Global Distiller’s Dried Grains with Solubles (DDGS) Feed Market Size, Share Analysis Report By Product Type (Corn, Wheat, Rice, Mixed Grains, and Others), By Animal Type (Ruminants, Swine, Poultry, Aquaculture, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170460

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

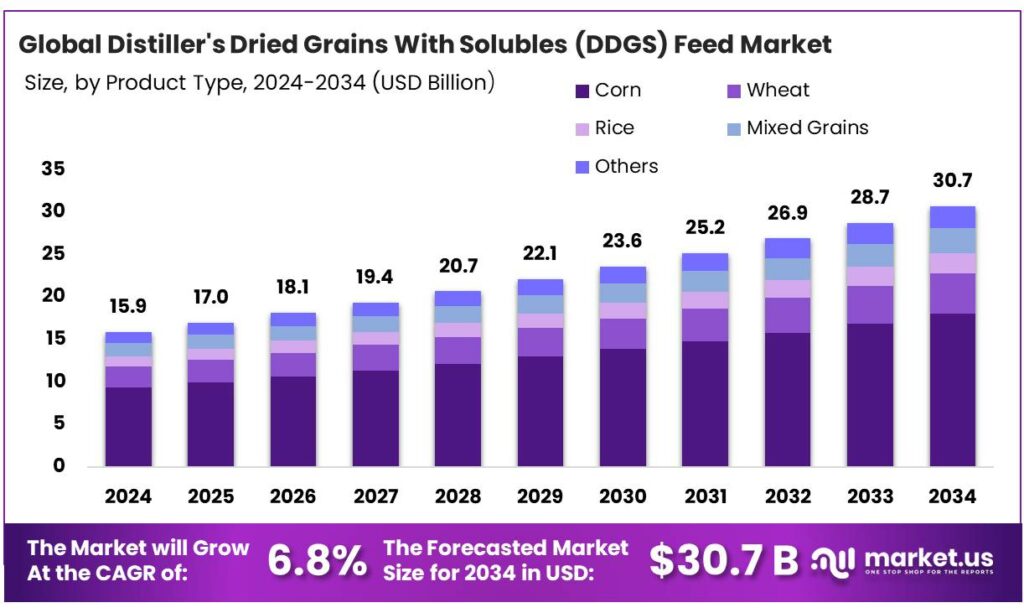

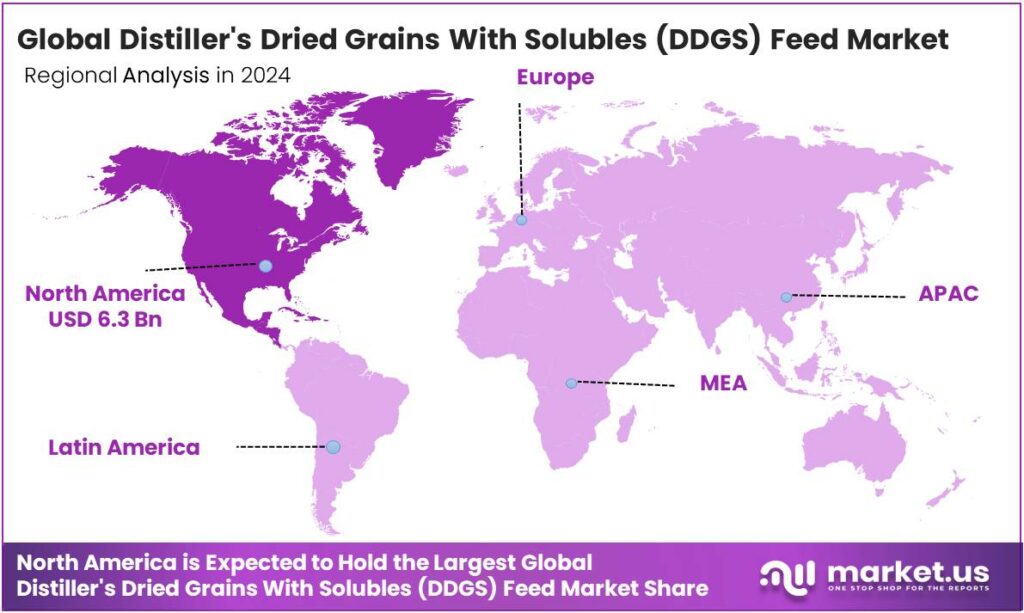

The Global Distiller’s Dried Grains with Solubles (DDGS) Feed Market size is expected to be worth around USD 30.7 Billion by 2034, from USD 15.9 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.7% share, holding USD 6.3 Billion revenue.

