Global Digital Camera Market Size, Share, Statistics Analysis Report By Lens (Built-in, Interchangeable), By Product (Compact Digital Camera, DSLR, Mirrorless), By End-use (Pro Photographers, Prosumers, Hobbyists), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 108970

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

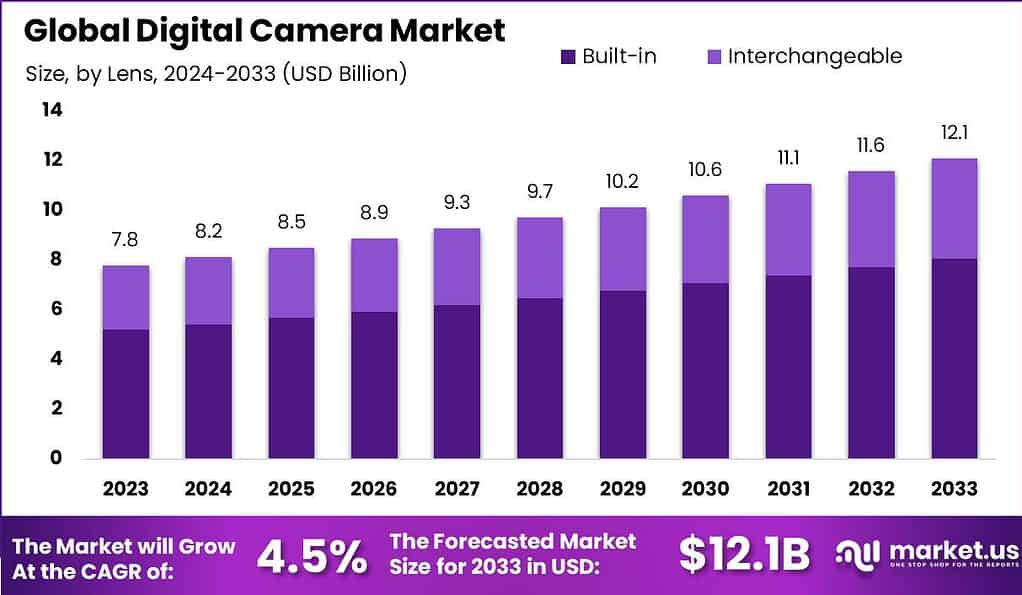

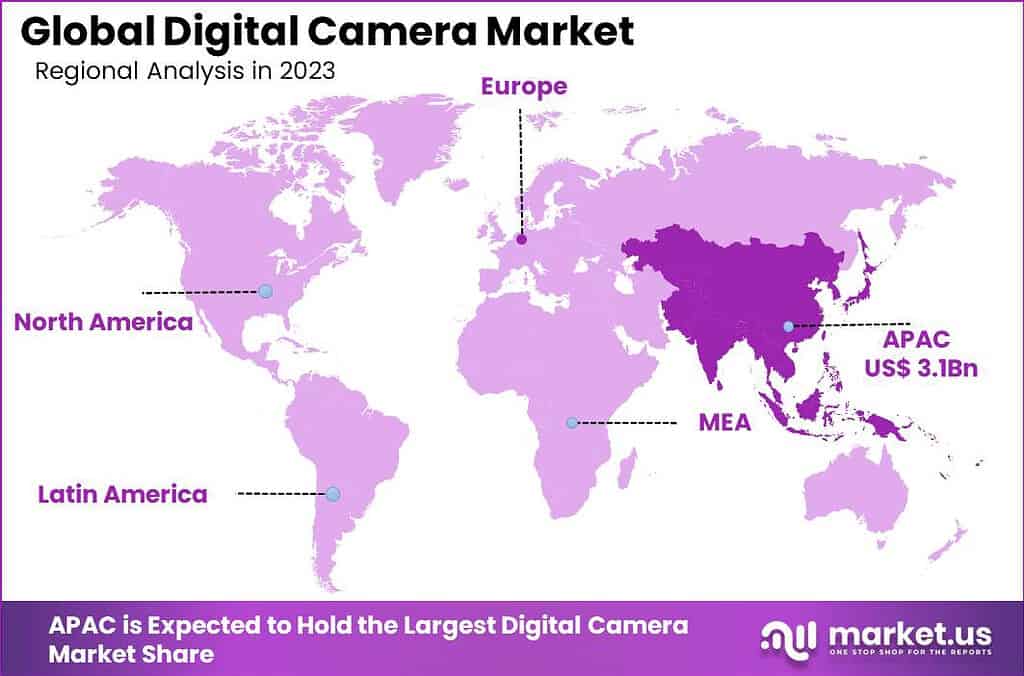

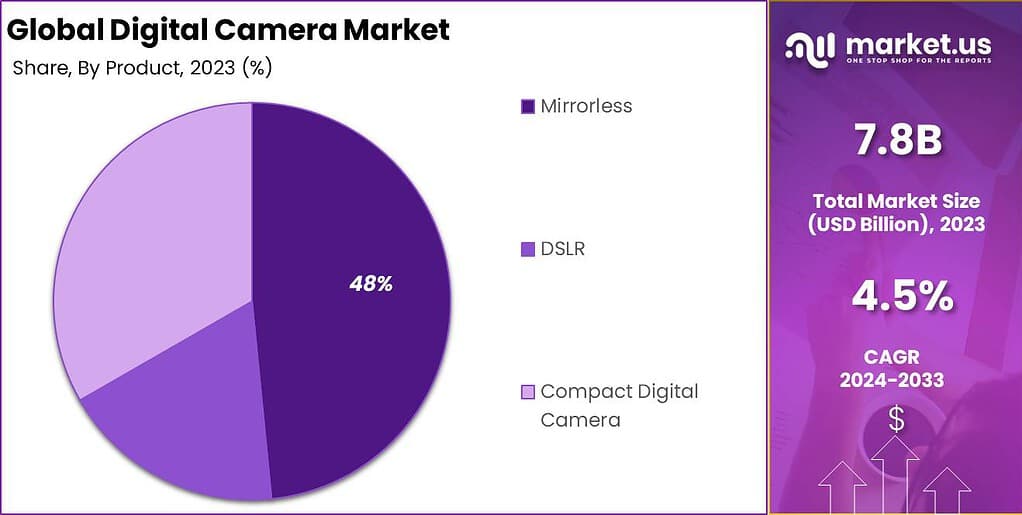

The Global Digital Camera Market size is expected to be worth around USD 12.1 Billion By 2033, from USD 7.8 billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 40.2% share, holding USD 3.1 Billion revenue.

A digital camera is a device that captures photographs and stores them as digital data rather than using photographic film like traditional cameras. These cameras use a digital optical system, comprising lenses and a digital sensor, to capture the light and color of an image and convert it into digital pixel data that can be stored on memory cards.

The digital camera market, once booming, has seen a shift due to the rise of smartphones with high-quality integrated cameras. However, dedicated digital cameras still hold a niche due to their superior image quality, versatility with interchangeable lenses, and better performance in conditions such as low light or fast action that smartphone cameras often struggle with.

The market for these cameras remains significant among professionals and enthusiasts who demand higher quality and performance than what current smartphones can provide. The digital camera market is primarily driven by the continuous innovations in technology that improve picture quality, battery life, storage capacity, and camera features. Advancements such as high-resolution sensors, optical zoom capabilities, and image stabilization features attract both amateur and professional photographers.

