Global Digital Freight Management Market Size, Industry Analysis Report By Solution Type (Freight Tracking & Visibility, Freight Matching & Optimization, Freight Audit & Payment, Warehouse Management, Transportation Management Systems (TMS), and Others), By Deployment Mode (Cloud-based and On-premise), By Mode of Transport (Roadways, Railways, Airways, and Waterways), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155896

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Digital Freight: Efficiency & Compliance

- U.S. Market Size

- By Solution Type Analysis

- By Deployment Mode Analysis

- By Mode of Transport Analysis

- By End-User Analysis

- Key Market Segments

- Emerging Trend

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

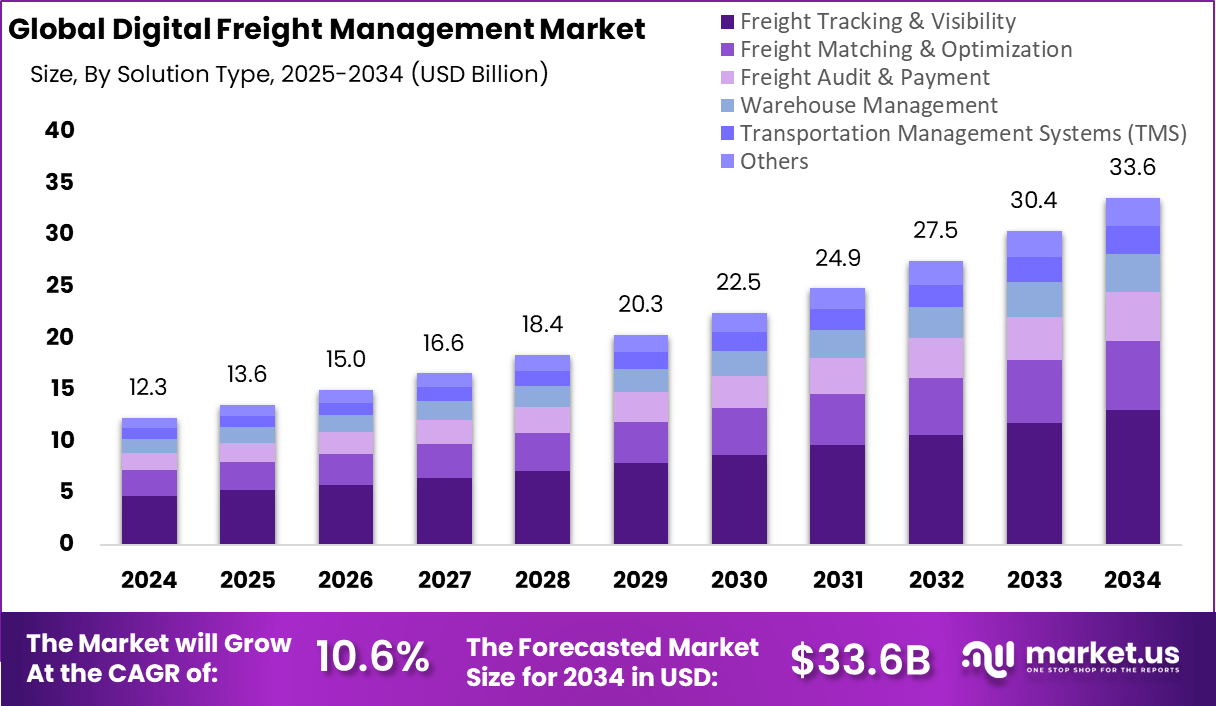

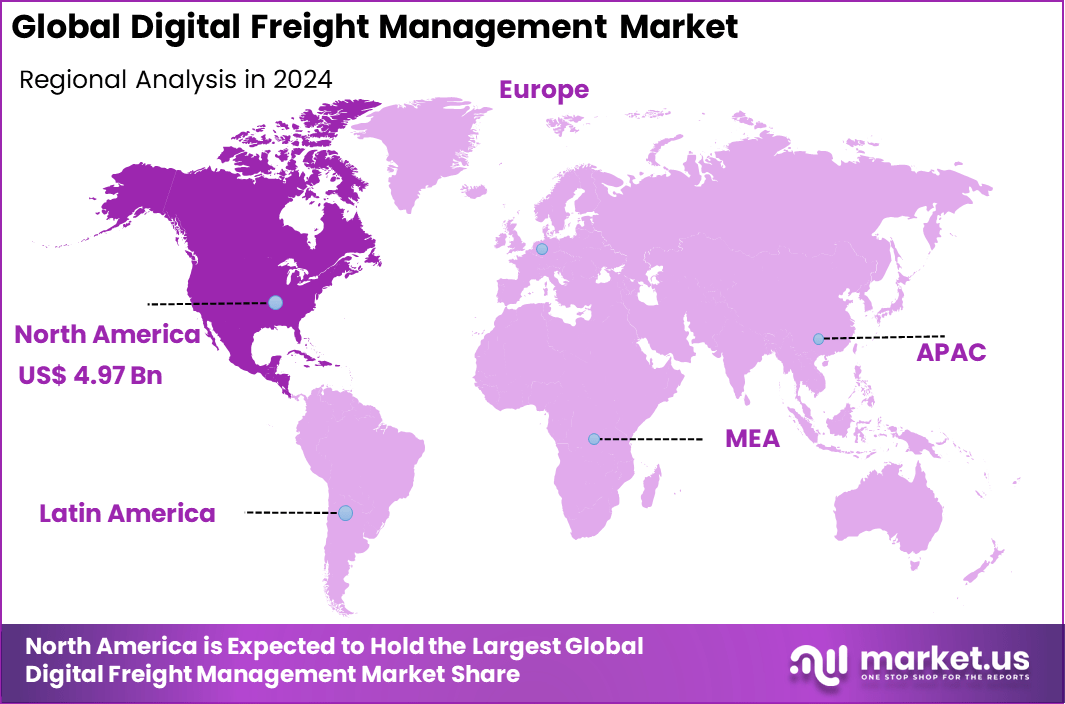

The Global Digital Freight Management Market size is expected to be worth around USD 33.6 billion by 2034, from USD 12.28 billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.5% share, holding USD 4.97 billion in revenue.

The digital freight management market covers solutions that support planning, tracking, documentation, routing, and auditing in freight logistics. These systems focus on improving visibility and transparency in shipping operations. Technologies such as real‑time tracking platforms, transportation management systems, and auditing tools are becoming widely adopted. This shift reflects the pressing need for logistics operators to coordinate complex freight movements with greater speed, accuracy, and integration.

Key driving factors include the demand for real-time shipment visibility, cost reduction through route and resource optimization, and the need for automation to handle increasing freight volumes efficiently. Regulatory pressures on decarbonization, customs compliance, and electronic documentation are also pushing adoption. Technologies like IoT sensors, AI-based decision tools, and cloud computing enable predictive analytics and dynamic scheduling, making freight operations more agile.

According to WiFiTalents, 67% of freight companies have adopted digital transformation strategies to enhance operational efficiency, while 58% of logistics firms reported improved customer satisfaction after deploying digital tools. Around 42% of freight carriers now use IoT sensors for real-time tracking, which has helped reduce delivery times by an average of 20%. Furthermore, 75% of freight companies believe that embracing digital transformation provides a strong competitive advantage in the market.

For instance, Maersk’s digital solutions and Uber Freight’s AI-driven marketplace are transforming how shippers and carriers connect, enabling faster and more efficient freight matching. These platforms optimize capacity utilization, reduce empty miles, and enhance operational transparency. Digital freight solutions can cut logistics costs by 15–20% while improving delivery reliability, making DFM a critical enabler of modern, resilient, and scalable transportation networks.

Key Takeaways

- The global digital freight management market size is valued at USD 12.28 billion in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2034.

