Global Digital Asset Trading Platform Market Size, Share, Trends Analysis By Type (Traditional Cryptocurrency Exchanges, Direct Trading Platforms, Cryptocurrency Brokers), By Application (Public traded funds, Private buy-and-hold funds, Hedge Funds), By End-User (Individuals, Institutions/Businesses), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 131952

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Digital Asset Trading Platform Market size is expected to be worth around USD 33.5 Billion by 2033, from USD 12.0 Billion in 2023, growing at a CAGR of 10.7% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 36.3% share, holding USD 4.3 Billion revenue.

A digital asset trading platform facilitates the buying, selling, and exchanging of digital assets, which include cryptocurrencies like Bitcoin and Ethereum, non-fungible tokens (NFTs), and other tokenized assets. These platforms are built on blockchain technology, which ensures the security and integrity of transactions by distributing transaction data across multiple locations. Users of these platforms typically need a digital wallet to manage and store their assets securely.

The digital asset trading platform market has seen significant growth, driven by the increasing popularity of digital assets as investment opportunities and the expanding use of blockchain technology in financial services. Major factors fueling this market include the rise of decentralized finance (DeFi), which offers a non-centralized trading experience, and the increasing recognition of digital assets as legitimate holdings for both individual investors and institutions.

Technological advancements are also pivotal in this sector, enhancing the security and efficiency of trading platforms. Innovations such as improved blockchain protocols, faster transaction speeds, and more user-friendly interfaces help in attracting a broader user base. Furthermore, regulatory advancements are helping to integrate digital asset markets into the traditional financial landscape, providing clearer frameworks for operations and fostering trust among new users.

There is a strong and growing demand for digital asset trading platforms that offer enhanced security, user-friendly interfaces, and advanced trading features. This demand is fueled by the rising number of digital asset traders and the growing complexity of the digital asset markets, which require sophisticated trading and analytical tools to navigate effectively.

The market sees significant opportunities in technological advancements, regulatory advancements, and the integration of traditional financial services with digital asset trading. New technologies like decentralized finance (DeFi) and improvements in blockchain infrastructure are creating more secure and efficient trading platforms, thereby opening new avenues for market growth.

Retail interest in digital assets has witnessed remarkable growth, with potential investors surging from 3% in 2021 to 23% in 2024, according to recent findings from Roland Berger. This upward trend reflects a significant shift in the retail market, signaling broader acceptance and confidence in digital assets as viable investments.

One of the primary drivers of this trend is the advancement in legislation. Nearly 70% of key countries have now established clear regulatory frameworks for digital assets, a development that has substantially lowered investment uncertainties. These regulations foster a sense of security for investors, reducing the ambiguity around digital asset transactions and enabling safer, more predictable engagement with digital currencies and tokenized assets.

The market potential is substantial. Forecasts suggest that tokenized real-world assets could reach a staggering valuation of approximately $10.9 trillion by 2030. Tokenization, by enabling fractional ownership and simplified transactions, is set to enhance liquidity in traditionally illiquid asset classes. This shift not only democratizes access to assets like real estate and fine art but also drives greater market efficiency and reach.

Key Takeaways

- The Global Digital Asset Trading Platform Market is projected to grow substantially, from USD 12.0 Billion in 2023 to an impressive USD 33.5 Billion by 2033, achieving a CAGR of 10.7% during the forecast period (2024-2033).

- In 2023, North America led the market, securing a dominant position with a 36.3% market share and generating USD 4.3 Billion in revenue. This leadership is attributed to robust regulatory frameworks and widespread adoption of digital assets in the region.

- Among the various types of platforms, Traditional Cryptocurrency Exchanges took the forefront in 2023, holding over 54% of the market share. This segment’s dominance reflects the strong user base and established trust in well-known exchange platforms.

- The Public Traded Funds (PTF) segment also played a significant role, capturing more than 43% of the market in 2023. Publicly traded funds have become an attractive option for investors seeking regulated and structured avenues for digital asset trading.

