Global Docking Station Market By Product Type (Smartphone & Tablet, Laptop, Other Product Types), By Distribution Channel (Online Platforms, Offline Stores), By Connectivity (Wireless, Wired), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 52861

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

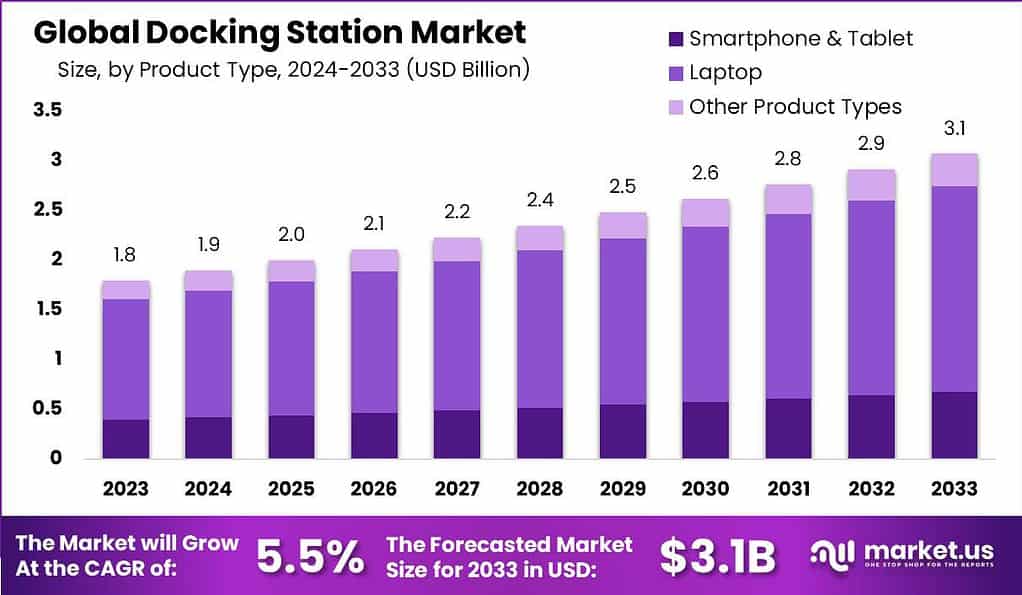

The Global Docking Station Market is estimated to be worth USD 1.8 billion in 2023 and projected to be valued at USD 3.1 billion in 2033. Between 2024 and 2033, the market is expected to register a growth rate of 5.5%.

A docking station is an electronic device that allows a laptop or other device to connect to peripherals and access various services typically offered via wired connections. Docking stations provide ports for connecting monitors, networking devices, external hard drives, printers, speakers and other accessories. They allow users to easily connect their portable devices to convert them into functional desktop workstations.

The docking station market has grown in recent years along with the rising popularity of mobile computing devices like laptops, tablets and smartphones. Key factors driving growth in the docking station market include the shift towards workflow mobility and bring-your-own-device (BYOD) work environments, as well as demand for desktop-like functionality from portable devices.

Note: Actual Numbers Might Vary In the Final Report

Key trends shaping the market include new USB Type-C and Thunderbolt 3 docking stations with faster charging and data transfer speeds, as well as wireless docking stations that provide cable-free connectivity. Overall, docking stations are an important accessory enabling users to enhance the utility of their portable devices and create more flexible, productive workspaces.

Key Takeaways

- Market Growth Projection: The global docking station market is expected to reach USD 3.1 billion by 2033, with a projected Compound Annual Growth Rate (CAGR) of 5.5%.

- Definition of Docking Station: A docking station is an electronic device that connects laptops or other devices to peripherals via wired connections, enhancing their functionality.

- Market Drivers: Rising Popularity of Mobile Devices: The market has witnessed growth due to the increasing usage of laptops, tablets, and smartphones.

- Product Type Analysis: In 2023, laptops held a dominant market position, capturing over 67.4% share.

- Distribution Channels: In 2023, offline stores held a dominant position with a 59.2% share.

- Connectivity Analysis: In 2023, wired docking stations dominated the market with a 62.1% share.