Additionally, the growing popularity of photography as a hobby, coupled with the increasing number of photography courses and social media platforms that encourage photo sharing, contribute significantly to the demand for digital cameras. Market demand for digital cameras is sustained by niche segments that value specific camera functionalities which smartphones cannot provide, such as advanced settings control, optical zoom, and accessory options.

Despite the decline in general consumer demand due to the convenience of smartphones, there is robust demand in professional, educational, and high-end consumer markets. These segments appreciate the enhanced control over photo composition, ability to handle diverse lighting situations, and the higher image quality offered by digital cameras.

For instance, In September 2023, FUJIFILM introduced the GFX100 II, a significant addition to its line of mirrorless digital cameras. This new model boasts a 102-megapixel high-speed image sensor paired with Fujifilm’s advanced 5th generation X-Processor 5, enhancing various aspects of photography and videography. The GFX100 II enhances the user experience with high-speed, continuous shutter mode capabilities, reaching up to 8 frames per second, a substantial increase from its predecessors.

Technological advancements are key in shaping the future of the digital camera market. Innovations like mirrorless cameras which offer the quality of DSLR cameras but in a more compact and lighter form factor are becoming popular. Improvements in sensor technology, autofocus speeds, and image processing software continue to enhance the functionality and appeal of digital cameras.

According to petapixel, only about 48.6% of households in Japan own a digital camera, indicating a significant decline in traditional camera ownership. This trend is reflective of the broader global market, where digital camera ownership is also reported to be decreasing. The shift can largely be attributed to the widespread adoption of smartphones, which incorporate increasingly advanced photographic capabilities.

