Global Domestic Booster Pump Market Size, Share, Growth Analysis By Product Type (Single Stage Pump, Multiple Stage Pump), By Power Source (Electric, Hydraulic, Gasoline, Others), By Rated Power (50-150 W, 10-50 W, 150-300 W, Above 300 W), By Water Pressure (1 Bar, 0.5 Bar, Above 1 Bar), By Material (Cast Iron, Aluminum, Stainless Steel, Others), By End-Use (Residential Buildings, Industries, Agriculture, Others), By Distribution Channel (Indirect Sales, Direct Sales), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177239

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Power Source Analysis

- Rated Power Analysis

- Water Pressure Analysis

- Material Analysis

- End-Use Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

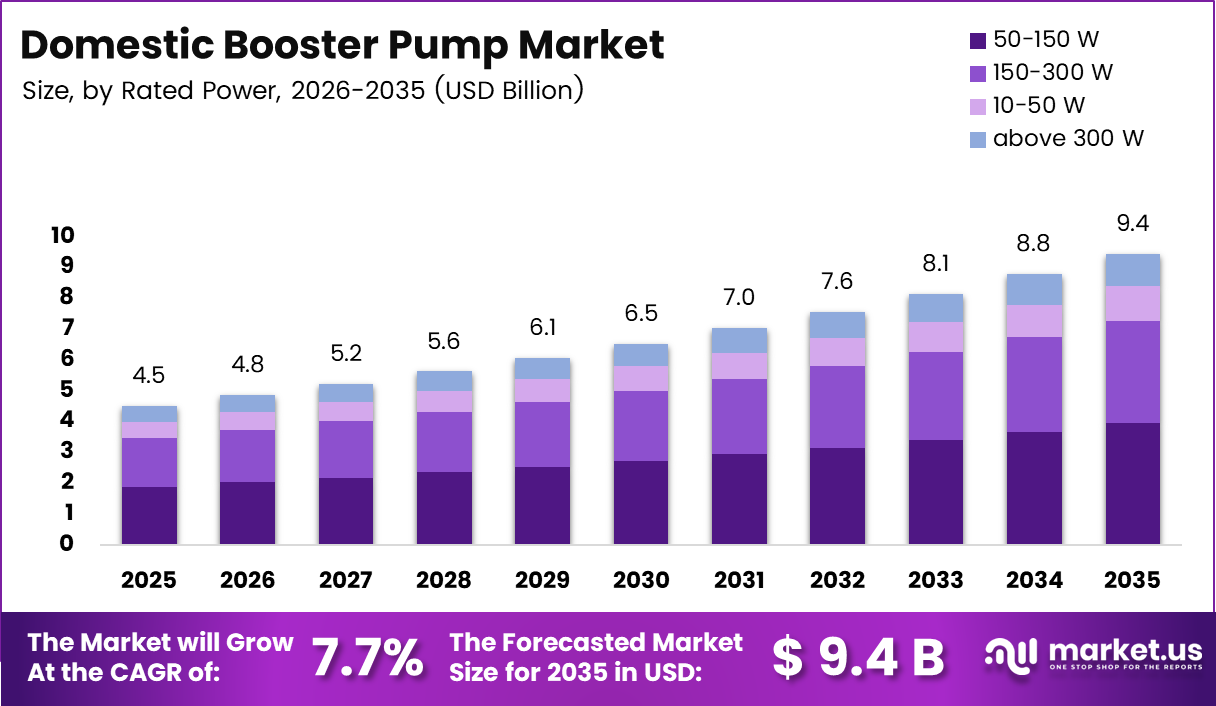

Global Domestic Booster Pump Market size is expected to be worth around USD 9.4 Billion by 2035 from USD 4.5 Billion in 2025, growing at a CAGR of 7.7% during the forecast period 2026 to 2035.

Domestic booster pumps are mechanical devices designed to increase water pressure in residential plumbing systems. These pumps ensure consistent water flow to fixtures like showers, faucets, and appliances. They address low-pressure challenges common in high-rise buildings and areas with inadequate municipal supply.

