Global Digital Tokens Market Size, Share, Industry Analysis Report By Type (Payment Token, Utility Token, Equity Token, Non-Fungible Token (NFT), Others), By End Users (Investors, Merchants, Individuals, Others), By Industry Vertical (Financial Services, Real Estate, Gaming, Supply Chain Management, Healthcare, Energy and Utilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161792

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Crypto & Tokenization Market Snapshot

- Role of Generative AI

- US Market Size

- By Type

- By End-Users

- By Industry Vertical

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

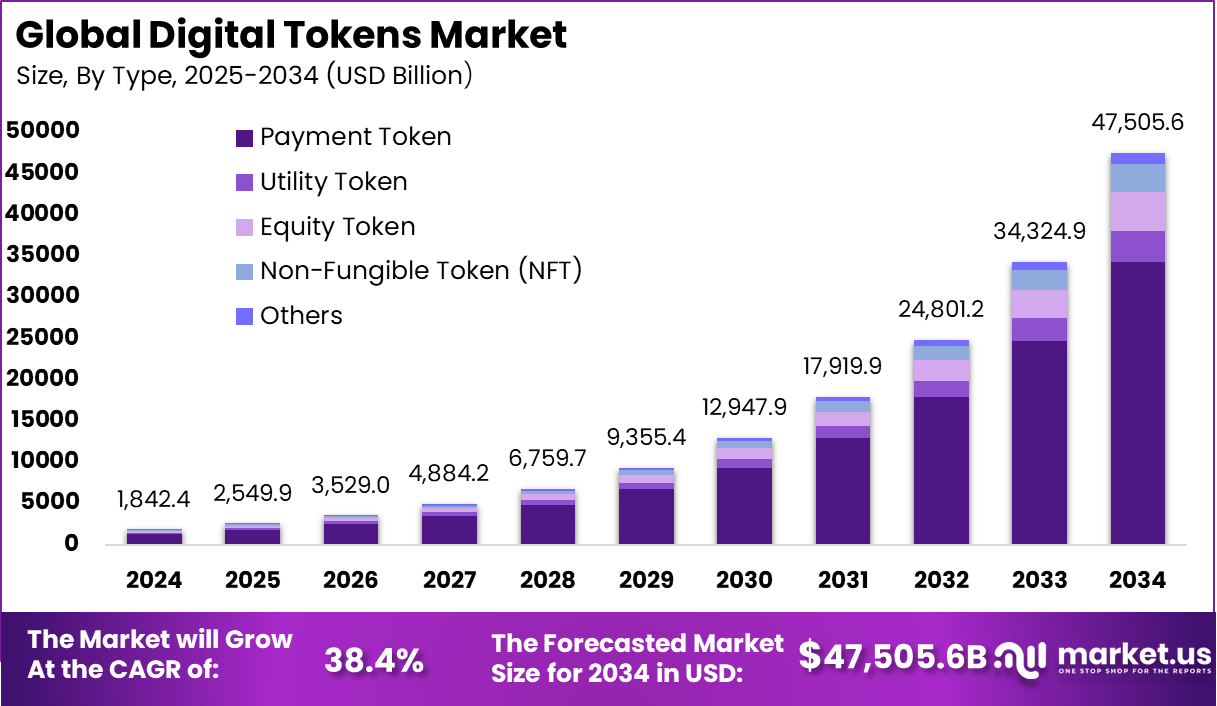

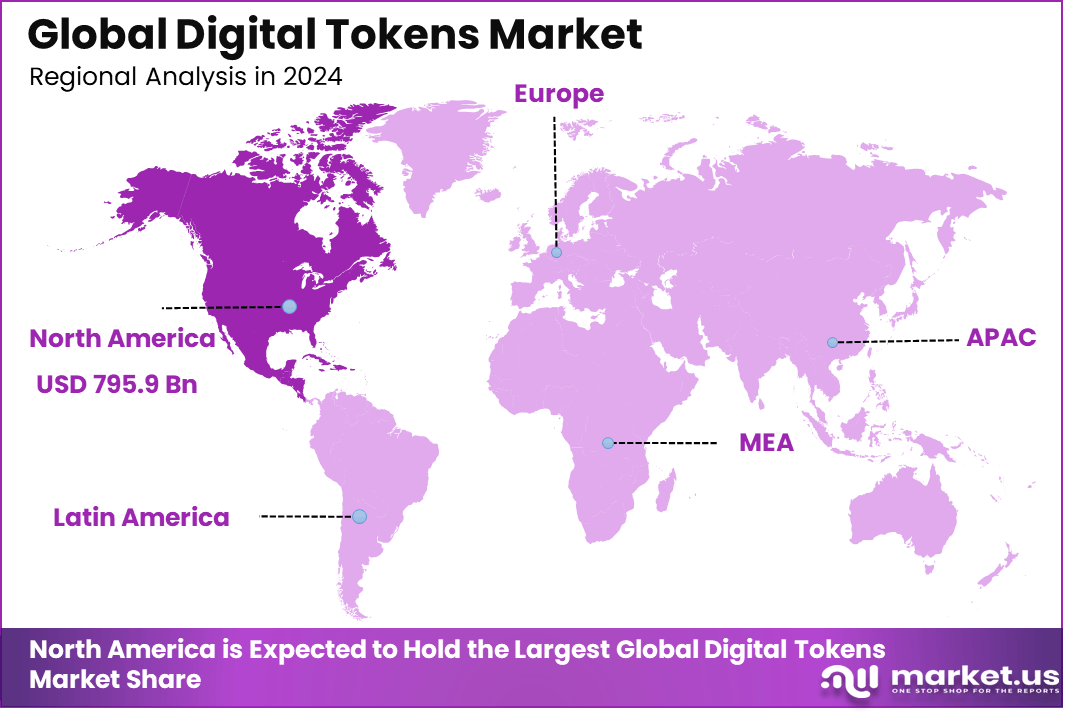

The Global Digital Tokens Market generated USD 1,842.4 billion in 2024 and is predicted to register growth from USD 2,549.9 billion in 2025 to about USD 47,505.6 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 43.2% share, holding USD 795.9 Billion revenue.

The digital tokens market covers blockchain-based units that represent value, ownership, or access to digital or physical assets. These include cryptocurrencies, utility tokens, security tokens, asset-backed tokens, stable-value tokens, and governance tokens. They are used for trading, payments, fundraising, investment, digital identity, and decentralized application access. Tokens are issued, transferred, and stored through blockchain networks and smart contracts.

Top driving factors include the widespread digitization of financial and non-financial assets, the growth of blockchain technology, and increasing demand for secure, fast, and transparent transaction methods. For instance, network externalities cause strong adoption momentum, where the rising number of users increases the token’s value, encouraging further adoption.

Tokenization reduces transaction costs and provides better liquidity for traditionally illiquid assets such as real estate and collectibles, opening new investment opportunities. Additionally, smart contracts on blockchain enable automated, trustless execution of agreements, which further propels market growth. Demand comes from both individual participants and institutional investors. Retail users trade tokens for speculative gains, payments, and staking rewards.

Top Market Takeaways

- Payment tokens hold about 72.1%, showing that transaction-focused digital assets remain the most widely used format.

