Global Digital Signage in Education & Universities Market Size, Share, Industry Analysis Report By Screen Size (22 inches-32 inches, 32 inches-45 inches, 45 inches-55 inches, 55 inches-65 inches, 65 inches-85 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Classroom Displays, Digital Learning, Interactive Whiteboards, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157989

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

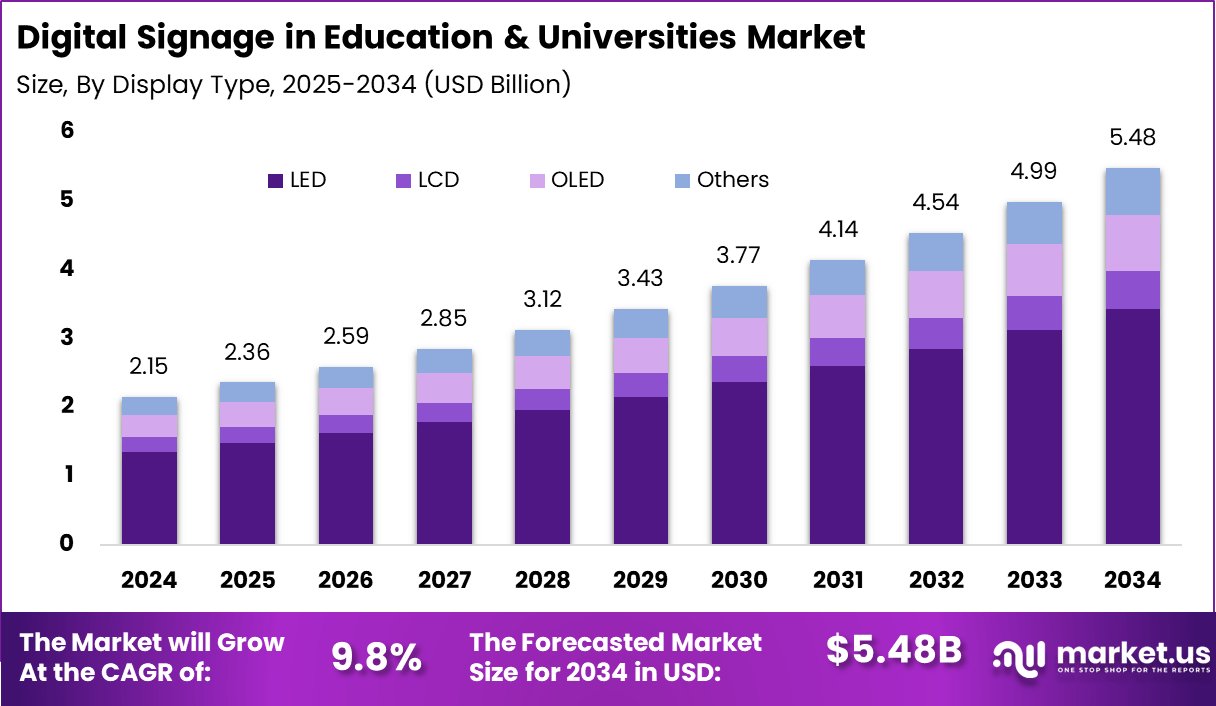

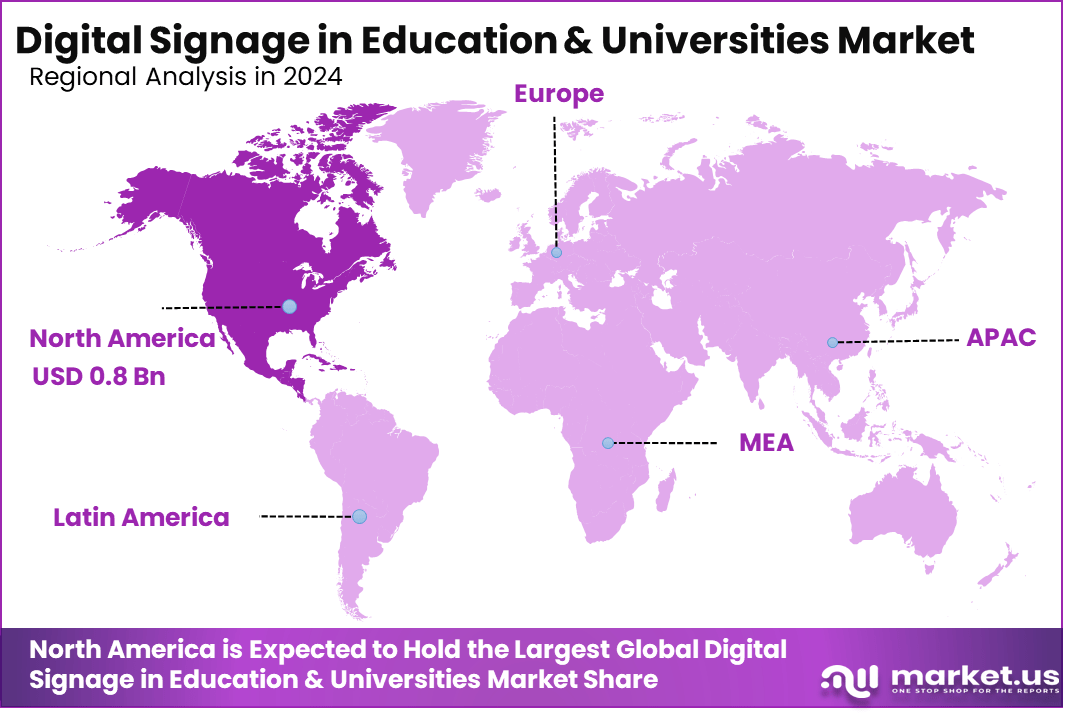

The Global Digital Signage in Education & Universities Market size is expected to be worth around USD 5.48 Billion By 2034, from USD 2.15 billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.4% share, holding USD 0.8 Billion revenue.

The Digital Signage in Education & Universities Market refers to the use of digital display systems to communicate information, enhance learning, and improve campus experiences in educational institutions. These systems consist of screens, software, and content management platforms that display real-time information, educational content, announcements, event schedules, and interactive elements.

The market also includes solutions for digital wayfinding, emergency notifications, and student engagement in campus settings. The primary drivers of the market include the increasing demand for interactive and dynamic communication tools in educational settings. With the growth of digital transformation in education, institutions are adopting technology to improve student engagement and streamline campus operations.

According to Market.us, In 2024, the global Digital Signage market was valued at USD 28.9 billion and is projected to reach USD 52.7 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032. Meanwhile, the global Digital Signage Hardware Market is expected to grow from USD 15.7 billion in 2024 to USD 30 billion by 2034, with a CAGR of 6.80% during the forecast period from 2025 to 2034.

The need for real-time updates, especially in large universities, is pushing the demand for digital signage solutions. Additionally, advancements in cloud-based content management systems, lower hardware costs, and the growing trend of modernizing campus infrastructure are contributing to market growth. The ability of digital signage to support a range of content, from academic messaging to event promotions, also makes it an attractive solution.

Key Insight Summary

- By screen size, 45–55 inches displays dominated, holding 61.8% share.

- By display type, LED screens led the market with 62.7% share.