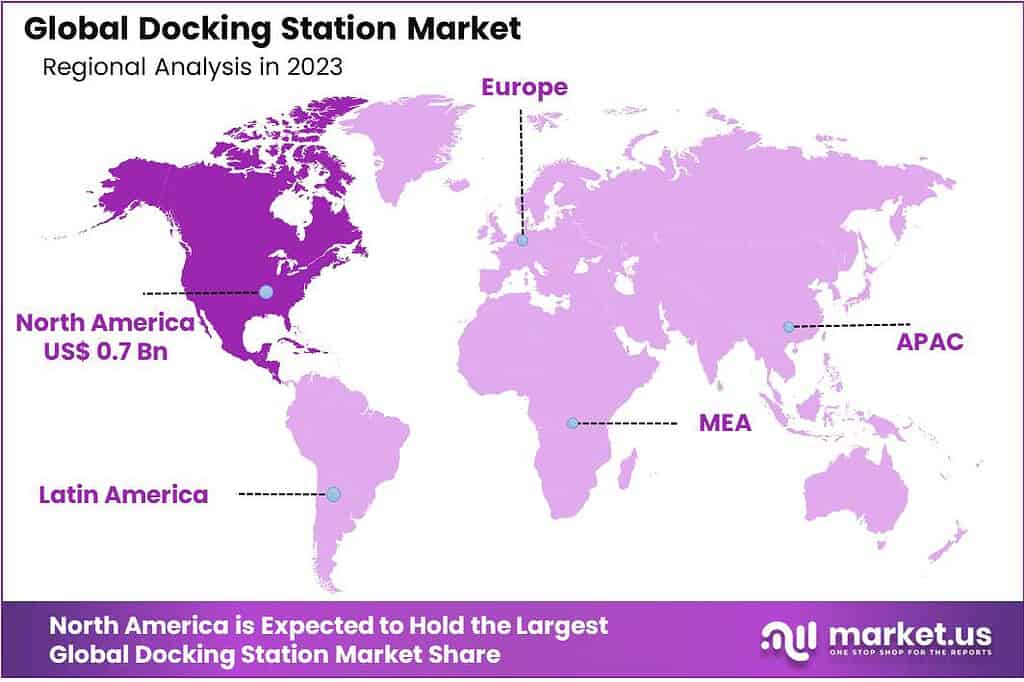

- Regional Analysis: North America Leads: North America held a dominant market position, with over 38.9% share in 2023.

- Key Players: Key players in the market include Dell Inc., Lenovo Group Limited, and The Hewlett-Packard Co.

Product Type Analysis

In 2023, the Laptop segment held a dominant market position in the docking station market, capturing more than a 67.4% share. This substantial portion can be attributed to the increasing demand for enhanced connectivity and the need for multiple device integrations among professional and personal users.

Laptops, being pivotal in daily computing tasks, have driven the need for more efficient and multifunctional docking solutions. These docking stations not only offer essential connectivity options like USB ports, Ethernet, and display outputs but also provide a streamlined workspace setup, which is highly favored in both remote and office environments.

On the other hand, the Smartphone & Tablet segment is also showing promising growth. With the continuous advancement in mobile technology, these devices are increasingly becoming powerful tools for both communication and productivity. The integration of docking stations with smartphones and tablets enables a seamless transition from mobile to a more stationary and ergonomic workspace, enhancing user experience and productivity. This segment is expected to expand as more individuals and enterprises recognize the efficiency and convenience brought by incorporating docking stations into their mobile-centric workflows.

Lastly, the Other Product Types segment includes specialized docking stations designed for unique or industry-specific applications. These may cater to specific technological requirements or niche markets and often incorporate additional features or customizations. While this segment is smaller compared to laptops and mobile devices, it remains an essential part of the market, addressing the needs of specialized sectors and contributing to the overall diversity and innovation within the docking station market.

Distribution Channel

In 2023, the Offline Stores segment held a dominant market position in the docking station market, capturing more than a 59.2% share. This significant market share is largely due to the consumer preference for a tactile buying experience, where they can physically assess the product’s compatibility and quality.

