Global Document AI Market Size, Share, Industry Analysis Report By Offering (Solution (IDP, Document Workflow Automation, Generative AI Document Generation, ECM & Government Tools), Services), By Document Type (Structured, Unstructured, Semi-Structured, Multimodal/Mixed Content), By Use Case (Finance & Accounting, Legal & Compliance, Customer Service, Marketing & Sales, HR, Supply Chain & Logistics), By Vertical (BFSI, Healthcare & Life Sciences, Government & Public Sector, Retail & E-Commerce, Manufacturing, Energy & Utilities, Telecommunications, Transportation & Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166260

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- Adoption Rates and Performance

- North America Market Size

- By Offering: Solution

- By Document Type: Structured

- By Use Case: Finance & Accounting

- By Vertical: BFSI

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

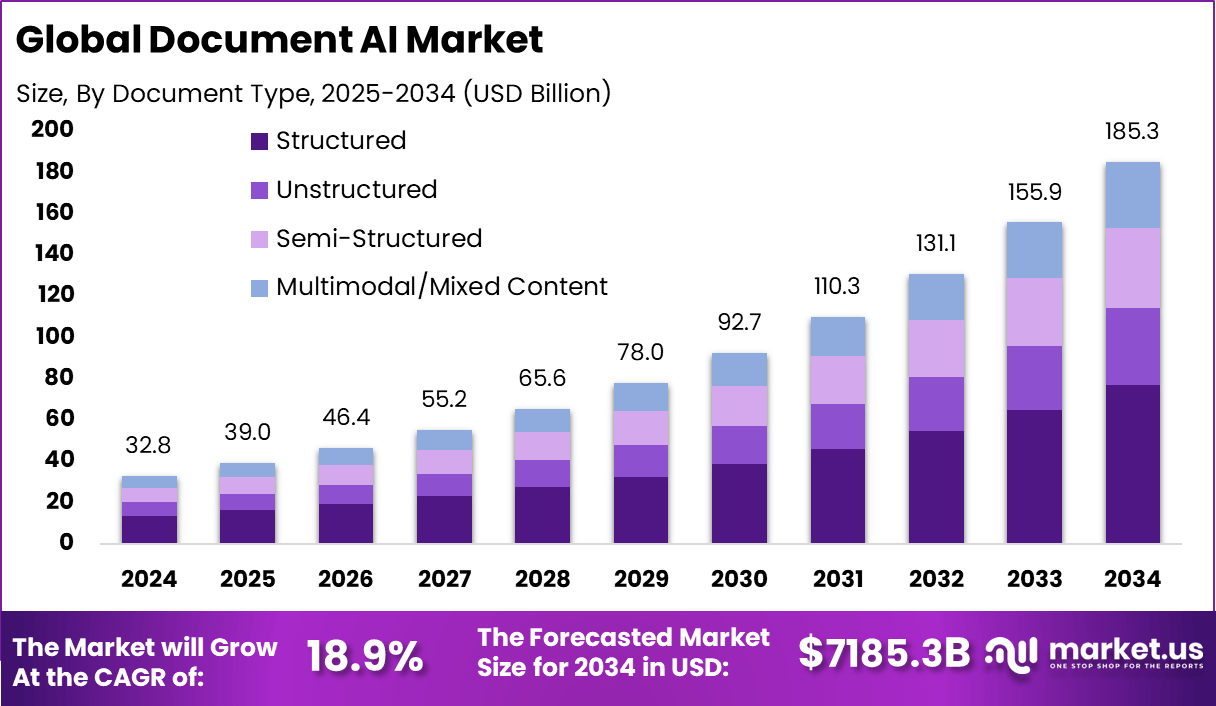

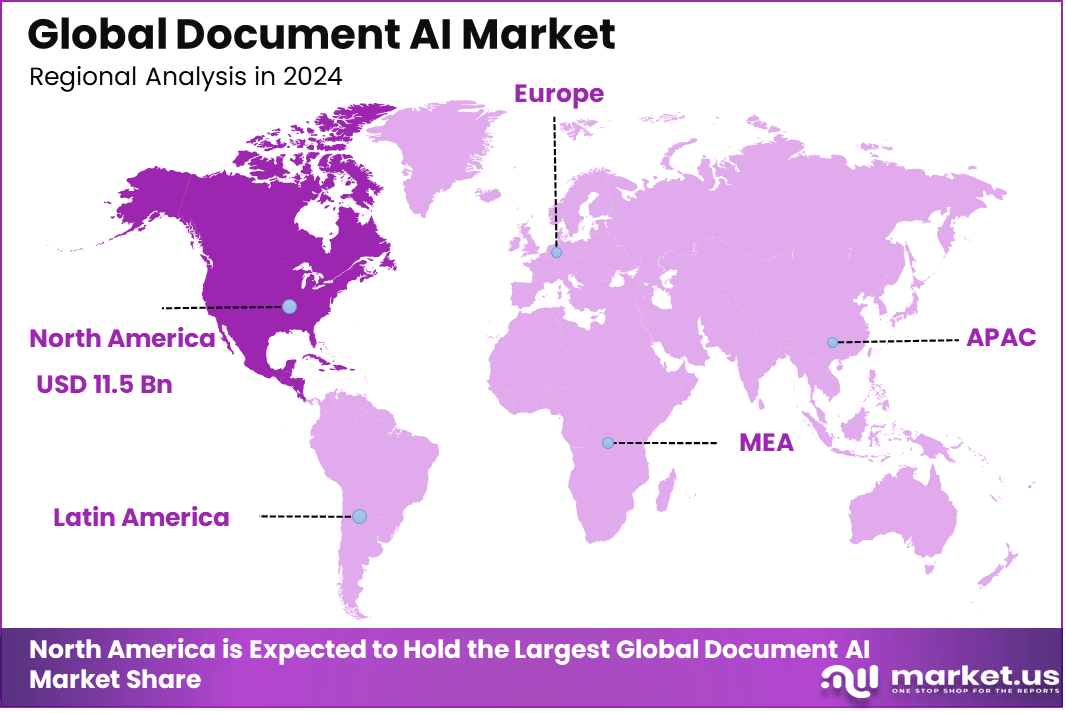

The Global Document AI Market generated USD 32.8 billion in 2024 and is predicted to register growth from USD 39 billion in 2025 to about USD 185.3 billion by 2034, recording a CAGR of 18.9% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.1% share, holding USD 11.5 Billion revenue.

The document AI market has expanded as organisations automate the extraction, classification and processing of information contained in unstructured documents. Growth is supported by higher volumes of digital records and the need for faster, more accurate document handling. The market has evolved from rule based document recognition to advanced AI systems capable of understanding context, formatting and intent across complex document types.

The growth of the market can be attributed to increasing digitalisation across industries, rising compliance requirements and the need for automated workflows that reduce human effort. Enterprises adopt document AI to handle large volumes of invoices, contracts, forms, identity records and communication logs. Improvements in natural language processing and computer vision make document interpretation more accurate, strengthening overall adoption.

Rising deployment of Document AI across mid-sized and large enterprises aiming to enhance productivity and reduce errors. Marketing departments use Document AI for personalized content creation and sentiment analysis, while finance teams automate invoice and audit processing. Cloud-based solutions dominate with about 72% market share, favored for their scalability and real-time access, which suits increasingly remote and hybrid work environments.

Business Benefits from Document AI include reduced processing times by up to 70%, improved data accuracy as high as 98%, and significant operational cost savings. Automation of repetitive document tasks frees human workers to focus on higher-value activities, increasing overall business agility while enhancing compliance and audit readiness. The tech also supports real-time insights and decision-making by converting unstructured documents into searchable data.