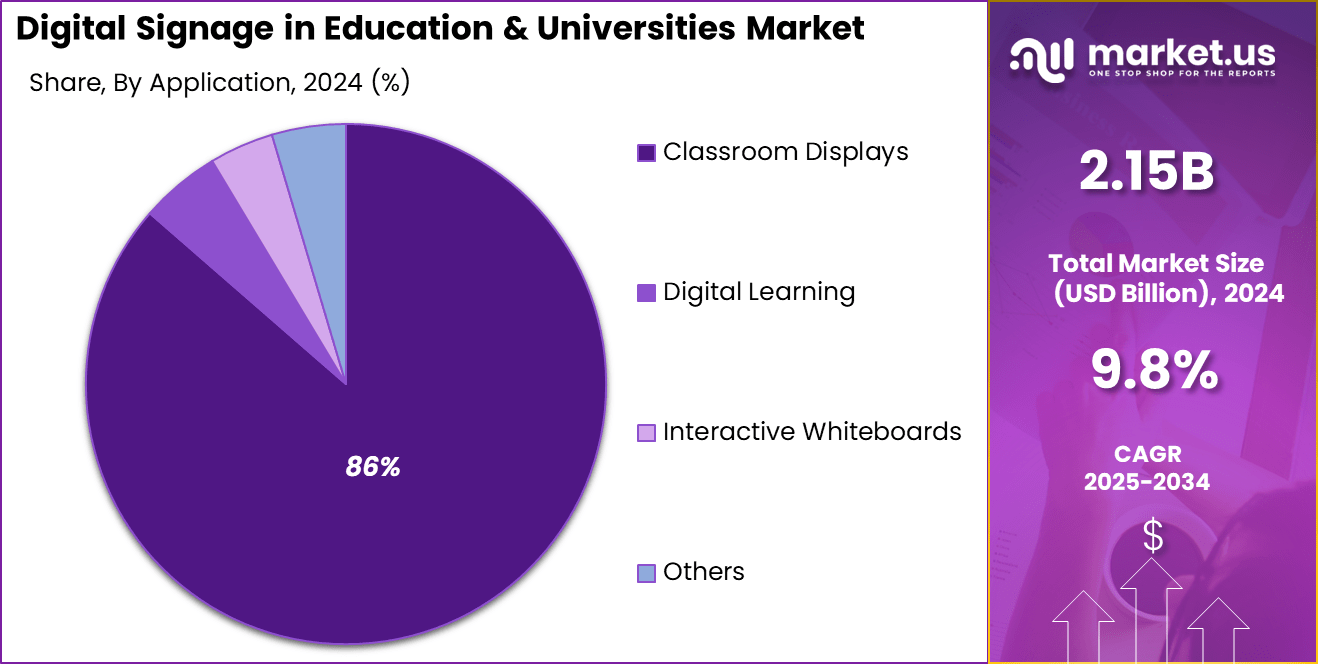

- By application, Classroom Displays were the top segment, accounting for a strong 86.4% share.

- Regionally, North America captured 38.4% share of the global market.

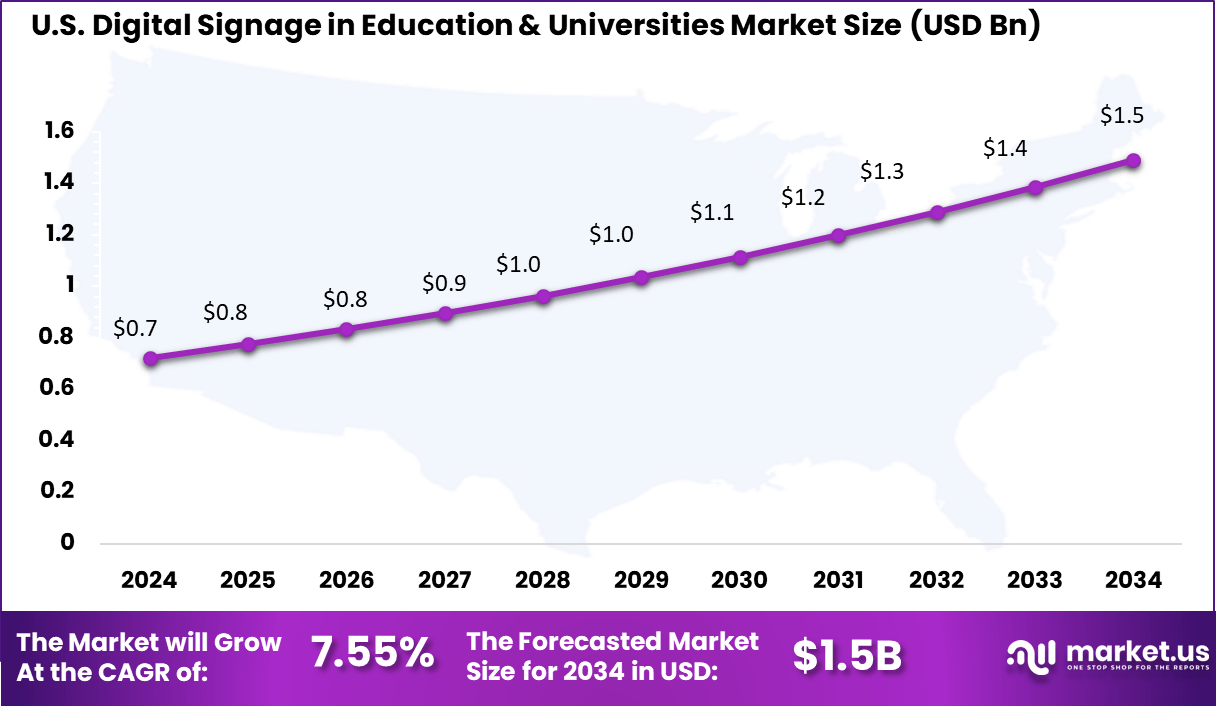

- The U.S. market was valued at USD 0.72 Billion, expanding at a steady 7.55% CAGR.