- Freight Tracking & Visibility is the leading solution type, accounting for 28.3% share in 2024, reflecting rising demand for real-time shipment monitoring.

- Cloud-based deployment dominates with 78.9% market share in 2024, driven by scalability, flexibility, and lower IT infrastructure costs.

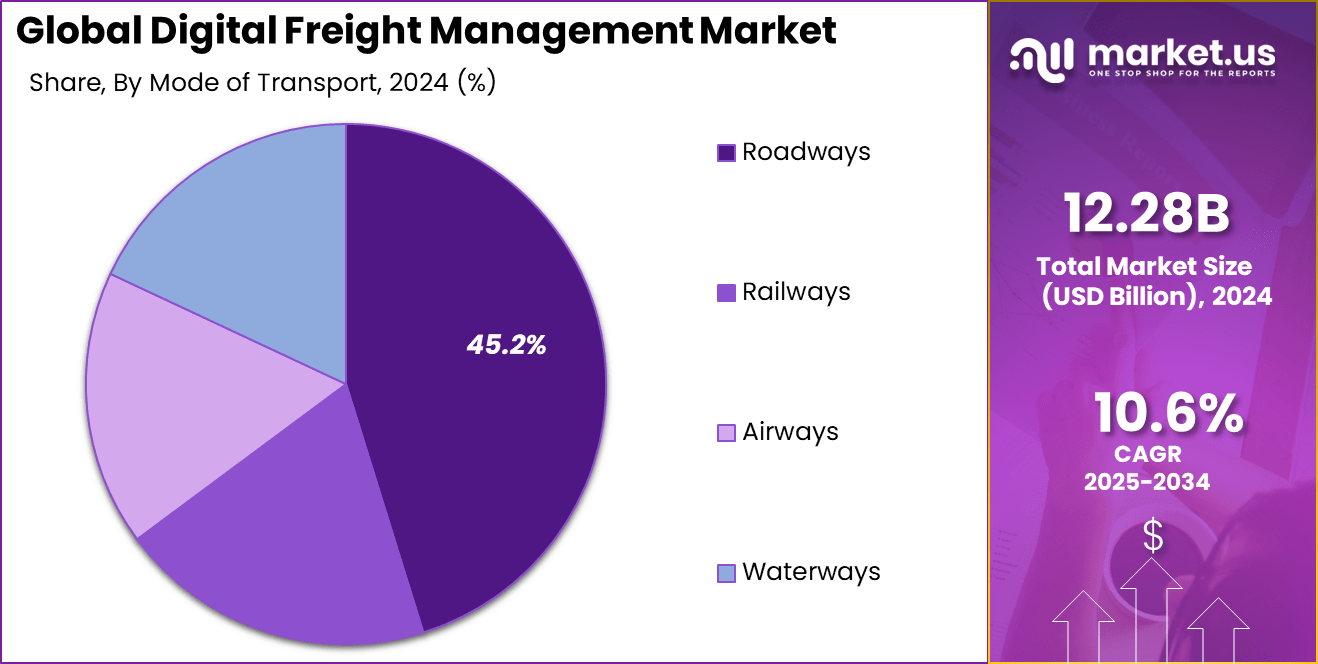

- Road transport leads among modes of transport with a 45.2% share in 2024, owing to the high volume of regional and last-mile freight movements.

- Shippers represent the largest end-user group with 48.1% market share, highlighting their adoption of digital platforms to improve efficiency and cost control.

