Global Digital Content Creation Market Size, Share Report By Component (Tools and Services), By Deployment Mode (Cloud-Based and On-Premise), By Content Type (Video, Textual, Graphical, and Audio), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By End-Use Industry (Retail & E-Commerce, Automotive, Healthcare & Pharmaceutical, Media & Entertainment, Travel & Tourism, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 25360

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Digital Content Creation Statistics

- North America Digital Content Creation Market

- Component Analysis

- Content Analysis

- Deployment Analysis

- Enterprise Size

- End-User Analysis

- Role of Generative AI

- Key Market Segments

- Drivers

- Restraints

- Opportunity

- Trends

- Geopolitical and Recession Impact Analysis

- 5 Top Use Cases

- Business Benefits

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

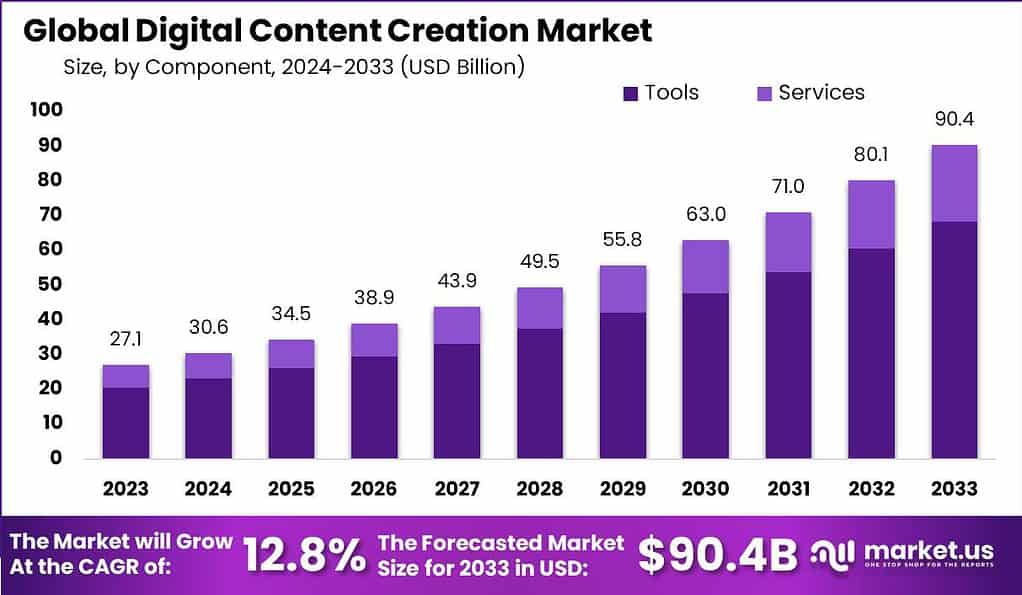

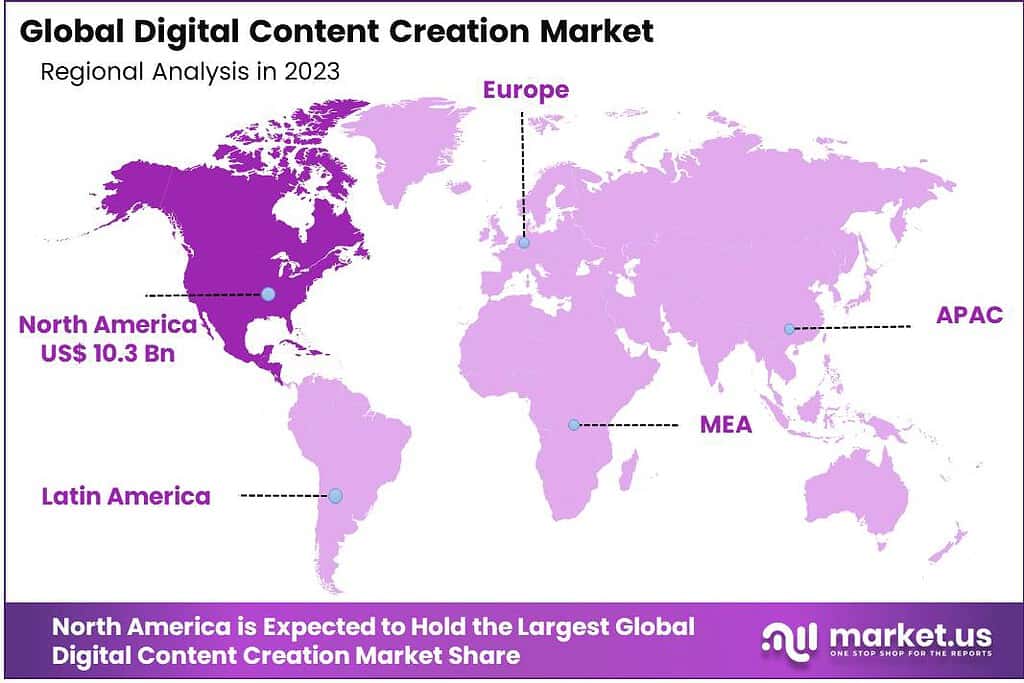

The Global Digital Content Creation Market size is expected to be worth around USD 90.4 Billion by 2033, from USD 27.1 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.1% share, holding USD 10.3 billion revenue.

Digital content creation involves the process of producing material like videos, articles, podcasts, and graphics that are shared online. This process is fundamental in digital marketing, education, and entertainment, providing valuable information or entertainment to a wide audience. Creators use various tools and platforms to develop and distribute content, aiming to engage audiences, boost brand visibility, or educate viewers and readers.

The digital content creation market is expanding as more businesses and individuals recognize the importance of online presence. This market includes the development and distribution of digital assets such as text, graphics, video, and interactive media. Driven by increasing internet usage and the popularity of social media platforms, the market is expected to grow significantly.

The demand for digital content creation is driven by the need for engaging and informative content across various online platforms. As businesses and individuals aim to establish a strong online presence, the requirement for high-quality digital content – ranging from videos to blogs and graphics – has become essential. This demand is further fueled by digital marketing strategies that rely heavily on content to attract and retain customers.

