Global Dirt Bike Market Size, Share, Growth Analysis By Product (Motocross Dirt Bikes, Enduro, Trail, Dual-sport), By Engine Capacity (Below 150 cc, 150 cc - 250 cc, 250 cc - 450 cc, Above 450 cc), By Propulsion (ICE, Electric), By Application (Recreational, Professional Sports, Adventure & Touring, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170587

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

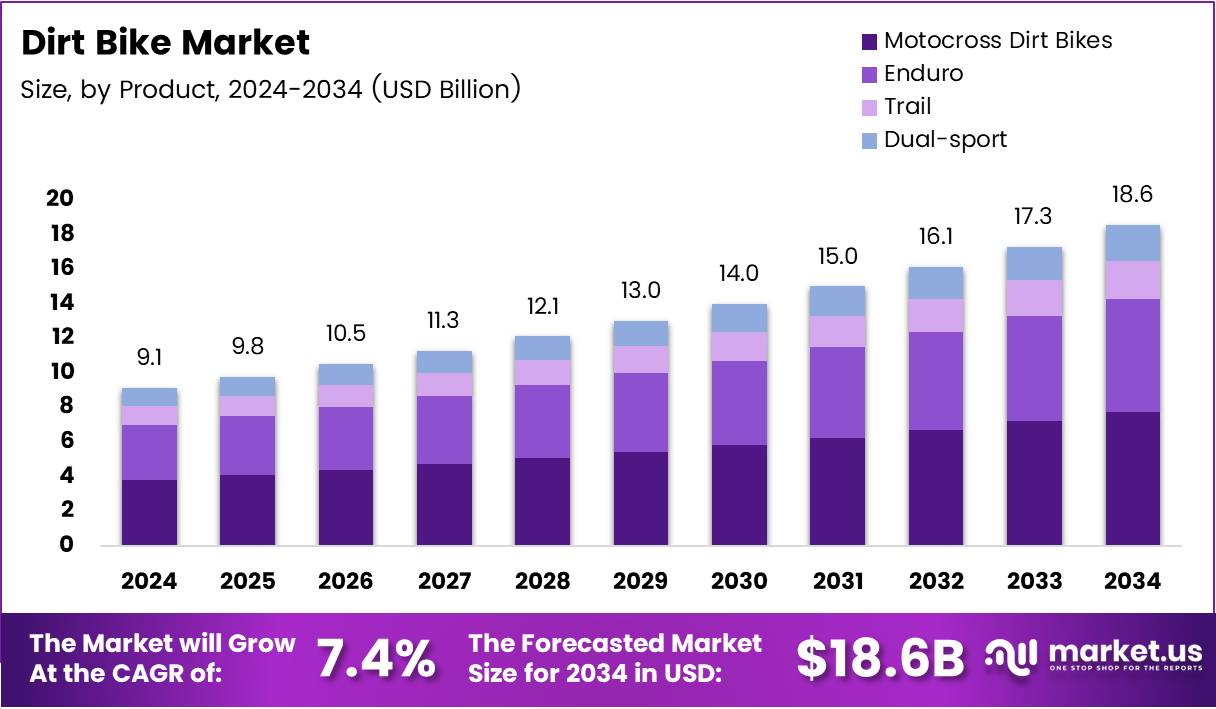

The global Dirt Bike Market size is expected to reach approximately USD 18.6 Billion by 2034, up from USD 9.1 Billion in 2024, expanding at a CAGR of 7.4% during the forecast period from 2025 to 2034. This remarkable growth trajectory reflects the increasing consumer appetite for off-road motorsports and adventure-based recreational activities worldwide.

Dirt bikes represent specialized off-road motorcycles designed for unpaved terrain, featuring lightweight frames, high ground clearance, and robust suspension systems. These vehicles cater to diverse applications including motocross racing, enduro competitions, trail riding, and recreational outdoor adventures. The market encompasses various engine capacities and propulsion technologies to meet different rider skill levels and performance requirements.

