Global Digital Nomad Services Market Size, Share, Industry Analysis Report By Service Type (Accommodation & Co-living Booking, Co-working Space Access & Management, Travel Insurance & Healthcare, Remote Work Tools & IT Support, Others), By Deployment Mode (Web-based Platforms, Mobile Applications), By Subscription Model (One-time Purchase, Subscription-based), By End-User (Individual Freelancers, Remote Employees, Entrepreneurs & Startup Founders, Corporations), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 164042

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Top Digital Nomad Statistics

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Digital Nomad Services Market Size

- Service Type Analysis

- Deployment Mode Analysis

- Subscription Model Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

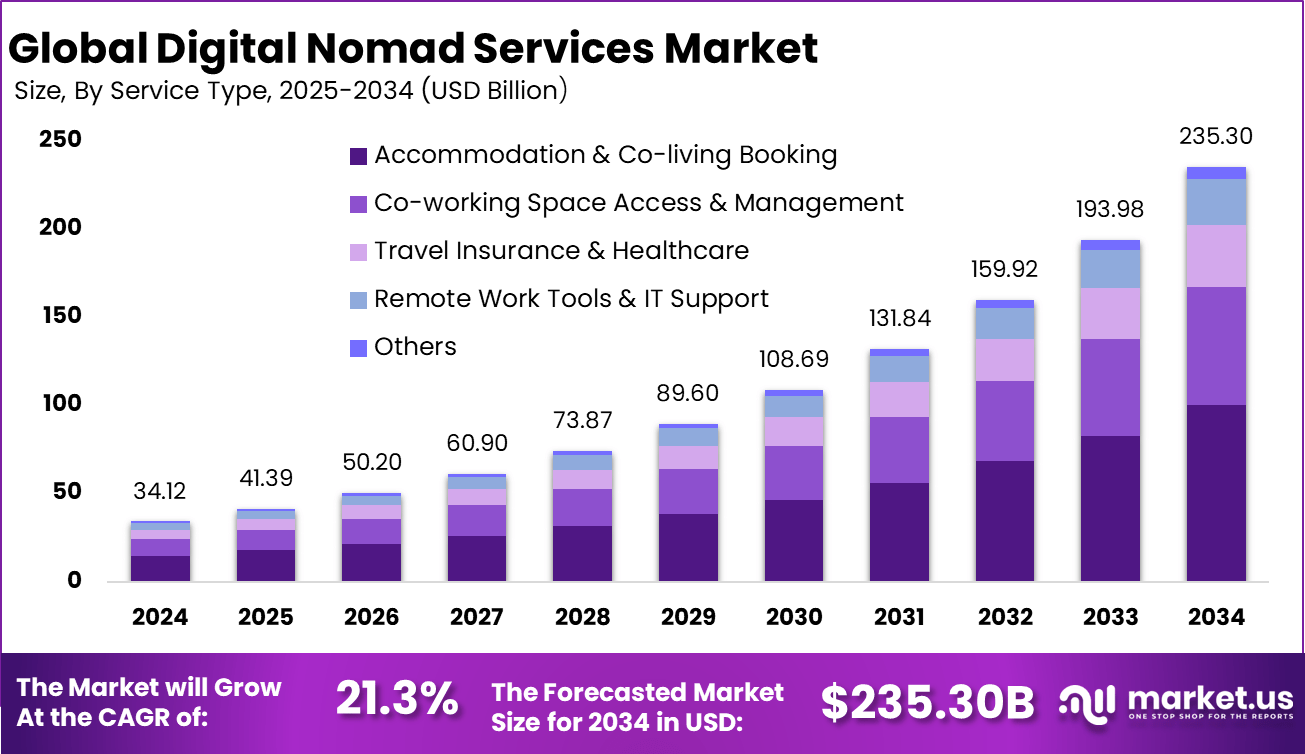

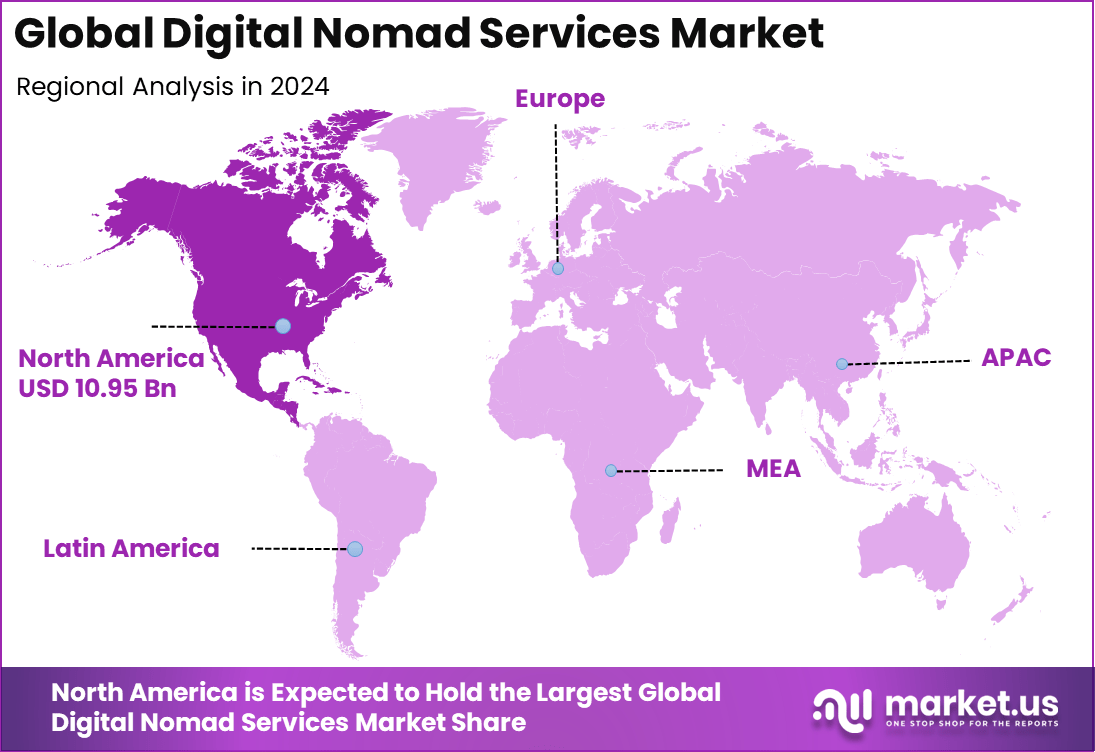

The Global Digital Nomad Services Market size is expected to be worth around USD 235.30 billion by 2034, from USD 34.12 billion in 2024, growing at a CAGR of 21.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.1% share, holding USD 10.95 billion in revenue.

The Digital Nomad Services Market is a rapidly evolving sector that caters to professionals who work remotely while traveling or living in different locations worldwide. This market encompasses diverse services such as coworking spaces, virtual offices, travel and accommodation arrangements, insurance plans, financial and tax advisory, and communication tools. These offerings aim to simplify the logistics of managing work remotely, fostering productivity and legal compliance for digital nomads.

According to atlys, By 2025, the global digital nomad population reached an estimated 40 million, nearly doubling from around 20 million a few years earlier. In the United States, the number of digital nomads surged from 7.3 million in 2019 to 18.1 million in 2024, marking a 147% increase since before the pandemic. This rapid growth highlights how remote work and flexible employment models have become mainstream, with 11% of U.S.

Top driving factors behind this market include widespread remote work adoption, technological advancements, and lifestyle preferences favoring mobility and work-life balance. Currently, approximately 18 million Americans identify as digital nomads, representing a significant portion of the workforce embracing this model. Advances in high-speed internet, cloud computing, and collaboration software have reduced barriers for remote work, enabling digital nomads to maintain productivity globally.

