Global Diabetic Food Market By Product (Confectionery, Snacks, Bakery Products, Dairy Products, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 55960

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

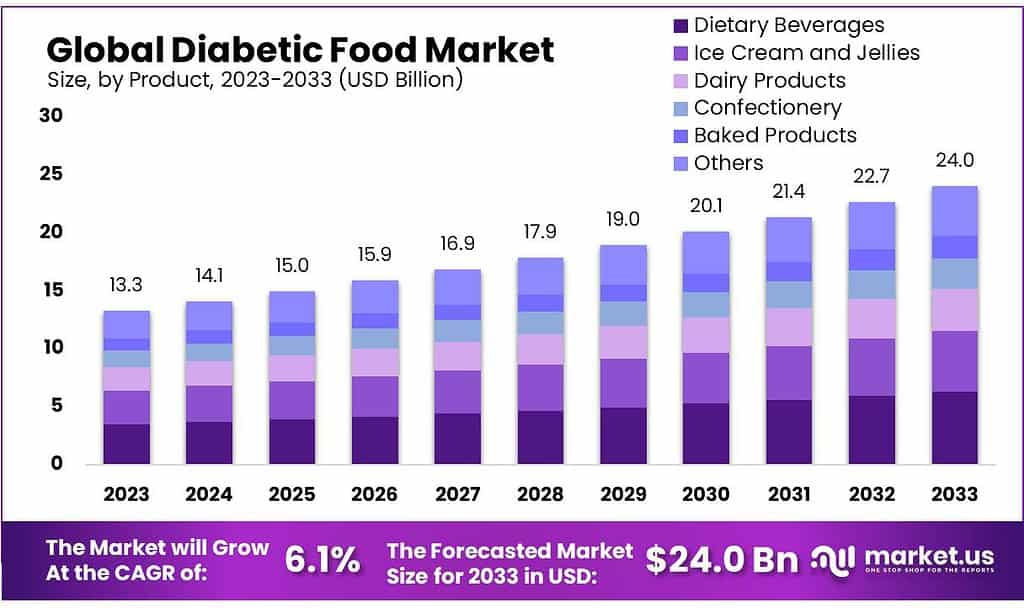

The global Diabetic Food market size is expected to be worth around USD 24.0 billion by 2033, from USD 13.3 billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033.

Diabetes has been on the rise, resulting in a greater demand for diabetic food. The Centers for Disease Control and Prevention’s “The National Diabetes Statistics Report”, published January 20,22, estimates that 37.3 million Americans have been diagnosed as having diabetes in 2021.

This is approximately 1 in 10 people. These factors are likely to support the overall market growth. The COVID-19 epidemic has hurt the entire food and beverage industry. According to the World Health Organization, healthy people are encouraged to stay home, along with those suffering from acute chronic diseases and symptoms.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global Diabetic Food market is projected to reach around USD 24.0 billion by 2033 from USD 13.3 billion in 2023, with a CAGR of 6.1% during 2023-2033.

- Product Dominance: Dairy Products held the largest market share (26.1%) in 2023 due to the availability of sugar-free or low-carb options like milk, yogurt, and cheese tailored for diabetic individuals.

- Emerging Sector: Confectionery is anticipated to witness rapid growth, fueled by launches of sugar-free products like chocolates, catering to the diabetic consumer base.