Offline stores, including electronics retailers and brand-specific shops, offer immediate customer service and expert advice, which is particularly valued when purchasing technical equipment like docking stations. Additionally, the instant gratification of taking home a purchase immediately remains a compelling factor for many consumers.

Conversely, the Online Platforms segment is rapidly expanding. With the global increase in internet penetration and the convenience of shopping from anywhere at any time, consumers are progressively turning to online platforms for their technology purchases. This segment benefits from a broader range of available products, competitive pricing, and detailed customer reviews, which can significantly influence purchasing decisions.

As e-commerce platforms continue to enhance their user experience and offer faster delivery options, it’s expected that the online segment will increase its market share. The rise of online shopping has been further accelerated by external factors such as the global shift towards remote working and the need for efficient home office setups.

Connectivity Analysis

In 2023, the Wired segment held a dominant market position in the docking station market, capturing more than a 62.1% share. This predominance can be largely attributed to the reliability and speed that wired connections offer. Wired docking stations provide a stable and fast data transfer rate, which is crucial for high-performance tasks and professional environments where efficiency and minimal latency are paramount. Additionally, wired docking stations are generally more affordable and offer a straightforward setup, making them accessible to a broad range of users, from corporate settings to individual consumers.

On the other hand, the Wireless segment of the docking station market is showing a growing trend, driven by the increasing demand for convenience and mobility. Wireless docking stations offer the advantage of a clutter-free workspace and ease of connectivity, catering to the modern preference for sleek, minimalistic designs. They are particularly appealing in environments where flexibility and aesthetics are key considerations.

As wireless technology continues to advance, with improvements in speed and reliability, it is expected that the market share for wireless docking stations will increase. This growth will be supported by the rising popularity of wireless devices and the ongoing trend towards more agile and adaptable workspaces.

Key Market Segments

Product Type

- Smartphone & Tablet

- Laptop

- Other Product Types

Connectivity

- Wireless

- Wired

Distribution Channel

- Online Platforms

- Offline Stores

Driving Factors

- Increasing adoption of portable devices: The rising usage of portable devices such as laptops, tablets, and smartphones has fueled the demand for docking stations, as they provide users with a convenient way to connect these devices to peripheral devices such as monitors, keyboards, and mice.

- Growing trend of remote work and flexible office spaces: The shift towards remote work and flexible office spaces has increased the need for docking stations. These stations enable employees to easily connect their laptops or tablets to larger screens and other peripherals at their home offices or co-working spaces, enhancing productivity and comfort.

- Technological advancements in connectivity options: Docking stations have evolved to support various connectivity options, including USB-C, Thunderbolt, and wireless technologies. This has made docking stations more versatile and compatible with a wide range of devices, driving their popularity among users.

- Expansion of gaming and entertainment industries: The gaming and entertainment industries have witnessed significant growth in recent years. Docking stations cater to the needs of gamers and media enthusiasts by providing enhanced graphics, audio, and connectivity options, thereby driving the demand for these devices.

Restraining Factors

- High cost of advanced docking stations: Docking stations with advanced features and connectivity options can be relatively expensive. The high cost of these devices may deter price-sensitive consumers from purchasing them, limiting market growth.

- Compatibility issues with older devices: Some docking stations may not be fully compatible with older devices that lack the required ports or connectivity options. This can restrict the target market for docking stations and hinder their widespread adoption.

- Limited awareness and availability in emerging markets: Docking stations may have limited awareness and availability in emerging markets, where the adoption of portable devices and remote work trends are still evolving. This can pose a challenge to market expansion in these regions.

- Increasing popularity of wireless connectivity: The growing popularity of wireless connectivity technologies, such as Bluetooth and Wi-Fi direct, has led to a decrease in the demand for docking stations that rely on wired connections. This shift in consumer preferences may limit the market growth of docking stations.

Growth Opportunities

- Integration of advanced features: There is an opportunity for docking station manufacturers to integrate additional features such as biometric authentication, multi-device charging, and built-in speakers. These value-added features can attract customers looking for enhanced functionality and convenience.

- Expansion into emerging markets: Manufacturers can focus on expanding their presence in emerging markets where the adoption of portable devices and remote work trends are on the rise. By increasing awareness and availability, companies can tap into the untapped potential of these markets.