Digital content creation has become increasingly popular due to the rise of digital media consumption. With more people accessing information and entertainment online, there is a continuous need for fresh and relevant content. Social media platforms, corporate websites, and online educational resources all contribute to the soaring popularity of content creation as a critical component of online engagement.

The market for digital content creation is expanding globally. Technological advancements, such as the availability of sophisticated content creation tools that simplify the production process, are lowering barriers for entry. This expansion is also supported by the growing number of content platforms and the increasing internet penetration worldwide, which opens up new audiences and markets for digital content creators.

According to the European Commission, 59% of Enterprises in the European Union (EU) used Social Media in 2021 compared to 37% in 2015. Innovations in content creation tools and platforms, including advancements in AI and machine learning for personalized content generation, further fuel this growth.

Video content creation emerged as the predominant segment, capturing 35% of the market share. This segment encompasses a broad array of services and tools dedicated to video production and editing, reflecting the increasing demand for high-quality video content across various platforms.

The trend towards branded content and digital media witnessed a significant uptick, with over 60% of companies augmenting their budgets in this domain in 2023 compared to the previous year. This strategic investment underscores the growing recognition of digital content’s value in engaging audiences and fostering brand loyalty.

Social media content creation services also experienced remarkable growth, accounting for 25% of the market share in 2023. Year-over-year growth for this segment reached 70%, propelled by brands intensifying their efforts to enhance social media engagement. The vitality of social media platforms in contemporary marketing strategies has catalyzed this surge, emphasizing the imperative to create compelling and resonant content for these channels.

The adoption of advanced technologies such as augmented reality (AR), virtual reality (VR), and mixed reality in content production has seen a dramatic increase. By 2023, over 70% of content creation firms incorporated these services into their offerings, a substantial rise from 30% in the preceding year. This evolution indicates the industry’s swift adaptation to immersive technologies, aiming to deliver more engaging and interactive experiences to audiences.

Key Takeaways

- The Digital Content Creation Market is anticipated to witness substantial growth, with an estimated worth of USD 90.4 billion by 2033, marking a robust CAGR of 12.8% throughout the forecast period.

