Global Digital Financial Planning Tools Market Size, Share and Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By User Type (Individual Consumers, Financial Advisors & Enterprises), By Application (Investment Planning & Management, Retirement Planning, Tax Planning & Optimization, Estate Planning, Budgeting & Cash Flow Management, Others), By End-User (Retail Investors, Independent Financial Advisors (IFAs), Banks & Wealth Management Firms), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172893

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- User Type Analysis

- Application Analysis

- End-User Analysis

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

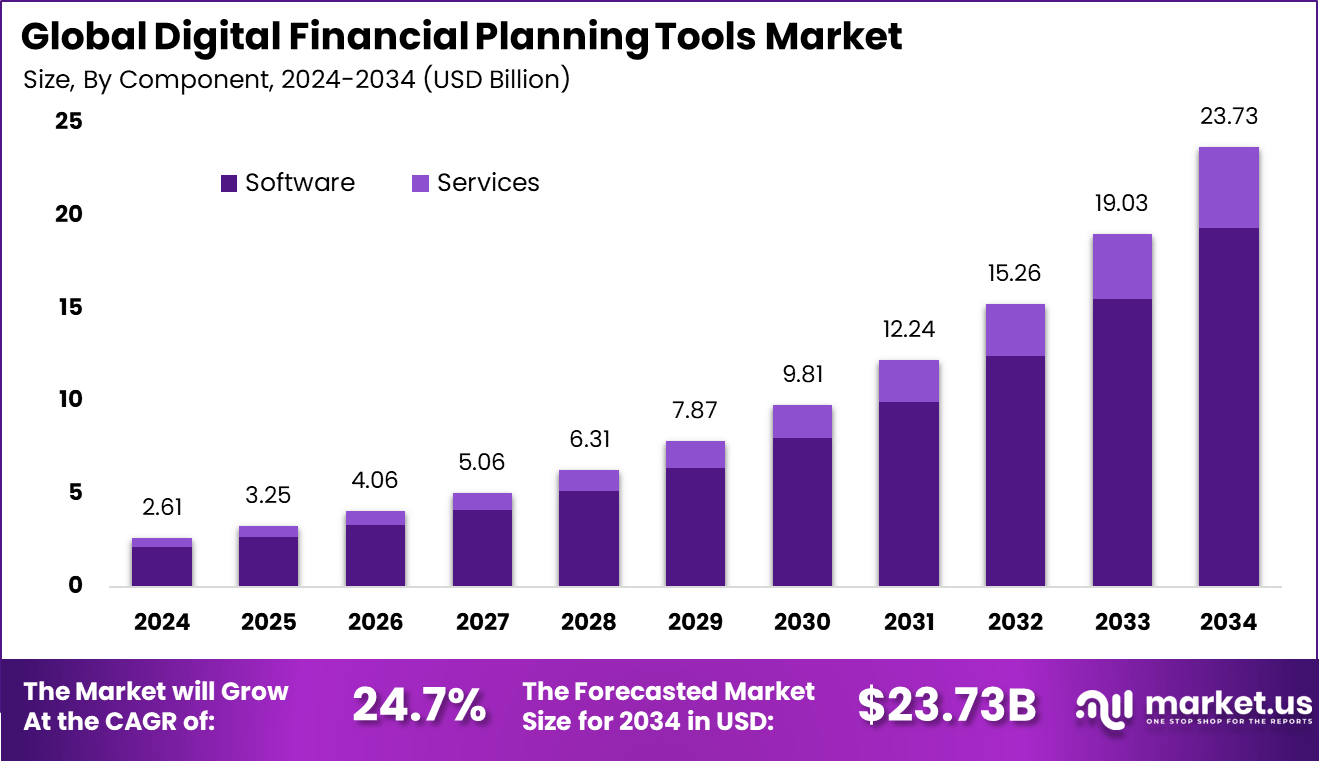

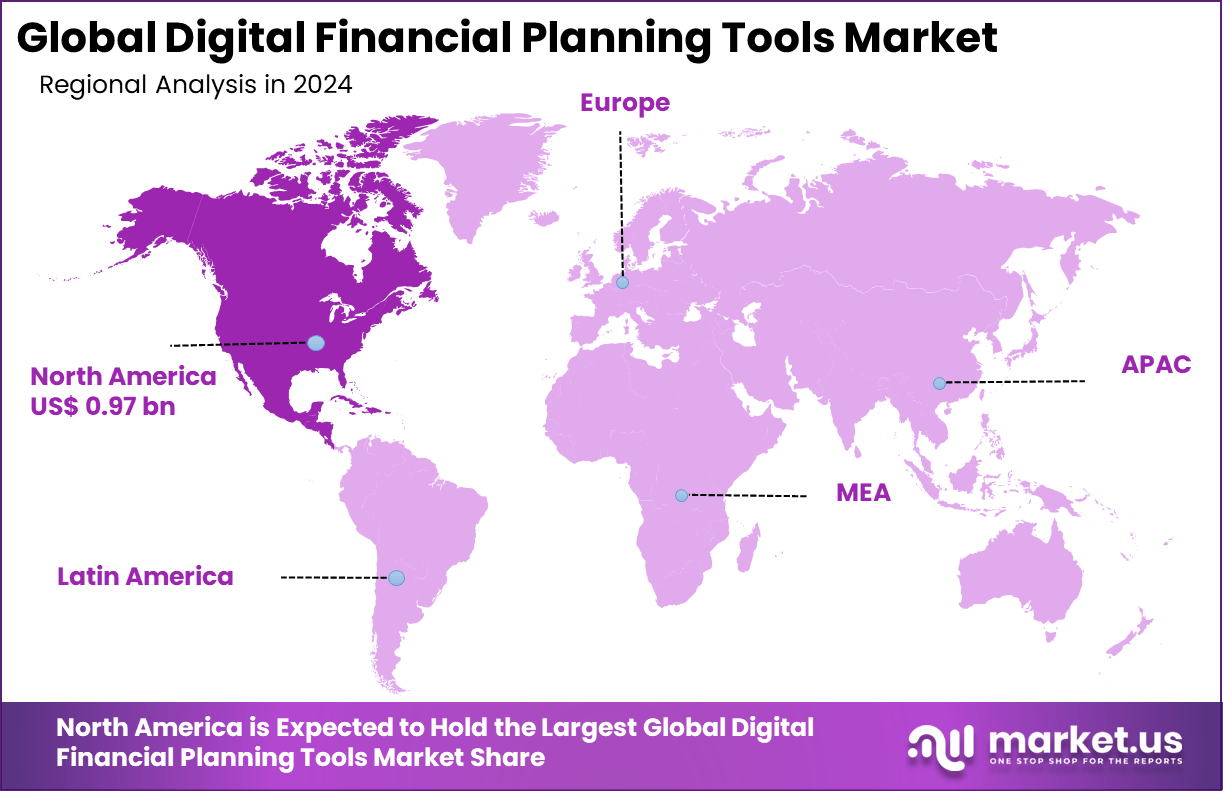

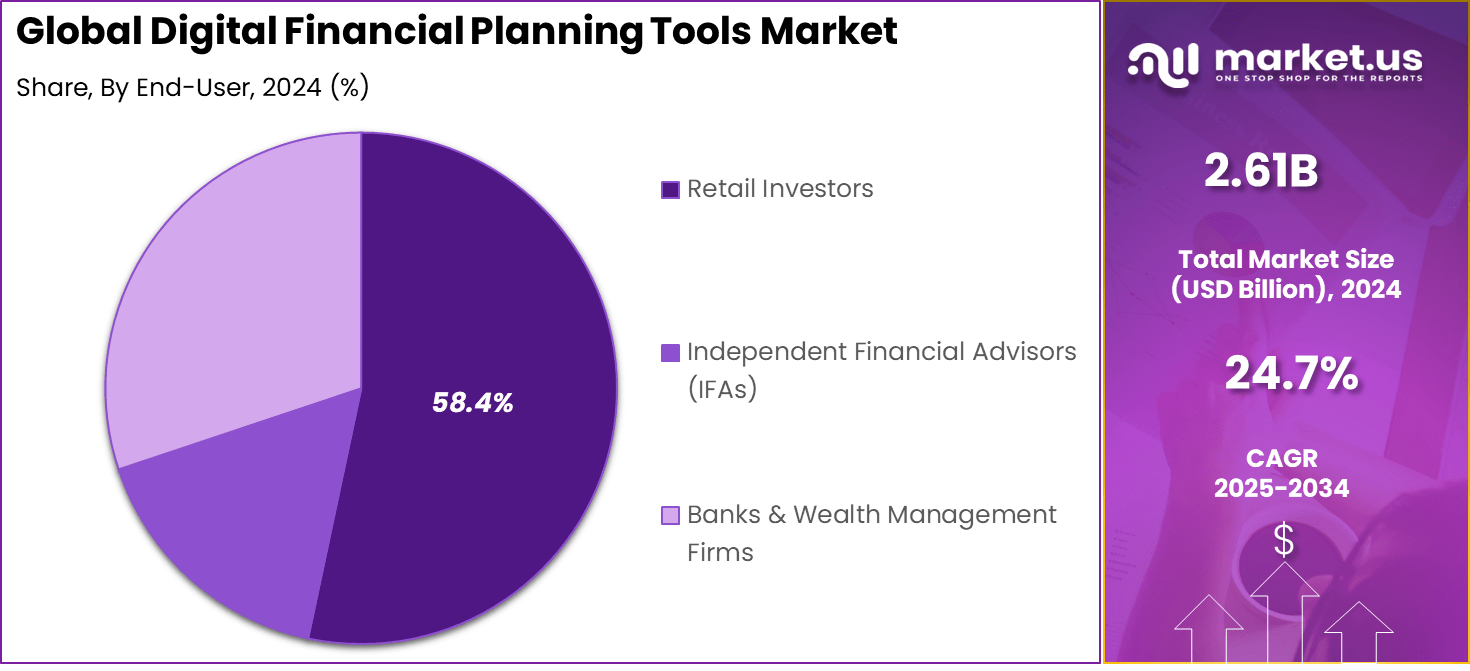

The Global Digital Financial Planning Tools Market size is expected to be worth around USD 23.73 billion by 2034, from USD 2.61 billion in 2024, growing at a CAGR of 24.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.97 billion in revenue.

The digital financial planning tools market refers to software and platforms that assist users and organizations with budgeting, forecasting, investment planning, retirement planning, and financial decision support. These tools use automated calculations, scenario analysis, and visualization features to simplify complex financial planning tasks. Adoption has been driven by both individual savers seeking clarity and financial professionals aiming for efficient advisory processes.

