Global Distributed Antenna Systems Market By Technology (Active DAS, Passive DAS, and Hybrid DAS), By Ownership (Neutral-Host Ownership, Carrier Ownership, Enterprise Ownership), By Application (Education Sector & Corporate Offices, Public Venues & Safety, Hospitality, Healthcare, Industrial, Airport & Transportation, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: August 2024

- Report ID: 64734

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

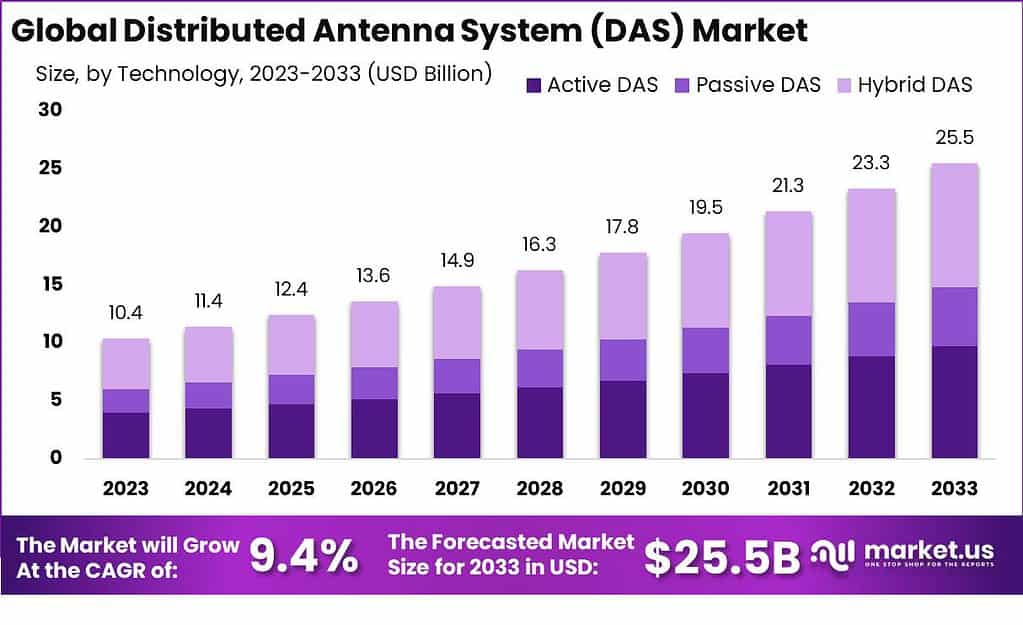

The global Distributed Antenna Systems (DAS) market size is expected to be worth around USD 25.5 Billion by 2033 from USD 10.4 Billion in 2023, growing at a CAGR of 9.4% during the forecast period from 2024 to 2033.

A Distributed Antenna System (DAS) is a network of spatially separated antenna nodes connected to a common source via a transport medium, typically coaxial or fiber-optic cable. This system effectively enhances wireless communication capabilities within a designated area or structure by ensuring robust and evenly distributed signal coverage. DAS is versatile in its applications, encompassing environments where direct signals are weak due to structural obstructions or distance from a cell tower, such as in large buildings, stadiums, and campuses.

The DAS market is experiencing growth due to increasing demand for enhanced cellular coverage and the rapid expansion of wireless broadband services. Key drivers for this market include the proliferation of mobile data traffic, the growing need for public safety communications, and advancements in connected devices and IoT. As urban densities increase and buildings become more complex, the requirement for efficient, continuous wireless coverage drives the adoption of DAS solutions across commercial buildings, healthcare facilities, educational institutions, and transportation hubs.

The demand for Distributed Antenna Systems (DAS) is primarily driven by the increasing need for enhanced mobile broadband experiences and seamless wireless connectivity in large venues, such as stadiums, hospitals, and universities. The widespread adoption of smartphones and the growing reliance on mobile connectivity for both personal and professional use have necessitated robust mobile coverage and capacity in densely populated areas.

Furthermore, the emergence of 5G technology has significantly boosted the demand for DAS, as these systems are essential for supporting the dense network infrastructure required for 5G deployments. Additionally, regulatory requirements for public safety communications and emergency services have mandated the installation of reliable wireless communication systems, further propelling the demand for DAS solutions.

Several growth factors are propelling the Distributed Antenna Systems (DAS) market. The transition to 5G networks is a major driver, as DAS is crucial for extending the reach and enhancing the density of these next-generation networks, particularly in urban areas and indoor environments where direct signal penetration is challenging.