Distillers’ Dried Grains with Solubles (DDGS) feed is a nutrient-rich co-product of the ethanol industry, made from corn or other grains, after starch fermentation, serving as an economical source of protein, energy, and phosphorus for livestock like cattle, swine, and poultry. The DDGS feed market is primarily driven by the growth of the ethanol and biofuel industries, with the U.S. being a dominant producer.

The byproduct is rich in protein, fiber, energy content, and essential amino acids, making it a highly nutritious supplement for animal diets. It is most commonly used for ruminants such as dairy and beef cattle, as their digestive systems can efficiently process its high fiber content. However, its use in monogastric animals such as swine and poultry is more limited due to potential digestive issues from excess fiber.

Technological advancements in ethanol production, such as improved fermentation and drying techniques, have enhanced the nutritional quality and availability of DDGS. Additionally, the market is characterized by growing demand for sustainable feed alternatives, with DDGS being seen as an environmentally friendly option that helps reduce waste from biofuel production.

- Incorporating distiller’s dried grains with solubles (DDGS) feed can replace up to 30% of corn in dairy cow diets without hampering milk production, and can cut feed costs by 10-20%.

Key Takeaways

- The global distiller’s dried grains with solubles (DDGS) feed market was valued at USD 15.9 billion in 2024.

- The global distiller’s dried grains with solubles (DDGS) feed market is projected to grow at a CAGR of 6.8% and is estimated to reach USD 30.7 billion by 2034.

- Based on the type of grain, corn dominated the distiller’s dried grains with solubles (DDGS) feed market, with a market share of around 58.7%.

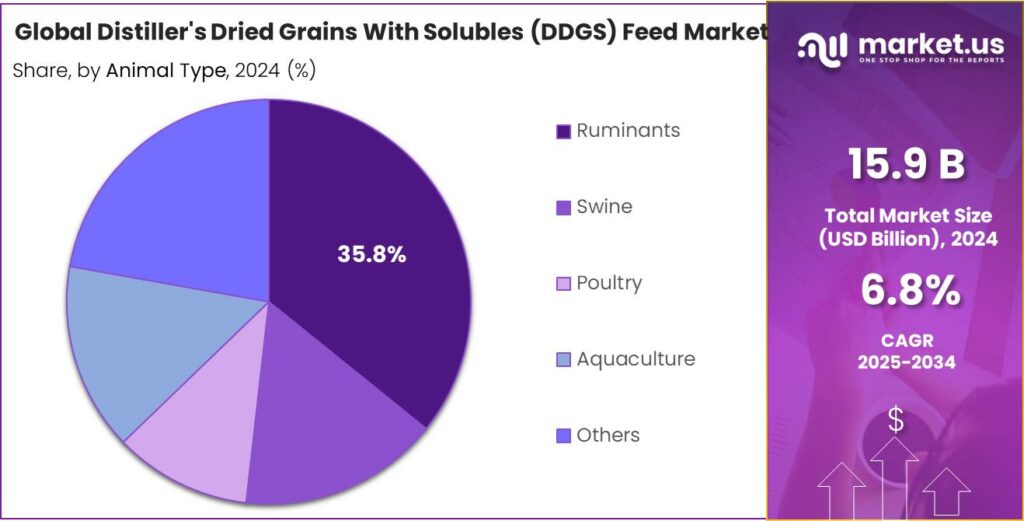

- Among the types of animals, ruminants held a major share in the distiller’s dried grains with solubles (DDGS) feed market, 35.8% of the market share.