The market includes offerings across personal finance apps, wealth management platforms, and enterprise grade planning suites. The market has diversified to serve a broad set of users including retail consumers, financial advisors, and corporate finance teams. Integration with data sources such as bank accounts, investment portfolios, and economic indicators enables real time financial visibility. Continued improvements in computational power and user experience design have made digital financial planning tools more accessible and effective.

People choose digital financial planning tools for easy access anytime on phones or laptops, matching fast-paced days. 78% of users point to quicker service from instant insights as a key win, while custom plans from spending patterns draw crowds. They also save cash compared to traditional experts, letting regular folks get solid advice without high costs. Busy parents and young workers love the alerts that keep them on track. Overall, these factors make tools a daily must-have for smarter money moves.

The market for Digital Financial Planning Tools is driven by the rise of digital transformation in financial services. Old ways of handling money by hand take too long and leave room for errors, so firms turn to software for quick automation. These tools track budgets, investments, and goals in real time, helping users spot issues early. Advisors use them to give clear advice and build stronger client ties. As phones and cloud access grow common, more people expect simple digital help for daily finances.

Demand for these tools rises as more people seek hands-on control over finances during tough times with higher bills. 71% of everyday consumers now manage money digitally, thanks to smartphones in most pockets. Younger folks like millennials lead with 69% using apps for targets and tracking, marking a big change to do-it-yourself planning. This pull comes from real needs like saving for homes or education. As trust builds, more join in for peace of mind on cash flow.

For instance, in August 2025, Wealthfront rolled out securities lending and fractional shares in automated investing accounts from Palo Alto, California. These features boost passive income and reduce tracking error, making automated wealth planning more accessible and efficient for everyday investors.

Key Takeaway

- In 2024, software solutions led the digital financial planning tools market with a 68% share, as users favored platforms offering automated insights, portfolio tracking, and personalized financial guidance.

- Cloud-based deployment accounted for 60%, reflecting demand for flexible access, real-time updates, and seamless integration across devices.

- Individual consumers represented 65% of total usage, driven by growing interest in self-managed financial planning and digital wealth tools.

- Investment planning and management held 42.8%, highlighting strong adoption of tools focused on asset allocation, goal-based investing, and performance monitoring.

