Global Dock and Yard Management Systems Market Market Size, Share, Growth Analysis By Component (Software, Services), By Deployment (On-premise, Cloud), By End User (Transportation & Logistics, Retail, Manufacturing, Food & Beverage, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025.

- Report ID: 168596

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

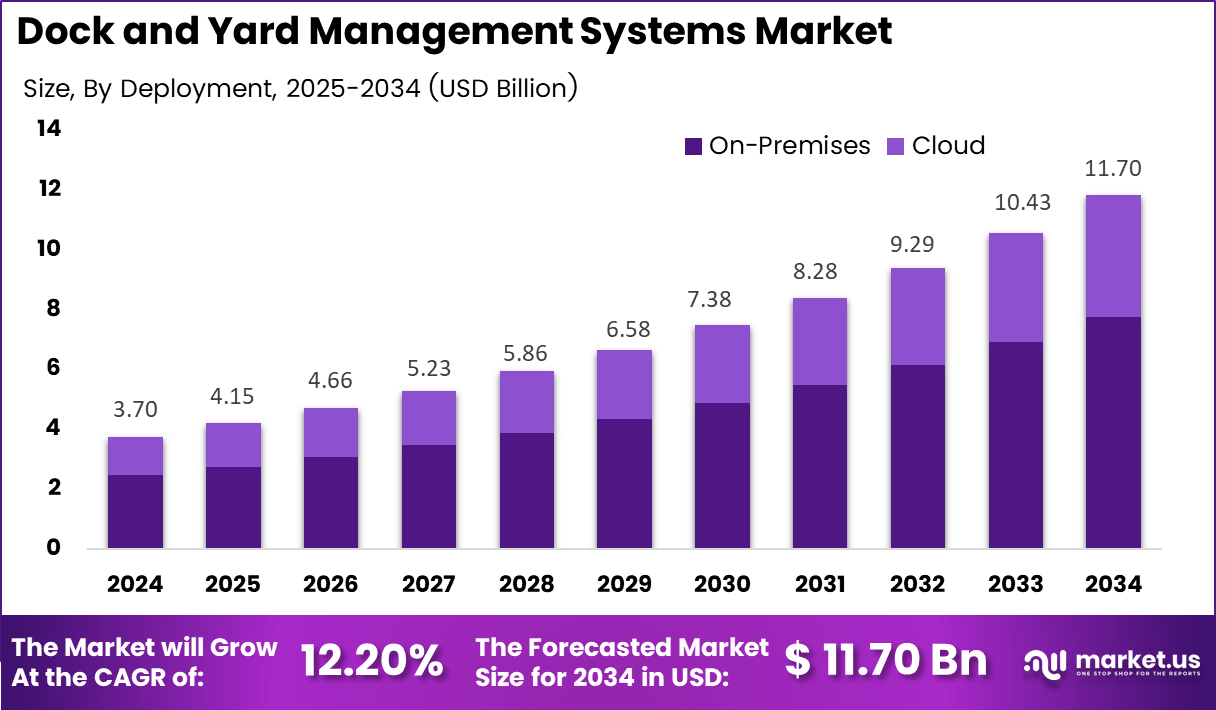

The Global Dock and Yard Management Systems Market size is expected to be worth around USD 11.70 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034.

The Dock and Yard Management Systems Market represents digital platforms that streamline dock scheduling, trailer movements, yard visibility, and workflow automation. These systems enhance operational accuracy, reduce delays, and support scalable logistics operations. They are widely adopted across transportation, retail distribution, and manufacturing hubs to improve asset utilization and overall supply-chain responsiveness.

The Dock and Yard Management Systems Market grows steadily as enterprises pursue higher throughput and real-time operational control. Rising pressure on supply-chain agility encourages companies to integrate automated dock scheduling and optimized trailer management to minimize congestion and accelerate turnaround cycles. Consequently, digital yard tools are increasingly becoming essential components of logistics modernization.

Moreover, opportunity expands as governments invest in smart logistics corridors, warehouse modernization incentives, and digital transparency initiatives. These policies accelerate adoption across distribution-heavy sectors by promoting higher efficiency standards. Companies benefit from enhanced visibility, shorter dwell times, and automated workflows that drive improved cost predictability and stronger service-level compliance across networks.

