Global Dicing Blade Market By Type (Hub Dicing Blades, and Hubless Dicing Blades), By Application (Semiconductors, Glass, Ceramics, and Crystals), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 20012

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Dicing Blade Overview

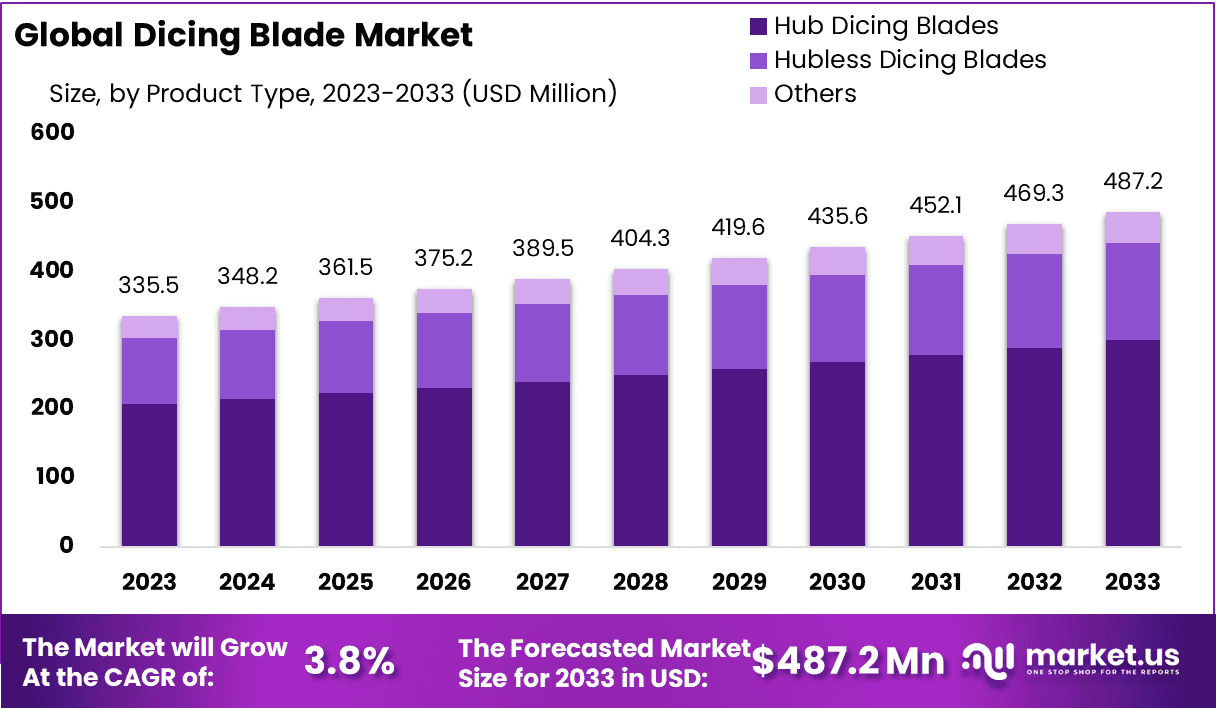

The Global Dicing Blade Market size is expected to be worth around USD 487.2 Million by 2033, From USD 335.5 Million by 2023, growing at a CAGR of 3.80% during the forecast period from 2024 to 2033.

A dicing blade is a blade that is connected to a saw to dice, cut, or groove semiconductor wafers, silicon, glass, ceramic, crystal, and several other types of materials. Dicing blades are precision cutting tools essential in semiconductor manufacturing, enabling the separation of silicon wafers into individual microelectronic devices. These blades play a crucial role in the dicing process, where semiconductor materials are precisely cut into tiny, uniform chips.

Composed of high-quality materials like diamond or cubic boron nitride, dicing blades exhibit exceptional hardness and wear resistance, ensuring precise and efficient cutting. Their design incorporates advanced geometries and bonding techniques, allowing for clean, chip-free cuts and minimizing material wastage.