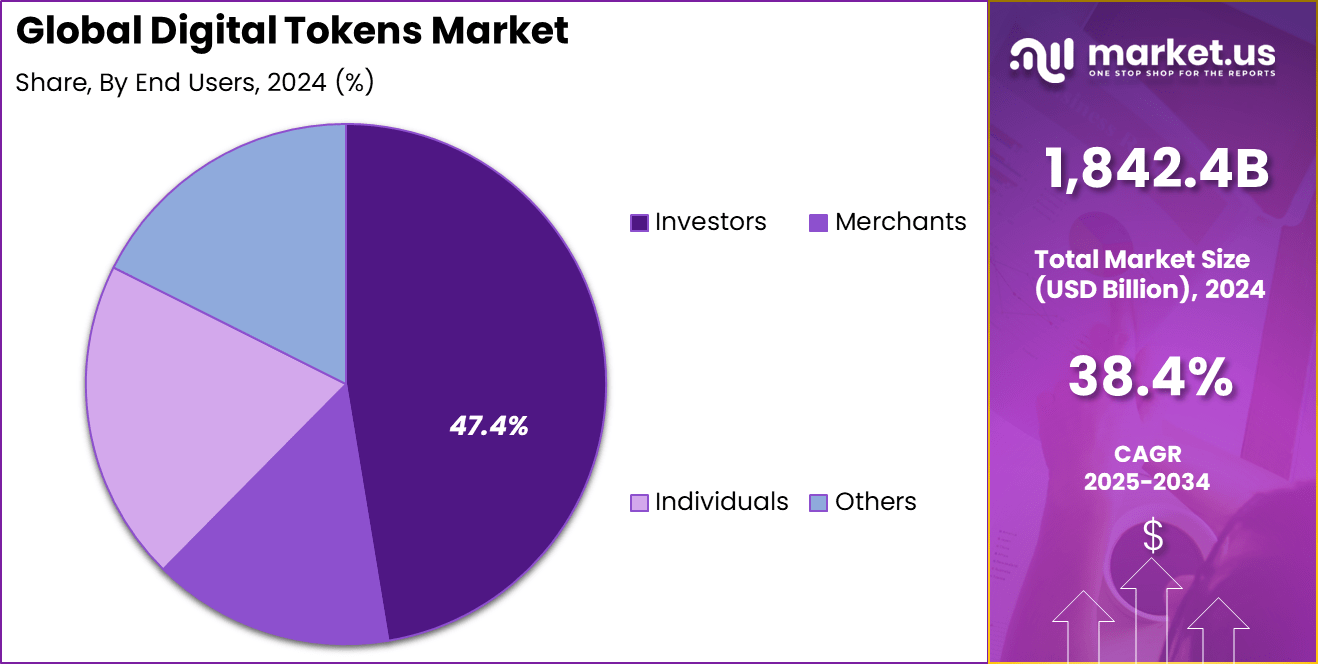

- Investors make up nearly 47.4% of end users, reflecting strong interest in digital tokens as alternative assets.

- Financial services account for around 42.7%, driven by adoption in trading, settlements, and digital finance infrastructure.

- North America captures roughly 43.2%, supported by regulatory advancements and institutional participation.

- The U.S. leads market activity due to fintech growth, tokenized payments, and rising digital asset ownership.