Additionally, regulations around load verification, worker safety, traceability, and yard security reinforce the need for integrated Dock and Yard Management Systems. These compliance-driven upgrades fuel demand for systematic tracking, digital records, and automated alert systems. As organizations transition toward Industry 4.0 operations, advanced yard systems offer measurable productivity improvements and long-term scalability.

Finally, statistical indicators further highlight system value. According to industry case studies, trailer search time decreases by 40 minutes, while a robust yard management system handles work equal to 4–5 employees. Further, real-time insights enhance customer satisfaction by 40%, and user organizations report idle time reductions of 25%, according to logistics performance assessments.

Key Takeaways

- The Global Dock and Yard Management Systems Market is projected to reach USD 11.70 Billion by 2034, up from USD 3.7 Billion in 2024.

- The market is expected to grow at a strong CAGR of 12.2% from 2025–2034.

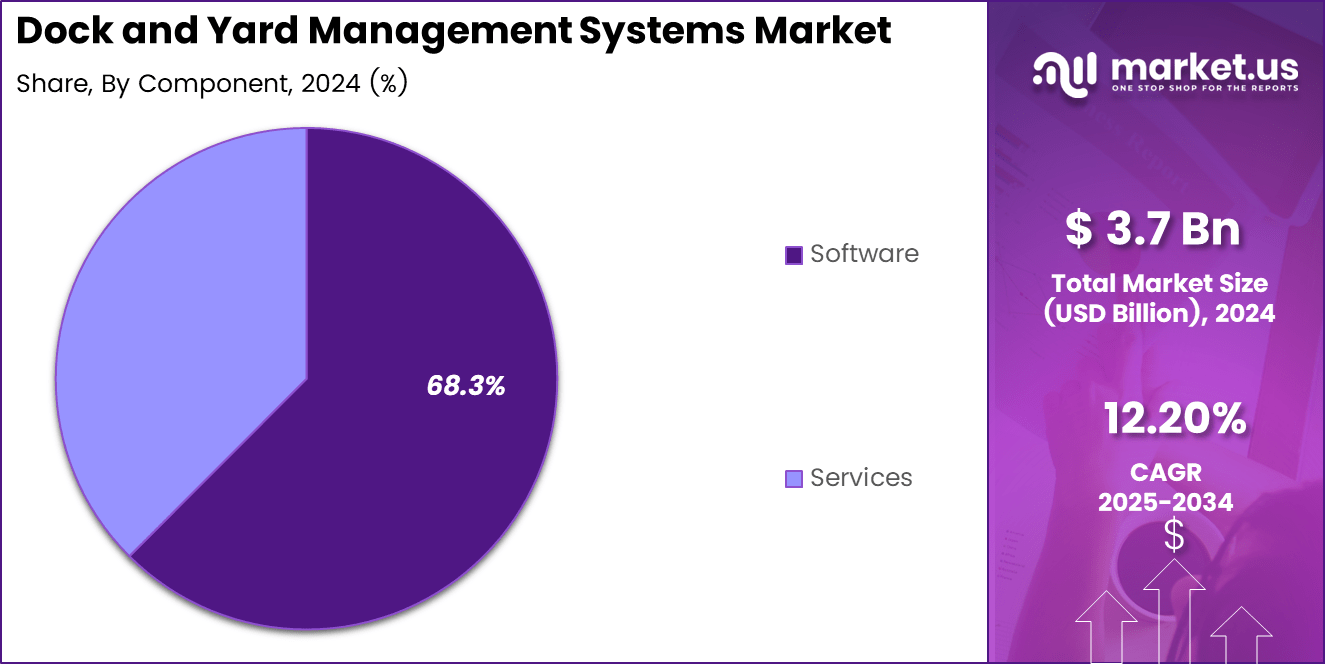

- Software dominated the component segment with a leading share of 68.3% in 2024.

- Cloud deployment remained the top deployment model, accounting for a 66.2% share in 2024.

- Transportation & Logistics led the end-user segment with a dominant 33.6% market share in 2024.