Investment and business benefits

Investment opportunities are growing in cloud-based platforms, AI integration, and interactive display technologies. Institutions are willing to invest in scalable solutions that offer long-term cost savings and flexibility. There is also potential in developing affordable hardware and software aimed at budget-conscious schools and expanding these solutions in emerging regions.

Partnerships with education departments and government initiatives promoting smart campuses present further avenues for investment. The business benefits of digital signage include improved communication flow, stronger student and staff engagement, and operational cost savings. These systems support real-time content updates, reducing manual effort and paper waste.

They help institutions present a modern, tech-forward image that appeals to students and parents. Data collected through digital signage interactions can provide insights to improve campus services and marketing efforts. The overall enhancement of campus life contributes positively to institutional reputation and student success.

US Market Outlook

The U.S. Digital Signage in Education & Universities Market was valued at USD 0.7 Billion in 2024 and is anticipated to reach approximately USD 1.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 38.4% share and generating USD 0.8 billion in revenue in the digital signage in education and universities market. This leadership is largely attributed to the rapid adoption of technology in educational institutions across the United States and Canada.

Universities and colleges are increasingly utilizing digital signage for various purposes, such as enhancing campus communication, delivering real-time updates, improving student engagement, and creating immersive learning environments. The demand for interactive displays, wayfinding systems, and dynamic content has surged, making digital signage a valuable tool in educational settings.

The dominance of North America is also supported by significant investments from educational institutions in modernizing their campuses and upgrading infrastructure. As institutions seek to provide better learning experiences, digital signage is being integrated across classrooms, lecture halls, libraries, and other student-centric areas.

By Screen Size

In 2024, Screens sized between 45 to 55 inches hold the largest share in the digital signage market for education and universities, capturing 61.8%. This size range is favored due to its optimal balance between visibility and spatial efficiency, making it highly suitable for classroom environments and common areas in educational institutions. Such screen sizes provide clear, legible content from various viewing angles without overwhelming room space, enhancing information delivery and engagement.

The growing demand for medium-sized screens reflects the need for digital signage solutions that cater specifically to educational settings where interactive and instructional content must be accessible to groups of students. Institutions prefer screens in this range to support multimedia learning, announcements, and collaboration activities, elevating communication effectiveness across campuses.

By Display Type

In 2024, LED displays dominate the digital signage market in education with a 62.7% share. These screens are preferred for their superior brightness, energy efficiency, and longer lifespan compared to other display technologies. LED digital signage offers vibrant color quality and better visibility in diverse lighting conditions, which is critical for dynamic content delivery in classrooms and public spaces within educational facilities.

Due to decreasing costs and improvements in LED technology, educational institutions are increasingly adopting LED signage to foster interactive learning environments. These displays support advanced content types, including videos and animations, helping institutions communicate effectively while reducing maintenance efforts.

By Application

In 2024, Classroom displays represent the largest application segment with 86.4% market share. These digital signage solutions are primarily integrated within learning spaces to facilitate instruction, interactive teaching, and student engagement. The adoption of digital displays in classrooms supports multimedia presentations, real-time collaboration, and immediate sharing of course materials, promoting more dynamic and flexible learning experiences.

The classroom display segment’s growth is driven by expanding educational technology initiatives and the push for hybrid learning models that leverage both in-person and digital tools. Schools and universities adopting these solutions aim to improve participation, comprehension, and interaction between students and educators.

Key Market Segments

By Screen Size

- 22 inches – 32 inches

- 32 inches – 45 inches

- 45 inches – 55 inches

- 55 inches – 65 inches

- 65 inches – 85 inches

- Others

By Display Type

- LED

- LCD

- OLED

- Others

By Application

- Classroom Displays

- Digital Learning

- Interactive Whiteboards

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Integration of Technology in Education

The growth in digital signage within education and universities is primarily driven by the rising integration of technology into learning environments. Educational institutions are adopting digital signage systems to enhance communication and engage students, faculty, and staff more effectively. These systems provide dynamic platforms to deliver real-time information such as announcements, class schedules, and emergency alerts, which improve overall campus communication.

Moreover, there is an increasing preference for multimedia-based content in education, which digital signage supports by offering vibrant and diverse visual content. This approach helps captivate students’ interest and supports better retention of information compared to traditional methods. As educational institutions strive to modernize their infrastructure, these technology-driven enhancements not only improve learning experiences but also optimize administrative efficiency across large campuses.

Restraint Analysis

High Initial Implementation Costs

Despite its benefits, the growth of digital signage in education faces challenges due to the high initial costs involved in implementation. Purchasing digital hardware such as displays, interactive boards, and mounting systems requires significant capital investment, which can be prohibitive for many schools, especially smaller or public institutions with limited budgets.