- The Tools segment dominates, holding a larger revenue share of 75.6% in 2023, driven by continuous innovation and advancements in artificial intelligence and machine learning.

- Among content types, the Video segment commands a greater revenue share of 40.5% in 2023, owing to its effectiveness in engaging and retaining audience attention.

- The Cloud-Based deployment mode segment dominates the market, holding a major revenue share of 77.2% in 2023, due to its flexibility, scalability, and cost-effectiveness aligning with modern content creation needs.

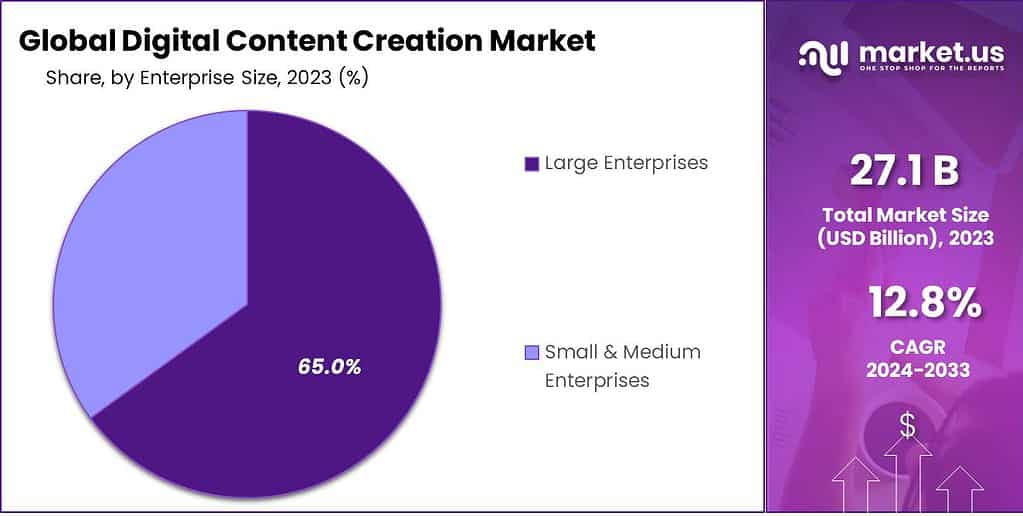

- Large Enterprises hold the largest revenue share of 65.0% in 2023, leveraging substantial resources and strategic investments in digital marketing and content production.

- The Retail & E-Commerce segment leads among end-use industries, obtaining a larger revenue share of 28.7% in 2023, emphasizing the pivotal role of digital content in driving online consumer engagement and sales.

- North America region dominated the Global Digital Content Creation Market with a larger revenue share of 38.1% in 2023.

Digital Content Creation Statistics

- Content marketing has proven to be remarkably efficient, generating leads three times more effectively than outbound marketing strategies, as highlighted by Review42. Notably, 60% of B2C marketers actively employ content marketing techniques to engage their audiences. Furthermore, 56% of businesses globally are planning to increase their budget for content creation, recognizing its pivotal role in lead generation and customer engagement.

- Around 73% of companies have dedicated personnel to oversee their content creation efforts, indicating a strategic commitment to content quality and consistency. The effectiveness of these efforts is evident as 72% of businesses report an increase in lead generation through content marketing.

- With more than 80% of marketers intending to escalate their investment in content strategies, and 92% of marketers considering content an invaluable business asset, the future of content marketing looks robust, with a clear trend towards increased allocation of resources and strategic focus in this area.

- Based on the research findings of Artios, In the digital content landscape, podcasts remarkably lead with an engagement rate of 51.29%, signifying a strong consumer preference for audio content. This type is favored for its convenience and ability to provide in-depth information or entertainment during commutes or other multi-tasking activities. Online courses and blogs also show notable engagement, with rates of 14.07% and 10.37% respectively. This indicates a solid interest in educational and written content that offers value and deeper insights into various subjects.

- Conversely, other types of content are experiencing significantly lower engagement rates. Social media posts and news articles have engagement rates of only 9.16% and 0.64%, suggesting that while these are common content formats, they may not sustain audience attention as effectively. The lowest engagement is seen in webinars, videos, forums, and e-books, with rates of 0.52%, 0.17%, 0.16%, and 0.00% respectively.