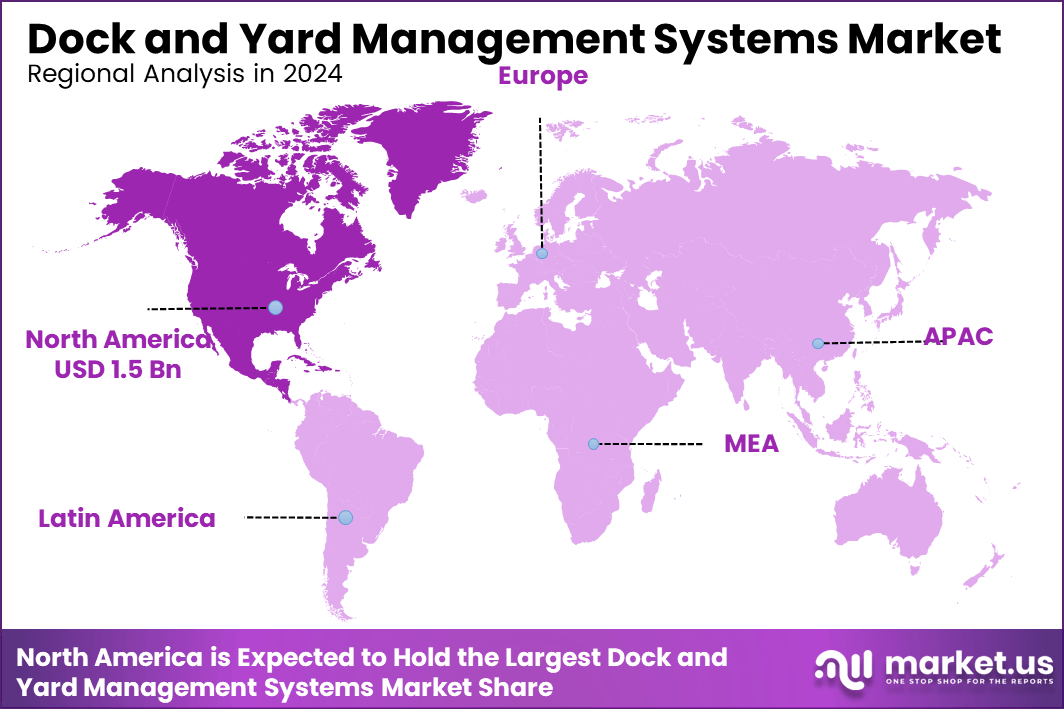

- North America held the largest regional share at 43.2%, reaching a valuation of USD 1.5 billion in 2024.

By Component Analysis

Software dominates with 68.3% due to its critical role in real-time yard visibility and automation.

In 2024, Software held a dominant market position in the By Component segment of the Dock and Yard Management Systems Market, with a 68.3% share. This segment expands as organizations transition from manual logs to automated platforms that offer predictive scheduling, load optimization, and workflow intelligence. These capabilities enhance operational discipline and significantly improve turnaround accuracy.

In 2024, Services contributed meaningfully to the By Component segment as enterprises relied on integration, maintenance, and training support. Service teams enable seamless onboarding of

and on-premise solutions, helping companies maximize uptime and adapt system functionalities to their operational models. This segment’s relevance grows as digital transformation accelerates across logistics operations.

By Deployment Analysis

Cloud dominates with 66.2% as companies prefer scalable, low-maintenance deployment models.

In 2024, On-premise solutions maintained relevance in the By Deployment segment of the Dock and Yard Management Systems Market. Enterprises with dedicated IT frameworks, strict data-governance needs, or heavy customization requirements continue choosing on-premise platforms. This segment supports high-control environments where direct hardware management and localized data storage remain operational priorities.

In 2024, Cloud held a dominant market position in the By Deployment segment of the Dock and Yard Management Systems Market, with a 66.2% share. Cloud platforms expand rapidly as users adopt subscription-based models that reduce CAPEX. Companies benefit from real-time updates, remote accessibility, and flexible scalability that support dynamic logistics workloads and multi-site visibility.

By End User Analysis

Transportation & Logistics dominates with 33.6% due to heavy dependence on optimized yard flows.

In 2024, Transportation & Logistics held a dominant market position in the By End User segment of the Dock and Yard Management Systems Market, with a 33.6% share. High trailer volumes, multi-carrier coordination, and constant loading-unloading cycles push logistics operators to adopt advanced yard automation to boost throughput and minimize detention penalties.