The industry is experiencing substantial momentum driven by rising global participation in off-road recreational sports. Meanwhile, the sector benefits from growing youth engagement through entry-level motocross programs that introduce younger demographics to the sport. Adventure tourism expansion continues to fuel demand, particularly in regions developing outdoor trail infrastructure for motorized recreation.

Furthermore, manufacturers are increasingly adopting lightweight electric dirt bike models to address environmental concerns and regulatory pressures. Innovation remains central to market evolution, with companies integrating smart connectivity features and rider-assistance technologies into next-generation models. The expansion of subscription-based and rental service models also creates new accessibility pathways for consumers hesitant about ownership costs.

Government initiatives supporting outdoor recreation infrastructure have positively impacted market growth in developed economies. However, regulatory constraints on off-road riding zones and noise emissions present ongoing challenges. According to the Insurance Institute for Highway Safety, the number of on-road motorcycles registered in the U.S. increased from approximately 4.3 million in 2002 to 8.8 million in 2023, demonstrating a significantly larger base of potential dirt and dual-sport riders.

Additionally, according to the Outdoor Industry Association, in 2023 the U.S. outdoor recreation participation base grew 4.1% to 175.8 million people, representing 57.3% of the population. This surge directly supports overall demand for outdoor sports including off-road motorcycling. The convergence of technological advancement, demographic shifts, and infrastructure development positions the dirt bike market for sustained expansion across both established and emerging economies throughout the forecast period.

Key Takeaways

- The global Dirt Bike Market is projected to grow from USD 9.1 Billion in 2024 to USD 18.6 Billion by 2034 at a CAGR of 7.4%.

- Motocross Dirt Bikes dominate the By Product segment with a 37.8% market share in 2024.

- The 250 cc – 450 cc engine capacity segment leads with 41.2% market share in 2024.

- ICE propulsion holds a commanding 86.6% share in the By Propulsion segment in 2024.

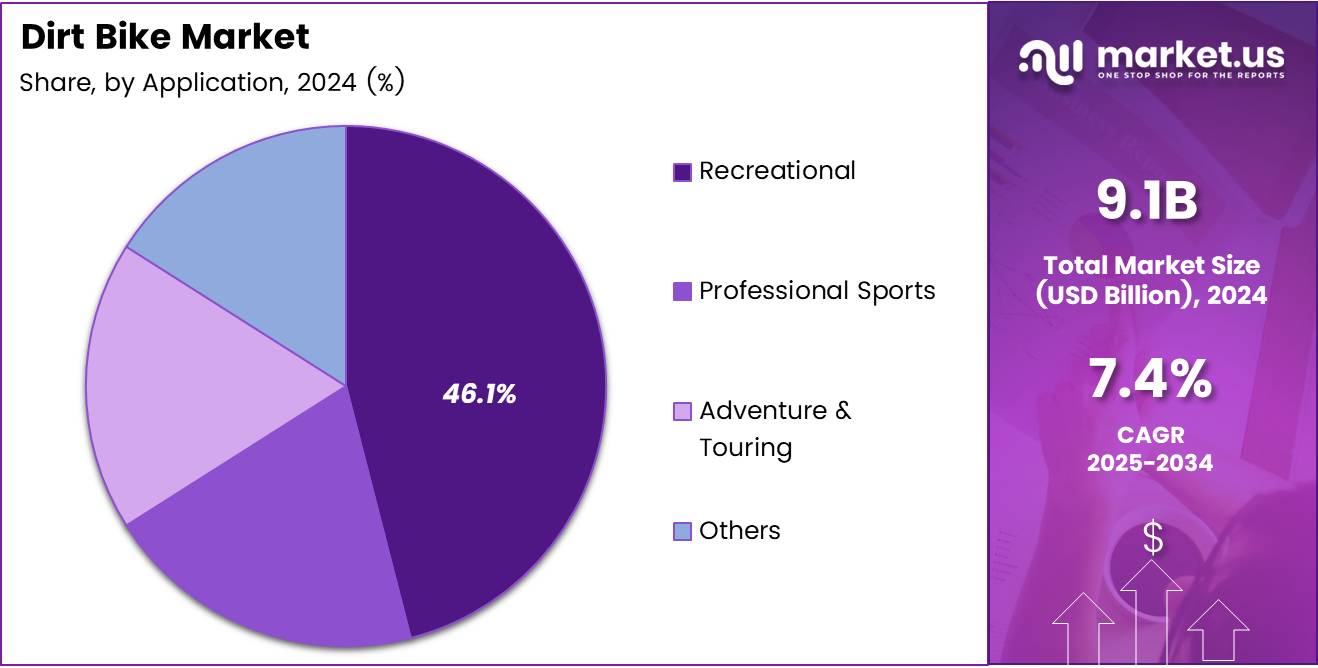

- Recreational application accounts for 46.1% of the market share in 2024.