Quick Market Facts

- Solutions dominated the offering segment with a 75.3% share, driven by strong adoption of automated document processing, classification, and data extraction tools across industries.

- Structured documents led with 41.7%, reflecting the high volume of standardized forms, invoices, and records processed through AI workflows.

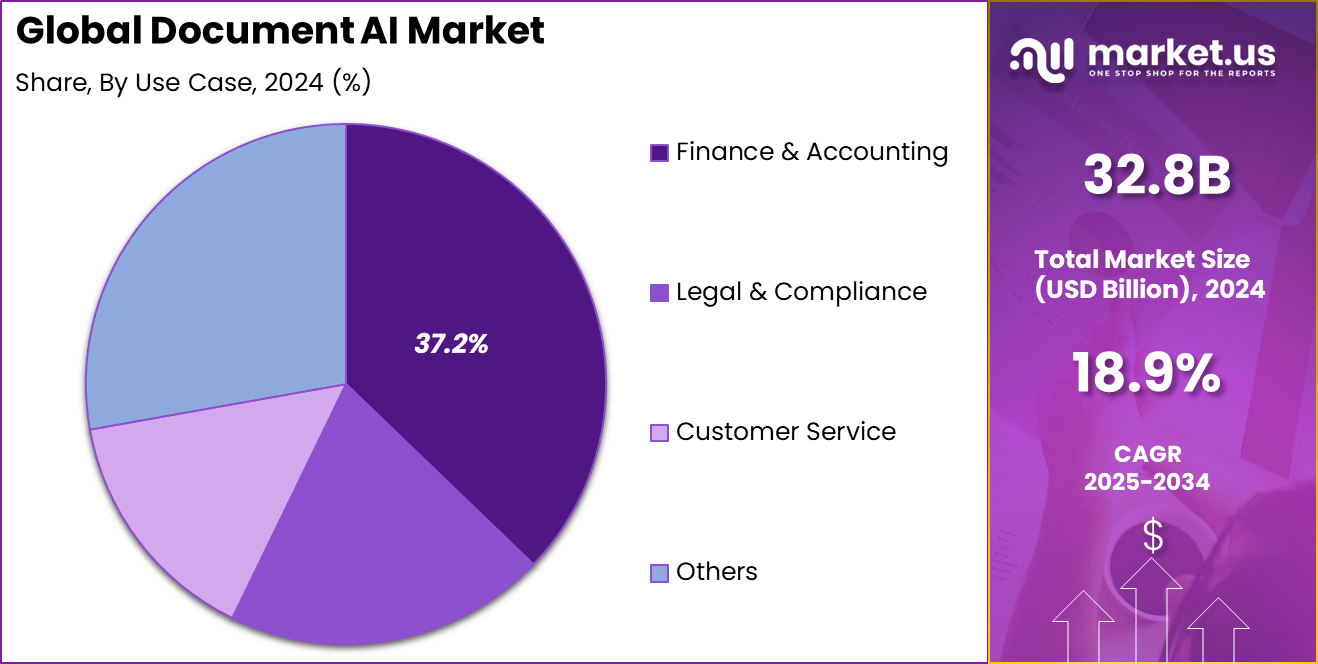

- Finance and Accounting was the top use case at 37.2%, supported by increasing automation of billing, audits, compliance reporting, and accounts payable/receivable operations.

- The BFSI sector captured 32.8%, highlighting its reliance on Document AI for fraud detection, KYC verification, loan processing, and operational risk management.

- North America held 35.1% of global market share, driven by rapid enterprise digitalization and strong Document AI deployment in regulated industries.