Retail continued to adopt Dock and Yard Management Systems to manage frequent inbound shipments and seasonal surges. Retail warehouses depend on real-time dock scheduling and automated trailer visibility to handle high SKU diversity efficiently. This segment grows as omnichannel operations expand and inventory turnover increases across large distribution networks.

Manufacturing adopted yard automation to synchronize raw-material deliveries with production schedules. Real-time tracking helps manufacturers reduce waiting times, prevent line stoppages, and maintain just-in-time workflows. This segment benefits from the rising focus on factory-to-warehouse connectivity, digital audits, and lean operational planning.

Food & Beverage strengthened adoption as companies needed temperature-controlled scheduling, rapid dock assignment, and compliance tracking. Yard systems help avoid spoilage risks, improve load sequencing, and support regulatory requirements for perishable goods. This segment expands due to increased demand for traceability and time-sensitive delivery coordination.

Healthcare expanded its share in the Dock and Yard Management Systems Market as medical distributors and pharmaceutical companies required precise shipment visibility. Automated monitoring reduces misrouting risks and ensures secure handling of high-value and regulated goods. The segment benefits from rising healthcare logistics complexity and growing cold-chain demands.

Others—including automotive, chemicals, and e-commerce—adopted yard systems to optimize inbound and outbound flows. These industries leverage automation to reduce congestion, improve safety oversight, and maintain service commitments. Growth continues as multi-site operations increasingly demand centralized visibility and standardized scheduling frameworks.

Key Market Segments

By Component

- Software

- Services

By Deployment

- On-premise

- Cloud

By End User

- Transportation & Logistics

- Retail

- Manufacturing

- Food & Beverage

- Healthcare

- Others

Drivers

Expansion of Automated Yard Workflows Drives Market Growth

The Dock and Yard Management Systems Market grows as companies automate yard workflows to replace slow manual coordination. Automation helps dispatchers assign docks faster, reduce trailer confusion, and eliminate paperwork errors. These improvements create smoother operations and allow logistics teams to handle higher shipment volumes without expanding staff.

The adoption of real-time dock scheduling tools also accelerates market expansion. Companies use digital schedules to reduce waiting time, manage peak-hour congestion, and improve turnaround accuracy. These systems help carriers arrive at the right time, preventing delays and providing a more predictable loading and unloading process for distribution centers.

Additionally, businesses increasingly focus on visibility solutions that support multi-site logistics operations. Centralized dashboards allow teams to track trailer status, dock availability, and yard movements across different warehouses. This visibility helps managers reduce bottlenecks, improve communication, and maintain consistent service performance even when operating multiple facilities in different regions.

The strong demand for automation, real-time scheduling, and multi-site visibility strengthens the market. As logistics networks become more complex, companies prioritize digital yard solutions to reduce costs and improve service quality. These capabilities also help operators respond faster to market fluctuations, ensuring stable performance during high-demand periods.

Restraints

Integration Challenges Limit Market Expansion

The Dock and Yard Management Systems Market faces restraints due to integration challenges with old warehouse management and transportation systems. Many logistics operators still use outdated platforms, making it difficult to connect new yard systems smoothly. This mismatch slows adoption and increases the cost of implementation for some businesses.

Small and mid-sized logistics operators also struggle with limited capital budgets, which reduces their ability to invest in advanced digital yard tools. These companies often prioritize immediate operational needs instead of long-term automation upgrades. Budget constraints restrict the adoption rate of real-time scheduling and visibility technologies.

The lack of technical expertise among smaller operators further limits adoption. Without strong IT support, companies hesitate to adopt complex digital systems that require training, configuration, and maintenance. This slows modernization across regions where logistics companies operate on thin margins and focus mainly on basic operational improvements.

Despite these restraints, demand continues to grow, but financial and system-compatibility barriers prevent uniform adoption. Companies with complex legacy setups face higher transition costs, prolonging decision cycles and implementation timelines. These limitations highlight the need for scalable, plug-and-play solutions that simplify integration for cost-sensitive logistics providers.

Growth Factors

AI-Driven Predictive Dock Allocation Creates Strong Opportunities

The Dock and Yard Management Systems Market experiences strong growth opportunities through AI-driven predictive dock allocation. These tools help companies forecast gate demand, assign docks intelligently, and prevent bottlenecks during high-traffic hours. Predictive analytics improves daily workflows and supports consistent, data-backed decision-making across yard operations.

