Global Dibutyl Phthalate Market Size, Share Analysis Report By Form (Liquid, Solid), By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade), By End-Use ( Construction, Automotive, Consumer Goods, Personal Care, Electronics, Medical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162349

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

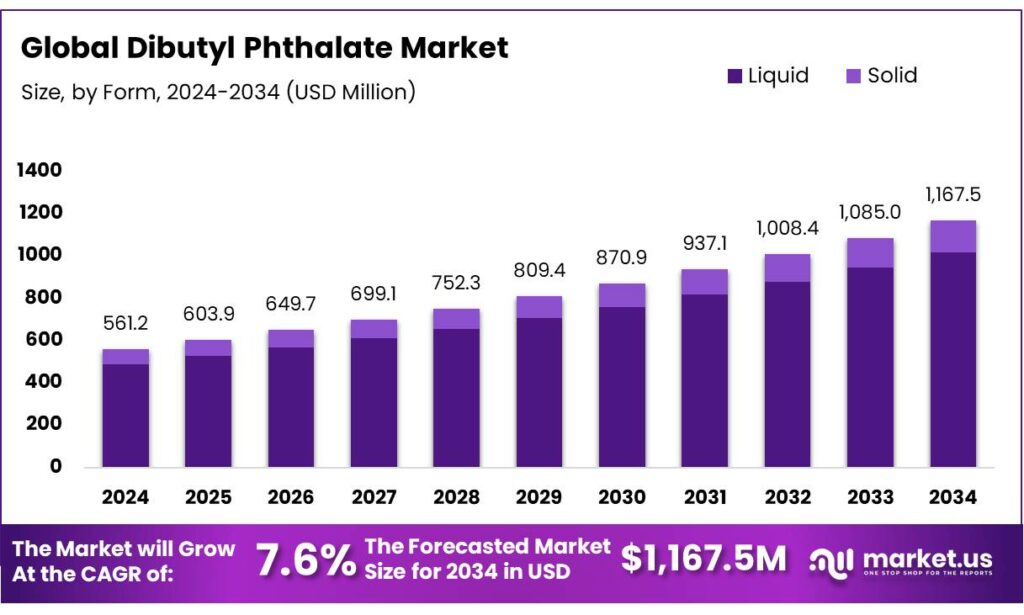

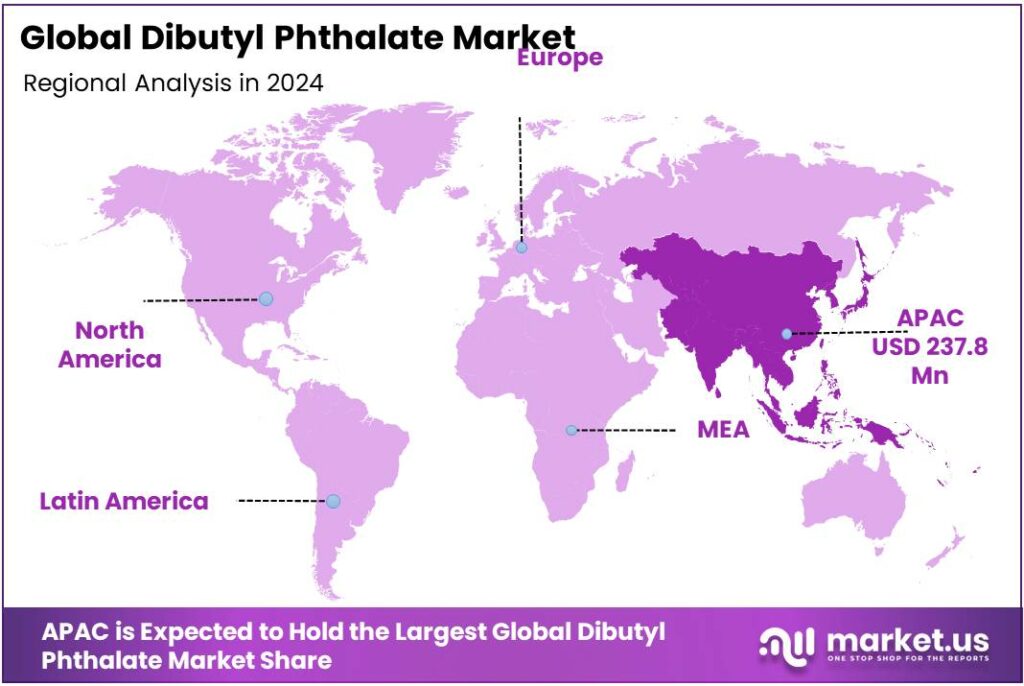

The Global Dibutyl Phthalate Market size is expected to be worth around USD 1167.5 Million by 2034, from USD 561.2 Million in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 42.4% share, holding USD 237.8 Million in revenue.