The market experiences robust growth driven by rapid urbanization and expanding residential infrastructure. Modern housing developments increasingly require reliable water pressure solutions. Moreover, aging plumbing systems in established neighborhoods create retrofit opportunities, boosting demand for upgraded pressure Control equipment.

Government regulations mandating backflow prevention devices have inadvertently increased booster pump adoption. These safety valves reduce system pressure by 7-10 psi, necessitating pressure compensation. Consequently, building codes now frequently recommend or require booster installations in multi-story residential structures.

Technological advancements have transformed product offerings significantly. Variable speed pumps with permanent magnet motors deliver up to 15% greater energy savings compared to standard units. Additionally, IoT-enabled smart pumps with automatic pressure sensors provide enhanced performance monitoring and efficiency optimization capabilities.

The residential construction boom in water-stressed regions presents substantial market opportunities. Compact, energy-efficient designs appeal to space-constrained urban dwellings. Furthermore, consumer awareness regarding water pressure optimization continues expanding, driving informed purchasing decisions across developed and emerging markets.

According to Aquagroup, domestic pressure booster pumps range from 0.5 HP to 2 HP with maximum heads reaching 72m. According to Armstrong Fluid Technology, variable speed booster packages serve buildings with flow capacities up to 2000 USgpm and power ranges extending to 250 hp.

Market dynamics reflect increasing preference for silent, compact designs suitable for residential environments. Energy-rated and eco-compliant systems gain traction as sustainability concerns influence consumer choices. Therefore, manufacturers prioritize innovation in noise reduction, space efficiency, and intelligent control integration to maintain competitive advantages.

Key Takeaways

- Global Domestic Booster Pump Market projected to reach USD 9.4 Billion by 2035 from USD 4.5 Billion in 2025

- Market expected to grow at a CAGR of 7.7% during forecast period 2026-2035

- Single Stage Pump segment dominates Product Type category with 67.2% market share