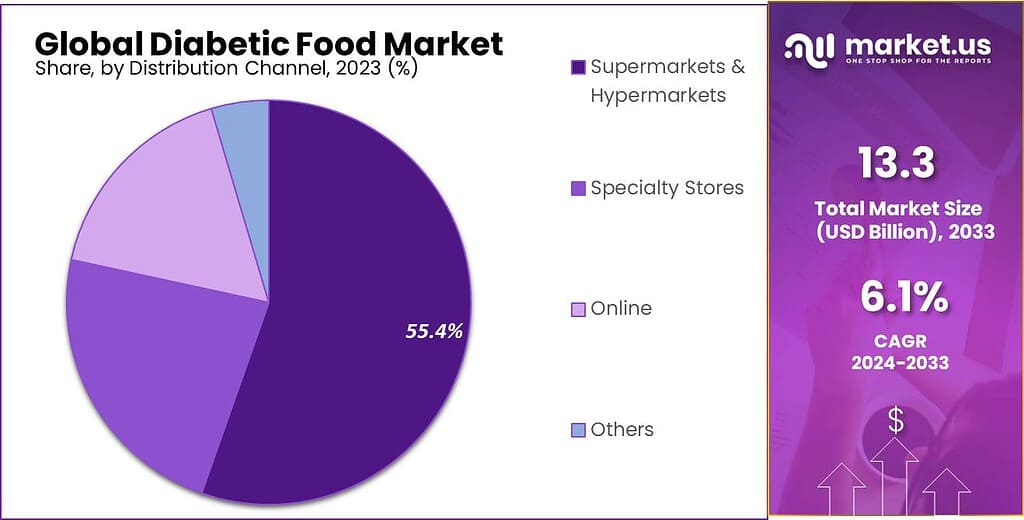

- Distribution Channels: Supermarkets & hypermarkets led the market (55.4% share) by offering a wide array of diabetic-friendly choices. Online channels are poised for the fastest growth, notably through major e-commerce platforms like Amazon and Walmart.com.

- Driving Factors: Increased diabetic cases worldwide, an aging population prone to diabetes, growing health consciousness, sugar substitutes’ popularity, and COVID-19’s impact on food distribution contribute to market expansion.

- Challenges: Costly production ingredients affect product pricing, hindering accessibility. Lack of awareness, especially in rural areas, poses a challenge to market growth.

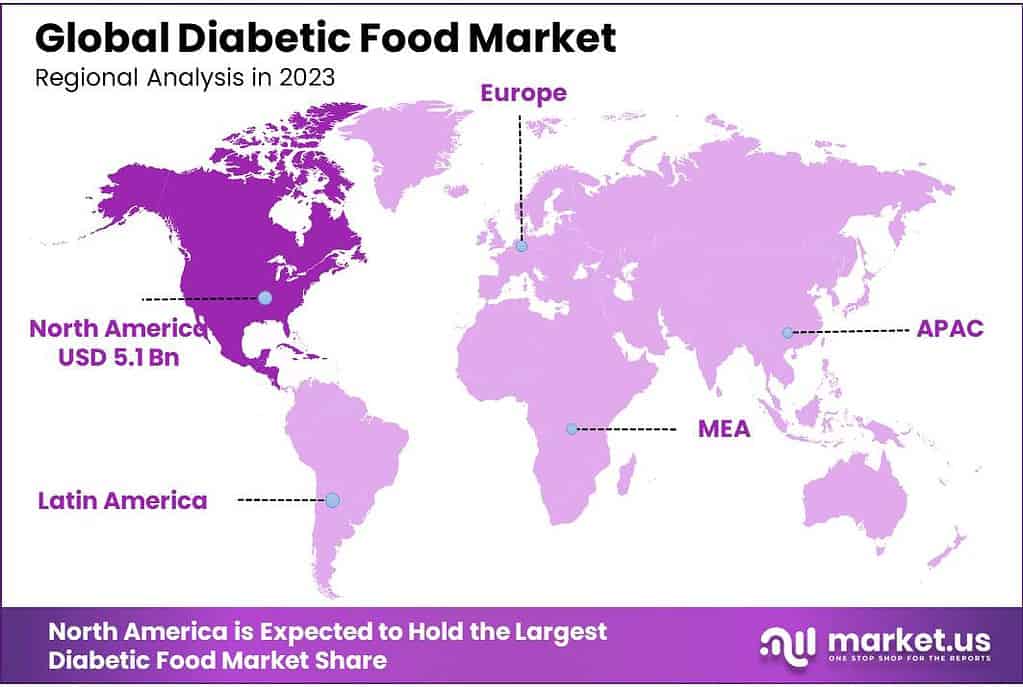

- Regional Insights: North America spearheaded the market due to rising health complications, while the Asia Pacific is projected for the fastest growth due to increasing diabetes cases in countries like China and India.

- Market Players & Developments: Major companies like Nestle, Unilever, Mars Inc., and others are launching diabetic-friendly products, emphasizing natural ingredients and innovative solutions to cater to this growing market.

Product Analysis

In 2023, Dairy Products took the lead in the diabetic food market, holding over 26.1% of the share. These products catered to consumers seeking diabetic-friendly options, offering alternatives like sugar-free or low-carb milk, yogurt, and cheese, meeting the specific dietary needs of individuals managing diabetes.

This is believed to be linked to increased glucose and insulin levels. People with diabetes choose Greek yogurt, string cheese, and grass-fed dairy options. Future growth is expected to be assured by the increasing number of product launches within this market.