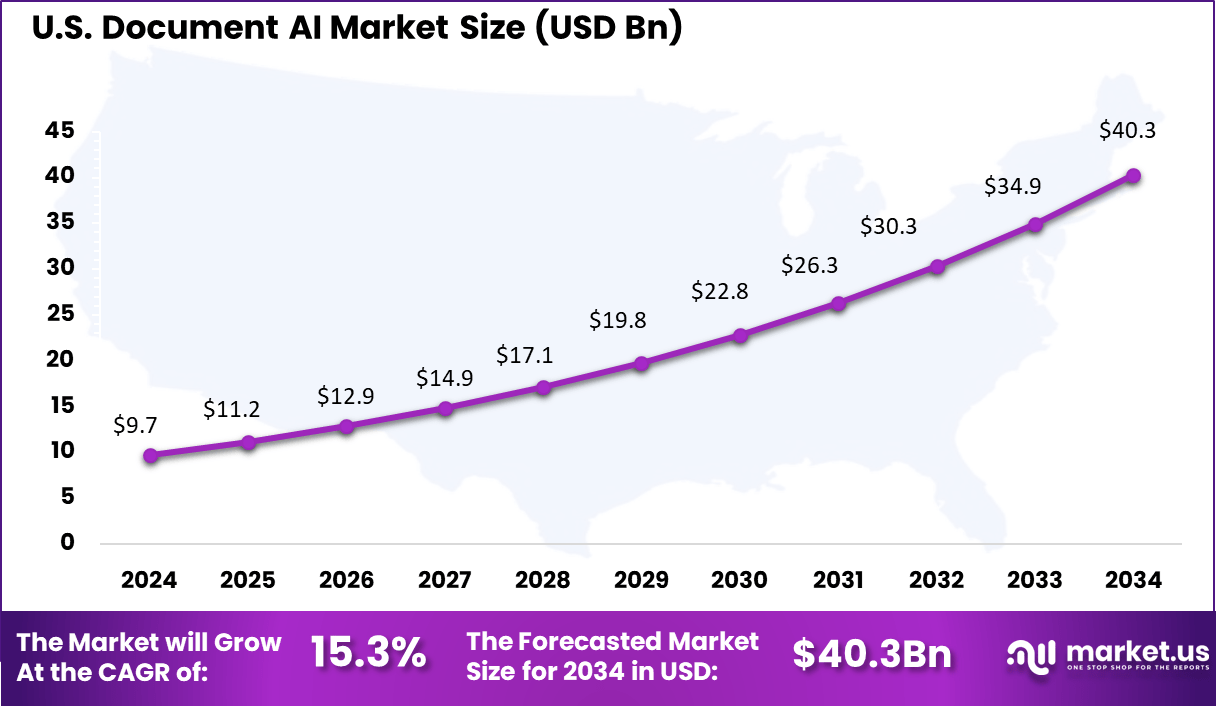

- The U.S. market reached USD 9.79 billion, expanding at a robust 15.3% CAGR, reflecting sustained investment in intelligent document workflows and compliance automation.

Adoption Rates and Performance

- High enterprise adoption: In 2024, about 78% of companies reported using AI in at least one business function, and this adoption level is expected to rise through 2025.

- Fortune 500 and 250 usage: A large share of Fortune 500 and Fortune 250 companies have deployed document automation or Intelligent Document Processing solutions to streamline high-volume workflows.

- Investment growth: More than 80% of enterprises plan to increase their investment in document automation by 2025, reflecting strong confidence in workflow automation.

- Integration with core systems: By 2025, most enterprises are expected to connect IDP platforms with their ERP environments to support end-to-end automation.

- Generative AI acceleration: About 65% of companies are accelerating IDP projects using Generative AI to improve extraction accuracy, classification, and automation speed.

- General accuracy: AI document reading systems typically achieve 90 to 99% accuracy in data extraction, depending on document complexity and model capability.

- Structured documents: For structured inputs such as invoices, bills, and claim forms, AI solutions reach 98 to 99% accuracy because of consistent layouts and predictable fields.

- Unstructured documents: Accuracy for unstructured content, including emails, letters, and handwritten notes, ranges from 80 to 95%, reflecting higher variability in formatting and language.