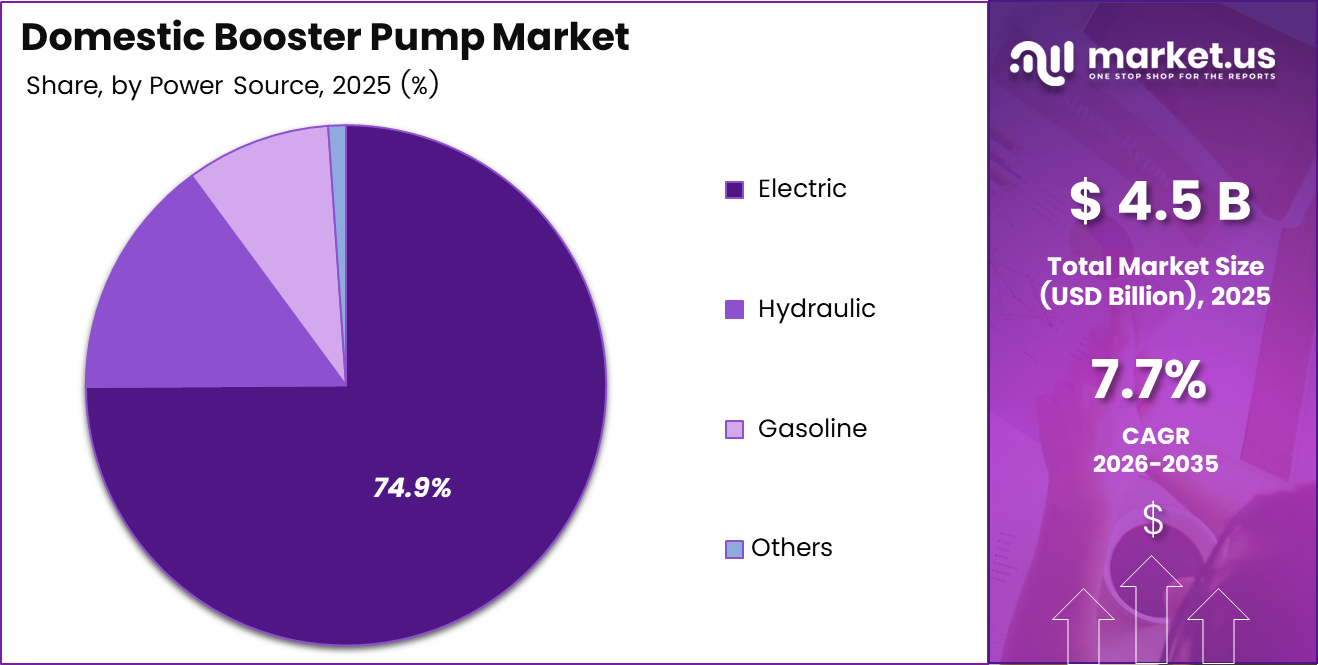

- Electric power source leads with 74.9% share in Power Source segment

- 50-150 W rated power category holds 41.7% market position

- 1 Bar water pressure segment commands 49.6% market share

- Cast Iron material accounts for 49.3% of Material segment

- Residential Buildings end-use dominates with 67.1% market share

- Indirect Sales channel leads Distribution Channel segment with 77.5% share

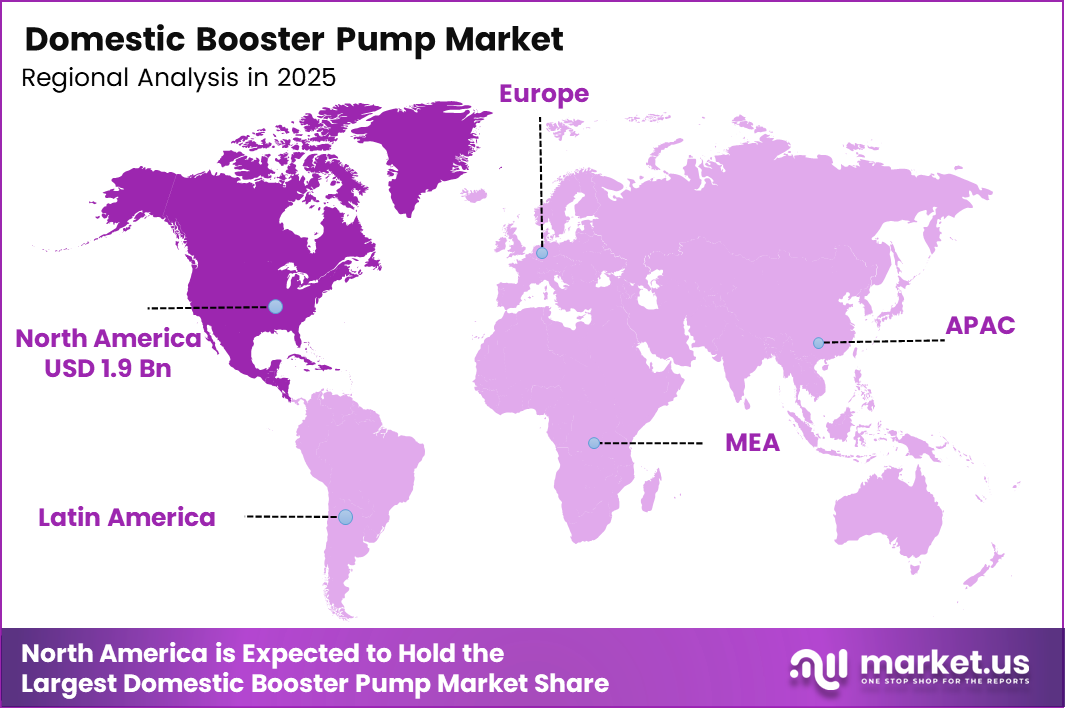

- North America dominates regional market with 43.70% share valued at USD 1.9 Billion

Product Type Analysis

Single Stage Pump dominates with 67.2% due to cost-effectiveness and simplicity in residential applications.