Dibutyl phthalate (DBP; CAS 84-74-2) is a widely used orthophthalate plasticizer valued for flexibility, low volatility, and processing efficiency in PVC and non-PVC applications such as adhesives, sealants, inks, and coatings. In industrial hygiene terms, U.S. agencies set an 8-hour time-weighted exposure limit of 5 mg/m³ (NIOSH REL and OSHA PEL), with an Immediately Dangerous to Life or Health (IDLH) value of 4,000 mg/m³, anchoring workplace controls in production and compounding environments.

The current industrial scenario is shaped by two countervailing forces: robust plastics and petrochemical demand on one side, and tightening product-safety regulation on the other. Upstream momentum remains significant—petrochemicals are set to account for >⅓ of global oil-demand growth by 2030 and nearly half by 2050, underscoring continued structural pull for chemical intermediates used across plastics value chains. At the same time, global plastics output reached 400.3 million tonnes in 2022, indicating the broad scale of materials flows into which plasticizers, including DBP, plug.

The European industry group reports ~8.4 million tonnes of plasticizers consumed worldwide annually, with >1.3 million tonnes in Europe—context that highlights the size of the addressable plasticizer pool even as portfolios shift away from legacy phthalates.

Regulation decisively influences DBP’s marketability and use patterns. In the European Union, DBP is restricted under REACH Annex XVII alongside DEHP, BBP, and DIBP, with a 0.1% (w/w) concentration limit applying to plasticized materials in articles falling under the scope—materially curbing DBP in consumer-exposed applications.

Key Takeaways

- Dibutyl Phthalate Market size is expected to be worth around USD 1167.5 Million by 2034, from USD 561.2 Million in 2024, growing at a CAGR of 7.6%.

- Chemical Tests held a dominant market position, capturing more than a 47.9% share of the Dibutyl Phthalate (DBP) market.

- Industrial Grade held a dominant market position, capturing more than a 62.9% share of the Dibutyl Phthalate (DBP) market.

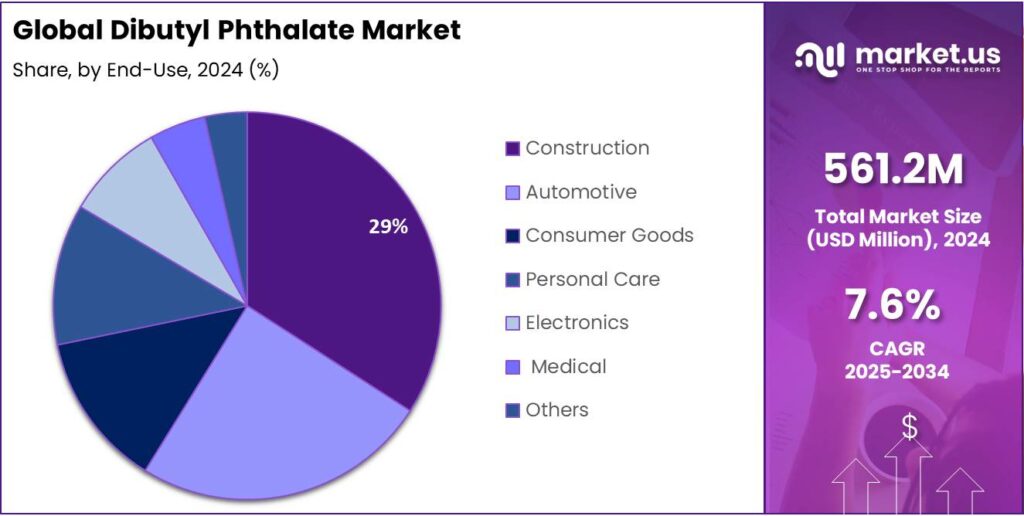

- Construction held a dominant market position, capturing more than a 28.6% share of the Dibutyl Phthalate (DBP) market.

- Asia Pacific (APAC) region dominated the global Dibutyl Phthalate (DBP) market, capturing a substantial 42.4% share, equivalent to approximately USD 237.8 million.

