Global Dimethyl Carbonate Market By Grade(Industry Grade, Pharmaceutical Grade, Battery Grade), By Application(Polycarbonate Synthesis, Battery Electrolyte, Solvents, Reagents, Others), By End-use(Plastics, Paints & Coating, Pharmaceutical, Battery, Agrochemicals, Others), By Sales Channel(Direct Sales, Indirect Sales), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 26695

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

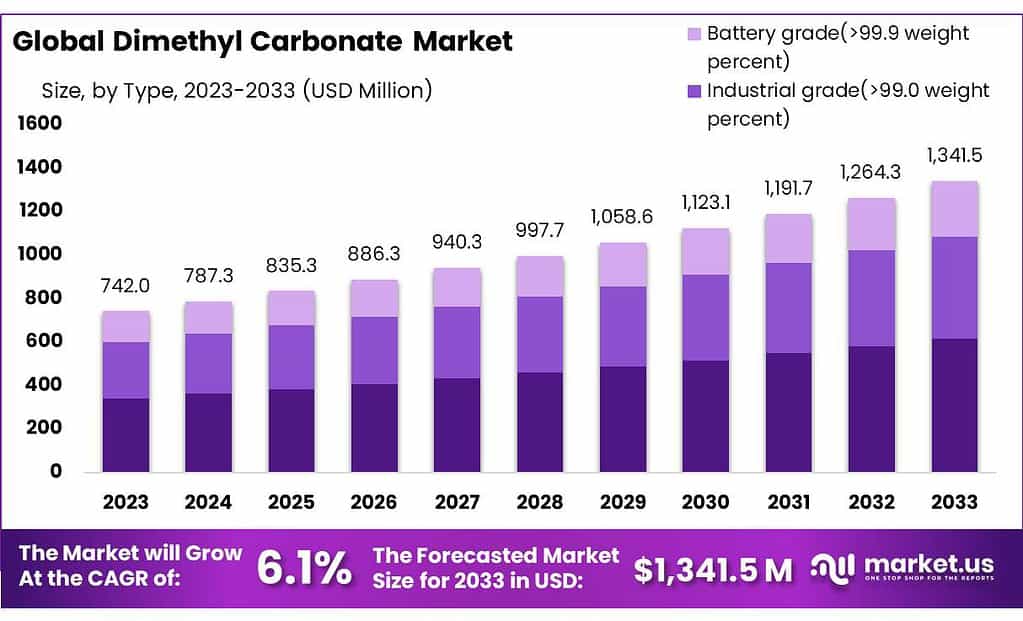

The global Dimethyl Carbonate market size is expected to be worth around USD 1341.5 Million by 2033, from USD 742.0 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

The Dimethyl Carbonate (DMC) market refers to the global industry and trade landscape surrounding the production, distribution, and application of Dimethyl Carbonate, a versatile chemical compound with the formula (CH3O)2CO. DMC is an organic compound that is colorless, flammable, and possesses a mild, pleasant odor. Due to its unique properties, such as being an excellent solvent and having a low toxicity profile, DMC finds extensive use across various sectors. It is commonly employed as a solvent in coatings, adhesives, and inks, and as an intermediate in the synthesis of polycarbonates, pharmaceuticals, and pesticides.

The significance of the DMC market is tied to its role in supporting and enabling a wide range of industrial processes and product formulations. The demand for DMC is driven by its utility in safer, more sustainable chemical processes and products, reflecting the broader industry shift towards greener alternatives. The market for Dimethyl Carbonate is influenced by factors such as environmental regulations, advancements in chemical manufacturing technologies, and the growing demand for biodegradable and eco-friendly solvents and materials.

Given its critical applications and the push for sustainability, the DMC market is subject to dynamic changes, with continuous innovation and regulatory developments shaping its evolution. Manufacturers and stakeholders in the DMC market are increasingly focused on improving production efficiencies, expanding application areas, and adhering to environmental standards, making it a vital component of the global chemical industry landscape.

Key Takeaways

- Market Growth: Dimethyl Carbonate market to reach USD 1341.5 million by 2033, with a CAGR of 6.1% from USD 742.0 million in 2023.

- Industry Dominance: Industry Grade DMC captures over 48.9% market share, favored for its solvency and low toxicity in industrial applications.

