Global Dietary Supplements in an Age of Personalized Nutrition Market By Product Type (Vitamins, Minerals, Amino Acids, Herbal and Botanicals, and Other Product Types), By Product Form (Tablets/Capsules Powders, Liquids, and Other Product Forms), By Application (General Wellness Sports Nutrition, Immune Support, Skin Health, and Other Applications), By Distribution Channel (Offline Stores and Online Platform), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 64170

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

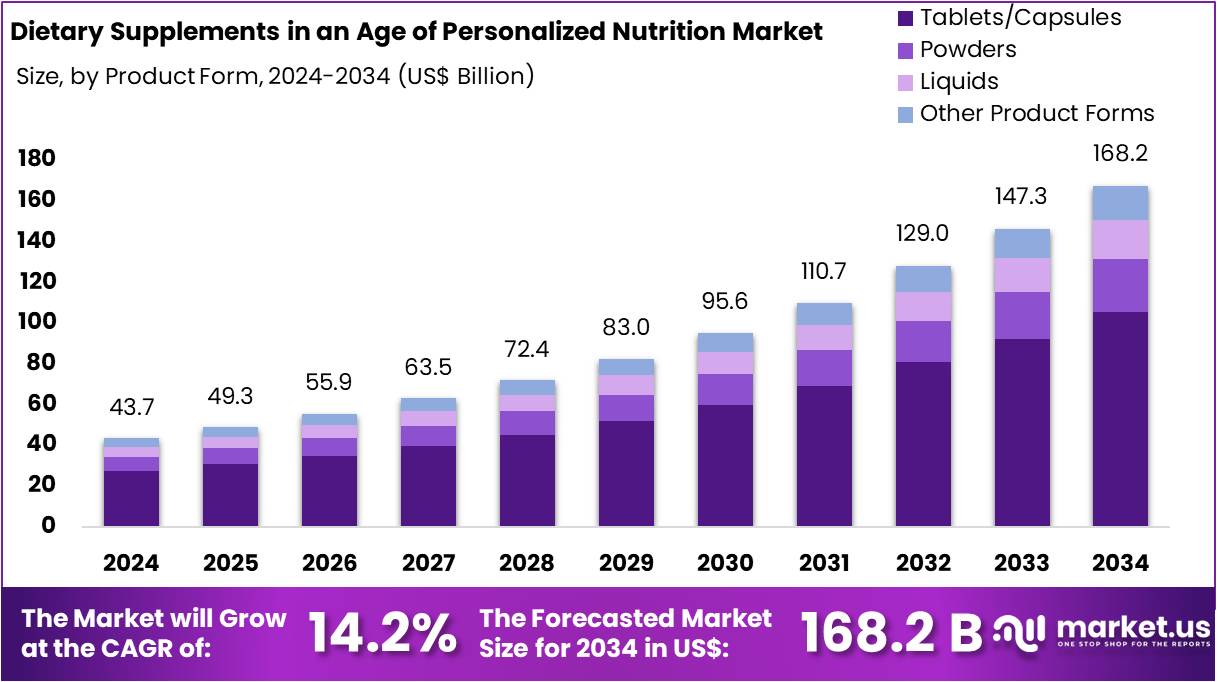

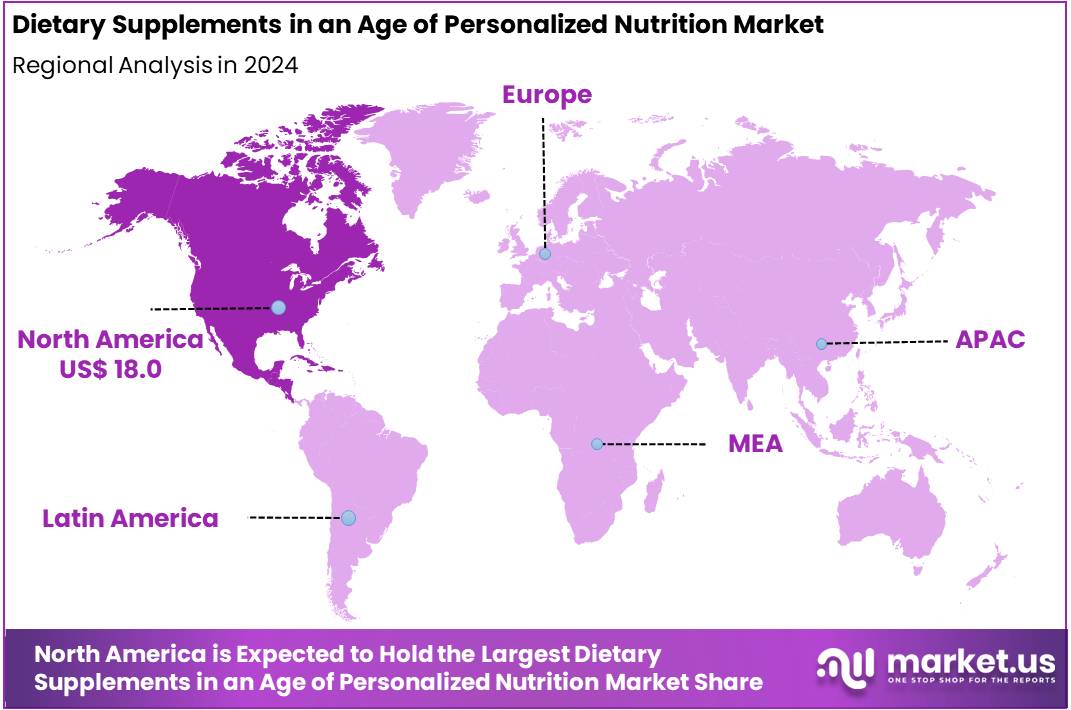

The Global Dietary Supplements in an Age of Personalized Nutrition Market size is expected to be worth around US$ 168.2 Billion by 2034, from US$ 43.7 Billion in 2024, growing at a CAGR of 14.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 41.3% share and holds US$ 18 Billion market value for the year.

Dietary supplements in the age of personalized nutrition is an industry focused on examining the role of dietary supplements in providing customized nutrition. Personalized nutrition refers to the area of nutrition that aims to deliver nutrition perfectly tailored to the needs of an individual. Also referred to as nutritional genomics and precision nutrition, this is a rapidly emerging area with a plethora of supporting research.