- According to a Forbes report, the content marketing industry is poised for significant growth, with its value projected to reach $600 billion in 2024. A substantial 90% of marketers now incorporate content into their marketing strategies, underscoring its integral role in modern advertising and customer engagement.

- Organic search remains a dominant channel for content consumption, accounting for 51%. Moreover, 74% of companies report an increase in lead generation through content marketing. Reflecting the importance of this tactic, most content marketers allocate over 10% of their marketing budget specifically to content creation and distribution.

North America Digital Content Creation Market

In 2023, North America held a dominant market position in the Digital Content Creation market, capturing more than a 38.1% share with revenues amounting to USD 10.3 billion. This leadership can be primarily attributed to the robust digital infrastructure and the significant presence of leading technology and media companies in the region.

North America has traditionally been at the forefront of technological advancements, with a highly developed internet and cloud infrastructure that supports substantial investments in digital content creation tools and platforms. The concentration of major technology giants, such as Google, Apple, and Microsoft, as well as major creative hubs like Hollywood and Silicon Valley, drives the adoption of cutting-edge technologies in content creation and distribution.

The dominance of North America is also fueled by the region’s strong emphasis on content marketing as a pivotal element of digital marketing strategies across businesses. North American companies are leading in terms of utilizing digital content to engage consumers, influence buyer behavior, and enhance brand recognition.

This is supported by significant investments in digital advertising and content marketing by companies aiming to capture the increasingly digital-first consumer base. The high internet penetration rates and the widespread use of smartphones and other digital devices facilitate the consumption of digital content, pushing businesses to invest more in content creation tools and services.

Component Analysis

In 2023, the Tools segment held a dominant market position within the Digital Content Creation market, capturing more than a 75.6% share. This substantial market share can be attributed to the increasing demand for advanced and integrated software solutions that enable the creation, management, and optimization of digital content across various platforms.

As organizations continue to emphasize brand presence and customer engagement through digital channels, the necessity for robust content creation tools that support graphics, video, and text has surged. This trend is further driven by the growing significance of content marketing strategies in achieving business objectives such as lead generation, brand awareness, and customer retention.

The leadership of the Tools segment is also bolstered by continuous technological advancements in content creation platforms, which integrate artificial intelligence, machine learning, and data analytics to enhance content relevance and engagement. Such technologies enable creators to produce personalized and targeted content efficiently, meeting the dynamic preferences of digital consumers.

Additionally, the integration of analytics tools allows businesses to gain insights into content performance, enabling continuous improvement and optimization of their marketing strategies. This aspect of digital content tools aligns with the increasing emphasis on data-driven marketing and the need for scalability in content production.

Moreover, the rise of social media platforms and the increasing consumption of digital media have propelled the demand for diverse and high-quality content, which further cements the dominance of the Tools segment. As platforms like YouTube, Instagram, and TikTok evolve, content creators and marketers require more sophisticated tools to create engaging and platform-specific content.

Content Analysis

In 2023, the Video segment held a dominant position in the Digital Content Creation market, capturing more than 40.5% of the market share. This leadership can be attributed to the escalating demand for dynamic media content across various platforms such as social media, digital advertisements, and corporate promotions.

As visual and interactive content becomes more integral to engaging users, brands are increasingly investing in video content to communicate their messages effectively. Furthermore, the rise in consumer engagement through video on platforms like YouTube, TikTok, and Instagram has compelled marketers to increase their video content budget, supporting the segment’s growth.

Video content’s ability to convey complex information quickly and effectively is unmatched by other content types, making it a preferred choice for storytelling and information dissemination. Technological advancements such as 4K, 8K, and virtual reality (VR) have further enhanced the quality and immersive experience of video content, driving its consumption and production.

Additionally, video analytics powered by artificial intelligence (AI) allows for deeper insights into viewer behavior, helping content creators and marketers refine their strategies and optimize viewer engagement. The proliferation of smartphones and improved internet bandwidth have also played significant roles in the expansion of the video content segment.

These factors have made streaming high-quality videos more accessible to a wider audience, fostering growth in content consumption. As video production tools and platforms become more user-friendly and cost-effective, even smaller content creators are able to produce high-quality videos, democratizing the creation process and propelling the segment’s growth.