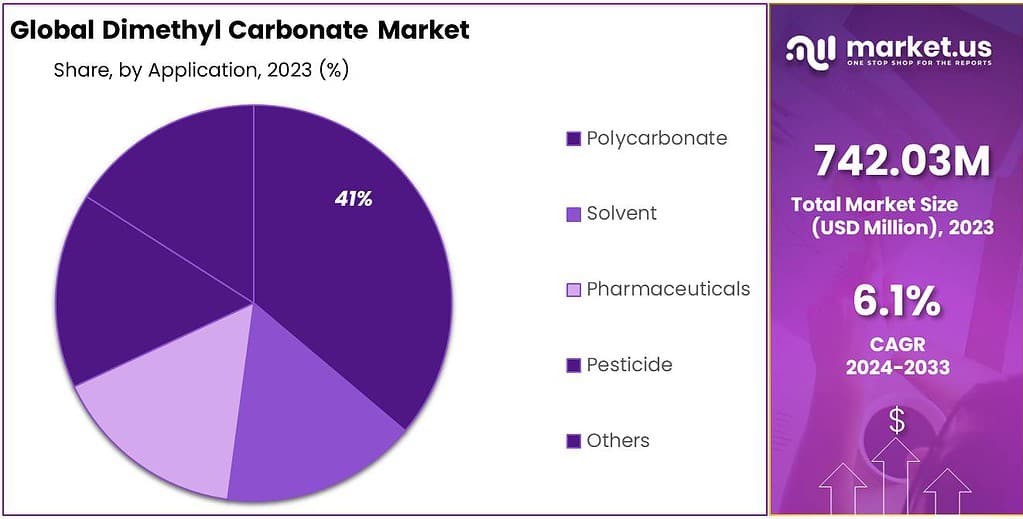

- Application Trends: Polycarbonate synthesis holds over 45.5% market share, crucial for high-performance polymer production in the automotive and electronics industries.

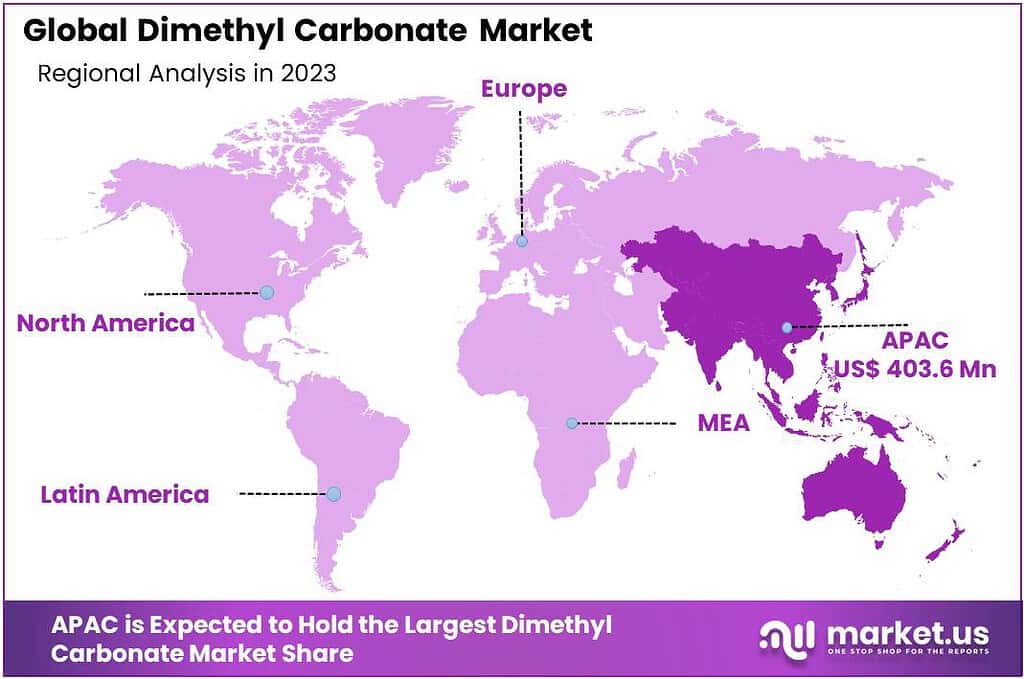

- Regional Market: Asia Pacific leads with a 54% market share, driven by rapid development and strong demand from countries like China and India.

- End-use Diversity: Plastics sector dominates with 36.5% market share, driving demand across packaging, automotive, and consumer goods industries.