Demand analysis reveals digital nomads prefer locations with affordable living costs, excellent internet infrastructure, and clear visa policies allowing them to work legally. Popular destinations in Southeast Asia, Europe, and Latin America attract nomads due to these advantages. Key employment sectors for digital nomads include technology, marketing, and education, relying heavily on digital marketing and AI tools to enhance efficiency.

For instance, in October 2025, WiFi Tribe continues to offer flexible month-to-month membership programs allowing digital nomads to live and work from locations worldwide. Their community-based model emphasizes inclusivity and shared experiences with a growing calendar of chapters in global hotspots like Cape Town, Barcelona, and Buenos Aires.

Key Takeaway

- The Accommodation & Co-living Booking segment dominated with 42.6%, driven by rising demand for flexible, short-term housing solutions tailored to remote professionals and travelers.

- Web-based Platforms held 62.8%, reflecting strong user preference for centralized online portals that offer integrated booking, workspace, and travel management services.

- The Subscription-based model captured 68.3%, supported by the growing popularity of membership-driven services that provide exclusive access to co-living spaces, coworking hubs, and travel deals.

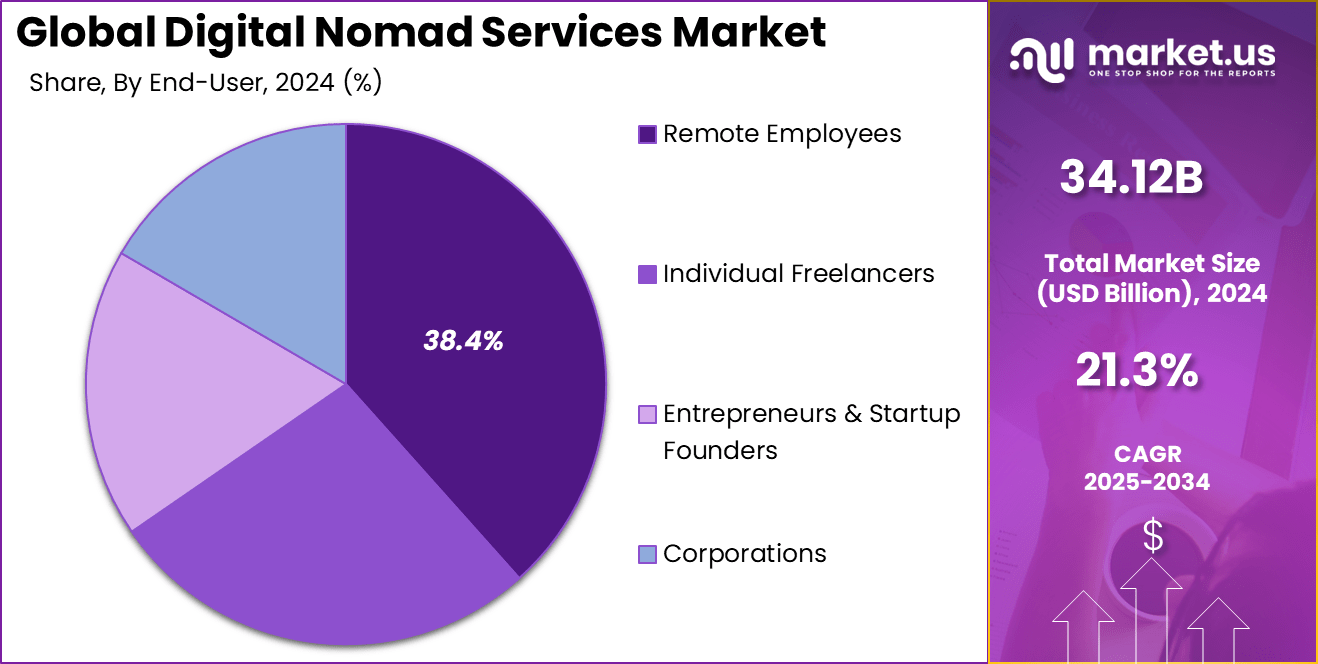

- The Remote Employees segment accounted for 38.4%, underscoring the increasing adoption of hybrid work models and corporate support for location-independent employees.