Deployment Analysis

In 2023, the Cloud-Based segment held a dominant market position, capturing more than a 77.2% share of the Digital Content Creation Market. This segment’s leadership is primarily attributed to the growing demand for flexible, scalable, and cost-efficient solutions. Cloud-based platforms allow content creators and organizations to access advanced tools, collaborate in real-time, and store large amounts of data without the need for expensive on-site infrastructure.

The scalability offered by cloud solutions supports the dynamic and fast-paced nature of digital content creation, which often requires quick adaptation to market trends and consumer preferences. One of the key reasons for the dominance of the Cloud-Based segment is its ability to provide seamless accessibility and collaboration across global teams.

As businesses increasingly operate with remote or distributed teams, cloud-based platforms enable real-time collaboration, allowing creators, marketers, and developers to work together from different locations. This results in faster content production cycles, which is crucial in industries such as digital marketing, e-commerce, and media, where timely delivery of content can impact consumer engagement and revenue generation.

Another significant factor is the cost-effectiveness of cloud deployment. For both small and large businesses, cloud-based content creation solutions reduce the need for heavy upfront investments in infrastructure and maintenance. Instead, companies can benefit from subscription-based models, paying only for the resources they use, which allows for better budget management. The rise of AI-driven tools within cloud platforms further enhances their value, enabling the automation of various content creation processes and improving overall efficiency.

The Cloud-Based segment also benefits from enhanced security features offered by major cloud providers, which address concerns related to data privacy and protection. With continuous improvements in encryption, data backups, and compliance with global standards, organizations increasingly trust cloud-based systems to manage their digital assets securely. These advantages make the cloud-based deployment mode the preferred choice for companies looking to stay competitive in the evolving digital content landscape

Enterprise Size

In 2023, the Large Enterprises segment held a dominant market position in the digital content creation market, capturing more than a 65% share. This significant market share can be attributed to the substantial resources and capital that large enterprises have at their disposal, which enable them to invest in advanced digital content creation tools and technologies.

These organizations often have dedicated teams for content strategy, production, and distribution, which help in generating high-quality, diverse content at scale. The leadership of the Large Enterprises segment is also reinforced by their ability to leverage economies of scale, making it cost-effective to produce vast amounts of content.

Moreover, large enterprises are typically involved in multiple markets globally, necessitating a varied and extensive content strategy to engage diverse audiences effectively. This global reach and the need for a strong digital presence drive their investment in comprehensive digital content creation solutions that support a wide range of content types and distribution channels.

Furthermore, large enterprises are more likely to engage in multichannel marketing campaigns that require consistent and high-quality content across all platforms. Their capacity to integrate sophisticated analytics and customer relationship management (CRM) tools with content creation efforts allows for more targeted and personalized content, enhancing audience engagement and ROI. The focus on building a strong brand image and maintaining market leadership compels large enterprises to prioritize content quality and innovation continually.

End-User Analysis

In 2023, the Retail & E-Commerce segment held a dominant market position in the Digital Content Creation market, capturing more than a 28.7% share. This segment’s leadership can be attributed to the increasing adoption of digital platforms for shopping and the growing necessity for unique marketing strategies to attract and retain customers.

Retailers and e-commerce platforms are leveraging high-quality, engaging content to enhance the customer experience, drive traffic, and increase conversion rates. This content ranges from detailed product descriptions and reviews to interactive media such as augmented reality experiences and personalized video content.

The influence of social media platforms has further propelled the demand for continuous and dynamic content creation in the Retail & E-commerce sector. As platforms like Instagram, Facebook, and TikTok have become central to digital advertising strategies, the need for captivating content that can be quickly updated and distributed has surged. This requirement has fueled investments in technologies and services that support rapid, high-volume content production, often tailored to the preferences and behaviors of diverse consumer bases.

Moreover, the integration of advanced technologies like AI and machine learning in content creation tools has enabled more personalized and targeted content. Retail & E-commerce businesses are using these tools to analyze customer data and predict purchasing trends, thus optimizing their content for better engagement. The ability to generate real-time, relevant, and engaging content allows for a more dynamic interaction with consumers, enhancing brand loyalty and driving further growth in this segment.