- Retail investors dominated with a 58.4% share, supported by rising participation in equities, ETFs, and digital advisory services.

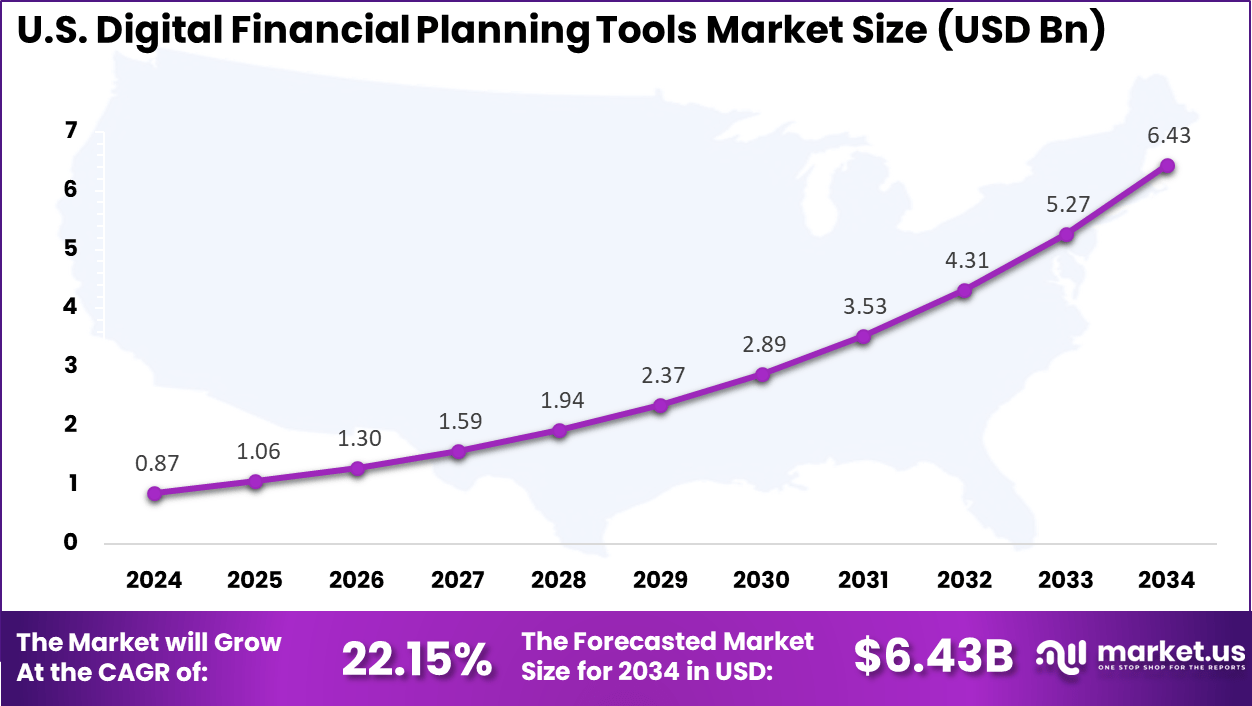

- The U.S. market reached USD 0.87 billion in 2024 and is expanding at a 22.15% CAGR, driven by fintech innovation and increasing demand for digital financial literacy tools.

- North America led globally with over 37.2% share, supported by advanced fintech adoption, high investor awareness, and strong digital infrastructure.

U.S. Market Size

The market for Digital Financial Planning Tools within the U.S. is growing tremendously and is currently valued at USD 0.87 billion, the market has a projected CAGR of 22.15%. The market is growing due to rising demand for personalized financial advice amid economic uncertainty, widespread smartphone adoption enabling anytime access, and AI advancements that make tools smarter and more predictive.

Younger generations prioritize self-managed investing over traditional advisors, while regulatory pushes for transparency boost trust in digital platforms. Integration with banking apps streamlines budgeting and goal tracking, drawing in retail users eager for control.

For instance, in December 2025, Vanguard’s CIO Nitin Tandon emphasized AI integration for hyper-personalized guidance via its Digital Advisor, including customized client summaries and future voicebot capabilities. With plans to enhance digital portals and personalized tools, Vanguard leverages AI to scale advice for 50 million clients. This innovation cements U.S. leadership in accessible, tech-powered financial planning.