Cloud-based yard management tools also create new opportunities, especially for companies with multiple distribution centers. Cloud deployment reduces hardware expenses, offers remote access, and ensures real-time synchronization across different sites. This flexibility allows operators to scale operations faster and manage all facilities through a unified platform.

Rising demand for RFID and IoT-enabled tracking solutions strengthens the opportunity landscape. These technologies provide precise, real-time location data for trailers, pallets, and equipment. The improved accuracy enhances security, reduces search time, and supports automated workflows that eliminate manual scanning and reduce human errors in the yard.

As logistics becomes more data-driven, companies increasingly prefer solutions that offer predictive planning, cloud scalability, and automated tracking. These advanced capabilities help reduce costs, improve service levels, and support long-term digital transformation. The market benefits from investments that prioritize smart, connected, and efficient yard operations.

Emerging Trends

Digital Twin Simulation Accelerates Market Trends

The Dock and Yard Management Systems Market sees notable trends with the rising use of digital twin simulation. These virtual yard models help operators test workflows, identify bottlenecks, and improve layout planning. Companies use digital simulations to make more informed decisions and optimize yard performance without disrupting live operations.

Mobile-based yard check-in and gate automation also emerge as strong trends. Drivers can complete digital check-ins, receive dock assignments, and track queue status through mobile apps. This approach reduces gate delays, minimizes paperwork, and enhances safety by reducing face-to-face interactions during peak logistics periods.

The adoption of geofencing technology further supports trending behaviors in modern yards. Geofencing enables real-time monitoring of trailer movements, improving security and reducing misplaced assets. Automated alerts inform managers when trailers enter or exit specific zones, improving accuracy and reducing operational confusion.

These trends show how logistics operators increasingly favor digital, automated, and mobile-enabled solutions. As companies move toward smarter yard operations, technologies like digital twins, geofencing, and mobile check-ins redefine day-to-day workflows. This shift strengthens efficiency, reduces manual errors, and supports more connected logistics ecosystems.

Regional Analysis

North America Dominates the Dock and Yard Management Systems Market with a Market Share of 43.2%, Valued at USD 1.5 Billion

North America stands as the leading region, driven by large-scale logistics automation, strong adoption of cloud-based dock scheduling tools, and rapid modernization of distribution and warehouse networks. The region accounts for a dominant 43.2% share, representing a valuation of nearly USD 1.5 billion supported by widespread deployment of IoT-enabled yard visibility, RFID tracking, and intelligent workflow optimization. Growing e-commerce fulfillment volumes and high operational standards further strengthen the region’s position in advanced dock and yard management technologies.

Europe Dock and Yard Management Systems Market Trends

Europe demonstrates steady growth, supported by rising cross-border trade, strong regulatory emphasis on supply chain safety, and increasing investment in intelligent automation within logistics clusters. The region benefits from expanding e-commerce penetration, which drives demand for efficient dock allocation and structured yard operations. Modern warehouse designs across Western Europe continue to integrate digital solutions to reduce congestion and improve scheduling accuracy.

Asia Pacific Dock and Yard Management Systems Market Trends

Asia Pacific emerges as a rapidly expanding region due to strong industrial growth, large manufacturing bases, and accelerated development of smart logistics parks. Expanding e-commerce ecosystems in China, India, and Southeast Asia contribute significantly to the adoption of automated dock and yard tools. Government-backed infrastructure upgrades further encourage integration of real-time yard monitoring and digital freight coordination systems.

Middle East & Africa Dock and Yard Management Systems Market Trends

The Middle East & Africa market grows steadily, supported by modernization initiatives across major ports, free-trade zones, and logistics corridors. Gulf countries increasingly adopt digital yard optimization platforms to enhance throughput and reduce turnaround times. Africa’s maturing logistics sector also begins adopting structured dock management systems to minimize operational inefficiencies.

Latin America Dock and Yard Management Systems Market Trends

Latin America shows gradual adoption as countries modernize warehouse infrastructure and upgrade transportation networks. Brazil, Mexico, and Chile drive demand through expanding retail distribution and growing industrial output. Increasing logistics digitalization supports the use of dock scheduling and structured yard workflows to improve load handling efficiency.