Moreover, the global increase in data traffic due to higher video consumption and mobile application usage demands continuous enhancement of mobile network capacities, where DAS plays a vital role. The growing number of connected devices per individual and the push towards smart city initiatives also contribute to the expansion of DAS installations worldwide. Additionally, the ongoing improvements in DAS technology, such as higher energy efficiency and compatibility with multiple carriers, make these systems more attractive to potential users, ensuring sustained market growth.

The market for Distributed Antenna Systems (DAS) is ripe with opportunities, particularly in the development and upgrading of infrastructure in emerging economies. As these regions experience rapid urbanization and economic growth, the demand for improved wireless communication systems is expected to rise. There is also a significant opportunity in retrofitting existing buildings with advanced DAS to comply with newer regulations and technological standards, including public safety communication mandates.

The integration of DAS with other communication technologies like small cells, which complement the coverage and capacity enhancements provided by DAS, offers another pathway for growth. Moreover, the proliferation of IoT applications across industries presents a unique opportunity for DAS providers to expand their offerings beyond traditional markets, tapping into industrial, healthcare, and transportation sectors where reliable, widespread coverage is crucial for operational efficiency.

Key Takeaways

- The Distributed Antenna Systems (DAS) market is projected to expand from USD 10.4 Billion in 2023 to approximately USD 25.5 Billion by 2033, demonstrating a compound annual growth rate (CAGR) of 9.4% over the forecast period from 2024 to 2033.

- In terms of system types, the Hybrid DAS segment maintained a commanding lead in the market in 2023, securing a significant 42% market share of the overall Distributed Antenna System (DAS) market.

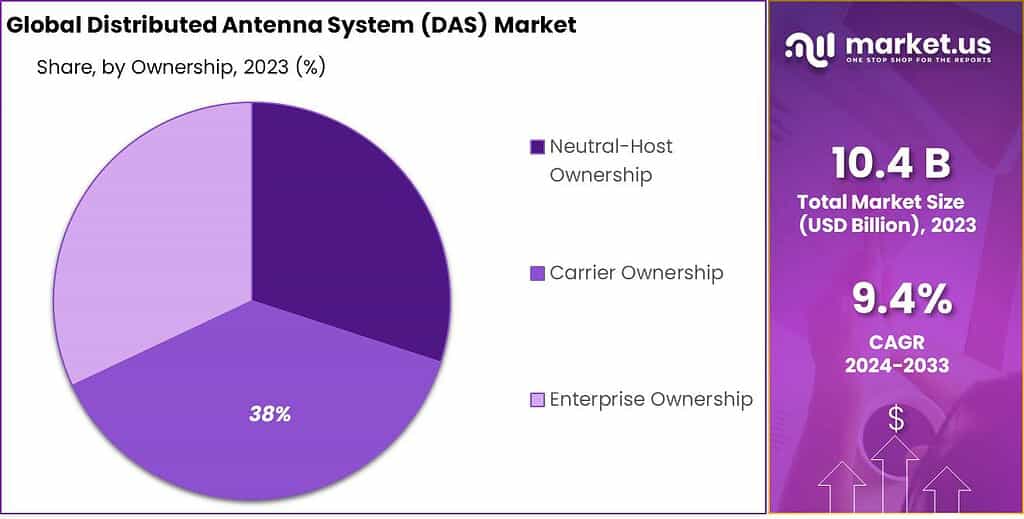

- From an ownership perspective, the Carrier Ownership segment was predominant in 2023, holding a substantial 38% market share of the Distributed Antenna System (DAS) market.

- Regarding applications, the Public Venues & Safety segment was a leading category in 2023, capturing over 23% market share of the Distributed Antenna System (DAS) market.

- Geographically, North America was the leading region in the Distributed Antenna System (DAS) market in 2023, accounting for a dominant 40% market share, with revenues reaching USD 4.2 billion.

Technology Analysis

In 2023, the Hybrid DAS segment held a dominant market position, capturing more than a 42% share of the Distributed Antenna System (DAS) market. The Hybrid DAS segment is leading the market due to its ability to combine the strengths of both active and passive DAS technologies, offering enhanced flexibility and scalability for various applications.

Hybrid DAS provides a balanced approach, allowing for efficient signal distribution over long distances while maintaining cost-effectiveness. This adaptability makes it particularly appealing for large venues such as stadiums, airports, and commercial buildings, where the need for reliable and widespread coverage is critical.

Moreover, the growing demand for improved indoor coverage, especially in dense urban environments, has further propelled the adoption of Hybrid DAS. As urban areas continue to expand, the limitations of traditional passive DAS systems in providing consistent and reliable coverage become more apparent.