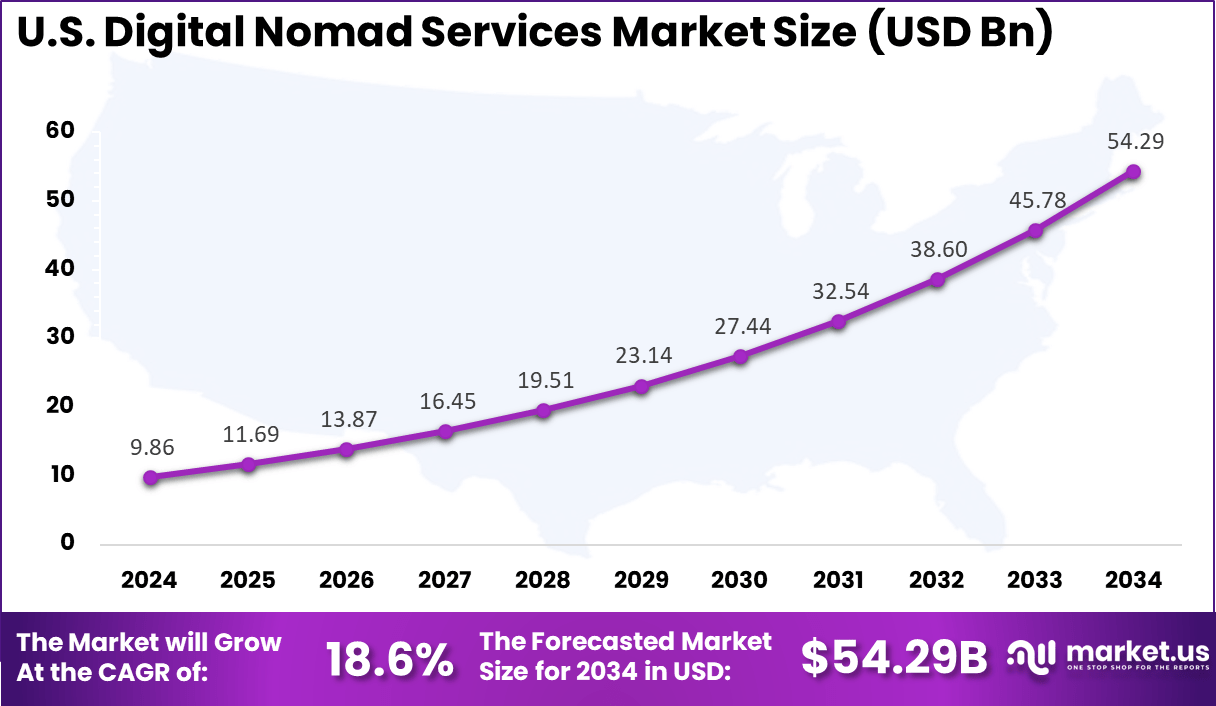

- The US market reached USD 9.86 Billion in 2024, expanding at a robust 18.6% CAGR, fueled by the rise of digital work culture, flexible employment structures, and mobile-first service platforms.

- North America led the global market with a 32.1% share, supported by advanced digital infrastructure, high freelance participation rates, and strong integration of remote work technologies.

Top Digital Nomad Statistics

- Based on data from passport-photo.online, In 2024, there were approximately 45 million digital nomads worldwide, with the population expected to surpass 60 million by 2030, reflecting continued expansion of remote and flexible work cultures.

- The United States accounted for over 18 million digital nomads in 2024, marking a 4.7% increase from 2023 and an impressive 147% growth since 2019.

- Roughly 11% of the US workforce now identifies as digital nomads, signaling a structural shift in how Americans engage in remote employment and travel-based lifestyles.

- Although the explosive growth seen during the 2020–2021 pandemic period has moderated, the digital nomad population remains 147% higher than pre-pandemic levels, showing lasting behavioral change in workforce mobility.

- Around 90% of digital nomads possess higher education qualifications, with 54% holding at least a bachelor’s degree, highlighting a highly skilled and professional demographic.