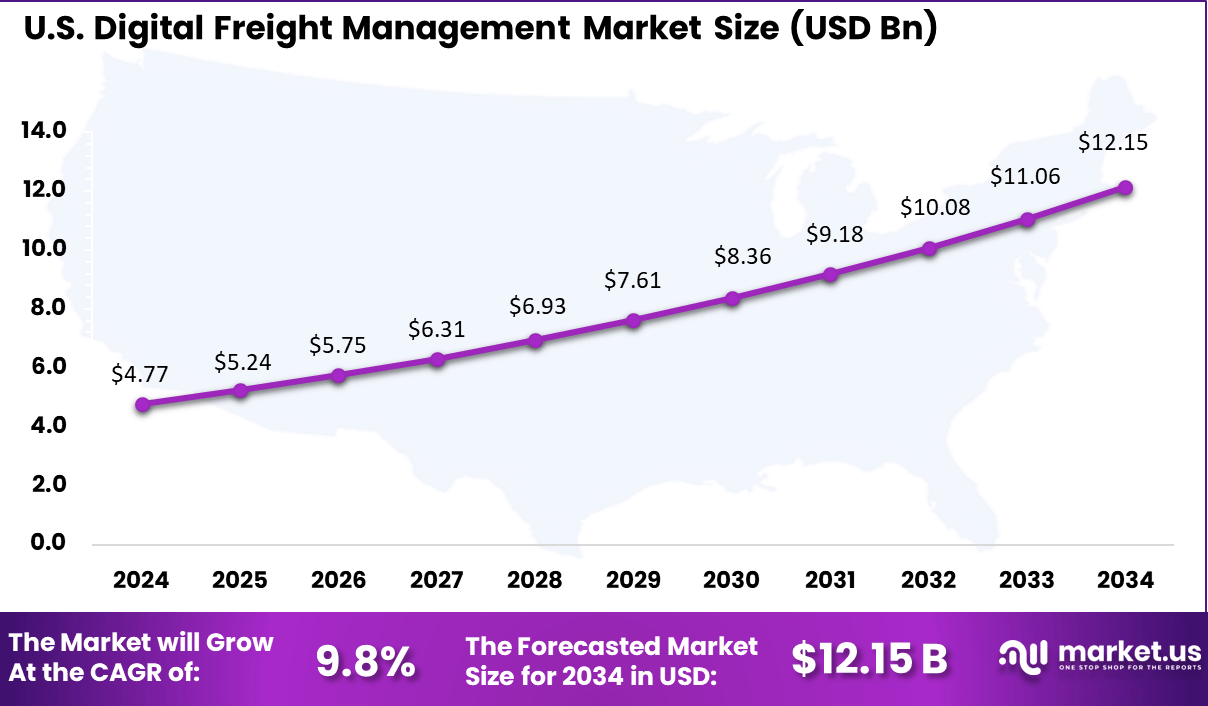

- North America holds 40.5% of the global market, with the U.S. valued at USD 4.77 billion in 2024 and expected to grow at a 9.8% CAGR, fueled by advanced logistics infrastructure and early technology adoption.

Digital Freight: Efficiency & Compliance

Investment opportunities abound in developing advanced digital freight platforms that integrate AI, blockchain, and IoT for enhanced security, transparency, and intelligence. Expanding into emerging markets like Asia-Pacific offers growth potential, supported by rising trade and government digitization initiatives.

Companies investing in modular, interoperable systems that can integrate with legacy infrastructure and provide real-time data insights stand to gain. There is also scope for innovation in automated freight matching, cargo tracking technologies, and compliance management tools. Businesses adopting digital freight management systems benefit from improved operational efficiency and cost-effectiveness.

Automation reduces manual tasks and human errors, while real-time tracking enhances decision-making and customer service. These platforms enable better resource allocation and route planning, decreasing delivery delays and fuel consumption. The ability to integrate with warehouse and inventory systems enables synchronization across the supply chain.

The regulatory environment focuses on ensuring compliance with transportation laws, customs regulations, and environmental standards. Digital freight management platforms help businesses comply with stringent regulations such as electronic logging mandates and trade agreements that affect cross-border shipments. Compliance-driven investments are essential to avoid operational fines and shipment delays, and to meet increasing regulatory demands for transparency and security in the logistics sector.

U.S. Market Size

The U.S. Digital Freight Management Market was valued at USD 4.77 Billion in 2024 and is anticipated to reach approximately USD 12.15 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.8% during the forecast period from 2025 to 2034.

