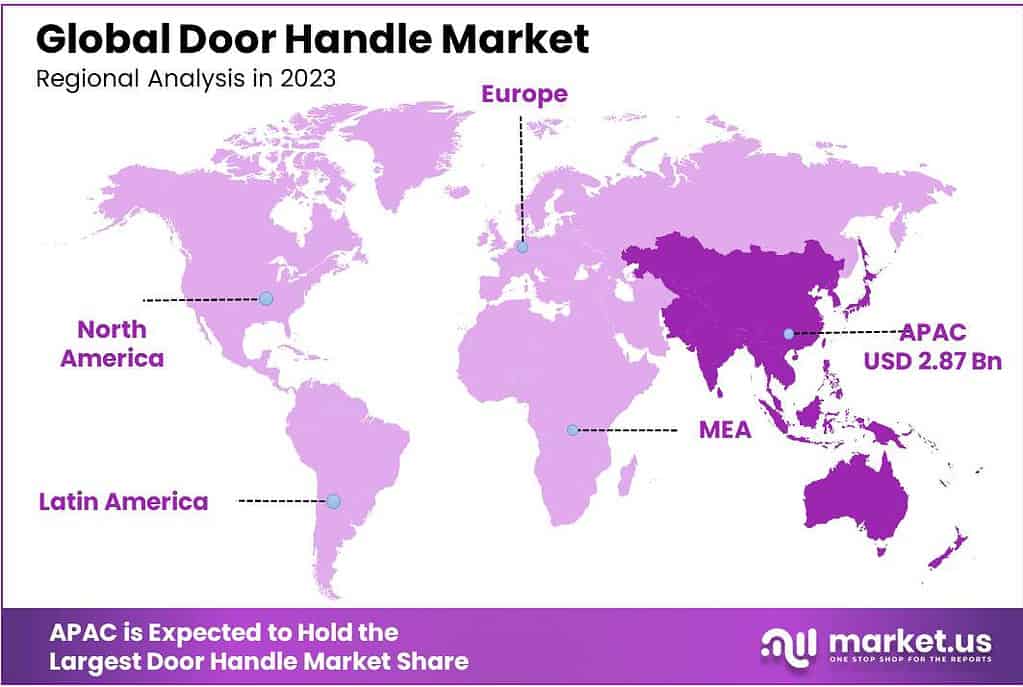

Asia Pacific (APAC) had the largest revenue share at over 36.10% in 2024. It is expected to index significant growth over the forecast period. This growth can be attributed to the increasing establishment of residential and commercial infrastructures as well as a booming tourist industry. Hotel Management Japan, the operating company, is planning to push investment plans that will focus on three new hotels being built in Andhra Pradesh.

The state’s tourist department also wants to increase the number of guestrooms until 2025. These projects will spike the demand for door handles over the next few decades. In response to the increasing demand for modern doors in North America, manufacturers have been able to launch products that are more appealing to customers. Masonite International Corporation released DuraStyle exterior wood doors using AquaSeal technology.

This process seals the edges and inserts of wood with a clear barrier that prevents water penetration. This is a leading cause of door collapse. Innovations and product development are likely to have a lasting effect on North America’s door-handle market growth over the forecast period. The biggest consumer is North America of the outside door handle market.

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

To maintain market competition, companies actively participate in product enhancements to meet changing consumer tastes or preferences. Yanko Design created Zento, an illuminating handle that has an independent wireless power supply. This is useful in situations like fire, smoke, or blackouts.

Key Market Players

- Assa Abloy AB

- The Häfele Group

- Allegion Plc

- Aarkay Vox

- Hoppe Holding AG

- Emtek Products Inc.

- Kuriki Manufacture Co.

- Ace Hardware Corp.

- West INX Ltd.

- Sugatsune America, Inc.

Recent Developments

In January 2022, Emtek launched a dedicated product line for door hardware and accessories that offer endless customization options and ease of assembly. The new product launch includes cabinet hardware, lever, and door knob

Report Scope

Report Features Description Market Value (2022) US$ 8 Bn Forecast Revenue (2032) US$ 12 Bn CAGR (2023-2032) 4.4% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Lever Handles, Door Knobs, Sliding Door Handles, Pull Handles), By Material(Metal, Plastic, Fiber, Others), By Price Range(Economy, Premium, Luxury), By Distribution Channel(Specialty Stores, Online Retail, Others), By Application(Residential, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Assa Abloy AB, The Häfele Group, Allegion Plc, Aarkay Vox, Hoppe Holding AG, Emtek Products Inc., Kuriki Manufacture Co., Ace Hardware Corp., West INX Ltd., Sugatsune America, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Assa Abloy AB

- The Häfele Group

- Allegion Plc

- Aarkay Vox

- Hoppe Holding AG

- Emtek Products Inc.

- Kuriki Manufacture Co.

- Ace Hardware Corp.

- West INX Ltd.

- Sugatsune America, Inc.