- The average age of a digital nomad is 37 years, indicating that most belong to the millennial and early Gen X workforce segments.

- By employment type, 64% are full-time professionals, while 36% are part-timers who work seasonally or intermittently.

- Despite varying work arrangements, 46% of digital nomads report household incomes of USD 75,000 or higher, emphasizing that the lifestyle increasingly appeals to financially stable professionals and entrepreneurs.

Key Statistics

- Global population: In 2025, the global digital nomad population is estimated to range between 40 and 80 million, reflecting the continued acceleration of remote work adoption and location-independent lifestyles.

- U.S. growth: In the United States, the number of digital nomads reached 18.1 million in 2024, marking a remarkable 147% increase since 2019. This growth highlights the expanding appeal of flexible work arrangements across industries.

- Demographics: The average digital nomad is aged 36 to 37, with Millennials making up 38–47% of the overall group. This confirms a strong preference for nomadic work among mid-career professionals.

- Income levels: Financial stability is a defining feature of this segment. Approximately 46% of digital nomads earn $75,000 or more per year, and the average annual income is reported at around $124,170, signaling strong earning potential within this lifestyle.

- Work status: While traditionally associated with freelance work, the majority of digital nomads -around 56% – now hold full-time jobs. Another 18% identify as freelancers, and 18% are startup founders, illustrating a diverse workforce composition.

Role of Generative AI

Generative AI plays a growing role in digital nomad services by automating content creation, streamlining communication, and enhancing task management. Around 60% of digital nomads report using AI-powered tools to generate marketing content or analyze data, enabling them to boost productivity and work smarter. These technologies help digital nomads produce personalized content, manage projects efficiently, and foster collaboration despite geographic distances.

This adoption of generative AI is transforming how nomads work remotely, allowing them to complete complex tasks faster and with less effort. The synergy between AI and the digital nomad lifestyle helps maintain high productivity while providing flexibility, which is a core attraction of the nomadic work style. As AI capabilities advance, more digital nomads are expected to rely on these tools to enhance creativity and communication.

Investment and Business Benefits

Generative AI plays a growing role in digital nomad services by automating content creation, streamlining communication, and enhancing task management. Around 60% of digital nomads report using AI-powered tools to generate marketing content or analyze data, enabling them to boost productivity and work smarter. These technologies help digital nomads produce personalized content, manage projects efficiently, and foster collaboration despite geographic distances.

This adoption of generative AI is transforming how nomads work remotely, allowing them to complete complex tasks faster and with less effort. The synergy between AI and the digital nomad lifestyle helps maintain high productivity while providing flexibility, which is a core attraction of the nomadic work style. As AI capabilities advance, more digital nomads are expected to rely on these tools to enhance creativity and communication.

U.S. Digital Nomad Services Market Size

The market for Digital Nomad Services within the U.S. is growing tremendously and is currently valued at USD 9.86 billion, the market has a projected CAGR of 18.6%. This market is growing due to the increasing adoption of remote work and Americans embracing location-independent lifestyles by 2025.

The mainstreaming of digital nomadism is also propelled by the rise of flexible work policies, better internet infrastructure, and the expanding availability of coworking spaces and co-living accommodations. Additionally, demand for flexible coworking spaces, co-living accommodations, and subscription-based services continues to rise, reflecting changing work-life priorities and lifestyle choices.

For instance, in June 2025, Slack rolled out significant upgrades aimed at supporting U.S. and North American enterprises embracing remote and hybrid work models. Enhancements include expanded AI-powered conversation summaries, tighter security controls, and deeper Salesforce integrations to better manage distributed teams.

In 2024, North America held a dominant market position in the Global Digital Nomad Services Market, capturing more than a 32.1% share, holding USD 10.95 billion in revenue. This dominance is due to the widespread adoption of remote work policies and technological advancements in the region. Increasing numbers of professionals are embracing flexible work arrangements, supported by strong digital infrastructure and advanced coworking ecosystems.