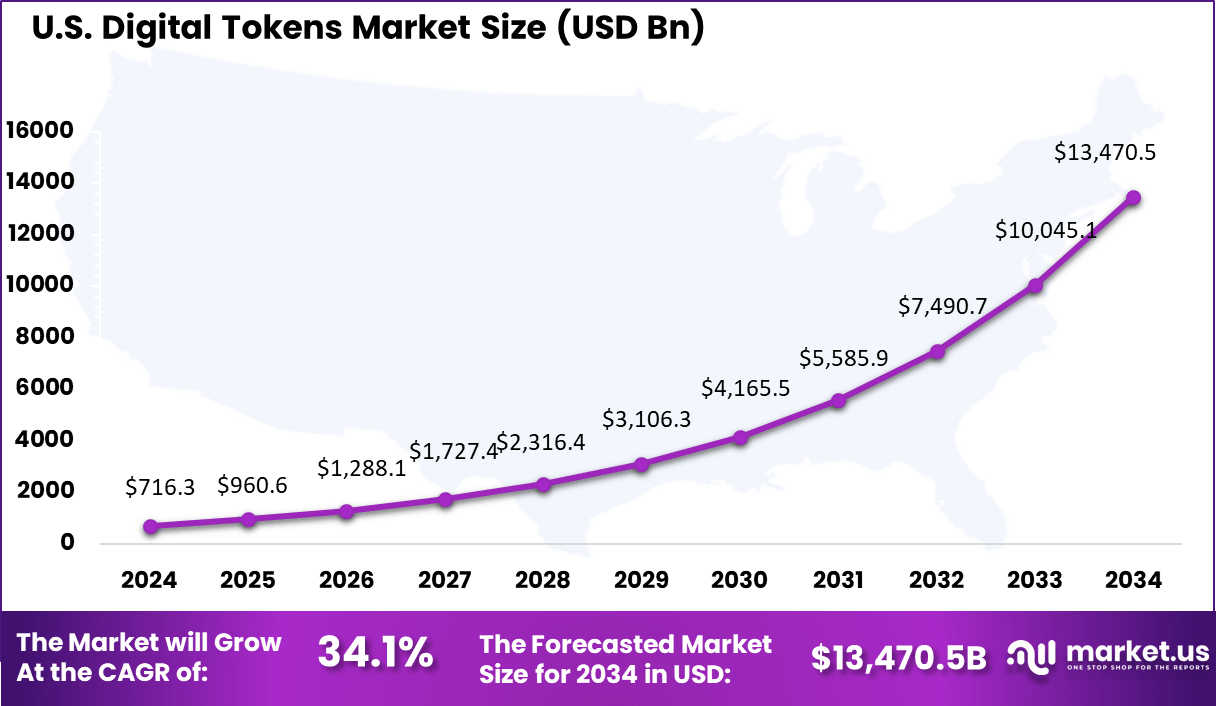

- Growth at nearly 34.1% CAGR signals accelerating use of tokens in payments, investments, and financial platforms.

Quick Market Facts

The adoption of technologies around tokenization is increasing thanks to blockchain infrastructure, distributed ledger technology (DLT), and advanced cryptographic protocols. These technologies ensure enhanced data security, reduce fraud risks, and enable fractional ownership and trading of assets. Businesses are also leveraging tokenization to improve customer loyalty programs, streamline supply chains, and innovate employee reward systems through easily transferable tokens.

Investment opportunities abound in tokenized digital and physical assets. Tokenization unlocks liquidity in markets that were previously difficult to access, facilitating fractional ownership of high-value assets, from real estate to debt securities. This creates novel avenues for asset-backed financing and community-driven innovation funding.

Projections indicate that institutional interest in digital tokens will grow substantially as regulatory clarity improves and technology matures, signaling robust investment potential in tokenized asset platforms and related financial services. Business benefits from digital tokens include enhanced security through decentralized transaction records that are almost impossible to hack or alter.

The reduction in intermediaries lowers operational costs and increases transaction speed. Transparency and traceability improve compliance and investor confidence. Moreover, tokenization supports automation through smart contracts, which can reduce administrative burdens in payments and asset management. Overall, businesses gain flexibility, cost efficiency, and new revenue streams by implementing tokenization strategies.

Crypto & Tokenization Market Snapshot

General Market Statistics

- Total market cap: As of October 2025, the cryptocurrency market capitalization reached $3.89 trillion, reflecting a +59.7% year-over-year increase.

- Trading volume: Daily trading volume across all crypto assets is approximately $329.17 billion.

- Adoption: Global crypto ownership climbed to 562 million people in 2024, equal to 6.8% of the world’s population. This figure now exceeds the combined populations of the EU, U.S., and Japan.

Dominant Tokens

- Bitcoin (BTC): Maintains its lead with 57% market dominance, remaining the largest cryptocurrency by capitalization.

- Ethereum (ETH): Holds 12.6% market dominance as the second-largest token. In August 2023, Ethereum processed over 1 million daily on-chain transactions, surpassing Bitcoin in network activity.

- Stablecoins: The combined stablecoin market cap is approximately $313 billion. Tether (USDT) dominates the category, followed by USD Coin (USDC) and Binance USD (BUSD).

Market Performance

- Volatility: Crypto assets remain highly volatile. For instance, in May 2022, Bitcoin’s price fell 20% in a week and Ethereum declined 26%, while major equity indices dropped far less.

- Cross-listings: A 2020 study found that tokens cross-listed on multiple exchanges experienced a 16% market-adjusted return within two weeks, alongside increases in price, trading volume, and network growth.

Tokenization of Real-World Assets

- Market size: Tokenized assets were valued at $0.4 trillion in 2023 and $0.6 trillion in 2024, with projections reaching $4-5 trillion by 2030.

- Institutional involvement: Financial institutions such as JPMorgan are piloting deposit tokens, while asset managers are launching tokenized funds.

- Fractional ownership: Tokenization enables investors to own fractional stakes in assets like real estate, opening opportunities for small and retail investors.

Payment Tokenization

- Adoption by payment networks: Companies like Visa utilize payment tokenization to replace sensitive payment data with unique tokens, enhancing transaction security.

- Market growth: The payment tokenization market was valued at $3.32 billion in 2024 and is projected to grow to $12.83 billion by 2032, at a CAGR of 18.3%.