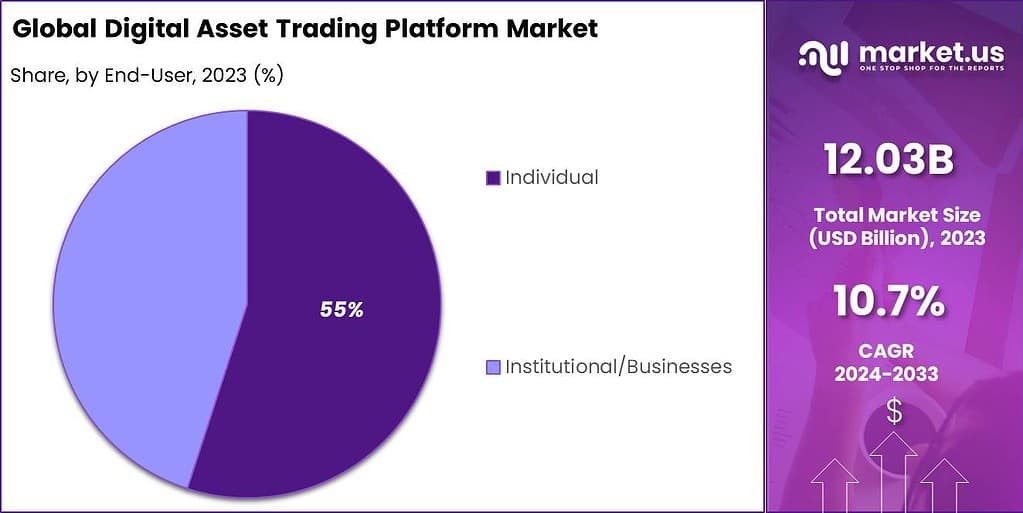

- Finally, the Individual segment emerged as the largest user base in 2023, holding over 55% of the market share. This is driven by growing individual interest in digital assets, as more people seek alternative investment opportunities and greater financial independence.

Type Analysis

In 2023, the Traditional Cryptocurrency Exchanges segment held a dominant market position, capturing more than a 54% share. This segment’s supremacy can be attributed to several compelling factors. Firstly, traditional cryptocurrency exchanges offer a high level of liquidity, ensuring that large volumes of transactions can be executed quickly without a significant impact on the market price.

This feature is particularly valued by both individual and institutional traders who require rapid execution to capitalize on market opportunities. Furthermore, these platforms tend to offer a broad array of cryptocurrencies, providing traders and investors with a diverse range of assets to trade. This diversity appeals to a wide audience, from beginners seeking to invest in mainstream cryptocurrencies like Bitcoin and Ethereum to experienced traders exploring more obscure altcoins.

Another major advantage is the level of regulatory compliance and security measures that traditional exchanges maintain. This regulatory adherence fosters a trustworthy environment for users, protecting against fraud and theft, which are significant risks in less regulated segments of the cryptocurrency market.

Additionally, traditional exchanges often provide more sophisticated trading features such as futures and margin trading, appealing to professional traders looking for advanced trading tools. These platforms integrate complex charting tools, a variety of order types, and sometimes even options for algorithmic trading, which are indispensable for conducting detailed market analysis and executing strategic trades efficiently.

Despite these strengths, the dominance of traditional exchanges also faces challenges such as regulatory uncertainty, which can impact their operation and the scope of services offered. Moreover, the segment competes with emerging decentralized platforms that offer advantages in terms of user autonomy and potentially lower fees. However, for many users, the benefits of robust security, diverse offerings, and high liquidity continue to make traditional cryptocurrency exchanges a cornerstone of the digital asset trading landscape

Application Analysis

In 2023, the Public Traded Funds segment in the Digital Asset Trading Platform market held a dominant position, capturing more than a 43% share. This segment’s leading position is largely due to the significant liquidity and market depth it offers, making it an attractive option for a wide range of investors, from retail to institutional.

Public traded funds in digital assets, such as Bitcoin ETFs, provide investors with an opportunity to gain exposure to digital assets without the complexities of direct ownership, like managing cryptographic keys and dealing with the technical nuances of digital wallets. These funds are often seen as more secure and less volatile than direct investments in cryptocurrencies.

They offer the advantage of being traded on traditional exchanges, making them accessible to a broader investor base who may be familiar with ETFs but not with direct cryptocurrency trading platforms. The regulated nature of these funds also adds a layer of security and compliance, which is appealing given the regulatory scrutiny surrounding direct cryptocurrency investments.

Moreover, the integration of these funds into traditional finance and investment portfolios has been facilitated by the increasing recognition of digital assets as a legitimate asset class by financial authorities worldwide. This recognition has encouraged more institutional investors to enter the market, further bolstering the dominance of public traded funds within the digital asset space.

The growth and appeal of this segment are underscored by the broader market acceptance and the burgeoning infrastructure of the digital asset trading platforms that support these funds. These platforms have evolved to offer more robust, secure, and user-friendly trading experiences, which has also supported the growth and dominance of public traded funds in the digital asset market

End-User Analysis

In 2023, the Individual segment of the Digital Asset Trading Platform market held a significant lead, capturing more than a 55% market share. This dominance can be attributed primarily to the increased accessibility and user-friendliness of digital asset platforms that cater to individual investors.

These platforms have simplified the trading process, making it easier for non-professional traders to participate in the digital asset market. Additionally, the proliferation of mobile trading applications has significantly contributed to this trend, as they allow individual users to trade digital assets conveniently from anywhere, further driving user engagement and market participation.