Personalized nutrition is a concept rooted in the belief that standardization of dietary needs is not enough to ensure adequate nutrition, instead, nutrition should be bespoke for it to be effective. By accounting for dietary preferences, restrictions, and nutritional requirements, it is possible to overcome poor nutrition. Moreover, factors such as metabolism, microbiome, cholesterol levels, and lifestyle habits are also taken into consideration.

Further, such nutrition also allows for the provision of better medical treatment for chronic diseases. Simply put, it is a type of diet that is focused on individual nutrition needs and caters to one individual only. Alternatively, dietary supplements assist in meeting the nutritional requirements that are not fulfilled by the diet. They contain active ingredients that supplement the diet to achieve enhancement of nutrition. They have become indispensable for meeting one’s nutritional needs in recent years.

Dietary Supplements in an Age of Personalized Nutrition Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 27.5 31.2 34.7 38.9 43.7 14.2% Key Takeaways

- The global dietary supplements in an age of personalized nutrition market was valued at USD 43.7 billion in 2024 and is anticipated to register substantial growth of USD 168.2 billion by 2034, with 14.2% CAGR.

- In 2024, the vitamins segment took the lead in the global market, securing 40.1% of the total revenue share.

- The tablets/capsules segment took the lead in the global market, securing 62.6% of the total revenue share.

- The general wellness segment took the lead in the global market, securing 36.4% of the total revenue share.