- The purity of commercial-grade DMC ranges from 99.5% to 99.9%, with the highest purity grades used in battery applications.

- DMC can be used as a methylating agent in organic synthesis, with a typical yield of 80-95% for methylation reactions.

By Grade

Industry Grad: Industry Grade DMC took the lead in the market, capturing more than a 48.9% share. This grade is primarily used as a solvent and reagent in the manufacture of paints, coatings, adhesives, and plastics. Its popularity stems from its excellent solvency and low toxicity, making it a preferred choice in industrial applications. The push towards environmentally friendly and safer chemical processes has significantly driven the demand for Industry Grade DMC, reflecting its critical role in sustainable industrial practices.

Pharmaceutical Grade: Pharmaceutical Grade DMC serves a vital role in the pharmaceutical industry, utilized in the synthesis of various drugs and as a solvent in drug formulations. This grade is distinguished by its high purity and stringent quality standards required for medical applications. The growing pharmaceutical sector, coupled with the ongoing development of new medications, underscores the importance of Pharmaceutical Grade DMC. Its demand is fueled by the industry’s need for safe, effective, and high-quality chemical components.

Battery Grade: Battery Grade DMC is essential in the production of lithium-ion batteries, where it is used as an electrolyte component. The increasing demand for electric vehicles (EVs) and portable electronic devices has propelled the need for high-performance lithium-ion batteries, thus driving the demand for battery-grade DMC. This grade is characterized by its high purity and specific chemical properties that enhance the performance and longevity of batteries. The shift towards renewable energy sources and the global push for electrification further emphasize the significance of battery-grade DMC in the energy sector.

By Application

In 2024, Polycarbonate Synthesis held a dominant market position, capturing more than a 45.5% share. Polycarbonate synthesis, a leading application, drives demand for dimethyl carbonate, crucial for producing high-performance polymers used in various industries like automotive and electronics. Battery Electrolytes have emerged as a significant application, powering the growing demand for energy storage solutions in electric vehicles and renewable energy systems.

Solvent application witnesses steady growth, serving diverse industries such as paints, coatings, and pharmaceuticals due to dimethyl carbonate’s effective solvent properties. Reagent application finds traction in chemical synthesis processes, benefiting from dimethyl carbonate’s role as a versatile reagent in organic chemistry. Other applications encompass a broad spectrum of uses, reflecting dimethyl carbonate’s adaptability across multiple industries, including agriculture and personal care.

By End-use

In 2024, Plastics held a dominant market position, capturing more than a 36.5% share. Plastics, being the frontrunner end-use segment, drive the demand for dimethyl carbonate owing to its essential role in manufacturing various plastic products used in packaging, automotive, and consumer goods industries.

Paints & Coatings emerge as a significant end-use sector, benefiting from dimethyl carbonate’s properties as a solvent and intermediate in the production of coatings and paints for construction and automotive applications. The pharmaceutical industry witnesses notable demand, utilizing dimethyl carbonate in drug synthesis and as a solvent in pharmaceutical formulations due to its eco-friendly and safe characteristics.

The battery sector gains momentum, fueled by the rising adoption of electric vehicles and renewable energy storage solutions, where dimethyl carbonate is utilized as an electrolyte material. The agrochemicals segment experiences growth, leveraging dimethyl carbonate in pesticide formulations and as a solvent in agricultural applications. Other end-use sectors encompass diverse applications such as personal care products and electronics, highlighting dimethyl carbonate’s versatility across multiple industries.

By Sales Channel

In 2023, Direct Sales held a dominant market position, capturing more than a 56.7% share. Direct Sales involve selling dimethyl carbonate directly from manufacturers to customers, offering personalized service and efficient communication channels, which enhances customer satisfaction and fosters long-term relationships.

Indirect Sales, although representing a smaller share, encompass sales through intermediaries like distributors and retailers, providing convenience and wider market coverage by leveraging established distribution networks and reaching customers in various regions.

Key Market Segments

By Grade

- Industry Grade

- Pharmaceutical Grade

- Battery Grade

By Application

- Polycarbonate Synthesis

- Battery Electrolyte

- Solvents

- Reagents

- Others

By End-use

- Plastics

- Paints & Coating

- Pharmaceutical

- Battery

- Agrochemicals

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Driving Factors

Growing Demand for Environmentally Friendly Chemicals

The growing demand for environmentally friendly chemicals stands as a major driver for the dimethyl carbonate market. Dimethyl carbonate (DMC) is increasingly preferred over traditional solvents and reagents due to its eco-friendly properties, which align with sustainability goals and regulatory requirements. As awareness of environmental issues like pollution and climate change continues to rise, industries are under pressure to adopt cleaner and greener alternatives, driving the demand for dimethyl carbonate across various applications.