Hybrid DAS addresses these challenges by leveraging active components to boost signal strength, ensuring that users experience seamless connectivity even in complex environments. This capability to deliver high-quality service in challenging conditions is a significant factor contributing to the Hybrid DAS segment’s leadership in the market.

Additionally, the rise of 5G technology has also played a pivotal role in the dominance of the Hybrid DAS segment. As 5G networks require more sophisticated infrastructure to handle higher data speeds and increased device connectivity, Hybrid DAS systems have emerged as a preferred solution. They provide the necessary infrastructure to support 5G deployment while allowing for future upgrades, making them a long-term investment for organizations.

Ownership Analysis

In 2023, the Carrier Ownership segment held a dominant market position, capturing more than a 38% share of the Distributed Antenna System (DAS) market. The Carrier Ownership segment is leading the market primarily because of the significant investments and resources that telecom carriers bring to the deployment and management of DAS systems.

Carriers are motivated to ensure optimal network performance and customer satisfaction, driving them to take direct control of DAS infrastructure. By owning the DAS, carriers can more effectively manage signal quality, capacity, and coverage, particularly in high-traffic areas like stadiums, shopping malls, and large commercial complexes.

Furthermore, carrier-owned DAS systems often benefit from streamlined integration with the broader network infrastructure. This direct control allows carriers to implement upgrades and maintenance more efficiently, ensuring that the DAS systems remain aligned with evolving network standards and technologies, such as 5G. The ability to quickly adapt and scale these systems to meet increasing demand for data and connectivity is a significant advantage, making carrier ownership an attractive option for ensuring long-term network reliability and performance.

Additionally, carriers’ established relationships with large enterprises and public venues contribute to the dominance of the Carrier Ownership segment. These partnerships enable carriers to expand their DAS deployments across various sectors, ensuring consistent coverage in critical locations. As carriers continue to prioritize customer experience and network efficiency, their ownership of DAS infrastructure positions them to lead the market, providing robust and reliable connectivity solutions that meet the growing needs of businesses and consumers alike.

Application Analysis

In 2023, the Public Venues & Safety segment held a dominant market position, capturing more than a 23% share of the Distributed Antenna System (DAS) market. The Public Venues & Safety segment is leading the market due to the critical need for reliable and uninterrupted communication in large, crowded spaces where public safety is a top priority.

Public venues such as stadiums, concert halls, and convention centers require robust DAS solutions to ensure that both emergency services and attendees have seamless access to cellular and communication networks. The ability to provide consistent coverage in these environments is crucial for managing large crowds and ensuring quick response times in case of emergencies.

Moreover, the increasing focus on public safety regulations and compliance has driven the adoption of DAS systems in public venues. Authorities and venue operators are increasingly investing in advanced communication infrastructure to meet the stringent safety requirements mandated by governments and regulatory bodies.

DAS systems in these settings not only enhance the visitor experience by improving mobile connectivity but also play a vital role in supporting emergency services, including fire, police, and medical personnel, by providing them with reliable communication channels during critical situations.

Additionally, the rise in large-scale events and the growing popularity of smart cities have further contributed to the dominance of the Public Venues & Safety segment. As cities become more interconnected and technology-driven, the demand for sophisticated communication infrastructure in public spaces has surged. DAS systems are becoming essential for supporting the high volume of data traffic generated in these venues, ensuring that both routine operations and emergency responses can be handled effectively.

Key Market Segments

By Technology

- Active DAS

- Passive DAS

- Hybrid DAS

By Ownership

- Neutral-Host Ownership

- Carrier Ownership

- Enterprise Ownership

By Application

- Education Sector & Corporate Offices

- Public Venues & Safety

- Hospitality

- Healthcare

- Industrial

- Airport & Transportation

- Other Applications

Driver

Proliferation of 5G Technology

The Distributed Antenna System (DAS) market is significantly driven by the widespread adoption and rollout of 5G technology, which demands high-speed and reliable network coverage, particularly in dense urban areas and large indoor spaces.

As 5G technology utilizes millimeter-wave frequencies known for high bandwidth but limited range and penetration, DAS is critical in overcoming these limitations. By distributing the 5G signal within buildings and crowded areas, DAS ensures comprehensive connectivity. This is essential for supporting the burgeoning data traffic and the Internet of Things (IoT), which are pivotal in modern digital ecosystems.

Restraint

High Initial Investment Costs

One major challenge hindering the broader adoption of DAS is the significant initial investment required for infrastructure development, including antennas, cabling, and central hubs. This high cost can be prohibitive, particularly for smaller venues or organizations with constrained budgets.

