Global Digital Music Content Market by Type (Permanent Downloads, Music Streaming), Age Group (Below 18 Years, 18-40 Years, 41-60 Years, Above 60 Years), Application (Commercial Use, Household Use), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2023

- Report ID: 109887

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

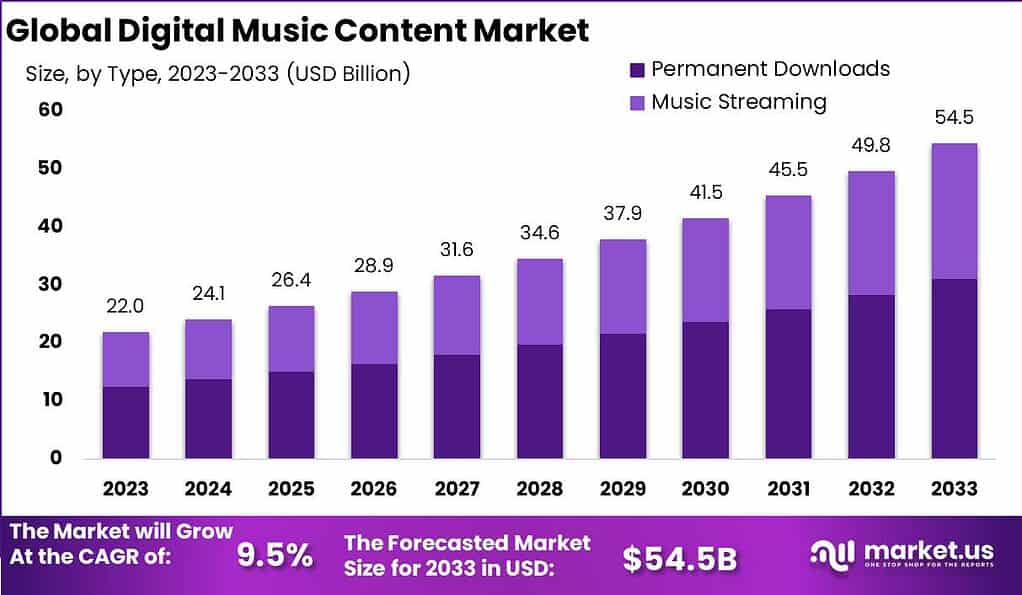

The global Digital Music Content Market is anticipated to be USD 54.5 billion by 2033. It is estimated to record a steady CAGR of 9.5% in the Forecast period 2023 to 2033. It is likely to total USD 22.0 billion in 2023.

Digital music content refers to songs, albums, and other audio files available to consumers in a downloadable, streaming, or other direct digital format. This contrasts with physical music formats, although digital content may often be tied to the purchase of CDs, vinyl, and the like.

The Digital Music Content market represents the industry involved in digital music distribution, streaming platforms, and associated services. It encompasses various stakeholders, such as music labels, artists, streaming platforms, online retailers, and technology providers. This market has experienced notable growth and transformation recently, propelled by the transition from physical music formats like CDs to the prevalent trend of digital consumption.

Note: Actual Numbers Might Vary In Final Report

The digital music content market encompasses the various platforms providing access to this content, including paid download stores like iTunes, subscription streaming services like Spotify or Apple Music, music/video sites like YouTube, and online radio providers. It also includes emerging models like in-game music, bundled content with concert tickets, and shareable tracks on social apps.

Key Takeaways

- Market Size and Growth Projection: The Digital Music Content Market is expected to reach USD 54.5 billion by 2033. It is estimated to have a steady Compound Annual Growth Rate (CAGR) of 9.5% from 2023 to 2033.

- Age Group Preferences: The 18-40 years age group holds a dominant market position, favoring on-the-go and personalized music experiences through streaming services.

- Application Segmentation: Household Use is the dominant segment in 2023, with music streaming services integrated into daily life.

- Driving Factors: Increased smartphone penetration facilitates easy access to digital music content.

- Restraining Factors: Piracy concerns persist, causing revenue losses.

- Growth Opportunities: Expanding into emerging markets with rising smartphone adoption presents a significant growth opportunity.

- Key Market Trends: Shift towards high-resolution audio formats.

- Regional Analysis: North America holds a dominant market position, driven by robust digital infrastructure and early adoption of music streaming.