Overall, the Retail & E-commerce segment’s lead in the Digital Content Creation market is reinforced by its swift adaptation to digital transformation trends, the critical role of content in online consumer engagement, and technological advancements that enable efficient and impactful content delivery. This trend is expected to continue as more retailers embrace digital channels to expand their reach and personalize the shopping experience.

Role of Generative AI

- Productivity Gains: Companies using generative AI report significant time savings and increased content output. For instance, marketing teams have noted a reduction in the time spent on content creation, with AI taking over repetitive tasks like drafting and data analysis.

- Creativity Enhancement: Contrary to concerns about AI stifling human creativity, it is often used to handle mundane aspects of content creation, allowing human creators to focus on more innovative and strategic elements.

- Market Adaptability: With its capability to rapidly produce diverse content, generative AI helps businesses stay competitive in a fast-evolving digital landscape. This adaptability is crucial as content demands continue to grow and evolve.

- Risk Management: The use of AI in content creation does bring challenges, particularly in areas like intellectual property and maintaining authentic engagement. It necessitates careful management to mitigate potential legal and ethical risks.

Key Market Segments

By Component

- Tools

- Services

By Content Type

- Textual

- Graphical

- Video

- Audio

By Deployment Mode

- On-Premise

- Cloud

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End-User

- Retail & E-Commerce

- Automotive

- Healthcare & Pharmaceutical

- Media & Entertainment

- Travel & Tourism

- Other End-Users

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Mobile Internet Penetration and Consumption

The widespread penetration and consumption of mobile internet are crucial factors driving demand in the Digital Content Creation Market. With the global increase in smartphone usage and improvements in mobile internet connectivity, consumers are accessing digital content more frequently and from a variety of locations.This shift towards mobile consumption has led to a higher demand for mobile-optimized content, including responsive websites, mobile apps, and content formatted for easy viewing on smaller screens. The convenience of mobile internet encourages higher engagement rates, as users can easily share and comment on content, further amplifying its reach.

Additionally, the rise of mobile-based content platforms and social media apps has created new avenues for content distribution and consumption, making mobile optimization a critical consideration for content creators. The mobile internet revolution not only expands the audience base for digital content but also shapes content creation and distribution strategies, emphasizing the importance of mobile in the digital content ecosystem.

For Instance, according to the International Telecommunication Union (ITU), the number of individuals using internet globally reached at 5.4 Billion in 2023 compared to 5.1 Billion in 2022 and the total worldwide population aged 10 years and above who own a mobile phone reached at 78%, showing and increase of 5% compared to 73% in 2022.

Restraints

Complexity and Cost of Content Production

The complexity and associated costs of producing high-quality digital content significantly hinder the growth of the Global Digital Content Creation Market. As consumer expectations for engaging and sophisticated content rise, so do the demands on content creators to utilize advanced tools and technologies. This sophistication requires investments in professional equipment, software, and skilled personnel, which can be prohibitively expensive, especially for smaller organizations and independent creators.The need for ongoing content production to maintain audience engagement further escalates costs, imposing a continuous financial burden. This scenario creates a barrier to entry for new creators and can limit the ability of existing ones to scale their operations, thereby restraining market growth. Moreover, the challenge of ensuring a return on investment on such high production costs adds a layer of financial risk, making it difficult for businesses to justify extensive content creation expenditures without assured outcomes.

Opportunity

Increased Utilization of AI and Machine Learning

The increased utilization of artificial intelligence (AI) and machine learning in content creation offers significant opportunities for efficiency, personalization, and scalability. AI-driven tools can automate routine tasks such as data analysis, content curation, and even some aspects of content production, freeing human creators to focus on more creative and strategic activities. Machine learning algorithms can analyze audience behavior and preferences, enabling the delivery of highly personalized content that resonates with individual users. This level of personalization can significantly enhance user engagement and loyalty.Furthermore, AI technologies can generate insights and predictions about content trends, helping creators and businesses stay ahead of the curve. Embracing AI and machine learning technologies can lead to more targeted, effective, and efficient content creation practices, offering a competitive advantage in the rapidly evolving digital marketplace. For Instance, Adobe Firefly from Adobe Inc. utilizes Generative AI technology to create content based on text prompts.