The United States is leading the digital freight management market due to the scale and sophistication of its logistics ecosystem. The country operates one of the largest and most complex freight networks in the world, with extensive road, rail, air, and port infrastructure that requires advanced digital solutions to manage efficiently.

The rapid growth of e-commerce and same-day or next-day delivery expectations have further driven adoption, as companies rely on digital freight platforms for route optimization, load matching, and real-time tracking to meet customer demand.

In 2024, North America held a dominant market position, capturing more than a 40.5% share and generating USD 4.9 billion revenue in the digital freight management market. The region’s leadership is strongly linked to its advanced logistics infrastructure, rapid adoption of cloud-based platforms, and the presence of a highly integrated supply chain network.

Increased reliance on e-commerce and retail trade has accelerated the adoption of digital freight solutions, as businesses focus on improving real-time visibility, reducing transit delays, and enhancing cost efficiency. The strong push toward automation and the use of AI-driven freight solutions have further supported North America’s dominance in this industry.

By Solution Type Analysis

In 2024, Freight tracking and visibility solutions hold a significant 28.3% share of the Digital Freight Management market. These solutions are crucial as they provide real-time monitoring of shipments, enabling stakeholders to gain comprehensive insight into freight status, location, and estimated arrival times. Enhanced visibility not only improves operational efficiency but also increases customer satisfaction by providing transparency and proactive communication.

The rise of IoT, GPS technologies, and AI-powered analytics has further boosted the demand for freight tracking solutions. Companies rely on these tools to optimize routing, reduce delays, prevent loss or theft, and respond quickly to unexpected disruptions, making tracking and visibility pivotal for effective freight management.

By Deployment Mode Analysis

In 2024, Cloud-based deployment dominates the Digital Freight Management market with an overwhelming 78.9% share. The preference for cloud solutions stems from their ability to offer scalable, flexible, and cost-effective platforms that enable real-time data access and collaboration across multiple stakeholders.

Cloud deployment supports easier integration with existing enterprise systems and fosters seamless sharing of information between shippers, carriers, and logistics providers. Additionally, cloud-based freight management platforms ensure rapid software updates, enhanced security, and disaster recovery capabilities, which are critical for maintaining uninterrupted supply chain operations in today’s fast-paced logistics environment.

By Mode of Transport Analysis

In 2024, Roadways account for the largest mode of transport segment in the market, representing 45.2%. The prominence of road freight is due to its widespread use for last-mile delivery and regional transportation of goods. Road freight offers flexibility, cost efficiency, and a vital link in multi-modal logistics chains, which drives its significance in digital freight management.

According to the American Trucking Associations (ATA), trucks move over 72% of U.S. domestic freight by weight, underscoring the dominance of road transport in North America. Real-time visibility tools like project44 and FourKites are increasingly adopted to monitor driver performance, track shipments, and enhance on-time delivery rates.

Digital solutions tailored for roadways focus on route optimization, load planning, real-time vehicle tracking, and compliance management. These capabilities help reduce fuel consumption, minimize delays, and enhance overall transportation efficiency, benefiting shippers and carriers alike.

By End-User Analysis

In 2024, Shippers are the largest end-user group in the Digital Freight Management market, holding 48.1% of the market share. As primary stakeholders responsible for initiating and managing shipments, shippers increasingly leverage digital freight management platforms to gain better control over logistics costs and improve shipment transparency.

By adopting these solutions, shippers can optimize freight planning, improve carrier selection, and enhance supply chain responsiveness. The focus on meeting customer expectations for faster and more reliable deliveries continues to drive shippers’ adoption of advanced digital tools for efficient freight management.

Companies using digital freight platforms can reduce transportation costs by 10-12% through dynamic pricing, automated load matching, and optimized route planning. For example, Walmart leverages cloud-based TMS and visibility tools to streamline its extensive supplier network and improve on-time deliveries.