Furthermore, North America’s progressive corporate attitudes towards remote work, coupled with governments facilitating digital nomad visas and support services, contribute to this market’s robust growth. The region’s proactive embrace of digital nomadism makes it a key hub for innovation in services catering to remote workers and location-independent professionals.

For instance, in February 2025, Notion saw increased adoption among North American digital nomads due to its all-in-one workspace capabilities that facilitate complex project management and collaboration across time zones. Key updates include stronger security features and expanded integration with cloud tools, making it a top choice for remote teams.

Service Type Analysis

In 2024, The Accommodation & Co-living Booking segment held a dominant market position, capturing a 42.6% share of the Global Digital Nomad Services Market. Digital nomads value flexible and affordable lodging options that combine comfort and social interaction, and this segment caters to their evolving needs.

Providers are constantly innovating to offer short-term stays, co-living spaces, and community-driven environments that enable professionals to work remotely while feeling connected and supported. Apart from accommodation, services like virtual offices, travel bookings, and insurance solutions are becoming more prevalent.

These services aim to simplify the logistics of working from anywhere by offering reliable internet, legal compliance, and health coverage. As the remote working landscape continues to grow, service providers are diversifying their offerings to support digital nomads in multiple areas, making their lifestyle easier and more sustainable.

For Instance, In August 2025, Airbnb announced its expansion into boutique and independent hotels to complement its home rental offerings. The initiative enhances accommodation options for digital nomads and remote workers, strengthening the platform’s position in the global hospitality sector. This diversification reflects Airbnb’s focus on flexible, long-term stays suited to evolving work and travel trends.

Deployment Mode Analysis

In 2024, the Web-based Platforms segment held a dominant market position, capturing a 62.8% share of the Global Digital Nomad Services Market. These platforms enable remote workers to book accommodations, find workspaces, and stay connected through easy-to-use digital interfaces. The reliance on online services has increased significantly as they provide instant access to a wide array of resources, making remote work more convenient than ever.

Advancements in internet infrastructure and cloud-based tools have fueled this trend, allowing digital nomads to operate seamlessly from any location worldwide. Companies are enhancing these platforms by integrating new features such as real-time booking, secure payments, and remote communication tools. The growing demand for reliable digital support continues to drive further innovation in web-based services, making them indispensable for modern remote workers.

For instance, in October 2025, Nomad List remains a popular web platform providing digital nomads with location rankings based on criteria like safety, cost, and connectivity. It fosters a global community where remote workers can find local meetups and resources, easing the decision-making for where to live and work remotely.

Subscription Model Analysis

In 2024, The Subscription-based segment held a dominant market position, capturing a 68.3% share of the Global Digital Nomad Services Market. These models typically bundle multiple services, including coworking access, health insurance, and financial management tools, into a convenient recurring payment plan. They offer remote workers ongoing support without the hassle of negotiating separate deals for each service.

This subscription approach appeals especially to frequent travelers who seek stability while maintaining their mobility. Service providers are developing customized packages that address the specific needs of freelancers, employees, and entrepreneurs on the go. The recurring nature of subscriptions encourages loyalty and ongoing engagement, making them a key growth driver in this market.

For Instance, in August 2025, SafetyWing offers subscription-style travel medical insurance tailored for remote workers and nomads with flexible plans that renew every 28 days and can be canceled anytime. This recognized insurance product provides valuable health coverage and peace of mind on the road.

End-User Analysis

In 2024, The Remote Employees segment held a dominant market position, capturing a 38.4% share of the Global Digital Nomad Services Market. Many organizations now embrace flexible working policies that enable employees to work from different locations around the world. These remote workers rely heavily on services that help them stay productive, such as digital collaboration tools, legal support, and health coverage.

As hybrid work models become more mainstream, the demand for support services for remote employees continues to rise. Companies are increasingly investing in legal advice, insurance, and flexible workspace solutions to accommodate this growing segment. The ability to work efficiently from anywhere is transforming the traditional workplace, with remote employees at the forefront of this change.

For Instance, in September 2025, Remote.com enhanced its platform dedicated to remote employees by facilitating connections between companies and a flexible global workforce. The platform supports legal compliance, payroll management, and team collaboration tools, catering specifically to the needs of remote employees working worldwide.