- Collaboration with device manufacturers: Collaborating with laptop, tablet, and smartphone manufacturers can open up new opportunities for docking station manufacturers. By bundling docking stations with devices or developing customized solutions, companies can enhance their market reach and offer a seamless user experience.

- Focus on sustainability: With increasing environmental concerns, there is a growing demand for sustainable products. Docking station manufacturers can explore eco-friendly materials, energy-efficient designs, and recyclable packaging to align with consumer preferences and capitalize on the growing sustainability trend.

Challenges

- Intense competition from alternative connectivity solutions: Docking stations face competition from alternative connectivity solutions such as wireless adapters, dongles, and cloud-based services. These alternatives offer similar functionalities without the need for a physical docking station, posing a challenge to the market.

- Rapidly evolving device standards: The technology landscape is constantly evolving, with new device standards and connectivity options being introduced. Docking station manufacturers need to stay updated and ensure compatibility with the latest devices, which requires continuous research and development efforts.

- Security concerns: Docking stations that connect to multiple devices may pose security risks, as they can potentially transfer malware or unauthorized access between the connected devices. Addressing these security concerns and implementing robust security measures is crucial to gain the trust of users.

- Supply chain disruptions: The global supply chain is susceptible to disruptions due to various factors such as natural disasters, trade conflicts, and pandemics. Docking station manufacturers need to have contingency plans in place to mitigate the impact of such disruptions and ensure a steady supply of components.

Key Market Trends

- Increased demand for universal docking stations: Universal docking stations that support multiple device types and connectivity options are gaining popularity. Users prefer versatile docking solutions that can be used with different devices, eliminating the need for multiple docking stations.

- Rise of wireless docking solutions: Wireless docking solutions are witnessing a surge in demand, driven by the convenience and flexibility they offer. These solutions enable users to connect their devices to external displays and peripherals without the need for physical connections, providing a clutter-free workspace.

- Focus on compact and portable designs: Docking stations with compact and portable designs are in high demand, catering to the needs of users who frequently travel or have limited desk space. Compact docking stations offer the convenience of easy setup and transportation without compromising on functionality.

- Integration of smart features and IoT connectivity: Docking stations are being integrated with smart features and Internet of Things (IoT) connectivity to enhance user experience. This includes features such as voice recognition, automated device recognition, and remote control capabilities. IoT connectivity allows users to control and manage their docking stations remotely, adding an extra layer of convenience and automation.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 38.9% share in the global docking station market. The region’s strong market presence can be attributed to several factors. Firstly, North America has a robust technology infrastructure and a high adoption rate of portable devices, such as laptops, tablets, and smartphones, which drives the demand for docking stations. The demand for Docking Station in North America was valued at US$ 0.7 billion in 2023 and is anticipated to grow significantly in the forecast period.

Europe’s market growth can be attributed to the widespread adoption of portable devices, the rise of remote work, and the increasing demand for flexible office solutions. Countries like Germany, the United Kingdom, and France have been at the forefront of this growth, driven by their strong technology infrastructure and high smartphone and laptop penetration rates.

Moreover, the region’s emphasis on sustainability and eco-friendly practices has created opportunities for docking station manufacturers to offer energy-efficient and environmentally conscious solutions. The presence of prominent players and the availability of advanced connectivity options have further contributed to the market growth in Europe.

The Asia Pacific (APAC) region has emerged as a promising market for docking stations, experiencing substantial growth in 2023. The region’s rapid economic development, coupled with the increasing adoption of portable devices, has been a key driver of market growth. Countries like China, Japan, South Korea, and India have witnessed a surge in demand for docking stations, driven by the growing IT sector, the rise of remote work, and the increasing popularity of gaming and entertainment.

Moreover, the region’s large population and urbanization trends have created a substantial customer base for docking station manufacturers. The presence of local players offering cost-effective solutions, coupled with the expanding middle-class population, has further propelled the market growth in APAC.

Latin America has shown steady growth in the docking station market, capturing a notable market share of in 2023. The region’s market growth can be attributed to the increasing adoption of portable devices, particularly in countries like Brazil and Mexico. The rise of remote work and the growing entertainment industry have contributed to the demand for docking stations in the region.