- Key Players: Top players include Apple Inc., Spotify, Deezer, SoundCloud, and others.

Type Insights

In 2023, the Music Streaming Segment held a dominant market position, capturing more share in the Digital Music Content Market. This segment’s prominence can be attributed to the significant shift in consumer preferences towards convenient and on-demand music access. Music streaming platforms have gained immense popularity, offering users an extensive library of songs accessible anytime, anywhere. The convenience of streaming music without the need for permanent downloads aligns with the modern, fast-paced lifestyle.

Moreover, music streaming services have adapted to evolving technologies, providing high-quality audio and personalized playlists through algorithms that understand individual tastes. The ease of discovering new music and the flexibility to create customized playlists have further fueled the adoption of music streaming. As a result, the Music Streaming Segment has witnessed substantial growth, reflecting the evolving digital music landscape and indicating a continuing trend towards streaming as the preferred mode of music consumption.

Age Group Insights

In 2023, the digital music content market showcased a fascinating landscape, with distinct trends and preferences emerging across different age groups. Analyzing the data, it became evident that the 18-40 years age segment held a dominant market position, capturing a substantial share. This demographic, often characterized by tech-savviness and a strong affinity for digital platforms, demonstrated a significant appetite for diverse music content. The prevalence of streaming services and digital music platforms among this age group contributed to their prominent market presence.

This age segment, constituting the majority of the consumer base, exhibited a remarkable inclination towards on-the-go and personalized music experiences. Streaming services offering curated playlists, personalized recommendations, and seamless access to an extensive music library resonated exceptionally well with the preferences of individuals aged 18 to 40.

Contrastingly, the Below 18 Years segment showcased a unique pattern in its digital music consumption behavior. With the increasing prevalence of smartphones and widespread access to high-speed internet, this younger demographic exhibited a proclivity for engaging with music on various social media platforms. Short-form video content featuring music snippets and user-generated challenges significantly influenced their music consumption patterns.

Moving to the 41-60 Years age group, a distinctive trend emerged as this demographic embraced a blend of traditional and digital music consumption methods. While streaming services gained traction, there was a notable preference for digital platforms that offered a combination of radio-style programming and on-demand options. Podcasts related to music history, interviews with artists, and nostalgia-driven content found resonance among individuals aged 41 to 60.

Surprisingly, the Above 60 Years age group demonstrated an increasingly tech-savvy approach to digital music consumption. With a market share in 2023, this demographic showcased a growing interest in streaming services and user-friendly digital platforms. The ease of navigation, coupled with the ability to explore a wide range of genres, allowed this age group to actively participate in the digital music revolution. The availability of user guides, personalized assistance, and intuitive interfaces contributed to the increased adoption of digital music content among individuals above 60 years.

Application Insights

In 2023, the digital music content market exhibited a clear segmentation based on application, primarily categorized into Commercial Use and Household Use. The dynamics within these segments offer valuable insights into the prevailing market trends and consumer preferences.

Starting with the Household Use segment, it emerged as the dominant force in the market, capturing a substantial share. The year 2023 witnessed a surge in the adoption of digital music content for personal and household entertainment purposes. Factors contributing to the prominence of this segment include the increasing popularity of music streaming services for individual consumption, the rising prevalence of smart home devices, and the growing significance of curated playlists and personalized recommendations for enhancing the at-home music experience.

Households across the globe have embraced digital music content as a key component of their daily lives, with streaming platforms becoming integral to creating immersive domestic environments. The ease of access to an extensive library of songs, coupled with customizable playlists tailored to individual tastes, has driven the preference for digital music content within households. Additionally, advancements in audio technology and the availability of high-quality digital music formats have further fueled the adoption of digital music for leisure and relaxation within the confines of homes.

On the commercial front, the Commercial Use segment also played a pivotal role in shaping the digital music content market. Businesses across various industries, including retail, hospitality, and events, leveraged digital music content to enhance customer experiences and create atmospheres conducive to their brand identity. Background music in retail stores, restaurants, and public spaces has become an essential element of the customer journey, influencing purchasing behavior and establishing brand recall.

Moreover, the commercial sector witnessed an increased demand for licensed digital music content, ensuring compliance with copyright regulations and contributing to the revenue streams of artists and content creators. The integration of digital music solutions into public spaces and commercial establishments highlights the evolving role of music in shaping brand narratives and fostering memorable customer interactions.