One significant aspect propelling the demand for dimethyl carbonate is its role in promoting green chemistry practices. Unlike conventional solvents and reagents, DMC is non-toxic, non-carcinogenic, and biodegradable, making it a safer and more environmentally benign option. Its low volatility and minimal environmental impact contribute to reduced emissions of volatile organic compounds (VOCs) and greenhouse gases, supporting efforts to mitigate air pollution and global warming. As a result, industries are increasingly substituting hazardous chemicals with dimethyl carbonate in processes such as polycarbonate synthesis, battery electrolytes, and solvent formulations.

Furthermore, the regulatory landscape is driving the adoption of dimethyl carbonate as companies strive to comply with stringent environmental regulations and sustainability targets. Governments worldwide are implementing regulations to restrict the use of harmful chemicals and promote the adoption of safer alternatives. For instance, regulations such as the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the U.S. Environmental Protection Agency’s Safer Choice Program encourage the substitution of hazardous chemicals with greener alternatives like dimethyl carbonate. This regulatory push fosters a favorable market environment for dimethyl carbonate manufacturers, incentivizing investment in research, development, and production capacities.

Moreover, the versatility of dimethyl carbonate across multiple applications further drives its market growth. In addition to its use as a solvent and reagent, DMC serves as a key intermediate in polycarbonate synthesis, contributing to the production of lightweight, durable plastics used in automotive, electronics, and construction industries. Its application as a battery electrolyte additive enhances battery performance and safety in electric vehicles and portable electronic devices, catering to the burgeoning demand for energy storage solutions in the renewable energy sector.

Restraining Factors

Competition from Substitutes

One major restraining factor for the dimethyl carbonate market is the competition from substitutes, which poses challenges to its widespread adoption and market growth. Dimethyl carbonate (DMC) competes with various alternative solvents, reagents, and chemicals across its diverse applications, presenting barriers to its market penetration and expansion.

One significant substitute for dimethyl carbonate is traditional solvent systems, such as acetone, toluene, and methylene chloride, which are widely used in industries like paints, coatings, adhesives, and pharmaceuticals. While these solvents may pose environmental and health risks, they often have established supply chains, established applications, and lower costs compared to dimethyl carbonate. As a result, industries may hesitate to switch to DMC due to concerns about compatibility, performance, and economic viability.

Additionally, the availability of alternative reagents and chemicals for specific applications poses a challenge to the dimethyl carbonate market. For instance, in polycarbonate synthesis, phosgene and bisphenol-A are traditional precursors that have been widely used for decades. Despite their associated hazards and environmental concerns, these chemicals remain entrenched in the industry due to factors such as established production processes, familiarity, and cost considerations. While dimethyl carbonate offers a safer and greener alternative, convincing manufacturers to transition from established practices to DMC-based processes may be met with resistance and inertia.

Moreover, the emergence of bio-based and renewable chemicals presents a competitive threat to dimethyl carbonate. With increasing emphasis on sustainability and renewable resources, industries are exploring alternatives derived from biomass, such as bio-based solvents and reagents. These bio-based alternatives offer environmental benefits and may appeal to environmentally conscious consumers and businesses seeking to reduce their carbon footprint. As a result, dimethyl carbonate faces competition not only from conventional chemicals but also from emerging bio-based substitutes.

Furthermore, technological advancements and innovations in chemical synthesis and process engineering may lead to the development of novel substitutes with improved performance and cost-effectiveness compared to dimethyl carbonate. For example, advances in catalysis and reaction engineering may enable the production of polycarbonates using alternative precursors or methods that offer advantages over DMC-based processes in terms of efficiency, yield, and environmental impact.

Growth Opportunity

Transition towards Sustainable Chemical Solutions

One major growth opportunity for the dimethyl carbonate (DMC) market lies in the global transition towards sustainable chemical solutions. As industries and governments increasingly prioritize environmental sustainability and seek to reduce their carbon footprint, there is growing demand for greener alternatives to traditional solvents, reagents, and chemicals. Dimethyl carbonate, with its eco-friendly properties and versatile applications, is well-positioned to capitalize on this trend and emerge as a key player in the sustainable chemicals market.