- Business adoption: Enterprises are adopting tokenization to reduce fraud risks and ensure compliance for card-not-present transactions in e-commerce and digital payments.

Role of Generative AI

Generative AI is playing an increasingly important role in the evolution of digital tokens by enhancing automation and driving innovative new use cases. About 75% of the value generative AI creates in industries like banking and technology comes from enhancing customer operations, marketing, software development, and research, which directly supports tokenized ecosystems.

In digital tokens, AI-powered autonomous agents are being used to execute complex tasks like trade strategies and decentralized market functions with minimal human intervention. This integration helps improve the speed, accuracy, and scalability of digital token operations, making them more efficient and accessible to users. Generative AI also enables predictive analytics platforms that support crypto trading with data-driven insights.

A growing number of AI tokens represent access to computing power and machine learning models, giving investors exposure to the backbone technology fueling AI innovation. This combination is advancing a more open and inclusive economy around digital tokens, with AI tokens becoming a key focus for investors looking to capitalize on the intersection of artificial intelligence and blockchain technology.

US Market Size

The United States market is particularly significant, with valuations over USD 716 billion and a CAGR of 34.1%, reflecting its rapid expansion and investor appetite. This growth is underpinned by increasing institutional adoption, enhanced regulatory clarity, and growing consumer trust in digital assets. The U.S. also benefits from strategic efforts such as blockchain-related pilot projects and government initiatives supporting digital asset frameworks.

Given the mature financial infrastructure and ongoing technological advances, the U.S. market continues to pioneer new token-based financial products, from tokenized securities to digital payment innovations. This environment fosters opportunities for both established firms and emerging startups aiming to redefine asset ownership and trading paradigms.

North America controls a dominant 43.2% share of the digital tokens market, reflecting the region’s advanced fintech landscape and high blockchain adoption rates. Several factors contribute to the region’s leadership, including strong regulatory frameworks, a large base of institutional investors, and rapid integration of tokenization in mainstream financial services.

The U.S. is a critical market within North America, supported by a substantial ecosystem of technology developers, financial institutions, and investors. This robust environment fuels continued innovation and commercialization of digital tokens, positioning North America as a global hub for tokenization technology development and application.

By Type

In 2024, Payment tokens dominate the digital tokens market, holding a commanding 72.1% share. These tokens are primarily used as a medium for transactions, facilitating secure and efficient digital payments across various platforms. Their widespread adoption is driven by the increasing shift toward cashless payments and the growing acceptance of digital transaction methods in both retail and online environments.

The importance of payment tokens lies in their ability to reduce fraud and protect sensitive financial information through tokenization processes. They enable seamless transactions without exposing actual payment details, which enhances trust among users and businesses. This secure nature has made payment tokens the cornerstone of digital token usage in the global financial ecosystem.

By End-Users

In 2024, Investors represent the largest user group in the digital tokens market, accounting for 47.4% of total end users. The rise in investor interest is fueled by the appeal of digital tokens as an innovative asset class that offers ease of trading, diversification, and fractional ownership opportunities. Digital tokens are increasingly seen as a viable alternative to traditional investment vehicles due to their accessibility and liquidity.

Investor demand is also supported by blockchain technology, which ensures transparency and security of transactions, making digital tokens attractive for portfolio inclusion. This heightened interest has prompted more platforms to offer tokenized assets, including equity and commodities, enabling investors to enter previously inaccessible markets with smaller capital commitments.

By Industry Vertical

In 2024, The financial services sector leads all industry verticals with a 42.7% share in the digital tokens market. Financial institutions are embracing tokens for a variety of uses such as payments, asset tokenization, and digital securities. This sector benefits from tokenization by improving transaction speed, reducing settlement costs, and increasing liquidity through fractional asset ownership.

Institutions have also begun to collaborate on building standard frameworks and regulatory compliance measures that encourage wider adoption of tokenization technologies. The promise of transforming traditional finance workflows into more agile, secure, and transparent processes has made financial services a key driver of digital token market growth.

Emerging Trends

One major trend in digital tokens is the rise of real-world asset tokenization, where physical and financial assets are converted into digital tokens on blockchain networks. This market has grown over 260% in the first half of 2025 alone, driven by institutional interest in tokenizing assets like private credit and government securities.