- In 2024, North America was the most dominant region in the distiller’s dried grains with solubles (DDGS) feed market, accounting for around 39.7% of the total global consumption.

Product Type Analysis

Corn Held the Largest Share in the Distiller’s Dried Grains with Solubles (DDGS) Feed Market.

The distiller’s dried grains with solubles (DDGS) feed market is segmented based on the types of grains into corn, wheat, rice, mixed grains, and others. Corn dominated the distiller’s dried grains with solubles (DDGS) feed market, comprising around 58.75% of the market share, due to the scale of corn production and the efficiency of ethanol production processes.

- The U.S., a leading producer of ethanol, relies heavily on corn as its primary feedstock. According to the US Department of Agriculture, in 2024, U.S. corn production was around 14.9 billion bushels, with a yield of roughly 179.3 bushels per acre.

Corn-based ethanol plants generate a consistent and large volume of DDGS, making it readily available and cost-effective for animal feed. Additionally, corn DDGS contains a favorable nutrient profile, particularly its high protein and fiber content, which suits a variety of livestock, including cattle, poultry, and swine. In contrast, wheat and rice DDGS are produced in smaller quantities due to less extensive ethanol production from these grains, and their nutrient composition can vary more, making them less predictable and often less preferred. The prevalence of corn as the primary feedstock in the biofuel industry ensures the dominance of corn DDGS in the feed market.

Animal Type Analysis

Ruminants are a Major Segment in the Distiller’s Dried Grains with Solubles (DDGS) Feed Market.

Based on the types of animals, the distiller’s dried grains with solubles (DDGS) feed market is divided into ruminants, swine, poultry, aquaculture, and others. Ruminants dominated the market, with a market share of 35.8%. DDGS feed is predominantly used for ruminants, such as dairy and beef cattle, due to its high fiber content and the digestive characteristics of ruminant animals. Ruminants have a complex stomach system that allows them to efficiently process fibrous materials such as DDGS, which is rich in both fiber and protein. This makes DDGS an ideal fit for cattle, as it provides a good balance of nutrients necessary for growth, milk production, and weight gain.

In contrast, monogastric animals such as swine, poultry, and aquaculture species have simpler digestive systems that are less capable of efficiently breaking down the high fiber content in DDGS. While they can digest DDGS to some extent, the higher fiber levels and nutrient imbalances can lead to reduced feed efficiency and digestive issues. The nutritional profile of DDGS aligns better with the dietary needs of ruminants than with those of monogastric animals, and the DDGS-to-overall feed ratio in ruminants is higher than for other livestock.

Key Market Segments

By Product Type

- Corn

- Wheat

- Rice

- Mixed Grains

- Others

By Animal Type

- Ruminants

- Dairy Cattle

- Beef Cattle

- Swine

- Poultry

- Aquaculture

- Others

Drivers

Massive Expansion of Ethanol and Biofuel Industry Boosts the Supply of Distiller’s Dried Grains with Solubles (DDGS) Feed.

According to the Renewable Fuels Association, the global ethanol production in 2024 reached approximately 31.2 billion gallons, led by the United States and Brazil, together producing around 80% of the total global ethanol production. This significant expansion of the ethanol and biofuel industries has considerably increased the production of distiller’s dried grains with solubles (DDGS), a byproduct of ethanol production, which has, in turn, driven the growth of the DDGS feed market.

As the demand for ethanol continues to rise globally, DDGS has become a vital ingredient in animal feed, particularly for livestock such as cattle, poultry, and swine. This surge in DDGS availability has led to cost-effective feed solutions for farmers, providing a sustainable alternative to traditional feed ingredients such as soybean meal.

Moreover, the growing adoption of biofuel policies across various regions has further reinforced the demand for DDGS in the feed market. For instance, the Renewable Fuel Standard (RFS) in the US requires refiners to blend increasing volumes of renewable fuels, such as ethanol and advanced biofuels, into gasoline.

Restraints

Nutrient Inconsistency Might Pose a Challenge to the Distiller’s Dried Grains with Solubles (DDGS) Feed Market.