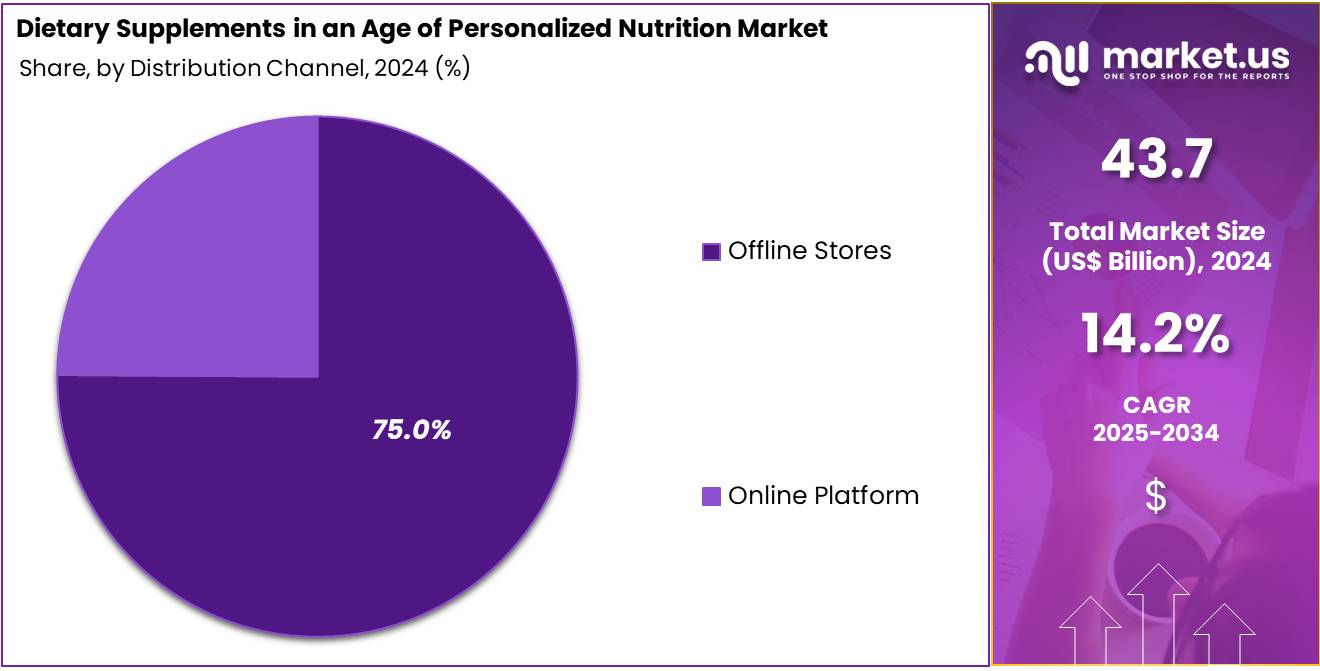

- The offline stores segment took the lead in the global market, securing 75.0% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 41.3% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into vitamins, minerals, amino acids, herbal and botanicals, and other product types. Amongst these, vitamins segment dominated the global dietary supplements in an age of personalized nutrition market capturing a significant market share of 40.1% in 2024. The vitamins segment has dominated the global dietary supplements in an age of personalized nutrition market, driven by increasing consumer awareness of the vital role vitamins play in overall health and wellness.

As consumers become more health-conscious and proactive about preventive care, there is a growing demand for personalized vitamin supplements tailored to individual health needs. Advances in genetic testing, lifestyle tracking, and AI-driven customization allow for the creation of personalized vitamin regimens, targeting specific deficiencies or health goals, such as boosting immunity, improving energy levels, or enhancing skin health.

Dietary Supplements in an Age of Personalized Nutrition Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Minerals 6.1 6.9 7.7 8.5 9.5 Vitamins 11.1 12.5 14.0 15.6 17.6 Amino Acids 2.0 2.3 2.6 2.9 3.3 Herbal and Botanicals 4.5 5.1 5.7 6.4 7.2 Other Product Types 3.8 4.3 4.8 5.4 6.1 Product Form Analysis

The market is fragmented by product form into tablets/capsules powders, liquids, and other product forms. Tablets/Capsules dominated the global dietary supplements in an age of personalized nutrition market capturing a significant market share of 62.6% in 2024, driven by their convenience, ease of use, and established consumer preference. These forms of supplements are widely recognized for their ability to deliver precise dosages, making them ideal for personalized nutrition plans that require exact nutrient combinations tailored to individual needs.

Tablets and capsules are also highly scalable for mass production, ensuring they can meet the growing demand for customized vitamin regimens. Additionally, their long shelf life, portability, and cost-effectiveness make them an attractive option for both consumers and manufacturers. As personalized nutrition continues to gain traction, the ability to integrate genetic testing, lifestyle data, and AI-driven recommendations into customized tablet and capsule formulations is enhancing their appeal.

Dietary Supplements in an Age of Personalized Nutrition Market, Product Form Analysis, 2020-2024 (US$ Billion)

Product Form 2020 2021 2022 2023 2024 Tablets/Capsules 17.2 19.5 21.7 24.4 27.4 Powder 5.7 6.4 7.2 8.0 9.0 Liquid 3.3 3.8 4.2 4.8 5.4 Other Product Forms 1.3 1.5 1.6 1.8 2.0 Tablets/Capsules 17.2 19.5 21.7 24.4 27.4 Application Analysis

The market is fragmented by application into general wellness sports nutrition, immune support, skin health, and other applications. General wellness dominated the global dietary supplements in an age of personalized nutrition market capturing a significant market share of 36.4% in 2024, driven by an increasing consumer focus on maintaining overall health and preventing disease rather than just addressing specific health conditions.

With growing awareness about the importance of balanced nutrition, consumers are seeking personalized supplements to support immune health, energy levels, mental well-being, and stress management. Advances in AI and genomics allow companies to offer customized wellness solutions that align with individual lifestyle factors, such as diet, exercise, and sleep patterns.