- OEM sales channel dominates with 78.9% market share in 2024.

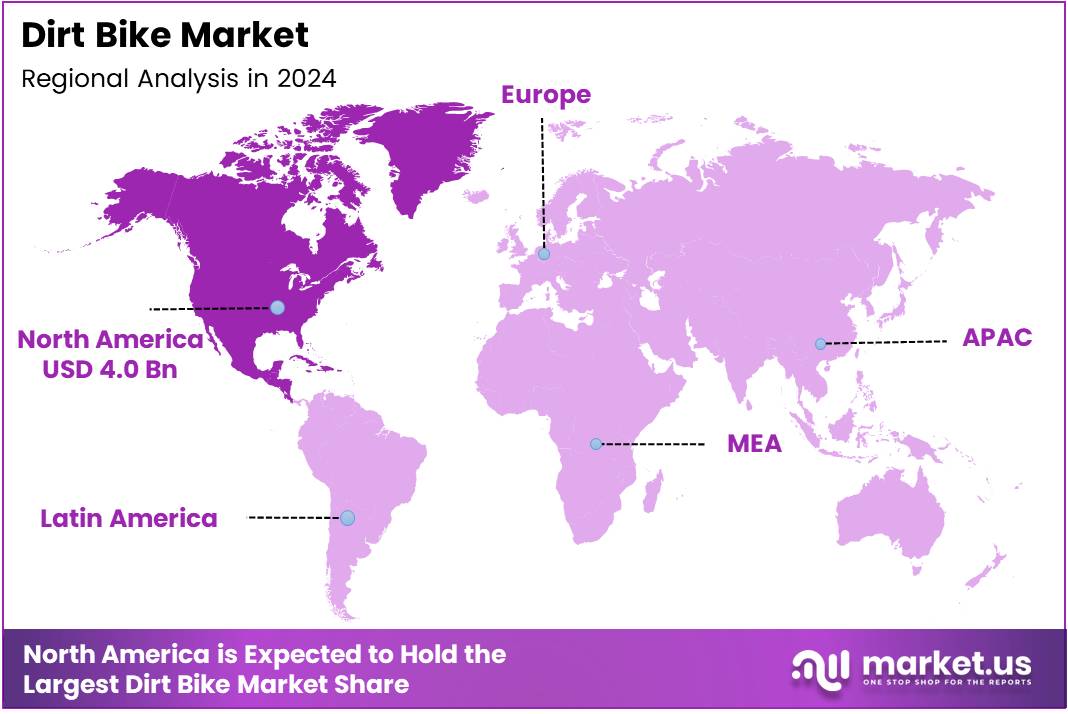

- North America leads the regional market with 44.8% share, valued at USD 4.0 Billion in 2024.

Product Analysis

Motocross Dirt Bikes dominate with 37.8% due to their high-performance capabilities and competitive racing appeal.

In 2024, Motocross Dirt Bikes held a dominant market position in the By Product segment of the Dirt Bike Market, with a 37.8% share. These specialized machines appeal strongly to competitive riders and motorsports enthusiasts seeking peak performance on closed-circuit tracks. Their lightweight construction combined with powerful engines delivers exceptional acceleration and maneuverability during competitive events. Professional racing leagues worldwide continue driving demand for advanced motocross models with cutting-edge suspension technology and aerodynamic designs.

Enduro dirt bikes represent the second major product category, designed specifically for long-distance off-road racing across varied terrain. These versatile machines balance performance with durability, featuring larger fuel tanks and enhanced comfort for extended riding sessions. Manufacturers increasingly equip enduro models with advanced navigation systems and rider-assistance features to support competitive endurance racing applications.