In semiconductor fabrication, the dicing process is a critical step in producing microchips and integrated circuits. Dicing blades are utilized in various dicing methods, such as blade dicing, laser dicing, and stealth dicing, each tailored to specific semiconductor applications. The semiconductor industry’s relentless pursuit of miniaturization and increased device density necessitates dicing blades capable of achieving sub-micron precision.

The evolution of dicing blade technologies continues to parallel advancements in semiconductor manufacturing, contributing to enhanced yields, improved quality, and increased productivity. As the demand for smaller, more powerful electronic devices persists, the role of dicing blades remains integral, driving innovation in materials, design, and manufacturing processes within the semiconductor industry.

Key Takeaways

- Market Growth: The Dicing Blade Market demonstrates steady growth, with the market value expected to rise from USD 335.5 million in 2023 to USD 487.20 million in 2033, reflecting a consistent Compound Annual Growth Rate (CAGR) of 3.80%.

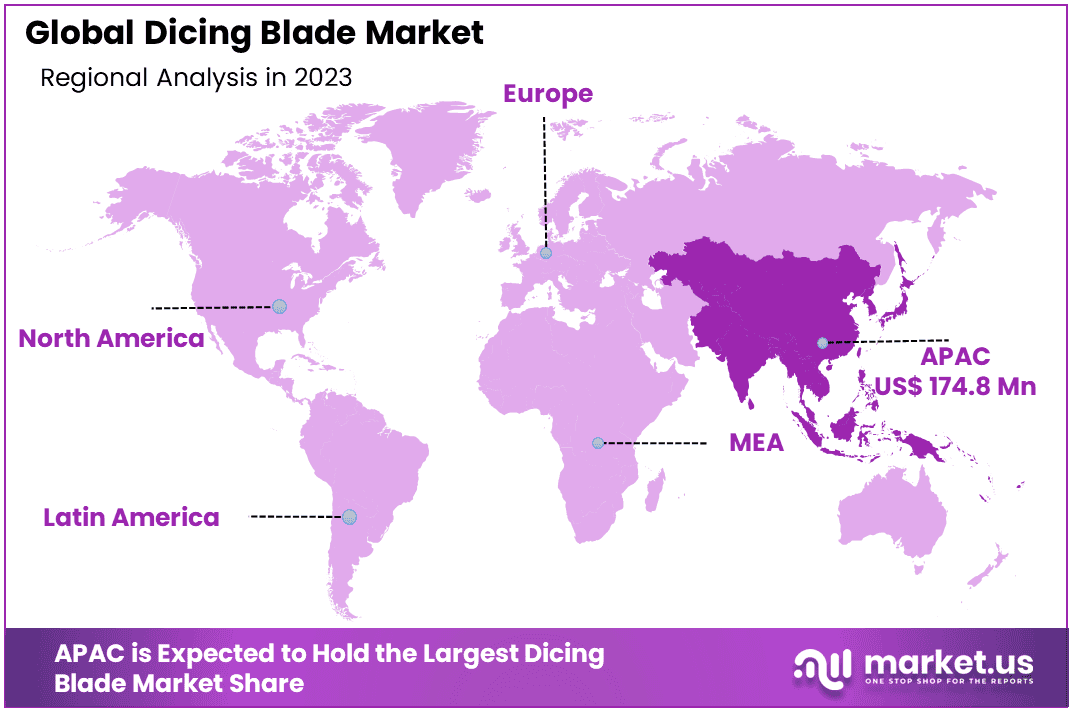

- Regional Dominance: Asia-Pacific (APAC) emerges as the dominant region, holding a substantial 52.1% share. This dominance signifies a significant demand and market presence for dicing blades in the semiconductor manufacturing hub of the APAC region.

- Segmentation Insights:

- Product Type Leadership: Hubless Dicing Blades take the lead with a noteworthy 61.7% share, emphasizing their popularity and effectiveness in precision cutting applications.