Dietary Supplements in an Age of Personalized Nutrition Market, Application Analysis, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 General Wellness 9.8 11.2 12.5 14.1 15.9 Sports Nutrition 5.6 6.3 7.0 7.8 8.8 Immune Support 6.1 6.9 7.7 8.6 9.6 Skin Health 3.7 4.2 4.7 5.2 5.9 Other Applications 2.4 2.7 2.9 3.2 3.6 Distribution Channel Analysis

The market is fragmented by distribution channel into offline stores and online platform. Offline Stores dominated the global dietary supplements in an age of personalized nutrition market capturing a significant market share of 75.0% in 2024 due to their ability to offer direct consumer interaction, product testing, and personalized consultations. Many consumers still prefer to make dietary supplement purchases in person, where they can consult with knowledgeable staff, get recommendations, and evaluate product labels before making decisions.

Traditional health food stores, pharmacies, and wellness centers provide a trusted environment for consumers to explore personalized nutrition options, such as tailored vitamin packs and supplements. Additionally, in-store promotions, product samples, and the ability to ask questions in real-time make offline stores an attractive choice for consumers seeking personalized wellness solutions.

Dietary Supplements in an Age of Personalized Nutrition Market, Distribution Channel Analysis, 2020-2024 (US$ Billion)

Distribution Channel 2020 2021 2022 2023 2024 Offline Stores 21.0 23.7 26.3 29.4 32.8 Online Platform 6.5 7.5 8.4 9.6 10.9 Key Segments Analysis

By Product Type

- Vitamins

- Minerals

- Amino Acids

- Herbal and Botanicals

- Other Product Types

By Product Form

- Tablets/Capsules

- Powders

- Liquids

- Other Product Forms

By Application

- General Wellness

- Sports Nutrition

- Immune Support

- Skin Health

- Other Applications

By Distribution Channel

- Offline Stores

- Online Platform

Drivers

Rising Demand for Personalized Nutrition

Poor lifestyle habits and a preference for sedentary lifestyles have given rise to health-related complications worldwide. This created a demand for nutrition-oriented solutions. Personalized Nutrition is able to deliver an optimized healthcare experience that perfectly caters to individual needs is one of the reasons behind its increasing popularity.

A study by the European Journal of Public Health shows that 30% of consumers were willing to pay more for personalized nutrition services. Additionally, offering personalization of services is a rising trend in the service sector. Although the industry is relatively new, it shows immense promise in nutrition.

- Nutrition research has shown that a ‘one size fits all’ approach to nutrition is entirely ineffective. While many factors impact nutrition in its entirety, it is believed that genetics play an important role in determining the individual response to food. Genomic Testing is on the rise since it can reveal specifics of the human genome.

Restraints

Limited Accessibility

Limited accessibility is a significant restraint in the global dietary supplements in an age of personalized nutrition market, hindering widespread adoption. Many consumers face challenges in accessing high-quality, customized supplements due to high costs, lack of availability in certain regions, and inadequate distribution networks. Personalized nutrition often relies on genetic testing, microbiome analysis, and AI-driven recommendations, which are expensive and not widely available in developing markets.

Additionally, the lack of awareness and education about the benefits of personalized supplements prevents many consumers from adopting these solutions. Regulatory barriers and inconsistencies in supplement quality and labeling further limit market expansion, as consumers struggle to find trustworthy, science-backed products.

Opportunities

AI-driven Personalized Dietary Supplements

AI-driven personalized dietary supplements are creating significant growth opportunities in the global dietary supplements in an age of personalized nutrition market by enhancing precision, efficiency, and customization in nutrition planning. AI technology analyzes genetic data, microbiome composition, lifestyle habits, and health conditions to recommend tailored supplement formulations for individual needs.

This innovation allows companies to offer personalized vitamin, mineral, and probiotic blends, optimizing nutrient intake based on real-time health assessments and predictive analytics. AI-driven platforms also improve customer engagement through smart algorithms, wearable device integration, and real-time health tracking, making personalized nutrition more accessible and effective.

Impact of Macroeconomic Factors / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the global dietary supplements in an age of personalized nutrition market, influencing supply chains, production costs, consumer purchasing power, and regulatory environments. Economic fluctuations, inflation, and changing disposable incomes affect consumer spending on premium personalized supplements, with demand often declining during economic downturns.

Trade restrictions, tariffs, and geopolitical tensions disrupt global supply chains, leading to shortages of raw materials, increased production costs, and delayed product deliveries. Additionally, currency fluctuations and inconsistent import-export regulations create pricing challenges for international brands. On the regulatory side, governments are tightening policies on supplement safety, labelling, and ingredient sourcing, making compliance more complex.