Tokenization brings increased liquidity, fractional ownership, faster settlements, and cross-border efficiencies, fundamentally changing how assets are managed and traded globally. Another key emerging trend is the use of AI-powered compliance automation in token platforms.

Approximately 49% of institutional investors highlight regulatory uncertainty as a main challenge, and AI is helping to automate tasks like KYC/AML processes and smart contract auditing. This reduces legal costs, speeds up onboarding, and builds institutional trust, enabling smoother multi-jurisdictional launches that support broader adoption of digital tokens.

Growth Factors

The rapid growth of digital tokens is supported by the increasing demand for secure and transparent digital payment and asset management solutions. Since the pandemic, the shift to digitization and cashless payments has accelerated, pushing more businesses and consumers to adopt digital tokens to protect sensitive data and enable seamless transactions.

Industry research shows that platforms providing tokenization solutions now make up nearly 79% of the market, reflecting strong demand for technologies that manage creation, trading, and security of tokenized assets. Furthermore, institutional interest is a significant growth driver, with more than 75% of surveyed investors expecting to increase allocations to digital assets in 2025.

About 84% of firms are either already using or interested in stablecoins for yield generation and convenient transactions, while 76% plan to invest in tokenized assets by 2026 as part of portfolio diversification strategies. This institutional momentum is helping to legitimize and expand digital token markets rapidly.

Key Market Segments

By Type

- Payment Token

- Utility Token

- Equity Token

- Non-Fungible Token (NFT)

- Others

By End Users

- Investors

- Merchants

- Individuals

- Others

By Industry Vertical

- Financial Services

- Real Estate

- Gaming

- Supply Chain Management

- Healthcare

- Energy and Utilities

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Institutional Demand Fuels Growth

One key driver for digital tokens is the growing institutional demand that has been witnessed recently. This surge is reflected in record-breaking trading volumes and increasing participation from large open interest holders. Institutional investors see digital tokens as an attractive asset class, leading to a substantial broadening of the market beyond just retail investors.

The Q3 of 2025, for example, marked a historic high in combined crypto futures and options volumes, crossing $900 billion, with an average daily open interest of over $31 billion. This influx of institutional money brings more liquidity and credibility, encouraging further adoption and market stability. This institutional focus helps digital tokens evolve into mainstream financial products, supported by better infrastructure and regulatory clarity.

As institutional players diversify their portfolios with digital tokens, it drives innovations in trading instruments like futures and options, expanding the product suite continuously. This institutional pull is crucial because it reduces volatility caused by retail speculation and supports sustainable market growth in the long term.

Restraint Analysis

Market Volatility and Sudden Price Swings

A major restraint for digital tokens is the market’s inherent volatility, which can lead to sharp price drops and trigger panic selling among investors. Recent months have seen dramatic crashes where major tokens like Bitcoin and Ethereum plunged significantly within short periods, wiping billions off the market. For example, Bitcoin dropped from highs around $123,000 to near $107,000 in a few hours, causing liquidity crises on various exchanges.

This volatility acts as a strong deterrent for cautious investors and companies considering entry into digital token markets. Sudden market crashes damage confidence, disrupt trading strategies, and can solidify negative perceptions about digital tokens as unstable or speculative assets rather than dependable investments. The unpredictable price patterns also complicate the integration of digital tokens into conventional financial systems, restraining wider use cases and adoption.

Opportunity Analysis

Tokenization’s Potential to Transform Finance

The rise of tokenization presents a major opportunity for digital tokens to reshape traditional financial markets. By converting physical and digital assets into tokens on blockchain networks, tokenization enables faster settlement times, greater transparency, and improved liquidity. Tokenized assets can settle trades in near real-time across borders, which is a significant improvement over the days-long processes common in traditional finance.

Transparency is enhanced through blockchain’s immutable ledger, providing a clear, auditable trail of ownership and transactions. This builds trust among investors and simplifies regulatory oversight. Tokenization could democratize access to investments like real estate, art, or private equity, broadening market participation beyond traditional financial elites.

Challenge Analysis

Legal and Regulatory Uncertainty

A significant challenge facing digital tokens is the unclear and evolving legal and regulatory environment. Different jurisdictions offer varying rules around digital token classifications, trading, taxation, and consumer protections. This lack of global regulatory harmonization creates compliance difficulties for issuers, exchanges, and investors.