By Form Analysis

Chemical Tests dominates with 47.9% share in 2024 due to its widespread industrial application

In 2024, Chemical Tests held a dominant market position, capturing more than a 47.9% share of the Dibutyl Phthalate (DBP) market by form. This significant share can be attributed to its extensive use in laboratories and industrial quality control processes, where precise testing of DBP concentrations is crucial for ensuring product safety and compliance with regulatory standards. Over the year, the consistent demand from research facilities, chemical manufacturers, and polymer industries reinforced the prominence of Chemical Tests as the preferred form. The reliability and accuracy offered by these tests have made them indispensable for evaluating DBP content in various applications, particularly in plastics, coatings, and adhesives.

Additionally, the segment benefited from increasing industrial activities and heightened regulatory scrutiny in 2024, which necessitated regular testing of phthalates to meet environmental and safety norms. Looking forward to 2025, the Chemical Tests segment is expected to maintain its leading position, supported by continuous demand from emerging markets and technological advancements in analytical methods, ensuring faster and more precise measurement of DBP in complex matrices. This steady growth underscores the essential role of Chemical Tests in the DBP industry, making it a core component for manufacturers aiming to meet quality and safety standards efficiently.

By Grade Analysis

Industrial Grade leads with 62.9% share in 2024 driven by high demand in manufacturing

In 2024, Industrial Grade held a dominant market position, capturing more than a 62.9% share of the Dibutyl Phthalate (DBP) market by grade. This strong market presence is primarily due to its extensive application in manufacturing processes, particularly in the production of flexible plastics, coatings, and adhesives, where large-scale consistency and performance are essential. The high purity and stability of Industrial Grade DBP make it the preferred choice for industrial operations, ensuring reliable results in polymer modification and chemical formulations.

During 2024, rising industrialization and infrastructure development further reinforced demand for Industrial Grade DBP, as manufacturers sought durable and efficient plasticizers to meet production needs. Moving into 2025, the segment is expected to maintain its leading position, supported by ongoing industrial expansion and continuous adoption of DBP in construction, automotive, and consumer goods sectors. The dominance of Industrial Grade underscores its critical role in meeting large-scale industrial requirements, making it the backbone of the DBP market for functional and performance-oriented applications.

By End-Use Analysis

Construction leads with 28.6% share in 2024 driven by growing infrastructure demand

In 2024, Construction held a dominant market position, capturing more than a 28.6% share of the Dibutyl Phthalate (DBP) market by end-use. This prominence is largely due to the increasing use of DBP as a plasticizer in polyvinyl chloride (PVC) and other flexible materials widely applied in construction projects, including pipes, flooring, and window profiles. The segment benefited from rising urbanization and infrastructure development across both emerging and developed regions, which drove consistent demand for durable and flexible building materials.

Throughout 2024, manufacturers prioritized DBP-enhanced plastics to improve longevity, flexibility, and performance of construction components, ensuring compliance with safety and quality standards. Looking ahead to 2025, the Construction segment is expected to sustain its leading position as infrastructure projects expand globally and adoption of high-performance materials continues, highlighting DBP’s integral role in supporting the growth and modernization of the construction industry.

Key Market Segments

By Form

- Liquid

- Solid

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By End-Use

- Construction

- Automotive

- Consumer Goods

- Personal Care

- Electronics

- Medical

- Others

Emerging Trends

Design-for-Compliance Plasticization Around Food Systems

A clear, current trend for dibutyl phthalate (DBP) is the shift toward design-for-compliance: using plasticized materials only where rules are precise, exposure is controlled, and documentation is strong. Food systems are pushing this change. Policymakers and retailers want packaging and processing equipment that protects food while meeting strict migration limits. The United Nations shows why this matters: in 2022, 1.05 billion tonnes of food were wasted across households, food service, and retail—about 19% of food available to consumers and 132 kg per person. Reducing waste requires robust packaging and handling, but it must also be safe and compliant.

Food-system numbers keep the pressure on packaging performance—yet also favor controlled niches for plasticizers. FAO’s global monitoring shows about 13.2% of food is lost between harvest and retail, before consumers ever see it. That loss sits upstream of the UNEP waste figures and reminds processors why protective packaging, bundling films, conveyor coatings, and cable sheathing matter in cold chains and distribution centers. The trend in DBP usage is therefore not more everywhere, but only where allowed, engineered, and proven.