U.S. Dock and Yard Management Systems Market Trends

The U.S. market experiences strong momentum due to high logistics density, rising automation investments, and widespread digital adoption in third-party logistics and retail distribution networks. Increased focus on real-time scheduling, IoT-based yard monitoring, and trailer inventory management enhances operational accuracy. Expanding cold chain and high-velocity delivery networks continue to elevate demand for advanced yard management solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dock and Yard Management Systems Market Company Insights

The global Dock and Yard Management Systems Market in 2024 reflects steady momentum as enterprises prioritize synchronized logistics, real-time visibility, and automated scheduling across multi-facility networks. The competitive landscape is shaped by a mix of established supply-chain technology providers and specialized yard-management innovators, each strengthening capabilities through workflow automation, cloud-native platforms, and predictive analytics.

Manhattan Associates, Inc. is expected to reinforce market growth by advancing unified supply-chain orchestration, integrating yard execution with warehouse and transportation systems. Its increasing focus on AI-driven slotting and appointment optimization strengthens real-time control for high-volume distribution centers.

Blue Yonder Group, Inc. continues to shape market direction through cognitive automation, with expanding adoption of its Luminate platform enabling dynamic dock-scheduling decisions. Its emphasis on machine-learning-based ETA predictions and yard-task automation supports operators transitioning to more autonomous logistics environments.

C3 Solutions, Inc. maintains strong traction in the sector by offering dedicated yard and dock management applications with configurable workflow engines. Its cloud-based platform enhances throughput for retail, grocery, and 3PL operators by improving carrier collaboration and digital gate processes.

Descartes Systems Group Inc. strengthens market competitiveness through its integrated logistics portfolio that combines routing, visibility, and appointment scheduling. Its increasing focus on multimodal visibility and real-time compliance workflows accelerates adoption among fleets and global shippers seeking tighter control over gate congestion.

Overall, these key companies are anticipated to play a central role in accelerating digital yard transformation, enabling logistics networks to shift from manual coordination to synchronized, data-driven operations across global supply chains

Top Key Players in the Market

- Manhattan Associates, Inc.

- Blue Yonder Group, Inc.

- C3 Solutions, Inc.

- Descartes Systems Group Inc.

- 4SIGHT Connect (4sight Solution)

- Epicor Software Corporation

- Oracle Corporation

- SAP SE

- Infor, Inc.

- Zebra Technologies Corporation

Recent Developments

- In February 2025, Loadsmart launched an integrated Yard Management System (YMS) that unifies gate, yard, and dock operations into a single workflow.The solution connects with Opendock and NavTrac to improve visibility, reduce congestion, and streamline overall facility operations.

- In January 2024, C3 Solutions introduced a digital driver onboarding system with a unified login across its Yard and Dock Management platform.

This development enhanced gate security, reduced manual check-in time, and improved driver flow efficiency at logistics facilities. - In July 2024, Kaleris acquired CAMS Software to integrate the Prospero Transportation Management System (TMS) with its existing Yard Management System.The acquisition specifically targeted grocers and wholesalers, enabling more end-to-end logistics control across transportation, yard, and warehouse operations.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 11.70 Billion CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment (On-premise, Cloud), By End User (Transportation & Logistics, Retail, Manufacturing, Food & Beverage, Healthcare, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Manhattan Associates, Inc., Blue Yonder Group, Inc., C3 Solutions, Inc., Descartes Systems Group Inc., 4SIGHT Connect (4sight Solution), Epicor Software Corporation, Oracle Corporation, SAP SE, Infor, Inc., Zebra Technologies Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dock and Yard Management Systems MarketPublished date: Dec 2025.add_shopping_cartBuy Now get_appDownload Sample

Dock and Yard Management Systems MarketPublished date: Dec 2025.add_shopping_cartBuy Now get_appDownload Sample -

-

- Manhattan Associates, Inc.

- Blue Yonder Group, Inc.

- C3 Solutions, Inc.

- Descartes Systems Group Inc.

- 4SIGHT Connect (4sight Solution)

- Epicor Software Corporation

- Oracle Corporation

- SAP SE

- Infor, Inc.

- Zebra Technologies Corporation