Companies must navigate complex regulations while facing the risk of restrictive policies or sudden crackdowns that can impact market confidence. Furthermore, uncertainty over whether digital tokens qualify as securities, commodities, or other financial instruments complicates product design and innovation.

Regulatory gray areas hinder collaboration between traditional finance and blockchain industries. These legal obstacles delay large-scale adoption and integration of digital tokens into everyday financial systems. Addressing these regulatory challenges requires coordinated frameworks and standards, which is still a work in progress, prolonging a phase of cautious market development.

Competitive Analysis

The Digital Tokens Market is led by major cryptocurrency exchanges and financial infrastructure providers such as Binance Holdings Ltd., Coinbase Global, Inc., KuCoin Global, and Payward, Inc. (Kraken). These platforms facilitate the issuance, trading, and custody of digital tokens across retail and institutional markets. Their ecosystems support spot trading, derivatives, staking, and tokenized assets, driving liquidity and adoption worldwide.

Key blockchain and fintech firms including Ripple Labs, Inc., Circle Internet Financial, LLC, Tether Limited, and Block, Inc. play a central role in powering stablecoins, payment tokens, and cross-border settlement systems. These companies enable token-based financial services through on-chain transfers, digital wallets, and programmable money applications used in remittances, DeFi, and merchant payments.

Additional contributors such as Gemini Trust Company, LLC, Bullish, Inc., Universal Navigation Inc. (Uniswap), iFinex Inc. (Bitfinex), ConsenSys Software Inc., and Aux Cayes Fintech Co. Ltd. (OKX) expand the ecosystem with decentralized exchanges, token development platforms, and Web3 infrastructure. A group of other market participants continues to diversify token utility across finance, gaming, real-world asset tokenization, and digital identity solutions.

Top Key Players in the Market

- Binance Holdings Ltd.

- Coinbase Global, Inc.

- Ripple Labs, Inc.

- Block, Inc.

- Circle Internet Financial, LLC

- Payward, Inc.

- Gemini Trust Company, LLC

- Bullish, Inc.

- Universal Navigation Inc.

- iFinex Inc.

- KuCoin Global

- Tether Limited

- ConsenSys Software Inc.

- Aux Cayes Fintech Co. Ltd.

- Others

Recent Developments

- In October 2025, Binance Holdings Ltd. finalized its long-delayed acquisition of South Korean crypto exchange Gopax in October, following regulatory approval after a two-year wait. This move marks Binance’s reentry into South Korea’s tightly regulated market. The acquisition addresses Gopax’s prior liquidity crisis caused by $47 million frozen funds and positions Binance to rebuild market presence and liquidity in the region.

- In August 2025, Ripple announced the $200 million acquisition of Rail, a Canadian stablecoin-based international payments startup. Rail’s platform processes over 10% of global B2B stablecoin transactions, accelerating Ripple’s strategy in cross-border stablecoin payments and financial infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 1,842.4 Bn Forecast Revenue (2034) USD 47,505.6 Bn CAGR(2025-2034) 38.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Payment Token, Utility Token, Equity Token, Non-Fungible Token (NFT), Others), By End Users (Investors, Merchants, Individuals, Others), By Industry Vertical (Financial Services, Real Estate, Gaming, Supply Chain Management, Healthcare, Energy and Utilities, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Binance Holdings Ltd., Coinbase Global, Inc., Ripple Labs, Inc., Block, Inc., Circle Internet Financial, LLC, Payward, Inc., Gemini Trust Company, LLC, Bullish, Inc., Universal Navigation Inc., iFinex Inc., KuCoin Global, Tether Limited, ConsenSys Software Inc., Aux Cayes Fintech Co. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Binance Holdings Ltd.

- Coinbase Global, Inc.

- Ripple Labs, Inc.

- Block, Inc.

- Circle Internet Financial, LLC

- Payward, Inc.

- Gemini Trust Company, LLC

- Bullish, Inc.

- Universal Navigation Inc.

- iFinex Inc.

- KuCoin Global

- Tether Limited

- ConsenSys Software Inc.

- Aux Cayes Fintech Co. Ltd.

- Others