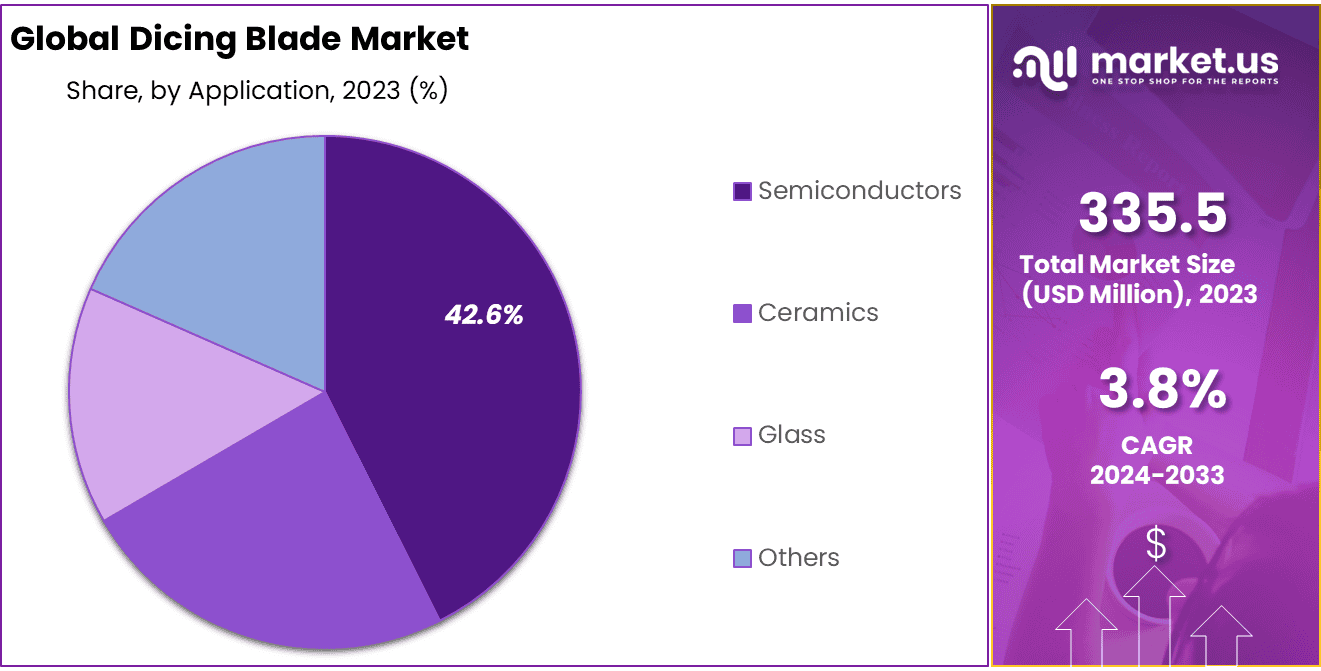

- Application Significance: Semiconductors constitute a substantial 42.6% share, indicating the critical role of dicing blades in the semiconductor industry’s precision cutting processes.

Market Dynamics:

- Steady Market Growth: The market exhibits steady growth, driven by the consistent demand for high-precision cutting tools in semiconductor manufacturing and related industries.

- APAC Market Dominance: APAC’s substantial share underscores the region’s pivotal role in semiconductor manufacturing, driving the demand for advanced dicing blades.

Industry Analysis:

- Precision-Centric Market: The market’s steady CAGR reflects its position as a precision-centric industry, where dicing blades play a crucial role in achieving accurate cuts in semiconductor materials.

- Semiconductor Industry Dependency: The dominance of dicing blades in the semiconductor application indicates a strong dependence on these cutting tools for the production of microelectronic devices.