Formulators design multilayer structures where any plasticized layer is shielded from direct food contact, or they verify that the article meets the 0.12 mg/kg ceiling with real test data. Second, evidence files: buyers now expect certificates, test reports, and exposure rationales attached to each lot and product code; FDA’s clarified stance makes those file requests more routine.

Drivers

Rising Demand from Flexible Food Packaging Applications

One of the major driving factors behind increased usage of additives such as plasticizers – including the likes of Dibutyl phthalate (DBP) – is the growing demand for flexible packaging in the food industry. While DBP is one of many plasticizers used in flexible polyvinyl chloride (PVC) and other polymers, the surge in food-packaging film and flexible packaging formats pushes the need for these materials — and hence those additives.

PVC films (and their additives) serve a niche in these applications due to specific functional properties (e.g., barrier characteristics, clarity, flexibility). One briefing document notes that in Europe roughly 185,000 tonnes per year of PVC resin are used for food-contact applications. Because PVC films used in food packaging are inherently flexible materials, they require plasticizers to achieve the softness and processability needed.

This dynamic drives the relevance of DBP (or plasticizers of similar nature) because as more food is packaged using flexible formats, more film material is produced, meaning more plasticizer demand arises. At the same time, regulatory regimes ensure that materials contacting food meet migration and safety criteria.

- For instance, in the European Union under Regulation (EU) 10/2011, DBP is permitted as a plasticizer in repeated-use food contact materials for non-fatty foods, subject to migration and concentration limits (for example, a maximum technical support agent concentration of 0.05 % w/w and specific migration limit of 0.12 mg/kg food).

Restraints

Regulatory clampdowns on food-contact uses

A major restraint on dibutyl phthalate (DBP) demand is the tightening of food-contact and consumer-safety rules across large markets. Food regulators have narrowed where phthalates can be used in materials that touch food, and they have lowered the numerical limits that manufacturers must meet. In 2023, the European Union amended its plastics food-contact regulation (Regulation (EU) 10/2011), cutting DBP’s specific migration limit from 0.30 mg/kg to 0.12 mg/kg food and maintaining group restrictions with other phthalates. Articles placed on the market before February 1, 2025 can be sold until stocks are exhausted, but all new compliant production must meet the stricter 0.12 mg/kg limit—raising reformulation costs, testing burdens, and the risk of substitution away from DBP.

The U.S. Food and Drug Administration (FDA) has also reshaped the landscape. While the FDA still lists nine phthalates as allowable in certain food-contact polymers (eight as plasticizers, one as a monomer), the agency finalized a rule removing authorized food-contact uses for most phthalates because industry had already abandoned them. In October 2024, the FDA rejected objections and upheld this decision, signaling a lasting policy stance that encourages migration controls and alternatives in food-contact applications. This combination—limited allowable uses and formal withdrawal of many others—makes DBP a riskier choice for packaging and processing gear that contacts food.

Strict child-safety rules further compress DBP’s addressable market in any consumer item that could plausibly intersect with food or childcare environments. In the United States, the Consumer Product Safety Improvement Act (CPSIA) permanently bans children’s toys and child-care articles containing > 0.1% DBP by weight; the U.S. Consumer Product Safety Commission reaffirmed and expanded phthalate restrictions in its 2017 final rule. Even though these products are not food packaging, the zero-tolerance posture toward DBP in children’s environments spills over to retail and brand policies, nudging procurement teams to avoid DBP broadly to minimize compliance and reputational risk.

Opportunity

Compliant Roles in Reducing Food Loss and Waste

A clear growth opportunity for dibutyl phthalate (DBP) sits in tightly controlled, compliant applications that help the food system cut losses and waste—especially secondary packaging films, pallet stretch wraps, and non-food-contact components around processing lines (e.g., conveyor belts, gaskets, cable sheathing). The human story is simple: too much food never reaches our plates, so every incremental gain in protection, handling, and shelf life matters. Globally, the Food and Agriculture Organization (FAO) estimates 13.2% of food is lost between harvest and retail, before it ever reaches consumers; that is a vast, avoidable leakage in value chains that packaging and better logistics can help reduce.

The United Nations Environment Programme (UNEP) reports 1.05 billion tonnes of food were wasted in 2022, roughly 19% of food available to consumers across households, food service, and retail. This equals about 132 kg per capita, with households causing 60% of waste, food service 28%, and retail 12%—numbers that keep pressure on retailers and brands to adopt packaging formats that better protect products and portion sizes. Each percentage point avoided represents millions of meals saved and real demand for protective films and flexible wrap systems where plasticization is functionally essential.