Connectivity features such as Wi-Fi and Bluetooth for easy sharing and control are also becoming standard, aligning digital cameras more closely with the connectivity demands of modern technology users. Opportunities in the digital camera market are significant in areas such as travel photography, sports, and wildlife photography where the capabilities of a digital camera are essential.

Additionally, the increasing interest in videography, vlogging, and content creation for platforms like YouTube also presents new opportunities. Manufacturers focusing on niche markets and specialized photography equipment can leverage these trends to cater to a dedicated customer base looking for high-performance cameras.

Key Takeaways

- The global digital camera market is poised for steady growth. In 2023, the market size was valued at USD 7.8 billion and is expected to rise to approximately USD 12.1 billion by 2033. This growth reflects a compound annual growth rate (CAGR) of 4.5% from 2024 to 2033.

- In terms of regional dominance, the Asia-Pacific (APAC) region held the largest share of the market in 2023. With a revenue of USD 3.1 billion, it accounted for over 40.2% of the total market.

- Looking at product types, the built-in lens segment led the market in 2023, securing a substantial 66.7% market share. This segment includes cameras that have non-interchangeable lenses.

- In the technology division, mirrorless cameras captured a significant portion of the market in 2023, with more than 48% of the market share. These cameras are favored for their compact size and lighter weight compared to traditional DSLR cameras.

- Professionals, particularly pro photographers, continue to be a key demographic for the digital camera market. In 2023, this segment maintained a strong market presence, underscoring the ongoing demand among professional photographers for high-quality imaging tools.

APAC Digital Camera Market Size

In 2023, the Asia-Pacific (APAC) region held a dominant market position in the digital camera market, capturing more than a 40.2% share and generating revenue of USD 3.1 billion. This leading position can be attributed to several key factors that are unique to the APAC region.

Firstly, the presence of major digital camera manufacturers in countries like Japan and South Korea has driven innovation and accessibility in the region. These countries are home to industry giants such as Nikon, Canon, and Sony, whose advancements in camera technology frequently set global trends.

Additionally, the APAC region has witnessed a surge in demand for digital cameras due to the increasing popularity of photography as a hobby and profession. This is coupled with rising disposable incomes in rapidly developing economies such as China and India, where consumers are more willing to invest in high-quality photography equipment.

The region’s expanding middle class is particularly keen on adopting the latest technologies, including high-end digital cameras for personal and professional use. Furthermore, the APAC region benefits from strong governmental support for technology and export, with numerous incentives for companies engaging in technological advancements and international trade.

This supportive environment fosters growth and innovation within the digital camera industry. Moreover, the cultural emphasis on capturing and preserving memories through travel and festivals in many APAC countries boosts the demand for digital cameras, sustaining the region’s dominant position in the global market.

Lens Type Analysis

In 2023, the built-in lens segment of the digital camera market held a dominant position, capturing more than a 66.7% market share. This significant market share can be attributed to several factors that appeal to a broad consumer base, particularly those prioritizing convenience, affordability, and ease of use.

Built-in lens cameras, often referred to as point-and-shoot cameras, offer simplicity that attracts casual photographers and the general public. These cameras are compact, easy to operate, and typically more affordable than their interchangeable lens counterparts, making them an attractive option for everyday photography.

The dominance of the built-in lens segment is further reinforced by the continuous improvements in image quality and features such as optical zoom and image stabilization, which have enhanced the appeal of these cameras despite the competitive pressure from smartphones.

Although smartphones continue to encroach on the lower end of the digital camera market, built-in lens cameras maintain relevance through dedicated features that enhance ergonomics and functionality, providing a superior photographic experience compared to phone cameras.

Moreover, built-in lens cameras benefit from their appeal to specific market segments, including travelers and families, who appreciate the ability to capture high-quality images without the need to carry additional lenses or photography equipment. The convenience of having a single, all-encompassing device that fits easily into a pocket or bag continues to drive consumer preference for built-in lens cameras.

Despite facing significant competition, the built-in lens camera segment’s sustained market share highlights its ongoing relevance to consumers who value simplicity and effectiveness in their photography devices, alongside the technological advancements that keep these cameras competitive in terms of image quality and user-friendly features.