- Human versus AI error rates: Human reviewers may achieve about 99% accuracy on single tasks but show higher error rates of 10 to 20% when handling repetitive, large-volume workloads. AI systems can maintain lower error rates in repetitive processes with consistent patterns.

North America Market Size

North America plays a leading role in the Document AI market, accounting for 35.1% of the global share. This dominance is driven by several factors including strong enterprise digitization efforts, advanced AI infrastructure, and regulatory compliance mandates across sectors such as banking, healthcare, and insurance. Early technology adoption and sizable investments by organizations have positioned North America as a mature and innovative hub for Document AI solutions.

Within the region, the United States is a major contributor with a market value around USD 9.79 billion and a robust CAGR of 15.3%. The US market benefits from its advanced digital infrastructure, widespread AI integration, and strong presence of major AI and cloud technology providers. Continuous demand for automation, improved data accuracy, and regulatory adherence further fuel growth, making the US a critical driver of global Document AI market expansion

By Offering: Solution

The solution segment accounts for a dominant 75.3% share of the Document AI market, reflecting the strong preference for comprehensive software packages that automate document processing end-to-end. These solutions combine capabilities like optical character recognition (OCR), natural language processing (NLP), and machine learning to extract, classify, and analyze data effectively.

Companies favor solutions for their ability to streamline operations, reduce manual work, and enhance decision-making across departments. These solutions are often designed for scalability and integration with existing enterprise systems, making them adaptable to various business sizes. The growing demand for advanced, automated document workflows pushes vendors to enhance their offerings continuously.

By Document Type: Structured

Structured documents represent 41.7% of the market focus. These include forms, invoices, purchase orders, and other data-rich documents that follow predefined formats. The preference for structured document processing stems from its critical role in industries like finance and insurance, where accurate data extraction from such documents is essential for compliance and operational efficiency.

Handling structured documents efficiently allows organizations to reduce errors and accelerate processing times. As AI models improve, the accuracy and speed of extracting relevant information from structured documents continue to advance, boosting market adoption.

By Use Case: Finance & Accounting

Finance and accounting use cases cover 37.2% of the market, underlining the importance of Document AI in automating transaction processing, auditing, compliance, and reporting. Organizations use AI to manage large volumes of financial documents quickly while ensuring accuracy and regulatory adherence.

Automating financial document workflows reduces operational costs and enhances productivity in critical areas like invoicing and expense reconciliation. The complexity of finance documents makes AI solutions particularly valuable in extracting nuanced data relevant to these tasks.

By Vertical: BFSI

The BFSI (Banking, Financial Services, and Insurance) vertical holds a 32.8% share, representing one of the most mature and fast-growing sectors in Document AI adoption. Regulatory pressures, high transaction volumes, and the need for fraud detection and risk management drive BFSI companies to implement intelligent document processing.

BFSI firms prioritize automation to improve turnaround times for loan processing, claims management, and customer onboarding. The vertical’s demand for accuracy and compliance creates fertile ground for continued AI-driven innovation.

Emerging Trends

Key Trends Description Hyperautomation Document AI is rapidly advancing with hyperautomation, which combines AI, robotic process automation, and analytics to automate end-to-end document workflows, reduce manual tasks, and accelerate processing. Generative AI Integration The adoption of generative AI models enables Document AI to understand context better and generate summaries, answers, or risk insights from documents, making extraction faster and more accurate. Multimodal AI Models New AI models can process text, images, tables, and other formats simultaneously, improving accuracy for complex documents such as invoices or contracts and reducing manual verification efforts. Industry-Specific Solutions Vendors are developing Document AI tailored for sectors like healthcare, finance, and legal services. These solutions improve domain accuracy and help meet regulatory requirements more effectively. Privacy and Security Emphasis With rising data sensitivity, Document AI is integrating stronger privacy-first frameworks and technologies such as blockchain to ensure document authenticity, compliance, and secure processing. Growth Factors