In 2025, Single Stage Pump held a dominant market position in the Product Type segment of Domestic Booster Pump Market, with a 67.2% share. Single stage pumps offer straightforward installation, lower maintenance requirements, and adequate pressure boosting for typical residential needs. Their affordability makes them preferred choices for individual homes and small apartment complexes.

Multiple Stage Pump systems cater to high-rise buildings requiring significant pressure elevation across multiple floors. These pumps deliver superior performance in demanding applications where single stage units prove insufficient. However, their higher cost and complexity limit adoption primarily to commercial-grade residential towers and luxury housing developments.

Power Source Analysis

Electric dominates with 74.9% due to reliability, convenience, and widespread electrical infrastructure availability.

In 2025, Electric held a dominant market position in the Power Source segment of Domestic Booster Pump Market, with a 74.9% share. Electric pumps provide consistent performance with minimal operational intervention. Their integration with smart home systems and automatic controls enhances user convenience while ensuring optimal energy consumption patterns.

Hydraulic power sources find niche applications in specialized residential settings with existing hydraulic infrastructure. These systems offer powerful pressure generation but require dedicated hydraulic supply networks. Consequently, their adoption remains limited to specific architectural configurations and custom installations.

Gasoline powered pumps serve off-grid residential properties and emergency backup scenarios. They provide independence from electrical supply but involve higher operating costs and maintenance demands. Additionally, noise and emissions considerations restrict their suitability for densely populated urban residential environments.

Others category encompasses alternative power sources including solar and battery-operated systems. These emerging solutions address sustainability concerns and energy independence objectives. Moreover, they appeal to environmentally conscious consumers seeking reduced carbon footprints in residential water management systems.

Rated Power Analysis

50-150 W dominates with 41.7% due to optimal balance between performance and energy efficiency for standard homes.

In 2025, 50-150 W held a dominant market position in the Rated Power segment of Domestic Booster Pump Market, with a 41.7% share. This power range adequately serves typical residential requirements including shower pressure boosting and appliance supply. Its energy efficiency aligns with consumer cost-saving priorities while delivering reliable performance.

10-50 W pumps target compact apartments and single-fixture applications requiring minimal pressure enhancement. These low-power units appeal to budget-conscious consumers and small dwelling occupants. Their reduced energy consumption makes them economically attractive for limited-use scenarios and supplementary pressure support.

150-300 W systems address larger homes with multiple bathrooms and extensive plumbing networks. They handle simultaneous fixture operation without pressure drops. Additionally, these mid-range pumps suit modern homes with higher water consumption patterns and premium appliance installations.

Above 300 W pumps serve luxury residences, multi-family units, and properties with complex water distribution requirements. These high-power systems deliver maximum pressure elevation across extensive vertical and horizontal distances. However, their higher operational costs limit adoption to premium residential segments.

Water Pressure Analysis

1 Bar dominates with 49.6% due to standard pressure requirements in typical residential plumbing systems.

In 2025, 1 Bar held a dominant market position in the Water Pressure segment of Domestic Booster Pump Market, with a 49.6% share. This pressure level effectively addresses common residential low-pressure challenges. It provides sufficient boost for comfortable shower operation and reliable appliance functionality without excessive system stress.

0.5 Bar pumps cater to minor pressure enhancement needs in low-rise buildings and single-story homes. These units offer gentle pressure increases for specific fixtures or localized supply issues. Their application focuses on supplementary support rather than comprehensive system-wide pressure management.

Above 1 Bar systems target high-rise residential buildings and properties with significant elevation challenges. They deliver powerful pressure boosting for multi-story water distribution. Consequently, these pumps ensure adequate flow to upper-floor fixtures in tall apartment complexes and hillside residences.

Material Analysis

Cast Iron dominates with 49.3% due to durability, cost-effectiveness, and proven reliability in residential applications.