Trends

The global personalized nutrition market is experiencing significant growth, driven by several key trends. Consumers are increasingly seeking customized dietary solutions tailored to their individual health needs, leading to a surge in demand for personalized vitamins and supplements. Companies like Persona, Care/of, and Gainful offer customized services, utilizing quizzes and consultations to create formulas based on health goals and lifestyles.

Advancements in genetic testing and digital health technologies enable more precise personalization, allowing for recommendations based on genetic makeup and health data. The integration of Artificial Intelligence (AI) in analyzing individual health metrics has further enhanced the ability to provide tailored nutritional advice.

Regional Analysis

North America maintained a leading position in the market, accounting for over 41.3% of the total share. The region’s market value was estimated at approximately USD 18 billion for the year. North America held a significant position in the global dietary supplements in an age of personalized nutrition market, driven by high consumer awareness, advanced healthcare infrastructure, and a strong demand for customized nutrition solutions. The region benefits from technological advancements in AI-driven health assessments, genetic testing, and microbiome analysis, enabling highly personalized supplement recommendations.

Leading companies in North America, such are pioneering innovative subscription-based and data-driven supplement models, enhancing consumer engagement. Additionally, rising disposable income and increasing health consciousness are fueling demand for science-backed, precision-based dietary supplements. The presence of well-established e-commerce platforms and direct-to-consumer (DTC) brands has also made personalized nutrition more accessible.

Dietary Supplements in an Age of Personalized Nutrition Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 11.2 12.8 14.3 16.1 18.0 Europe 7.7 8.5 9.3 10.2 11.2 Asia Pacific 5.4 6.3 7.1 8.1 9.3 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global dietary supplements in an age of personalized nutrition market is highly competitive, with key players focusing on AI-driven customization, genetic testing integration, and direct-to-consumer (DTC) subscription models to gain market share. Leading companies such as are leveraging biotechnology, AI, and big data analytics to provide personalized supplement recommendations based on DNA analysis, microbiome testing, and lifestyle factors.

Competition is intensifying as major pharmaceutical and nutrition companies invest in the space, acquiring or partnering with personalized nutrition startups. Additionally, the rise of e-commerce platforms, telehealth consultations, and wearable health device integrations is further driving innovation. Regulatory challenges and the need for scientific validation of personalized supplement claims create barriers for new entrants.

Top Key Players in the Dietary Supplements in an Age of Personalized Nutrition Market

- Nestlé S.A

- Amway Corporation

- Archer Daniels Midland Company

- Herbalife Nutrition Ltd.

- GNC Holdings Inc.

- Glanbia PLC

- Astellas Pharma Inc.

- Metagenics LLC

- Bactolac Pharmaceutical Inc.

Recent Developments

- In June 2023, Arizona Nutritional Supplements saw consistent growth, with a notable increase in sales in January driven by New Year’s health resolutions, especially in categories like multivitamins and immune support supplements.

- In March 2023, Asiamerica Ingredients expanded its market presence through strategic partnerships with prominent supplement brands, tapping into the growing demand for personalized nutrition.

Report Scope

Report Features Description Market Value (2024) US$ 43.7 billion Forecast Revenue (2034) US$ 168.2 billion CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamins, Minerals, Amino Acids, Herbal and Botanicals, and Other Product Types), By Product Form (Tablets/Capsules Powders, Liquids, and Other Product Forms), By Application (General Wellness Sports Nutrition, Immune Support, Skin Health, and Other Applications), By Distribution Channel (Offline Stores and Online Platform) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nestlé S.A, Amway Corporation, Archer Daniels Midland Company, Herbalife Nutrition Ltd., GNC Holdings Inc., Glanbia PLC, Astellas Pharma Inc., Metagenics LLC, and Bactolac Pharmaceutical, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dietary Supplements in an Age of Personalized Nutrition MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Dietary Supplements in an Age of Personalized Nutrition MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arizona Nutritional Supplements

- Asiamerica, Ingredients

- Bactolac Pharmaceutical Inc.

- Balchem Corporation

- Barrington Nutritionals

- BASF SE

- DNA Fit

- DNAlysis

- DSM

- Foodsmart

- Helix

- Herbalife Nutrition

- Lallemand Bio-Ingredients

- Maat Nutritionals

- Metagenics, Inc.

- Mixfix, Inc.

- Natures Product Inc.

- Noho Health Inc.

- Nutralliance, Inc.

- Superior Supplement Manufacturing

- Wellcome Trust Sanger Institute Morgan Building

- Wellness Coaches