The complexity of integrating DAS with existing wireless infrastructures, which may involve compatibility issues with different technologies and frequencies, further complicates deployments and adds to the overall expenses.

Opportunity

Expansion in Commercial and Healthcare Sectors

DAS presents substantial growth opportunities in various commercial applications, notably in sectors requiring robust and uninterrupted connectivity such as healthcare and public venues. For instance, hospitals and healthcare facilities are increasingly dependent on reliable wireless communication systems to support critical medical applications and emergency communications, making DAS an integral component of modern healthcare infrastructure.

Challenge

Technological and Operational Complexities

While DAS offers enhanced connectivity, the technology itself introduces complexities that can act as barriers to its implementation. The installation of DAS involves not just financial outlay but also technical challenges related to the system’s design and compatibility with existing networks.

The need for frequent upgrades and maintenance, coupled with the aesthetic and spatial considerations of installing multiple antennas, often complicates the adoption of DAS. Moreover, evolving standards and the need for systems that support a wide range of frequencies and technologies demand continuous technical innovation and adaptability from providers.

Growth Factors

The growth of the Distributed Antenna System (DAS) market is primarily fueled by the increasing demand for seamless and enhanced indoor wireless coverage. As buildings are constructed with materials that often impede wireless signals, such as thick concrete walls and energy-saving glass, DAS becomes essential to ensure reliable mobile connectivity.

This need is further compounded by the rising consumption of mobile data and the expansion of mobile communication networks, including 5G, which require robust infrastructure to maintain high-quality service delivery in densely populated areas such as stadiums, airports, and large office buildings

Emerging Trends

A notable emerging trend in the DAS market is the integration of DAS with 5G technology to address the coverage and capacity challenges in complex environments. As the 5G rollout accelerates, DAS is evolving to support higher frequencies and greater bandwidth requirements.

Another trend is the shift towards more intelligent DAS solutions that can dynamically manage and optimize wireless coverage in real-time. Additionally, the adoption of DAS in venues such as hospitals, campuses, and large commercial complexes is increasing, driven by the need for reliable communication for safety, operational efficiency, and user satisfaction.

Top Use Cases

DAS finds its top use cases in scenarios where maintaining a strong and reliable wireless signal is critical. In the healthcare sector, DAS ensures that medical staff have uninterrupted communication, crucial for emergency responses and routine operations.

It is also vital in educational institutions, supporting digital learning platforms and enhancing campus safety through improved communications. In the corporate sector, DAS supports a myriad of business operations, facilitating seamless connectivity for everyday communications and robust data transfer capabilities that support enterprise applications and remote work requirements.

Regional Analysis

In 2023, North America held a dominant market position in the Distributed Antenna System (DAS) market, capturing more than a 40% share, with revenues amounting to USD 4.2 billion. This leading position can be attributed to several pivotal factors. Firstly, the substantial investment in advanced telecommunications infrastructure by both public and private sectors across the United States and Canada has significantly propelled the adoption of DAS solutions.

Such investments are aimed at enhancing mobile coverage and capacity, especially in densely populated urban areas and large-scale commercial environments which demand robust wireless communication systems. Furthermore, the presence of major technology and telecommunication firms in North America, which are continually innovating and expanding their wireless solutions portfolios, has also spurred the growth of the DAS market in this region.

Companies like AT&T, Verizon, and T-Mobile have been key players in deploying DAS to improve connectivity for their vast customer bases, particularly in response to the growing demand for enhanced mobile data services and the gradual rollout of 5G networks.

Additionally, stringent regulations and standards regarding building safety and wireless communication capabilities in the United States and Canada mandate the use of DAS in new constructions and significant renovations. This regulatory environment has created a sustained demand for DAS installations, ensuring public safety and high-quality communication access in buildings like hospitals, universities, and corporate campuses.

The ongoing technological advancements and the rapid expansion of smart cities projects in North America also play a crucial role. These initiatives often incorporate DAS to ensure seamless wireless communication essential for IoT devices and services, contributing further to the market growth. With these factors combined, North America is expected to maintain its lead in the DAS market as it continues to evolve in alignment with global technological advancements and infrastructure requirements.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Distributed Antenna Systems (DAS) market is driven by several key players who are actively shaping the industry’s landscape through strategic moves and technological advancements. Among these players, CommScope Inc., Corning Inc., and SOLiD Inc. stand out as leaders due to their significant market presence and continuous innovation.