Product Type Analysis

In 2023, the mirrorless segment of the digital camera market held a dominant position, capturing more than a 48% market share. This prominence is largely due to the technological advancements that mirrorless cameras have undergone, which have significantly enhanced their appeal to both professional photographers and photography enthusiasts.

Mirrorless cameras offer a lighter, more compact alternative to traditional DSLRs, without sacrificing image quality. These cameras are equipped with electronic viewfinders and lack the mirror mechanism of DSLRs, which allows for faster shooting speeds and reduced camera shake.

The growth in the mirrorless camera segment can also be attributed to their improved autofocus capabilities, which are particularly effective in video mode, making them highly suitable for vloggers and professional filmmakers. Additionally, many mirrorless models now offer features that were once exclusive to high-end DSLRs, such as 4K video recording and advanced image stabilization, making them an even more attractive option.

Furthermore, the industry has seen a significant shift as consumers and professionals move towards cameras that offer both high performance and portability. Manufacturers have responded by expanding their mirrorless product lines and offering a wider range of lenses and accessories, which has helped to solidify the market position of mirrorless cameras.

End Use Analysis

In 2023, the pro photographers segment held a dominant market position in the digital camera market, capturing a significant share. This segment’s strong performance can be attributed to several factors that align with the needs and demands of professional photographers.

Firstly, pro photographers require high-quality equipment that offers precision, versatility, and durability to handle various shooting environments and conditions. Cameras targeted at this segment typically feature high resolution, superior low-light performance, and robust build quality, making them suitable for professional use in fields such as sports, journalism, and fashion photography.

Moreover, the demand within this segment is driven by the ongoing professional need for cameras that can deliver exceptional image quality with fast autofocus systems and high dynamic range capabilities. These features are crucial for professionals who often work in fast-paced or challenging conditions and need reliable equipment that can capture sharp, detailed images under various lighting scenarios.

Additionally, the market for professional photographers continues to expand with the growth of digital marketing and content creation, where high-quality visuals are essential. As brands and businesses increasingly rely on visual content to engage audiences, professional photographers are sought after for their expertise, thereby driving the demand for high-end digital cameras.

The pro photographers segment benefits from the continuous technological advancements in camera technology, including mirrorless models that combine the lightweight design with powerful imaging capabilities, appealing to professionals looking for lighter, more agile equipment. This ongoing innovation helps sustain the segment’s growth and dominance in the digital camera market.

Key Market Segments

Lens Type

- Built-in

- Interchangeable

Product Type

- Compact Digital Camera

- DSLR

- Mirrorless

End Use

- Pro Photographers

- Prosumers

- Hobbyists

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Technological Advancements and Increased Social Media Engagement

One of the primary drivers propelling the digital camera market forward is the significant advancement in camera technology, especially in terms of image sensors and connectivity features. Innovations such as higher resolution sensors and faster autofocus systems are increasingly enticing both amateur and professional photographers to upgrade their equipment.

This technological progression is matched by a growing interest in photography as a hobby, further stimulated by the ubiquity of social media platforms. As users seek to produce and share high-quality visual content online, the demand for digital cameras with professional-grade capabilities continues to rise.

The market’s growth is supported by the availability of a variety of camera models across different price points, catering to a wide range of consumers. This trend suggests a robust competitive landscape where manufacturers are continuously innovating to meet consumer expectations and enhance their market presence.

Restraint

High Competition from Smartphone Cameras

Despite the growth, the digital camera market faces significant challenges, particularly from the proliferation of advanced smartphone cameras. These smartphones offer increasingly high-quality cameras that satisfy the casual photography needs of most consumers, posing a substantial threat to traditional digital camera sales.

The convenience of smartphones, combined with their multifunctional capabilities, makes them a more appealing option for many consumers, especially those who prefer not to carry multiple devices. This shift has forced traditional camera manufacturers to focus more on niche markets and innovate beyond the capabilities of smartphones to retain their customer base.

Opportunity

Expansion into Emerging Markets and Technological Integration

The digital camera market is presented with extensive opportunities, particularly in emerging markets where the penetration of professional-grade cameras is still evolving. As economic conditions improve in these regions, a surge in disposable income could lead to increased consumer spending on luxury and hobbyist items, including high-end cameras.

Additionally, integrating cameras with newer technologies such as artificial intelligence for improved scene and object recognition, and augmented reality features for creative photography, presents a significant growth opportunity. These innovations can attract a tech-savvy demographic looking for devices that offer more than just basic functionalities.