This analysis highlights the Dicing Blade Market’s steady growth trajectory, driven by its indispensable role in precision cutting processes, particularly in the semiconductor industry. The consistent CAGR and regional dominance in APAC suggest a resilient market with ongoing relevance in high-tech manufacturing processes.

Driving Factors

The exponential expansion of the semiconductor industry is leading to a surge in the demand for silicon and compound wafers, semiconductor packages, etc., and this is a primary factor that is expected to subsequently fuel the revenue growth of the global dicing blade market in the foreseeable future.

Nonetheless, the robust growth experienced by end-use industries such as glass and ceramics, which employ the extensive use of dicing blades for a list of increasing applications, is anticipated to boost the revenue growth of the global dicing blade market shortly.

Moreover, the ongoing increase in the availability of dicing blades with different types of thicknesses, compositions, as well as coatings, is enabling end-users to choose from a broader spectrum of products, with which they can effectively complete a designated task with ease, which is another factor slated to positively impact the expansion of this global market in the coming years.

Moreover, the dicing precision and speed of these blades is lower than that offered by laser dicing products, and this is also slated to negatively influence this market’s global footprint.

Restraining Factors

Despite their crucial role in semiconductor manufacturing, the Dicing Blade Market encounters certain restraining factors. The high initial cost of advanced dicing blades, especially those employing cutting-edge materials and technologies, can be a significant barrier for manufacturers looking to adopt these tools.

Additionally, the delicate nature of semiconductor materials poses challenges in terms of blade wear and maintenance, impacting the lifespan of the blades.

Compatibility issues with specific manufacturing equipment and the need for skilled operators proficient in handling these precision tools further contribute to the market’s constraints. Overcoming these challenges requires continuous innovation and collaboration within the semiconductor industry.

Growth Opportunities

The Dicing Blade Market presents compelling growth opportunities driven by several factors. The increasing demand for smaller and more powerful semiconductor devices, particularly in industries like electronics and telecommunications, fuels the need for advanced dicing solutions.

As the semiconductor industry embraces technologies like 5G, artificial intelligence, and the Internet of Things, the demand for precise and efficient dicing blades is poised to surge. Moreover, ongoing research and development activities focused on enhancing blade materials, geometries, and manufacturing processes contribute to continuous innovation.

Collaborations between dicing blade manufacturers and semiconductor companies further open avenues for growth, ensuring alignment with evolving industry requirements. Expanding into emerging semiconductor markets and diversifying applications beyond traditional electronics offer additional strategic growth opportunities for the Dicing Blade Market.

Trending Factors

Several trending factors contribute to the dynamic landscape of the Dicing Blade Market. One notable trend is the adoption of advanced materials, such as diamond-like carbon and ceramic composites, in dicing blade manufacturing. These materials enhance blade durability and precision, catering to the semiconductor industry’s demand for finer cuts and increased yields.

Another trend involves the integration of smart technologies in dicing blades, incorporating sensors and data analytics to monitor blade performance in real time. This facilitates predictive maintenance, optimizing blade longevity and minimizing production downtime.

Furthermore, the trend towards wafer-level packaging and the development of ultra-thin electronic devices drive the demand for thinner and more precise dicing blades, reflecting the industry’s continuous pursuit of miniaturization. These trends collectively propel the Dicing Blade Market toward increased efficiency, reliability, and adaptability to evolving semiconductor manufacturing requirements.

Market Segmentation

The markets in the Asia Pacific region accounted for the majority number of revenue shares of the global dicing blade market in 2023, and are anticipated to remain this market’s front-runner for the remainder of this forecast period. The markets in North America accounted for a considerable number of revenue shares in 2023, and are anticipated to continue to do so in the years to come.