Emerging Trends

Emerging trends in digital nomad services reflect a shift in destinations and lifestyle choices. More than 70 countries now offer digital nomad visas, signaling a worldwide embrace of remote professionals. Nomads are moving beyond traditional hotspots like Bali and Lisbon toward emerging markets in Asia, Europe, and Latin America that offer better visa terms, lower costs, and improved infrastructure. This geographic spread shows how the community is diversifying and maturing.

Another notable trend is the rise of niche lifestyles like “slow travel” and mobile living, which emphasize deeper cultural experiences and flexibility. Families are also becoming a bigger part of the nomad community, spurring services tailored to mobile education and family needs. Technological infrastructure advances, including satellite internet, enable work from more remote locations than ever before.

Growth Factors

The growth of digital nomad services is driven mainly by the broader adoption of remote work policies and better technology access. Remote jobs have increased steadily as companies embrace flexible work, with reliable internet improving by double digits annually in many regions. Interest in location freedom and work-life balance also motivates more professionals to become digital nomads.

The demographic profile of nomads supports this growth, with over 50% holding college degrees and many using advanced digital tools. Employers increasingly support remote work options, while skills development and generative AI use help nomads succeed in diverse roles. The interplay between flexible work, technology, and education creates robust momentum for service expansion.

Key Market Segments

By Service Type

- Accommodation & Co-living Booking

- Co-working Space Access & Management

- Travel Insurance & Healthcare

- Remote Work Tools & IT Support

- Others

By Deployment Mode

- Web-based Platforms

- Mobile Applications

By Subscription Model

- One-time Purchase

- Subscription-based

By End-User

- Individual Freelancers

- Remote Employees

- Entrepreneurs & Startup Founders

- Corporations

Drivers

Remote Work Growth

The rapid rise of remote work across multiple industries has been a key driver for the Digital Nomad Services Market. More companies are supporting flexible work arrangements, enabling employees to work from anywhere in the world. This shift increases demand for services like coworking spaces, virtual offices, travel accommodations, and remote work tools that help digital nomads stay productive and connected.

As remote work becomes mainstream, workers seek lifestyle flexibility, pushing the market to offer innovative solutions tailored to their needs. Technologies such as fast internet, cloud collaboration platforms, and mobile connectivity have made it easier than ever for individuals to sustain their careers while traveling, fueling growth in this sector.

For instance, in October 2025, Airbnb transformed its platform to focus on long-term stays favored by digital nomads seeking work-friendly environments. Its new features highlight flexible search options and listings geared towards remote work, allowing users to book places that feel like home, thereby supporting the growing remote work trend.

Restraint

Regulatory Barriers

One significant restraint limiting this market’s expansion is the complexity of regulatory environments. Different countries have varying visa policies, work permit rules, and tax regulations that can create roadblocks for digital nomads looking to live and work across borders. Navigating these legal requirements often involves time-consuming and costly processes that may discourage some remote workers.

Additionally, uncertainty around compliance can reduce market adoption, as nomads might avoid countries with restrictive or unclear regulations. This fragmentation in rules prevents seamless travel and complicates service providers’ ability to offer standard packages globally.

For instance, in January 2025, Remote Year, a pioneer in nomadic travel and work programs, abruptly shut down due to operational challenges and complexities related to business viability. The closure reflects difficulties companies face in navigating fragmented regulatory landscapes and sustaining services for globally mobile workers.

Opportunities

Expanding Service Offerings

The expanding needs of digital nomads create considerable opportunities for service providers to innovate and diversify their offerings. Beyond traditional coworking spaces, there is increasing demand for legal and tax advisory services, specialized health insurance, financial management, and community-building platforms designed specifically for this mobile workforce.

Emerging markets, especially in Southeast Asia, Latin America, and parts of Europe, are investing in infrastructure and visa programs that attract digital nomads. This growth allows companies to explore new revenue streams by creating comprehensive, all-in-one solutions that simplify remote work and travel logistics for nomads worldwide.