Trail dirt bikes cater to recreational riders prioritizing user-friendly handling and moderate power delivery over raw performance. This segment attracts beginners and casual enthusiasts exploring natural trails and forest paths at controlled speeds. The growing popularity of family-oriented outdoor activities continues expanding the trail bike customer base, particularly in regions with established recreational riding infrastructure.

Dual-sport dirt bikes offer street-legal functionality alongside off-road capability, creating unique versatility for daily commuting and weekend adventures. These hybrid models appeal to practical consumers seeking single-vehicle solutions for both urban transportation and trail exploration. Rising fuel costs and parking constraints in urban areas further enhance the attractiveness of compact dual-sport motorcycles for multi-purpose usage.

Engine Capacity Analysis

250 cc – 450 cc engine capacity dominates with 41.2% due to optimal power-to-weight ratio for diverse riding applications.

In 2024, the 250 cc – 450 cc segment held a dominant market position in the By Engine Capacity segment of the Dirt Bike Market, with a 41.2% share. This capacity range delivers ideal performance characteristics for both intermediate and advanced riders across various disciplines. Professional motocross and enduro competitions predominantly feature bikes within this displacement category, driving substantial demand from competitive athletes. The power output provides sufficient torque for challenging terrain while maintaining manageable handling characteristics that prevent rider fatigue during extended sessions.

Below 150 cc engines primarily target entry-level riders and younger demographics learning fundamental off-road riding skills. These smaller displacement models offer less intimidating power delivery and lighter overall weight, reducing the learning curve for beginners. Youth motocross programs and training academies represent significant demand drivers for this segment, introducing new generations to motorsports through age-appropriate equipment.

The 150 cc – 250 cc category bridges the gap between beginner and advanced segments, attracting riders transitioning from smaller bikes. This displacement range provides progressive performance increases while maintaining relatively forgiving handling dynamics. Manufacturers strategically position mid-displacement models to capture upgrading customers seeking enhanced capabilities without jumping directly to full-size competition bikes.

Above 450 cc engines cater to experienced riders demanding maximum power for extreme terrain and competitive applications. These large-displacement machines deliver exceptional torque and acceleration but require advanced riding skills for safe operation. Professional enduro racing and desert racing disciplines particularly favor higher-displacement models where raw power proves advantageous across open terrain and steep climbing sections.

Propulsion Analysis

ICE propulsion dominates with 86.6% due to established infrastructure and superior range capabilities.

In 2024, ICE (Internal Combustion Engine) held a dominant market position in the By Propulsion segment of the Dirt Bike Market, with an 86.6% share. Traditional gasoline engines continue dominating through proven reliability, extensive service network availability, and rapid refueling convenience during extended riding sessions.

The existing infrastructure strongly favors ICE models, with fuel stations readily accessible in most riding regions compared to limited charging facilities for electric alternatives. Performance characteristics including sustained power delivery and predictable throttle response remain preferred by competitive riders and motorsports professionals.

Electric propulsion represents the emerging alternative, capturing growing attention from environmentally conscious consumers and urban riders. Battery-powered dirt bikes offer instantaneous torque delivery and virtually silent operation, opening new riding opportunities in noise-restricted areas.

Recent technological advancements have significantly improved electric model range and charging speeds, addressing previous limitations that hindered widespread adoption. Manufacturers are increasingly investing in electric platform development, recognizing long-term regulatory pressures and shifting consumer preferences toward sustainable transportation solutions across all vehicle categories.

Application Analysis

Recreational application dominates with 46.1% due to expanding outdoor leisure participation and adventure tourism growth.

In 2024, Recreational held a dominant market position in the By Application segment of the Dirt Bike Market, with a 46.1% share. Casual riders seeking weekend adventures and family-oriented outdoor activities represent the largest consumer demographic purchasing dirt bikes. The expanding adventure tourism industry continues fueling recreational demand as resorts and tour operators incorporate off-road motorcycle experiences into package offerings. Growing disposable income levels in emerging markets enable more households to afford recreational vehicles for leisure pursuits and outdoor exploration activities.