Trends

Content Personalization and AI-driven Analytics

Content personalization with the help of AI-driven analytics, is a leading trend shaping the Digital Content Creation Market. Advanced analytics and machine learning algorithms enable content creators and marketers to understand their audiences, facilitating the delivery of tailored content that meets individual preferences and behaviors. This personalization enhances user engagement by providing more relevant content experiences.AI-driven tools can analyze large datasets to identify patterns, predict preferences, and suggest content strategies that are most likely to resonate with specific audience segments. This capability not only improves the effectiveness of content marketing campaigns but also increases the efficiency of content creation process. The trend towards personalized content reflects a broader move towards data-driven decision-making in content strategy.

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis

Geopolitical tensions and events significantly influence the Global Digital Content Creation Market. Shifts in political landscapes, international trade policies, and cross-border relations can directly affect the availability of digital content creation tools and platforms, as well as the distribution and consumption of digital content across borders.

For instance, trade disputes may lead to increased tariffs on technology imports, raising the costs of content creation software and hardware for creators. Geopolitical instability can also disrupt global supply chains, affecting the production and availability of electronic devices used for content consumption. These factors collectively can lead to a fragmented digital content market, posing challenges for content creators aiming for a global audience and necessitating adaptable strategies to navigate varying regulatory and market conditions.

Recession Impact Analysis

Economic downturns or recessions have a dual impact on the Global Digital Content Creation Market. On one hand, recessions can lead to reduced marketing budgets and lower spending on content creation tools and platforms, as businesses and individuals prioritize essential expenditures. This can slow the growth of the digital content market.

On the other hand, recessions can lead to an increase in content consumption, as individuals spend more time online seeking information and educational content during periods of economic uncertainty. This can present opportunities for content creators to capture a larger audience, especially for those able to produce cost-effective, high-value content that meets the changing needs and interests of consumers. Moreover, recessions can drive innovation in content creation and distribution, as creators seek more efficient ways to produce and monetize their content amidst financial constraints.

5 Top Use Cases

- Marketing and Branding: Digital content creation is integral for developing compelling marketing strategies that include social media campaigns, email marketing, and targeted advertisements, helping to enhance brand awareness and customer engagement.

- Sales Enablement: Creating engaging presentations, product demos, and detailed case studies can empower sales teams by providing them with tools to effectively communicate value propositions to potential buyers.

- Human Resources: Digital content is used to streamline onboarding processes through engaging training materials and to foster a strong company culture via internal communications.

- Corporate Communications: It plays a critical role in managing stakeholder relationships through regular updates and reports that keep the internal and external stakeholders informed.

- Customer Service and Support: Building comprehensive FAQ sections, creating instructional content, and providing real-time updates can enhance customer service experiences and support.

Business Benefits

- Increased Engagement: Utilizing AI and advanced tools to create targeted and personalized content can significantly increase user engagement and drive more interactions.

- Enhanced Efficiency: AI-powered content creation tools automate and streamline the content production process, reducing the time and resources required for content development.

- Improved SEO and Web Traffic: Digital content optimized for SEO can enhance visibility on search engines, driving more organic traffic to websites.

- Cost-Effectiveness: AI tools help in minimizing the costs associated with content creation by automating repetitive tasks and leveraging data to produce content at scale.

- Better Content Quality and Consistency: AI can maintain a consistent brand voice across all content types and platforms, ensuring high-quality content that resonates with the audience.

- Data-Driven Insights: AI-driven analytics tools provide valuable insights into content performance, enabling businesses to refine strategies and maximize content effectiveness.

Key Players Analysis

The competitive landscape of the Global Digital Content Creation Market is highly dynamic, characterized by the presence of both established players and emerging startups. Major technology companies dominate the market, offering comprehensive suites of content creation tools, platforms, and analytics services. These key players invest significantly in research and development to introduce innovative features and maintain a competitive edge, such as AI-driven content personalization and analytics tools.

On the other hand, niche startups are disrupting the market by focusing on specific segments of content creation, such as mobile content creation apps, video editing software, and AR/VR content platforms. These startups often leverage innovative technologies to meet the changing needs of digital creators.