For instance, in July 2024, Selina launched its “Work Everywhere” campaign, spotlighting its CoWork spaces that blend leisure and work environments targeted at digital nomads. This initiative enhances community-driven services and varied work settings, tapping into the rising demand for comprehensive experiences beyond just accommodation.

Challenges

Cross-border Compliance

A major challenge lies in managing the complexities of cross-border taxes, social security arrangements, and legal compliance for digital nomads. Service providers must cater to diverse industries and professional needs while adapting to constantly changing local laws across countries. This complexity often results in inconsistent service quality and operational hurdles in less-developed or remote regions.

Ensuring data security and privacy in multiple jurisdictions adds another layer of challenge, as protecting nomads’ sensitive information is critical but varies by law. Overcoming these issues requires continuous adaptation, local partnerships, and robust technological solutions to maintain user trust and service reliability.

For instance, in May 2025, SafetyWing secured $8 million in funding to expand its international health insurance services for remote workers and digital nomads. The expansion aims to address the complexities of providing compliant health coverage across multiple countries with varying legal requirements, highlighting challenges in cross-border service delivery.

Key Players Analysis

The Digital Nomad Services Market is led by established platforms such as Airbnb, Selina, Remote Year, and WiFi Tribe. These companies provide accommodation, community, and travel experiences tailored for remote workers. Their services focus on enabling location-independent lifestyles by combining flexible housing, coworking spaces, and networking opportunities that promote productivity and global mobility.

Prominent participants such as SafetyWing, World Nomads, Nomad List, and WeWork contribute to the ecosystem through travel insurance, workspace access, and digital tools. Their offerings support nomads in maintaining financial security, health coverage, and reliable working environments across different geographies, strengthening the global infrastructure for mobile professionals.

Additional players including Upwork, Fiverr, Revolut, TransferWise (Wise), Slack, and Notion, along with other market participants, provide the essential digital backbone for freelance work, payments, and collaboration. Their integration of fintech, productivity software, and remote communication tools continues to shape a connected, technology-driven lifestyle economy for the growing digital nomad population.

Top Key Players in the Market

- Airbnb

- Selina

- Remote Year

- WiFi Tribe

- SafetyWing

- World Nomads

- Nomad List

- WeWork

- com

- Upwork

- Fiverr

- Revolut

- TransferWise (Wise)

- Slack

- Notion

- Others

Recent Developments

- In June 2025, Airbnb launched a major platform transformation called the 2025 summer release, turning itself from a simple home-sharing site into a comprehensive travel ecosystem. They introduced professional services directly within listings, allowing guests to book vetted chefs, personal trainers, massage therapists, and more at the Airbnb property or their own home.

- In May 2025, SafetyWing raised $8 million to expand its insurtech offerings focused on remote and gig economy workers, including digital nomads. Their coverage includes affordable health insurance plans catering to nomads working across different countries, addressing a critical need for global health coverage in this community.

Report Scope

Report Features Description Market Value (2024) USD 34.12 Bn Forecast Revenue (2034) USD 235.3 Bn CAGR(2025-2034) 21.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Accommodation & Co-living Booking, Co-working Space Access & Management, Travel Insurance & Healthcare, Remote Work Tools & IT Support, Others), By Deployment Mode (Web-based Platforms, Mobile Applications), By Subscription Model (One-time Purchase, Subscription-based), By End-User (Individual Freelancers, Remote Employees, Entrepreneurs & Startup Founders, Corporations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbnb, Selina, Remote Year, WiFi Tribe, SafetyWing, World Nomads, Nomad List, WeWork, Remote.com, Upwork, Fiverr, Revolut, TransferWise (Wise), Slack, Notion, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Nomad Services MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Nomad Services MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbnb

- Selina

- Remote Year

- WiFi Tribe

- SafetyWing

- World Nomads

- Nomad List

- WeWork

- com

- Upwork

- Fiverr

- Revolut

- TransferWise (Wise)

- Slack

- Notion

- Others