Professional Sports applications encompass competitive motocross, enduro, and supercross racing where athletes demand cutting-edge performance equipment. This segment drives technological innovation as manufacturers develop advanced features to gain competitive advantages on professional circuits. Sponsorship investments and prize money in organized racing events sustain professional rider demand for premium high-performance models with factory-level specifications and customization options.

Adventure and Touring applications attract riders planning long-distance expeditions across challenging terrain and remote regions. These enthusiasts prioritize reliability, comfort, and cargo capacity for multi-day journeys through varied landscapes. Manufacturers increasingly offer adventure-oriented packages featuring enhanced fuel capacity, protective equipment, and navigation systems tailored for expedition-style riding beyond traditional recreational trails.

Other applications include military and law enforcement usage, agricultural operations, and utility work in remote locations. These specialized use cases require rugged durability and utilitarian functionality rather than performance-focused features. Industrial and commercial buyers typically purchase fleet quantities, representing stable demand independent of consumer recreational trends and economic cycles.

Sales Channel Analysis

OEM sales channel dominates with 78.9% due to consumer preference for factory warranties and financing options.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Dirt Bike Market, with a 78.9% share. Authorized dealerships provide comprehensive purchase experiences including test rides, financing arrangements, and manufacturer-backed warranties that build consumer confidence.

New bike buyers particularly value factory support and maintenance packages offered exclusively through official distribution networks. Dealers also serve as brand ambassadors, offering expert advice and accessories that enhance customer relationships and drive repeat business through service departments.

Aftermarket channels serve price-conscious consumers seeking used equipment and budget-friendly alternatives to new purchases. Independent retailers and online marketplaces facilitate secondary transactions between private sellers and buyers exploring dirt biking without significant upfront investment.

The aftermarket also supplies replacement parts, performance upgrades, and customization components that support enthusiasts modifying existing bikes. As the installed base of dirt bikes grows, aftermarket opportunities expand proportionally, creating sustainable business models for independent retailers and specialty shops focused on niche customer segments.

Key Market Segments

By Product

- Motocross Dirt Bikes

- Enduro

- Trail

- Dual-sport

By Engine Capacity

- Below 150 cc

- 150 cc – 250 cc

- 250 cc – 450 cc

- Above 450 cc

By Propulsion

- ICE

- Electric

By Application

- Recreational

- Professional Sports

- Adventure & Touring

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Global Participation in Off-Road Recreational Sports Drives Market Expansion

The increasing popularity of outdoor adventure activities continues propelling dirt bike demand across multiple demographics and geographic regions. More consumers are embracing off-road motorsports as viable leisure pursuits, particularly as urbanization increases desire for nature-based recreation. This trend reflects broader lifestyle shifts toward active outdoor experiences rather than passive entertainment options.

Meanwhile, the expansion of dedicated trail systems and off-road parks provides safe, legal environments for dirt bike enthusiasts. Public and private investments in riding infrastructure remove barriers to participation and encourage new riders to enter the sport. Social media amplification of extreme sports content further normalizes off-road motorcycling, attracting younger audiences inspired by professional riders and influencers.

Additionally, manufacturers are developing more accessible entry-level models that reduce intimidation factors for beginners exploring the sport. Affordable starter bikes with user-friendly features enable broader market participation beyond traditional motorsports demographics. Training programs and riding schools also support newcomer confidence, creating sustainable pathways from initial interest to long-term participation and vehicle ownership.

Restraints

High Upfront Purchase and Maintenance Costs Limit Market Accessibility

The substantial initial investment required for quality dirt bikes presents significant barriers preventing mass-market adoption. Entry-level models still command prices that exceed budget constraints for many potential recreational riders. Beyond purchase costs, ongoing maintenance expenses including replacement parts, tires, and regular servicing create cumulative financial burdens that discourage casual participation.

Furthermore, regulatory constraints on off-road riding zones and noise emissions restrict where enthusiasts can legally operate their vehicles. Many regions lack adequate designated trails and parks, forcing riders to travel long distances to access suitable terrain. Urban expansion continues reducing available riding areas, while environmental concerns prompt stricter land-use regulations limiting off-road vehicle access.