The growth in the Individual segment is also supported by the broader acceptance of digital assets among the general public. As digital assets become more mainstream, there is a noticeable increase in the number of individuals looking to diversify their personal investment portfolios with cryptocurrencies and other digital assets. This trend is bolstered by educational resources and tools that help demystify digital asset trading for beginners, making it more accessible to a wider audience.

Moreover, the regulatory landscape has been gradually evolving to provide a safer trading environment by addressing issues like fraud and market manipulation. This regulatory progress has helped in building trust among individual investors, encouraging more participants to enter the market. Despite these advancements, the market for individual traders remains highly volatile and speculative, underscoring the importance of cautious investment strategies within this segment.

Overall, the individual traders’ segment benefits from enhancements in trading technology, educational outreach, and regulatory improvements, making it the largest and most dynamic component of the digital asset trading platform market

Key Market Segments

By Type

- Traditional Cryptocurrency Exchanges

- Direct Trading Platforms

- Cryptocurrency Brokers

By Application

- Public Traded Funds

- Private buy-and-hold Funds

- Hedge Funds

By End-User

- Individual

- Institutional/Businesses

Driver

Increasing Institutional Investment

The growth of the digital asset trading platform market is significantly driven by the surge in institutional investments. As mainstream financial entities and high-net-worth individuals increasingly adopt digital assets, the demand for robust, secure, and compliant trading platforms has escalated.

These platforms facilitate the trading of diverse cryptocurrencies and digital assets, offering features that comply with regulatory standards to attract institutional investors. The entry of these large players not only injects substantial capital into the market but also enhances its legitimacy, stability, and growth prospects.

Restraint

Regulatory Challenges

One of the primary restraints facing the digital asset trading platform market is the evolving and often stringent regulatory environment. Governments and financial regulators worldwide are scrutinizing digital asset transactions to prevent money laundering, fraud, and other illicit activities.

This regulatory uncertainty can impede market growth as trading platforms must continuously adapt to new regulations, which can be costly and time-consuming. Moreover, the lack of uniform global regulatory standards creates a challenging environment for these platforms to operate internationally.

Opportunity

Technological Advancements and Decentralized Finance (DeFi)

Technological advancements present significant opportunities for the digital asset trading platform market. Innovations such as blockchain technology, smart contracts, and the rise of decentralized finance (DeFi) platforms allow for more secure, transparent, and efficient trading mechanisms.

These technologies reduce the need for intermediaries, lower transaction costs, and provide users with more control over their assets. As technology continues to evolve, trading platforms that incorporate these advancements can attract a broader user base by offering enhanced trading experiences and new financial products.

Challenge

Security Concerns

Despite advancements in technology, security remains a paramount challenge for digital asset trading platforms. High-profile hacks and security breaches have led to substantial financial losses for traders and platforms alike. The imperative to develop and maintain advanced security measures, such as multi-factor authentication and cold storage solutions, is crucial.

However, these measures entail significant investments and continuous updates to stay ahead of cyber threats. Ensuring robust security is essential for maintaining user trust and the overall integrity of the trading platform.

Growth Factors

The Digital Asset Trading Platform market is anticipated to experience significant growth due to several key factors. The increasing adoption of digital assets as legitimate financial instruments is a major driver. As traditional financial markets show interest in digital currencies, platforms that offer robust, secure, and comprehensive trading ecosystems are becoming essential.

This is further supported by technological advancements that improve platform functionalities, such as enhanced transaction speeds and security measures, appealing to a broader spectrum of individual and institutional investors

Moreover, government and regulatory bodies are beginning to establish clearer guidelines for digital asset trading, which helps reduce market volatility and increases user trust. Initiatives to formalize the market through regulations not only help in mitigating the risks associated with digital asset trading but also foster a more secure trading environment, encouraging further adoption.

The integration of new technologies, like blockchain and decentralized finance (DeFi) applications, into trading platforms, also catalyzes market growth. These technologies offer improved transparency, reduced costs, and increased efficiency, making digital asset platforms more attractive to users. As these technologies become more mainstream, they could potentially redefine the boundaries of traditional financial trading systems.

Emerging Trends

Emerging trends that are shaping the digital asset trading platform market include the rise of decentralized exchanges (DEXs) and increased tokenization of real-world assets. DEXs operate without a central authority, offering peer-to-peer trading environments that enhance privacy and reduce counterparty risks. This trend is gaining traction as users seek more control over their trading operations and personal data.

Tokenization, the process of converting rights to an asset into a digital token on a blockchain, is another significant trend. It is expanding beyond cryptocurrencies to include a wide range of assets like real estate, art, and commodities, providing liquidity and making these markets accessible to a broader audience. This not only enhances market efficiency but also opens up new investment opportunities for traders and investors.