Chobani’s Greek Yogurt Mango & Cream was launched in June 2021. It contains 60 calories and is made with natural ingredients. The price at US retail stores is US$ 4.29.

However, the segment of confectionery is expected to experience the fastest growth over the forecast period. The overall growth has been supported by product launches in the confectionery sector by major brands and startups from around the world. BeyondBrands, for example, launched GoodSam Foods in January 2021.

This brand is dedicated to sugar-free products. The product line comprises three chocolate bars, including dark chocolate, dark chocolate & sea salt nibs, dark chocolate, and mint.

Distribution Channel Analysis

In 2023, Supermarkets and hypermarkets were at the top in the diabetic food market, grabbing over 55.4% of the share. These large retail spaces offered a wide variety of diabetic-friendly options, providing convenience and accessibility for consumers managing their dietary needs.

Customers visit local supermarkets and hypermarkets for the convenience of finding a variety of food items, including diabetic food, in one place. Future segment growth will be supported by new product launches at supermarkets in segments like bakery, dairy, confectionery, and other food items. Fitbakes introduced sugar-free caramel cake in around 1000 Tesco stores in the U.K.

Online delivery channels are expected to grow the fastest during the forecast. This segment will likely see a significant shift to online ordering from major retailers like Amazon, Walmart.com, and Target.com.

A majority of brands and companies in the diabetic market prefer to launch their products through third-party e-commerce sellers. Amazon U.S. has a distinct range of diabetic snacks and foods under brands like Happy Belly, PLANTERS, and Simple Mills.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

Product

- Confectionery

- Snacks

- Bakery Products

- Dairy Products

- Others

Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

Drivers

Increase in Diabetics Worldwide: With diabetes becoming an ever-more-common illness worldwide, there’s an increased demand for foods designed specifically to cater to those living with the condition.

Aged People and Diabetes: With increasing numbers of older people comes an increase in diabetes prevalence; the elderly are especially prone to this condition and require food that meets their specific nutritional requirements.

People Wanting Healthier Options: Many folks are thinking more about their health, especially concerning diabetes and being overweight. This interest in health is making the market for diabetes-friendly food bigger.

Problematic Prices: Although people desire these foods, their costs can become more costly as more people discover them and demand increases for these goods.

Substituting Other Items for Sugar: There has been an upsurge in people using alternatives to sugar as part of their daily lives, opening up opportunities to create various food for people living with diabetes.

COVID-19’s Impact: The pandemic has made things tough for the diabetic food market. It’s caused problems in how food is made and given out, especially in countries where people don’t have a lot of money.

All these things – more diabetes cases, an older population, wanting healthier choices, prices being a problem, using things instead of sugar, and the impact of COVID-19 – affect how much diabetic-friendly food people want and can get.

Restraints

Diabetic food often uses expensive ingredients like low-calorie sweeteners and other healthy components, increasing production costs significantly and discouraging some people from buying these food items, further diminishing the market growth of diabetic-friendly meals.

Lack of Awareness: Not everyone understands the advantages of diabetic food products, especially in rural areas, which means many don’t know much about what they can do for diabetic patients and could hinder the growth of diabetic food markets in those regions.

So, expensive ingredients making food expensive and the lack of awareness regarding health benefits in rural areas may hinder the growth of the market for diabetic-friendly food products.

Opportunities

More People Understand Diabetic Foods: As more individuals learn about diabetic-friendly foods, their popularity is on the rise. With their understanding expanding, so too has its market for these specialty items.

Sugar Substitutes Are Becoming More Popular: People have begun turning more frequently to substitutes for sugar, creating opportunities to create food products with reduced or no sugar added at all. This trend fits well with healthier eating and the need for foods which help regulate blood sugar levels.

As more folks discover foods made for diabetes and use sugar substitutes more, it’s made a bigger market for foods that help manage this condition. People really like low-sugar or sugar-free choices because everyone’s into eating healthier and keeping their blood sugar levels in check.

Challenges

More People Understand Diabetic Foods: As more individuals learn about diabetic-friendly foods, their popularity is on the rise. With their understanding expanding, so too has their market for these specialty items.

Sugar Substitutes Are Becoming More Popular: People have begun turning more frequently to substitutes for sugar, creating opportunities to create food products with reduced or no sugar added at all. This trend fits well with healthier eating and the need for foods that help regulate blood sugar levels.