Despite the benefits of distiller’s dried grains with solubles (DDGS) as an animal feed ingredient, certain challenges persist, particularly related to nutrient inconsistency and high sulfur and phosphorus contents. The nutrient profile of DDGS can vary significantly depending on factors such as the source of the grain, the fermentation process, and the drying method used.

For instance, protein levels in DDGS can range from 25% to 35%, while fiber content can vary widely, affecting its suitability for different livestock species. Additionally, DDGS is known for its relatively high sulfur and phosphorus levels, which, when consumed in excess, can pose health risks to animals, particularly in poultry and swine.

Excessive sulfur intake can lead to reduced feed intake and digestive issues, while high phosphorus can cause kidney problems in livestock. These inconsistencies and imbalances require careful formulation and monitoring, posing challenges for feed manufacturers and farmers in ensuring optimal nutrition while minimizing the risk of mineral toxicity.

- In a case study in 2024, it was observed that in cattle, reduced production responses were due to the high sulfur (S) content in DDGS, due to either toxicity or a shift in dietary cation-anion difference in the ration, or high levels of polyunsaturated fatty acids (PUFA) in DDGS compared to soybean meal.

Opportunity

Technological Advancements in the Production of Distiller’s Dried Grains with Solubles (DDGS) Feed Create Opportunities in the Market.

Technological advancements in the production of distiller’s dried grains with solubles (DDGS) are creating significant opportunities in the DDGS feed market by enhancing the efficiency and quality of DDGS as a livestock feed. Innovations in ethanol production technologies, such as improved fermentation processes and advanced drying techniques, have led to higher yields of DDGS while reducing production costs.

For instance, modern continuous fermentation processes have increased ethanol output by optimizing enzyme usage, thus generating more DDGS from the same amount of raw material. Additionally, the introduction of advanced drying systems, such as flash and rotary dryers, has improved the preservation of nutrients in DDGS, making it a more digestible and nutritionally balanced feed ingredient.

Similarly, advancements such as fractionation technology help in the production of grain distillers dried yeast (GDDY), a higher-protein version of DDGS made by concentrating yeast from the fermentation process, resulting in GDDY having significantly more digestible amino acids, like lysine, and protein, making it a more valuable protein source. These advancements contribute to better environmental sustainability by reducing energy consumption during production. More farmers are adopting DDGS in their animal feed formulations, capitalizing on its cost-effectiveness and nutritional benefits to meet the growing demand for animal protein.

Trends

Shift Towards Sustainable Feed Substitute.

The growing emphasis on waste reduction and sustainability is a key driver of the increasing adoption of distiller’s dried grains with solubles (DDGS) as a feed substitute in the agriculture sector. As industries and governments prioritize circular economy principles, DDGS, a byproduct of ethanol production, has emerged as a sustainable alternative to traditional feed ingredients such as soybean meal. By utilizing a waste product from biofuel production, DDGS contributes to reducing food waste and lowering environmental impact.

- According to the National Corn Growers Association, cattle accounted for nearly 80% of the consumption of DDGS in the US, effectively diverting large quantities of organic material from landfills.

Additionally, the carbon footprint of DDGS production is lower compared to conventional feed crops, as it benefits from the efficiency of ethanol production processes. This shift is further supported by the increasing demand for environmentally conscious farming practices, with farmers seeking cost-effective, sustainable feed solutions to meet growing protein consumption needs.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Distiller’s Dried Grains with Solubles (DDGS) Feed Market by Shifting Trade Flows.

The geopolitical tensions, particularly those involving major agricultural producers such as the United States, Brazil, and Russia, have had a considerable impact on the DDGS feed market. As global trade dynamics shift due to trade disputes, sanctions, and export restrictions, the availability and pricing of raw materials used in DDGS production, such as corn, have become volatile. For instance, disruptions in corn supplies from key producers, such as Ukraine, led to increased production costs for ethanol plants in the EU and China, which in turn affected the cost and availability of DDGS as an animal feed.