Moreover, the development of mobile trading solutions is on the rise, driven by the increasing use of smartphones and tablets. Mobile platforms are making trading more accessible, allowing users to manage their investments and trade on-the-go. This convenience is likely to attract more participants to the digital asset markets, further increasing market growth and dynamism.

Regional Analysis

In 2023, North America held a dominant market position in the Digital Asset Trading Platform Market, capturing more than a 36.3% share with revenues reaching USD 4.3 billion. This leading position can be attributed to several key factors that uniquely position North America at the forefront of the digital asset revolution.

Firstly, the region has a highly developed technological infrastructure, which is essential for the advancement and adoption of digital trading platforms. The availability of advanced IT infrastructure and widespread internet connectivity provides an ideal environment for digital asset trading platforms to operate and innovate.

Additionally, the presence of major technology hubs such as Silicon Valley contributes to ongoing technological advancements and the rapid adoption of new technologies. Secondly, North America benefits from a regulatory environment that, while complex, has begun to provide clearer guidelines and frameworks for digital assets and cryptocurrencies.

In the United States, for instance, regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have started to offer more definitive guidance on how digital assets fit into existing financial systems, which provides legal certainty and fosters growth in the sector.

Moreover, the region is home to some of the world’s largest and most influential financial markets and institutions, which have been increasingly integrating digital assets into their offerings. This includes major banks and investment funds incorporating cryptocurrencies into their portfolios and providing customers with related trading services.

The involvement of these established financial institutions promotes trust and validation of digital asset platforms, encouraging broader consumer and investor engagement. Finally, the entrepreneurial culture and investment climate in North America foster innovation in the digital asset space. There is significant venture capital available for startups in this sector, and many of the world’s leading digital asset trading platforms are headquartered in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The digital asset trading platform market has witnessed significant activity among leading companies, marked by strategic acquisitions, product innovations, and mergers. Binance has solidified its position as a market leader through strategic acquisitions and product diversification. In 2024, Binance acquired the crypto custody firm Metaco for $250 million, enhancing its custody infrastructure to better serve institutional clients.

Coinbase has focused on expanding its global footprint and enhancing its service offerings. In 2024, Coinbase acquired the London-based ETC Group, a move aimed at entering the European market and offering a wider range of digital asset products to European investors.This acquisition allows Coinbase to leverage ETC Group’s existing infrastructure and regulatory approvals, facilitating a smoother entry into the European market.

Robinhood has made significant strides in integrating advanced technologies and expanding its market presence. In July 2024, Robinhood acquired Pluto Capital, an AI-powered investment platform, to incorporate artificial intelligence tools into its trading app, enhancing data analysis and personalized investment strategies for its users.

Top Key Players in the Market

- Binance

- Coinbase

- Kraken

- Huobi Global

- OKEx

- Bitfinex

- Bittrex

- KuCoin

- FTX

- eToro

- Bitstamp

- Bybit

- Poloniex

- Other Key Players

Recent Developments

- In June 2024, Robinhood Markets announced its agreement to acquire European cryptocurrency exchange Bitstamp for approximately $200 million. This strategic move aims to enhance Robinhood’s cryptocurrency offerings and expand its international presence, leveraging Bitstamp’s extensive global licenses and customer base across Europe, Asia, and the U.S.

- In March 2024, Kraken’s institutional division introduced a cryptocurrency custody service in the United States, targeting traditional financial firms. Offered through Kraken Financial, a Wyoming-based chartered bank, this service addresses the growing institutional interest in crypto assets, particularly following the approval of spot Bitcoin ETF applications.

- In October 2024, Coinbase Global reported third-quarter earnings of $1.21 billion, slightly below analysts’ expectations. Concurrently, the company announced a $1 billion stock buyback program, reflecting confidence in its long-term growth prospects.

Report Scope

Report Features Description Market Value (2023) USD 12 Bn Forecast Revenue (2033) USD 33.5 Bn CAGR (2024-2033) 10.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Traditional Cryptocurrency Exchanges, Direct Trading Platforms, Cryptocurrency Brokers), By Application (Public traded funds, Private buy-and-hold funds, Hedge Funds), By End-User (Individuals, Institutions/Businesses) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Binance, Coinbase, Kraken, Huobi Global, OKEx, Bitfinex, Bittrex, KuCoin, FTX, eToro, Bitstamp, Bybit, Poloniex, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Asset Trading Platform MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Asset Trading Platform MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Binance

- Coinbase

- Kraken

- Huobi Global

- OKEx

- Bitfinex

- Bittrex

- KuCoin

- FTX

- eToro

- Bitstamp

- Bybit

- Poloniex

- Other Key Players