In 2024, North America held a dominant market position in the Global Digital Financial Planning Tools Market, capturing more than a 37.2% share, holding USD 0.97 billion in revenue. This dominance is due to advanced digital infrastructure, high smartphone penetration, and strong financial literacy among consumers.

Tech hubs foster innovation in AI-driven apps, while retail investors seek affordable alternatives to advisors. Regulatory support ensures secure data handling, building user trust. Busy lifestyles favor cloud-based tools for real-time planning across devices.

In June 2025, Charles Schwab’s Center for Financial Research published its Mid Year Outlook, introducing AI supported planning tools to guide wealth management decisions amid economic uncertainty. The update highlights the use of data driven insights across portfolios, reinforcing North America’s leadership in advanced financial planning solutions.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing an 81.6% share of the Global Digital Financial Planning Tools Market. Users prefer these programs for their straightforward features like budgeting trackers, investment monitors, and goal setters that work right out of the box. They save time and cut costs compared to hiring experts. This shift reflects how people now expect tools to handle complex calculations on their own devices. Every day reliability keeps software ahead in daily use.

The services segment trails far behind, focusing on setup, training, and tweaks for special cases. While helpful for first-timers or custom needs, it lacks the broad appeal of ready-made software. Most users find self-service options meet their needs without ongoing support. This balance shows software’s edge in meeting core demands for quick, independent financial oversight.

For Instance, in October 2025, Intuit, Inc. launched an upgraded Mint app integration within TurboTax, enhancing software-based budgeting and tax-linked planning features. This move strengthens software dominance by blending real-time spending insights with investment simulations, making it easier for users to forecast finances without add-on services. The update rolled out to millions, boosting standalone software appeal.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 94.3% share of the Global Digital Financial Planning Tools Market. They offer access from anywhere via phone or laptop, plus automatic updates and easy sharing with family or advisors. Setup takes minutes, and data stays safe with built-in backups. This mode fits busy lives where flexibility matters most. No need for heavy hardware makes it a clear favorite.

On-premise deployments hold a tiny slice, mainly for firms needing full data control. They suit strict privacy rules but demand upkeep and servers. Users face higher upfront costs and less mobility. Still, cloud’s convenience wins over most, as remote work and mobile habits grow. The gap highlights how ease trumps tradition in modern planning.

For instance, in November 2025, Wealthfront, Inc. expanded its free Path planning tool to all users via cloud access. The platform now uses machine learning for goal feasibility across devices, underscoring the cloud’s lead with seamless, location-free updates and data sync. It drives higher engagement without downloads.

User Type Analysis

In 2024, The Individual Consumers segment held a dominant market position, capturing a 68.7% share of the Global Digital Financial Planning Tools Market. They use apps to track spending, build savings, and plan for big goals like homes or college. No advisor fees make it affordable for singles or families starting. Simple interfaces help beginners grasp finances fast. This group fuels innovation in user-friendly designs.

Enterprises take the rest, using tools for team budgets and compliance. Their needs focus on scale and integration with company systems. Yet individuals outpace them due to sheer numbers and personal stakes. Retail growth shows self-reliance rising, with tools bridging the gap to pro-level insights without the price tag.

For Instance, in May 2025, PocketGuard, Inc. rolled out AI spending alerts customized for single households. This targets individual users tracking daily expenses and savings goals, highlighting the segment’s growth with intuitive mobile-first designs that fit casual finance managers.

Application Analysis

In 2024, The Investment Planning & Management segment held a dominant market position, capturing a 42.8% share of the Global Digital Financial Planning Tools Market. Users rely on it for portfolio reviews, risk checks, and growth strategies. Real-time data helps spot opportunities or dodge pitfalls. It empowers decisions on stocks, bonds, or funds with clear visuals. This app stands out for handling wealth building, core to long-term security.

Other applications, like budgeting or debt tracking, fill key roles but lag. They handle daily cash flow well, yet lack the high stakes. Users often start with the basics, then move to advanced planning. The lead spot underscores how tools evolve to support bigger financial pictures beyond monthly bills.

For Instance, in August 2025, Vanguard Group, Inc. upgraded Digital Advisor with point-in-time investment recommendations. The tool now integrates cash management for better portfolio balancing, solidifying investment app dominance by offering personalized strategies tied to market shifts.