Similarly, tensions between the U.S. and China have led to fluctuating demand for DDGS, as China is a significant importer of U.S. DDGS for its livestock industry. Furthermore, logistical challenges stemming from conflicts around Black Sea Ports and the South China Sea have led to delays in shipping and transportation, exacerbating supply chain disruptions. Due to these tensions, some feed manufacturers and farmers may turn to alternative feed ingredients or adjust their feeding strategies, which can dampen the growth of the DDGS market in the short term.

Regional Analysis

North America Held the Largest Share of the Global Distiller’s Dried Grains with Solubles (DDGS) Feed Market.

In 2024, North America dominated the global distiller’s dried grains with solubles (DDGS) feed market, holding about 39.7% of the total global consumption. The region holds the largest share of the global distiller’s dried grains with solubles (DDGS) feed market, driven primarily by the robust ethanol production industry in the United States.

- According to the National Corn Growers Association, in the U.S., the ethanol industry produces approximately 40 million metric tons of DDGS annually, with a significant portion used in animal feed.

The large-scale ethanol production in the region, accounting for around 52% of global ethanol output, has positioned DDGS as a key byproduct for livestock feed, offering a cost-effective, high-protein alternative to traditional feed ingredients. Additionally, favorable agricultural policies, such as those supporting biofuel production under the Renewable Fuel Standard (RFS), have bolstered the supply of DDGS. The abundance and relatively low cost of DDGS in North America have further encouraged its utilization, solidifying the dominant position of the region in the global market for DDGS feed.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the DDGS feed market employ several strategies to boost sales and maintain a competitive edge. The companies emphasize product differentiation, where manufacturers enhance the nutritional profile of DDGS by incorporating advanced processing technologies, such as enzyme supplementation, to improve digestibility and reduce nutrient variability.

Additionally, companies focus on strengthening their distribution networks to reach global markets, particularly in regions such as Asia, where demand for animal feed is rising. Similarly, major players focus on collaborative partnerships with livestock farmers and feed manufacturers to be able to tailor products to specific livestock needs. Furthermore, companies are increasingly focusing on expanding their presence through diversifying distribution channels and acquiring local companies.

The Major Players in The Industry

- Archer Daniels Midland Company

- CHS Inc.

- POET LLC

- CropEnergies AG

- Land O’ Lakes, Inc.

- Cargill Incorporated

- Green Plains Inc.

- Valero Energy Corporation

- The Andersons, Inc.

- Vertex Bioenergy S.L

- Globus Spirits Limited

- Nugen Feeds and Foods Private Limited

- Kent Corporation

- The Scoular Company

- Other Key Players

Key Development

- In September 2025, ADM, a global leader in innovative solutions from nature, and Alltech, a global leader in agriculture, announced the signing of a definitive agreement to launch a North American animal feed joint venture.

- In June 2025, Cargill acquired SJC Bioenergia, a company that processes sugar cane and corn, producing raw sugar, hydrated and anhydrous ethanol, corn oil, and dried distillers’ grains (DDGs) with high protein content, in addition to generating electricity.

Report Scope

Report Features Description Market Value (2024) USD 15.9 Bn Forecast Revenue (2034) USD 30.7 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Corn, Wheat, Rice, Mixed Grains, and Others), By Animal Type (Ruminants, Swine, Poultry, Aquaculture, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, CHS Inc., POET LLC, CropEnergies AG, Land O’ Lakes, Inc., Cargill Incorporated, Green Plains Inc., Valero Energy Corporation, The Andersons, Inc., Vertex Bioenergy S.L., Globus Spirits Limited, Nugen Feeds and Foods Private Limited, Kent Corporation, The Scoular Company, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Distiller’s Dried Grains with Solubles (DDGS) Feed MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Distiller’s Dried Grains with Solubles (DDGS) Feed MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- CHS Inc.

- POET LLC

- CropEnergies AG

- Land O' Lakes, Inc.

- Cargill Incorporated

- Green Plains Inc.

- Valero Energy Corporation

- The Andersons, Inc.

- Vertex Bioenergy S.L

- Globus Spirits Limited

- Nugen Feeds and Foods Private Limited

- Kent Corporation

- The Scoular Company

- Other Key Players