Key Market Segments

Solution Type

- Freight Tracking & Visibility

- Freight Matching & Optimization

- Freight Audit & Payment

- Warehouse Management

- Transportation Management Systems (TMS)

- Others

Deployment Mode

- Cloud-based

- On-premise

Mode of Transport

- Roadways

- Railways

- Airways

- Waterways

End-User

- Logistics Service Providers

- Shippers

- Carriers

Emerging Trend

AI-Driven Automation and Real-Time Visibility

A critical emerging trend in digital freight management is the integration of AI-powered automation that significantly enhances operational efficiency. Platforms now use AI algorithms for dynamic route optimization, predictive analytics, and automated freight booking.

This trend is allowing logistics providers to better forecast demand, minimize delivery delays, and optimize fuel consumption, transforming traditional freight management into a digital-first process. Moreover, real-time visibility powered by IoT sensors and cloud platforms is becoming the norm.

Customers and logistics operators can now track shipments continuously, improving supply chain transparency and responsiveness. This visibility extends across multimodal freight networks, enabling quicker reactions to disruptions and streamlined freight auditing. Together, AI and real-time tracking are making freight operations more agile and customer-centric.

Driver

Rising E-Commerce and Demand for Transparent Freight Operations

The explosive growth of e-commerce is one of the most powerful drivers shaping the digital freight management market today. As online shopping surges, companies face increasing pressure to deliver goods quicker and more reliably. This drives demand for sophisticated freight management systems that can handle complex, high-volume shipments with greater speed and accuracy.

In parallel, the need for transparency is rising across the entire logistics ecosystem. Real-time shipment tracking, predictive delivery updates, and automated documentation are now expected features. Businesses seek digital platforms that promote collaboration between shippers, carriers, and customs, reducing delays and enhancing customer trust. These factors together accelerate investment in digital freight technologies.

Restraint

High Cost and Complexity of Adoption

Despite the clear benefits, cost remains a significant restraint in digital freight management adoption. Implementing AI-driven digital freight platforms involves substantial upfront investment in sophisticated software, IoT devices for tracking, and skilled personnel to operate and maintain these systems.

Additionally, integrating new solutions with existing legacy infrastructure presents complexity. Many freight operators rely on outdated manual processes or disconnected systems, making seamless migration and real-time data synchronization challenging. This complexity can deter smaller firms or those lacking technical expertise from adopting digital freight management solutions fully, slowing market penetration.

Opportunity

Growth in Cross-Border and Intermodal Freight

The growth of cross-border and intermodal freight transport opens vast opportunities for digital freight management solutions. Increasing international trade flows demand efficient coordination between multiple transport modes such as sea, rail, road, and air.

Digital platforms that facilitate seamless transitions between these modes reduce customs delays and improve overall delivery speed. Furthermore, governments and trade agreements are encouraging digitization to streamline customs compliance and regulatory adherence.

Freight providers adopting advanced digital platforms can capitalize on these trends by offering enhanced service reliability and cost savings for global shipments. This opportunity is particularly pronounced in growing e-commerce hubs and emerging markets embracing logistics modernization.

Challenge

Integration with Legacy Systems and Data Security Concerns

One of the foremost challenges in the digital freight management market is integrating new digital platforms with legacy freight and ERP systems. Many logistics firms operate with heterogeneous technologies accumulated over years, creating fragmented data silos.

Achieving end-to-end visibility and automated processes requires complex system harmonization, often involving costly customization and training. In parallel, data security remains a major concern. The sensitive nature of freight and customer data necessitates robust cybersecurity measures to prevent breaches, theft, or tampering.

Companies must balance openness for real-time data sharing with strict controls to protect proprietary information and ensure regulatory compliance. Addressing these integration and security challenges is critical for digital freight solutions to gain trust and widespread adoption.

Key Player Analysis

In the digital freight management market, global consulting and technology leaders such as Accenture, Descartes Systems Group, Manhattan Associates, and JDA Software Group have built strong reputations by offering advanced digital solutions. Their focus on automation, predictive analytics, and AI-driven freight platforms supports logistics efficiency for global enterprises.