In 2025, Cast Iron held a dominant market position in the Material segment of Domestic Booster Pump Market, with a 49.3% share. Cast iron construction provides excellent corrosion resistance and mechanical strength for long-term operation. Its thermal properties enable efficient heat dissipation during continuous pump operation cycles.

Aluminum pumps offer lightweight alternatives with good corrosion resistance and easier installation handling. These units suit applications prioritizing weight reduction and simplified mounting configurations. However, their strength limitations restrict use in high-pressure or heavy-duty residential scenarios.

Stainless Steel pumps deliver superior corrosion resistance and hygienic water contact surfaces. They excel in premium installations and regions with aggressive water chemistry. Additionally, their aesthetic appeal and longevity justify higher investment costs for quality-conscious consumers.

Others category includes composite materials and specialized alloys addressing specific performance requirements. These innovative materials target niche applications demanding unique property combinations. Moreover, they represent emerging material technologies seeking broader market acceptance and cost competitiveness.

End-Use Analysis

Residential Buildings dominates with 67.1% due to widespread domestic water pressure challenges in urban housing.

In 2025, Residential Buildings held a dominant market position in the End-Use segment of Domestic Booster Pump Market, with a 67.1% share. Apartments, condominiums, and single-family homes constitute the primary market for domestic booster pumps. Urbanization drives continuous demand as high-rise construction intensifies pressure management requirements.

Industries utilize domestic-scale booster pumps for small-facility applications and auxiliary water supply systems. These installations support manufacturing processes, cleaning operations, and employee facilities. However, industrial requirements typically favor larger commercial-grade systems, limiting domestic pump adoption.

Agriculture applications employ booster pumps for irrigation systems, livestock facilities, and farm building water supply. These rural installations address pressure challenges in remote locations with limited infrastructure. Additionally, agricultural operations benefit from reliable water delivery for operational efficiency.

Others segment encompasses commercial establishments, educational institutions, and mixed-use developments. These applications require reliable pressure management across diverse facility types. Moreover, they represent growing opportunities as building codes increasingly mandate adequate water pressure standards.

Distribution Channel Analysis

Indirect Sales dominates with 77.5% due to established retail networks and installer partnerships.

In 2025, Indirect Sales held a dominant market position in the Distribution Channel segment of Domestic Booster Pump Market, with a 77.5% share. Hardware stores, plumbing suppliers, and online marketplaces provide extensive product accessibility. These channels offer consumers product variety, comparative shopping opportunities, and professional installation referrals.

Direct Sales channels connect manufacturers directly with large-scale developers and institutional buyers. This approach enables customized solutions and volume pricing arrangements. However, residential consumers typically prefer indirect channels offering immediate product availability and local support services.

Key Market Segments

By Product Type

- Single Stage Pump

- Multiple Stage Pump

By Power Source

- Electric

- Hydraulic

- Gasoline

- Others

By Rated Power

- 50-150 W

- 10-50 W

- 150-300 W

- Above 300 W

By Water Pressure

- 1 Bar

- 0.5 Bar

- Above 1 Bar

By Material

- Cast Iron

- Aluminum

- Stainless Steel

- Others

By End-Use

- Residential Buildings

- Industries

- Agriculture

- Others

By Distribution Channel

- Indirect Sales

- Direct Sales

Drivers

Rising Urban High-Rise Housing and Modern Plumbing Systems Drive Market Growth

Urban expansion accelerates high-rise residential construction requiring effective water pressure management solutions. Multi-story buildings face inherent pressure loss challenges as water travels vertically through plumbing systems. Consequently, booster pumps become essential infrastructure components ensuring adequate pressure delivery to upper-floor fixtures and appliances.

Modern plumbing systems incorporate advanced fixtures demanding consistent water pressure for optimal performance. Low-flow showerheads, tankless water heaters, and smart appliances require stable pressure inputs. Therefore, homeowners increasingly invest in booster pumps to maximize their plumbing infrastructure’s functionality and efficiency.