Regulatory initiatives, while strict on direct food-contact, also clarify compliant pathways rather than closing the door entirely. In the European Union, the 2023 amendment to the plastics food-contact regulation cut DBP’s specific migration limit to 0.12 mg/kg food and allowed sell-through of legacy items placed on the market before 1 February 2025. For producers willing to invest in migration testing and robust quality systems, the rule provides a defined ceiling and a basis for carefully engineered uses, particularly in repeat-use or non-fatty contexts and in non-food-contact outer layers where migration is not relevant.

Regional Insights

Asia Pacific (APAC) leads with 42.4% share in 2024, valued at USD 237.8 million, driven by robust industrial demand

In 2024, the Asia Pacific (APAC) region dominated the global Dibutyl Phthalate (DBP) market, capturing a substantial 42.4% share, equivalent to approximately USD 237.8 million. This dominance is primarily attributed to the region’s extensive manufacturing base, particularly in countries like China, India, and Southeast Asia, where rapid industrialization and urbanization are driving demand for flexible plastics, coatings, and adhesives.

The availability of cost-effective raw materials, favorable government policies, and large-scale infrastructure projects further bolster DBP consumption in this region. The APAC market’s growth is also supported by the increasing adoption of DBP in various applications, including construction materials, automotive components, and consumer goods, aligning with the region’s expanding industrial activities.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eastman Chemical Company, a U.S.-based global leader in specialty chemicals, has been producing plasticizers, including Dibutyl Phthalate (DBP), for over 75 years. The company offers a range of plasticizers designed to meet durability and flexibility needs across various markets. Eastman’s plasticizers are utilized in applications such as coatings, adhesives, and sealants, providing formulators with options that comply with evolving regulatory standards. While Eastman has historically been a significant player in the DBP market, it has also been expanding its portfolio to include non-phthalate alternatives to address environmental and health concerns associated with traditional plasticizers.

KLJ Group, an Indian conglomerate, produces Dibutyl Phthalate (DBP) under the brand name Kanatol. Their DBP products, such as Kanatol-400 (M), are utilized as plasticizers in various applications, including protective coatings based on cellulose acetate, ethyl cellulose, and vinyl polymers. KLJ’s DBP offerings are known for their plasticizing efficiency and are used effectively in applications requiring flexibility and durability. The company emphasizes quality control and environmental compliance in its manufacturing processes.

Kaifeng Jiuhong Chemical Co., Ltd., located in Henan Province, China, is a manufacturer of Dibutyl Phthalate (DBP) with a production capacity of 300,000 tons per year. The company produces DBP with a purity of ≥99.5%, suitable for applications such as nitrocellulose coatings, PVC processing, and as a plasticizer or softener for various resins. Kaifeng Jiuhong Chemical emphasizes the resilience and quality of its products, catering to industries requiring high-performance materials. The company’s strategic location and production capacity position it as a significant player in the DBP market.

Top Key Players Outlook

- Eastman

- Nan Ya Plastics (NPC)

- KLJ Group

- Taoka Chemical

- Kaifeng Jiuhong Chemical

- Shandong Kexing Chemicals

- The Chemical Company

- Supreme Plasticizers

- Others

Recent Industry Developments

In 2024 Nan Ya Plastics Corporation, reported a notable increase in revenue from phthalate plasticizers, rising by NT$261 million, primarily driven by higher sales volumes as downstream industries in China resumed production post-holiday.

In 2024, Eastman reported a 23% growth in earnings per share (EPS) and generated approximately $1.3 billion in cash from operating activities, reflecting robust financial health.

Report Scope

Report Features Description Market Value (2024) USD 561.2 Mn Forecast Revenue (2034) USD 1167.5 Mn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade), By End-Use ( Construction, Automotive, Consumer Goods, Personal Care, Electronics, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eastman, Nan Ya Plastics (NPC), KLJ Group, Taoka Chemical, Kaifeng Jiuhong Chemical, Shandong Kexing Chemicals, The Chemical Company, Supreme Plasticizers, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eastman

- Nan Ya Plastics (NPC)

- KLJ Group

- Taoka Chemical

- Kaifeng Jiuhong Chemical

- Shandong Kexing Chemicals

- The Chemical Company

- Supreme Plasticizers

- Others