End-User Analysis

In 2024, the Retail Investors segment held a dominant market position, capturing a 58.4% share of the Global Digital Financial Planning Tools Market. They seek apps for trade ideas, performance tracking, and balanced portfolios. Independent trading booms with low barriers, drawing in hobbyists and serious savers alike. Tools simplify charts and alerts for confident moves. This segment thrives on personal empowerment.

Institutional users manage larger sums with custom setups, but their share stays smaller. They prioritize security and reporting over retail’s speed. Retail’s dominance comes from mass adoption via apps on app stores. It reflects a shift where everyday people act like pros, using tech to level the field.

For Instance, in July 2025, Charles Schwab Corporation enhanced its retail investor dashboard with predictive analytics. This free tool helps everyday traders simulate outcomes, supporting the retail lead by providing pro-level insights without advisor fees.

Emerging Trend Analysis

The Digital Financial Planning Tools Market is experiencing growth in the adoption of intelligent recommendation systems that help users make informed financial decisions. These systems provide personalized suggestions for budgeting, saving, and investment based on individual financial data. Users benefit from insights that align with their goals and preferences, which supports more confident planning.

Another trend in the market is the integration of real time data feeds that allow users to monitor financial positions instantly. Tools now connect with bank accounts, investment portfolios, and spending accounts to provide up to date snapshots of financial health. This immediacy enables users to respond quickly to changes in market conditions or personal circumstances.

Driver Analysis

A primary driver of the market is the rising demand for accessible financial planning solutions among individual investors and households. Growing interest in financial independence, retirement readiness, and wealth preservation has motivated users to seek tools that simplify complex planning tasks. Digital financial planners offer structured guidance without the cost of personal advisors, making them appealing to a broad audience.

Another driver is the expansion of mobile and online financial services that facilitate convenient planning on any device. Consumers increasingly prefer to manage their finances using smartphones or laptops, which encourages developers to optimize planning tools for these platforms. Easy access supports frequent interaction and helps users stay engaged with their financial plans.

For instance, in November 2025, Intuit rolled out new AI features in QuickBooks to speed up budgeting tasks for small businesses. Users now get automatic reports that save hours of manual work each week. The update ties right into daily cash flow tracking. Advisors praise how it simplifies client reviews during meetings. This move shows a clear shift to digital tools for everyday finance handling.

Restraint Analysis

One restraint on market growth is concern about data privacy and security when linking financial accounts to planning platforms. Users may hesitate to share sensitive financial information due to fear of unauthorized access or data breaches. Providers must implement strong safeguards and transparent privacy policies to build user trust. Without clear security assurances, some users may avoid adopting digital planning tools.

Another restraint is the fragmentation of available tools and the challenge users face in selecting solutions that meet their specific needs. The market includes a wide range of products with varying features, which can make comparison difficult. Users may delay adoption while evaluating options or revert to traditional planning methods if they feel overwhelmed by choices. Simplifying selection criteria is important to improve accessibility.

For instance, in December 2025, Schwab added multi-layer checks to its planning app after spotting rising hack threats in the industry. Users must confirm logins via phone for big changes. This step reassures those nervous about sharing bank links. Feedback shows some still prefer offline methods despite the upgrades. Security focus slows quick feature rollouts.

Opportunity Analysis

There is significant opportunity in developing tools that integrate retirement, tax, and investment planning into a unified platform. Users often engage with multiple financial goals simultaneously, and a consolidated solution can provide comprehensive guidance. By offering holistic planning features, providers can attract users who want a single source for diverse financial needs. This integration improves user experience and supports deeper engagement.

Another opportunity lies in enhancing education and guidance features that help users understand financial concepts more clearly. Tools that include tutorials, scenario simulations, and contextual explanations can empower users to make better decisions. Improving financial literacy through integrated education increases user confidence and long term tool usage. Educational features can differentiate products in a competitive market.

For instance, in September 2025, Wealthfront launched cloud syncing for portfolios across phones and laptops without downloads. Investors pull up forecasts from anywhere now. This draws remote workers planning on the move. Growth spiked as users shared access with spouses easily. Cloud ease opens doors for casual finance trackers.

Challenge Analysis

A major challenge for the market is ensuring accuracy and reliability of recommendations amidst changing financial regulations and market conditions. Planning tools must continuously update underlying models to reflect interest rate changes, tax law updates, and evolving investment products. Maintaining current and precise calculations requires ongoing development effort. Failure to update models promptly can reduce user trust and diminish tool value.