Municipal water supply networks often deliver inadequate pressure to meet contemporary residential demands. Aging infrastructure, peak consumption periods, and distribution network limitations create persistent pressure deficiencies. Additionally, smart home integration drives demand for automated pressure management systems ensuring seamless operation across connected household devices.

Restraints

High Initial Investment Costs and Noise Concerns Limit Market Adoption

Installation expenses for quality booster pump systems represent significant financial barriers for budget-conscious homeowners. Comprehensive installations require professional plumbing modifications, electrical work, and pressure tank integration. Moreover, ongoing maintenance costs including filter replacements, seal repairs, and periodic servicing add to total ownership expenses.

Noise and vibration generation during pump operation creates acceptance challenges in compact residential environments. Older pump technologies produce disruptive sound levels affecting living comfort, particularly in apartments with shared walls. Therefore, consumers often hesitate adopting booster systems despite pressure needs, seeking quieter alternatives or delaying purchases.

Compact urban dwellings struggle accommodating booster pump equipment within limited mechanical spaces. Installation feasibility constraints and aesthetic concerns restrict pump placement options. Additionally, building regulations and homeowner association restrictions may prohibit or complicate retrofit installations in existing residential structures.

Growth Factors

Energy-Efficient Technologies and Urban Water Scarcity Drive Market Expansion

Variable speed pump technologies with intelligent controls deliver substantial energy consumption reductions compared to conventional fixed-speed systems. Permanent magnet motors optimize power usage based on real-time demand fluctuations. Consequently, operational cost savings and environmental benefits encourage adoption among sustainability-conscious consumers and green building developers.

Water-scarce urban regions experience accelerated residential construction requiring comprehensive pressure management infrastructure. Population growth concentrates in metropolitan areas with stressed water supply networks. Additionally, climate change impacts intensify water resource challenges, making efficient pressure boosting systems increasingly critical for residential development viability.

Aging apartment complexes and housing societies present substantial retrofitting opportunities for modern booster pump solutions. Deteriorating plumbing infrastructure and outdated pressure systems necessitate upgrades to maintain habitability standards. Moreover, increasing consumer awareness of water pressure optimization benefits drives proactive system improvements and replacement investments.

Emerging Trends

IoT Integration and Compact Design Innovations Reshape Market Landscape

Smart booster pumps with IoT connectivity enable remote monitoring, predictive maintenance, and automated performance optimization. Integrated sensors track pressure levels, flow rates, and energy consumption patterns. Therefore, homeowners gain unprecedented control and operational insights through smartphone applications and cloud-based management platforms.

Consumer preferences shift toward compact, space-saving pump designs accommodating limited installation areas in modern urban dwellings. Manufacturers develop integrated systems combining pumps, controllers, and pressure tanks in minimal footprints. Additionally, silent operation technologies address noise concerns, making booster pumps viable for previously unsuitable residential applications.

Automatic pressure sensors and intelligent controllers eliminate manual adjustments and operational intervention requirements. These systems dynamically respond to changing demand patterns ensuring consistent pressure delivery. Moreover, energy-rated and eco-compliant certifications increasingly influence purchasing decisions as regulatory frameworks prioritize efficiency and environmental performance standards.

Regional Analysis

North America Dominates the Domestic Booster Pump Market with a Market Share of 43.70%, Valued at USD 1.9 Billion

North America leads the global market driven by extensive residential infrastructure and stringent building codes. The region’s aging housing stock requires significant retrofitting while new construction incorporates advanced pressure management systems. Moreover, high consumer awareness and purchasing power support premium product adoption across 43.70% market share valued at USD 1.9 Billion.

Europe Domestic Booster Pump Market Trends

Europe demonstrates strong market growth fueled by sustainability initiatives and energy efficiency regulations. Countries prioritize building modernization and green technology integration. Additionally, dense urban populations and high-rise residential developments create consistent demand for reliable pressure boosting solutions.