Additionally, adopting the necessary software platforms for content management and ongoing system maintenance adds further expenses that institutions must account for. This financial barrier often delays or limits the adoption of digital signage solutions in education. The challenge is more pronounced in developing regions or rural areas where funding for such technology upgrades is less accessible.

Consequently, some educational institutions hesitate to invest in these systems, fearing cost overruns or uncertain return on investment. The combination of equipment costs, installation expenses, and the need for staff training creates a notable restraint to market growth, impacting the pace of digital signage adoption.

Opportunity Analysis

Expansion in Developing Regions and Hybrid Learning

Significant opportunities exist for digital signage growth in education, particularly in expanding adoption across developing regions where modernization efforts in education are gaining momentum. Governments and educational bodies in Asia Pacific, Latin America, and the Middle East are increasingly investing in digital infrastructure upgrades, creating fertile ground for digital signage solutions.

Another key opportunity arises from the rising trend of hybrid and blended learning models, which combine in-person and online instruction. Digital signage can support these models by delivering updated schedules, event notifications, and remote learning resources that keep both on-campus and virtual students informed. These systems help bridge communication gaps and create a unified learning environment, enhancing inclusivity.

Challenge Analysis

Managing Content and Technical Expertise

A major challenge in deploying digital signage in education is the complexity of managing and updating content across multiple screens and locations. Many schools and universities lack the technical expertise or sufficient IT staff to effectively operate and maintain their digital signage networks. This deficiency can lead to outdated or poorly managed content that diminishes the system’s intended impact and benefits.

The content management challenge is coupled with the need for training personnel to use digital signage software, update schedules, and troubleshoot hardware issues. Without these capabilities, educational institutions struggle to fully leverage digital signage solutions, resulting in suboptimal utilization. This challenge can deter potential adopters who fear operational difficulties or additional resource burdens, especially in institutions that lack dedicated support teams.

Competitive Analysis

In the digital signage for education and universities market, Promethean, SMART Technologies, and BenQ are key players. They lead with interactive display solutions that enhance classroom engagement and facilitate collaborative learning. Their products, such as interactive whiteboards and touchscreen displays, are designed to improve educational experiences.

Epson, Sharp Corporation, ViewSonic, and Cisco Systems contribute by offering high-quality projectors, displays, and digital signage solutions. These products are widely used in lecture halls, auditoriums, and campuses to support dynamic teaching methods. Their technologies enable seamless integration with existing learning management systems, making them popular choices for educational institutions looking to modernize their classrooms.

NEC Corporation, Samsung Electronics, LG Electronics, and Hitachi also play a significant role, offering versatile signage solutions for educational institutions. Their digital displays and projectors are used for campus-wide communication, event management, and educational presentations. These companies are focused on providing high-resolution, energy-efficient, and scalable solutions that meet the diverse needs of the education sector.

Top Key Players in the Market

- Promethean

- SMART Technologies

- BenQ

- Epson

- Sharp Corporation

- ViewSonic

- Cisco Systems

- NEC Corporation

- Samsung Electronics

- LG Electronics

- Hitachi

- Others

Recent Developments

- BenQ released its SL04 and SH04 series in April 2025, the world’s first digital signage displays to earn Google EDLA (Education Device License Agreement) certification, along with Pantone® Validation, underscoring a focus on color accuracy and educational content reliability tailored to school and university settings.

- In early 2024 was LG’s acquisition of Navori Labs for approximately $200 million. Navori Labs is a leader in digital signage software, and the acquisition is expected to strengthen LG’s market position by combining its high-quality hardware with advanced software solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.15 Bn Forecast Revenue (2034) USD 5.48 Bn CAGR(2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Screen Size (22 inches-32 inches, 32 inches-45 inches, 45 inches-55 inches, 55 inches-65 inches, 65 inches-85 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Classroom Displays, Digital Learning, Interactive Whiteboards, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Promethean, SMART Technologies, BenQ, Epson, Sharp Corporation, ViewSonic, Cisco Systems, NEC Corporation, Samsung Electronics, LG Electronics, Hitachi, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage in Education & Universities MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage in Education & Universities MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Promethean

- SMART Technologies

- BenQ

- Epson

- Sharp Corporation

- ViewSonic

- Cisco Systems

- NEC Corporation

- Samsung Electronics

- LG Electronics

- Hitachi

- Others