Noise ordinances particularly impact traditional ICE dirt bikes, with communities increasingly restricting operating hours and locations. These regulatory pressures create uncertainty for potential buyers concerned about limited riding opportunities justifying their investment. Insurance costs and liability concerns also deter some prospective riders, especially in markets with stringent safety requirements and registration mandates.

Growth Factors

Development of Long-Range Battery Technologies Unlocks Electric Dirt Bike Potential

Advances in lithium-ion battery chemistry and energy density enable electric dirt bikes to achieve ranges approaching traditional gasoline models. Improved battery performance addresses the primary limitation historically preventing widespread electric adoption in off-road applications. Faster charging technologies further enhance practical usability, reducing downtime between riding sessions and improving overall ownership experience.

Simultaneously, untapped market penetration in emerging economies with rising disposable income presents substantial growth opportunities. Countries experiencing middle-class expansion show increasing interest in recreational vehicles and motorsports activities. Local manufacturers in these regions are developing affordable models tailored to domestic preferences, accelerating market development beyond traditional Western strongholds.

Moreover, integration of smart connectivity and rider-assistance technologies creates differentiated value propositions attracting tech-savvy consumers. GPS navigation, performance tracking, and smartphone integration transform dirt bikes into connected devices appealing to digital-native demographics. Subscription-based and rental service models also reduce ownership barriers, allowing consumers to experience off-road riding without long-term commitment or significant capital outlays.

Emerging Trends

Surge in Eco-Friendly Motocross Events Promotes Electric Platform Adoption

Organized competitions exclusively featuring electric dirt bikes are gaining traction, legitimizing battery-powered models among performance-oriented riders. These events demonstrate that electric propulsion can deliver competitive performance while eliminating noise pollution and exhaust emissions. Professional racing series adoption accelerates manufacturer investment in electric platform development and performance optimization.

Concurrently, increased customization demand through modular components enables riders to personalize bikes matching individual preferences and riding styles. Aftermarket suppliers offer extensive modification options including suspension upgrades, graphics packages, and performance parts. This customization culture strengthens community engagement and brand loyalty as enthusiasts showcase unique builds through social media channels.

Additionally, rising popularity of dirt bike content across social media platforms and esports expands awareness and interest beyond traditional motorsports audiences. Viral videos and streaming content introduce off-road riding to demographics previously unexposed to the sport. Growing collaboration between manufacturers and adventure tourism operators creates package experiences combining guided riding with travel, attracting experiential consumers seeking memorable outdoor adventures.

Regional Analysis

North America Dominates the Dirt Bike Market with a Market Share of 44.8%, Valued at USD 4.0 Billion

North America maintains clear market leadership with a 44.8% share, valued at approximately USD 4.0 Billion in 2024. The region benefits from deeply established motorsports culture and extensive off-road riding infrastructure across the United States and Canada. High disposable income levels support premium product demand, while organized racing leagues sustain professional and amateur participation. Manufacturers concentrate marketing efforts and dealer networks throughout North America, ensuring strong brand presence and customer service capabilities.

Europe Dirt Bike Market Trends

Europe represents a significant market driven by strong motocross traditions in countries including France, Italy, and the United Kingdom. The region shows particular leadership in electric dirt bike adoption, responding to stringent environmental regulations and emission standards. European manufacturers emphasize premium engineering and advanced technologies, commanding higher price points in global markets.

Asia Pacific Dirt Bike Market Trends

Asia Pacific demonstrates the fastest growth potential, fueled by expanding middle classes in China, India, and Southeast Asian nations. Rising disposable incomes enable recreational vehicle purchases previously considered luxury items. Japanese manufacturers leverage regional production capabilities to offer competitive pricing while maintaining quality standards that appeal to cost-conscious consumers.

Middle East and Africa Dirt Bike Market Trends

Middle East and Africa show growing interest in off-road motorsports, particularly in Gulf countries with desert landscapes ideal for dirt bike activities. Adventure tourism development creates opportunities for recreational riding experiences. However, limited infrastructure and harsh climate conditions present ongoing challenges requiring specialized equipment adaptations.