Key Factors Description Increasing Enterprise Digitization Organizations are investing heavily in digital transformation, driving demand for automated document processing to handle large volumes of paper and digital documents efficiently. Rising Regulatory Compliance Compliance with regulations requires accurate and auditable document handling. Document AI helps reduce risk by ensuring documents meet legal and policy standards, fueling market growth. Advances in AI Infrastructure Maturing AI technologies and infrastructure enable more powerful and scalable Document AI solutions, supporting wider adoption across industries. Growing Use Across Marketing & Sales Automation in marketing and sales document management, like personalized proposals and campaign analysis, shows fast growth, expanding use cases for Document AI. Expansion in Asia Pacific Region Rapid digital adoption and government automation initiatives in Asia Pacific are accelerating the Document AI market growth, making it the fastest-growing regional market. Key Market Segments

By Offering

- Solution

- IDP

- Document Work-flow Automation

- Generative AI Document Generation

- ECM & Government Tools

- Services

By Document Type

- Structured

Unstructured - Semi-Structured

- Multimodal/Mixed Content

By Use Case

- Finance & Accounting

- Legal & Compliance

- Customer Service

- Others

By Vertical

- BFSI

- Healthcare & Life Sciences

- Government & Public Sector

- Retail & E-Commerce

- Manufacturing

- Energy & Utilities

- Telecommunications

- Transportation & Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Advancements in Intelligent Automation

A key driver fueling Document AI growth is the continuous progress in intelligent automation and AI models specialized for document processing. Advanced optical character recognition (OCR) combined with natural language understanding enables the extraction of accurate data from diverse document formats such as contracts, invoices, and handwritten forms.

Additionally, innovations in vision-language models allow better interpretation of complex documents that combine text, images, and tables. This multimodal understanding supports more precise data extraction across mixed-content documents, further expanding Document AI’s usefulness. The ability to handle multilingual and varied document types widely expands potential implementation across global businesses, boosting demand steadily as firms prioritize automation and accuracy in document-centric workflows.

Restraint

Data Privacy and Regulatory Restrictions

A major restraint limiting Document AI adoption is the strict regulations around data privacy and residency, especially in sensitive regions like the EU, China, and India. These laws restrict cross-border transfer of enterprise data required for training AI models, causing challenges in aggregating diverse datasets needed for broad, scalable model accuracy.

Companies face increased development costs as they often have to build region-specific AI infrastructures or rely on synthetic data to meet compliance. These data silos lead to slower innovation and reduced performance of AI models, as limited data variety hinders the systems’ generalization ability across different domains and languages.

Opportunity

Growth in SME Segment and Cloud Adoption

The expanding small and medium-sized enterprise (SME) segment presents a significant opportunity for Document AI vendors. Cloud-based offerings are lowering barriers by providing affordable, scalable, and flexible solutions that do not require heavy upfront IT investments.

SMEs are increasingly drawn to automate repetitive document tasks to cut errors and boost productivity, creating a rising demand for modular and pay-as-you-go AI models. As digital transformation accelerates especially in emerging economies across Asia Pacific, governments and businesses invest more in AI infrastructure and document automation to modernize workflows.

This regional growth coupled with increasing cloud adoption creates a fertile ground for expanding Document AI use beyond large enterprises to smaller organizations that stand to gain operational efficiency and enhanced compliance through automation.

Challenge

Integration Complexity and Skill Shortage

One notable challenge in Document AI deployment is the complexity of integrating AI systems with existing legacy infrastructure, especially for small and mid-sized companies. High upfront costs and technical difficulties in aligning new AI capabilities with traditional document management processes can delay adoption.

Additionally, there is a shortage of skilled professionals who understand both AI technologies and domain-specific document workflows, limiting smooth implementation and ongoing maintenance. The need for continuous innovation also requires constant updates to AI models, demanding specialized expertise and significant resources.