One significant aspect driving the growth opportunity for dimethyl carbonate is its role in promoting green chemistry practices. Unlike conventional solvents and reagents, DMC offers several environmental benefits, including low toxicity, biodegradability, and minimal environmental impact. As a result, dimethyl carbonate is gaining traction as a safer and more sustainable alternative in various industries, such as paints, coatings, adhesives, and pharmaceuticals. Its use can help companies reduce their environmental footprint, comply with regulations, and meet sustainability targets, driving demand for dimethyl carbonate as a green chemical solution.

Furthermore, the expansion of end-use applications presents a significant growth opportunity for the dimethyl carbonate market. While DMC is already utilized in sectors such as polycarbonate synthesis, battery electrolytes, and solvent formulations, there is potential for further diversification and innovation in its applications. For example, dimethyl carbonate shows promise as a raw material for the production of specialty chemicals, pharmaceutical intermediates, and agrochemicals. Additionally, ongoing research and development efforts may uncover new applications and processes that leverage the unique properties of dimethyl carbonate, opening up new market opportunities and driving demand growth.

Latest Trends

Increasing Adoption of Dimethyl Carbonate as a Green Solvent

One major latest trend in the dimethyl carbonate (DMC) market is the increasing adoption of dimethyl carbonate as a green solvent across various industries. With a growing emphasis on sustainability and environmental responsibility, there is a rising demand for eco-friendly solvents that offer high performance while minimizing environmental impact. Dimethyl carbonate, with its unique properties and eco-friendly characteristics, is gaining popularity as a green solvent solution, driving a significant trend in the market.

One key aspect driving this trend is the growing awareness of the environmental and health hazards associated with traditional solvents. Conventional solvents, such as acetone, toluene, and methylene chloride, are often toxic, volatile organic compounds (VOCs), and pose risks to human health and the environment. In contrast, dimethyl carbonate is non-toxic, non-carcinogenic, and biodegradable, making it a safer and more environmentally benign alternative. As a result, industries are increasingly replacing hazardous solvents with dimethyl carbonate in various applications, such as paints, coatings, adhesives, and cleaning products, to reduce emissions and improve workplace safety.

Furthermore, regulatory initiatives and sustainability mandates are driving the adoption of dimethyl carbonate as a green solvent. Governments worldwide are implementing stringent regulations to restrict the use of harmful chemicals and promote the adoption of safer alternatives. For example, regulations such as the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the U.S. Environmental Protection Agency’s Safer Choice Program encourage the substitution of hazardous solvents with greener alternatives like dimethyl carbonate. Compliance with these regulations is pushing industries to transition to environmentally friendly solvents, thus fueling the demand for dimethyl carbonate.

Additionally, technological advancements and innovations are contributing to the growing adoption of dimethyl carbonate as a green solvent. Manufacturers are investing in research and development to optimize the production processes and improve the performance of dimethyl carbonate-based solvent formulations. Advanced formulations of dimethyl carbonate solvents offer enhanced solubility, stability, and efficiency, meeting the stringent requirements of various applications while minimizing environmental impact.

Moreover, consumer preferences and corporate sustainability initiatives are driving the demand for products manufactured using eco-friendly solvents. Companies are increasingly incorporating sustainability considerations into their product development and manufacturing processes to meet consumer expectations for environmentally responsible products. Dimethyl carbonate-based solvent formulations align with these sustainability goals, offering companies a competitive edge and enhancing their brand reputation as environmentally conscious enterprises.

Regional Analysis

In 2024, the dimethyl carbonate (DMC) market witnessed significant growth, with the Asia Pacific region emerging as a key player, capturing a substantial share of 54%. This expansion is primarily propelled by the rapid development of the DMC sector in the region, driven by factors such as increasing urbanization, population growth, and infrastructure projects.

Countries like China and India have played a pivotal role in establishing the Asia Pacific market’s dominance in the DMC industry. Their robust economies and extensive urbanization endeavors have spurred demand for DMC in various sectors, including automotive, electronics, pharmaceuticals, and agriculture, fostering investment and developmental activities across the region.

Furthermore, the widespread use of DMC across diverse applications has contributed to the region’s significant demand for this chemical compound. With China and India leading the market, the Asia Pacific benefits from its strong manufacturing capabilities and infrastructure, facilitating the production and distribution of DMC to meet the escalating demand.