Latin America Dirt Bike Market Trends

Latin America exhibits steady growth supported by motorsports enthusiasm in Brazil, Argentina, and Mexico. Economic volatility impacts premium product demand, but entry-level segments maintain consistent sales. Regional manufacturers produce affordable models targeting local markets, while international brands focus on urban centers with higher purchasing power.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Dirt Bike Company Insights

Honda Motor Co. Ltd. maintains strong global market presence through comprehensive product portfolios spanning all major dirt bike categories and engine displacement ranges. The company leverages decades of racing heritage and engineering expertise to deliver reliable performance across recreational and professional segments. Honda’s extensive dealer network ensures widespread product availability and after-sales support in virtually all major markets worldwide.

KTM AG commands significant market share in competitive motocross and enduro segments through aggressive racing programs and performance-focused product development. The Austrian manufacturer emphasizes lightweight construction and cutting-edge suspension technology that appeals to serious enthusiasts and professional riders. KTM’s premium positioning and distinctive orange branding create strong differentiation in crowded market landscapes.

Yamaha Motor Co. Ltd. offers diverse dirt bike lineups targeting multiple customer segments from entry-level youth models to professional racing machines. The company balances performance innovation with user-friendly features that attract both newcomers and experienced riders. Yamaha’s reputation for reliability and competitive pricing strengthens its position across price-sensitive emerging markets and established Western economies.

Kawasaki Heavy Industries Ltd. focuses on mid-to-large displacement segments where its powerful engines and distinctive green livery enjoy strong brand recognition. The manufacturer maintains competitive racing presence supporting product credibility and technological advancement. Kawasaki’s strategic emphasis on performance value positions its offerings attractively against premium European competitors.

Key Players

- Honda Motor Co. Ltd.

- KTM AG

- Yamaha Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Betamotor S.p.A.

- Suzuki Motor Corp.

- Triumph Motorcycles Ltd.

- Sherco Motorcycles

- TM Racing S.p.A.

- Fantic Motor S.p.A.

Recent Developments

- November 2024 – Husqvarna launched the Pioneer 2025, a brand-new street-legal electric offroad motorcycle featuring advanced battery technology and urban-capable design. This launch represents significant progress in electric dirt bike development, offering riders versatile on-road and off-road functionality. The Pioneer 2025 addresses growing demand for environmentally friendly alternatives without sacrificing performance capabilities.

- November 2024 – CFMoto showcased groundbreaking electric dirt bike innovations at the EICMA Show, demonstrating the company’s commitment to battery-powered off-road platforms. The revealed models featured impressive specifications that challenge traditional electric limitations in the dirt bike segment. CFMoto’s aggressive electric strategy positions the brand competitively in the rapidly evolving sustainable motorsports landscape.

- November 2025 – Yamaha Motor announced plans to reveal the YE-01 Electric Motocross Concept Model at EICMA 2025, specifically designed for the new MXEP electric motocross racing series. This development signals Yamaha’s strategic entry into organized electric racing competitions and validates electric propulsion viability in professional motorsports. The YE-01 concept represents Yamaha’s broader commitment to advancing EV technologies across its product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 9.1 Billion Forecast Revenue (2034) USD 18.6 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Motocross Dirt Bikes, Enduro, Trail, Dual-sport), By Engine Capacity (Below 150 cc, 150 cc – 250 cc, 250 cc – 450 cc, Above 450 cc), By Propulsion (ICE, Electric), By Application (Recreational, Professional Sports, Adventure & Touring, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Honda Motor Co. Ltd., KTM AG, Yamaha Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Betamotor S.p.A., Suzuki Motor Corp., Triumph Motorcycles Ltd., Sherco Motorcycles, TM Racing S.p.A., Fantic Motor S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honda Motor Co. Ltd.

- KTM AG

- Yamaha Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Betamotor S.p.A.

- Suzuki Motor Corp.

- Triumph Motorcycles Ltd.

- Sherco Motorcycles

- TM Racing S.p.A.

- Fantic Motor S.p.A.