Alongside this, organizations must navigate complex and evolving regulatory compliance requirements, which vary by country and industry, further complicating deployment. Resistance to change and lack of awareness about AI’s full potential slow down market penetration. Overcoming these hurdles calls for more educational initiatives, vendor support for integration, and simplified solutions.

Competitive Analysis

Google, Microsoft, SAP, Appian, IBM, Oracle, Adobe, and EdgeVerve lead the document AI market with advanced platforms that automate extraction, classification, and validation of large document volumes. Their systems use deep learning, NLP, and computer vision to reduce manual workload and improve accuracy. These companies support enterprises in finance, healthcare, and public services by enabling fully digital workflows.

AWS, UiPath, EXL, OpenText, ABBYY, Automation Anywhere, and Super.AI expand the competitive landscape with specialized automation and intelligent document processing solutions. Their platforms focus on configurable models, low-code deployment, and real-time analytics. These providers help organizations scale processing capacity and reduce turnaround time for complex document types.

Emerging players such as Rossum, Tungsten Automation, Hyland, Hyperscience, Salesforce, and others contribute with agile, AI-first architectures designed for high-accuracy extraction and adaptive learning. Their solutions prioritize continuous model improvement, rapid onboarding, and seamless integration with enterprise systems. These companies address growing demand for touchless processing and end-to-end automation.

Top Key Players in the Market

- Microsoft

- SAP

- Appian

- IBM

- ORACLE

- ADOBE

- EDGEVERVE SYSTEMS (INFOSYS)

- AWS

- UIPATH

- EXL

- APPIAN

- OPENTEXT

- ABBYY

- AUTOMATION ANYWHERE

- SUPER.AI

- ROSSUM

- TUNSTEN AUTOMATION

- HYLAND

- HYPERSCIENCE

- SALESFORCE

- Others

Recent Developments

- November 2025, Google expanded its Document AI capabilities by releasing general availability support for layout parsing of DOCX, PPTX, XLSX, and XLSM files. This enhancement improves extraction of paragraphs, tables, and structural elements, enabling better contextual understanding for AI applications. Additionally, Google deprecated its Human-in-the-Loop feature, signaling a shift toward more automated processes.

- September 2025, SAP launched SAP Document AI, a business solution focused on automating document data extraction and workflow integration across SAP applications. The product promises improved accuracy and reduced manual effort, with plans to expand integration options later this year.

Report Scope

Report Features Description Market Value (2024) USD 32.8 Bn Forecast Revenue (2034) USD 185.3 Bn CAGR(2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution (IDP, Document Workflow Automation, Generative AI Document Generation, ECM & Government Tools), Services), By Document Type (Structured, Unstructured, Semi-Structured, Multimodal/Mixed Content), By Use Case (Finance & Accounting, Legal & Compliance, Customer Service, Marketing & Sales, HR, Supply Chain & Logistics), By Vertical (BFSI, Healthcare & Life Sciences, Government & Public Sector, Retail & E-Commerce, Manufacturing, Energy & Utilities, Telecommunications, Transportation & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google, Microsoft, SAP, Appian, IBM, Oracle, Adobe, EdgeVerve Systems (Infosys), AWS, UiPath, EXL, Appian, OpenText, ABBYY, Automation Anywhere, Super.AI, Rossum, TunstEN Automation, Hyland, Hyperscience, Salesforce, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft

- SAP

- Appian

- IBM

- ORACLE

- ADOBE

- EDGEVERVE SYSTEMS (INFOSYS)

- AWS

- UIPATH

- EXL

- APPIAN

- OPENTEXT

- ABBYY

- AUTOMATION ANYWHERE

- SUPER.AI

- ROSSUM

- TUNSTEN AUTOMATION

- HYLAND

- HYPERSCIENCE

- SALESFORCE

- Others