These companies have established themselves as dominant forces in the DAS market by offering comprehensive solutions that cater to various applications, including public venues, safety, and carrier-owned networks. Their competitive edge is maintained through ongoing investments in research and development, allowing them to stay ahead of the curve in a rapidly evolving market.

CommScope Inc. has been particularly active in expanding its market reach through acquisitions and new product launches. In recent years, the company acquired ARRIS International, a move that significantly broadened its portfolio and enhanced its position in the DAS market.

Corning Inc. has also made strategic acquisitions, including the purchase of 3M’s Communication Markets Division, which bolstered its DAS offerings and market share. Meanwhile, SOLiD Inc. has focused on innovation, launching next-generation DAS solutions that provide enhanced coverage and capacity for indoor and outdoor environments.

Some key players in the DAS market:

- Anixter Inc.

- Cobham PLC

- Antenna Products Corporation

- CommScope Inc.

- Tower Bersama Group

- SOLiD Inc.

- TE Connectivity Ltd

- Corning Inc.

- Comba Telecom Systems Holdings Ltd

- Boingo Wireless Inc.

- American Tower Corporation

- Other Key Players

Recent Development

- Corning Inc. – In April 2023, Corning Inc. announced the launch of its new high-capacity DAS solutions designed to support the increasing demand for 5G networks. This solution is aimed at enhancing indoor wireless coverage in large venues, including stadiums and airports.

- CommScope Inc. – In June 2023, CommScope introduced an upgraded version of its OneCell C-RAN small cell solution, which integrates DAS to provide seamless connectivity in high-density environments. This product is designed to meet the growing need for high-capacity wireless networks in urban areas.

- Boingo Wireless Inc. – In October 2023, Boingo Wireless partnered with the Metropolitan Transit Authority (MTA) to deploy a comprehensive DAS network across New York City’s subway system. This deployment is expected to significantly improve connectivity for millions of daily commuters.

- SOLiD Inc. – In February 2024, SOLiD launched its new ALLIANCE multi-carrier DAS platform, which supports both legacy and emerging 5G frequencies. This product is aimed at offering a scalable solution for complex indoor environments such as hospitals and universities.

Report Scope

Report Features Description Market Value (2023) USD 10.4 Bn Forecast Revenue (2032) USD 25.5 Bn CAGR (2023-2032) 9.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Active DAS, Passive DAS, and Hybrid DAS), By Ownership (Neutral-Host Ownership, Carrier Ownership, Enterprise Ownership), By Application (Education Sector & Corporate Offices, Public Venues & Safety, Hospitality, Healthcare, Industrial, Airport & Transportation, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Anixter Inc., Cobham PLC, Antenna Products Corporation, CommScope Inc., Tower Bersama Group, SOLiD Inc., TE Connectivity Ltd, Corning Inc., Comba Telecom Systems Holdings Ltd, Boingo Wireless Inc., American Tower Corporation, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Distributed Antenna System (DAS)?A Distributed Antenna System, or DAS, is a network of small antennas strategically placed in buildings, stadiums, airports, or other locations to improve wireless communication signals, like those for cell phones and mobile devices.

Why are DAS systems important?DAS systems are important because they enhance signal coverage and capacity in areas where regular cell towers may not reach or provide weak signals. This ensures better connectivity and mobile communication quality for users.

How big is Distributed Antenna Systems (DAS) market?The global Distributed Antenna Systems (DAS) market size is expected to be worth around USD 25.5 Billion by 2033 from USD 10.4 Billion in 2023, growing at a CAGR of 9.4% during the forecast period from 2024 to 2033.

What are the key players in the DAS market?Major companies in the DAS market include telecommunications equipment manufacturers, system integrators, and service providers. Some well-known players are Anixter Inc., Cobham PLC, Antenna Products Corporation, CommScope Inc., Tower Bersama Group, SOLiD Inc., TE Connectivity Ltd, Corning Inc., Comba Telecom Systems Holdings Ltd, Boingo Wireless Inc., American Tower Corporation, Other Key Players

What are the future trends in the DAS market?Future trends in the DAS market include the integration of 5G technology, increased use in smart buildings, and the expansion of DAS systems into industrial applications to support IoT (Internet of Things) devices.

Distributed Antenna System (DAS) MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Distributed Antenna System (DAS) MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Anixter Inc.

- Cobham PLC

- Antenna Products Corporation

- CommScope Inc.

- Tower Bersama Group

- SOLiD Inc.

- TE Connectivity Ltd

- Corning Inc.

- Comba Telecom Systems Holdings Ltd

- Boingo Wireless Inc.

- American Tower Corporation

- Other Key Players