Asia Pacific Domestic Booster Pump Market Trends

Asia Pacific experiences rapid market expansion driven by unprecedented urbanization and infrastructure development. Emerging economies invest heavily in residential construction requiring comprehensive water management systems. Furthermore, rising living standards and growing middle-class populations increase demand for modern plumbing amenities.

Middle East & Africa Domestic Booster Pump Market Trends

Middle East and Africa markets grow steadily supported by urban development projects and water scarcity challenges. Government investments in residential infrastructure and tourism-related construction drive adoption. Moreover, extreme climate conditions necessitate reliable water pressure systems for residential comfort and functionality.

Latin America Domestic Booster Pump Market Trends

Latin America shows promising growth potential with increasing urbanization and housing development initiatives. Government programs addressing housing shortages create opportunities for pressure management solutions. Additionally, modernization of existing residential buildings supports retrofit market expansion across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Grundfos maintains industry leadership through innovative pump technologies and comprehensive residential water solutions portfolios. The company pioneers energy-efficient designs incorporating intelligent controls and IoT connectivity. Their global distribution network and strong brand reputation support market dominance across residential and commercial segments. Moreover, continuous research and development investments enable technological advancement and competitive differentiation.

Xylem Inc. delivers advanced water technology solutions addressing residential pressure management challenges with sophisticated engineering approaches. The company focuses on sustainable product development and digital integration capabilities. Their diversified portfolio serves multiple market segments while maintaining strong residential booster pump presence. Additionally, strategic acquisitions expand technological capabilities and geographic market coverage.

Pentair Plc. offers comprehensive water treatment and pressure boosting solutions emphasizing reliability and performance optimization. The company leverages extensive industry experience to develop innovative residential pump systems. Their customer-centric approach and quality focus strengthen market position across premium product categories. Furthermore, integrated solutions combining filtration and pressure management appeal to discerning residential customers.

KSB AG provides robust pump engineering expertise with proven reliability in residential applications worldwide. The company emphasizes durability and long-term performance through superior manufacturing standards. Their technical support infrastructure and service network enhance customer satisfaction and brand loyalty. Moreover, continuous product innovation addresses evolving market demands and regulatory requirements.

Key Players

- ESPA

- Zoeller Company

- Honda India Power Limited

- IMBIL

- Lorentz

- C.R.I Pumps Private Limited

- Grundfos

- Pentair Plc.

- Xylem Inc.

- KSB AG

Recent Developments

- October 2024 – Duty point strengthened its water solutions offering through strategic acquisition of Flowtech, expanding product portfolio and market capabilities. This consolidation enhances the company’s position in residential and commercial water pressure management segments.

- August 2025 – Penn Pump acquired Alyan Pump and Federal Pump, significantly expanding manufacturing capabilities and market reach. The acquisition valued at undisclosed amount strengthens Penn Pump’s competitive position across multiple water management sectors.

Report Scope

Report Features Description Market Value (2025) USD 4.5 Billion Forecast Revenue (2035) USD 9.4 Billion CAGR (2026-2035) 7.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Stage Pump, Multiple Stage Pump), By Power Source (Electric, Hydraulic, Gasoline, Others), By Rated Power (50-150 W, 10-50 W, 150-300 W, Above 300 W), By Water Pressure (1 Bar, 0.5 Bar, Above 1 Bar), By Material (Cast Iron, Aluminum, Stainless Steel, Others), By End-Use (Residential Buildings, Industries, Agriculture, Others), By Distribution Channel (Indirect Sales, Direct Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ESPA, Zoeller Company, Honda India Power Limited, IMBIL, Lorentz, C.R.I Pumps Private Limited, Grundfos, Pentair Plc., Xylem Inc., KSB AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Domestic Booster Pump MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Domestic Booster Pump MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ESPA

- Zoeller Company

- Honda India Power Limited

- IMBIL

- Lorentz

- C.R.I Pumps Private Limited

- Grundfos

- Pentair Plc.

- Xylem Inc.

- KSB AG