Traditional logistics leaders such as Maersk (Twill), CMA CGM, Kuehne + Nagel, CEVA Logistics, and DSV dominate with strong physical infrastructure and global freight networks. These companies are integrating digital freight tools to strengthen end-to-end visibility and lower transportation costs. By combining digital freight booking platforms with existing networks, they provide shippers with scalable and flexible options.

Emerging digital-first firms such as Flexport, Forto (Freighthub), iContainers, Shypple, Zencargo, and FreightAmigo Services Limited are redefining freight forwarding with technology-driven platforms. They leverage AI, automation, and real-time data sharing to deliver faster, cost-efficient, and transparent freight management solutions.

Top Key Players in the Digital Freight Management Market

- Accenture

- CEVA Logistics

- CTSI – Global

- Descartes System Group

- DSV

- High Jump Software

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate

- Dreamorbit

- Mcleod Software

- iContainers

- Forto (Freighthub)

- Flexport

- FreightAmigo Services Limited

- Maersk (Twill)

- CMA CGM

- Kuehne + Nagel

- Shypple

- Zencargo

- Expeditors (FLEET)

- Other Key Players

Recent Developments

- July 2025: Rail-Flow has acquired Rotterdam-based Simply Deliver to create a unified digital logistics ecosystem spanning rail, road, and intermodal transport. Combining Rail-Flow’s rail-focused TMS with Simply Deliver’s road logistics automation and visibility tools, the merger integrates capabilities, scales innovation, supports CO₂ reduction, and delivers enhanced end-to-end solutions while retaining all teams and locations.

- July 2025: Freightos has expanded its partnership with SEKO Logistics, integrating 7LFreight and WebCargo solutions globally to unify air and ground rate management within SEKO’s TMS. The integration delivers faster, more accurate quoting, real-time visibility, and streamlined multimodal bookings across 70+ airlines, 150 LTL carriers, and 3,000 cartage providers worldwide.

- June 2025: Cargo.one has integrated its digital air freight booking platform directly into Descartes’ transportation management system (TMS), enabling 25,000+ forwarders in 134 countries to search, compare, quote, and book with 65+ airlines in just clicks. The integration automates data entry, boosts accuracy, streamlines operations, and accelerates shipment management with real-time rate visibility.

- February 2025: LinkedLogi launches unified digital freight platform, integrating 500+ providers across road, rail, air, ocean, and warehousing. By digitizing workflows, consolidating loads, and automating routing, it cuts logistics costs by up to 30% while adding AI, IoT, and predictive fleet management capabilities.

Report Scope

Report Features Description Market Value (2024) USD 12.3 Bn Forecast Revenue (2034) USD 33.6 Bn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Freight Tracking & Visibility, Freight Matching & Optimization, Freight Audit & Payment, Warehouse Management, Transportation Management Systems (TMS), and Others), By Deployment Mode (Cloud-based and On-premise), By Mode of Transport (Roadways, Railways, Airways, and Waterways), By End-User Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture, CEVA Logistics, CTSI – Global, Descartes System Group, DSV

High Jump Software, JDA Software Group, Inc., Manhattan Associates, MercuryGate, Dreamorbit, Mcleod Software, iContainers, Forto (Freighthub), Flexport, FreightAmigo Services Limited, Maersk (Twill), CMA CGM, Kuehne + Nagel, Shypple, Zencargo, Expeditors (FLEET), and Other Key PlayersCustomization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Freight Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Freight Management MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture

- CEVA Logistics

- CTSI - Global

- Descartes System Group

- DSV

- High Jump Software

- JDA Software Group, Inc.

- Manhattan Associates

- MercuryGate

- Dreamorbit

- Mcleod Software

- iContainers

- Forto (Freighthub)

- Flexport

- FreightAmigo Services Limited

- Maersk (Twill)

- CMA CGM

- Kuehne + Nagel

- Shypple

- Zencargo

- Expeditors (FLEET)

- Other Key Players