Driving Factors

- Increasing Smartphone Penetration: The proliferation of smartphones has enabled easy access to digital music content. With smartphones becoming ubiquitous, consumers can stream or download music on-the-go, driving the growth of the market.

- Rise in Subscription-Based Models: Subscription-based music streaming services have gained popularity, providing a steady revenue stream for the industry. These models offer a vast catalog of songs without ads, enhancing user experience and market growth.

- Expansion of Internet Connectivity: Improved internet connectivity, especially high-speed mobile data and broadband, has facilitated seamless music streaming. This expansion has removed barriers to streaming and contributed to market growth.

- Artist Collaborations and Exclusive Releases: Collaborations between music artists and exclusive releases on streaming platforms have attracted subscribers. Unique content and partnerships with renowned artists drive user engagement and market expansion.

Restraining Factors

- Piracy Concerns: Despite efforts to combat piracy, illegal downloading and sharing of music persist. Piracy remains a significant challenge, causing revenue losses and hindering market growth.

- Competitive Fragmentation: The digital music content market is highly competitive, with numerous streaming platforms vying for users. This intense competition can lead to pricing wars and reduced profitability.

- Licensing Complexities: Licensing agreements with record labels and artists can be intricate and costly. These complexities may limit the availability of certain songs or albums, impacting user satisfaction.

- Quality and Connectivity Issues: In regions with poor internet connectivity or limited bandwidth, users may face issues with buffering and low-quality music streams, affecting the user experience.

Growth Opportunities

- Global Expansion: The untapped potential in emerging markets presents a significant growth opportunity. Expanding services to regions with rising smartphone adoption can open new revenue streams.

- Podcast Integration: Integrating podcasts and audio content can enhance user engagement. Podcasts have gained popularity, and their inclusion can attract a broader user base.

- AI-Driven Personalization: Leveraging artificial intelligence for personalized recommendations can increase user retention. Tailoring playlists and content to individual preferences enhances the user experience.

- Partnerships and Exclusivity: Collaborations with artists, influencers, or other media outlets can create exclusive content and attract a dedicated user following.

Challenges

- Copyright and Licensing Issues: Maintaining up-to-date licensing agreements and addressing copyright concerns can be a continuous challenge for digital music content providers.

- Monetization Models: Striking the right balance between free and premium tiers while ensuring profitability can be challenging for service providers.

- Changing Consumer Preferences: Rapid shifts in consumer preferences and behaviors require constant adaptation to meet evolving demands.

- Data Privacy Concerns: As digital platforms collect user data for personalization, addressing data privacy concerns and complying with regulations is a persistent challenge.

Key Market Trends

- High-Resolution Audio: A noticeable shift is underway towards high-resolution audio formats, catering to the preferences of audiophiles and enthusiasts who prioritize superior sound quality.

- Live Streaming and Virtual Concerts: The incorporation of live streaming and virtual concerts into digital music platforms is becoming increasingly popular. This trend not only introduces a new revenue stream but also offers users unique and immersive musical experiences.

- Localized Content: Platforms are focusing on regional and local content to cater to diverse audiences and promote regional artists.

- Social Media Integration: Integrating music into social media platforms enhances discoverability and sharing, creating a symbiotic relationship between music and social networking.

Key Market Segments

Type Insights

- Permanent Downloads

- Music Streaming

Age Group Insights

- Below 18 Years

- 18-40 Years

- 41-60 Years

- Above 60 Years

Application Insights

- Commercial Use

- Household Use

Regional Analysis

In 2023, North America held a dominant market position, capturing more share in the Digital Music Content Market. This region’s supremacy is attributed to its robust digital infrastructure, high smartphone penetration, and early adoption of music streaming services. North America has witnessed a surge in subscription-based models, with a significant portion of the population opting for premium music streaming services. The presence of key industry players and a culture of music consumption contribute to the region’s leadership. Furthermore, collaborations between music artists and digital platforms have heightened user engagement, reinforcing North America’s position as a key revenue generator in the global digital music content landscape.

Europe, in 2023, also played a substantial role in the digital music content market. With diverse and rich musical traditions, Europe boasts a diverse user base. Music streaming services have gained significant traction, with a growing preference for subscription-based models. The European market benefits from a competitive landscape and strong regional players. Additionally, the integration of high-resolution audio formats and localized content has resonated with European audiences, contributing to the region’s market share.