Another challenge is designing interfaces that balance advanced functionality with user friendliness. Financial planning involves complex concepts, and presenting them in an intuitive manner is difficult. Users may feel overwhelmed by sophisticated features if the interface is not clear and supportive. Providers must invest in user experience design to make tools effective for users with varying levels of financial knowledge.

For instance, in August 2025, eMoney updated its software to match new data rules across states, delaying a big release. Planners juggle extra compliance steps for client files. Users wait longer for fresh tools due to checks. The firm holds training sessions to avoid fines. Rules create hurdles in fast updates.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By User Type

- Individual Consumers

- Financial Advisors & Enterprises

By Application

- Investment Planning & Management

- Retirement Planning

- Tax Planning & Optimization

- Estate Planning

- Budgeting & Cash Flow Management

- Others

By End-User

- Retail Investors

- Independent Financial Advisors (IFAs)

- Banks & Wealth Management Firms

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Intuit, Inc., Vanguard Group, Inc., Charles Schwab Corporation, and Fidelity Investments, Inc. lead the digital financial planning tools market by offering comprehensive platforms for budgeting, retirement planning, and investment management. Their solutions integrate account aggregation, forecasting, and advisory features. These companies focus on data accuracy, regulatory alignment, and user trust.

Betterment Holdings, Inc., Wealthfront, Inc., Empower, Personal Capital, and eMoney Advisor, LLC strengthen the market with digital first planning tools and robo advisory capabilities. Their platforms support goal based planning, cash flow analysis, and portfolio optimization. These providers emphasize automation, transparency, and personalized insights.

MoneyGuidePro, RightCapital, Inc., YNAB (You Need A Budget), Quicken, Inc., and PocketGuard, Inc. expand the landscape with focused tools for budgeting, scenario planning, and financial discipline. Their offerings target individuals, advisors, and small households. These companies focus on ease of use and affordability.

Top Key Players in the Market

- Intuit, Inc.

- Empower

- Betterment Holdings, Inc.

- Wealthfront, Inc.

- Personal Capital

- Vanguard Group, Inc.

- Charles Schwab Corporation

- Fidelity Investments, Inc.

- eMoney Advisor, LLC

- MoneyGuidePro

- RightCapital, Inc.

- PocketSmith, Ltd.

- YNAB (You Need A Budget)

- Quicken, Inc.

- PocketGuard, Inc.

- Others

Recent Developments

- In September 2025, Fidelity Investments launched Wealthscape Intelligence from Boston, Massachusetts, along with fully digital onboarding enhancements for advisors. These tools streamline workflows, bulk account opening, and real-time CRM integration, helping wealth managers deliver personalized digital planning experiences amid rising demand for holistic financial guidance.

- In September 2025, RightCapital debuted advanced business planning features from Shelton, Connecticut, letting advisors model client businesses directly into financial plans. This innovation handles complex cash flows and scenarios, empowering planners to serve entrepreneurs with integrated digital tools.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Bn Forecast Revenue (2035) USD 23.7 Bn CAGR(2025-2035) 24.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (Cloud-based, On-premises), By User Type (Individual Consumers, Financial Advisors & Enterprises), By Application (Investment Planning & Management, Retirement Planning, Tax Planning & Optimization, Estate Planning, Budgeting & Cash Flow Management, Others), By End-User (Retail Investors, Independent Financial Advisors (IFAs), Banks & Wealth Management Firms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intuit, Inc., Empower, Betterment Holdings, Inc., Wealthfront, Inc., Personal Capital, Vanguard Group, Inc., Charles Schwab Corporation, Fidelity Investments, Inc., eMoney Advisor, LLC, MoneyGuidePro, RightCapital, Inc., PocketSmith, Ltd., YNAB (You Need A Budget), Quicken, Inc., PocketGuard, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Financial Planning Tools MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Financial Planning Tools MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Intuit, Inc.

- Empower

- Betterment Holdings, Inc.

- Wealthfront, Inc.

- Personal Capital

- Vanguard Group, Inc.

- Charles Schwab Corporation

- Fidelity Investments, Inc.

- eMoney Advisor, LLC

- MoneyGuidePro

- RightCapital, Inc.

- PocketSmith, Ltd.

- YNAB (You Need A Budget)

- Quicken, Inc.

- PocketGuard, Inc.

- Others