Key Market Segmentation:

By Product Type:

- Hub Dicing Blades

- Hubless Dicing Blades

- Other Products

By Application:

- Semiconductors

- Ceramics

- Glass

- Other Applications

Regional Analysis

APAC leads the market segment by 52.1%. The Dicing Blade Market exhibits distinctive regional dynamics influenced by semiconductor manufacturing hubs and technological advancements. Asia-Pacific, with a strong presence of semiconductor fabrication facilities in countries like Japan, South Korea, Taiwan, and China, dominates the market. The region benefits from a robust electronics industry, fostering continuous demand for high-precision dicing solutions.

North America, particularly the United States, plays a pivotal role in semiconductor innovation, contributing to the growth of the Dicing Blade Market. Europe also participates in the market, with key semiconductor manufacturing activities concentrated in countries like Germany.

The Middle East and Africa, as well as Latin America, contribute to the market to a lesser extent but are witnessing increased semiconductor-related activities. The regional analysis underscores the global nature of the Dicing Blade Market, driven by the strategic placement of semiconductor manufacturing facilities worldwide.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key players in the Dicing Blade Market typically include established companies with expertise in precision cutting tools for semiconductor applications.

Companies like Disco Corporation, ADT (Advanced Dicing Technologies Ltd.), and Accretech (Tokyo Seimitsu Co., Ltd.) are known for their significant contributions to the dicing technology space. However, the market landscape may evolve, and new players may emerge, so it’s essential to refer to the latest market research for a comprehensive analysis.

Key players profiled in the market report are:

- Disco Corporation

- Advanced Dicing Technologies

- Kulicke & Soffa Industries, Inc.

- Load point Bearings

- Engis Corporation

- Meyer Burger Technology AG

- Beijing Technol Science

- Shanghai Sinyang Semiconductor Materials Co., Ltd.

- Kasco Abrasives

- South Bay Technology, Inc.

- Kinik Company

- Asahi Diamond Industrial Co., Ltd.

Recent Developments:

In 2023:

- Focus on Sustainability: Growing environmental concerns led to the development of eco-friendly dicing blades with reduced use of harmful materials and improved recycling capabilities. Additionally, advancements in manufacturing processes aimed to minimize resource consumption and waste generation.

- Micro-dicing Solutions: The increasing miniaturization of electronic devices fueled the demand for micro-dicing blades capable of handling ultra-thin wafers and achieving precise cuts with minimal kerf loss. This trend aligns with the growing adoption of advanced packaging technologies.

Report Scope:

Report Features Description Market Value (2023) USD 335.5 Million Forecast Revenue (2032) USD 487.20 Million CAGR (2023-2032) 3.80% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Hub Dicing Blades, Hubless Dicing Blades, Other Products), By Application(Semiconductors, Ceramics, Glass, Other Applications) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Disco Corporation, Advanced Dicing Technologies, Kulicke & Soffa Industries, Inc., Load point Bearings, Engis Corporation, Meyer Burger Technology AG, Beijing Technol Science, Shanghai Sinyang Semiconductor Materials Co., Ltd., Kasco Abrasives, South Bay Technology, Inc., Kinik Company, Asahi Diamond Industrial Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Dicing Blade Market Size in the Year 2023?The Global Dicing Blade Market size was USD 335.5 Million by 2023, growing at a CAGR of 3.80%.

What is the Dicing Blade Market Estimated CAGR During the Forecast Period?The Global Dicing Blade Market size is expected to grow at a CAGR of 3.80% during the forecast period from 2024 to 2033.

What is the Dicing Blade Market Estimated Size During the Forecast Period?The Global Dicing Blade Market size is expected to be worth around USD 487.2 Million during the forecast period from 2024 to 2033.

-

-

- Disco Corporation

- Advanced Dicing Technologies

- Kulicke & Soffa Industries, Inc.

- Load point Bearings

- Engis Corporation

- Meyer Burger Technology AG

- Beijing Technol Science

- Shanghai Sinyang Semiconductor Materials Co., Ltd.

- Kasco Abrasives

- South Bay Technology, Inc.

- Kinik Company

- Asahi Diamond Industrial Co., Ltd.