As more folks discover foods made for diabetes and use sugar substitutes more, it’s made a bigger market for foods that help manage this condition. People really like low-sugar or sugar-free choices because everyone’s into eating healthier and keeping their blood sugar levels in check.

Regional Analysis

North America held the top spot in the market for diabetic products and was responsible for the largest share of revenue in 2023. With a market share of 38.4% for all diabetes foods, North America dominated the industry. This was due to rising health complications caused by high blood sugar levels and an aging population.

High blood pressure and high cholesterol are other factors that have led to a rise in demand for diabetic food products in the U.S. This market will continue to grow. According to the Centers of Disease Control and Prevention report, approximately 1.4 million new cases of diabetes were reported in 2019. Of those, 69.0% of them had high blood pressure and 44% had elevated cholesterol. These facts are likely favorable to regional market growth.

The Asia Pacific is expected to experience the fastest growth in the market for diabetic meals during the forecast period. Expect a positive impact on regional demand from the growing number of diabetics with high cholesterol, chronic renal disease, and obesity in China and India. A strong preference for these products will lead to high demand in the Asia Pacific. This will aid the regional growth of the diabetic food market.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

There are many players in the diabetic food market, both regionally and globally. These players are involved in major acquisitions and merges, awareness campaigns, product launches, and product launches to increase brand loyalty and customer base. They are also developing new products, including barley porridge, white oats (oat bran), and 100.0% of natural ingredients that have no harmful or chemical content in diabetes foods.

Kate Farms launched glucose support for diabetics in the U.S. in February 2022 with a sugar-support 1.2 plant-based, natural Nutrition Shake.

Glucose Health, Inc. introduced new GLUCODOWN water-enhancement drink mixes in December 2021. These are now available on Amazon North America.

Splenda, a Splenda sweetener brand, launched Splenda diabetes care shakes in June 2020. These are designed to manage blood sugar and prediabetes.

Key Market Players

- Nestle

- Unilever

- Mars Inc.

- Conagra Brands Inc.

- The Kellogg Company

- Tyson Foods

- Hain Celestial Group

- The Hershey Company

- Cadbury PLC

- David Chapman’s Ice Cream Ltd.

- Fifty 50 Foods Inc.

- Pepsico Inc.

- Zen Health Japan Co. Ltd.

- Glucose Health, Inc

Recent Development

In February 2022, Kate Farms, glucose a manufacture support 1.2 plant-based, organic Nutrition Shake for diabetics was released in the North America

In May 2022, Cargill announced it would support Cubiq Foods’ expansion of alternative fat ingredients in the United States. Cubiq Foods sees Cargill as an important partner, providing essential elements for its plant-based products. This investment by Cubiq Foods marks the beginning of a partnership.

Report Scope

Report Features Description Market Value (2023) USD 13.3 Billion Forecast Revenue (2033) USD 24.0 Billion CAGR (2023-2032) 6.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Confectionery, Snacks, Bakery Products, Dairy Products, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle, Unilever, Mars Inc., Conagra Brands Inc., The Kellogg Company, Tyson Foods, Hain Celestial Group, The Hershey Company, Cadbury PLC, David Chapman’s Ice Cream Ltd., Fifty 50 Foods Inc., Pepsico Inc., Zen Health Japan Co. Ltd., Glucose Health, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What defines diabetic food?Diabetic food refers to products specifically designed for individuals with diabetes or those looking to manage their blood sugar levels. These foods are typically low in sugar, carbohydrates, and sometimes have reduced fat content.

What role do regulations play in the diabetic food market?Regulations are crucial in ensuring that diabetic food products meet specific standards for ingredients, nutritional information, and health claims. Compliance with labeling and quality standards is essential for market players.

Are there any emerging trends in the diabetic food market?Yes, there's a growing trend toward natural sweeteners like stevia or monk fruit, innovative product development to enhance taste and nutritional value, and advancements in technology for sugar reduction in food without affecting flavor.

-

-

- Nestle

- Unilever

- Mars Inc.

- Conagra Brands Inc.

- The Kellogg Company

- Tyson Foods

- Hain Celestial Group

- The Hershey Company

- Cadbury PLC

- David Chapman's Ice Cream Ltd.

- Fifty 50 Foods Inc.

- Pepsico Inc.

- Zen Health Japan Co. Ltd.

- Glucose Health, Inc