Moreover, the Asia Pacific’s dominance in the DMC market is reinforced by its expanding applications across industries such as paints, coatings, adhesives, and batteries. This versatility of DMC enables its utilization in a wide range of products, further driving demand and market growth in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The dimethyl carbonate (DMC) market boasts a diverse landscape with several key players contributing to its growth and development. Some of the prominent companies operating in this market include UBE Industries Ltd., Alfa Aesar (Thermo Fisher Scientific Inc.), Merck KGaA, Haike Chemical Group, and Shandong Shida Shenghua Chemical Group Co., Ltd.

These companies are actively involved in research and development activities, product innovation, strategic partnerships, and geographical expansion to strengthen their market position and meet the evolving needs of customers.

Market Key Players

- Alfa Aesar

- Connect Chemicals

- Dongying Hi-tech Spring Chemical Industry Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

- Haike Chemical Group

- Hebei New Chaoyang Chemical Stock Co., Ltd.

- Kishida Chemical Co. Ltd.

- Kowa Company Ltd.

- Lotte Chemical

- Merck KGaA

- Shandong Depu Chemical Industry Science and Technology Co., Ltd.

- Shandong Shida Shenghua Chemical Group Co., Ltd.

- Tokyo Chemical Industry Co., Ltd

- Ube Industries Ltd.

- Qingdao Aspirit Chemical Co., Ltd.

Recent Developments

In 2024, Alfa Aesar entered into strategic partnerships with key players in the automotive sector to supply dimethyl carbonate for battery electrolyte applications.

In 2024, Haike Chemical Group introduced innovative packaging solutions for its dimethyl carbonate products to improve storage, handling, and transportation efficiency

Report Scope

Report Features Description Market Value (2023) USD 742.0 Mn Forecast Revenue (2033) USD 1341.5 Mn CAGR (2023-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Industry Grade, Pharmaceutical Grade, Battery Grade), By Application(Polycarbonate Synthesis, Battery Electrolyte, Solvents, Reagents, Others), By End-use(Plastics, Paints & Coating, Pharmaceutical, Battery, Agrochemicals, Others), By Sales Channel(Direct Sales, Indirect Sales) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Alfa Aesar, Connect Chemicals, Dongying Hi-tech Spring Chemical Industry Co., Ltd., Guangzhou Tinci Materials Technology Co., Ltd., Haike Chemical Group, Hebei New Chaoyang Chemical Stock Co., Ltd., Kishida Chemical Co. Ltd., Kowa Company Ltd., Lotte Chemical, Merck KGaA, Shandong Depu Chemical Industry Science and Technology Co., Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Tokyo Chemical Industry Co., Ltd, Ube Industries Ltd., Qingdao Aspirit Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Dimethyl Carbonate Market?Dimethyl Carbonate market size is expected to be worth around USD 1341.5 Million by 2033, from USD 742.0 Million in 2023

What is the projected CAGR at which the Dimethyl Carbonate Market is expected to grow at?The Dimethyl Carbonate Market is expected to grow at a CAGR of 6.1% (2022-2032).Name the major industry players in the Dimethyl Carbonate Market?Alfa Aesar, Connect Chemicals, Dongying Hi-tech Spring Chemical Industry Co., Ltd., Guangzhou Tinci Materials Technology Co., Ltd., Haike Chemical Group, Hebei New Chaoyang Chemical Stock Co., Ltd., Kishida Chemical Co. Ltd., Kowa Company Ltd., Lotte Chemical, Merck KGaA, Shandong Depu Chemical Industry Science and Technology Co., Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Tokyo Chemical Industry Co., Ltd, Ube Industries Ltd., Qingdao Aspirit Chemical Co., Ltd.

Dimethyl Carbonate MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Dimethyl Carbonate MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Aesar

- Connect Chemicals

- Dongying Hi-tech Spring Chemical Industry Co., Ltd.

- Guangzhou Tinci Materials Technology Co., Ltd.

- Haike Chemical Group

- Hebei New Chaoyang Chemical Stock Co., Ltd.

- Kishida Chemical Co. Ltd.

- Kowa Company Ltd.

- Lotte Chemical

- Merck KGaA

- Shandong Depu Chemical Industry Science and Technology Co., Ltd.

- Shandong Shida Shenghua Chemical Group Co., Ltd.

- Tokyo Chemical Industry Co., Ltd

- Ube Industries Ltd.

- Qingdao Aspirit Chemical Co., Ltd.