However, economic challenges and limited awareness about docking stations among consumers in certain parts of Latin America have posed constraints to market expansion. Nonetheless, with the rising digital transformation and the increasing need for productivity-enhancing devices, Latin America presents growth opportunities for docking station manufacturers.

In the Middle East and Africa (MEA) region, the docking station market is gradually gaining traction. The rising adoption of portable devices, the growth of the IT sector, and the increasing demand for advanced connectivity options have driven the market growth in MEA. Countries like the United Arab Emirates, Saudi Arabia, and South Africa have been key contributors to the market growth, fueled by their strong technology infrastructure and growing awareness of docking stations.

However, economic challenges and limited availability of advanced docking station models in certain parts of the region have posed challenges to market expansion. Nevertheless, with the increasing digitalization initiatives and the rising focus on improving workplace productivity, the docking station market in MEA is expected to witness steady growth in the coming years.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The docking station market boasts a competitive landscape with several key players vying for market share. These players are continuously striving to innovate and offer advanced docking solutions to cater to the evolving needs of consumers.

Top Key Players

- Dell Inc.

- Lenovo Group Limited

- The Hewlett-Packard Co.

- ACCO Brands Corporation

- Targus International LLC

- Toshiba Corporation

- Belkin International, Inc.

- Acer Inc.

- Samsung Electronics Co., Ltd.

- ASUSTeK Computer Inc.

- Panasonic Corporation

- Wavlink Technology Ltd.

- StarTech.com Ltd.

- Plugable Technologies

- Other Key Players

Recent Developments

- In June 2023, Lenovo introduced its new docking station in China, featuring 12-in-1 multi-functionality. The Lenovo Type-C 12-in-1 Docking Station boasts a versatile set of 12 connectivity interfaces, including USB 3.2, USB 2.0, HDMI, SD card slot, DisplayPort, and PD

- In April 2023, Kensington expanded its desktop connectivity solutions for offices and homes by introducing the SD5760T Thunderbolt 4 Dual 4K Docking Station and SD4810P USB-C 5Gbps Triple Video Driverless Dock.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 3.1 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smartphone & Tablet, Laptop, Other Product Types), By Distribution Channel (Online Platforms, Offline Stores), By Connectivity (Wireless, Wired) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Dell Inc., Lenovo Group Limited, The Hewlett-Packard Co., ACCO Brands Corporation, Targus International LLC, Toshiba Corporation, Belkin International, Inc., Acer Inc., Samsung Electronics Co., Ltd., ASUSTeK Computer Inc., Panasonic Corporation, Wavlink Technology Ltd., StarTech.com Ltd., Plugable Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Docking Station?A docking station is a device that allows users to connect and expand the functionality of laptops or tablets by providing additional ports for peripherals like monitors, USB devices, and audio equipment.

How big was the docking station market in 2023?It was valued at US$ 1.8 Bn in 2023How big will the docking station industry be in 2033?It is projected to reach US$ 3.1 Bn by the end of 2033.Which region is expected to hold the highest share in the Global Docking Station Market?North America is expected to hold the highest share in the Global Docking Station Market.

Who are the top key players in the Global Docking Station Market?Dell Inc., Lenovo Group Limited, The Hewlett-Packard Co., ACCO Brands Corporation, Targus International LLC, Toshiba Corporation, Belkin International, Inc., Acer Inc., Samsung Electronics Co., Ltd., ASUSTeK Computer Inc., Panasonic Corporation, Wavlink Technology Ltd., StarTech.com Ltd., Plugable Technologies, Other Key Players are the key pl

-

-

- Dell Inc.

- Lenovo Group Limited

- The Hewlett-Packard Co.

- ACCO Brands Corporation

- Targus International LLC

- Toshiba Corporation

- Belkin International, Inc.

- Acer Inc.

- Samsung Electronics Co., Ltd.

- ASUSTeK Computer Inc.

- Panasonic Corporation

- Wavlink Technology Ltd.

- StarTech.com Ltd.

- Plugable Technologies

- Other Key Players