The market is also witnessing collaborations and partnerships among content creation platforms to offer end to end content solutions. Overall, the competitive landscape is shaped by technological innovation, strategic partnerships, and the increasing value placed on engaging and high-quality digital content.

Top Key Players in Market

- Adobe Inc.

- Google LLC

- Autodesk, Inc.

- Microsoft Corporation

- Acrolinx GmbH

- Integra Software Services Pvt. Ltd.

- Quark Software, Inc.

- MarketMuse, Inc.

- Aptara, Inc.

Recent Development

- Quark Software launched “QuarkXPress 2024” in January 2024, featuring advanced typography tools, enhanced PDF accessibility options, and improved collaboration features to streamline the digital content creation process for designers and publishers.

- In March 2024, MarketMuse secured a $10 million Series B funding round to expand its AI-driven content strategy platform. This investment will help further develop its technology for optimizing digital content creation and marketing.

- Microsoft unveiled several enhancements in its digital content creation tools integrated within Microsoft 365 in 2023. These updates focus on AI-powered features that improve content creation and management, such as AI-driven writing assistance and smart content suggestions.

- In May 2023, Google launched its AI-powered image generation tool, “Imagen,” which allows users to create high-quality images from text descriptions. This tool is part of Google’s ongoing efforts to integrate advanced AI into their suite of content creation tools.

- Autodesk acquired Moxion, a cloud-based platform for digital dailies, in February 2023. This acquisition aims to enhance Autodesk’s media and entertainment portfolio by integrating Moxion’s technology into its existing software solutions, improving the efficiency of content creation and review processes.

- Acrolinx announced the release of its latest AI-driven content alignment platform in April 2023. This update includes advanced features for ensuring consistent and inclusive language across large volumes of content, catering to the growing need for high-quality, brand-aligned digital content.

- In June 2023, Integra Software Services partnered with a leading educational publisher to provide enhanced digital content creation and management services, aiming to streamline the production of educational materials globally.

Report Scope

Report Features Description Market Value (2023) USD 27.1 Bn Forecast Revenue (2033) USD 90.4 Bn CAGR (2024-2033) 25.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Tools and Services), By Deployment Mode (Cloud-Based and On-Premise), By Content Type (Video, Textual, Graphical, and Audio), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By End-Use Industry Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Google LLC, Autodesk Inc., Microsoft Corporation, Acrolinx GmbH, Integra Software Services Pvt. Ltd., Quark Software Inc., MarketMuse Inc., Aptara Inc., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Digital Content Creation (DCC)?Digital Content Creation (DCC) refers to the process of generating digital media content, such as images, videos, animations, audio, and text, using various software tools and technologies.

How big is Digital Content Creation Market?The Global Digital Content Creation Market size is expected to be worth around USD 90.4 Billion by 2033, from USD 27.1 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

What are the major trends driving the Digital Content Creation Market?Some major trends driving the Digital Content Creation Market include the increasing demand for immersive content (e.g., virtual reality, augmented reality), the rise of user-generated content, and the adoption of artificial intelligence (AI) and machine learning (ML) in content creation.

What are the challenges faced by the Digital Content Creation Market?Some challenges faced by the Digital Content Creation Market include the need for continuous innovation to keep up with changing consumer preferences, the high cost of software tools and hardware, and the increasing competition in the market.

Who are the key players in the Digital Content Creation Market?Adobe Inc., Google LLC, Autodesk Inc., Microsoft Corporation, Acrolinx GmbH, Integra Software Services Pvt. Ltd., Quark Software Inc., MarketMuse Inc., Aptara Inc.,

What are the factors driving the growth of the Digital Content Creation Market?Some factors driving the growth of the Digital Content Creation Market include the increasing use of digital content in marketing and advertising, the growing popularity of social media platforms, and the rising demand for high-quality content.

Digital Content Creation MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Content Creation MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Google LLC

- Autodesk, Inc.

- Microsoft Corporation

- Acrolinx GmbH

- Integra Software Services Pvt. Ltd.

- Quark Software, Inc.

- MarketMuse, Inc.

- Aptara, Inc.