In the Asia-Pacific (APAC) region, digital music content has been on a remarkable growth trajectory in 2023. APAC’s expanding middle-class population, rising smartphone adoption, and improving internet connectivity have fueled the demand for music streaming. Several emerging economies in APAC have witnessed a surge in digital music consumption, with a preference for both local and international music. The region’s market is characterized by dynamic growth, with numerous global and local players vying for market share.

Latin America, in 2023, showcased a burgeoning digital music content market. The region’s diverse music genres and vibrant cultural heritage have created a fertile ground for music streaming platforms. Latin America has seen a rise in music streaming subscriptions, driven by exclusive content and collaborations with popular regional artists. This has led to Latin America becoming an increasingly influential player in the global digital music content arena.

The Middle East and Africa (MEA) region have witnessed growing interest in digital music content in 2023. Despite challenges related to internet access and infrastructure, the MEA market has shown potential, with a burgeoning youth population eager to explore music streaming platforms. Content localization and partnerships with regional artists have been key strategies to cater to MEA’s unique music preferences. While the market is still evolving, it represents an emerging frontier in the global digital music content landscape.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Digital Music Content market is highly competitive and comprises several key players that play significant roles in the distribution, streaming, and monetization of digital music. These players offer platforms, services, and technologies that enable users to access and enjoy a wide range of digital music content.

Top Key Players

- Apple Inc.

- Deezer

- Gamma Gaana Ltd

- Hungama Digital Media Entertainment Pvt. Ltd.

- iHeartMedia Inc.

- JB Hi-Fi Limited

- JioSaavn

- Mixcloud

- SoundCloud

- Spotify AB

Recent Developments

- January 2023: Deezer, a French music streaming service, is acquired by Spotify.

- February 2023: Apple Music achieves a milestone with over 100 million subscribers, securing its position as the second-largest music streaming service, trailing behind Spotify.

- March 2023: Amazon Music introduces a premium high-definition audio option exclusively for Prime members.

- April 2023: YouTube Music finalizes a licensing agreement with Universal Music Group, a major player in the global record label industry.

- May 2023 : Tidal, a high-fidelity music streaming platform, acquires SoundCloud, a prominent platform for independent artists.

Report Scope

Report Features Description Market Value (2023) USD 22.0 Billion Forecast Revenue (2033) USD 54.5 Billion CAGR (2023-2032) 9.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Type (Permanent Downloads, Music Streaming), Age Group (Below 18 Years, 18-40 Years, 41-60 Years, Above 60 Years), Application (Commercial Use, Household Use) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Apple Inc., Deezer, Gamma Gaana Ltd, Hungama Digital Media Entertainment Pvt. Ltd., iHeartMedia Inc., JB Hi-Fi Limited, JioSaavn, Mixcloud, SoundCloud, Spotify AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the digital music content market?The digital music content market refers to the industry involved in the creation, distribution, and consumption of music in digital formats, including streaming services, downloads, and online platforms.

How big is Digital Music Content Market?The global Digital Music Content Market is anticipated to be USD 54.5 billion by 2033. It is estimated to record a steady CAGR of 9.5% in the Forecast period 2023 to 2033. It is likely to total USD 22.0 billion in 2023.

What are the key drivers of growth in the digital music content market?Factors driving growth include the widespread adoption of streaming services, increased internet penetration, advancements in technology, and the convenience of on-demand access to a vast music library.

Which companies dominate the digital music content market?Major players in the digital music content market include Spotify, Apple Music, Amazon Music, YouTube Music, and other platforms that provide streaming, downloads, and related services.

How does streaming contribute to the digital music content market?Streaming services allow users to listen to music in real-time without the need for downloads. This subscription-based model has become a significant revenue stream for the industry.

How has artificial intelligence impacted the digital music content market?Artificial intelligence is used to enhance user experience, recommend personalized playlists, and optimize content discovery on digital music platforms, contributing to increased engagement and user satisfaction.

Digital Music Content MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Digital Music Content MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Deezer

- Gamma Gaana Ltd

- Hungama Digital Media Entertainment Pvt. Ltd.

- iHeartMedia Inc.

- JB Hi-Fi Limited

- JioSaavn

- Mixcloud

- SoundCloud

- Spotify AB