Challenge

Maintaining Innovation Pace with High Production Costs

A major challenge facing the digital camera industry is the need to balance the pace of technological innovation with the associated high production costs. Advanced features such as improved sensor technology, enhanced connectivity options, and sophisticated image processing algorithms are essential for staying competitive.

However, these features come at a high cost in terms of research, development, and manufacturing, impacting the overall profitability of camera manufacturers. Moreover, the global supply chain volatility, particularly in semiconductor manufacturing, continues to pose risks to steady production and pricing strategies, making it difficult for companies to plan long-term investments and product launches.

Growth Factors

The digital camera market is significantly driven by the continuous advancements in technology that cater to a diverse range of consumer needs, from casual photography enthusiasts to professional photographers. One key driver is the escalating demand for high-quality imaging for both personal use and professional content creation. This demand is particularly strong in sectors such as media, advertising, and social media content production, where visual quality can directly influence audience engagement and brand perception.

Moreover, innovations such as mirrorless cameras have revitalized the market by offering superior image quality, reduced camera shake, and higher speeds of image processing, appealing especially to professionals and hobbyists looking for compact and efficient alternatives to traditional DSLRs. The growth is also supported by increasing disposable incomes in developing regions, allowing more consumers to invest in advanced photographic equipment.

Emerging Trends

A notable trend in the digital camera market is the rise of mirrorless cameras, which are increasingly favored over traditional DSLRs due to their lighter weight, more compact size, and faster performance. These cameras are becoming popular not just among professionals but also among amateur photographers who appreciate the ability to change lenses and access various photography styles without the bulk and heft of a DSLR.

Additionally, the integration of artificial intelligence in cameras for features such as autofocus, facial recognition, and enhanced image processing is setting new standards in the market. This technological integration is making cameras smarter, thereby enhancing the photography experience by making it easier to capture high-quality images in a variety of settings.

Business Benefits

Digital cameras continue to offer substantial benefits for businesses, particularly in fields like real estate, where high-quality images are crucial for sales. In industries such as fashion, sports, and event management, the ability to produce vivid, detailed photos can significantly impact customer satisfaction and business outcomes. Businesses are also leveraging advanced camera technologies to enhance their marketing materials and digital presentations, which are vital components of modern digital marketing strategies.

Furthermore, the adoption of digital cameras in commercial settings is being driven by their cost-effectiveness over time compared to traditional film cameras, with added benefits such as instant image review, lower long-term costs due to the lack of film, and reduced time spent in post-production.

Key Player Analysis

The digital camera market features a strong presence of established companies known for their innovations and comprehensive product offerings. Key players include Canon, Nikon, Sony, and Fujifilm, each holding significant market shares due to their reputations for quality and technological advancement.Recent Development

- In October 2024, Canon introduced the RF-S7.8mm F4 STM Dual lens, an affordable option for creators producing 3D VR content. Designed for the EOS R7 camera, it is compatible with headsets like Meta Quest 3 and Apple Vision Pro. The lens is priced at $449.99 and became available in November 2024.

- In July 2024, Leica Camera AG launched the Leica D-Lux 8, embodying the brand’s commitment to superior design and functionality. This compact camera enhances the photographic experience with its intuitive controls and user-friendly interface. The D-Lux 8 features an optimized button layout and ergonomically designed controls, making it highly accessible for photographers of all skill levels.

- In March 2024, Nikon Corporation acquired Red Digital Cinema, a U.S.-based cinema camera manufacturer, aiming to expand into the digital cinema camera market. The acquisition was completed in April 2024.

Report Scope

Report Features Description Market Value (2023) USD 7.8 billion Forecast Revenue (2033) USD 12.1 Billion CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Lens (Built-in, Interchangeable), By Product (Compact Digital Camera, DSLR, Mirrorless), By End-use (Pro Photographers, Prosumers, Hobbyists) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Canon Inc., Eastman Kodak Company, FUJIFILM Holdings Corporation, Leica Camera AG, Nikon Corporation, Olympus Corporation, OM Digital Solutions Corporation, Panasonic Corporation, Comp9RICOH IMAGING COMPANY LTD., SIGMA CORPORATION, Sony Corporation, Hasselblad Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Canon Inc.

- Eastman Kodak Company

- FUJIFILM Holdings Corporation

- Leica Camera AG

- Nikon Corporation

- Olympus Corporation

- OM Digital Solutions Corporation

- Panasonic Corporation

- Comp9RICOH IMAGING COMPANY, LTD.

- SIGMA CORPORATION

- Sony Corporation

- Hasselblad